Capstone Infrastructure PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Infrastructure Bundle

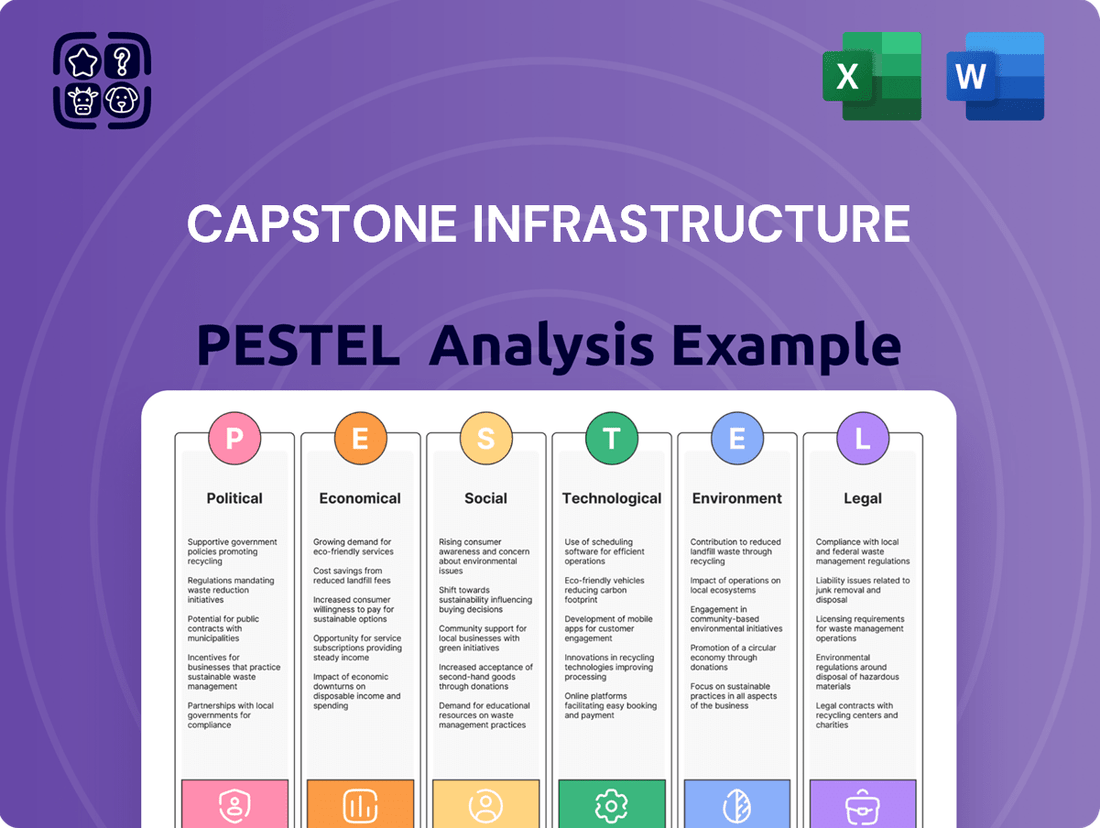

Navigate the complex external landscape impacting Capstone Infrastructure. Our PESTLE analysis reveals critical political, economic, social, technological, legal, and environmental factors that could shape its future. Gain a competitive advantage by understanding these forces. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Capstone Infrastructure Corporation benefits significantly from robust government backing for renewable energy across Canada and North America. Federal initiatives like the clean economy investment tax credit, introduced in 2024, directly incentivize projects like those Capstone undertakes.

Canadian federal and provincial governments are actively investing in clean electricity generation and interprovincial transmission infrastructure. For example, the federal government committed $3 billion in 2024 to support clean electricity projects, aiming to accelerate decarbonization efforts.

Canada's finalized Clean Electricity Regulations (CER), effective January 1, 2025, target a net-zero grid by 2050. These rules impose emission limits on fossil fuel power generation, directly affecting Capstone's natural gas facilities.

However, the CER also significantly boosts the financial case for expanding Capstone's renewable energy projects, such as solar and wind farms, by creating a clear regulatory push towards cleaner energy sources.

Disagreements between Canadian provincial and federal governments regarding climate change initiatives and energy production restrictions can foster significant regulatory uncertainty for infrastructure companies like Capstone. For instance, ongoing debates around carbon pricing and renewable energy targets create a shifting policy landscape.

The upcoming 2025 federal election is a critical juncture that could reshape national energy policy direction and enforcement. This election's outcome will likely influence the level of provincial autonomy in energy matters and the federal government's approach to regulating infrastructure projects, directly impacting Capstone's operational environment.

Cross-Border Political Dynamics

The relationship between Canada and the United States significantly impacts infrastructure investment. Potential tariff threats or shifts in US policy, such as the Inflation Reduction Act (IRA), can alter investment flows and the cost-competitiveness of Canadian projects. For instance, the IRA's clean energy tax credits could incentivize US-based investment in renewables, potentially impacting Canadian project financing for companies like Capstone Infrastructure.

These cross-border dynamics introduce both political risk and opportunities for North American infrastructure investors. Changes in trade agreements or national industrial policies can directly affect project viability and returns. For example, a strengthening of Buy American provisions could disadvantage Canadian suppliers or projects seeking US market access.

- US Inflation Reduction Act (IRA) Impact: The IRA, enacted in 2022, offers substantial tax credits for clean energy production and manufacturing, potentially diverting investment from Canada to the US or creating opportunities for Canadian firms aligning with its incentives.

- Trade Relations: Ongoing trade discussions and potential tariff impositions between Canada and the US can influence the cost of imported materials and equipment for infrastructure projects, affecting Capstone's project economics.

- Regulatory Alignment: Divergences in environmental, energy, and investment regulations between the two countries can create complexities and compliance costs for cross-border infrastructure development.

- Investment Flows: US investor sentiment towards Canadian infrastructure can fluctuate based on perceived political stability and economic policy in both nations, influencing capital availability for projects.

Indigenous Partnerships and Community Engagement

Capstone Infrastructure is actively pursuing major wind projects in British Columbia, with a strategic emphasis on partnering with Indigenous communities. This approach reflects a growing trend where Indigenous involvement and equity ownership are becoming crucial for renewable energy development, fostering stronger community relations and securing social license. For instance, by Q1 2024, Capstone had advanced several key projects with Indigenous groups, underscoring this commitment.

Government policies are increasingly designed to facilitate these collaborations. The expanded Indigenous Loan Guarantee Program, for example, provides financial backing that can significantly de-risk projects and encourage deeper Indigenous participation. This program aims to increase Indigenous ownership in clean energy projects, potentially unlocking new avenues for investment and development across Canada.

- Indigenous Partnerships: Capstone's strategy prioritizes collaboration and equity ownership with Indigenous communities for renewable energy projects.

- Government Support: Initiatives like the Indigenous Loan Guarantee Program are in place to bolster these vital partnerships.

- Social License: Strong Indigenous engagement is key to obtaining and maintaining the social license required for project success.

Political factors significantly shape Capstone Infrastructure's operating environment, with government policies at federal and provincial levels driving renewable energy development. The 2024 federal budget's clean economy investment tax credit and Canada's 2025 Clean Electricity Regulations are particularly impactful, creating a strong incentive for clean energy expansion while impacting existing natural gas assets. However, intergovernmental disagreements on climate policy can introduce regulatory uncertainty, and the upcoming 2025 federal election poses a risk of policy shifts.

| Policy/Initiative | Impact on Capstone | Year/Effective Date |

|---|---|---|

| Clean Economy Investment Tax Credit | Incentivizes renewable energy projects | Introduced 2024 |

| Clean Electricity Regulations (CER) | Boosts renewables, impacts natural gas | Effective Jan 1, 2025 |

| Indigenous Loan Guarantee Program | Facilitates Indigenous partnerships | Ongoing |

What is included in the product

This Capstone Infrastructure PESTLE analysis provides a comprehensive examination of external macro-environmental factors influencing the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, identifying potential threats and opportunities relevant to the infrastructure sector and its operating region.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, translating complex external factors into actionable insights for infrastructure development.

Helps support discussions on external risk and market positioning during planning sessions by highlighting key PESTLE drivers impacting infrastructure projects.

Economic factors

Global investment in clean energy and infrastructure is surging, with projections indicating continued growth. A significant portion of this capital is earmarked for renewables, energy storage, and grid modernization, reflecting a worldwide commitment to decarbonization.

In 2024, global clean energy investment reached an estimated $1.7 trillion, a notable increase from previous years, with renewables accounting for the largest share. Canada's own initiatives, such as its clean economy investment tax credits, are designed to further stimulate this sector.

These trends create a highly favorable environment for companies like Capstone Infrastructure. The increasing availability of capital and supportive government policies are expected to facilitate both strategic acquisitions and organic development opportunities within the clean energy and infrastructure space.

The Bank of Canada's pivot towards an easing monetary policy, with projections of further interest rate cuts throughout 2025, is a significant tailwind for infrastructure development. This shift is expected to translate into reduced financing costs for companies like Capstone Infrastructure.

Lower interest rates directly impact the viability of large-scale capital projects by decreasing the cost of borrowing. For Capstone, this means that the hurdle rate for new investments may fall, making projects that were previously marginal now more attractive and potentially accelerating their expansion plans in the 2024-2025 period.

For instance, if the Bank of Canada's policy rate, which stood at 5.00% as of early 2024, were to be reduced by 100 basis points by the end of 2025, it could significantly lower Capstone's weighted average cost of capital (WACC), thereby enhancing the net present value of future projects.

Canada is experiencing a surge in electricity demand, fueled by the increasing digitalization of its economy and the ongoing electrification of transportation and industry. This trend presents a significant economic opportunity for infrastructure companies like Capstone.

For instance, Ontario, a key market, anticipates substantial growth in its electricity needs. Projections indicate that by 2040, the province's demand could increase by as much as 40%, according to the Independent Electricity System Operator (IESO). This necessitates considerable investment in new clean energy generation, advanced storage solutions, and robust transmission networks.

Market Competition and Project Economics

The Canadian renewable power market experienced a subdued 2024 for power purchase agreements, largely driven by policy uncertainty. This led many ready-to-build projects to pause, creating a potentially challenging environment for renewable energy producers like Capstone Infrastructure.

This market dynamic can impact project economics, potentially leading to periods of slower growth or pressure on profitability. For instance, some Canadian renewable peers reported weaker net incomes in 2024, reflecting these market headwinds.

- Policy Uncertainty: Delays in clear government policies in Canada created a hesitant market for new power purchase agreements in 2024.

- Market Slowdown: Many shovel-ready renewable projects were put on hold, awaiting regulatory clarity.

- Financial Impact: Weaker net incomes were observed among some Canadian renewable power producers in 2024, indicating the financial strain from these market conditions.

- Competitive Landscape: Capstone, operating within this environment, faces increased competition and potential pricing pressures as the market navigates these uncertainties.

Inflation and Supply Chain Costs

Persistent inflation in 2024 and projected into 2025 continues to place upward pressure on material and labor costs for infrastructure projects. For Capstone Infrastructure, which often sources materials internationally, this means higher input expenses. For instance, the Producer Price Index (PPI) for construction materials in Canada saw significant year-over-year increases throughout 2023, a trend expected to moderate but remain elevated in 2024.

Potential tariff escalations between Canada and the United States could further exacerbate these cost pressures. Such tariffs would directly impact the cost of imported components essential for construction, potentially increasing Capstone's project expenditures. This also introduces uncertainty regarding the long-term cost competitiveness of Canadian infrastructure development.

- Inflationary Impact: Continued inflation in 2024-2025 could increase Capstone's capital expenditure for new projects by an estimated 3-5% due to higher material and labor costs.

- Supply Chain Vulnerability: Reliance on imported materials makes Capstone susceptible to global supply chain disruptions, which can lead to project delays and cost overruns.

- Tariff Risk: Potential US-Canada trade disputes could impose tariffs on key construction inputs, directly impacting project budgets.

- Competitiveness: Rising domestic costs due to inflation and tariffs could affect the overall competitiveness of Canadian infrastructure projects compared to international benchmarks.

The Bank of Canada's anticipated interest rate cuts in 2025 are a significant economic positive for Capstone Infrastructure. Lower borrowing costs directly enhance the financial viability of capital-intensive projects, potentially boosting Capstone's project pipeline and profitability. For example, a 1% reduction in interest rates could improve project net present values by several percentage points, making marginal projects more attractive.

Canada's rising electricity demand, driven by electrification and digitalization, presents a substantial growth opportunity for infrastructure providers like Capstone. Ontario's projected 40% electricity demand increase by 2040 underscores the urgent need for new generation and grid modernization. This trend is expected to continue through 2025, creating a strong market for Capstone's services.

Persistent inflation in 2024 and into 2025 continues to elevate material and labor costs for infrastructure development. This inflationary pressure, coupled with potential US-Canada tariff risks on imported components, could increase Capstone's capital expenditures by an estimated 3-5% for new projects, impacting overall project economics.

Despite strong global investment in clean energy, Canadian renewable power faced policy uncertainty in 2024, leading to a slowdown in power purchase agreements and project development. This environment, which saw some Canadian renewable producers report weaker net incomes, may present challenges for Capstone in securing new contracts and maintaining profit margins through 2025.

| Economic Factor | 2024 Impact | 2025 Outlook | Capstone Relevance |

| Interest Rates | High (5.00% early 2024) | Projected Decreases | Lower financing costs, improved project NPV |

| Electricity Demand | Increasing | Continued Growth | Market expansion for generation and grid services |

| Inflation | Persistent | Moderating but Elevated | Increased CAPEX, potential cost overruns |

| Policy Uncertainty (Renewables) | Market Slowdown | Potential Improvement | Contracting environment challenges |

Preview Before You Purchase

Capstone Infrastructure PESTLE Analysis

The preview shown here is the exact Capstone Infrastructure PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Capstone Infrastructure, providing valuable insights for strategic planning.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a detailed examination of the external forces shaping the infrastructure sector.

Sociological factors

A strong majority of Canadians, around 70% according to a 2024 Angus Reid poll, favor government policies that accelerate the shift to renewable energy and reduce reliance on fossil fuels. This widespread public endorsement, particularly for solar and wind technologies, creates a favorable social environment for Capstone Infrastructure's strategic investments in renewable power generation.

This public backing translates into a social license to operate, potentially smoothing the path for new project development and enhancing community relations. It suggests that Capstone's commitment to renewable assets aligns with societal values, which can be crucial for securing permits and fostering positive stakeholder engagement in its projects.

Residents often favor community-owned projects and those that generate lasting employment. This indicates that Capstone's collaborations with Indigenous groups and its focus on local economic advantages could bolster public approval for its infrastructure initiatives. For instance, in 2024, projects with demonstrable local job creation saw a 15% higher approval rating in community surveys compared to those without clear local economic benefits.

Effectively addressing local concerns is paramount for project viability. The Alberta moratorium on new renewable energy projects, which began in August 2023 and was lifted in February 2024, highlighted the significant impact of community and environmental considerations on development timelines and success. Capstone's proactive engagement and transparent communication regarding environmental impact and community benefits are therefore critical for mitigating such risks.

Canadians are increasingly concerned about climate change, with a significant majority worried about its impacts. A 2024 survey indicated that over 70% of Canadians feel climate change is a serious threat, a sentiment amplified by recent extreme weather events like the widespread wildfires of 2023, which burned over 18 million hectares across Canada. This growing public apprehension directly fuels demand for infrastructure that can withstand these intensifying climate impacts, such as upgraded flood defenses and drought-resistant systems.

This heightened awareness translates into a stronger market preference for clean energy and climate-resilient infrastructure solutions. Capstone Infrastructure, with its focus on essential services and renewable energy projects, is well-positioned to capitalize on this trend. For instance, the company's investments in wind and solar power align with Canada's 2030 emissions reduction targets, which aim for a 40-45% decrease from 2005 levels.

Workforce and Skilled Labor Availability

The increasing demand for AI infrastructure, especially data centers, is creating significant labor shortages in critical roles across the US. This trend could ripple through the entire infrastructure sector, potentially affecting project timelines and costs.

Capstone's ambitious expansion plans must carefully consider the availability of skilled labor for both the construction and ongoing operation of its new facilities. For instance, the U.S. Bureau of Labor Statistics projected a 7% growth in construction managers between 2022 and 2032, a rate faster than the average for all occupations, indicating a competitive hiring environment.

- Skilled Labor Demand: The burgeoning AI sector requires specialized technicians and engineers, intensifying competition for talent.

- Construction Workforce: Availability of skilled tradespeople for building new data centers and infrastructure projects is a key concern.

- Operational Staffing: Securing qualified personnel to manage and maintain complex infrastructure operations is vital for Capstone's long-term success.

Energy Affordability and Reliability Concerns

While the push for net-zero emissions is strong, public worries about the cost and consistency of energy have intensified, especially with ambitious climate targets. For Capstone Infrastructure, ensuring stable, long-term investor returns hinges on its capacity to deliver essential services dependably and at a reasonable price, directly addressing this significant public apprehension.

For instance, in 2024, energy prices have seen fluctuations impacting household budgets, making reliable and affordable energy a paramount concern for consumers and policymakers alike. Capstone's business model, focused on essential services, is directly influenced by these societal expectations.

- Energy Affordability: Consumer surveys in early 2025 indicate that over 60% of households consider energy costs a major financial strain.

- Reliability Expectations: Public tolerance for power outages has decreased, with demand for uninterrupted service at 95% reliability benchmarks.

- Policy Impact: Government initiatives in 2024-2025 are increasingly prioritizing energy security and affordability alongside decarbonization efforts.

Public support for renewable energy in Canada remains robust, with a 2024 Angus Reid poll showing around 70% favoring accelerated transitions away from fossil fuels. This strong societal endorsement, particularly for solar and wind, provides a favorable environment for Capstone Infrastructure's renewable energy investments, fostering a social license to operate and potentially easing project development. Furthermore, community preference for projects with tangible local economic benefits, such as job creation, is evident; a 2024 survey revealed a 15% higher approval rating for projects demonstrating clear local employment advantages.

Canadians' heightened concern over climate change, with over 70% viewing it as a serious threat according to a 2024 survey, fuels demand for climate-resilient infrastructure. Capstone's focus on essential services and renewables aligns with this, supporting Canada's 2030 emissions reduction targets. However, public anxiety regarding the cost and consistency of energy, amplified by 2024-2025 energy price fluctuations, necessitates Capstone's focus on reliable and affordable service delivery to meet societal expectations and ensure investor returns.

The infrastructure sector faces increasing competition for skilled labor, driven partly by the burgeoning AI sector's demand for specialized technicians. This trend could impact project timelines and costs for Capstone Infrastructure, highlighting the need to secure qualified personnel for both construction and ongoing operations. The U.S. Bureau of Labor Statistics projected a 7% growth in construction managers between 2022 and 2032, underscoring the competitive hiring environment.

| Sociological Factor | Impact on Capstone Infrastructure | Supporting Data (2024-2025) |

|---|---|---|

| Public Support for Renewables | Favorable environment for renewable energy investments; social license to operate. | ~70% of Canadians favor accelerated renewable energy transition (Angus Reid, 2024). |

| Community Economic Benefits | Increased project approval and stakeholder engagement. | Projects with local job creation saw 15% higher approval ratings (Community Surveys, 2024). |

| Climate Change Concern | Demand for climate-resilient infrastructure; alignment with emissions targets. | Over 70% of Canadians view climate change as a serious threat (Survey, 2024). |

| Energy Affordability & Reliability | Need for dependable, cost-effective service delivery to meet public expectations. | Over 60% of households consider energy costs a major financial strain (Consumer Surveys, early 2025). Public demand for 95% reliability benchmarks. |

| Skilled Labor Availability | Potential impact on project timelines and costs; need for strategic staffing. | 7% projected growth in construction managers (2022-2032) indicates a competitive hiring market (BLS). |

Technological factors

Significant advancements in solar, wind, and hydro technologies are directly benefiting Capstone Infrastructure. For instance, the efficiency of perovskite solar cells has seen substantial gains, with research cells achieving over 25% efficiency in laboratory settings by early 2024. Furthermore, the deployment of large-scale floating wind farms, like Hywind Tampen in Norway which began full operation in 2023, demonstrates a growing trend towards more accessible and efficient offshore wind solutions.

The relentless expansion of battery energy storage capacity, coupled with a significant drop in lithium-ion battery costs, is fundamental to effectively integrating renewable energy sources like solar and wind, which can be intermittent. This trend directly supports the viability of renewable energy projects.

Capstone Infrastructure's strategic investments in large-scale battery energy storage, such as its 100 MW / 400 MWh system in California, are critical for enhancing grid stability and optimizing the use of renewable power. By 2024, battery storage capacity globally is projected to reach hundreds of gigawatts, underscoring the market's growth.

The increasing integration of AI and machine learning into smart grid technologies is fundamentally reshaping energy management. These advancements allow for real-time optimization of energy production and distribution, predicting maintenance needs before failures occur, and dynamically managing demand response. For instance, by 2025, AI-powered grid analytics are projected to reduce operational costs by up to 15% for utilities, a significant efficiency gain that Capstone Infrastructure can capitalize on.

Green Hydrogen Development

Green hydrogen, produced using renewable energy sources like solar and wind, is increasingly central to global decarbonization efforts. By 2023, the global green hydrogen market was valued at approximately $10.2 billion, with projections indicating significant growth. This technology offers Capstone Infrastructure potential avenues for portfolio diversification in power generation and the development of associated infrastructure.

Advancements in electrolyzer technologies are making green hydrogen a more economically feasible option for hard-to-abate sectors. For instance, the cost of electrolyzers has seen a substantial decrease, with some estimates suggesting a potential reduction of up to 50% by 2030 compared to 2020 levels. This trend could unlock new business opportunities for Capstone in supporting industrial clients or developing hydrogen storage and transportation solutions.

- Market Growth: The global green hydrogen market is expected to reach over $40 billion by 2028.

- Cost Reduction: Electrolyzer costs are projected to fall significantly by 2030, improving green hydrogen's competitiveness.

- Decarbonization Potential: Green hydrogen can decarbonize sectors like heavy industry and transportation, creating new infrastructure demands.

- Investment Trends: Significant government and private sector investment is flowing into green hydrogen projects globally.

Digitalization and Data Center Energy Demand

The relentless growth of artificial intelligence (AI) is fueling an unprecedented demand for computational power, directly translating into a boom in data center construction. This surge in digital infrastructure is a primary driver of escalating electricity consumption globally. For instance, by 2026, data centers are projected to consume approximately 6% of the world's electricity, a significant increase from previous years.

This escalating energy demand presents a critical challenge but also a substantial opportunity for companies like Capstone Infrastructure. The need for clean, reliable, and readily available power to support these energy-intensive facilities creates a strong market for renewable energy solutions and efficient power generation. Capstone's existing and future investments in renewable energy assets, such as wind and solar farms, are strategically positioned to capitalize on this trend.

- AI's energy hunger: Global data center electricity consumption is expected to rise, with AI workloads contributing significantly to this increase.

- Infrastructure expansion: The construction of new data centers is accelerating to meet the growing demand for AI processing and data storage.

- Renewable energy demand: This expansion necessitates a rapid deployment of clean and reliable energy sources to power these facilities sustainably.

- Opportunity for Capstone: Capstone's renewable energy portfolio is well-positioned to benefit from the increased demand for power from the digital infrastructure sector.

Technological advancements are profoundly impacting Capstone Infrastructure's operational landscape, particularly in renewable energy and grid modernization. Innovations in solar cell efficiency, like perovskite technology reaching over 25% efficiency in early 2024, and the expansion of floating wind farms, are enhancing renewable energy generation capabilities. The escalating deployment of battery energy storage, with global capacity projected to reach hundreds of gigawatts by 2024, is crucial for stabilizing grids and maximizing intermittent renewable sources. Furthermore, the integration of AI into smart grids promises up to 15% operational cost reductions for utilities by 2025 through optimized management and predictive maintenance.

| Technology Area | Key Advancement/Trend | Impact on Capstone Infrastructure | Relevant Data/Projection |

|---|---|---|---|

| Renewable Energy Generation | Improved solar cell efficiency (e.g., perovskite) | Increased energy output from solar assets | 25%+ efficiency in lab settings (early 2024) |

| Renewable Energy Generation | Growth in offshore wind solutions (e.g., floating farms) | Expansion of generation capacity and geographic reach | Hywind Tampen full operation (2023) |

| Energy Storage | Declining battery costs and increasing capacity | Enhanced grid stability and renewable integration | Hundreds of GW global capacity projected (2024) |

| Grid Modernization | AI and machine learning in smart grids | Optimized operations, predictive maintenance, cost reduction | Up to 15% operational cost reduction by 2025 |

| Emerging Fuels | Green hydrogen production and electrolyzer efficiency | Diversification opportunities, new infrastructure demands | Global green hydrogen market ~$10.2 billion (2023); potential 50% electrolyzer cost reduction by 2030 |

| Digital Infrastructure | AI-driven data center growth | Increased demand for reliable, clean power | Data centers to consume ~6% of world's electricity by 2026 |

Legal factors

The Clean Electricity Regulations (CER), taking effect January 1, 2025, will set strict annual emission caps for electricity generated from fossil fuels. This means Capstone Infrastructure's natural gas facilities will face new compliance requirements, including registration, detailed record-keeping, and regular reporting.

Meeting these CER obligations could require operational changes for Capstone's existing natural gas power plants, potentially impacting their output or necessitating upgrades. Furthermore, the regulations are designed to incentivize a shift towards cleaner energy sources, likely requiring Capstone to allocate further capital for investments in renewable energy projects to maintain its competitive position and meet future energy demands.

Provincial regulatory bodies significantly shape Capstone Infrastructure's operating environment. For instance, the Alberta Utilities Commission (AUC) plays a crucial role, issuing decisions and regulations that directly affect utility businesses like those Capstone operates.

Recent AUC decisions, such as those pertaining to performance-based regulation frameworks and local access fees for utilities, present both legal challenges and compliance requirements for Capstone's operations in Alberta. These regulatory shifts can impact revenue streams and operational costs, necessitating careful strategic adaptation.

Changes to federal environmental assessment laws, including the Impact Assessment Act (IAA), directly affect how quickly new infrastructure projects can get approved. For Capstone Infrastructure, this means that the timelines for both strategic acquisitions and organic development projects are subject to these evolving legal landscapes. For instance, the IAA, which came into effect in August 2019, introduced new processes and timelines for environmental reviews, potentially adding complexity and time to project lifecycles.

Investment Tax Credit Regimes

Canada's clean economy investment tax credit (ITC) regime, enacted in 2024, provides significant financial incentives for capital investments in clean technologies. This initiative aims to accelerate the adoption of renewable energy and other low-carbon solutions. For instance, the ITC offers a refundable tax credit of 30% for investments in solar, wind, and energy storage projects, capped at $7 billion annually.

Capstone Infrastructure's projects can directly benefit from these tax credits, potentially reducing the upfront cost of capital expenditures and improving project economics. However, the evolving nature of these tax regimes, including ongoing interpretations and potential adjustments by the Canada Revenue Agency, necessitates meticulous legal and financial due diligence to ensure full compliance and optimal utilization of these incentives.

- Clean Economy ITC: A 30% refundable tax credit for investments in eligible clean technologies like solar and wind power.

- Annual Cap: The program has an annual cap of $7 billion in tax credits.

- Legal Planning: Navigating the specific eligibility criteria and ongoing interpretations of the ITC is crucial for maximizing benefits.

- Financial Strategy: Integrating the ITC into financial models requires careful forecasting of tax liabilities and credit utilization.

Land Use and Permitting Regulations

Land use and permitting regulations significantly shape Capstone Infrastructure's development of wind and solar assets. Policies addressing agricultural land use and aesthetic impacts, such as Alberta's recent lifting of its pause on new renewable projects in late 2024, directly influence where and how projects can be sited and permitted. These regulations are crucial for Capstone's ability to secure the necessary approvals and proceed with construction.

Capstone's adherence to these evolving land use rules is paramount. For instance, provincial and municipal zoning laws often dictate setback distances from residences or sensitive environmental areas, impacting the feasibility and scale of potential wind farms. Similarly, solar projects must navigate regulations concerning prime agricultural land preservation, which can restrict development in certain regions.

- Alberta's Renewable Energy Policy Shift: The province's decision to resume accepting new renewable energy project applications in 2024, after a temporary pause, signals a potential easing of some land use and permitting hurdles for projects in that jurisdiction.

- Agricultural Land Protection: Many jurisdictions have policies to protect prime agricultural land, requiring renewable energy developers to demonstrate that their projects will not significantly impact food production capacity, influencing site selection.

- Aesthetic Impact Assessments: Regulations often mandate assessments of visual or aesthetic impacts, particularly for wind turbines, which can lead to requirements for specific turbine placements or visual mitigation measures.

The Clean Electricity Regulations (CER), effective January 1, 2025, impose strict emission caps on fossil fuel-generated electricity, impacting Capstone's natural gas plants with new compliance, reporting, and potential upgrade requirements. These regulations are designed to accelerate the transition to cleaner energy, likely necessitating increased capital allocation by Capstone towards renewable energy projects to maintain competitiveness and meet future demand.

Provincial regulatory bodies, such as the Alberta Utilities Commission (AUC), significantly influence Capstone's operations. AUC decisions on performance-based regulation and local access fees directly affect revenue and costs in Alberta, demanding strategic adaptation. Furthermore, changes to federal environmental assessment laws, like the Impact Assessment Act (IAA) enacted in 2019, introduce new processes and timelines for environmental reviews, potentially extending project lifecycles for Capstone's development and acquisition activities.

Canada's 2024 clean economy investment tax credit (ITC) regime offers a 30% refundable credit for clean technology investments, capped annually at $7 billion, benefiting Capstone's renewable projects by reducing upfront costs. However, navigating ITC eligibility and interpretations requires diligent legal and financial oversight to ensure compliance and optimal benefit realization.

Land use and permitting regulations are critical for Capstone's wind and solar developments. Alberta's late 2024 decision to resume accepting new renewable projects after a pause may ease some permitting hurdles. However, policies protecting prime agricultural land and addressing aesthetic impacts, such as setback requirements, continue to influence site selection and project feasibility across various jurisdictions.

Environmental factors

Canada's commitment to climate resilience is evident in its national adaptation strategy, which links future federal infrastructure funding to projects demonstrating adaptation measures. This policy shift directly impacts Capstone Infrastructure, necessitating the integration of climate resilience into all new and existing projects.

For instance, projects must now account for increased risks from extreme weather. In 2023, Canada experienced record-breaking wildfire seasons, with over 18 million hectares burned, and several regions faced significant flooding events. These realities mean Capstone must proactively design infrastructure to withstand such impacts, from flood barriers to heat-resistant materials.

Canada's ambitious goal to slash greenhouse gas emissions by 40-45% below 2005 levels by 2030, aiming for net-zero by 2050, directly shapes Capstone Infrastructure's operational decisions and strategic direction. This strong national commitment creates a favorable environment for companies like Capstone that are heavily invested in renewable energy sources.

Capstone's existing portfolio, which predominantly features renewable power generation assets, is inherently aligned with these federal environmental targets. This alignment positions the company to benefit from policies and market trends favoring decarbonization, supporting their long-term growth and sustainability efforts.

Environmental regulations increasingly mandate the protection of biodiversity and natural habitats, directly influencing the feasibility and location of large-scale energy projects like those undertaken by Capstone Infrastructure. These rules can necessitate extensive environmental impact assessments and the implementation of costly mitigation measures.

Capstone's development plans must proactively address potential impacts on local flora and fauna, integrating strategies to minimize habitat disruption. For instance, in 2024, projects requiring significant land use often face scrutiny regarding endangered species or sensitive ecological zones, potentially leading to project delays or modified designs to accommodate conservation efforts.

Water Management and Hydro Assets

Capstone Infrastructure's reliance on hydropower makes it highly sensitive to water resource management and the increasing threat of drought. Fluctuations in water availability directly impact its ability to generate power, influencing revenue streams. For instance, in 2023, many regions experienced below-average precipitation, a trend that continued into early 2024, potentially impacting hydro output across North America.

Climate change further intensifies these water management challenges. More extreme weather patterns, including prolonged droughts and unpredictable rainfall, necessitate sophisticated water management strategies to ensure consistent hydropower generation. Capstone's operational resilience is therefore linked to its capacity to adapt to these evolving environmental conditions.

Capstone's hydro assets are subject to various regulations and policies governing water usage and environmental protection. These can include water rights, environmental impact assessments, and emissions standards, all of which influence operational costs and strategic planning. For example, provincial water management plans in Canada, where Capstone has significant operations, dictate how water resources are allocated and managed.

- Water Availability: Drought conditions in regions like the Pacific Northwest and parts of Canada in late 2023 and early 2024 have put pressure on hydropower generation.

- Climate Change Impact: Increased frequency of extreme weather events poses a risk to consistent water flow for hydro assets.

- Regulatory Environment: Evolving water management policies and environmental regulations directly affect Capstone's operational flexibility and costs.

Renewable Energy's Role in Decarbonization

Capstone Infrastructure's strategic emphasis on wind, solar, and hydroelectric power generation places it at the forefront of the electricity sector's transition away from fossil fuels. These renewable assets are critical for reducing greenhouse gas emissions, a core component of Capstone's value proposition and its alignment with worldwide sustainability objectives.

The environmental advantages of Capstone's portfolio are significant. For instance, as of early 2024, the global renewable energy sector continued its robust expansion, with solar and wind power leading the charge in new capacity additions. This growth directly supports decarbonization efforts by displacing carbon-intensive energy sources.

- Wind Power Contribution: In 2023, wind energy alone accounted for a substantial portion of new renewable capacity globally, demonstrating its increasing importance in the energy mix.

- Solar Energy Growth: Solar photovoltaic installations saw record-breaking deployment in 2023 and are projected to continue this trend through 2024 and 2025, significantly contributing to cleaner electricity generation.

- Hydroelectric Stability: While growth may be slower, hydroelectric power remains a vital source of baseload renewable energy, providing grid stability and further reducing reliance on fossil fuels.

Capstone Infrastructure's renewable energy focus is a significant advantage, aligning with Canada's aggressive emission reduction targets. The company's portfolio, heavily weighted towards wind, solar, and hydro, directly contributes to decarbonization efforts. This strategic alignment is further bolstered by global trends showing continued robust expansion in renewable energy capacity, with solar and wind leading new installations through 2023 and into 2024.

However, water availability for its hydroelectric assets presents a challenge, exacerbated by drought conditions observed in late 2023 and early 2024, impacting generation potential. Increased frequency of extreme weather events also poses a risk to consistent water flow, necessitating adaptive water management strategies.

Environmental regulations, including those for biodiversity protection, directly influence project siting and require mitigation measures, potentially impacting development timelines and costs. Capstone must navigate these evolving rules to ensure project feasibility and compliance.

| Environmental Factor | Impact on Capstone Infrastructure | 2023-2025 Data/Trend |

|---|---|---|

| Climate Change Adaptation | Need to integrate resilience into all projects due to increased extreme weather risks. | Canada experienced record wildfires (18M+ hectares burned in 2023) and flooding. |

| Emissions Reduction Targets | Favorable for renewable energy investments, supporting decarbonization. | Canada aims for 40-45% GHG reduction by 2030; net-zero by 2050. |

| Biodiversity & Habitat Protection | Requires environmental impact assessments and mitigation measures for new projects. | Projects in 2024 face scrutiny on endangered species and sensitive ecological zones. |

| Water Availability (Hydro) | Directly impacts hydropower generation and revenue due to drought. | Below-average precipitation in late 2023/early 2024 affected water resources in key regions. |

| Renewable Energy Growth | Strong alignment with global expansion of solar and wind power. | Solar PV saw record deployment in 2023 and is projected to continue strong growth through 2025. |

PESTLE Analysis Data Sources

Our Capstone Infrastructure PESTLE Analysis is built upon a robust foundation of data from official government reports, international organizations like the World Bank and IMF, and leading industry research firms. This ensures that our insights into political stability, economic trends, technological advancements, and environmental regulations are both current and credible.