Casey's General Stores PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casey's General Stores Bundle

Navigate the evolving landscape of the convenience store industry with our comprehensive PESTLE analysis of Casey's General Stores. Understand how political shifts, economic fluctuations, social trends, technological advancements, environmental concerns, and legal frameworks are shaping their operations and future growth. Gain a strategic advantage by uncovering critical insights that drive informed decision-making. Download the full PESTLE analysis now and unlock actionable intelligence to sharpen your market strategy.

Political factors

Changes in federal and state excise taxes on gasoline and diesel directly impact Casey's fuel pricing strategies and profitability. For instance, as of early 2024, the federal excise tax on gasoline remains at 18.4 cents per gallon, while state taxes can add significantly more, with some states exceeding 50 cents per gallon, impacting Casey's competitive pricing and margins.

Furthermore, regulations concerning fuel quality, storage, and dispensing equipment require continuous compliance and potential investment. The Environmental Protection Agency (EPA) mandates certain fuel standards, and state-specific environmental regulations for underground storage tanks can necessitate costly upgrades, impacting operational expenditures for Casey's numerous locations.

These regulations can vary significantly by state, influencing operational costs across Casey's diverse geographic footprint. For example, California's stringent emissions standards and fuel blend requirements differ from those in the Midwest, creating a complex compliance landscape that Casey must navigate to maintain consistent operations and profitability.

Casey's General Stores, as a major retailer offering prepared foods, must navigate a complex web of federal and state food safety and health regulations. These rules govern everything from how food is handled and prepared to the accuracy of labeling and allergen disclosures, directly impacting consumer confidence and the company's bottom line. For instance, the U.S. Food and Drug Administration (FDA) continuously updates its Food Code, with recent revisions focusing on enhanced traceability and preventative controls, which Casey's must integrate into its operations.

Staying compliant requires ongoing investment in training and operational adjustments. In 2024, the FDA conducted thousands of inspections nationwide, identifying violations that can lead to significant fines and reputational damage. Casey's commitment to rigorous food safety protocols, including regular internal audits and staff training on updated standards, is therefore paramount to mitigating these risks and ensuring the quality of its offerings.

Fluctuations in minimum wage laws across the states where Casey's General Stores operates directly impact labor costs, a significant expense. For instance, as of January 1, 2024, 22 states and numerous cities increased their minimum wage, with some reaching $15 per hour or more. This trend is expected to continue, potentially increasing Casey's payroll expenses if they need to raise wages to remain competitive or comply with new mandates.

Beyond minimum wage, other labor regulations, such as those concerning overtime pay, mandated employee benefits like paid sick leave, and rules around scheduling flexibility, also influence staffing and human resource management. For example, new regulations in states like California regarding predictable scheduling can affect how Casey's manages store operations and staff allocation. Adapting to these evolving labor laws is crucial for maintaining cost control and fostering positive employee relations.

Local Zoning and Permitting

Casey's General Stores' strategy of focusing on small towns and rural areas makes local zoning and permitting paramount for growth. These regulations directly impact where new stores can be built and how existing ones can be modified, influencing everything from a store's physical footprint to its operating hours. For instance, a new Casey's location in a Midwestern town might face specific requirements regarding building height or the type of facade allowed, all dictated by local ordinances.

Navigating the varied landscape of local governmental structures and their unique permitting processes is a continuous effort for Casey's. This requires diligent research and adaptation to different municipal codes across the states where they operate. For example, in 2024, Casey's continued its expansion, opening new locations in communities where understanding and complying with local zoning was a key step in the development timeline.

- Zoning Impact: Local zoning dictates permissible store size, parking lot configurations, and signage, directly affecting development costs and timelines.

- Permitting Hurdles: Obtaining necessary permits can involve lengthy review processes, varying significantly from one municipality to another.

- Operational Constraints: Ordinances may also specify operating hours, influencing customer access and revenue potential.

- Expansion Strategy: Casey's must factor the complexity of local regulations into its site selection and expansion planning to ensure efficient rollout.

Trade Policies and Tariffs

While Casey's General Stores operates primarily within the United States, its extensive supply chain is susceptible to indirect impacts from international trade policies and tariffs. These can affect the cost of goods, from construction materials for new stores to certain food ingredients or operational equipment. For instance, tariffs imposed on steel or lumber in 2024 could have marginally increased capital expenditures for store renovations or new builds, impacting the company's investment budget.

The ripple effect of global trade disputes can translate into higher procurement costs for Casey's. Even if Casey's doesn't directly import a significant volume of goods, tariffs on upstream components or raw materials used by their suppliers can lead to price increases passed down the chain. This subtle pressure on operational expenses, though not always immediately apparent, is a consideration for long-term cost management.

- Tariff Impact: Potential for increased costs on construction materials and equipment due to tariffs on imported goods.

- Supply Chain Vulnerability: Indirect exposure to global trade policies affecting suppliers of food items and operational necessities.

- Cost Management: Trade policies can influence overall operational expenses, requiring strategic sourcing and cost-control measures.

Government policies on fuel taxes and environmental regulations directly influence Casey's operational costs and pricing strategies. For example, federal gasoline excise taxes remained at 18.4 cents per gallon in early 2024, with state taxes varying significantly, impacting fuel margins. Additionally, EPA mandates on fuel quality and storage necessitate ongoing compliance investments, with state-specific rules like California's emissions standards adding complexity.

Labor laws, including minimum wage increases and mandated benefits, significantly affect Casey's payroll expenses. By January 1, 2024, 22 states and numerous cities raised their minimum wages, with some reaching $15 per hour, a trend likely to continue and influence Casey's labor costs.

Local zoning and permitting are crucial for Casey's expansion, dictating store placement, size, and operational hours. Navigating these varied municipal codes is essential for new site development, as exemplified by Casey's continued expansion in 2024.

International trade policies and tariffs can indirectly impact Casey's costs for construction materials and certain food ingredients, affecting capital expenditures and operational expenses.

What is included in the product

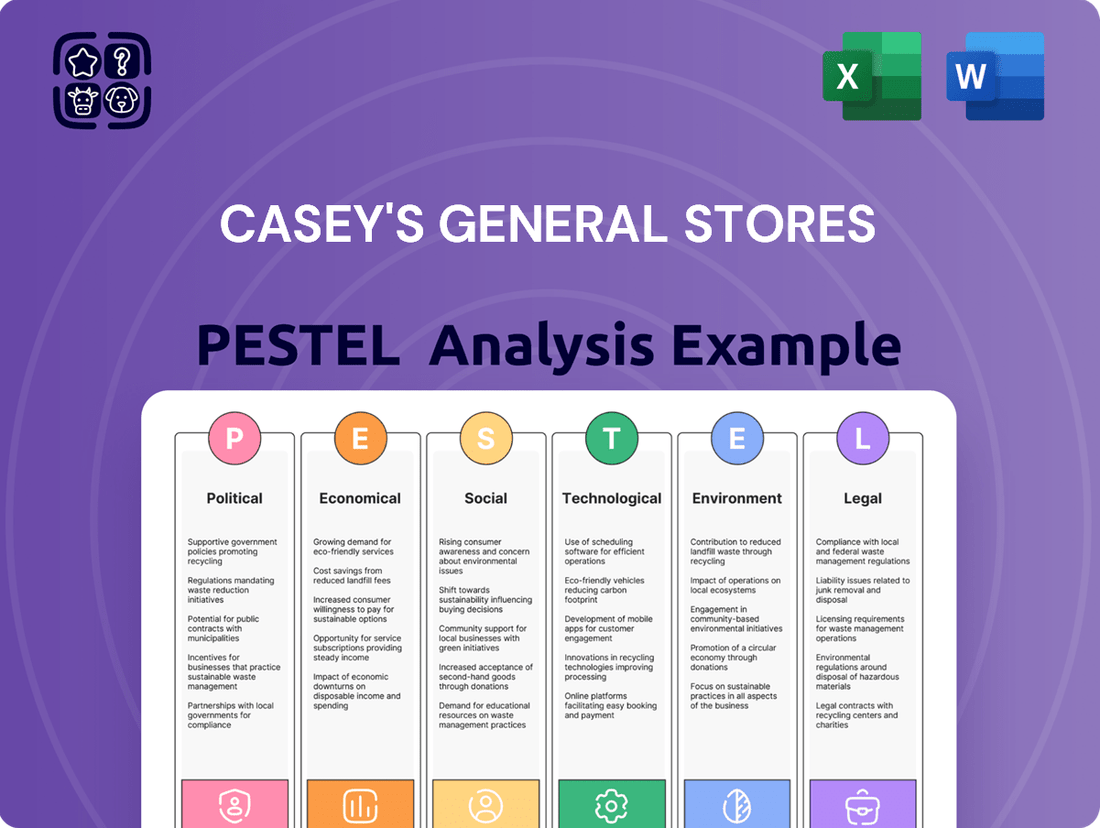

This PESTLE analysis examines the external macro-environmental factors impacting Casey's General Stores across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights by detailing how these forces create opportunities and threats, aiding strategic decision-making.

A PESTLE analysis for Casey's General Stores provides a clear, summarized view of external factors influencing their business, acting as a pain point reliever by enabling proactive strategy development and risk mitigation.

Economic factors

Fuel price volatility directly impacts Casey's General Stores, as gasoline and diesel sales represent a substantial revenue stream. For instance, in fiscal year 2024, Casey's reported over $5.6 billion in fuel sales, highlighting their sensitivity to oil market swings.

While elevated fuel prices can inflate top-line revenue figures, they often squeeze consumer purchasing power for non-fuel items. This means customers might buy less from the convenience store sections, impacting overall profitability.

Conversely, periods of lower fuel prices can stimulate in-store purchases by freeing up consumer budgets. However, these lower prices also compress the profit margins on fuel itself, necessitating astute pricing and merchandising strategies to maintain profitability.

The economic well-being of the Midwest and South, Casey's key markets, directly influences how much people spend. For instance, as of early 2024, the U.S. unemployment rate remained low, hovering around 3.9%, which generally supports consumer confidence. However, wage growth has been a mixed bag, with some sectors seeing solid increases while others lag, impacting the disposable income available for Casey's offerings.

In the rural areas where Casey's is a vital store, shifts in disposable income are particularly impactful. If people have more money after essential bills, they're more likely to buy Casey's prepared foods or grab-and-go items. Conversely, if inflation, which saw a Consumer Price Index increase of 3.4% year-over-year in April 2024, eats into their budgets, consumers might opt for cheaper groceries or cut back on impulse buys.

Rising inflation directly impacts Casey's General Stores by increasing the cost of goods sold. This affects everything from the price of food ingredients and beverages to fuel for their operations and essential store supplies. For instance, the Producer Price Index for finished goods saw a notable increase in early 2024, indicating upstream cost pressures that filter down to retailers like Casey's.

Effectively managing these escalating costs is paramount for Casey's to protect its profit margins. This involves strategic procurement, carefully considered pricing adjustments for consumers, and driving operational efficiencies across all store locations. The company's ability to absorb or pass on these increased costs will be a key determinant of its financial performance.

Furthermore, supply chain disruptions, often amplified by inflationary environments, pose an additional challenge. These disruptions can lead to product shortages, forcing Casey's to seek alternative, potentially more expensive, suppliers and increasing transportation costs as demand for logistics services rises.

Interest Rates and Access to Capital

Changes in interest rates directly impact Casey's General Stores' cost of capital. For instance, if the Federal Reserve raises the federal funds rate, borrowing costs for new store construction, renovations, and technology investments will likely increase. This can make expansion projects less profitable, potentially leading to a slowdown in growth initiatives.

Access to capital on favorable terms is crucial for Casey's to fund its strategic growth. For example, if interest rates rise significantly, the cost of issuing new debt or securing loans for major capital expenditures will go up. This could affect their ability to undertake ambitious expansion plans or invest in new store formats.

The Federal Reserve's monetary policy decisions, particularly regarding interest rates, are a key economic factor for Casey's. As of early 2024, the Fed has maintained a relatively stable interest rate environment, though future adjustments are anticipated.

- Impact on Borrowing Costs: Higher interest rates increase the expense of financing capital expenditures like new store builds or renovations.

- Expansion Plans: Rising financing costs can deter or slow down Casey's expansion efforts and new investment profitability.

- Access to Credit: Favorable credit terms are essential for Casey's to secure the necessary funding for strategic growth initiatives.

- Federal Reserve Policy: The Fed's actions on interest rates directly influence the cost and availability of capital for businesses like Casey's.

Regional Economic Health and Agricultural Performance

Casey's General Stores' significant footprint in rural and agricultural areas means regional economic health is paramount. The financial well-being of its core customer base is directly linked to agricultural commodity prices and the strength of local industries. For instance, in 2024, while some agricultural sectors experienced price volatility, others saw stabilization, influencing disposable income in these communities.

A robust agricultural season typically translates to increased consumer spending at Casey's, especially for discretionary items. Conversely, unfavorable weather patterns or falling commodity prices can dampen sales. For example, a strong corn harvest in the Midwest during late 2024 could positively impact sales in surrounding Casey's locations.

- Regional GDP Growth: Monitoring local GDP growth in Casey's key operating states, such as Iowa and Illinois, provides a direct indicator of economic vitality.

- Agricultural Commodity Prices: Tracking the price trends of key crops like corn, soybeans, and ethanol in 2024 and projected for 2025 directly correlates with rural consumer spending power.

- Unemployment Rates: Lower unemployment in rural counties served by Casey's signifies a healthier local economy and greater consumer confidence.

- Farm Income: Changes in net farm income, a critical metric for agricultural communities, directly affect the purchasing capacity of a significant portion of Casey's customer base.

Economic factors significantly shape Casey's General Stores' performance, particularly fuel price volatility and inflation. In fiscal year 2024, Casey's reported over $5.6 billion in fuel sales, making them highly susceptible to oil market fluctuations. Rising inflation, evidenced by a 3.4% year-over-year CPI increase in April 2024, directly increases the cost of goods sold and operational expenses, necessitating careful pricing strategies.

Interest rates also play a crucial role, impacting Casey's cost of capital for expansion and renovations. As of early 2024, the Federal Reserve maintained a stable rate environment, but anticipated future adjustments could influence borrowing costs and investment decisions. Regional economic health, especially in the Midwest and South, is vital, with low unemployment rates around 3.9% in early 2024 generally supporting consumer confidence, though wage growth remains varied.

| Economic Factor | Impact on Casey's | Relevant Data (2024/2025) |

|---|---|---|

| Fuel Price Volatility | Affects significant fuel revenue and consumer spending on in-store items. | FY24 Fuel Sales: >$5.6 billion |

| Inflation | Increases cost of goods sold and operational expenses; impacts profit margins. | CPI (April 2024): 3.4% YoY increase; PPI for finished goods showed upstream cost pressures. |

| Interest Rates | Influences cost of capital for expansion and investment. | Federal Reserve maintained stable rates in early 2024, with future adjustments anticipated. |

| Regional Economic Health | Impacts disposable income and consumer spending in core markets. | U.S. Unemployment Rate (early 2024): ~3.9%; Mixed wage growth trends. |

Preview Before You Purchase

Casey's General Stores PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Casey's General Stores delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic positioning. Gain immediate access to this detailed report to understand the external forces shaping Casey's future.

Sociological factors

Consumers are increasingly prioritizing convenience and healthier choices, a trend that extends even to rural areas. Casey's strong presence in these locations, with its emphasis on prepared foods like pizza and donuts, aligns well with this demand. However, staying ahead requires ongoing menu development to cater to evolving tastes, including options for various dietary needs and a growing health consciousness.

The market is seeing a significant rise in demand for fresh, high-quality, and customizable food items. For instance, a 2024 survey indicated that over 60% of consumers are willing to pay more for food that is perceived as healthier or fresher. This signals a clear opportunity for Casey's to further integrate these elements into its prepared food offerings, potentially through expanded salad bars, fresh fruit options, or customizable sandwich stations.

Demographic shifts significantly impact Casey's target small towns. For instance, an aging population in some rural areas might increase demand for convenience items and prepared foods, aligning with Casey's existing offerings. Conversely, a decline in younger residents due to rural-to-urban migration, as seen in many Midwestern states, could shrink the core customer base for certain product categories.

Understanding these trends is crucial for Casey's to adapt. If a town experiences an influx of new residents, perhaps drawn by remote work opportunities, Casey's might need to expand its product selection to cater to diverse tastes. The company's ability to remain a relevant community hub hinges on its responsiveness to these evolving local demographics, potentially influencing everything from store hours to the types of community events it sponsors.

Modern lifestyles, even in rural settings, increasingly value convenience and efficiency. Casey's General Stores' integrated model, combining fuel, groceries, and made-to-order food, directly addresses this societal shift. This one-stop-shop approach caters to customers seeking to maximize their time, a key driver of their purchasing decisions.

The company's strategic placement and diverse offerings allow customers to fulfill multiple errands simultaneously, fostering loyalty. In 2024, Casey's reported strong same-store sales growth, partly attributed to its ability to meet the demand for quick and easy solutions. By continuing to streamline operations and enhance product accessibility, Casey's reinforces its position as a convenient choice.

Community Engagement and Local Identity

In small towns, Casey's General Stores can solidify its position by actively participating in community life. This involvement is crucial for building a strong local identity, as demonstrated by Casey's sponsorship of over 2,500 youth sports teams in 2023, a testament to their commitment to local engagement.

By supporting community initiatives and local events, Casey's fosters a sense of belonging and strengthens its brand image. This approach is particularly effective in close-knit communities where local businesses are often seen as integral parts of the social fabric. For instance, in 2024, Casey's continued its tradition of supporting local school fundraisers, contributing to the financial health of educational institutions.

- Strengthened Community Ties: Active participation in local events enhances brand perception.

- Customer Loyalty: Being a supportive local establishment builds enduring customer relationships.

- Brand Image Enhancement: Positive community involvement translates to a favorable brand reputation.

- Economic Impact: Supporting local initiatives contributes to the economic vitality of the towns Casey's serves.

Workforce Availability and Expectations

Casey's General Stores faces the challenge of securing a qualified workforce in rural locations, where the labor pool may be smaller. This is further complicated by evolving employee expectations. For instance, in 2024, the U.S. Bureau of Labor Statistics reported that average hourly wages for retail workers continued to see modest increases, reflecting a broader trend of higher wage demands. Employees are increasingly prioritizing competitive pay, comprehensive benefits packages, and improved work-life balance, putting pressure on employers to adapt.

Attracting and retaining staff, particularly for customer-facing roles that often require flexible scheduling, remains a significant hurdle for Casey's. The retail sector, in general, experienced a national quit rate that, while fluctuating, has remained elevated in recent years as workers seek better opportunities. This competitive labor market necessitates that Casey's continually refine its recruitment and retention tactics to align with these sociological shifts.

- Workforce Availability: Rural areas may present a more limited pool of potential employees.

- Employee Expectations: Demands for higher wages, better benefits, and flexible work arrangements are increasing.

- Talent Retention: The competitive nature of the retail job market makes it challenging to keep employees.

- Adaptation Needs: Casey's must adjust its HR strategies to meet current workforce demands.

Societal trends highlight a growing consumer preference for convenience and healthier food options, a demand Casey's is well-positioned to meet with its prepared food offerings in rural areas. However, adapting to evolving tastes, including dietary needs and a general health consciousness, is crucial for continued success. For instance, a 2024 consumer survey revealed that over 60% of shoppers are willing to pay a premium for food perceived as fresher or healthier, indicating a clear opportunity for Casey's to expand its healthy and customizable choices.

Demographic shifts, such as an aging rural population, can increase the demand for convenient, ready-to-eat meals, aligning with Casey's current business model. Conversely, the out-migration of younger residents from some Midwestern states could potentially shrink Casey's core customer base in certain areas, necessitating strategic adjustments to product offerings and marketing efforts.

Modern lifestyles, even in rural settings, increasingly prioritize efficiency, making Casey's integrated model of fuel, groceries, and prepared foods highly attractive. This one-stop-shop approach caters to customers seeking to maximize their time, a significant driver of their purchasing decisions, as evidenced by Casey's strong same-store sales growth in 2024, partly attributed to its convenience factor.

Casey's commitment to community involvement, such as sponsoring over 2,500 youth sports teams in 2023 and supporting local school fundraisers in 2024, strengthens its brand image and fosters customer loyalty. This deep integration into the social fabric of small towns is vital for maintaining relevance and building enduring customer relationships.

| Sociological Factor | Impact on Casey's | Supporting Data/Trend |

|---|---|---|

| Consumer Preferences | Demand for convenience and healthier options | 60% of consumers willing to pay more for healthier/fresher food (2024 survey) |

| Demographic Shifts | Aging population increases demand for convenience; youth out-migration poses a challenge | Varied demographic trends across rural Midwestern states |

| Lifestyle Changes | Increased value placed on efficiency and one-stop shopping | Casey's strong same-store sales growth in 2024 |

| Community Engagement | Builds brand loyalty and positive perception | Sponsored 2,500+ youth sports teams (2023); supported local school fundraisers (2024) |

Technological factors

The rise of digital payments, including mobile wallets and contactless options, necessitates ongoing upgrades to Casey's point-of-sale (POS) systems to maintain seamless transactions. This trend is significant, with U.S. contactless payment transaction volume projected to reach $6.5 trillion by 2025, up from $2.8 trillion in 2023, according to Statista.

Consumer demand for mobile ordering and curbside pickup, especially for prepared foods, offers Casey's a clear opportunity to boost convenience and operational efficiency. In 2024, over 60% of consumers expressed a preference for ordering food via mobile apps, highlighting the strategic importance of this channel for businesses like Casey's.

Investing in secure and user-friendly digital platforms is paramount for Casey's to capitalize on these technological shifts, ensuring data protection and a positive customer experience in an increasingly digital marketplace.

Leveraging data analytics offers Casey's a significant advantage in understanding customer behavior and optimizing operations. By analyzing sales data, the company can gain deeper insights into purchasing patterns, which directly informs inventory management and the effectiveness of promotions. This granular understanding allows for better product assortment decisions and a reduction in waste.

For instance, in 2024, retailers broadly saw a 15-20% increase in sales uplift when utilizing personalized promotions driven by customer data analytics. Casey's can apply this to tailor marketing campaigns, ensuring they resonate with specific customer segments and even individual store locations, thereby enhancing operational efficiency and supporting more informed strategic decisions.

Automation is significantly reshaping how Casey's operates, from the checkout counter to the kitchen. Technologies like self-checkout kiosks, automated beverage dispensers, and even advanced robotic systems for food preparation are being integrated to boost efficiency and tackle labor shortages. For instance, many convenience stores are seeing a reduction in customer wait times by as much as 30% with self-checkout options.

The strategic deployment of these tools allows Casey's to maintain its valued personal touch, especially crucial in its rural community base, while simultaneously streamlining operations. This means staff can focus on more engaging customer interactions rather than routine tasks, leading to improved service quality and consistency in offerings, including advancements in fuel dispensing technology.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are increasingly critical for Casey's General Stores, especially as they gather customer information through loyalty programs and digital transactions. In 2024, companies are facing heightened scrutiny over data handling, making robust protection of sensitive data a top priority to maintain customer trust and avoid substantial penalties. For instance, the average cost of a data breach in the retail sector was estimated to be around $4.5 million in 2023, highlighting the financial risks involved.

Adherence to evolving data privacy regulations, such as new state-specific laws that emerged in 2024, is essential. Non-compliance can lead to significant legal repercussions and damage to brand reputation. Casey's must ensure its practices align with these dynamic legal landscapes to operate smoothly and ethically.

Investing in secure IT infrastructure and comprehensive employee training is fundamental to mitigating cyber risks effectively. These proactive measures are vital in defending against sophisticated cyber threats that continue to emerge. By prioritizing these areas, Casey's can build a more resilient and trustworthy operation.

- Data Breach Costs: The retail sector’s average data breach cost reached approximately $4.5 million in 2023.

- Regulatory Landscape: 2024 saw the implementation of new state-specific data privacy laws across the US.

- Customer Trust: Protecting customer data is paramount for maintaining loyalty and avoiding reputational damage.

- Investment Needs: Secure IT infrastructure and ongoing employee training are key to cyber risk mitigation.

Supply Chain Technology and Logistics

Advanced supply chain technologies are crucial for Casey's General Stores. Real-time tracking, predictive analytics for demand forecasting, and optimized routing software can significantly boost efficiency in product distribution. These tools are essential for managing inventory, cutting transportation expenses, and ensuring consistent product availability, especially in the complex rural logistics Casey's navigates.

In 2024, the logistics industry is seeing increased investment in automation and AI. For instance, companies are leveraging AI to predict potential disruptions, like weather events or port congestion, allowing for proactive rerouting. This focus on resilience and efficiency is directly applicable to Casey's operational model.

- Real-time Inventory Management: Technologies that provide instant visibility into stock levels across all stores and distribution centers.

- Predictive Demand Forecasting: Utilizing AI and machine learning to anticipate customer demand more accurately, reducing stockouts and overstock situations.

- Route Optimization Software: Employing algorithms to determine the most efficient delivery routes, minimizing fuel consumption and delivery times.

- Warehouse Automation: Implementing robotics and automated systems in distribution centers to speed up order fulfillment and reduce labor costs.

The integration of advanced data analytics is pivotal for Casey's to understand customer behavior and optimize its operations. By analyzing sales data, the company can refine inventory management and promotional strategies, leading to better product assortment and reduced waste. Retailers saw a 15-20% sales uplift in 2024 from data-driven personalized promotions.

Legal factors

Casey's operates in numerous states, each with its own minimum wage and overtime regulations. For instance, as of January 1, 2024, many states, including Illinois and Iowa where Casey's has a significant presence, adjusted their minimum wages. Illinois' minimum wage rose to $14.00 per hour, while Iowa's increased to $7.25 per hour, though many municipalities within Iowa have higher rates. These varying state-specific labor laws necessitate constant vigilance and adaptation in payroll and workforce management to ensure compliance.

Fluctuations in these legal mandates directly affect Casey's labor expenses, a critical component of its operational costs. For example, a rise in the federal minimum wage, or even state-level increases, can substantially impact the company's profitability if not adequately factored into pricing strategies and operational efficiency. The need to track and implement these changes across all operating locations requires robust internal systems and a deep understanding of labor law.

Failure to adhere to these evolving minimum wage and overtime requirements can result in severe financial penalties and legal entanglements. In 2023, the U.S. Department of Labor recovered millions of dollars in back wages for employees due to minimum wage and overtime violations across various industries. For Casey's, such non-compliance could lead to costly lawsuits, reputational damage, and significant operational disruptions, underscoring the importance of meticulous legal adherence.

Casey's General Stores, as a retailer of both packaged goods and prepared foods, navigates a complex web of federal and state food labeling and advertising laws. This includes mandates for nutritional information, clear allergen declarations, and country of origin labeling, all crucial for consumer safety and informed purchasing decisions. For instance, the FDA's Food Allergen Labeling and Consumer Protection Act of 2004 continues to be a cornerstone, requiring clear identification of major allergens in packaged foods.

Advertising claims made by Casey's regarding their food and beverage offerings are also subject to rigorous legal oversight. Regulatory bodies like the Federal Trade Commission (FTC) actively monitor advertising to prevent deceptive or misleading statements that could unfairly influence consumers. Maintaining absolute accuracy and unwavering compliance in all labeling and promotional materials is not merely a legal obligation but a foundational element for building and sustaining consumer trust, essential for a retailer's long-term success.

Casey's General Stores operates within a complex web of alcohol and tobacco sales regulations. These laws, enforced at federal, state, and local levels, mandate stringent age verification, licensing procedures, and limitations on advertising. For instance, the federal minimum age for tobacco purchase is 21, a standard adopted by all states by late 2019. Compliance is critical, as violations can lead to substantial fines and even the revocation of selling licenses, impacting Casey's ability to generate revenue from these product categories.

Data Privacy and Consumer Protection Laws

Casey's General Stores, like all retailers, faces significant legal obligations regarding data privacy and consumer protection. With the growing reliance on loyalty programs, digital payment systems, and online ordering, strict adherence to laws such as the California Consumer Privacy Act (CCPA) and similar state-level regulations is paramount. In 2024, data breaches continue to be a major concern, with the average cost of a data breach reaching $4.45 million in 2023, according to IBM's Cost of a Data Breach Report. This underscores the financial and reputational risks associated with inadequate data protection.

Protecting sensitive customer information, including payment card details, is not just a legal requirement but a cornerstone of maintaining customer trust. Casey's must ensure transparency in how customer data is collected, stored, and utilized. Failure to comply can result in substantial fines and damage to brand reputation. For instance, the CCPA grants consumers rights to know what personal information is collected, to request its deletion, and to opt-out of its sale, requiring robust data management practices.

- Compliance with CCPA and similar state laws: Ensuring transparency in data collection and usage practices.

- Secure handling of payment card information: Protecting financial data to prevent breaches and associated penalties.

- Maintaining customer trust: Demonstrating a commitment to data privacy to avoid reputational damage.

- Avoiding legal repercussions: Mitigating risks of fines and lawsuits related to data privacy violations.

Environmental Compliance for Fuel Stations

Operating fuel stations necessitates rigorous adherence to environmental laws, especially concerning underground storage tanks (USTs), air emissions, hazardous waste management, and spill prevention. For instance, the U.S. Environmental Protection Agency (EPA) continues to update UST regulations, with states often implementing their own, sometimes more stringent, requirements. Casey's must ensure all its fuel stations comply with these multifaceted legal frameworks.

Compliance demands ongoing investment in infrastructure maintenance and potential upgrades to meet evolving environmental standards. This can include leak detection systems, secondary containment for tanks, and vapor recovery units. Failure to comply can lead to significant penalties; for example, violations of the Clean Air Act can result in fines of tens of thousands of dollars per day per violation, alongside substantial remediation costs and potential legal liabilities for environmental damage.

- UST Compliance: Ensuring all underground storage tanks meet federal and state regulations for installation, operation, and leak detection.

- Air Quality Standards: Adhering to regulations on fuel vapor emissions during refueling and storage.

- Hazardous Waste Disposal: Proper handling and disposal of any hazardous materials, such as used oil or contaminated soil.

- Spill Prevention and Response: Implementing plans and infrastructure to prevent and manage fuel spills effectively.

Casey's must navigate a complex landscape of consumer protection laws, particularly concerning product safety and advertising accuracy. Regulations from agencies like the Consumer Product Safety Commission (CPSC) and the Federal Trade Commission (FTC) dictate standards for product labeling, marketing claims, and recall procedures. For instance, in 2024, the FTC continued its focus on preventing deceptive advertising, with significant enforcement actions against companies making unsubstantiated health or performance claims.

The company's commitment to accurate product information and fair advertising practices is crucial for maintaining consumer trust and avoiding legal challenges. Misleading promotions or the sale of unsafe products can lead to substantial fines, mandatory recalls, and severe damage to Casey's brand reputation. Adherence to these legal frameworks is therefore essential for sustained operational integrity and market standing.

Environmental factors

Evolving environmental regulations concerning fuel emissions and vehicle standards directly impact Casey's General Stores' fuel offerings and station infrastructure. Stricter standards, such as those being considered or implemented in various regions by 2024 and 2025, may require significant investments in advanced vapor recovery systems or the integration of alternative fuel options like higher ethanol blends or even electric charging infrastructure.

For instance, the U.S. Environmental Protection Agency (EPA) continues to refine its standards for vehicle emissions, and state-level initiatives, like California's Advanced Clean Cars II program, are pushing for greater adoption of zero-emission vehicles. Casey's must monitor these trends to ensure compliance and to strategically plan for potential shifts in consumer demand and fuel types needed at their over 2,200 locations.

Casey's General Stores, like many in the convenience retail sector, faces significant waste generation from items like prepared food packaging and beverage containers. In 2023, the U.S. generated over 292 million tons of municipal solid waste, highlighting the scale of the challenge.

Growing consumer demand for sustainability and tightening regulations are pushing companies like Casey's to adopt more robust recycling programs and explore options for reducing single-use plastics. This environmental pressure is a key factor in operational planning for the 2024-2025 period.

Investing in eco-friendly waste management solutions, such as improved in-store recycling infrastructure or partnerships for responsible disposal, can positively influence public perception and brand image.

Consumers increasingly favor products that are sourced sustainably and ethically. For Casey's, this means looking for opportunities to offer more eco-friendly options, like ingredients for their prepared foods that come from sustainable farms or items with a smaller environmental impact. This shift is significant, with studies in 2024 showing that over 60% of consumers are willing to pay more for sustainable products.

While a convenience store format presents challenges, Casey's can still explore partnerships with suppliers who prioritize environmentally sound practices. By working with suppliers on sustainability within the supply chain, Casey's can build a stronger brand image and appeal to a growing segment of environmentally conscious shoppers. For example, in 2025, many major food retailers are setting targets to reduce their supply chain emissions by 20-30%.

Climate Change Impacts on Operations

Climate change presents tangible risks to Casey's General Stores' operations. More frequent extreme weather events, like the severe storms and flooding that impacted the Midwest in 2024, can directly disrupt supply chains, damage physical store locations, and hinder customer access to stores. For instance, the widespread flooding in Iowa and Illinois during spring 2024 caused significant disruptions to transportation networks, impacting product delivery and store accessibility.

Adapting to these evolving environmental conditions is becoming a critical strategic imperative. Casey's must develop robust resilience plans to mitigate the impact of potential climate-related disruptions. This includes investing in infrastructure upgrades to withstand severe weather and diversifying supply chain routes to reduce vulnerability.

Furthermore, the agricultural sector, a key supplier for many of Casey's products, is highly susceptible to climate change. Shifts in weather patterns and increased instances of drought or excessive rainfall can lead to volatile agricultural yields, directly influencing the cost of goods sold and potentially impacting consumer purchasing power for essential items. For example, projected increases in corn prices due to climate variability in 2025 could affect the cost of many staple food items sold at Casey's.

- Physical Impacts: Increased frequency of floods and severe storms in Casey's core operating regions (e.g., Midwest) can damage infrastructure and disrupt logistics.

- Supply Chain Vulnerability: Extreme weather events in 2024 led to documented supply chain delays for convenience store operators across the nation, impacting product availability.

- Agricultural Costs: Climate-induced volatility in crop yields, such as potential impacts on 2025 corn harvests, can drive up food costs for Casey's and its customers.

- Adaptation Needs: Developing operational resilience and supply chain flexibility is a growing necessity to counter climate-related business risks.

Energy Consumption and Renewable Energy Adoption

Casey's General Stores, with its extensive network of over 2,500 locations, faces substantial energy demands for daily operations, including lighting, refrigeration, and climate control. The company has an opportunity to significantly lower its environmental footprint and operational expenses by implementing energy efficiency measures. For instance, transitioning to LED lighting can cut lighting energy use by up to 80% compared to traditional incandescent bulbs. Furthermore, exploring renewable energy sources, such as solar panels on store rooftops, could provide a sustainable power alternative, aligning with growing consumer and investor expectations for corporate environmental responsibility. In 2023, the U.S. retail sector's energy consumption accounted for roughly 18% of total commercial building energy use, highlighting the potential impact of efficiency improvements for companies like Casey's.

The adoption of greener energy practices presents a dual benefit for Casey's: reduced operational costs and enhanced corporate social responsibility. Investing in energy-efficient refrigeration units, for example, can lead to annual savings on electricity bills. Data from the Department of Energy suggests that upgrading to ENERGY STAR certified commercial refrigerators can reduce energy consumption by as much as 20%. By proactively embracing these changes, Casey's can not only mitigate the financial impact of rising energy prices but also strengthen its brand image as an environmentally conscious retailer, a factor increasingly influencing consumer purchasing decisions.

Key opportunities for Casey's in energy management include:

- Implementing widespread LED lighting retrofits across all stores.

- Upgrading to energy-efficient refrigeration and HVAC systems.

- Investigating the feasibility of on-site renewable energy generation, like solar installations.

- Exploring power purchase agreements for renewable energy to offset grid electricity consumption.

Environmental factors increasingly shape Casey's operational and strategic decisions. Stricter emissions standards and waste reduction mandates, like those evolving in 2024-2025, necessitate investments in cleaner fuel infrastructure and sustainable packaging solutions. Growing consumer preference for eco-friendly products, with over 60% willing to pay more for sustainability in 2024, pushes Casey's to prioritize sustainable sourcing and supply chain practices.

Climate change poses tangible risks, including supply chain disruptions from extreme weather events, as seen with Midwest flooding in spring 2024, and potential increases in agricultural costs, such as projected corn price volatility for 2025 harvests. Energy efficiency and renewable energy adoption offer significant opportunities for cost savings and enhanced corporate responsibility, with the U.S. retail sector's energy consumption being a notable area for improvement.

PESTLE Analysis Data Sources

Our PESTLE analysis for Casey's General Stores is informed by a diverse range of data sources, including government economic reports, industry-specific market research, and reputable news outlets. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.