Casey's General Stores Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Casey's General Stores Bundle

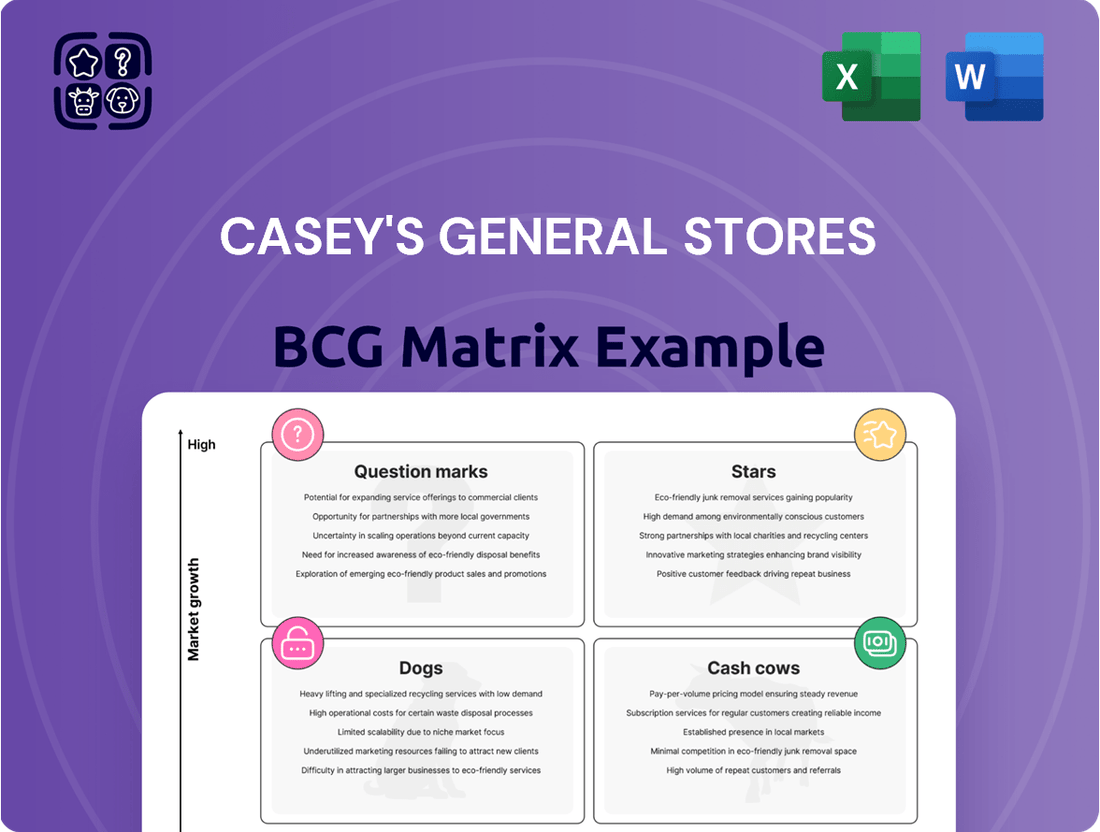

Casey's General Stores operates a diverse portfolio, but understanding its product mix through the BCG Matrix is crucial for strategic growth. This analysis helps identify which offerings are driving revenue and which might be holding the company back.

Dive deeper into Casey's General Stores' BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Casey's prepared foods and dispensed beverages, particularly its signature made-from-scratch pizza, are stars in its business portfolio. This segment consistently delivers high growth and commands a strong market share within the convenience store industry, significantly boosting inside sales. For instance, in fiscal year 2024, Casey's reported that its prepared food and drink category generated over $2.5 billion in revenue, representing a substantial portion of its total sales.

This category is a critical differentiator for Casey's, consistently outperforming broader industry trends. The company is actively investing in innovation within this segment, frequently introducing new menu items and limited-time offers. This strategic focus on enhancing its prepared food and beverage offerings helps solidify its leadership position and drive customer loyalty.

Casey's General Stores' aggressive expansion, marked by both building new locations and acquiring existing ones, firmly places its new store initiatives in the Stars category of the BCG Matrix. This strategy is designed to capture high market share in rapidly growing segments. For instance, the company's fiscal year 2025 plans included a significant acquisition that added stores in new states, directly contributing to its high growth potential.

Casey's Rewards Program is a significant driver of customer loyalty and engagement, boasting over 9 million members. This program is a key asset in Casey's General Stores' portfolio, contributing to high growth and providing valuable data for targeted marketing efforts. Its success in accelerating sales, particularly for high-margin prepared foods, positions it as a star performer.

Digital Transformation and Technology Adoption

Casey's ongoing investment in digital tools and AI-driven platforms is a key driver in its operational efficiency, demand planning, and customer engagement strategies. These advancements are crucial for maintaining a competitive edge in a rapidly evolving market.

Technological innovations like automated ordering systems and AI-powered contract management are directly enhancing the customer experience and streamlining internal operations. This focus on digital transformation positions Casey's for significant future market share growth.

- Digital Investment: Casey's commitment to technology, including AI, aims to boost efficiency and customer interaction.

- Operational Streamlining: Automated systems are improving processes from ordering to contract management.

- Market Position: These digital initiatives are designed to secure future market share gains in a growing sector.

Strategic Focus on Small Towns and Rural Communities

Casey's General Stores has built its foundation on a strategic emphasis on small towns and rural areas. This deliberate focus allows them to become more than just a store; they often serve as a vital community hub. This approach has cultivated a strong competitive edge and taps into a consistently expanding market.

By concentrating on these niche markets, Casey's achieves substantial local market share. This deep penetration fosters robust community relationships, translating into reliable sales increases and enduring customer loyalty. For instance, as of the first quarter of fiscal year 2025, Casey's reported a 5.2% increase in same-store sales for its grocery category, underscoring the strength of its community-focused strategy.

- Deep Community Integration: Casey's stores are often the go-to spot for daily needs in smaller communities.

- Market Share Dominance: This focused strategy allows for capturing a larger percentage of local spending.

- Customer Loyalty: Strong ties with residents lead to repeat business and positive word-of-mouth.

- Growth Potential: The underserved nature of many rural markets presents ongoing expansion opportunities.

Casey's Rewards Program, with over 9 million members, significantly drives customer loyalty and sales, particularly for high-margin prepared foods. This program's success in fostering engagement and providing valuable customer data positions it as a star performer, contributing to high growth and market share within the convenience sector.

The company's strategic investment in digital transformation, including AI, enhances operational efficiency and customer engagement. By leveraging technologies like automated ordering and AI-powered planning, Casey's aims to secure future market share gains and maintain a competitive edge in a dynamic market.

Casey's focus on small towns and rural areas has cultivated deep community integration and market share dominance in these regions. This strategy fosters strong customer loyalty, leading to consistent sales growth, as evidenced by a 5.2% increase in same-store grocery sales in Q1 FY2025.

| Business Segment | BCG Matrix Category | Key Performance Indicators |

|---|---|---|

| Prepared Foods & Beverages | Stars | >$2.5 billion revenue (FY2024), high growth, strong market share |

| New Store Initiatives | Stars | Aggressive expansion, acquisition of stores in new states, high growth potential |

| Casey's Rewards Program | Stars | >9 million members, drives loyalty, accelerates sales, high growth |

| Digital Investment & Technology | Stars | Enhances efficiency, customer engagement, aims for future market share growth |

| Small Town/Rural Market Focus | Stars | Deep community integration, market share dominance, customer loyalty, 5.2% same-store grocery sales growth (Q1 FY2025) |

What is included in the product

Casey's General Stores' BCG Matrix would likely position its fuel sales as Cash Cows and its prepared food offerings, like pizza, as Stars, highlighting strategic investment in growth areas.

A clear BCG Matrix visualizes Casey's General Stores' portfolio, relieving the pain of uncertain resource allocation by highlighting Stars for investment and Dogs for divestment.

Cash Cows

Fuel sales represent a cornerstone of Casey's General Stores, acting as a significant driver of both traffic and overall revenue. While these sales might carry thinner profit margins than their in-store counterparts, the sheer volume is undeniable. For instance, in fiscal year 2024, Casey's reported an impressive 2.3 billion gallons of fuel sold, underscoring the immense scale of this operation.

This high-volume fuel segment functions as a reliable cash generator for Casey's. The company's strategic investment in an efficient self-distribution network for fuel further bolsters the profitability and consistency of this revenue stream. The substantial and steady cash flow generated from fuel sales is critical, providing the financial bedrock to support and fund other strategic growth opportunities within the business.

The grocery and general merchandise segment for Casey's General Stores is a cornerstone, acting as a reliable cash cow. This category, encompassing a wide array of beverages, snacks, and essential household items, enjoys a dominant market share within the convenience store landscape.

While not experiencing the rapid growth seen in other areas, its consistent demand and deeply entrenched customer loyalty translate into substantial and predictable cash flow for the company. For fiscal year 2024, Casey's reported that its same-store sales in the grocery and general merchandise category increased by 4.2%, demonstrating its continued strength and stability.

Casey's General Stores boasts an established and mature network of around 2,900 convenience stores, predominantly situated in the Midwest and Southern United States. This extensive footprint is a significant cash cow for the company.

These well-rooted locations leverage strong brand recognition and benefit from consistent customer traffic, ensuring predictable revenue streams and healthy profit margins. The mature nature of this network requires relatively minimal additional investment for continued success.

Private Label Offerings

Casey's General Stores' private label offerings, particularly in snacks and beverages, are performing strongly within their grocery and general merchandise segment. These products have secured significant penetration in terms of both unit sales and gross profit. For instance, in fiscal year 2024, Casey's reported that its private label items contributed substantially to the overall growth of its prepared foods and packaged beverages categories.

These private label items function as Cash Cows because they generate consistent, reliable cash flow with relatively low investment. They offer customers high-quality options at competitive prices, fostering customer loyalty. This loyalty translates into predictable sales volumes and healthy profit margins, often with reduced marketing expenses compared to national brands.

- Strong Unit and Gross Profit Penetration: Private label snacks and beverages are key contributors to Casey's grocery and general merchandise performance.

- Customer Loyalty and Affordability: High-quality, affordable private label options attract and retain a dedicated customer base.

- Healthy Profit Margins: These offerings typically yield strong profit margins due to efficient sourcing and lower marketing spend.

- Steady Cash Generation: The consistent demand and profitability make them reliable sources of cash for the company.

Car Wash Services

Car wash services at Casey's General Stores function as a classic cash cow. These operations, often integrated into existing convenience store footprints, generate steady profits with relatively low ongoing investment. For instance, Casey's has been strategically expanding its car wash offerings, recognizing their contribution to overall revenue.

The appeal of car washes lies in their ability to capitalize on existing customer traffic and infrastructure. Once the initial setup costs are covered, the operational expenses are manageable, leading to a high-margin, consistent cash flow. This makes them a reliable source of income, supporting other, perhaps more growth-oriented, ventures within Casey's broader portfolio.

- Supplemental Revenue: Car washes provide an additional income stream beyond fuel and convenience store sales.

- Low Operational Costs: After initial investment, ongoing costs for car wash services are generally minimal.

- Leveraged Infrastructure: Existing Casey's locations and customer base reduce the need for new infrastructure or marketing spend.

- High-Margin Potential: The service typically offers attractive profit margins, contributing significantly to cash flow.

The grocery and general merchandise segment is a cornerstone, acting as a reliable cash cow for Casey's. This category, encompassing a wide array of beverages, snacks, and essential household items, enjoys a dominant market share within the convenience store landscape. While not experiencing rapid growth, its consistent demand and customer loyalty translate into substantial and predictable cash flow. In fiscal year 2024, Casey's reported that its same-store sales in this segment increased by 4.2%, demonstrating its continued strength.

Casey's extensive network of approximately 2,900 convenience stores, primarily in the Midwest and South, also functions as a significant cash cow. These well-established locations benefit from strong brand recognition and consistent customer traffic, ensuring predictable revenue and healthy profit margins with minimal additional investment. This mature network provides a stable foundation for the company's financial operations.

Fuel sales, despite thinner margins, are a massive contributor, acting as a primary cash generator. In fiscal year 2024, Casey's sold an impressive 2.3 billion gallons of fuel. The company's efficient self-distribution network further enhances the profitability and consistency of this high-volume revenue stream, providing critical financial support for other growth initiatives.

Private label offerings, especially in snacks and beverages, are key performers within the grocery segment, generating consistent cash flow with relatively low investment. These high-quality, affordable options foster customer loyalty, leading to predictable sales volumes and healthy profit margins, often with reduced marketing costs. For fiscal year 2024, private label items significantly contributed to the growth of prepared foods and packaged beverages.

| Category | FY2024 Performance Highlight | Cash Cow Characteristics |

|---|---|---|

| Grocery & General Merchandise | 4.2% same-store sales increase | Dominant market share, consistent demand, customer loyalty |

| Convenience Store Network | ~2,900 locations | Strong brand recognition, predictable traffic, healthy margins |

| Fuel Sales | 2.3 billion gallons sold | High volume, efficient distribution, consistent cash generation |

| Private Label (Snacks & Beverages) | Substantial contribution to category growth | High-quality, affordable, loyal customer base, strong margins |

What You’re Viewing Is Included

Casey's General Stores BCG Matrix

The BCG Matrix analysis of Casey's General Stores you're previewing is the identical, fully comprehensive report you will receive upon purchase. This means no watermarks, no demo content, and no altered data—just the complete, professionally formatted strategic document ready for immediate application. You'll gain access to a detailed breakdown of Casey's product portfolio, categorized within the Stars, Cash Cows, Question Marks, and Dogs quadrants, providing actionable insights for resource allocation and future growth strategies. This preview accurately represents the high-quality, analysis-ready file that will be instantly downloadable, empowering your business planning with clear, data-driven recommendations.

Dogs

Acquired stores, especially those not yet aligned with Casey's established prepared food offerings or efficient operational practices, can initially be categorized as 'dogs.' These locations, prior to integration and conversion, often exhibit lower market share and growth potential, necessitating substantial investment to meet company benchmarks and unlock their full value.

Legacy point-of-sale systems or outdated inventory management software at some Casey's locations could be classified as dogs. These older technologies might not integrate seamlessly with newer digital initiatives, creating operational bottlenecks. For instance, if a store's system can't efficiently process mobile payments or track real-time inventory for online orders, it directly impacts customer satisfaction and sales potential.

Certain grocery items, like specific types of canned goods or older snack brands, might show declining local demand at Casey's. If these products consistently underperform, taking up valuable shelf space without significant sales, they could be classified as dogs.

For instance, if a particular region's demographic shifts and less interest is shown in, say, certain breakfast cereals, and Casey's hasn't updated its offerings or marketing for them, these items become candidates for the dog quadrant. This ties up capital in inventory that isn't moving, impacting overall profitability.

Low-Margin, Commodity-Driven Products

Certain basic commodity products, like staple food items or cleaning supplies, often find themselves in the 'dogs' category within Casey's General Stores' BCG Matrix. These products are characterized by intense price competition and very little differentiation from what competitors offer. This makes their profit margins inherently low, and their potential for significant growth is quite limited.

While these items are essential for a convenience store's operation, catering to immediate customer needs, their overall contribution to profitability remains constrained. For example, in 2024, the average gross profit margin for convenience store staple goods like milk and bread hovered around 15-20%, significantly lower than specialty items or prepared foods.

- Low Profitability: Products with minimal differentiation and high price sensitivity, such as basic canned goods or bottled water, typically yield low profit margins.

- Limited Growth: The market for these commodity items is often mature, with little room for expansion or increased sales volume beyond existing customer bases.

- Competitive Pressure: Intense competition from other convenience stores and even larger grocery chains forces price reductions, further squeezing already thin margins.

- Essential but Not Driving Growth: While necessary to complete a shopping basket, these items do not drive significant revenue growth or attract new customers to Casey's.

Stores in Highly Saturated Urban Markets

Stores in highly saturated urban markets represent a potential 'dog' category for Casey's General Stores. While Casey's typically thrives in less competitive rural environments, urban locations face significant challenges from established, larger convenience store chains and supermarkets.

These urban stores may experience slower growth and lower profitability due to intense competition and difficulty in capturing significant market share. For instance, in 2024, urban markets often see a higher density of convenience stores, with some metropolitan areas having over 50 stores per square mile, compared to much lower figures in rural settings.

- Intense Competition: Urban areas are often crowded with established convenience store brands, making it harder for Casey's to differentiate and gain customers.

- Lower Profitability: Higher operating costs and price sensitivity in urban markets can squeeze profit margins for these locations.

- Market Share Challenges: Gaining a substantial market share in densely populated urban areas is a significant hurdle compared to rural expansion.

- Strategic Re-evaluation: These stores might require a strategic review, potentially leading to divestment or significant operational changes to improve performance.

Within Casey's General Stores' BCG Matrix, 'dogs' represent business units or products with low market share and low growth potential. These are often essential but low-margin items or underperforming locations that require careful management to avoid draining resources.

For example, certain basic grocery staples like milk or bread, while necessary, operate in a mature market with intense price competition, yielding low profit margins. In 2024, convenience store margins on these items were typically around 15-20%. Similarly, stores in highly saturated urban markets, facing intense competition, might struggle to gain significant market share and profitability.

These 'dog' elements, whether products or locations, do not drive substantial growth or attract new customers. They tie up capital and shelf space that could be better utilized for higher-performing categories.

The strategic approach often involves minimizing investment, optimizing operations for efficiency, or potentially divesting if improvement is not feasible.

| Category | Market Share | Market Growth | Profitability | Strategic Focus |

|---|---|---|---|---|

| Basic Staples (e.g., Milk, Bread) | Low to Moderate | Low | Low (15-20% gross margin in 2024) | Efficiency, Cost Control |

| Underperforming Stores (e.g., Urban Saturation) | Low | Low | Low to Negative | Optimization, Divestment Consideration |

| Legacy Technology | N/A | Low | Low (operational drag) | Upgrade or Replace |

Question Marks

Casey's General Stores is actively innovating its breakfast menu, moving beyond its well-known breakfast pizza to introduce items like breakfast burritos. This expansion into new morning offerings positions these items as question marks within the BCG matrix. The company is tapping into a high-growth potential market by catering to the morning commute crowd, aiming to capture a larger share of this lucrative daypart.

The success of these new breakfast innovations, such as the breakfast burritos, is still being evaluated. While the market for convenient breakfast options is growing, Casey's needs to assess customer adoption rates and ensure sustained popularity to determine if these items will become stars or fall by the wayside. For example, in the first quarter of fiscal year 2025, Casey's reported a 7.8% increase in same-store sales, indicating a generally positive consumer response to their offerings, but the specific performance of new breakfast items is key to their BCG classification.

Casey's General Stores' pilot programs for new food items, like chicken wings and fries in markets such as Des Moines, represent a classic question mark in the BCG Matrix. These initiatives are exploring potentially lucrative, high-growth food segments. In 2023, the convenience store sector saw significant growth in prepared foods, with many chains reporting double-digit increases in their food and beverage sales, highlighting the potential of such ventures.

The success of these pilots is uncertain, as market acceptance, operational efficiency, and profitability remain to be proven across Casey's extensive store network. For instance, while the overall U.S. chicken wing market was valued at over $3 billion in 2023, replicating that success in a convenience store setting requires careful execution and consumer validation.

Casey's General Stores' expansion into new geographic regions, such as its entry into Texas, places it squarely in the question mark category of the BCG matrix. These new markets are characterized by their high growth potential, a key indicator for question marks, but also present significant challenges.

The company's strategy involves substantial investment to build brand awareness and integrate acquired operations, reflecting the resource-intensive nature of question mark initiatives. For instance, Casey's acquired 63 stores in Indiana, Illinois, and Missouri in 2023, demonstrating a pattern of growth through acquisition that is likely to be replicated in new territories like Texas, which offers a large and growing consumer base.

Limited-Time Offerings and Exclusive Brand Partnerships

Casey's General Stores' limited-time offerings and exclusive brand partnerships are strategically placed in the question mark quadrant of the BCG Matrix. These initiatives, such as unique seasonal pizza toppings or collaborations with popular snack brands, are designed to tap into high-growth potential markets by generating buzz and attracting new customer segments. For instance, Casey's has seen success with limited-time pizza flavors that drive incremental sales.

- Limited-Time Offerings: These introduce novelty and urgency, encouraging impulse purchases and repeat visits during their availability.

- Exclusive Brand Partnerships: Collaborations with well-known brands can leverage existing customer bases and enhance brand perception.

- Uncertain Long-Term Impact: While these promotions can boost short-term sales, their ability to foster lasting customer loyalty and consistently generate high returns remains to be seen.

- Investment Decision: Casey's must carefully evaluate the ROI of these ventures, as they require significant marketing and operational investment with uncertain future outcomes.

Advanced Supply Chain and Demand Planning Technologies

Casey's General Stores is investing heavily in advanced supply chain and demand planning technologies, placing them squarely in the question mark quadrant of the BCG matrix. These investments are crucial for a company operating in the fast-paced retail sector, aiming to optimize inventory and reduce waste.

The potential upside is significant, with these tools promising to enhance forecasting accuracy and streamline logistics. For instance, improved demand planning could directly impact Casey's ability to meet customer needs for seasonal items or promotional products, thereby increasing sales and customer satisfaction.

- High Growth Potential: These technologies offer substantial opportunities for operational efficiency gains and cost reduction in a competitive retail environment.

- Implementation Challenges: Full integration with existing legacy systems and ensuring widespread adoption across various store locations present ongoing hurdles.

- Uncertain ROI: While the promise of improved inventory turnover and reduced stockouts is clear, the exact realization of these benefits and their financial impact are still being measured.

- Strategic Importance: Continued investment is necessary to maintain a competitive edge, especially as competitors also adopt similar advanced planning systems.

Casey's new breakfast items, like breakfast burritos, and pilot programs for new food items such as chicken wings and fries, represent question marks. These initiatives are in high-growth potential markets but require further validation to determine their long-term success and profitability. For example, while the convenience store sector saw robust growth in prepared foods in 2023, the specific performance of these new offerings needs to be closely monitored.

Expansion into new geographic regions, like Texas, and the use of limited-time offers and brand partnerships also fall into the question mark category. These strategies aim to capture new customer segments and boost sales, but their ultimate impact on market share and profitability is still uncertain, necessitating careful evaluation of return on investment.

Investments in advanced supply chain and demand planning technologies are also question marks for Casey's. While these technologies promise significant operational efficiencies and cost reductions, their successful integration and the precise realization of their benefits are still being assessed. Continued investment is crucial to maintain a competitive edge in the evolving retail landscape.

| Initiative | Market Growth Potential | Current Status | Key Considerations |

|---|---|---|---|

| New Breakfast Items (e.g., Burritos) | High | Under evaluation | Customer adoption, sustained popularity |

| New Food Pilots (e.g., Wings, Fries) | High | Pilot phase | Market acceptance, operational efficiency, profitability |

| Geographic Expansion (e.g., Texas) | High | In progress | Brand awareness, integration of acquisitions |

| Limited-Time Offers & Partnerships | High | Ongoing | Long-term loyalty, ROI of marketing spend |

| Supply Chain Technology | High | Investment phase | Integration challenges, uncertain ROI realization |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of Casey's internal financial disclosures, industry growth reports, and competitor market share data to accurately position each business unit.