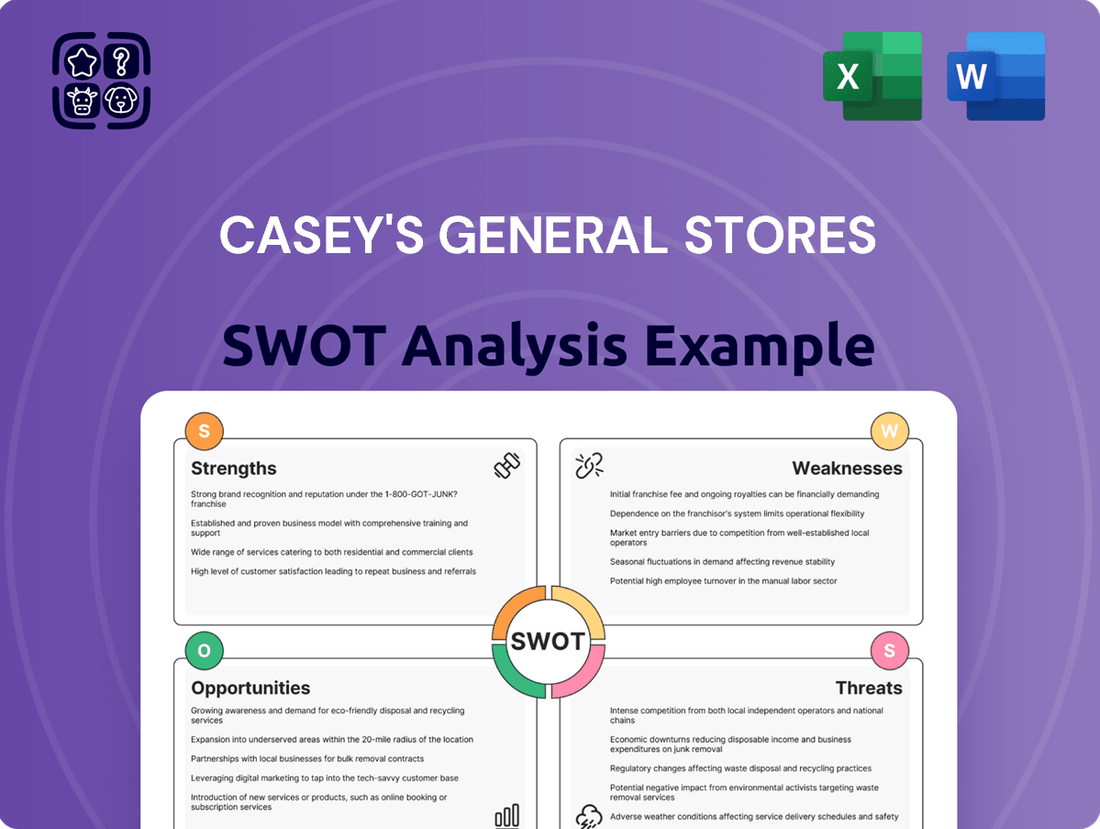

Casey's General Stores SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casey's General Stores Bundle

Casey's General Stores boasts strong brand recognition and a loyal customer base, but faces intense competition and potential supply chain disruptions. Understanding these dynamics is crucial for any investor or strategist looking to capitalize on their unique convenience store model.

Want the full story behind Casey's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Casey's boasts a robust prepared food program, particularly its pizza offering, which has cemented its position as the fifth-largest pizza chain in the United States. This strategic focus on hot, ready-to-eat items like pizza and donuts is a key driver of impressive inside sales, setting it apart from conventional convenience store formats.

The company's commitment to innovation within its prepared food segment, including the introduction of new menu items and its own private label products, directly contributes to enhanced profit margins and fosters greater customer loyalty.

Casey's General Stores' strategic focus on rural and small-town markets is a significant strength, allowing them to become essential community hubs. This niche approach often means less direct competition from larger national retailers, fostering deep customer loyalty. For instance, in fiscal year 2024, Casey's reported over 2,500 stores, with a substantial portion located in these underserved areas, demonstrating their commitment to this strategy.

Casey's has been aggressively expanding its store footprint, a key strength. This growth is driven by both building new locations and acquiring existing ones, like the recent purchase of CEFCO/Fikes stores.

The company has a clear vision for continued expansion, targeting the addition of hundreds of new stores by fiscal year 2026. This strategic growth not only increases their market presence but also directly contributes to their earnings before interest, taxes, depreciation, and amortization (EBITDA).

Diversified Revenue Streams Beyond Fuel

Casey's General Stores effectively diversifies its income beyond just fuel sales. Their in-store offerings, encompassing groceries, prepared foods, beverages, and general merchandise, represent a substantial revenue driver.

This strategic diversification, especially the focus on high-margin prepared foods, significantly cushions the business against the volatility of fuel prices. For instance, in fiscal year 2024, same-store sales for prepared foods and fountain beverages saw robust growth, highlighting their importance to overall profitability.

- In-Store Sales Growth: Casey's reported strong performance in its prepared food and beverage categories during fiscal year 2024.

- Margin Enhancement: Prepared foods typically carry higher profit margins than fuel, improving overall gross profit.

- Resilience to Fuel Volatility: Diversification reduces reliance on fuel, providing greater financial stability.

- Customer Convenience: Offering a broad range of goods caters to diverse customer needs, driving repeat business.

Growing Loyalty Program and Digital Engagement

Casey's Rewards program continues to be a significant driver of customer loyalty, boasting millions of active members. This robust program encourages repeat business and fosters a deeper connection with the brand.

The company is actively investing in digital transformation, enhancing customer experience through technology. Initiatives like mobile ordering and personalized promotions are key to this strategy, aiming to make shopping more convenient and tailored.

By focusing on digital engagement and a growing loyalty program, Casey's is building a strong foundation for sustained customer relationships and increased sales volume, as evidenced by the program's continued expansion.

- Millions of members in Casey's Rewards program.

- Focus on mobile ordering and personalized promotions.

- Digital tools enhancing customer experience.

Casey's strong prepared food program, especially its pizza, makes it the fifth-largest pizza chain in the US. This focus on hot, ready-to-eat items drives impressive inside sales, differentiating it from typical convenience stores.

The company's expansion strategy, including new builds and acquisitions like CEFCO/Fikes, is a major strength. Casey's aims to add hundreds of new stores by fiscal year 2026, boosting its market presence and EBITDA.

Casey's Rewards program, with millions of active members, is crucial for customer loyalty and repeat business. The company's investment in digital tools like mobile ordering further enhances customer experience and engagement.

| Metric | Fiscal Year 2024 Data | Significance |

|---|---|---|

| Prepared Food & Fountain Same-Store Sales Growth | +5.4% | Highlights strong customer demand for in-store offerings. |

| Total Stores | Over 2,500 | Demonstrates significant market penetration, especially in rural areas. |

| Casey's Rewards Members | Millions | Indicates a robust loyalty base driving repeat purchases. |

What is included in the product

Offers a full breakdown of Casey's General Stores’s strategic business environment, detailing its strong brand recognition and convenient locations while also noting potential challenges in expanding its prepared food offerings and navigating competitive pressures.

Offers a clear, actionable framework to address Casey's General Stores' competitive challenges and capitalize on its market strengths.

Weaknesses

While Casey's has been expanding its grocery and prepared food offerings, a substantial portion of its revenue still comes from fuel sales. This makes the company vulnerable to swings in gasoline prices and demand, which can be unpredictable. For example, in fiscal year 2024, fuel sales accounted for roughly 65% of Casey's total revenue, highlighting this ongoing dependency.

Casey's primary operational focus remains concentrated within the Midwestern and Southern United States. While this provides a robust regional footprint, it also exposes the company to heightened vulnerability from localized economic downturns or adverse weather patterns. For instance, a severe drought impacting agricultural output in key Midwestern states could disproportionately affect Casey's sales compared to a competitor with a broader national presence.

Casey's General Stores operates in a convenience store sector that is incredibly crowded. Major national brands, alongside many smaller, local operators, are all vying for customer attention. This intense competition is further amplified by grocery chains and fast-food restaurants increasingly offering convenience items, directly challenging Casey's traditional market.

This competitive landscape puts significant pressure on pricing strategies and can make it challenging to maintain or grow market share. For instance, in 2023, the convenience store industry saw a 5.7% increase in sales, reaching $907 billion, but this growth is spread across a vast number of retailers, making it harder for any single player to capture a disproportionately large piece of the pie.

Potential for High Operating Costs

Operating a vast network of physical convenience stores, particularly those with extensive prepared food offerings, inherently translates to substantial overhead. These costs encompass staffing, utilities, and the intricate logistics of managing a diverse inventory. For instance, the U.S. Bureau of Labor Statistics reported a 4.1% increase in the Consumer Price Index for all urban consumers in 2023, impacting energy and food prices, which directly affects Casey's operating expenses.

Furthermore, ongoing inflationary trends, especially concerning wages and the cost of goods, can exert considerable pressure on Casey's profit margins and overall operational efficiency. The company's reliance on a physical footprint means these cost increases are a constant challenge to mitigate.

- Labor Costs: Rising minimum wages and competition for qualified staff can significantly increase payroll expenses.

- Energy Expenses: Maintaining lighting, refrigeration, and HVAC systems in hundreds of locations contributes to high utility bills, especially with fluctuating energy prices.

- Inventory Management: The cost of spoilage for prepared foods and the capital tied up in managing a wide variety of products can be substantial.

- Real Estate and Maintenance: Rent, property taxes, and ongoing upkeep for a large number of physical stores represent a fixed cost burden.

Challenges with Supply Chain and Labor Consistency

Managing Casey's General Stores' extensive supply chain, which serves numerous locations, many in rural areas, is a significant undertaking. This complexity is amplified by the need to ensure product availability across a diverse inventory. For instance, in 2024, the company operated over 2,500 stores, each requiring a steady flow of goods, from fuel to fresh food items.

The convenience store sector, including Casey's, grapples with persistent labor management issues. These challenges encompass maintaining adequate staffing levels, attracting qualified employees, and standardizing training protocols across its vast network. In 2023, the retail sector as a whole experienced a notable labor shortage, with average hourly wages for retail workers increasing to support recruitment and retention efforts.

- Logistical Hurdles: Distributing a wide array of products to over 2,500 stores, many in geographically dispersed rural settings, creates inherent supply chain complexities.

- Staffing Shortages: The convenience store industry consistently faces difficulties in recruiting and retaining sufficient staff, impacting operational efficiency.

- Training Consistency: Ensuring uniform and effective employee training across all Casey's locations is a continuous challenge, vital for maintaining service quality and brand standards.

- Rising Labor Costs: Increased competition for workers in the retail sector has driven up wages, impacting the cost of labor for companies like Casey's.

Casey's significant reliance on fuel sales, approximately 65% of its revenue in fiscal year 2024, exposes it to volatile gasoline prices and demand fluctuations. This dependency can negatively impact financial performance when fuel markets are unfavorable. Furthermore, its concentrated presence in the Midwest and South makes it susceptible to regional economic downturns or severe weather events that could disrupt operations and sales.

The convenience store market is highly competitive, with numerous national chains, local operators, and even grocery stores and fast-food restaurants encroaching on the sector. This intense rivalry, evidenced by the industry's $907 billion in sales in 2023, puts pressure on pricing and market share growth for Casey's.

Operating a large network of physical stores incurs substantial overhead costs, including labor, utilities, and maintenance, all of which are subject to inflationary pressures like the 4.1% CPI increase in 2023. These rising expenses, particularly for wages and energy, can squeeze profit margins.

Casey's faces ongoing labor management challenges, including staffing shortages and the need for consistent training across its over 2,500 locations. The retail sector's average hourly wages increased in 2023 to attract and retain workers, adding to Casey's operational costs.

What You See Is What You Get

Casey's General Stores SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for Casey's General Stores. This comprehensive report details their Strengths, Weaknesses, Opportunities, and Threats. The complete version, offering in-depth insights and actionable strategies, becomes available immediately after checkout.

Opportunities

Casey's General Stores is actively pursuing expansion, with a strategic focus on both acquiring existing locations and building new stores. Their goal is to significantly increase their store count, potentially adding hundreds more locations in the coming years. This growth is a key opportunity to reach more customers.

A prime example of this expansion strategy is their entry into new states, such as Texas. By entering these new markets, Casey's can tap into previously unreached customer bases and deepen their market penetration. This geographical diversification is crucial for long-term growth.

Casey's has a prime opportunity to boost its prepared foods segment by introducing exciting, unique, and signature menu items. This focus on craveable, exclusive offerings can drive traffic and increase sales of high-margin items, a key growth area for convenience retailers.

Expanding its private label product line also presents a substantial avenue for growth. By developing and promoting its own branded goods, Casey's can capture more consumer spending and potentially improve profitability, leveraging the increasing consumer acceptance of private label brands.

Casey's can boost efficiency by integrating AI for smarter inventory tracking, reducing stockouts and overstocking. This technology also aids in predicting customer buying habits, allowing for more targeted promotions and personalized shopping experiences. Think of automated checkout systems streamlining the process, making it quicker for customers to get what they need.

Digital transformation initiatives, including enhanced loyalty programs powered by data analytics, can foster deeper customer engagement. In 2024, retailers leveraging AI saw an average 15% increase in customer retention rates. This focus on personalization and smoother transactions directly translates to improved customer satisfaction and potentially higher sales volumes.

Responding to Evolving Consumer Preferences

Consumers are increasingly prioritizing healthier food and beverage choices, along with a growing demand for sustainable business practices. Casey's can leverage this shift by expanding its product lines to include more fresh, nutritious, and environmentally conscious options. This strategic move not only addresses current consumer desires but also fosters long-term brand loyalty.

For instance, the convenience store sector has seen a notable rise in demand for grab-and-go salads and healthier snack alternatives. In 2024, sales of healthy snacks in convenience stores were projected to grow by 5-7%, indicating a significant market opportunity. Casey's can capitalize on this by:

- Introducing a wider variety of fresh fruit and vegetable options.

- Expanding the selection of low-sugar and plant-based beverages.

- Highlighting products with clear nutritional information and sustainable sourcing.

- Offering more prepared meals featuring whole grains and lean proteins.

Strategic Partnerships and Community Engagement

Forming strategic partnerships, like those with popular food delivery platforms, can significantly boost Casey's General Stores' reach. Imagine integrating with services that already have a strong presence in the communities Casey's serves, making their offerings more accessible. This could translate into increased sales and a wider customer base, especially for their popular pizza and breakfast items.

Nurturing its community-first ethos is a powerful opportunity for Casey's. By continuing to support local events and initiatives, the brand can deepen its connection with customers, particularly in the rural areas that form its core. This genuine engagement fosters strong brand loyalty, which is invaluable. For instance, Casey's commitment to sponsoring local youth sports teams in 2023 alone involved over 2,000 teams, underscoring this community focus.

- Expand reach through partnerships with food delivery services, potentially increasing sales volume by leveraging existing customer bases.

- Strengthen brand affinity by continuing to invest in community initiatives, fostering customer loyalty and positive brand perception.

- Enhance convenience for customers by integrating with services that align with their daily needs and preferences.

- Differentiate from competitors by emphasizing a strong community connection, a key factor for consumers in rural markets.

Casey's can capitalize on the growing demand for healthier options by expanding its fresh food and beverage selections, aligning with consumer preferences for nutritious and sustainable choices. This strategic pivot, supported by a 5-7% projected growth in healthy snack sales within convenience stores in 2024, offers a significant avenue for increased market share and customer loyalty.

Threats

Ongoing economic uncertainties, including persistent inflation, continue to pose a significant threat. For instance, the U.S. inflation rate was 3.3% in April 2024, impacting consumer purchasing power and potentially reducing discretionary spending at stores like Casey's.

Rising operational costs are a major concern, with fuel prices, labor, and wholesale goods all contributing to increased expenses. Average U.S. gasoline prices in May 2024 hovered around $3.60 per gallon, directly affecting both Casey's fuel sales margins and the disposable income of its customers.

These combined pressures can significantly erode profitability and challenge the financial stability of convenience store chains. The delicate balance between maintaining competitive pricing and absorbing rising costs is a critical operational hurdle for Casey's General Stores in the current economic climate.

Changes in consumer preferences, such as a growing demand for healthier food options and a significant shift towards online shopping, could directly reduce in-store traffic and sales for Casey's General Stores. This trend is further amplified by the increasing popularity of GLP-1 drugs, which may alter overall food and beverage consumption patterns for a segment of the population.

The accelerating adoption of electric vehicles presents a substantial long-term threat to Casey's fuel sales, a critical revenue stream. As more consumers transition to EVs, the demand for gasoline at their convenience stores is projected to decline, necessitating strategic adjustments to their business model.

Casey's General Stores faces a significant threat from an increasingly crowded market. Beyond traditional convenience store competitors, grocery chains and fast-casual restaurants are actively enhancing their convenience-focused product lines and services, directly encroaching on Casey's core business. This heightened competition can trigger price wars, making it difficult for Casey's to protect its market share and profitability.

Labor Shortages and Rising Wages

The convenience store industry, including businesses like Casey's General Stores, is grappling with significant labor shortages. This scarcity drives up wages as companies compete for a limited pool of workers. For instance, the U.S. Bureau of Labor Statistics reported that average hourly earnings for all employees in the food services and drinking places sector, which often overlaps with convenience store staffing, saw an increase of 4.8% year-over-year as of early 2024.

These staffing issues directly impact operational efficiency. When stores are understaffed, it can lead to longer customer wait times, reduced product availability, and a strain on existing employees, potentially affecting morale and retention. Consistent, quality training is also harder to maintain with high turnover, which is a common challenge in the sector.

The combined effect of higher wages and potential dips in service quality can negatively affect profitability. Casey's, like its competitors, must invest more in compensation and benefits to attract and retain staff, while also ensuring that customer experience remains a priority despite these pressures. The National Association of Convenience Stores (NACS) has highlighted that labor costs represent a significant portion of operating expenses for many convenience retailers.

- Labor Shortages: Difficulty in finding and retaining qualified employees.

- Rising Wages: Increased compensation costs to attract and keep staff.

- Operational Impact: Potential for reduced efficiency and service quality due to understaffing.

- Profitability Concerns: Higher labor expenses can squeeze profit margins.

Technological Disruption and Cybersecurity Risks

The relentless march of technology, while a boon for efficiency, also poses significant threats to retailers like Casey's General Stores. Keeping pace with innovations, from AI-driven inventory management to personalized customer experiences, demands substantial and ongoing capital investment. Failure to adapt quickly can lead to competitive disadvantages.

Furthermore, Casey's increasing integration of digital platforms and its handling of sensitive customer data create a heightened vulnerability to cybersecurity threats. A data breach could not only lead to financial losses from remediation and regulatory fines but also severely damage customer trust. For instance, the retail sector experienced a notable increase in cyberattacks targeting customer data in 2024, with average costs for a data breach reaching millions of dollars.

- Technological Obsolescence: The risk of current systems becoming outdated, requiring costly upgrades to maintain operational efficiency and customer engagement.

- Cybersecurity Breaches: Exposure to data theft, ransomware, and other cybercrimes that could compromise customer information and disrupt business operations.

- Increased IT Spending: The necessity for continuous investment in new technologies to remain competitive, potentially straining budgets if not managed strategically.

Intensifying competition from grocery stores and fast-casual dining presents a significant threat, potentially leading to price wars and market share erosion. The rise of electric vehicles also poses a long-term risk to Casey's core fuel sales, necessitating diversification.

Economic headwinds, including persistent inflation and rising operational costs like fuel and labor, directly impact consumer spending and Casey's profit margins. For example, U.S. inflation was 3.3% in April 2024, and average gas prices were around $3.60 per gallon in May 2024.

Shifting consumer preferences towards healthier options and online shopping, coupled with potential impacts from GLP-1 drugs on consumption patterns, could reduce in-store traffic. Furthermore, cybersecurity threats and the need for continuous technological investment add financial strain and operational risk.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of robust data, drawing from Casey's General Stores' official financial filings, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic perspective.