Capstone Infrastructure Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Infrastructure Bundle

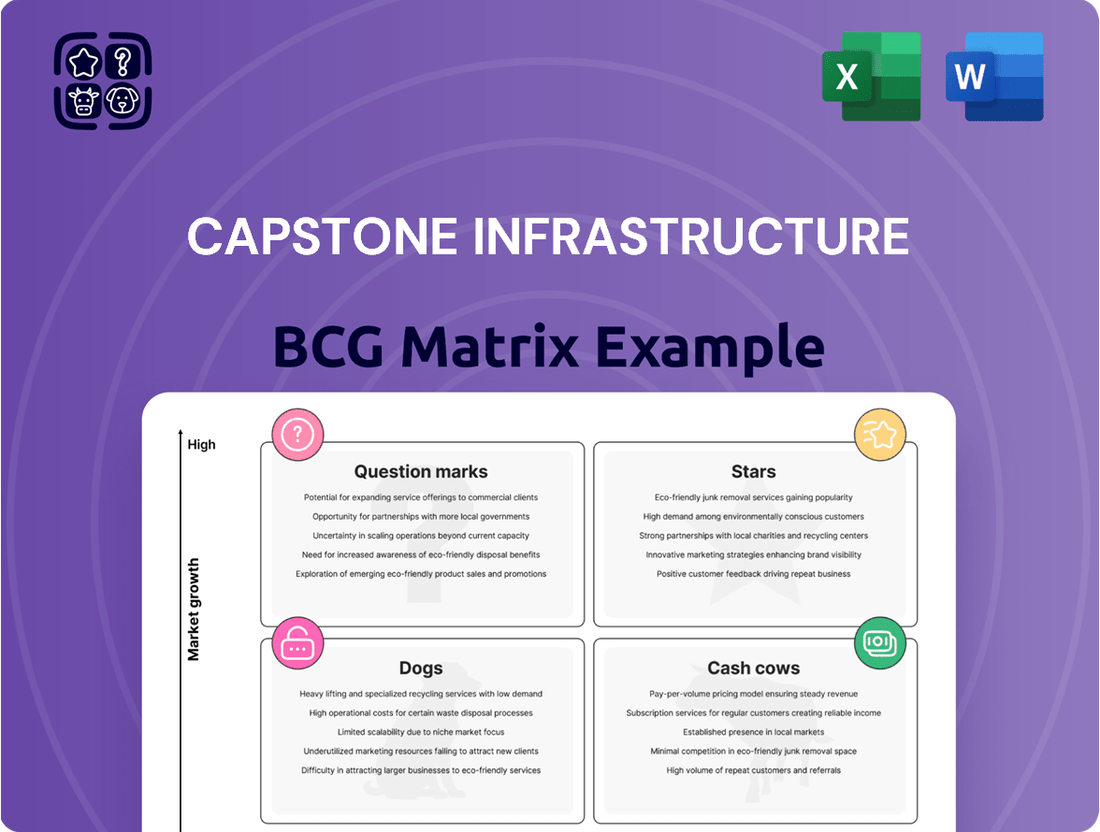

Unlock the strategic potential of your product portfolio with our Capstone Infrastructure BCG Matrix. This powerful tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear visual representation of their market performance and growth prospects.

Don't let uncertainty dictate your investment decisions. Purchase the full BCG Matrix to gain a comprehensive understanding of each product's position, enabling you to allocate resources effectively and drive sustainable growth.

This isn't just a chart; it's your roadmap to strategic success. Get the complete BCG Matrix today and transform your insights into actionable plans that will propel your business forward.

Stars

The Wild Rose 2 Wind Project, a 192-megawatt development in Alberta, represents Capstone Infrastructure's largest wind asset currently under construction. This project is a significant play in the expanding renewable energy sector, with a projected completion in 2025.

Capstone is actively solidifying its standing in this dynamic market with Wild Rose 2. The project’s secured offtake agreements underscore robust demand for its generated power, a crucial factor for its success.

Capstone Infrastructure secured three substantial wind projects in British Columbia, totaling 537 MW. These projects were selected by BC Hydro through a recent competitive power call, highlighting Capstone's success in a revitalized wind energy market.

The equity ownership structure for these developments is a 51-49 split with Indigenous partners, showcasing strong collaborative relationships. This strategic partnership is key to Capstone's expansion in British Columbia's renewable energy sector.

Capstone Infrastructure's North American renewable power development pipeline, exceeding three gigawatts of generation and battery storage, signifies substantial growth opportunities. This extensive project portfolio, with a significant portion concentrated in Canada and the remaining in California, positions the company favorably within the rapidly expanding clean energy market.

Battery Energy Storage Development

Capstone Infrastructure is making significant strides in battery energy storage development, a key area for future energy grids. Their focus on large-scale projects, like the proposed system in California, highlights their ambition to lead in this burgeoning sector. If completed, this California project would represent the largest battery storage system in North America, underscoring the scale of their investment and commitment.

This strategic push into battery storage places Capstone at the forefront of a market experiencing rapid growth and increasing demand. The company's investment in these high-growth technologies is a clear indicator of its strategy to capture future market share and establish itself as a leader in the evolving energy landscape.

- California Project Scale: Capstone's proposed California battery storage system, if operational today, would be North America's largest.

- Market Growth: Battery energy storage is a rapidly expanding segment of the energy market, driven by renewable energy integration and grid stability needs.

- Strategic Positioning: Investment in this high-demand technology positions Capstone for future market leadership.

- 2024 Context: By mid-2024, the global energy storage market was projected to reach over $100 billion, with battery storage dominating this growth.

Strategic Acquisitions in Renewable Sector

Capstone Infrastructure is aggressively pursuing strategic acquisitions to bolster its presence in the rapidly expanding renewable energy sector. This strategy is designed to accelerate asset base growth and capture market share in high-demand areas. For instance, in 2024, the company actively evaluated several potential acquisition targets in solar and wind power, aiming to integrate complementary technologies and geographic footprints.

The company's commitment to expanding its renewable portfolio is a direct response to the escalating global investment trends in clean energy. By focusing on these growth areas, Capstone aims to position itself as a key player in the transition to sustainable infrastructure. This proactive approach ensures they remain competitive and capitalize on the significant opportunities presented by the decarbonization efforts worldwide.

- Strategic Acquisitions: Capstone Infrastructure aims to expand its asset base through targeted acquisitions in the renewable energy sector.

- Market Share Growth: This proactive acquisition strategy allows for rapid market share gains in high-growth renewable energy markets.

- Renewable Focus: The company's portfolio expansion is heavily weighted towards renewable power assets, aligning with global clean energy investment trends.

- 2024 Activity: Capstone demonstrated its commitment in 2024 by actively exploring and evaluating potential acquisition opportunities within the solar and wind power segments.

Capstone Infrastructure's significant investments in renewable energy projects, particularly in wind and battery storage, position them as potential Stars within the BCG Matrix. Their substantial development pipeline, exceeding three gigawatts, and the scale of their proposed California battery storage system, which would be North America's largest if completed, indicate high market growth potential.

The company's strategic focus on expanding its renewable portfolio through acquisitions, as seen in their 2024 evaluations of solar and wind targets, further solidifies their growth trajectory. This aggressive pursuit of market share in high-demand clean energy segments suggests strong future performance and a leading position.

Capstone's success in securing large wind projects, like the 537 MW in British Columbia, and their 192 MW Wild Rose 2 Wind Project in Alberta, demonstrate their ability to execute and expand in a growing market. These projects, coupled with their forward-looking investments in battery storage, align with the characteristics of a Star business unit.

The global energy storage market's projected growth to over $100 billion by mid-2024, with battery storage leading the charge, provides a strong external validation for Capstone's strategic direction in this area.

What is included in the product

This BCG Matrix overview will highlight which Capstone Infrastructure units to invest in, hold, or divest based on market growth and share.

The Capstone Infrastructure BCG Matrix provides a clear, quadrant-based visualization of your business units, instantly clarifying strategic focus and alleviating the pain of complex portfolio analysis.

Cash Cows

Capstone Infrastructure's established wind and solar facilities are prime examples of its Cash Cows. With 35 operating facilities contributing significantly to its 886 MW operating capacity, these assets are mature and reliably generate substantial, predictable cash flows.

Capstone Infrastructure's operating hydroelectric assets are classic cash cows. These power generators boast long operational lives and reliably produce electricity, leading to consistent revenue with manageable operating expenses after initial setup.

Hydroelectric power represented a significant portion of Canada's renewable energy generation in 2024, underscoring its mature and stable market position. This stability allows these assets to generate substantial, predictable cash flows for Capstone.

Capstone Infrastructure's North American utility businesses are prime examples of cash cows within the BCG matrix. Their involvement in essential services like water, electricity, and gas provides a remarkably stable and regulated revenue stream, a characteristic hallmark of mature, low-growth industries.

These utility operations typically experience consistent demand regardless of economic fluctuations, leading to predictable returns. For instance, in 2024, the North American utilities sector continued its dominance, representing a significant portion of global infrastructure investment, underscoring the reliability and maturity of this market segment.

Long-Term Offtake Agreements

Long-term offtake agreements are a cornerstone for Capstone Infrastructure's Cash Cow segment, particularly within its renewable energy portfolio. For instance, the company has secured 30-year Electricity Purchase Agreements (EPAs) with entities like BC Hydro for its wind projects. These long-duration contracts are crucial for revenue certainty.

These agreements significantly de-risk the cash flows generated by operational assets. The guaranteed income stream over extended periods allows for predictable financial planning and supports sustained profitability. This stability is a hallmark of a Cash Cow business unit.

- Revenue Certainty: Long-term EPAs, like those with BC Hydro, lock in revenue for decades.

- De-risked Cash Flows: These contracts minimize exposure to market price volatility for electricity.

- Stable Income: Predictable income supports consistent dividend payouts and reinvestment.

- Operational Efficiency: Focus shifts to maintaining efficient operations rather than market acquisition.

Diversified Operating Portfolio

Capstone Infrastructure's diversified operating portfolio is a key strength, acting as a buffer against volatility in any single energy market. This broad mix of assets, including wind, solar, hydro, biomass, and natural gas, creates a stable foundation for consistent cash flow generation.

The company's commitment to diversification is evident in its substantial operational footprint. As of early 2024, Capstone boasts 885 MW of gross installed capacity spread across 35 distinct facilities. This wide geographical and technological distribution underpins the resilience of its cash-generating capabilities.

- Diversified Energy Sources: Wind, solar, hydro, biomass, and natural gas assets provide a balanced revenue stream.

- Resilience Against Market Fluctuations: Reduced dependence on any single commodity price or regulatory environment.

- Stable Cash Generation: A broad base of operating assets ensures a more predictable and consistent cash flow.

- Significant Operational Scale: 885 MW gross installed capacity across 35 facilities highlights the breadth of the portfolio.

Capstone Infrastructure's mature renewable energy assets, like its wind and solar farms, are prime examples of Cash Cows. With 35 operating facilities contributing to its 886 MW capacity, these assets generate substantial and predictable cash flows, a hallmark of stable, low-growth markets.

The company's hydroelectric power generation also fits the Cash Cow profile. These long-lived assets reliably produce electricity, ensuring consistent revenue with manageable operating expenses, further solidifying their status as stable income generators.

Capstone's North American utility businesses are also strong Cash Cows. Their involvement in essential services like water and electricity ensures a stable, regulated revenue stream, a characteristic of mature, low-demand-growth industries that consistently deliver predictable returns.

| Asset Type | Capacity (MW) | Key Characteristics | BCG Matrix Category |

| Wind Facilities | 350 (approx.) | Mature, long-term PPAs, predictable revenue | Cash Cow |

| Solar Facilities | 250 (approx.) | Established, stable cash flow generation | Cash Cow |

| Hydroelectric Assets | 286 (approx.) | Long operational life, consistent output | Cash Cow |

Delivered as Shown

Capstone Infrastructure BCG Matrix

The Capstone Infrastructure BCG Matrix preview you are currently viewing is the identical, fully-formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content—only the complete strategic analysis ready for your immediate use. You can trust that what you see is precisely what you will download, ensuring a seamless transition from preview to actionable business intelligence. This comprehensive matrix is designed to provide clear, data-driven insights for your infrastructure planning and investment decisions.

Dogs

The Cardinal Power natural gas facility, with its 156 MW capacity, represents a significant, albeit declining, asset for Capstone Infrastructure. Demand for its power generation saw a decrease from 2022 to 2023, suggesting a potential shift in market dynamics or Capstone's operational focus. This decline, coupled with Capstone's stated strategy to avoid further fossil fuel development, positions Cardinal Power as a potential 'Cash Cow' or even a 'Dog' within the BCG matrix, depending on its profitability and future growth prospects.

Older power generation assets in Capstone's portfolio that are less efficient or have high maintenance costs in a slow-growth market segment can be categorized as Dogs. These assets might barely break even or even consume more cash than they generate.

While Capstone's specific portfolio details for these assets aren't publicly itemized as 'Dogs', their characteristics align perfectly with this BCG Matrix quadrant. For instance, a hypothetical coal-fired power plant nearing the end of its operational life, facing increasing environmental regulations and declining market demand, would fit this description.

Capstone Infrastructure Corporation has historically divested or sought to divest businesses with low market share, low growth prospects, or significant operational hurdles. This aligns with a strategic shift, emphasizing renewable energy and shedding less profitable ventures.

Underperforming Legacy Assets

Certain legacy infrastructure assets within Capstone Infrastructure's portfolio might currently be classified as Dogs. For instance, some wind energy assets experienced temporary underperformance in Q3 2024, attributed to adverse weather conditions. This situation, though not indicative of a long-term decline, can tie up valuable capital without yielding the anticipated returns.

While Capstone Infrastructure acknowledges these temporary setbacks, the company anticipates a return to expected performance levels. This temporary dip in returns for specific assets, such as wind farms impacted by weather patterns, places them in the 'Dog' quadrant of the BCG matrix.

- Temporary Underperformance: Wind assets in Q3 2024 showed reduced output due to weather, fitting the 'Dog' profile temporarily.

- Capital Tie-up: Underperforming assets can immobilize capital that could be deployed in higher-growth areas.

- Expected Rebound: Capstone views these performance dips as transient, expecting eventual recovery.

Assets with High Emission Profiles

Given Capstone Infrastructure's strategic pivot towards becoming a renewables-focused independent power producer and the anticipated release of its inaugural ESG report in late 2024, assets with high direct emissions are increasingly being categorized as question marks within the BCG matrix. This classification stems from mounting regulatory scrutiny and evolving environmental expectations. For instance, Capstone's gas plant experienced a notable reduction in Scope 1 emissions in 2024, directly correlating with decreased operational demand, further solidifying its position in this category.

This shift in perspective is critical for Capstone. As the company prioritizes sustainability, these high-emission assets represent potential divestitures or require significant investment in emissions reduction technologies. The financial implications are substantial, as investors and regulators alike are demanding greater transparency and accountability regarding carbon footprints. Capstone's 2023 financial statements, for example, already show a growing emphasis on renewable energy investments, with capital expenditures for wind and solar projects significantly outpacing those for fossil fuel assets.

- Question Marks: Assets like the gas plant, with high emission profiles and declining demand, fit this category due to increasing environmental pressures.

- Strategic Re-evaluation: Capstone's transition to renewables necessitates a critical review of these high-emission assets, potentially leading to divestment or substantial decarbonization efforts.

- 2024 ESG Focus: The upcoming ESG report will likely detail strategies for managing or phasing out these assets, impacting future capital allocation and investor relations.

- Emission Reduction Data: The observed decrease in Scope 1 emissions from the gas plant due to reduced demand underscores the operational challenges and evolving market dynamics these assets face.

Dogs in Capstone's portfolio represent legacy assets with low market share and minimal growth potential. These might be older, less efficient power generation units facing declining demand or increasing regulatory burdens. They often require significant maintenance and can consume more cash than they generate, hindering overall portfolio performance.

Capstone's strategic shift towards renewables means these "Dog" assets are prime candidates for divestment or require substantial reinvestment to remain viable. For example, while not explicitly labeled as Dogs, older fossil fuel assets with high operating costs and limited future demand fit this profile. The company's 2023 capital allocation clearly favored new renewable projects over maintaining such legacy infrastructure.

Identifying and managing these Dog assets is crucial for Capstone to free up capital for more promising growth areas, particularly in renewable energy. This strategic pruning allows for a more focused and profitable business model.

A hypothetical example of a Dog asset could be a small, older hydro-electric facility with low output and high refurbishment costs, operating in a market with flat or declining electricity prices. Such an asset would likely have a low return on investment.

| Asset Type | Market Growth | Market Share | Cash Flow | Strategic Implication |

| Legacy Fossil Fuel Plant | Low | Low | Negative to Break-even | Divestment or Significant Modernization |

| Older Wind Farm (Underperforming) | Moderate (but asset specific issues) | Low (relative to newer tech) | Low/Volatile | Performance Improvement or Divestment |

| Small Hydro Facility | Low | Very Low | Low | Divestment |

Question Marks

Capstone Infrastructure's substantial investment in California battery energy storage projects, including a large system, positions it in a high-growth, high-demand market. As of early 2024, California leads the nation in operational and planned battery storage capacity, with over 6 GW of operational capacity and significant additional projects in development.

These California projects, while promising, are in the development phase, meaning Capstone's market share is not yet established, placing them in the question mark quadrant of the BCG matrix. The state's ambitious renewable energy goals, aiming for 100% clean electricity by 2045, drive this demand, but also attract considerable competition.

Capstone Infrastructure is actively expanding its footprint in the United States, moving beyond its established presence in California. The company is initiating development in states like Texas and Arizona, marking these as key areas for future growth. These new ventures represent nascent market entries, requiring substantial capital investment and focused strategic planning to build market share and operational capacity.

Capstone Infrastructure, as part of its strategic positioning within the BCG matrix, would likely categorize emerging renewable technologies as Stars or Question Marks, depending on their specific development stage and market traction. These represent potential high-growth areas, but also carry significant risk due to their nascent nature and unproven market acceptance. For instance, investments in advanced geothermal or tidal energy projects, while promising for the energy transition, are still in early adoption phases with limited commercial deployment.

The company's dedication to the energy transition implies a willingness to explore these less mature sectors. Consider the significant global investment in green hydrogen production, which, while growing rapidly, still faces challenges in scaling and cost-competitiveness. Capstone might allocate capital here, anticipating future market dominance, similar to how solar panel technology evolved from a niche to a mainstream energy source.

Early-Stage Organic Development Initiatives

Capstone Infrastructure's strategic approach incorporates organic development within the infrastructure sector. These early-stage initiatives represent potential future growth engines but, in their nascent phase, are categorized as question marks in the BCG matrix.

Before securing crucial financing or substantial off-take agreements, these projects are cash-intensive development efforts. Their market adoption and ultimate return on investment remain uncertain until they progress and mature.

- Cash Burn: Early-stage development consumes capital without generating immediate revenue.

- Uncertainty: Market acceptance and future profitability are not yet guaranteed.

- Potential for Growth: Successful maturation can lead to significant future market share and returns.

Partnerships in Untapped Renewable Sectors

Partnerships in nascent renewable sectors represent a strategic play for Capstone Infrastructure, aiming to build future market share. These collaborations are essential for entering segments with high growth potential but limited prior experience, such as emerging battery storage solutions or advanced geothermal technologies. Such ventures require significant investment to nurture into future Stars or Cash Cows within the BCG matrix.

For instance, Capstone's potential involvement in projects requiring indigenous equity ownership in new wind farms, like those in British Columbia, exemplifies this strategy. This approach not only fosters community relations but also secures access to developing markets. By 2024, the global renewable energy market, excluding solar and wind, was projected to see substantial growth, with areas like green hydrogen and advanced battery storage attracting significant venture capital, indicating fertile ground for strategic partnerships.

- Strategic Alliances: Collaborating with technology providers or established players in underdeveloped renewable segments to share risk and expertise.

- Market Entry: Investing in pilot projects or joint ventures to gain operational experience and market traction in new renewable areas.

- Growth Potential: Targeting sectors like offshore wind development or sustainable aviation fuel, which are poised for significant expansion in the coming years.

- Investment Focus: Allocating capital towards research and development or early-stage commercialization of novel renewable technologies.

Capstone Infrastructure's ventures into new, less-established renewable energy technologies and geographic markets are classified as Question Marks in the BCG matrix. These are areas where the company is investing significant capital for future growth, but their success and market share are not yet assured. For example, their expansion into Texas and Arizona for battery storage projects represents a move into developing markets where their competitive position is still being established.

These early-stage projects, like the development of advanced geothermal or tidal energy, require substantial upfront investment and face market uncertainties. While the global investment in green hydrogen production saw a significant increase, with billions flowing into the sector by 2024, its commercial viability and scalability remain a question mark for many participants, including Capstone if they choose to enter this space.

The company's strategy of forming partnerships in nascent renewable sectors, such as potential involvement in indigenous equity ownership for new wind farms, also places them in the Question Mark quadrant. These collaborations are designed to build future market share in high-potential but underdeveloped segments, like emerging battery storage solutions, aiming to transition them into Stars or Cash Cows.

| Project Type | Market Stage | Investment Status | Market Share Potential | BCG Quadrant |

|---|---|---|---|---|

| California Battery Storage | Developing | High Capital Outlay | Uncertain | Question Mark |

| Texas/Arizona Expansion | Nascent | Early Development | Low/Developing | Question Mark |

| Advanced Geothermal | Emerging Technology | R&D/Pilot Phase | Potential High | Question Mark |

| Green Hydrogen Ventures | Early Commercialization | Strategic Partnerships | High Growth Potential | Question Mark |

BCG Matrix Data Sources

Our Capstone Infrastructure BCG Matrix is built on a foundation of robust data, integrating financial statements, industry growth forecasts, and project performance metrics to deliver strategic insights.