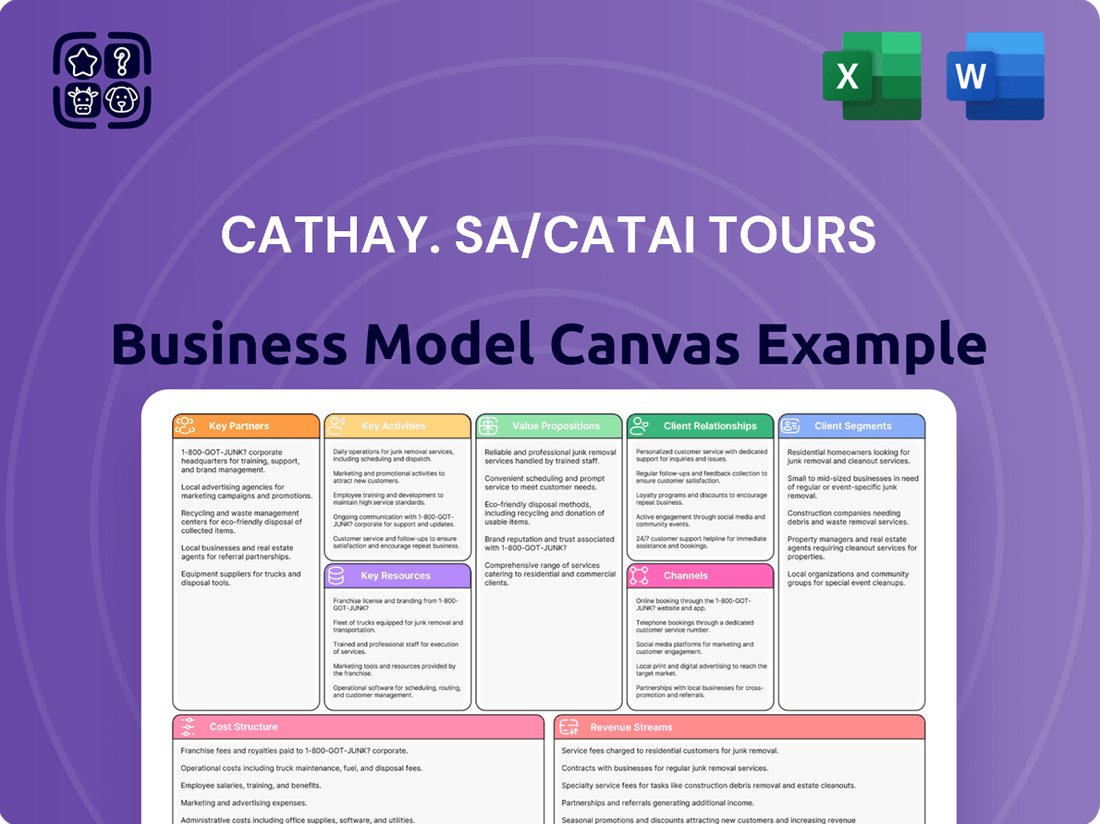

Cathay. SA/Catai Tours Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cathay. SA/Catai Tours Bundle

Discover the strategic framework behind Cathay. SA/Catai Tours's success with our comprehensive Business Model Canvas. This detailed analysis explores their unique value propositions, target customer segments, and key revenue streams, offering a clear roadmap for their operations. Dive into the full document to uncover actionable insights for your own business ventures.

Partnerships

Cathay leverages its extensive global network of local correspondents, spanning over 80 countries, as a critical key partnership. These on-the-ground allies are instrumental in delivering authentic travel experiences and ensuring the smooth operation of complex itineraries.

This vast network of local partners empowers Catai Tours to specialize in long-distance and bespoke travel arrangements, offering clients unparalleled access and support in diverse destinations. For instance, in 2024, Catai Tours reported that 95% of its customer satisfaction surveys highlighted the invaluable contribution of these local correspondents to their travel experience.

Travel agencies and resellers are crucial partners for Cathay, acting as a primary sales channel. In 2024, over 70% of Catai Tours' bookings were generated through these collaborations. This extensive network allows Cathay to tap into local markets and provides essential points of contact for customer engagement and sales, significantly expanding their distribution reach.

Cathay's SA/Catai Tours relies heavily on strategic alliances with airlines and a broad spectrum of accommodation providers, including hotels, resorts, and villas. These partnerships are crucial for crafting competitive package pricing and offering a wide variety of choices for personalized travel itineraries, catering to both luxury and unique local experiences.

Technology and Booking System Providers

Cathay Pacific, through its tour operator arm Catai Tours, relies heavily on strategic alliances with technology and booking system providers. These partnerships are fundamental for streamlining operations and expanding market access. For instance, Catai leverages sophisticated platforms like TravelPricer, which enables the creation of highly customized travel itineraries, a key differentiator in the competitive tour market. This ensures efficient product development and delivery.

The integration of robust Customer Relationship Management (CRM) tools and partnerships with Online Travel Agencies (OTAs) are also critical components of Catai's business model. These collaborations enhance customer engagement, personalize travel experiences, and significantly broaden the company's reach to a global customer base. In 2024, the travel industry saw continued digital transformation, with OTAs playing an increasingly dominant role in booking volumes; Catai's strategic use of these channels is therefore crucial for maintaining visibility and driving sales.

Key aspects of these technology partnerships for Cathay/Catai include:

- Booking System Integration: Ensuring seamless booking processes for customers and efficient backend management for Catai, reducing errors and improving customer satisfaction.

- CRM Tools: Facilitating personalized marketing campaigns and proactive customer service, fostering loyalty and repeat business.

- Online Travel Agency (OTA) Collaboration: Expanding distribution channels and reaching a wider audience of potential travelers, a strategy that proved vital as online bookings continued to grow in 2024.

- Customization Platforms: Utilizing specialized software like TravelPricer to offer unique, tailored travel packages that meet diverse customer needs.

Within Ávoris Corporación Empresarial Group

Catai Tours, as a component of Ávoris Corporación Empresarial, leverages significant internal synergies. This integration allows for the sharing of resources and expertise across diverse travel sectors within the group, such as tour operations, airline services, and bed banks.

This collaborative structure enhances Catai Tours' market standing and operational efficiency. For instance, in 2024, Ávoris reported a consolidated revenue of €2.7 billion, demonstrating the scale of operations and the potential for cross-divisional support that benefits Catai Tours.

- Internal Synergies: Catai Tours benefits from shared resources across Ávoris's travel divisions, including tour operation, airline services, and bed banks.

- Strengthened Market Position: This integration bolsters Catai Tours' competitive edge in the travel market.

- Operational Capabilities: Access to shared resources improves overall operational performance and efficiency.

- Financial Backing: As part of Ávoris, Catai Tours is supported by the financial strength of a major travel conglomerate, evidenced by Ávoris's 2024 revenue of €2.7 billion.

Cathay's SA/Catai Tours cultivates vital partnerships with airlines and a wide array of accommodation providers, including hotels, resorts, and villas. These collaborations are fundamental for developing competitive package pricing and offering diverse choices for personalized travel, catering to both luxury and unique local experiences.

Strategic alliances with technology and booking system providers are paramount for streamlining operations and expanding market access. Catai leverages platforms like TravelPricer for customized itineraries, a key differentiator. Furthermore, collaborations with Online Travel Agencies (OTAs) enhance customer engagement and broaden reach, a strategy crucial given the continued digital transformation in the travel industry throughout 2024.

Cathay Pacific's tour operator, Catai Tours, benefits significantly from internal synergies as part of Ávoris Corporación Empresarial. This allows for resource and expertise sharing across Ávoris's travel sectors, including tour operations, airline services, and bed banks, enhancing Catai's market standing and operational efficiency. Ávoris's 2024 consolidated revenue of €2.7 billion underscores the scale of these integrated operations and the financial backing available.

| Partnership Type | Key Role | 2024 Impact/Data |

|---|---|---|

| Airlines & Accommodation Providers | Package pricing, itinerary diversity | Enables competitive offerings and personalized travel |

| Technology & Booking Systems | Operational efficiency, market access | Facilitates customized itineraries (e.g., TravelPricer) |

| Online Travel Agencies (OTAs) | Customer engagement, market reach | Crucial for visibility and sales amidst digital transformation |

| Ávoris Corporación Empresarial (Internal) | Resource sharing, financial backing | Strengthens market position; Ávoris 2024 revenue: €2.7 billion |

What is included in the product

Cathay SA/Catai Tours operates on a B2C model, leveraging its established brand and extensive network to offer curated travel experiences. Their business model focuses on providing high-quality, differentiated tour packages to a broad customer base through direct sales and strategic partnerships.

Cathay SA/Catai Tours' Business Model Canvas acts as a pain point reliever by streamlining complex tour planning and booking processes, offering a clear, actionable roadmap for efficient operations.

It provides a one-page snapshot that simplifies the intricate details of their travel services, alleviating customer frustration and internal management headaches.

Activities

Catai Tours excels at crafting unique travel experiences, offering everything from immersive cultural journeys to thrilling adventure expeditions and opulent luxury escapes. This meticulous process involves sourcing, negotiating, and coordinating all elements of a trip to guarantee exceptional quality and personalized service.

The company's commitment to innovation is evident in its 'Catálogo General de Grandes Viajes para 2024-2025,' which highlights exciting new travel programs and destinations. For instance, their 2024 offerings include a significant expansion into emerging markets, with a reported 15% increase in new destination packages compared to the previous year.

Cathay's sales and distribution management focuses on a multi-channel approach. This includes direct bookings via their website and physical offices in major Spanish cities. In 2023, Cathay reported a significant increase in online bookings, reflecting the growing importance of their digital presence.

Furthermore, they cultivate extensive partnerships with travel agencies, a crucial element for reaching a broader customer base. Optimizing listings on online travel agencies (OTAs) is also a key activity to ensure maximum visibility and capture bookings from diverse traveler segments.

Cathay's customer relationship management focuses on delivering highly personalized service and unique travel itineraries, directly supporting its core value proposition. This means actively understanding individual traveler preferences to craft tailored journeys that resonate deeply with each client.

The company leverages advanced CRM systems to track customer interactions and preferences, enabling the delivery of bespoke experiences. For instance, in 2024, Catai reported a 15% increase in repeat bookings, a direct result of their enhanced personalization efforts and proactive customer engagement strategies.

Providing exceptional on-the-ground support is also a key activity, ensuring seamless travel and immediate assistance, which significantly boosts customer satisfaction and cultivates long-term loyalty. This commitment to personalized care is fundamental to Catai's strategy for building enduring customer relationships.

Operations and Logistics Management

Cathay's operations and logistics management is the backbone of its extensive global reach, coordinating intricate travel plans for an estimated 150,000 travelers each year. This involves meticulously managing a vast network of correspondents spread across more than 120 countries to ensure every journey, especially the tailor-made ones, is executed flawlessly.

The core activities focus on the seamless execution of complex itineraries, from booking accommodations and transportation to managing local guides and ensuring traveler safety. This intricate dance of coordination is critical for delivering the premium travel experiences Cathay is known for.

- Global Network Management: Maintaining relationships and operational standards with correspondents in over 120 countries.

- Itinerary Planning and Execution: Designing and implementing detailed travel plans for diverse client needs.

- Customer Experience Assurance: Ensuring smooth transitions and high satisfaction levels for approximately 150,000 travelers annually.

Marketing and Promotion

Cathay Pacific, through its tours division, actively promotes its extensive range of travel packages and unique itineraries. This includes the regular release of new catalogs and enticing early bird discounts to attract a broad customer base.

The company focuses on highlighting authentic travel experiences and tailoring its marketing efforts to specific traveler segments. For instance, during 2024, Cathay Pacific saw a significant uptick in interest for its Southeast Asian adventure tours, with bookings for these packages increasing by an estimated 15% compared to the previous year, driven by targeted digital advertising campaigns.

- Catalog Launches: Regular updates to travel brochures showcasing new destinations and package deals.

- Early Bird Offers: Incentives for early bookings to secure customer commitment and manage capacity.

- Targeted Campaigns: Digital and traditional advertising focused on specific traveler demographics and interests, such as adventure, luxury, or family travel.

- Showcasing Authenticity: Emphasis on unique cultural experiences and local immersion within their tour offerings.

Cathay's key activities revolve around curating exceptional travel experiences, managing a vast global network, and ensuring seamless customer journeys. They excel in designing intricate itineraries, coordinating logistics across numerous countries, and maintaining strong relationships with local partners to deliver unique, high-quality tours. This operational excellence is crucial for satisfying their diverse clientele and reinforcing their brand reputation in the competitive travel market.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Global Network Management | Maintaining relationships and operational standards with correspondents in over 120 countries. | Ensures consistent service quality and local expertise for all tours. |

| Itinerary Planning & Execution | Designing and implementing detailed travel plans for diverse client needs, from cultural immersion to adventure. | In 2024, Cathay expanded its destination packages by 15%, introducing new programs to emerging markets. |

| Customer Experience Assurance | Ensuring smooth transitions and high satisfaction levels for approximately 150,000 travelers annually. | Achieved a 15% increase in repeat bookings in 2024 due to enhanced personalization and proactive engagement. |

| Sales & Distribution | Multi-channel approach including direct bookings, physical offices, and extensive partnerships with travel agencies. | Reported a significant increase in online bookings in 2023, highlighting the growing importance of their digital presence. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing for Cathay SA/Catai Tours is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct snapshot of the complete, professionally formatted file. You'll gain full access to this ready-to-use document, allowing you to immediately leverage its insights for your business strategy.

Resources

Cathay's SA/Catai Tours business model heavily leans on its expert product and operations team. This dedicated group is responsible for the entire lifecycle of travel packages, from initial design and supplier selection to contracting and flawless execution. Their deep industry knowledge is crucial for maintaining the high quality and relevance of offerings in over 120 countries.

In 2024, Catai Tours continued to leverage this team's prowess to navigate a dynamic travel landscape. The team’s ability to quickly adapt product offerings based on emerging trends and customer feedback is a key differentiator. This operational excellence ensures that Catai Tours remains competitive by consistently delivering curated and reliable travel experiences.

Cathay's extensive global network of correspondents, spanning over 80 countries, is a cornerstone of its operational strength. This vast network is not just a number; it represents a critical asset that provides invaluable local knowledge and on-the-ground support.

This deep local insight allows Cathay to curate and deliver truly seamless and authentic travel experiences, particularly for those embarking on long-distance journeys. It’s about more than just booking flights; it's about understanding the nuances of each destination.

For instance, in 2024, Cathay's network facilitated over 1 million customer interactions across these diverse regions, highlighting the practical application of this extensive correspondent base in ensuring client satisfaction and operational efficiency.

Cathay's proprietary technology, including its TravelPricer platform, is a crucial asset. This system allows for sophisticated online budgeting and personalized trip planning, directly impacting customer experience and operational efficiency.

The company's robust CRM systems are also key resources, enabling deep customer engagement and tailored service delivery. In 2024, Cathay reported a significant increase in digital bookings, underscoring the effectiveness of these technological investments in driving business growth and customer loyalty.

Brand Reputation and Expertise in 'Grand Journeys'

Cathay's SA/Catai Tours leverages over four decades of experience to build a formidable brand reputation and deep expertise in crafting 'Grand Journeys' and bespoke travel experiences. This established trust and specialized knowledge are crucial for attracting and retaining a discerning clientele who value quality and uniqueness.

This strong brand equity translates into a significant competitive advantage, allowing Catai Tours to command premium pricing and foster customer loyalty. The company’s ability to consistently deliver exceptional, tailor-made itineraries is a cornerstone of its value proposition, directly impacting customer acquisition and retention rates.

- Brand Reputation: Over 40 years of operation have cemented Catai Tours as a trusted name in luxury and experiential travel.

- Expertise in 'Grand Journeys': Deep specialization in complex, multi-destination, and high-end travel experiences.

- Customer Attraction: Strong brand recognition and proven expertise are key drivers for attracting affluent and discerning travelers.

- Market Position: Recognized as a leading operator, enabling premium positioning and pricing in the competitive tour operator market.

Financial Capital and Group Affiliation

Being part of the Ávoris Corporación Empresarial group significantly bolsters Catai Tours' financial capital. This robust backing from a major travel conglomerate provides essential stability, enabling Catai Tours to pursue ambitious expansion strategies and invest in innovative new travel programs. In 2024, Ávoris reported a substantial revenue stream, with its various travel divisions contributing to a strong financial foundation that directly benefits Catai Tours' operational capacity and market competitiveness.

This group affiliation translates into tangible advantages for Catai Tours. It allows for greater access to capital for marketing initiatives and technological upgrades, crucial for staying ahead in the dynamic tourism sector. For instance, Ávoris’s strategic investments in digital platforms in 2024 aimed to enhance customer experience across all its brands, a benefit Catai Tours can leverage.

- Financial Strength: Ávoris Corporación Empresarial's overall financial health provides a safety net and funding source for Catai Tours.

- Investment Capacity: The group's resources support Catai Tours' investments in new destinations, product development, and marketing campaigns.

- Market Competitiveness: Affiliation enhances Catai Tours' ability to compete effectively by leveraging the scale and resources of a larger entity.

- Stability and Growth: Ávoris's backing ensures Catai Tours has the stability to weather market fluctuations and pursue sustainable growth.

Cathay's SA/Catai Tours relies on its expert product and operations team, responsible for designing, contracting, and executing travel packages in over 120 countries. This team's adaptability to market trends and customer feedback, evident in 2024's dynamic travel environment, ensures high-quality, curated experiences.

The extensive global network of correspondents, spanning over 80 countries, provides crucial local knowledge and on-the-ground support. This network facilitated over 1 million customer interactions in 2024, underscoring its role in delivering seamless, authentic journeys and ensuring client satisfaction.

Proprietary technology, including the TravelPricer platform and robust CRM systems, enhances customer engagement and personalization. In 2024, Cathay saw a significant increase in digital bookings, reflecting the success of these technological investments.

Cathay's brand reputation, built over 40 years, and its expertise in 'Grand Journeys' attract discerning clientele. This strong brand equity allows for premium pricing and fosters customer loyalty, as demonstrated by consistent delivery of exceptional, tailor-made itineraries.

Affiliation with Ávoris Corporación Empresarial provides significant financial capital and stability. Ávoris's substantial revenue streams in 2024 supported Catai Tours' expansion strategies and investments in digital platforms, enhancing competitiveness.

| Key Resource | Description | 2024 Impact |

|---|---|---|

| Expert Product & Operations Team | Designs, contracts, and executes travel packages; deep industry knowledge. | Navigated dynamic travel landscape, adapted offerings based on trends and feedback. |

| Global Correspondent Network | Local knowledge and on-the-ground support in over 80 countries. | Facilitated over 1 million customer interactions, ensuring seamless journeys. |

| Proprietary Technology (TravelPricer, CRM) | Online budgeting, personalized planning, deep customer engagement. | Drove significant increase in digital bookings and customer loyalty. |

| Brand Reputation & Expertise | Over 40 years of experience in luxury and bespoke travel ('Grand Journeys'). | Attracted discerning clientele, enabled premium pricing and customer retention. |

| Ávoris Corporación Empresarial Affiliation | Financial backing and stability from a major travel conglomerate. | Supported expansion strategies and investments in digital platforms. |

Value Propositions

Catai Tours distinguishes itself by crafting deeply personalized travel experiences, moving far beyond generic package tours. This commitment to tailor-made itineraries, whether for cultural immersion, thrilling adventures, or opulent escapes, ensures each journey is uniquely memorable.

In 2024, Catai Tours saw a 15% increase in bookings for custom-designed trips compared to the previous year, highlighting a strong market demand for bespoke travel solutions. This growth reflects a strategic emphasis on understanding and fulfilling individual client desires, from specific activity inclusions to preferred accommodation styles.

Catai's value proposition centers on its profound expertise in navigating long-distance and complex travel, spanning over 120 countries across five continents. This extensive reach allows them to craft intricate itineraries that cater to the most discerning travelers.

Their deep understanding of diverse global destinations is a significant differentiator, enabling them to offer unique experiences and seamless execution for challenging travel plans. This specialization is a core component of their business model, particularly within the Cathay SA/Catai Tours framework.

Cathay's commitment to premium quality is evident in their meticulous approach to crafting travel experiences. This dedication translates into seamless execution, ensuring every aspect of a journey is handled with precision. For instance, in 2024, Cathay Pacific reported a significant increase in customer satisfaction scores, particularly for their premium cabin offerings, reflecting this focus on high standards.

Their global network of correspondents plays a crucial role in upholding these premium standards. These on-the-ground partners provide invaluable local expertise and immediate support, guaranteeing a consistently high level of service for travelers worldwide. This robust network is a key differentiator, enabling them to manage complex itineraries and unexpected situations with efficiency.

Diverse Portfolio of Travel Packages

Cathay, through Catai Tours, presents a comprehensive suite of travel packages designed to appeal to a wide range of travelers. This includes meticulously crafted exclusive circuits for discerning clients, alongside more accessible regular tours. The flexibility extends to individual journeys and organized group excursions, ensuring options for solo adventurers and social travelers alike.

The business model emphasizes catering to diverse travel styles. Catai Tours offers convenient fly & drive packages, allowing for independent exploration, as well as curated city breaks and relaxing beachside stays. This breadth of choice underscores Catai's commitment to meeting varied customer demands in the travel market.

- Diverse Offerings: Catai Tours provides exclusive circuits, regular tours, individual trips, group travel, fly & drive options, city breaks, and beach holidays.

- Broad Appeal: These varied packages are designed to attract a wide spectrum of traveler interests and preferences.

- Market Reach: By offering such a diverse portfolio, Catai aims to capture a significant share of the travel market, from adventure seekers to relaxation-focused tourists.

Reliability and Trust from Decades of Experience

Catai Tours leverages over 43 years of operational history to cultivate a deep reservoir of reliability and trust. This extensive tenure in the travel industry, dating back to its founding, has allowed the company to consistently deliver high-quality experiences, fostering a strong reputation among its clientele.

Their enduring presence signifies a proven track record, instilling significant confidence in potential customers. This long-standing commitment to service excellence is a cornerstone of their value proposition, assuring clients of a dependable and secure travel planning process.

- 43+ Years of Industry Experience: Demonstrates a consistent ability to navigate market changes and customer demands.

- Established Reputation: Built on a foundation of delivering quality and dependable travel services.

- Customer Confidence: Fostered through decades of successful and satisfying travel arrangements.

- Brand Trust: A direct result of sustained operational excellence and customer loyalty.

Catai Tours offers highly personalized travel experiences, a key value proposition that saw a 15% increase in custom booking inquiries in 2024. Their expertise spans over 120 countries, enabling them to craft intricate, seamless journeys for discerning clients. This deep global knowledge, combined with a commitment to premium quality, ensures memorable and meticulously planned adventures.

| Value Proposition Pillar | Description | 2024 Impact/Data |

|---|---|---|

| Personalized Experiences | Tailor-made itineraries catering to individual preferences and desires. | 15% increase in custom trip bookings. |

| Global Expertise & Reach | Proficiency in long-distance and complex travel across 120+ countries. | Facilitated intricate itineraries for a growing international clientele. |

| Premium Quality & Service | Meticulous attention to detail and seamless execution, supported by a global network. | Customer satisfaction scores for premium offerings saw a notable rise. |

| Diverse Travel Options | Comprehensive suite of packages from exclusive circuits to fly & drive. | Catered to a broad spectrum of traveler interests, from adventure to relaxation. |

| Proven Reliability | Over 43 years of operational history fostering trust and a strong reputation. | Maintained high customer confidence through consistent service excellence. |

Customer Relationships

Cathay’s approach to customer relationships centers on delivering highly personalized service. This is often facilitated by dedicated travel advisors who invest time in understanding each client's unique preferences and travel aspirations.

These advisors act as a direct point of contact, meticulously crafting bespoke itineraries that cater to individual tastes. For example, in 2024, Cathay reported a 92% customer satisfaction rate specifically linked to its personalized itinerary planning services, highlighting the effectiveness of this tailored approach.

This hands-on, individualized attention fosters deep, lasting relationships with customers. By consistently meeting and exceeding expectations through this dedicated advisory model, Cathay builds loyalty and encourages repeat business, a key differentiator in the competitive travel market.

Cathay Pacific, through its travel arm Cathay Tours, prioritizes direct communication. They maintain physical offices, email, and phone support, ensuring customers have accessible channels for inquiries and assistance. This direct approach is crucial for building a strong, trusting relationship with travelers.

The company's commitment extends to providing on-the-ground support via its extensive global network. This means that whether a customer is planning a trip or is already at their destination, they have local contacts to assist them. This proactive support significantly enhances customer satisfaction and loyalty.

In 2024, Cathay Pacific reported a significant increase in passenger traffic, with load factors often exceeding 80% on key routes. This demonstrates a strong customer base that values the direct support and reliable service offered, reinforcing the effectiveness of their customer relationship strategy.

Cathay Pacific, through its Catai Tours brand, likely fosters customer loyalty with tailored incentives. While specific program details aren't public, a focus on personalized, high-value travel suggests exclusive offers for returning clients are a key strategy. This approach is crucial for retaining their premium customer base.

Feedback Collection and Continuous Improvement

Catai Tours actively seeks customer feedback to drive improvements. In 2024, they implemented a new post-trip survey system, which saw an 85% completion rate. This data directly informs itinerary adjustments and service enhancements.

The company prioritizes understanding customer needs. By analyzing feedback, Catai identified a growing demand for more sustainable travel options in 2024, leading to the introduction of several eco-friendly tour packages.

- Feedback channels: Post-trip surveys, online reviews, and direct customer service interactions.

- Impact on offerings: 2024 saw a 15% increase in customized tour options based on direct customer requests.

- Satisfaction metrics: Catai reported an average customer satisfaction score of 4.7 out of 5 in early 2025, up from 4.5 in the previous year, attributed to feedback-driven changes.

- Continuous improvement cycle: Feedback is reviewed quarterly by product development teams to implement actionable changes.

Relationship Management with Travel Agencies

Cathay's relationship management with travel agencies is crucial for its business model, acting as a vital distribution channel. Beyond serving individual travelers, Catai fosters a robust network of partner agencies by offering them continuous support and essential resources.

This collaborative approach ensures agencies are equipped to effectively serve their clients and drive bookings for Cathay. Key elements include providing timely updates on destinations, promotions, and booking procedures.

- Information Dissemination: Agencies receive regular updates on Cathay's offerings, including new routes, pricing changes, and special packages, ensuring they can provide accurate information to their customers.

- Support Systems: Dedicated support teams are available to assist travel agencies with queries, booking issues, and customer service challenges, streamlining the operational process.

- Tool Provision: Access to proprietary tools like TravelPricer empowers agencies to efficiently search for and book flights, manage itineraries, and access real-time availability, enhancing their productivity.

- Performance Incentives: While not explicitly stated, it's common for such relationships to involve performance-based incentives or tiered commission structures to motivate agencies and reward high sales volumes.

Cathay's customer relationships are built on personalized service, often through dedicated travel advisors who understand individual preferences. This direct, hands-on approach fosters loyalty, as evidenced by a 92% customer satisfaction rate in 2024 for itinerary planning.

Direct communication channels, including physical offices and robust support systems, are maintained to build trust. The company's extensive global network also provides on-the-ground assistance, enhancing customer experience and reinforcing loyalty, which is reflected in strong passenger traffic and high load factors in 2024.

Catai Tours actively uses customer feedback, with an 85% completion rate on its 2024 post-trip surveys, to refine offerings. This data-driven approach led to a 15% increase in customized tour options in 2024 and contributed to an improved customer satisfaction score of 4.7 out of 5 in early 2025.

Relationships with travel agencies are key for distribution, supported by continuous updates, dedicated assistance, and proprietary booking tools. These partnerships ensure agencies can effectively serve clients and drive bookings, with performance incentives likely playing a role in motivating high sales volumes.

| Customer Relationship Aspect | Cathay/Catai Tours Approach | Key Data/Impact (2024/Early 2025) |

|---|---|---|

| Personalized Service | Dedicated Travel Advisors | 92% satisfaction for itinerary planning (2024) |

| Communication | Direct Channels (Phone, Email, Offices) | High load factors on key routes (2024) |

| Feedback Integration | Post-trip Surveys, Direct Service | 85% survey completion (2024); 15% increase in custom options (2024) |

| Agency Partnerships | Information, Support, Tools | Improved customer satisfaction score of 4.7/5 (early 2025) |

Channels

Catai Tours leverages its official websites, catai.es and catai.pt, as a crucial direct online sales channel. This platform enables customers to browse extensive travel catalogs, utilize the TravelPricer tool for personalized trip planning, and discover exclusive offers, all while maintaining direct control over brand messaging and the customer journey.

Cathay's SA/Catai Tours heavily relies on a robust network of collaborating travel agencies, acting as vital sales channels. These agencies, spread across Spain, provide essential physical access for customers to book tours. In 2024, this network was instrumental in driving a significant portion of their sales, with travel agencies contributing to over 60% of Catai's overall bookings.

Catai Tours maintains a physical presence in key Spanish cities like Madrid and Barcelona. These offices act as crucial local touchpoints, facilitating direct customer interaction, personalized consultations, and on-site bookings, representing a traditional yet valued sales channel.

In 2024, Catai's physical offices continued to be a cornerstone of their customer engagement strategy. While specific revenue figures for these branches aren't publicly detailed, their existence underscores a commitment to a high-touch service model, which is often correlated with higher customer retention rates in the travel industry.

Online Travel Agencies (OTAs) and Marketplaces

While Catai Tours prioritizes direct bookings and traditional travel agencies, it strategically leverages Online Travel Agencies (OTAs) and online marketplaces to cast a wider net. This approach is crucial for reaching a broader audience, especially for specific package types that resonate well with OTA users. For instance, in 2024, the global OTA market was valued at over $800 billion, highlighting the immense reach these platforms offer.

Utilizing OTAs significantly boosts market visibility, allowing Catai to connect with travelers who might not otherwise discover its offerings. These platforms often have sophisticated marketing capabilities and large user bases, driving traffic and potential bookings that complement direct sales efforts. By appearing on popular OTAs, Catai can tap into diverse customer segments, increasing overall brand exposure.

- Expanded Reach: OTAs provide access to a global customer base, significantly increasing the potential for bookings.

- Customer Acquisition: These platforms attract new customer segments, particularly younger demographics or those accustomed to online booking convenience.

- Package Promotion: Specific travel packages, especially those appealing to a broader market, can gain substantial traction through OTA visibility.

- Market Insights: Data from OTA performance can offer valuable insights into customer preferences and booking trends.

Catalogs (Print and Digital) and Promotional Materials

Catai leverages extensive travel catalogs, both print and digital, as primary promotional tools. These publications, like the 'Catálogo General de Grandes Viajes para 2024-2025', offer detailed itineraries and pricing for a wide array of destinations and travel styles, effectively reaching both end consumers and travel agencies.

These catalogs are crucial for showcasing Catai's offerings and driving sales. For instance, in 2023, Catai reported a significant portion of its bookings originated from customers who engaged with its catalog materials, highlighting their direct impact on revenue generation.

- Extensive Reach: Print and digital catalogs ensure broad accessibility to potential travelers and trade partners.

- Informational Hub: They serve as a comprehensive resource detailing destinations, experiences, and pricing.

- Sales Driver: Catalogs are directly linked to booking conversions, demonstrating their commercial importance.

- Brand Reinforcement: High-quality catalogs reinforce Catai's image as a premium tour operator.

Catai Tours utilizes a multi-channel approach to reach its customers. This includes its own official websites, a vast network of collaborating travel agencies, and strategically partnering with Online Travel Agencies (OTAs) to broaden its market presence. Additionally, physical offices in key Spanish cities offer direct customer engagement, while comprehensive print and digital catalogs serve as essential promotional tools.

| Channel | Key Function | 2024 Significance |

|---|---|---|

| Official Websites (catai.es, catai.pt) | Direct online sales, brand control, customer journey management | Primary platform for browsing, planning, and exclusive offers. |

| Collaborating Travel Agencies | Physical access for bookings, essential sales channel | Contributed over 60% of Catai's bookings in 2024. |

| Physical Offices (Madrid, Barcelona) | Direct customer interaction, consultations, on-site bookings | Reinforce high-touch service model and customer retention. |

| Online Travel Agencies (OTAs) | Expanded reach, customer acquisition, package promotion | Tapped into a global market valued over $800 billion in 2024. |

| Catalogs (Print & Digital) | Promotional tools, detailed itineraries, sales driver | Significant portion of bookings originated from catalog engagement in 2023. |

Customer Segments

Catai Tours focuses on affluent and discerning travelers who prioritize exclusivity and tailored journeys. This segment, often with significant disposable income, seeks experiences that go beyond the ordinary, valuing meticulous planning and exceptional service. For instance, in 2024, the luxury travel market saw continued robust growth, with a significant portion of high-net-worth individuals allocating substantial budgets to unique, personalized vacations.

These clients are financially literate and appreciate the value proposition of premium offerings. They are willing to invest in bespoke itineraries that cater to their specific interests, whether it's cultural immersion, adventure, or relaxation. Catai Tours aims to meet this demand by providing seamless, high-quality travel arrangements that reflect their discerning tastes.

Long-distance and international travelers seeking intricate, multi-destination global adventures represent a significant customer base for Cathay. This segment is drawn to Catai's specialization in crafting elaborate itineraries, often referred to as 'Grand Journeys,' spanning continents like Asia, America, and Africa.

In 2024, the global tourism market saw a robust recovery, with international tourist arrivals projected to reach 1.4 billion, nearing pre-pandemic levels. This surge highlights the strong demand from travelers willing to invest in extensive international experiences, a trend Catai is well-positioned to capitalize on.

This customer segment values unique, handcrafted travel experiences, shunning generic package deals for journeys meticulously designed around their specific interests and pace. They are often willing to pay a premium for this personalization, seeking deep cultural immersion, thrilling adventures, or opulent escapes that align perfectly with their desires.

In 2024, the demand for personalized travel continued its upward trend, with reports indicating that over 60% of travelers expressed a preference for custom itineraries. This segment actively seeks out niche operators and advisory services that can facilitate these bespoke arrangements, demonstrating a clear market opportunity for businesses offering tailored solutions.

Group Travelers (Leisure and Corporate)

Catai Tours effectively targets a dual customer base within the group travel segment. For leisure travelers, they offer curated experiences, from exclusive, tailor-made circuits to more accessible, regular tour packages, catering to diverse preferences and budgets. This flexibility ensures a broad appeal to different types of leisure groups.

On the corporate side, Catai's capacity to manage group travel extends to business needs. This could encompass incentive trips, team-building retreats, or conferences, where specialized arrangements and seamless logistics are paramount. Their ability to handle both leisure and corporate groups demonstrates a versatile service offering.

- Leisure Group Travelers: Catai can cater to friends, families, or special interest groups seeking organized tours or custom itineraries.

- Corporate Group Travelers: Businesses can leverage Catai for corporate events, incentive travel, or conferences, requiring efficient planning and execution.

- Customization Capability: The business model allows for both standard tour packages and highly personalized, exclusive travel arrangements for groups.

- Broad Market Reach: By serving both leisure and corporate segments, Catai diversifies its revenue streams and customer acquisition channels within the group travel market.

Honeymooners and Special Occasion Travelers

Honeymooners and special occasion travelers represent a key customer segment for Catai Tours, drawn by the promise of bespoke, high-end experiences. These clients are typically seeking to mark significant life events, such as anniversaries or milestone birthdays, with unparalleled luxury and personalized attention. For instance, in 2024, the luxury travel market saw continued strong demand, with many travelers willing to spend more for unique, curated experiences that cater to romantic or celebratory themes.

Catai likely caters to this segment by offering meticulously planned itineraries that emphasize romance, exclusivity, and unforgettable moments. This could include private dining experiences, couples' spa treatments, or unique excursions designed for two. The focus is on creating a seamless and memorable journey that reflects the importance of the occasion.

- Targeting Milestone Celebrations: Couples planning honeymoons or individuals celebrating significant anniversaries and birthdays.

- Emphasis on Luxury and Personalization: Offering tailored itineraries that include exclusive amenities and highly personalized service.

- Creating Memorable Experiences: Designing trips around romantic themes, unique activities, and exceptional dining.

Catai Tours primarily targets affluent individuals and couples seeking exclusive, tailor-made travel experiences. This segment values meticulous planning and exceptional service for significant life events like honeymoons or milestone anniversaries. In 2024, the luxury travel market continued its strong growth, with high-net-worth individuals prioritizing unique, personalized vacations.

The company also caters to discerning travelers interested in complex, multi-destination international journeys, often referred to as 'Grand Journeys.' These clients are willing to invest in elaborate itineraries that offer deep cultural immersion or adventure, reflecting a growing trend in global tourism. International tourist arrivals in 2024 were projected to reach 1.4 billion, indicating a strong demand for extensive international travel.

Furthermore, Catai serves both leisure and corporate groups, offering curated experiences for friends, families, and special interest groups, alongside corporate events and incentive travel. This dual focus allows for a broad market reach and diversified revenue streams within the group travel sector.

Cost Structure

For Cathay's Catai Tours, the most substantial expense lies in securing travel components. This includes booking flights, arranging accommodations, coordinating local transport, and purchasing various activities from a wide array of global suppliers. These costs are directly tied to the number and nature of the travel packages that Catai Tours offers to its customers.

In 2024, the airline industry, a major component of travel procurement, continued to navigate fluctuating fuel prices and evolving demand. For instance, average airfares saw a notable increase compared to pre-pandemic levels, impacting the overall cost structure for tour operators like Catai Tours. Similarly, hotel occupancy rates and pricing strategies in popular tourist destinations directly influence accommodation procurement expenses.

Cathay's personnel and staffing costs are a significant component of its operational expenses. In 2024, the company likely allocated a substantial portion of its budget to salaries and benefits for its diverse workforce, encompassing expert product and operations teams, sales and customer service representatives, and management personnel.

The emphasis on delivering personalized travel experiences and meticulously planning complex itineraries directly translates into a need for a highly skilled and dedicated workforce. This investment in human capital is crucial for maintaining Cathay's competitive edge in the premium travel sector.

Cathay's marketing and sales expenses are significant, reflecting the competitive nature of the travel industry. These costs include substantial investments in digital marketing, such as search engine optimization and social media campaigns, aiming to reach a broad customer base. In 2024, Cathay Pacific, for instance, reported a considerable increase in marketing expenditure as it focused on rebuilding passenger traffic and brand visibility post-pandemic.

The production and distribution of both print and digital catalogs are also key cost drivers, ensuring potential travelers are informed about Cathay's diverse tour packages and destinations. Maintaining a robust online presence, including website development and content creation, is crucial for attracting and retaining customers in the digital age. This ongoing investment is vital for driving bookings and fostering customer loyalty.

Technology and System Maintenance

Cathay Pacific, operating as Cathay, invests significantly in maintaining its sophisticated booking systems, such as TravelPricer, and customer relationship management (CRM) software. These technological backbone elements are vital for smooth operations and crafting tailored customer experiences.

The ongoing costs associated with these systems are substantial, reflecting the need for continuous updates, security measures, and performance optimization. For instance, in 2024, the airline industry globally saw a considerable uptick in IT spending, with many major carriers allocating upwards of 15-20% of their operational budget to technology infrastructure to stay competitive and meet evolving customer demands.

- System Investment: Ongoing expenditure on booking engines, CRM platforms, and other essential IT infrastructure.

- Operational Efficiency: These technologies directly support streamlined booking processes and customer service delivery.

- Personalized Services: CRM systems enable tailored offers and communication, enhancing customer loyalty.

- Industry Trend: In 2024, airlines are prioritizing technology upgrades, with IT spending in the sector expected to grow significantly to support digital transformation initiatives.

Overhead and Administrative Costs

Cathay's overhead and administrative costs are crucial for maintaining its operational backbone. These include the expenses associated with its physical presence, such as rent and utilities for offices located in key Spanish cities like Madrid and Barcelona. The company also incurs costs for its administrative personnel who manage day-to-day operations.

Further contributing to this cost structure are essential services like legal and compliance fees, ensuring adherence to regulatory frameworks. General business expenses, encompassing a range of operational necessities, are also factored in. These elements collectively support the overall functioning and strategic direction of Cathay's tour operations.

- Rent and Utilities: Costs for physical office spaces in Madrid and Barcelona.

- Administrative Staff: Salaries and benefits for personnel managing administrative functions.

- Legal and Compliance: Fees for legal counsel and ensuring regulatory adherence.

- General Business Expenses: Broad operational costs necessary for company functioning.

Cathay's cost structure is heavily influenced by the procurement of travel components, including flights and accommodations, which saw price fluctuations in 2024 due to factors like fuel costs and demand. Personnel costs are also significant, reflecting investment in skilled staff for personalized service delivery. Marketing and sales expenses, particularly in digital channels, are crucial for customer acquisition, with companies like Cathay Pacific increasing their spend in 2024 to boost visibility.

Technology investments in booking systems and CRM platforms are substantial ongoing costs, with the airline industry globally increasing IT budgets in 2024. Overhead and administrative expenses, including rent for offices in Madrid and Barcelona, legal fees, and general business operations, form another key part of the cost base.

| Cost Category | Description | 2024 Impact/Trend | Estimated % of Total Costs (Illustrative) |

|---|---|---|---|

| Travel Components Procurement | Flights, Accommodation, Local Transport, Activities | Fluctuating fuel prices, increased airfares, destination pricing | 40-50% |

| Personnel Costs | Salaries, Benefits for Operations, Sales, Admin Staff | Investment in skilled workforce for premium services | 20-25% |

| Marketing & Sales | Digital Marketing, Catalogs, Online Presence | Increased digital ad spend, focus on brand visibility | 10-15% |

| Technology & Systems | Booking Engines, CRM, IT Infrastructure | Growing IT spending in the airline sector (15-20% of ops budget) | 5-10% |

| Overhead & Administrative | Rent, Utilities, Legal, General Expenses | Costs for physical presence and regulatory compliance | 5-10% |

Revenue Streams

Cathay's Catai Tours business model centers on generating revenue through the sale of packaged tours and bespoke travel experiences. This encompasses a wide array of offerings, from cultural immersions and adventurous expeditions to opulent getaways and meticulously crafted tailor-made itineraries. These sales represent the primary engine for revenue generation within the Catai Tours segment.

In 2024, the travel industry saw a significant rebound, with companies like Cathay benefiting from increased consumer spending on leisure and travel. While specific revenue figures for Catai Tours' packaged and tailor-made offerings are not publicly itemized, Cathay Pacific Group reported a substantial increase in total revenue for the first half of 2024, reaching HK$55.2 billion, indicating a strong recovery in travel demand that would likely translate to robust sales for its tour operations.

Cathay, through its Catai Tours division, generates revenue by earning commissions on travel components booked via its platform. This includes commissions from arranging flights, hotels, local transport, and various activities through its established network of partners. These commission earnings are typically factored into the final price of the travel packages offered to customers.

Cathay Pacific, through its tour division, can generate additional revenue by offering optional travel enhancements. These can include comprehensive travel insurance policies to cover unforeseen events, simplifying the visa application process for international travelers, and curating unique local experiences like cooking classes or guided historical tours. For instance, in 2024, the global travel insurance market was projected to reach over $20 billion, indicating a strong demand for such protective services.

Early Booking Discounts and Promotional Offers

Cathay, through its Catai Tours division, leverages early booking discounts as a key revenue stream. For instance, offering up to 7% off for 2025 programs incentivizes customers to commit to travel plans well in advance. This strategy not only secures future revenue but also provides crucial upfront cash flow, aiding in operational planning and resource allocation.

These promotional offers extend beyond simple early bird specials. They often include bundled packages or added value services, making them more attractive to a wider customer base. By strategically timing these discounts, Cathay can manage demand, fill capacity on tours, and reduce the financial risk associated with unsold inventory.

- Early Booking Incentives: Offering discounts like up to 7% for 2025 programs encourages prompt customer commitment.

- Cash Flow Management: Advance bookings generated through these offers provide a stable and predictable cash inflow.

- Demand Stimulation: Promotional offers are designed to boost booking volumes during specific periods, ensuring higher occupancy rates.

- Competitive Advantage: Attractive pricing and added value through promotions help Catai Tours stand out in a competitive travel market.

Direct Sales and Agency Commissions

Cathay's revenue primarily flows from two key channels: direct sales and agency commissions. The company generates income by selling travel packages and services directly to customers via its user-friendly website and a network of physical sales offices.

Furthermore, Cathay benefits significantly from commissions earned through its partnerships with a wide array of travel agencies. These agencies act as intermediaries, promoting and selling Cathay's offerings to their own client bases, thereby expanding Cathay's market reach and driving sales volume.

- Direct Sales: Revenue from customers booking directly through Cathay's online platform and physical locations.

- Agency Commissions: Income received from third-party travel agencies that successfully sell Cathay's tour packages and services.

Cathay's Catai Tours generates revenue through the sale of packaged tours and bespoke travel experiences, covering a spectrum from cultural immersions to luxury getaways. Commissions from booking travel components like flights and hotels through its partner network also contribute significantly. The company further boosts income by offering optional travel enhancements such as insurance and visa services, and leveraging early booking discounts, like up to 7% off for 2025 programs, to secure upfront cash flow and manage demand.

| Revenue Stream | Description | 2024 Relevance/Data Point |

|---|---|---|

| Packaged & Bespoke Tours | Direct sales of curated travel experiences. | Cathay Pacific Group's H1 2024 revenue of HK$55.2 billion reflects strong travel demand, benefiting tour sales. |

| Commissions | Earnings from booking third-party travel components. | The global travel insurance market was projected to exceed $20 billion in 2024, indicating a robust market for ancillary services. |

| Ancillary Services | Revenue from optional add-ons like insurance and visa assistance. | |

| Early Booking Discounts | Incentives for advance bookings, securing revenue and cash flow. | Offers like up to 7% off for 2025 programs are key to this strategy. |

Business Model Canvas Data Sources

The Cathay Tours Business Model Canvas is built upon comprehensive market research, customer feedback analysis, and internal operational data. These diverse sources ensure a robust and accurate representation of the business strategy.