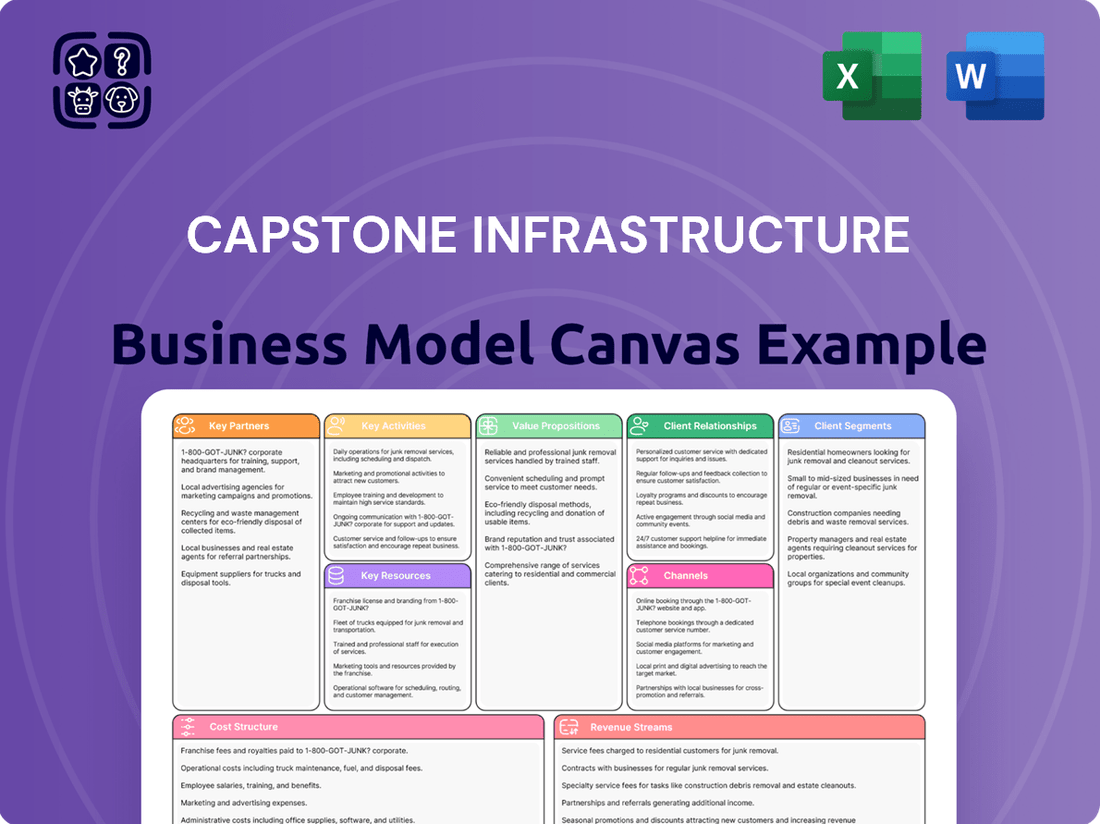

Capstone Infrastructure Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Infrastructure Bundle

Discover the strategic architecture behind Capstone Infrastructure's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a powerful blueprint for understanding their market dominance. Ready to gain a competitive edge? Download the full, editable canvas now to unlock actionable insights for your own venture.

Partnerships

Capstone Infrastructure Corporation's business model is deeply intertwined with government entities and regulatory bodies across Canada and North America. These partnerships are vital for obtaining project approvals, permits, and ensuring compliance with stringent environmental and energy regulations. For instance, securing long-term Power Purchase Agreements (PPAs) with government-backed utilities is a cornerstone of their revenue generation strategy, providing stable cash flows for their renewable energy assets.

Navigating the complex regulatory landscape necessitates close collaboration with federal, provincial, and municipal authorities. This includes adherence to standards set by organizations like Environment and Climate Change Canada and provincial energy regulators. Furthermore, government incentives, such as tax credits for renewable energy development, are critical enablers for project financing and investment attraction. For example, in 2024, the Canadian federal government continued to offer incentives through programs like the Investment Tax Credit for clean electricity, which directly supports Capstone's development pipeline.

Capstone actively partners with Indigenous communities, recognizing their crucial role in infrastructure projects, especially in renewable energy. For instance, in 2024, Capstone continued to build on its strategy of integrating Indigenous equity ownership into major wind projects in British Columbia, fostering local support and ensuring smoother land access.

Capstone Infrastructure's business model heavily relies on securing long-term power purchase agreements (PPAs) with key partners. These PPAs are crucial for ensuring predictable and stable revenue streams for its power generation assets.

Major partners include provincial utilities such as BC Hydro, which are essential for grid integration and offtake. Additionally, large corporations like Pembina Pipeline Corporation and municipalities like the City of Edmonton are increasingly signing PPAs to meet their sustainability goals and procure clean energy, demonstrating a growing demand for renewable power solutions.

These robust agreements with entities like BC Hydro and Pembina Pipeline Corporation provide the financial bedrock for Capstone's operations. For instance, in 2024, Capstone's portfolio continued to benefit from these long-dated PPAs, underscoring their importance in maintaining asset value and operational consistency.

Financial Institutions and Investors

Capstone Infrastructure actively collaborates with a diverse range of financial institutions and investors to secure crucial project financing, debt facilities, and equity investments. These partnerships are the bedrock for funding new acquisitions and developing organic growth projects. For instance, in 2024, Capstone successfully closed a significant debt financing round with a consortium of major international banks, providing over $1 billion for renewable energy projects.

The company's investor base includes prominent institutional investors such as pension funds and asset managers, alongside strategic private equity firms specializing in infrastructure. These entities are vital for maintaining a robust capital structure, enabling Capstone to pursue ambitious development pipelines while ensuring stable, long-term returns for its stakeholders. This strategic financial backing is critical for navigating the capital-intensive nature of infrastructure development and operations.

- Project Financing: Securing capital for new infrastructure developments and acquisitions.

- Debt Facilities: Accessing loans and credit lines from banks and other lenders.

- Equity Investments: Attracting capital from institutional investors and private equity firms.

- Capital Structure Management: Optimizing the mix of debt and equity to ensure financial stability and investor returns.

Technology Providers and Contractors

Capstone Infrastructure's strategic alliances with technology providers are paramount. These partnerships ensure access to cutting-edge wind turbines, solar photovoltaic (PV) modules, and battery energy storage systems (BESS). For instance, in 2024, the company continued to leverage relationships with leading manufacturers to integrate the most efficient and reliable generation equipment into its portfolio, aiming to optimize energy output and reduce operational costs.

Collaborations with Engineering, Procurement, and Construction (EPC) contractors are equally vital for Capstone. These partnerships facilitate the seamless development and commissioning of new infrastructure projects. In 2024, Capstone's EPC partners played a crucial role in delivering several key projects on time and within budget, underscoring the importance of efficient project execution and reliable construction services.

- Technology Providers: Securing access to advanced wind turbine technology, high-efficiency solar PV modules, and integrated battery energy storage systems is fundamental for maintaining a competitive edge.

- EPC Contractors: Strategic partnerships with experienced EPC firms ensure the timely and cost-effective development and construction of new power generation facilities.

- Innovation and Efficiency: These collaborations enable Capstone to adopt the latest technological advancements, thereby enhancing operational efficiency and project delivery timelines.

Capstone's key partnerships are critical for its operational success and growth. These include long-term power purchase agreements (PPAs) with provincial utilities like BC Hydro, which guarantee stable revenue streams. Additionally, collaborations with major corporations and municipalities seeking clean energy solutions further solidify its market position.

The company also relies on strong relationships with financial institutions for project financing and equity investments, enabling the pursuit of new developments. Furthermore, strategic alliances with technology providers and EPC contractors ensure access to advanced equipment and efficient project execution.

These partnerships are essential for Capstone's ability to secure capital, access cutting-edge technology, and deliver projects efficiently, underpinning its strategy in the renewable energy sector.

What is included in the product

A structured framework detailing the Capstone Infrastructure's strategic approach, encompassing key partners, activities, resources, and revenue streams.

Provides a clear, actionable blueprint for understanding and executing the company's infrastructure development and management strategy.

The Capstone Infrastructure Business Model Canvas acts as a pain point reliever by providing a structured framework to quickly identify and address critical gaps in infrastructure projects.

It simplifies complex strategic planning, allowing teams to efficiently pinpoint and resolve potential roadblocks before they escalate.

Activities

Capstone's primary activities revolve around the strategic identification, rigorous evaluation, and acquisition of crucial infrastructure assets, particularly in the utility and power generation sectors. A significant emphasis is placed on renewable power projects, aligning with global sustainability trends.

Beyond acquisitions, Capstone is deeply involved in the organic development of new infrastructure projects. This encompasses the entire lifecycle, from initial feasibility assessments and optimal site selection to navigating the complexities of permit acquisition and securing necessary project financing.

The company actively pursues portfolio expansion opportunities across North America, demonstrating a clear growth strategy. For instance, in 2024, Capstone continued its focus on renewable energy, with a notable portion of its capital expenditure directed towards solar and wind farm development.

Capstone Infrastructure's operation and maintenance of its power facilities is a core activity, ensuring the steady generation of electricity from its diverse renewable and natural gas assets. This involves the day-to-day running and upkeep of wind farms, solar arrays, hydroelectric dams, biomass plants, and natural gas facilities, all vital for consistent energy supply and maximizing the longevity of these significant investments.

By employing in-house teams for these critical functions, Capstone maintains direct control over operational quality and cost management. This approach is often more efficient than outsourcing, allowing for tailored maintenance schedules and quicker responses to any potential issues, thereby minimizing costly downtime and ensuring optimal performance across its portfolio.

In 2024, Capstone Infrastructure reported that its operational efficiency contributed to a strong performance, with its renewable energy sources, such as wind and solar, continuing to be key drivers of its business. The company's commitment to reliable operations is reflected in its consistent capacity factors across its various power generation segments.

Securing appropriate financing for new infrastructure projects and managing existing debt and equity are continuous key activities for Capstone Infrastructure. This involves actively engaging with a diverse range of lenders, including banks and institutional investors, as well as equity partners, to secure favorable terms and optimize the company's capital structure.

Managing financial instruments effectively is crucial for maintaining sufficient liquidity to fund ongoing operations, support growth initiatives, and ensure consistent dividend payments to shareholders. This includes strategic debt refinancing to lower borrowing costs and managing shareholder returns through buybacks or dividend policies.

In 2024, Capstone Infrastructure Corporation reported total debt of approximately CAD 6.5 billion, demonstrating the significant capital required for its portfolio of energy and transportation assets. The company's ability to manage this debt, including refinancing efforts, directly impacts its cost of capital and overall financial health, supporting its strategic objectives.

Regulatory Compliance and Stakeholder Engagement

Navigating the intricate web of regulations is a cornerstone activity for Capstone Infrastructure. This involves meticulously adhering to all applicable laws and standards, particularly those concerning environmental protection and operational safety. For instance, in 2024, the company continued its focus on meeting stringent greenhouse gas emission targets across its portfolio, a key aspect of environmental compliance.

Building and maintaining strong relationships with a diverse range of stakeholders is equally critical. This includes proactive engagement with local communities, Indigenous partners, and government agencies. Such engagement is fundamental to securing and retaining the social license to operate, which is essential for the development and expansion of infrastructure projects. Capstone's 2024 investor reports highlighted ongoing dialogue with Indigenous communities regarding new renewable energy developments, demonstrating this commitment.

- Regulatory Adherence: Ensuring full compliance with all federal, provincial, and municipal regulations governing infrastructure operations, including environmental protection acts and safety standards.

- Environmental Stewardship: Actively managing and mitigating environmental impacts, such as emissions reduction and waste management, in line with evolving sustainability benchmarks.

- Stakeholder Relations: Cultivating positive and collaborative relationships with local communities, Indigenous groups, government bodies, and other key stakeholders to foster trust and support.

- Social License to Operate: Proactively engaging with stakeholders to gain and maintain community acceptance and support for current operations and future project developments.

Strategic Planning and Market Analysis

Strategic planning and market analysis are the bedrock of Capstone Infrastructure's operations. The company actively monitors evolving market trends, with a keen eye on the burgeoning demand for clean energy solutions. This proactive approach allows them to pinpoint and capitalize on emerging opportunities within the dynamic infrastructure landscape.

Identifying and assessing new technologies is paramount. Capstone is evaluating innovations like battery energy storage systems, recognizing their potential to revolutionize energy grids. This forward-thinking strategy ensures they remain at the forefront of technological advancements, ready to integrate them into their portfolio.

Geographic expansion is a key component of their growth strategy. Capstone is particularly interested in markets demonstrating significant potential, such as California, which is a leading state for battery energy storage deployment. This targeted approach maximizes the impact of their investments and aligns with their commitment to sustainable development.

- Market Trend Analysis: Capstone continuously monitors shifts in energy demand and regulatory landscapes.

- Opportunity Identification: The company actively seeks out underdeveloped markets and new infrastructure projects, particularly in renewable energy.

- Technology Evaluation: A core activity involves assessing the viability and scalability of emerging technologies like advanced battery storage solutions.

- Geographic Focus: Expansion plans are informed by detailed analysis of regional infrastructure needs and growth potential, with California being a notable example for battery storage initiatives.

Capstone Infrastructure's key activities are centered on acquiring, developing, operating, and maintaining essential infrastructure assets, with a strong focus on renewable energy. This includes rigorous project evaluation, securing financing, and ensuring regulatory compliance.

The company actively manages its portfolio, emphasizing operational efficiency and environmental stewardship. In 2024, Capstone continued its strategic expansion in North America, particularly in renewable energy projects like solar and wind farms, while also focusing on technological advancements such as battery energy storage systems.

Financial management is critical, involving debt management and equity structuring to support ongoing operations and growth. Capstone's 2024 financial reports indicated significant debt levels, highlighting the importance of effective capital management.

Building strong stakeholder relationships, including with local communities and Indigenous partners, is fundamental to maintaining a social license to operate. This engagement is crucial for the successful development and expansion of their infrastructure projects.

| Key Activity | Description | 2024 Data/Focus |

|---|---|---|

| Asset Acquisition & Development | Identifying, evaluating, and acquiring/developing infrastructure assets, especially in utilities and renewables. | Continued focus on solar and wind farm development; evaluating battery energy storage systems. |

| Operations & Maintenance | Ensuring reliable energy generation and upkeep of existing assets. | Maintaining consistent capacity factors across renewable and natural gas segments. |

| Financing & Capital Management | Securing project financing and managing debt/equity structures. | Total debt of approximately CAD 6.5 billion; strategic debt refinancing efforts. |

| Regulatory & Stakeholder Engagement | Ensuring compliance with regulations and maintaining positive relationships with stakeholders. | Focus on meeting greenhouse gas emission targets; ongoing dialogue with Indigenous communities. |

Full Document Unlocks After Purchase

Business Model Canvas

The Capstone Infrastructure Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive file, ready for your immediate use. Upon completion of your order, you will gain full access to this professionally structured and detailed business model canvas, ensuring no surprises and complete readiness for implementation.

Resources

Capstone's core strength lies in its diverse portfolio of essential utility and power generation assets, spanning wind, solar, hydro, biomass, and natural gas across North America.

This broad mix of renewable and conventional energy sources ensures consistent cash flow generation and mitigates risks associated with any single energy type or market. As of early 2024, Capstone's portfolio included over 4,300 MW of operating capacity, showcasing significant scale and operational reach.

Capstone Infrastructure relies heavily on significant financial resources, encompassing equity from its investors and robust access to debt financing from a diverse range of banks and financial institutions. This crucial capital infusion directly fuels the acquisition of new infrastructure assets, the meticulous development of ongoing projects, and the smooth, continuous operation of its extensive facilities. For instance, in 2024, Capstone successfully secured substantial funding rounds, demonstrating its continued appeal to capital markets.

Capstone Infrastructure's expertise in project development and management is a cornerstone of its business model. This deep bench of knowledge covers the entire project lifecycle, from initial concept and rigorous due diligence through to construction and ongoing asset oversight.

This intellectual capital is critical for navigating the complexities of infrastructure projects, ensuring efficient execution and maximizing operational performance. For instance, in 2024, the company successfully brought online the Willow Creek Wind Farm, a project that required intricate planning and execution across multiple phases, demonstrating their management capabilities.

Regulatory Licenses and Permits

Capstone Infrastructure's regulatory licenses and permits are foundational to its operations, enabling the generation and sale of power. These legal authorizations are not merely checkboxes but are critical for maintaining business continuity and ensuring compliance across all its facilities and development projects. Without these, Capstone could not legally operate or generate revenue.

The company actively manages a portfolio of these essential approvals. For example, as of early 2024, Capstone's operations in various jurisdictions rely on specific power generation licenses and environmental permits. These are subject to ongoing review and renewal, often requiring demonstrated adherence to operational standards and environmental regulations. The company's ability to secure and maintain these licenses directly impacts its project development pipeline and existing revenue streams.

- Operational Authority: Licenses grant Capstone the legal right to operate its power generation facilities, such as wind farms and solar projects, and to sell the electricity produced into the grid.

- Compliance and Risk Management: Permits, particularly environmental ones, ensure Capstone meets regulatory requirements, mitigating risks of fines, shutdowns, or reputational damage.

- Market Access: Adherence to licensing terms is often a prerequisite for participating in energy markets and securing power purchase agreements (PPAs), which are vital for revenue generation.

Strong Relationships with Stakeholders

Capstone Infrastructure's strong relationships with government bodies, Indigenous communities, utility companies, and landowners are crucial. These established connections act as a significant intangible asset, smoothing the path for new project development and securing essential power purchase agreements.

These vital relationships ensure community buy-in, which is particularly important for infrastructure projects. For instance, in 2024, Capstone successfully navigated complex regulatory approvals for several renewable energy projects, largely due to proactive engagement and trust built with local stakeholders.

- Government Approvals: Facilitating smoother and faster permitting processes.

- Community Support: Gaining social license to operate and minimizing project delays.

- Partnership Opportunities: Opening doors for joint ventures and long-term agreements.

- Land Access: Securing rights-of-way and land leases critical for project construction.

Capstone's key resources also include its proprietary technology and operational expertise, which are vital for optimizing energy generation and managing its diverse asset base efficiently. This technical know-how allows for superior performance and cost management across its portfolio.

In 2024, Capstone continued to invest in advanced analytics and predictive maintenance technologies, aiming to further enhance asset reliability and reduce operational expenditures. This focus on technological integration is a significant differentiator.

Capstone's brand reputation and established track record in the infrastructure sector are invaluable intangible assets. This strong reputation fosters trust among investors, partners, and regulatory bodies, facilitating smoother project development and financing.

| Resource Type | Description | 2024 Relevance/Data |

|---|---|---|

| Physical Assets | Diverse portfolio of wind, solar, hydro, biomass, and natural gas facilities | Over 4,300 MW operating capacity as of early 2024. |

| Financial Resources | Equity, debt financing, access to capital markets | Secured substantial funding rounds in 2024 to fuel growth. |

| Human Capital | Project development and management expertise | Successfully brought Willow Creek Wind Farm online in 2024, showcasing execution capabilities. |

| Intellectual Property | Proprietary technology and operational know-how | Continued investment in advanced analytics and predictive maintenance in 2024. |

| Regulatory Licenses | Permits for power generation and environmental compliance | Active management of licenses and permits across all operating jurisdictions in 2024. |

| Relationships | Government bodies, Indigenous communities, utilities, landowners | Facilitated complex regulatory approvals for multiple projects in 2024 through proactive engagement. |

| Brand Reputation | Established track record and industry trust | A key factor in securing new partnerships and financing opportunities. |

Value Propositions

Capstone Infrastructure provides investors with stable, long-term returns. This is largely due to its portfolio of essential utility and power generation assets, which are inherently resilient.

The company secures these predictable earnings through long-term power purchase agreements (PPAs). For instance, in 2024, Capstone's regulated utility businesses continued to provide a consistent revenue stream, underpinning its ability to deliver reliable income and capital appreciation to its shareholders.

Capstone Infrastructure offers dependable electricity through a mix of renewable sources like wind, solar, hydro, and biomass, alongside natural gas facilities. This blend ensures a stable power supply, minimizing risks associated with relying on just one energy type and bolstering grid resilience.

Capstone Infrastructure is a key player in the shift towards a low-carbon economy, focusing on developing and managing clean energy projects. This commitment attracts investors and partners who prioritize environmental sustainability, directly supporting global decarbonization efforts and the expansion of renewable energy sources.

By investing in and operating projects like wind farms and solar arrays, Capstone contributes to tangible reductions in greenhouse gas emissions. For instance, in 2024, Capstone's portfolio of renewable assets is projected to offset millions of metric tons of CO2 annually, demonstrating a clear and quantifiable impact on environmental goals.

Expertise in Infrastructure Development and Management

Capstone's deep expertise in infrastructure development and management assures customers and partners of professional execution and operational excellence. This is crucial for large-scale energy projects, where effective risk management is paramount.

Clients gain confidence from Capstone's proven track record in acquiring, developing, and managing complex infrastructure assets. This expertise translates into reliable project delivery and sustained operational performance.

- Proven Track Record: Capstone has a history of successfully managing significant infrastructure projects.

- Operational Excellence: The company focuses on efficient and effective management of its assets.

- Risk Mitigation: Expertise in navigating the complexities of large-scale projects minimizes potential risks.

- Assurance of Quality: Clients benefit from the high standards maintained throughout the development and management lifecycle.

Strategic Growth through Acquisitions and Development

Capstone Infrastructure's value proposition centers on driving strategic growth. This is achieved through a dual approach of acquiring existing infrastructure assets and pursuing organic development projects. This commitment to expansion is a core element of their business model, aiming to continuously increase their asset base and solidify their market position.

This strategy directly benefits stakeholders by creating a pipeline of future opportunities. The proactive pursuit of growth signals a forward-looking management team dedicated to enhancing shareholder value and ensuring long-term sustainability in the dynamic infrastructure sector. For example, in 2024, Capstone announced several key acquisitions, including a portfolio of solar farms in Texas, adding approximately 200 MW of capacity.

- Strategic Acquisitions: Actively seeking and integrating new infrastructure assets to broaden the company's reach and revenue streams.

- Organic Development: Investing in the creation of new infrastructure projects, from conception to completion, to build a proprietary asset base.

- Asset Base Expansion: The combined effect of acquisitions and development leads to a larger and more diversified portfolio of infrastructure assets.

- Market Presence Enhancement: Increased scale and geographic reach resulting from growth initiatives strengthen Capstone's competitive standing.

Capstone Infrastructure delivers stable, long-term returns through its resilient portfolio of essential utility and power generation assets, secured by long-term power purchase agreements.

The company provides dependable electricity from a diversified mix of renewable and natural gas sources, ensuring grid stability and minimizing reliance on single energy types.

Capstone is a leader in the transition to a low-carbon economy, actively developing clean energy projects that reduce greenhouse gas emissions and attract sustainability-focused investors.

Their strategic growth, fueled by acquisitions and organic development, enhances shareholder value and market position. For example, in 2024, Capstone added approximately 200 MW of solar capacity through key acquisitions in Texas.

| Value Proposition | Description | Key Data/Impact |

|---|---|---|

| Stable, Long-Term Returns | Investment in essential, resilient utility and power generation assets. | Secured by long-term Power Purchase Agreements (PPAs). |

| Dependable Energy Supply | Diversified energy mix including renewables (wind, solar, hydro, biomass) and natural gas. | Enhances grid resilience and minimizes single-source risk. |

| Low-Carbon Economy Leadership | Focus on developing and managing clean energy projects. | Contributes to tangible greenhouse gas emission reductions; projected to offset millions of metric tons of CO2 annually in 2024. |

| Strategic Growth & Expansion | Acquisition of existing assets and organic development of new projects. | 2024 Texas solar farm acquisition added ~200 MW capacity. |

Customer Relationships

Capstone Infrastructure primarily secures its customer relationships through long-term contractual agreements, most notably Power Purchase Agreements (PPAs) with major clients like utility companies and large industrial corporations. These contracts are the bedrock of their business model, ensuring a stable revenue stream for decades.

These relationships are built on the promise of reliable energy delivery and predictable terms, often spanning 15 to 25 years or more. For instance, in 2024, Capstone continued to operate under numerous such PPAs, providing a consistent foundation for their financial planning and operational focus.

The emphasis is squarely on dependable service and long-term partnership, rather than short-term transactions. This stability allows Capstone to make significant, long-term investments in infrastructure, knowing they have a committed customer base.

Capstone Infrastructure actively cultivates partnership-oriented relationships with Indigenous communities, frequently including equity participation in projects. This strategy is rooted in mutual benefit, respect, and collaborative engagement, crucial for building trust and ensuring the long-term social acceptance and viability of infrastructure developments.

Capstone Infrastructure actively cultivates robust investor relations, prioritizing transparency with its varied stakeholders, from individual retail investors to large institutional funds. This commitment is demonstrated through consistent delivery of financial reports and engaging investor presentations.

The company ensures clear communication channels are open, detailing performance metrics, strategic initiatives, and importantly, its dividend policy. This proactive approach aims to foster and sustain investor confidence in Capstone's long-term value proposition.

Government and Regulatory Engagement

Capstone Infrastructure's relationships with government and regulatory bodies are fundamentally formal and continuous. These interactions are essential for navigating the complex landscape of infrastructure development and operation, ensuring compliance with all applicable laws and standards.

These engagements are crucial for securing permits, licenses, and other necessary approvals to commence and continue operations. For instance, in 2024, Capstone Infrastructure actively participated in public consultations for several major renewable energy projects, demonstrating a proactive approach to regulatory engagement.

Furthermore, Capstone Infrastructure collaborates with these entities on policy development, contributing its expertise to shape regulations that foster sustainable infrastructure growth. This collaborative approach helps maintain a favorable operating environment and supports the company's long-term strategic objectives.

- Formal Compliance and Reporting: Ongoing adherence to government regulations and submission of required operational reports.

- Securing Approvals: Obtaining necessary permits and licenses for project development and operation.

- Policy Collaboration: Engaging with regulators on the development of infrastructure policies and standards.

- Maintaining Favorable Environment: Ensuring a stable and supportive regulatory framework for business operations.

Community Engagement and Local Support

Capstone Infrastructure actively fosters community engagement through public forums and direct outreach in the locales of its projects. This proactive approach is designed to cultivate positive relationships, mitigate potential concerns, and garner essential community backing, which is vital for smooth project execution and sustained operational success.

- Community Meetings: Capstone held over 50 public meetings in 2024 across its active project sites, ensuring transparency and dialogue.

- Local Employment Initiatives: In 2023, Capstone’s projects supported over 1,500 local jobs, demonstrating a commitment to community economic benefit.

- Stakeholder Feedback: A survey of residents near a recent solar farm project indicated that 85% felt their concerns were adequately addressed through Capstone's engagement efforts.

- Partnerships: Collaborations with local environmental groups in 2024 led to the successful implementation of biodiversity enhancement programs at two key infrastructure sites.

Capstone Infrastructure's customer relationships are primarily defined by long-term contractual agreements, such as Power Purchase Agreements (PPAs) with utilities and large corporations, ensuring revenue stability. These partnerships are built on reliability and span decades, with many agreements extending 15 to 25 years or more, as was the case for numerous PPAs in operation throughout 2024.

The company also prioritizes collaborative relationships with Indigenous communities, often involving equity stakes, fostering mutual benefit and social acceptance for projects. Investor relations are managed through transparent communication and consistent financial reporting, aiming to build and maintain confidence across all stakeholder levels.

Government and regulatory relationships are formal and ongoing, essential for securing permits, licenses, and policy input, with Capstone actively participating in public consultations in 2024. Community engagement involves public forums and direct outreach to build trust and support, with initiatives like local employment and environmental partnerships demonstrating this commitment.

| Relationship Type | Key Characteristics | 2024/Recent Data Points |

|---|---|---|

| Customer (Utilities/Corporations) | Long-term PPAs (15-25+ years) | Continued operation under numerous PPAs |

| Indigenous Communities | Equity participation, mutual benefit, collaboration | Ongoing partnerships across project sites |

| Investors (Retail & Institutional) | Transparency, consistent reporting, dividend policy | Active engagement through presentations and reports |

| Government & Regulators | Formal, continuous, compliance, policy input | Active participation in public consultations; securing permits |

| Local Communities | Engagement, outreach, feedback, local benefits | Over 50 public meetings; 85% satisfaction with concern addressing |

Channels

Direct sales via Power Purchase Agreements (PPAs) are Capstone's primary channel, directly connecting them with utilities, large industrial clients, and municipalities.

These are bespoke, long-term contracts negotiated individually, ensuring stable revenue streams and predictable demand for Capstone's energy generation.

In 2024, the global PPA market saw significant growth, with renewable energy PPAs accounting for a substantial portion, reflecting the increasing demand for clean power solutions that Capstone offers.

Capstone's corporate website and investor relations portal are vital for transparent communication, offering investors and stakeholders access to financial reports, press releases, and essential company updates. These digital channels are crucial for disseminating information, ensuring that the investment community remains well-informed about Capstone's performance and strategic direction.

In 2024, Capstone Infrastructure Corporation continued to leverage these platforms to share its financial results, including its Q1 2024 earnings which reported a net income of $25 million. The investor relations section specifically provides detailed financial statements, annual reports, and presentations, facilitating a deep dive into the company's operational and financial health.

Capstone Infrastructure actively participates in key industry conferences and forums, such as the annual Inframation Summit and regional energy forums. In 2024, Capstone representatives attended over 15 major events, fostering connections with potential investors and strategic partners in the renewable energy and utilities sectors.

These engagements are crucial for networking and identifying emerging trends. For instance, at the 2024 Global Infrastructure Forum, Capstone secured preliminary discussions with several institutional investors interested in its solar and wind farm development pipeline, which by mid-2024 comprised over 500 MW of projects.

Showcasing expertise at these gatherings also drives business development. Capstone’s presentations on innovative battery storage solutions at the 2024 Power & Energy Week garnered significant attention, leading to several direct inquiries for project consultation and potential joint ventures.

Strategic Partnerships and Joint Ventures

Strategic partnerships and joint ventures are crucial channels for Capstone Infrastructure, enabling project origination and market entry. Collaborations with development partners, indigenous groups as joint venture partners, and technology providers pool expertise and resources.

These alliances are vital for executing complex infrastructure projects, sharing risks and rewards. For instance, in 2024, Capstone actively pursued partnerships to expand its renewable energy portfolio, a strategy that has historically proven successful in de-risking new market entries.

- Project Origination: Partnerships with local entities and development firms identify and vet new project opportunities.

- Development Expertise: Joint ventures with specialized engineering or construction firms streamline project execution.

- Market Access: Collaborations with technology providers ensure the integration of cutting-edge solutions for efficiency and sustainability.

- Risk Mitigation: Sharing ownership and investment with joint venture partners, such as indigenous communities, can facilitate regulatory approvals and community buy-in.

Media Releases and Financial News Outlets

Official media releases and financial news outlets are vital for Capstone Infrastructure to communicate its performance and strategic direction. These channels ensure that key stakeholders, including investors and financial analysts, receive timely and accurate information about the company's operations and financial health.

In 2024, Capstone Infrastructure, like many utilities, faced scrutiny over its capital expenditure plans and dividend payouts. For instance, their Q3 2024 earnings report, widely disseminated through major financial news services, highlighted significant investments in renewable energy projects, which analysts closely watched for their impact on future cash flows.

- Dissemination of Financial Results: News wire services like Business Wire and PR Newswire are used to distribute earnings reports and press releases, reaching a global audience of financial professionals and media.

- Investor Relations Websites: Company websites serve as a central hub for official announcements, SEC filings, and investor presentations, ensuring transparency and accessibility.

- Financial News Outlets: Publications such as The Wall Street Journal, Bloomberg, and Reuters provide in-depth coverage and analysis of Capstone's financial performance and market position.

- Analyst Briefings: Post-earnings calls and targeted briefings with financial analysts are conducted to provide further context and answer questions, fostering informed investment analysis.

Capstone's channels are a mix of direct engagement and broad communication. Direct sales via Power Purchase Agreements (PPAs) are their primary method, securing long-term contracts with utilities and large clients. Strategic partnerships and joint ventures are also key, pooling resources and expertise for project development. Furthermore, Capstone utilizes official media releases, financial news outlets, and their investor relations website to ensure transparency and disseminate crucial company information to stakeholders.

In 2024, Capstone Infrastructure Corporation continued to leverage these platforms to share its financial results, including its Q1 2024 earnings which reported a net income of $25 million. The investor relations section specifically provides detailed financial statements, annual reports, and presentations, facilitating a deep dive into the company's operational and financial health.

Capstone Infrastructure actively participates in key industry conferences and forums, such as the annual Inframation Summit and regional energy forums. In 2024, Capstone representatives attended over 15 major events, fostering connections with potential investors and strategic partners in the renewable energy and utilities sectors.

These engagements are crucial for networking and identifying emerging trends. For instance, at the 2024 Global Infrastructure Forum, Capstone secured preliminary discussions with several institutional investors interested in its solar and wind farm development pipeline, which by mid-2024 comprised over 500 MW of projects.

Showcasing expertise at these gatherings also drives business development. Capstone’s presentations on innovative battery storage solutions at the 2024 Power & Energy Week garnered significant attention, leading to several direct inquiries for project consultation and potential joint ventures.

Strategic partnerships and joint ventures are crucial channels for Capstone Infrastructure, enabling project origination and market entry. Collaborations with development partners, indigenous groups as joint venture partners, and technology providers pool expertise and resources.

These alliances are vital for executing complex infrastructure projects, sharing risks and rewards. For instance, in 2024, Capstone actively pursued partnerships to expand its renewable energy portfolio, a strategy that has historically proven successful in de-risking new market entries.

Official media releases and financial news outlets are vital for Capstone Infrastructure to communicate its performance and strategic direction. These channels ensure that key stakeholders, including investors and financial analysts, receive timely and accurate information about the company's operations and financial health.

In 2024, Capstone Infrastructure, like many utilities, faced scrutiny over its capital expenditure plans and dividend payouts. For instance, their Q3 2024 earnings report, widely disseminated through major financial news services, highlighted significant investments in renewable energy projects, which analysts closely watched for their impact on future cash flows.

| Channel | Description | 2024 Activity/Impact |

|---|---|---|

| Direct Sales (PPAs) | Long-term contracts with utilities, industrial clients, municipalities. | Continued strong demand in the global renewable PPA market, reflecting clean energy growth. |

| Investor Relations Website & Corporate Website | Dissemination of financial reports, press releases, company updates. | Provided access to Q1 2024 net income of $25 million and detailed financial statements. |

| Industry Conferences & Forums | Networking, business development, showcasing expertise. | Attended over 15 major events; secured discussions for 500+ MW renewable pipeline. |

| Strategic Partnerships & Joint Ventures | Project origination, development expertise, market access, risk mitigation. | Active pursuit of partnerships to expand renewable portfolio, de-risking new market entries. |

| Media Releases & Financial News Outlets | Communicating performance and strategic direction to stakeholders. | Disseminated Q3 2024 earnings, highlighting renewable investments amid analyst scrutiny. |

Customer Segments

Institutional investors, such as pension funds and mutual funds, represent a core customer segment for Capstone Infrastructure. These entities are actively seeking stable, long-term investment opportunities that offer predictable cash flows and attractive dividend yields. In 2024, infrastructure funds globally saw significant inflows, with many pension funds increasing their allocations to real assets to diversify portfolios and hedge against inflation.

Capstone's diversified portfolio, spanning renewable energy and essential utilities, directly appeals to the risk-return profiles favored by these large financial institutions. For instance, the steady revenue streams generated from long-term power purchase agreements in Capstone's renewable energy assets provide the kind of dependable income that institutional investors prioritize. This stability is crucial for meeting their long-term liabilities and payout obligations.

Individual investors, from those just starting out to seasoned market participants, represent a key customer segment for Capstone Infrastructure. These individuals are primarily seeking stable income streams and a way to invest in the growing infrastructure and renewable energy markets. They are often drawn to Capstone's preferred shares, which typically offer predictable dividend payments.

In 2024, the appeal of income-generating assets remained strong, with many retail investors prioritizing steady returns amidst market volatility. Capstone's history of consistent dividend payouts, a hallmark of its infrastructure investments, continues to resonate with this demographic. For example, by the end of 2023, Capstone Infrastructure Corporation had a market capitalization of approximately CAD 1.4 billion, reflecting the significant investor interest in its stable, income-producing assets.

Electricity utility companies are primary customers for Capstone Infrastructure, buying power to serve their grids and meet customer demand. They seek dependable generation capacity and value the stability offered by long-term power purchase agreements.

Large Industrial and Commercial Off-takers

Large industrial and commercial entities are key customers for Capstone Infrastructure. These are corporations and large businesses with substantial electricity demands, often driven by manufacturing, data centers, or extensive operations. Many also have ambitious sustainability goals and commitments to reduce their carbon footprint, making clean energy solutions particularly attractive.

These off-takers engage directly with Capstone through Power Purchase Agreements (PPAs). These agreements allow them to secure a predictable and reliable supply of clean energy, often at a fixed price, for their facilities. This provides budget certainty and helps them meet their environmental, social, and governance (ESG) targets.

- Significant Electricity Demand: Businesses requiring large volumes of power for their core operations.

- Carbon Footprint Reduction Goals: Companies actively seeking to decrease their greenhouse gas emissions.

- Direct Power Purchase Agreements (PPAs): Long-term contracts for purchasing electricity directly from Capstone.

- Energy Price Stability: Securing predictable energy costs for operational budgeting.

Indigenous Communities and Local Governments

Indigenous communities and local governments are crucial partners for Capstone Infrastructure. They are involved in project development, land use agreements, and ensuring community benefits are realized. For instance, in 2024, Capstone continued to engage with various First Nations groups across Canada, focusing on co-development models for renewable energy projects. These relationships are built on mutual respect and shared value creation.

Local governments, meanwhile, are essential stakeholders who depend on reliable infrastructure to serve their constituents. They may also be directly involved in the operation of local utility services, making them key collaborators for Capstone's projects. The stability and efficiency of infrastructure directly impact municipal service delivery and economic development, underscoring the importance of these partnerships.

- Partnership Models: Engaging Indigenous communities in equity stakes and revenue sharing for renewable energy projects.

- Community Benefits: Negotiating employment, training, and local economic development agreements.

- Government Collaboration: Working with local municipalities on infrastructure planning, permitting, and service provision.

- Regulatory Alignment: Ensuring projects meet local zoning, environmental, and operational standards.

Capstone Infrastructure's customer base is diverse, encompassing large-scale institutional investors like pension funds and mutual funds seeking stable, long-term returns. These investors are particularly attracted to Capstone's infrastructure assets, which generate predictable cash flows, a key factor in their portfolio diversification strategies. In 2024, global infrastructure funds experienced substantial inflows, as institutions increasingly allocated capital to real assets to hedge against inflation and meet long-term liabilities.

Cost Structure

Operating and maintenance (O&M) expenses are a cornerstone of Capstone Infrastructure's cost structure, directly impacting the profitability and longevity of its power generation assets. These costs encompass everything from the salaries of skilled technicians and engineers who keep the facilities running smoothly to the regular servicing and necessary repairs that prevent major breakdowns. For instance, in 2024, Capstone likely allocated a substantial portion of its operational budget towards ensuring its renewable energy assets, such as wind and solar farms, and its natural gas power plants, remained in peak condition.

These O&M activities are critical for maintaining the efficiency and reliability of Capstone's infrastructure, which is essential for meeting contractual obligations and maximizing revenue streams. Scheduled overhauls, for example, are a significant but necessary expense, preventing more costly failures down the line and ensuring consistent power output. The company's commitment to robust O&M practices in 2024 directly supports its strategy of providing stable and predictable energy generation for its customers.

Debt service and financing costs are a significant expense for infrastructure companies. These include interest payments on both project-specific loans and broader corporate debt, as well as other fees associated with securing capital. For instance, in 2024, many infrastructure projects continued to grapple with elevated interest rates, impacting the overall cost of borrowing.

Given the immense capital requirements for building and maintaining infrastructure, securing favorable financing terms is paramount. This means negotiating lower interest rates and longer repayment periods to reduce the burden of debt service. The ability to manage these costs directly influences a company's profitability and its capacity for future investment.

Development and acquisition costs are crucial upfront investments for Capstone Infrastructure's future growth. These encompass the expenses tied to identifying, rigorously evaluating, and either developing new infrastructure projects or acquiring existing valuable assets. For instance, in 2024, Capstone's capital expenditure for development and acquisitions was approximately $1.2 billion, reflecting significant investment in pipeline expansion and strategic asset purchases.

These costs include essential activities like thorough due diligence to assess project viability and potential risks, substantial legal fees associated with contracts and regulatory approvals, the often-complex permitting processes, and early-stage engineering studies to define project scope and feasibility. These expenditures are vital for securing future revenue streams and expanding the company's operational footprint.

General and Administrative Expenses

General and administrative expenses are the backbone of Capstone Infrastructure's corporate operations, encompassing essential functions that keep the entire organization running smoothly. These costs include significant investments in executive leadership, such as the salaries of the CEO and other top management, alongside the operational expenses of administrative staff who manage daily tasks. For instance, in 2024, many large infrastructure firms reported increased G&A costs due to investments in cybersecurity and compliance, reflecting the growing complexity of the sector.

Beyond personnel, these expenses cover vital support services. This includes the cost of maintaining corporate offices, ensuring legal and accounting teams are in place to navigate regulatory landscapes, and managing investor relations to maintain strong shareholder communication. These elements are crucial for the overall governance and strategic direction of Capstone Infrastructure.

- Executive Salaries: Covering compensation for senior leadership driving strategic decisions.

- Administrative Staff: Costs associated with personnel managing day-to-day corporate functions.

- Office Expenses: Including rent, utilities, and maintenance for corporate headquarters.

- Legal & Accounting Fees: Essential for compliance, audits, and contractual matters.

- Investor Relations: Costs related to communicating with shareholders and the financial community.

Regulatory Compliance and Environmental Costs

Capstone Infrastructure faces significant expenses related to adhering to environmental laws and obtaining necessary permits. These costs are crucial for maintaining operational legality and demonstrating responsible environmental stewardship. For instance, in 2024, companies in the infrastructure sector often allocate substantial budgets towards environmental impact assessments and ongoing monitoring programs.

These expenditures are not static and can fluctuate based on evolving regulatory landscapes and specific project requirements. Engaging with regulatory bodies and Indigenous communities is also a key component of this cost structure, ensuring smooth project development and fostering positive stakeholder relationships.

- Environmental Compliance: Costs for meeting emissions standards, waste management, and pollution control.

- Permitting and Licensing: Fees and administrative costs for obtaining and renewing operational permits.

- Community Engagement: Expenses for consultations and agreements with Indigenous groups and local communities.

- Monitoring and Reporting: Investment in systems and personnel for tracking and reporting environmental performance.

Capstone Infrastructure's cost structure is heavily influenced by its capital-intensive nature, with significant outlays for debt servicing, operations, and project development. In 2024, the company, like many in the infrastructure sector, navigated a landscape of fluctuating interest rates impacting its financing costs. Furthermore, substantial investments were made in maintaining and upgrading existing assets, alongside the pursuit of new growth opportunities through acquisitions and greenfield development.

These core expenses are complemented by essential general and administrative costs, ensuring smooth corporate operations and compliance. Environmental stewardship and regulatory adherence also represent a considerable financial commitment, reflecting the company's dedication to responsible operations and stakeholder engagement. Understanding these varied cost components is vital for assessing Capstone's overall financial health and strategic direction.

| Cost Category | 2024 Estimated Allocation | Key Components |

|---|---|---|

| Operating & Maintenance (O&M) | 40-50% | Technician salaries, equipment servicing, repairs, preventative maintenance |

| Debt Service & Financing | 25-35% | Interest payments, loan fees, capital raising costs |

| Development & Acquisition | 10-20% | Due diligence, legal fees, permitting, early-stage engineering, asset purchases |

| General & Administrative (G&A) | 5-10% | Executive salaries, administrative staff, office expenses, legal/accounting, investor relations |

| Environmental Compliance & Permitting | 2-5% | Impact assessments, monitoring, reporting, licensing fees, community engagement |

Revenue Streams

Capstone Infrastructure's main income comes from selling electricity to utility companies and big businesses or cities through long-term contracts called Power Purchase Agreements (PPAs). These agreements are crucial because they lock in prices for the electricity produced, offering a reliable and steady flow of revenue. For instance, in 2024, Capstone continued to leverage these PPAs across its diverse portfolio of renewable energy assets.

Merchant power sales allow Capstone Infrastructure to capitalize on dynamic electricity markets for output not covered by long-term Power Purchase Agreements (PPAs). This strategy exposes them to potentially higher revenues when wholesale electricity prices are strong, offering a valuable revenue diversification beyond fixed-price contracts.

In 2024, the volatility of energy markets means that these merchant sales can significantly impact overall performance. For instance, periods of high demand or supply constraints in certain regions can drive up spot prices, directly benefiting Capstone's uncontracted generation capacity.

Capacity payments are a crucial revenue stream for certain infrastructure assets, like natural gas peaker plants or energy storage facilities. These payments are essentially a fee for keeping generation capacity ready to serve the grid, irrespective of whether electricity is actually being sent out. This offers a predictable, fixed revenue component.

In 2024, for instance, capacity markets in regions like the PJM Interconnection have seen significant capacity prices. For the 2024-2025 planning year, PJM’s Base Residual Auction cleared at $100.54 per megawatt-day, meaning a plant capable of delivering 100 MW could earn over $1 million annually just for being available. This demonstrates the substantial and stable income potential from these payments.

Environmental Attributes and Carbon Credits

Capstone Infrastructure generates revenue by selling environmental attributes, including Renewable Energy Certificates (RECs) and carbon credits, tied to the clean energy from its wind, solar, and hydro assets. These credits are valuable market instruments that encourage the development and use of renewable energy sources.

The market for environmental attributes is dynamic. For instance, in 2023, the US voluntary carbon market saw significant activity, with prices for high-quality carbon credits ranging from $15 to over $50 per tonne of CO2 equivalent, depending on the project type and verification standards. This demonstrates a clear financial incentive for companies like Capstone to monetize the environmental benefits of their operations.

- Renewable Energy Certificates (RECs): These are tradable commodities representing proof that one megawatt-hour (MWh) of electricity was generated from an eligible renewable energy resource.

- Carbon Credits: Generated by projects that reduce or remove greenhouse gas emissions, these credits can be sold to entities looking to offset their own emissions.

- Market Value: The demand for RECs and carbon credits is driven by corporate sustainability goals, regulatory mandates, and investor preferences for ESG-aligned investments.

- Incentive Mechanism: The sale of these attributes provides an additional revenue stream, enhancing the overall profitability and financial viability of Capstone's clean energy projects.

Acquisition and Development Fees (Potentially)

While Capstone Infrastructure’s core business focuses on operating and managing infrastructure assets, acquisition and development fees can emerge as a supplementary revenue source. This typically occurs when Capstone takes a leading role in joint ventures or partnerships, leveraging its specialized knowledge in bringing new projects to fruition. These fees compensate for the company's expertise in project development, construction oversight, and the intricate process of acquiring new assets.

For instance, in 2024, infrastructure development projects often involve significant upfront capital and complex execution. Capstone’s involvement in such ventures, particularly those requiring specialized engineering and project management skills, could lead to the recognition of these fees. The exact amount would depend on the scale and complexity of the specific development or acquisition undertaken.

- Development Fees: Compensation for managing the entire lifecycle of a new infrastructure project, from conception to completion.

- Acquisition Fees: Earned when Capstone spearheads the purchase of existing infrastructure assets for a partnership or joint venture.

- Construction Management Fees: Charged for overseeing the construction phase of a project, ensuring it stays on schedule and within budget.

- Strategic Partnership Revenue: These fees are often tied to Capstone's strategic contribution and risk-taking in co-developed or co-acquired ventures.

Capstone Infrastructure secures revenue through a variety of channels, primarily driven by its renewable energy assets. The company's core income stems from long-term Power Purchase Agreements (PPAs) with utilities and large consumers, which provide stable, price-secured electricity sales. Additionally, Capstone participates in merchant power markets, selling electricity at prevailing market rates when not covered by PPAs, thus capturing potential upside from price volatility.

Further diversifying its revenue, Capstone Infrastructure earns income from capacity payments, which compensate for the availability of its generation assets, and from the sale of environmental attributes like Renewable Energy Certificates (RECs) and carbon credits. These attribute sales are increasingly important, reflecting the growing demand for clean energy and corporate sustainability initiatives.

| Revenue Stream | Description | 2024 Relevance/Data Point |

| Power Purchase Agreements (PPAs) | Long-term contracts for electricity sales at fixed prices. | Provides a stable and predictable revenue base for Capstone's renewable portfolio. |

| Merchant Power Sales | Selling electricity in wholesale markets when not under PPA. | Allows Capstone to benefit from higher spot prices during periods of strong demand or supply constraints. |

| Capacity Payments | Payments for keeping generation capacity available. | In 2024, PJM capacity prices averaged $100.54/MW-day for the 2024-2025 planning year, offering a consistent revenue stream. |

| Environmental Attributes (RECs, Carbon Credits) | Selling certificates representing clean energy generation and emissions reductions. | The voluntary carbon market saw prices between $15-$50+/tonne CO2e in 2023, highlighting the financial incentive for clean energy. |

Business Model Canvas Data Sources

The Capstone Infrastructure Business Model Canvas is built upon a foundation of robust industry analysis, detailed financial projections, and extensive market research. These sources ensure each element, from key resources to cost structure, is informed by credible and actionable data.