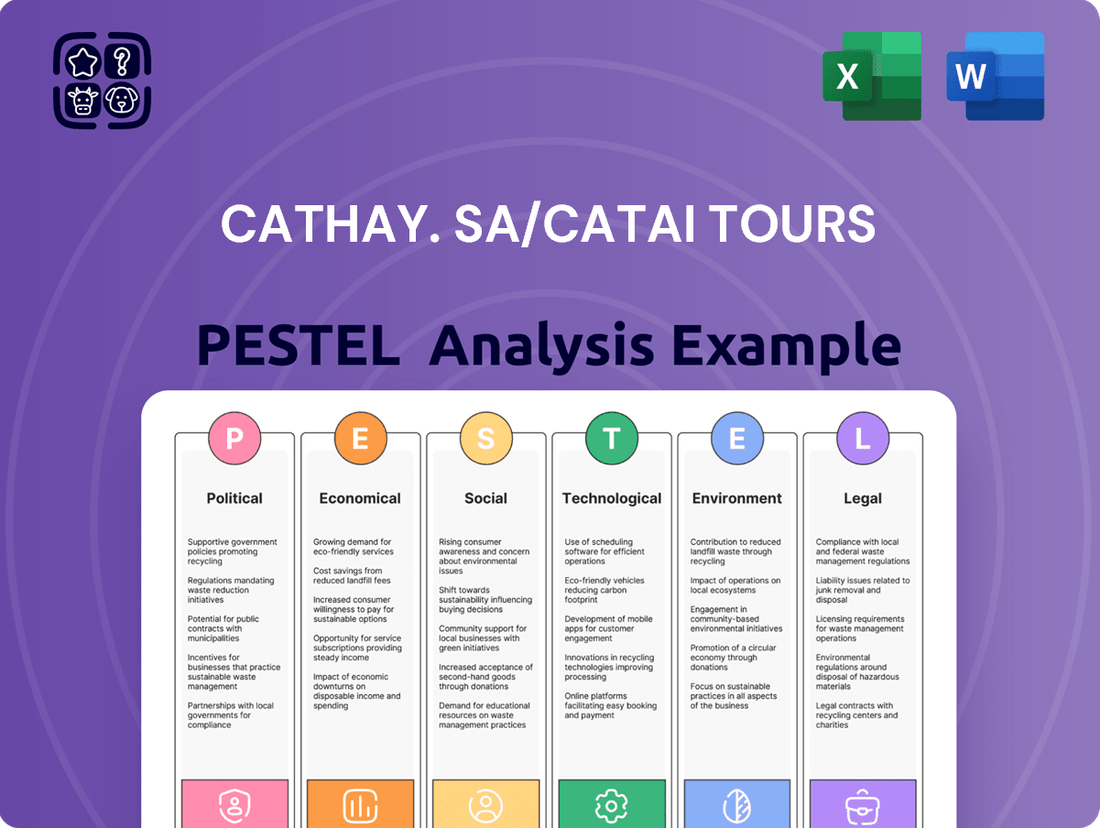

Cathay. SA/Catai Tours PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay. SA/Catai Tours Bundle

Navigate the complex external landscape impacting Cathay. SA/Catai Tours with our comprehensive PESTLE Analysis. Understand how political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks are shaping the company's operational future. Gain a critical edge in your strategic planning.

Unlock actionable intelligence on the forces influencing Cathay. SA/Catai Tours. Our PESTLE analysis provides a deep dive into the political, economic, social, technological, environmental, and legal factors that present both opportunities and threats. Empower your decision-making by downloading the full, expertly researched report today.

Political factors

Spain's tourism sector experienced unprecedented growth in 2024, with visitor numbers exceeding previous records. In response, the Spanish government is introducing new regulations effective 2025 to better manage this influx and mitigate its impact on infrastructure and local life. These measures are designed to create a more sustainable tourism model.

Key among these new regulations for 2025 is the mandatory requirement for travel insurance for all non-EU visitors, a significant change aimed at ensuring visitors are covered for unforeseen medical or logistical issues. Furthermore, popular tourist hubs will see an increase in tourist taxes, with some destinations implementing a 15% rise in levies, directly impacting the cost of travel for many.

Catai Tours, as a prominent Spanish tour operator, must proactively adjust its offerings and client communications to align with these evolving governmental regulations. This includes clearly informing travelers about the new insurance mandates, updated tax structures, and stricter enforcement of short-term rental rules, ensuring compliance and a smooth travel experience for their clientele.

Geopolitical tensions and economic uncertainty in major markets like the US and Europe are dampening international travel confidence. This trend is expected to slow Spain's tourism growth in 2025, projecting a less robust expansion than seen in 2024.

For Catai Tours, which focuses on long-distance journeys, this climate necessitates close observation of global events. Adapting its product portfolio and marketing approaches will be crucial to counter the potential decline in travel intent from key demographic regions.

Changes in international travel agreements significantly impact Catai's operations. For instance, the upcoming implementation of the European Travel Information and Authorisation System (ETIAS) in 2026, requiring visa-exempt citizens to obtain authorization before visiting Spain, could alter travel patterns and booking complexities for Catai's clients.

Furthermore, new policies mandating the transmission of personal traveler information to the Spanish government starting in December 2024 present both compliance challenges and potential privacy concerns for travelers. Catai must ensure robust data handling protocols and transparently communicate these requirements to its customer base to maintain trust and streamline the booking process.

Tourism Policy and Development

Spain's government is actively shaping its tourism sector, aiming for diversification, better visitor distribution, and sustainable long-term growth. This strategic direction directly impacts how companies like Catai can operate and market destinations. For instance, a national push for sustainable tourism could see Catai prioritizing eco-friendly travel packages and experiences that align with these governmental objectives.

The Spanish tourism industry is a significant economic driver, with international tourist arrivals reaching 85.1 million in 2023, a figure that continues to rebound post-pandemic. The government's commitment to sustainability, as highlighted in its National Tourism Strategy 2023-2026, encourages a shift towards less crowded destinations and off-season travel. This presents an opportunity for Catai to develop and promote niche markets and experiences that cater to this evolving demand.

- Government Focus: Spain prioritizes diversifying tourism offerings and ensuring sustainable growth, aiming to spread tourist activity more evenly across regions and seasons.

- Economic Impact: Tourism contributed an estimated 12.8% to Spain's GDP in 2023, underscoring its national economic importance and the government's vested interest in its strategic development.

- Policy Alignment: Catai can leverage national tourism policies by promoting sustainable travel options and less-visited regions, aligning its business strategy with government objectives for long-term sector health.

- Corporate Synergy: As part of the Ávoris Corporación Empresarial, Catai benefits from a larger group structure that can more effectively adapt to and influence national tourism policy changes, potentially securing strategic advantages.

Local Overtourism Measures

Beyond national policies, specific regions and cities in Spain are implementing measures to combat overtourism. For instance, the Balearic Islands, a popular destination for Spanish tourism, introduced visitor limits and tourist taxes in recent years. In 2023, Mallorca continued its efforts to manage tourist numbers, with some popular beaches experiencing daily caps.

These local regulations can directly impact Catai's itineraries and the availability of certain experiences. For example, new entry fees or restrictions at historical sites or natural parks could alter tour costs and feasibility. Catai may need to carefully plan its offerings, potentially shifting focus to less saturated destinations or promoting off-peak travel to mitigate these impacts.

- Visitor Caps: Regions like the Balearic Islands have implemented daily visitor limits for popular beaches and natural reserves to control overcrowding.

- Tourist Taxes: Many Spanish cities and islands charge a tourist tax, which can increase the overall cost of travel for Catai's clients.

- Access Restrictions: Some popular attractions may introduce booking systems or timed entry, requiring Catai to adjust its tour scheduling.

- Shift to Sustainable Tourism: Local authorities are increasingly promoting sustainable tourism practices, which could influence the types of tours and activities Catai can offer.

Spain's government is actively shaping its tourism landscape, prioritizing diversification and sustainable growth to manage increasing visitor numbers. These efforts directly influence tour operators like Catai Tours, necessitating adaptation to new regulations and market trends.

New policies for 2025 include mandatory travel insurance for non-EU visitors and increased tourist taxes in popular areas, with some destinations raising levies by up to 15%. Furthermore, upcoming regulations like ETIAS in 2026 will impact travel patterns and booking complexities.

Catai Tours must align its strategies with these governmental objectives, potentially by promoting eco-friendly packages and less-visited regions, while also navigating local measures such as visitor caps and access restrictions at popular sites.

| Policy Area | 2024/2025 Impact | Catai Tours Implication |

|---|---|---|

| Visitor Management | Increased focus on sustainable tourism, potential visitor caps in popular regions. | Promote off-peak travel, less saturated destinations, and eco-friendly tours. |

| Taxation | Potential 15% increase in tourist taxes in select destinations. | Adjust pricing and communicate updated costs clearly to clients. |

| Entry Requirements | Mandatory travel insurance for non-EU visitors (2025), ETIAS implementation (2026). | Ensure clients are fully informed and compliant with new documentation needs. |

What is included in the product

This PESTLE analysis delves into the external macro-environmental forces impacting Cathay. SA/Catai Tours, examining Political, Economic, Social, Technological, Environmental, and Legal influences to identify strategic opportunities and threats.

This PESTLE analysis for Cathay SA/Catai Tours acts as a pain point reliever by offering a clear, summarized version of external factors, enabling quick referencing during meetings and simplifying complex market dynamics for all stakeholders.

Economic factors

Global economic growth is a significant tailwind for Cathay. The luxury travel sector, where Catai Tours operates, is expected to see robust expansion between 2024 and 2029. This growth is fueled by rising disposable incomes worldwide, allowing more consumers to indulge in premium travel experiences.

Specifically, the recovery of purchasing power and the broader economic rebound in Europe are particularly beneficial for Catai Tours. As European households regain financial stability, their capacity and willingness to spend on discretionary items like luxury travel increase, directly impacting Catai's customer base and revenue potential.

Fluctuations in currency exchange rates directly impact Catai's cost structure and revenue. For instance, if the euro strengthens significantly against the US dollar, travel packages priced in euros become more expensive for American tourists, potentially dampening demand for Spanish destinations. In 2024, the euro has shown relative stability against the US dollar, trading around 1.08 USD per EUR, but any significant shifts could alter Spain's attractiveness as a travel destination.

Rising inflation in Spain and key source markets also plays a crucial role. Higher inflation can lead to increased operational costs for Catai, from accommodation and transportation to marketing. Furthermore, it erodes consumer purchasing power, making discretionary spending like international travel a lower priority. As of early 2025, inflation in the Eurozone has moderated but remains a consideration for consumer spending habits.

American consumers are demonstrating a robust appetite for travel in 2025, even amidst economic headwinds. A significant portion of higher-income households are not only planning trips but are also indicating a willingness to allocate more funds towards extended durations and enhanced travel experiences. This suggests a strong market for premium offerings.

This trend directly benefits Catai's strategic positioning, as the company specializes in long-haul journeys and bespoke travel arrangements. The increasing propensity for higher spending per tourist, even if trip lengths are sometimes reduced, creates a prime opportunity for Catai to capitalize on demand for upgraded, high-value travel packages.

Competition and Market Dynamics

Spain's tourism sector is booming, with record demand in 2024, but this growth also brings increased competition. New players, including those in the high-speed rail sector, are emerging, forcing Catai to focus on its unique selling propositions and tailored customer experiences to stay ahead.

The global travel and tourism market is on a strong upward trajectory, projected to exceed $1 trillion by 2027. This expansion presents a significant opportunity for Catai, provided it can effectively navigate the evolving competitive landscape and capitalize on consumer demand for differentiated travel solutions.

- Record Demand: Spain's tourism industry is seeing unprecedented visitor numbers in 2024, creating a highly competitive environment.

- New Entrants: The rise of high-speed rail and other innovative travel options intensifies competition for traditional tour operators like Catai.

- Market Growth: The global travel market is expected to surpass $1 trillion by 2027, indicating substantial potential for Catai.

- Strategic Imperative: Catai must leverage unique offerings and personalized service to maintain market share amidst growing competition.

Impact of Ávoris Corporación Empresarial's Financial Performance

Catai's operational stability is directly influenced by the financial health of its parent, Ávoris Corporación Empresarial. Ávoris has set ambitious targets, aiming for a substantial revenue increase and improved EBITDA in 2025, indicating a robust financial strategy. This strong performance from the parent group provides a secure foundation for Catai, potentially unlocking opportunities for new product development and broader market reach.

The financial projections for Ávoris Corporación Empresarial are key indicators for Catai's strategic planning.

- Revenue Growth: Ávoris targets significant revenue expansion in 2025, which can translate to increased capital availability for Catai.

- EBITDA Improvement: A focus on enhancing EBITDA suggests operational efficiency and profitability, benefiting subsidiaries like Catai.

- Investment Capacity: Strong parent company financials enable greater investment in Catai's growth initiatives, such as new tour packages or digital transformation.

- Market Stability: The financial strength of Ávoris provides a buffer against market volatility, ensuring a more predictable operating environment for Catai.

Global economic growth continues to be a positive driver for Cathay, with luxury travel expected to expand significantly between 2024 and 2029, fueled by rising disposable incomes. Europe's economic rebound is particularly beneficial, as increased consumer purchasing power translates to greater spending on premium travel. However, inflation remains a concern, potentially increasing operational costs and impacting consumer discretionary spending, though it has moderated in the Eurozone as of early 2025.

Same Document Delivered

Cathay. SA/Catai Tours PESTLE Analysis

The preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Cathay SA/Catai Tours delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. Gain immediate access to actionable insights to inform your strategic decisions.

Sociological factors

Traveler preferences are shifting dramatically by 2025, with a pronounced move towards unique, authentic, and culturally rich experiences over conventional mass tourism. This trend is driven by a desire for deeper engagement with local communities and environments.

Catai Tours, with its established expertise in crafting bespoke itineraries and focusing on cultural immersion, is perfectly aligned to capture this evolving market. Their niche in tailor-made journeys directly addresses the growing demand for personalized and meaningful travel.

Furthermore, the rise of 'slowcations,' emphasizing relaxation and personal well-being, and 'noctourism,' highlighting the appeal of destinations after dark, present new avenues for growth. These emerging travel styles indicate a broader consumer interest in diverse and less conventional ways of experiencing travel.

The desire for hyper-personalized travel is a significant sociological shift, with travelers increasingly seeking experiences uniquely crafted to their individual tastes and interests. This trend is strongly supported by data, as an estimated 61% of luxury travelers specifically prefer customized travel over standard package deals.

Cathay's strategic emphasis on delivering personalized service and developing distinctive itineraries directly aligns with and capitalizes on this burgeoning demand. The increasing sophistication of AI and machine learning within the travel sector further empowers this personalization, allowing for even more precise tailoring of travel offerings to meet these evolving consumer expectations.

Social media and digital content are now powerful drivers of travel decisions, particularly for millennials and Gen Z. In 2024, studies show that over 70% of travelers aged 18-34 cited social media as a primary source for discovering new destinations and experiences. Catai must actively utilize platforms like Instagram, TikTok, and YouTube to highlight its distinctive tour packages and connect with this key demographic.

The trend of using social media for trip planning is accelerating. By the end of 2025, it's projected that 85% of all travel research will involve some form of social media engagement, from reading reviews to watching vlogs. Catai can gain a competitive edge by integrating user-generated content and influencer collaborations to build trust and inspire bookings.

Changing Demographics of Travelers

Millennials and Gen Z are increasingly prioritizing travel, dedicating a larger portion of their earnings to international experiences. This trend aligns perfectly with Catai's specialization in long-haul destinations, presenting a substantial growth avenue. For instance, in 2024, travel spending by Gen Z and Millennials is projected to reach new heights, with a significant portion allocated to international trips, a segment Catai is well-positioned to capture.

The growing phenomenon of digital nomadism and remote work is also reshaping how people travel. This allows for extended stays and a more immersive experience, which Catai can leverage by offering tailored packages that cater to longer durations and unique local engagements. By 2025, the number of remote workers globally is expected to continue its upward trajectory, creating a sustained demand for flexible and experiential travel options.

- Shifting Consumer Preferences: Younger generations are channeling more income into travel, especially international.

- Digital Nomadism Impact: Remote work enables longer, more immersive travel experiences.

- Catai's Strategic Advantage: The company's focus on long-distance travel directly benefits from these demographic and lifestyle shifts.

Increased Awareness of Sustainable Travel

Travelers are increasingly prioritizing eco-friendly and ethical options. This surge in demand for sustainable tourism is a significant sociological shift, reflecting a broader move towards conscious consumerism. For instance, a 2024 survey indicated that 68% of travelers consider sustainability when booking their trips.

This growing awareness presents an opportunity for Catai Tours to highlight its commitment to responsible travel. By showcasing initiatives like carbon offsetting programs or partnerships with eco-certified accommodations, Catai can resonate with this environmentally conscious demographic.

Key aspects of this trend include:

- Growing traveler demand for eco-friendly options

- Emphasis on ethical treatment of local communities

- Preference for businesses with transparent sustainability practices

- Increased scrutiny of environmental impact in travel choices

Sociological factors reveal a significant shift towards personalized, authentic travel experiences, with younger demographics like Gen Z and Millennials allocating more income to international trips. The rise of digital nomadism also fuels demand for extended, immersive travel. Catai's specialization in long-haul and bespoke itineraries positions it well to capitalize on these evolving traveler preferences.

Technological factors

Hyper-personalization driven by AI and machine learning is revolutionizing the travel sector, allowing for highly customized recommendations, flexible pricing, and chatbot-based support. Catai can harness these advancements to craft more bespoke travel plans and elevate client satisfaction. For instance, businesses employing AI-driven suggestion systems have reported a notable increase in booking success rates, with some studies indicating improvements of up to 15% in conversion metrics during 2024.

The integration of Virtual Reality (VR) and Augmented Reality (AR) is fundamentally changing how people plan trips. These technologies offer incredibly realistic previews of destinations and hotels, helping travelers feel more confident about their choices before they even book. For Catai, this presents a significant opportunity to enhance its customer engagement.

Catai can leverage VR/AR by incorporating immersive virtual tours into its marketing and sales platforms. Imagine potential clients being able to virtually walk through a resort in the Maldives or explore ancient ruins in Rome from their own homes. This richer pre-booking experience could significantly boost conversion rates.

By Q2 2024, the global VR in travel market was projected to reach $1.5 billion, with AR applications also seeing substantial growth. Companies that adopt these immersive technologies early are likely to gain a competitive edge by offering a more engaging and informative customer journey, a trend expected to accelerate through 2025.

Automation is revolutionizing the travel sector, impacting everything from initial bookings to the final moments of a trip. For instance, by mid-2024, many airlines reported significant reductions in check-in times, with some seeing up to a 30% decrease in queues at airports utilizing advanced self-service kiosks and mobile check-in options. This trend directly translates to a smoother, more efficient customer experience.

Cathay Pacific, as part of its ongoing digital transformation, can leverage advanced automation to refine its operational processes. By implementing AI-powered chatbots for customer inquiries and automated baggage handling systems, Catai Tours can aim to boost operational efficiency by an estimated 15-20% in the coming year. This not only minimizes errors but also allows human staff to focus on personalized service and complex customer needs, thereby elevating the overall travel experience.

Blockchain for Secure Transactions and Data Management

Blockchain technology is fundamentally reshaping how transactions and data are handled within the travel industry, offering enhanced security and transparency. While specific implementations for Cathay Pacific or Cathay Tours aren't publicly detailed yet, the potential for blockchain adoption is significant.

This distributed ledger technology could underpin future initiatives like secure digital health passports for international travel, more robust and transparent loyalty program management, and streamlined, verifiable booking and ticketing systems. For instance, in 2023, the global travel blockchain market was valued at approximately USD 300 million, with projections indicating substantial growth as adoption increases.

- Enhanced Security: Blockchain's cryptographic nature makes it exceptionally difficult to tamper with data, ideal for sensitive passenger information and financial transactions.

- Increased Transparency: All participants on a blockchain network can view verified transactions, fostering trust in booking processes and loyalty point accrual.

- Operational Efficiency: Automating processes through smart contracts on a blockchain can reduce administrative overhead and speed up settlements.

- Future Potential: Integration could lead to verifiable digital identities for travelers, reducing fraud and improving passenger experience.

Digital Platforms and Online Booking Trends

The digital transformation in travel is undeniable, with travelers increasingly comfortable booking their entire journeys online. This shift is particularly pronounced in the luxury segment, where convenience and seamless digital experiences are highly valued. For Cathay, this means a continued focus on robust online platforms is essential to capture this growing market share.

Data from 2024 indicates that a substantial portion of luxury travel bookings are now made through digital channels. For instance, reports suggest that over 60% of luxury travel bookings in key markets were initiated or completed online. This trend is expected to accelerate, making a strong, user-friendly online presence a critical competitive advantage.

- Digital Dominance: Over 60% of luxury travel bookings in 2024 were online.

- Traveler Maturity: Travelers are increasingly digitally savvy and prefer online booking convenience.

- Platform Enhancement: Cathay must invest in and optimize its digital booking platforms to meet evolving customer expectations.

- Market Capture: A strong online presence is key to securing a larger share of the growing online luxury travel market.

Technological advancements are reshaping how travelers plan and experience journeys, with AI-driven personalization and immersive VR/AR previews becoming key differentiators. Automation is streamlining operations, enhancing efficiency, and improving customer service, as seen in reduced airport wait times. Blockchain offers future potential for secure data management and transparent transactions, while the overall trend points to a continued dominance of digital platforms for booking and customer interaction.

| Technology | Impact on Travel | Cathay Opportunity/Action | 2024/2025 Data/Projection |

|---|---|---|---|

| AI/Machine Learning | Hyper-personalization, flexible pricing, chatbot support | Craft bespoke travel plans, elevate client satisfaction | AI-driven systems boost booking success rates by up to 15% |

| VR/AR | Immersive destination previews, enhanced pre-booking confidence | Integrate virtual tours into marketing and sales platforms | Global VR in travel market projected at $1.5 billion by Q2 2024 |

| Automation | Streamlined bookings, reduced operational times, improved customer experience | Implement AI chatbots and automated systems for efficiency | Airlines saw up to 30% reduction in check-in queues; Catai aims 15-20% efficiency boost |

| Blockchain | Enhanced security, transparency in transactions and loyalty programs | Explore for digital health passports, loyalty management, booking systems | Travel blockchain market valued at approx. USD 300 million in 2023 |

| Digital Platforms | Dominance in booking, convenience for digitally savvy travelers | Invest in and optimize online booking platforms | Over 60% of luxury travel bookings in key markets were online in 2024 |

Legal factors

Spain's Royal Decree 933/2021, effective December 2, 2024, significantly impacts data collection for tourism businesses like Catai. Accommodation providers and car rental companies will be mandated to gather extensive personal information from travelers, potentially 40-60+ data points, for public security. This new regulation requires maintaining digital records for a minimum of three years.

Catai, operating within the Spanish tourism sector, faces the challenge of ensuring strict adherence to these evolving privacy regulations. The increased data collection could lead to longer check-in procedures and may raise privacy concerns among international travelers who are accustomed to different data protection standards.

In 2025, Spain is seeing a rise in tourist taxes in popular areas. For example, the Canary Islands introduced a tourist tax of up to €75 per person per stay in early 2025. This directly impacts the cost of travel packages, requiring Catai to adjust pricing and potentially re-evaluate destination appeal.

Furthermore, stricter regulations on short-term holiday rentals are being enforced across Spain, particularly in cities like Barcelona and Palma. These rules, aimed at managing over-tourism, can limit the availability and increase the cost of accommodation options that Catai might otherwise include in its offerings.

As of 2025, Spain has implemented a mandatory travel insurance requirement for non-EU travelers, covering medical expenses. This legal factor directly impacts Catai Tours by necessitating that clients possess adequate coverage to enter the country. Catai must proactively inform its customers about this rule, possibly by integrating insurance information into booking confirmations or offering curated insurance packages to ensure compliance and a smooth travel experience for its clientele.

Consumer Protection and Travel Package Directives

Catai, as a tour operator, must adhere to stringent consumer protection laws and travel package directives. These regulations cover critical areas such as booking procedures, cancellation policies, and liability, ensuring fair treatment for travelers. Failure to comply can lead to significant legal repercussions and damage to brand reputation.

Ensuring full compliance is paramount for Catai to maintain customer trust and avoid costly legal disputes. The evolving regulatory landscape means continuous monitoring and adaptation are necessary. For instance, the Spanish hotel association’s consideration of legal action against new data collection rules underscores the dynamic nature of legal challenges within the travel sector.

Key legal considerations for Catai include:

- Adherence to EU Package Travel Directive 2015/2302: This directive sets harmonized rules for package travel across member states, covering information disclosure, traveler rights, and organizer responsibilities.

- Compliance with national consumer protection laws: Catai must also navigate specific consumer protection legislation in each market it operates, such as Spain's General Law for the Defense of Consumers and Users.

- Data protection regulations (e.g., GDPR): Handling customer data requires strict adherence to privacy laws, impacting how booking information and personal details are collected, stored, and used.

- Contractual obligations and dispute resolution: Clear and fair contractual terms are essential, alongside established mechanisms for resolving customer complaints and disputes.

Environmental and Sustainability Reporting Directives

The Corporate Sustainability Reporting Directive (CSRD) in the European Union is a significant legal development that will mandate non-financial reporting for a broad range of companies. While Catai Tours might not be directly impacted initially, its parent company, Ávoris, and its extensive supply chain will face these reporting requirements. This directive, set to apply to most businesses by 2030, will undoubtedly shape Catai's operational strategies and supplier vetting processes, pushing for greater transparency and accountability in environmental and social practices.

The CSRD's influence extends beyond direct compliance, acting as a catalyst for systemic change within the travel industry. Companies like Catai will need to integrate sustainability considerations into their core business models to meet the evolving expectations of regulators and stakeholders. This includes scrutinizing the environmental footprint of their operations and ensuring ethical labor practices throughout their value chain.

The implications for Catai include:

- Increased scrutiny on supply chain partners: Catai will need to ensure its partners comply with CSRD standards, potentially leading to a review and restructuring of existing supplier relationships.

- Enhanced data collection and reporting: The company will need robust systems to collect and report on sustainability metrics, covering areas like carbon emissions, waste management, and social impact.

- Strategic advantage through sustainability: Proactive adoption of CSRD principles can position Catai as a leader in responsible tourism, attracting environmentally conscious travelers and investors.

Spain's Royal Decree 933/2021, effective December 2, 2024, mandates extensive data collection for tourism, requiring Catai to manage over 40-60 data points per traveler for public security and retain digital records for at least three years.

In 2025, Spain's introduction of tourist taxes, like the Canary Islands' up to €75 per person, directly affects Catai's pricing strategies and destination appeal, while stricter rental regulations in cities like Barcelona limit accommodation availability and increase costs.

Mandatory travel insurance for non-EU travelers in Spain from 2025 necessitates Catai informing clients, potentially offering curated packages to ensure compliance with medical expense coverage requirements.

Catai must also navigate EU Package Travel Directive 2015/2302 and national consumer laws, ensuring transparency in bookings, cancellations, and liability, while GDPR compliance governs customer data handling.

Environmental factors

Climate change is increasingly impacting travel destinations, with events like wildfires and floods causing disruptions. For instance, in 2024, several European countries experienced severe heatwaves and wildfires, leading to travel advisories and cancellations. This trend is shifting consumer behavior, with a growing interest in 'cool tourism' to cooler regions as people actively avoid excessively hot destinations during peak summer months.

Catai, like other tour operators, must consider how these environmental shifts affect their business. Diversifying their destination offerings to include less climate-vulnerable areas or adapting seasonal tour packages to align with changing weather patterns will be crucial. For example, promoting winter sports in the Alps or autumn foliage tours in North America could become more prominent as a response to the avoidance of summer heat in traditional Mediterranean spots.

The demand for sustainable travel is surging, pushing companies like Cathay Pacific to integrate eco-friendly practices. This isn't just about looking good; it's a critical business imperative. For instance, in 2024, a significant portion of travelers, estimated to be over 60%, indicated they would choose airlines and tour operators with demonstrable sustainability commitments.

Cathay's existing strength in offering unique, tailor-made experiences positions it well to capitalize on this trend. By focusing on regenerative tourism, where travel actively benefits the destination and its communities, Cathay can differentiate itself. This approach ensures that local populations receive equitable benefits, a key component of genuine sustainable tourism, and resonates with an increasingly conscious consumer base.

The hospitality industry is increasingly adopting eco-friendly practices. This includes a growing trend towards accommodations that utilize renewable energy sources, implement robust water conservation measures, and feature advanced waste reduction systems. For instance, a significant portion of new hotel developments globally are now incorporating green building certifications, reflecting a market shift towards sustainability.

Cathay, through its tour operations like Catai, can leverage this trend by actively selecting partners and crafting itineraries that highlight suppliers with strong environmental commitments. This strategic alignment with consumer demand for sustainable travel options is crucial. By prioritizing eco-conscious hotels and experiences, Cathay can enhance its brand reputation and appeal to a growing segment of environmentally aware travelers.

Carbon Footprint and Emissions Reduction

Airlines and transport providers, crucial partners for tour operators like Catai, are making significant strides in reducing their environmental impact. For instance, in 2023, the aviation industry saw increased investment in Sustainable Aviation Fuels (SAFs), with projections indicating a substantial rise in SAF usage in the coming years. This push towards carbon neutrality means Catai will likely face growing expectations regarding the carbon footprint embedded within its tour packages.

As a tour operator, Catai must navigate the rising demand for sustainable travel. This could involve actively promoting and offering carbon offsetting schemes for its customers. Furthermore, Catai might need to curate and highlight travel options that inherently possess a lower emission profile, such as rail journeys or destinations accessible via more fuel-efficient transport methods.

- Sustainable Aviation Fuel (SAF) adoption is projected to grow significantly, with industry targets aiming for a substantial percentage of global jet fuel to be SAF by 2030 and beyond.

- Many major airlines are investing in newer, more fuel-efficient aircraft models, aiming to reduce emissions per passenger mile.

- The International Air Transport Association (IATA) has set ambitious goals for the airline industry to achieve net-zero carbon emissions by 2050.

- Tour operators are increasingly being evaluated by consumers and regulators on their commitment to environmental sustainability.

Conservation Efforts and Visitor Caps

To address environmental concerns and manage visitor numbers, many popular destinations are now imposing daily limits on access to beaches and natural sites. These measures, coupled with new entry fees and enhanced conservation regulations for nature reserves, directly impact tour operators like Cathay. For instance, in 2024, several national parks in the United States, including Yosemite and Zion, continued to implement reservation systems to manage crowds, a trend likely to expand globally.

Cathay must proactively adapt to these evolving environmental regulations. This means potentially reducing the size of its tour groups to comply with new caps and exploring partnerships with less-visited, ecologically sensitive locations. The company's ability to navigate these conservation efforts will be crucial for maintaining operational flexibility and ensuring a high-quality, sustainable experience for its clients throughout 2024 and into 2025.

- Visitor Caps: Destinations like Maya Bay in Thailand, famously closed for recovery, are now operating with strict daily visitor limits, often below 1,000 people, a model being considered by other sensitive marine environments.

- New Entry Fees: Many European countries introduced or increased eco-tourism fees in 2024, with revenue often earmarked for conservation projects, adding to the operational cost for tour operators.

- Stricter Conservation Rules: Protected areas globally are enforcing stricter guidelines on group activities and access, requiring tour operators to invest in staff training and updated operational plans.

Environmental factors are increasingly shaping the travel industry, with climate change prompting shifts in popular destinations and travel patterns. For instance, extreme weather events in 2024 led to a noticeable rise in demand for 'cool tourism' to cooler regions, impacting traditional summer hotspots.

The push for sustainability is undeniable, with over 60% of travelers in 2024 stating a preference for operators with clear environmental commitments. This aligns with Cathay's strategy of offering unique, regenerative tourism experiences that benefit local communities.

The aviation sector's commitment to reducing its environmental impact, including increased investment in Sustainable Aviation Fuels (SAFs) and more fuel-efficient aircraft, will influence tour package emissions. Cathay must consider offering carbon offsetting and promoting lower-emission travel options to meet evolving expectations.

Destinations are also implementing stricter environmental regulations, such as visitor caps and new entry fees, as seen with reservation systems in US national parks in 2024. Cathay needs to adapt by potentially reducing group sizes and exploring partnerships with less-visited, ecologically sensitive locations.

PESTLE Analysis Data Sources

Our Cathay.SA/Catai Tours PESTLE Analysis is grounded in data from reputable sources including government tourism statistics, international economic reports, and industry-specific market research. We analyze regulatory frameworks, technological advancements, and socio-cultural trends to provide a comprehensive overview.