Capstone Infrastructure Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capstone Infrastructure Bundle

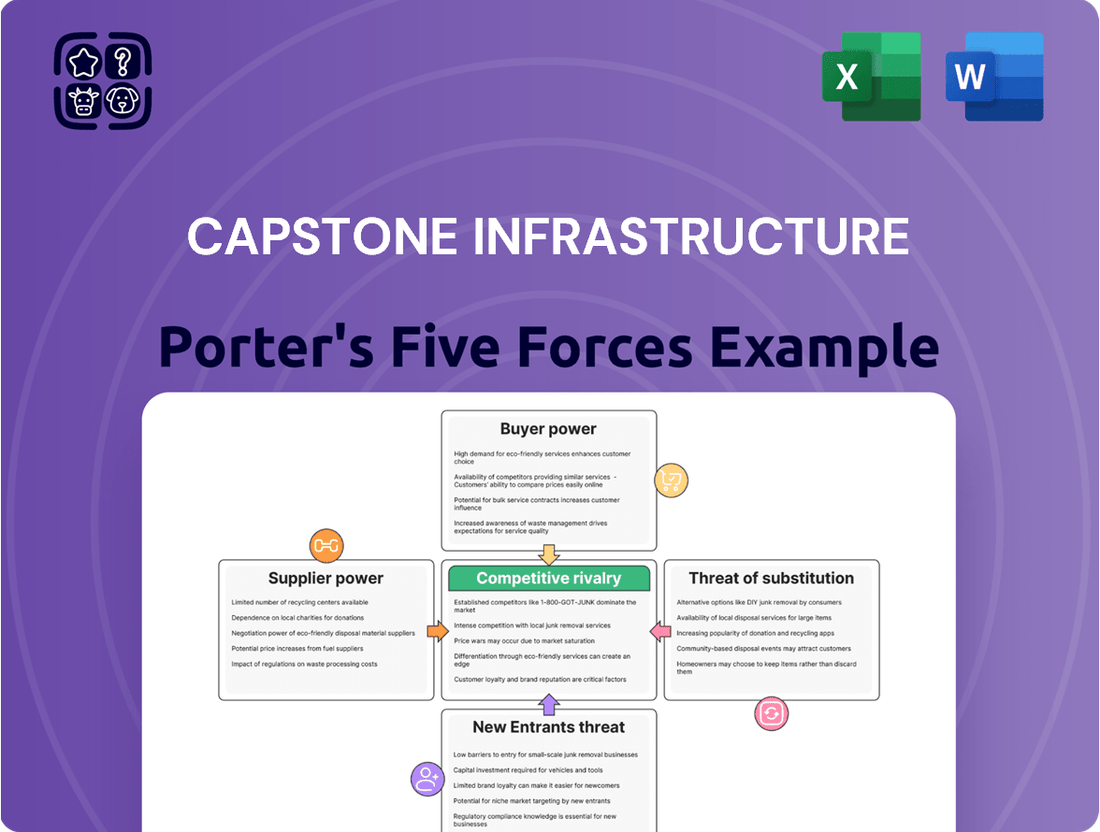

This brief snapshot only scratches the surface of the competitive landscape for Capstone Infrastructure. Understanding the intricate interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for any strategic decision.

Unlock the full Porter's Five Forces Analysis to explore Capstone Infrastructure’s competitive dynamics, market pressures, and strategic advantages in detail, equipping you with the knowledge to navigate this complex industry.

Suppliers Bargaining Power

Capstone Infrastructure's reliance on specialized equipment like wind turbines, solar panels, and generators for its diverse energy assets places it in a position where a limited number of manufacturers can hold significant bargaining power. This concentration in the supply chain for advanced components means these few providers can often dictate pricing and contract terms.

The solar industry, for example, has seen its supply chain, especially for critical materials like polysilicon, become highly concentrated among a handful of major global players. This concentration directly impacts the cost of solar panels, a key input for Capstone's solar projects, giving these suppliers considerable leverage in negotiations.

High switching costs for critical components significantly bolster supplier bargaining power for Capstone Infrastructure. Imagine needing to replace a turbine in a wind farm; the expense of re-engineering, re-tooling, and obtaining new certifications can easily run into millions of dollars, making a switch incredibly difficult.

These substantial costs, often running into the tens of millions for large-scale infrastructure, deter Capstone from easily changing suppliers for essential equipment like power transformers or specialized construction machinery. The long lead times and complex integration required for such components mean that once a supplier is chosen for a major project, they often retain that position for the project's entire lifecycle, diminishing Capstone's leverage.

Capstone Infrastructure's suppliers hold significant bargaining power, particularly those providing essential raw materials like metals and rare earth elements crucial for renewable energy projects. The price volatility of these inputs directly impacts Capstone's project economics.

Geopolitical tensions and disruptions within global supply chains can dramatically shift power towards suppliers. For instance, shortages of critical minerals like lithium, cobalt, or silicon, which have been observed in recent years, can lead to increased input costs and temporary supply constraints for Capstone, forcing them to accept less favorable terms.

Potential for Supplier Forward Integration

Key suppliers in the renewable energy and utility equipment sectors might consider forward integration, meaning they could start developing or owning projects themselves. This move would directly place them in competition with or as partners in stages of the value chain where Capstone Infrastructure operates.

If suppliers engage in forward integration, it can significantly bolster their bargaining power. This is because they would gain more control over the entire process, potentially reducing Capstone's negotiation flexibility and increasing their leverage.

- Supplier Forward Integration Threat: Renewable energy and utility equipment suppliers may integrate forward into project development or ownership.

- Increased Leverage: This vertical integration can transform suppliers into direct competitors or partners, enhancing their bargaining power over Capstone Infrastructure.

- Reduced Negotiation Flexibility: Capstone's ability to negotiate favorable terms could diminish as suppliers gain more control over project stages.

Regulatory and Certification Requirements

Suppliers of essential equipment for utility and power generation projects, especially in North America, face significant hurdles due to rigorous regulatory and certification demands. For instance, in 2024, navigating the complex web of environmental permits and safety certifications for new renewable energy installations often adds months and substantial costs to project timelines, directly impacting supplier selection.

These stringent requirements, encompassing everything from emissions standards to cybersecurity protocols for grid-connected assets, effectively limit the number of qualified suppliers. This scarcity naturally enhances the bargaining power of those companies that have invested in meeting and maintaining these high standards, allowing them to command higher prices or more favorable contract terms.

Compliance with federal and provincial regulations, such as those overseen by the U.S. Environmental Protection Agency (EPA) or Canada’s provincial energy ministries, is not merely a formality but a critical determinant of project viability. Failure to secure necessary approvals for equipment can halt projects, giving compliant suppliers a distinct advantage in negotiations.

- Regulatory Compliance Costs: Many suppliers must invest heavily in R&D and manufacturing upgrades to meet evolving environmental and safety standards, impacting their cost structures.

- Certification Barriers: Obtaining and maintaining certifications like ISO standards or specific product safety approvals can be time-consuming and expensive, creating barriers to entry for new suppliers.

- Limited Qualified Suppliers: The specialized nature of power generation equipment and the associated regulatory burden mean fewer suppliers can meet the necessary qualifications, consolidating power with existing players.

Capstone Infrastructure's suppliers, particularly those for specialized renewable energy components like advanced solar panels and wind turbine parts, wield considerable bargaining power. This is due to the concentrated nature of manufacturing for these high-tech items, where only a few global players can produce them efficiently. For example, the polysilicon supply chain, critical for solar technology, is dominated by a handful of companies, allowing them to influence pricing and terms for Capstone's solar projects.

High switching costs further solidify supplier leverage. Replacing specialized equipment, such as a large wind turbine, can involve millions in re-engineering, certification, and installation, making it economically unfeasible for Capstone to change providers frequently. This lock-in effect means suppliers often retain their position for the entire project lifecycle, significantly reducing Capstone's negotiation flexibility.

The bargaining power of Capstone's suppliers is amplified by stringent regulatory and certification requirements in the energy sector. In 2024, meeting complex environmental permits and safety standards for new installations adds significant costs and time for suppliers, limiting the pool of qualified providers. This scarcity allows compliant suppliers to demand higher prices and more favorable contract terms, as seen with compliance for EPA emissions standards or grid-connection cybersecurity protocols.

| Supplier Characteristic | Impact on Capstone Infrastructure | Example (2024 Data/Trends) |

|---|---|---|

| Supply Chain Concentration | Limited options increase supplier leverage. | Polysilicon for solar panels dominated by a few global producers. |

| Switching Costs | High costs deter changing suppliers, creating dependency. | Millions in re-engineering and certification for wind turbine replacement. |

| Regulatory & Certification Hurdles | Fewer qualified suppliers enhance power. | Meeting EPA emissions and cybersecurity standards limits provider options. |

| Supplier Forward Integration Threat | Potential competition or partnership shifts power dynamics. | Equipment manufacturers entering project development could reduce Capstone's negotiation space. |

What is included in the product

This analysis meticulously examines the five forces shaping Capstone Infrastructure's operating environment, providing a strategic overview of its competitive landscape and potential challenges.

Instantly identify and address competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Capstone Infrastructure's utility operations benefit from a customer base in largely regulated markets. In these areas, regulatory bodies often determine end-user rates, significantly reducing the ability of individual customers to negotiate prices directly. This regulatory oversight tends to dampen customer bargaining power.

For residential and smaller commercial customers, electricity is a necessity with few readily available alternatives within their designated service territories. This lack of substitutes, coupled with the essential nature of the service, further limits their leverage in price discussions. For instance, in 2024, the average residential electricity price in regulated utility markets often remained stable due to these oversight mechanisms, reflecting the limited ability of customers to influence pricing.

Capstone's large industrial and commercial customers, along with utility companies that buy power via Power Purchase Agreements (PPAs), hold considerable sway. This is because they purchase substantial volumes of electricity, giving them leverage to negotiate better terms, pricing, and contract lengths. For instance, many PPAs are structured to lock in predictable revenue streams for generators while securing stable, often lower, electricity costs for buyers.

Government entities and provincial utilities, like BC Hydro, are significant customers for Capstone Infrastructure's power generation. These large-scale buyers exert considerable influence through competitive procurement processes, such as the recent 'Call for Power.'

These procurement processes often set stringent requirements, pricing, and long-term contract conditions, directly impacting Capstone's revenue and operational flexibility. For instance, in 2023, BC Hydro's 'Call for Power' aimed to secure new electricity resources, highlighting the government's role in shaping market terms and customer power.

Limited Switching Costs for Utility-Scale Power

For utility-scale power, the bargaining power of customers can be surprisingly high. While residential customers in regulated markets might find it difficult and costly to switch electricity providers, large industrial or municipal buyers often have more options. If alternative generation sources or new providers emerge offering better prices or terms, these major customers can exert significant pressure on Capstone Infrastructure.

This dynamic means Capstone must remain highly competitive in its pricing and exceptionally reliable in its service delivery. Losing even one large utility-scale customer can represent a substantial hit to revenue. For instance, in 2024, the energy sector saw increased volatility, with some large industrial consumers actively seeking out more cost-effective power solutions, underscoring the need for continuous value proposition refinement by infrastructure providers like Capstone.

- Lower Switching Costs for Large Buyers: Unlike individual households, large-scale power purchasers can negotiate more favorable terms or explore alternative suppliers if Capstone's rates become uncompetitive.

- Price Sensitivity of Major Customers: Significant industrial or municipal clients are often highly sensitive to electricity costs, making them more inclined to switch for even marginal savings.

- Market Dynamics and Competition: The emergence of new energy technologies or independent power producers can create competitive alternatives, directly impacting Capstone's ability to retain large contracts.

- Reliability as a Key Differentiator: Consistent and dependable power delivery is crucial for Capstone to mitigate customer defection, even when facing price competition.

Customer Demand for Clean and Reliable Energy

The growing societal and corporate push for clean, reliable, and sustainable energy significantly shapes customer expectations, thereby enhancing their bargaining power. Large corporate clients, for instance, increasingly favor energy providers like Capstone Infrastructure that showcase robust Environmental, Social, and Governance (ESG) credentials and offer low-carbon power options.

This shift means customers can more readily switch to or demand better terms from suppliers aligning with their sustainability goals. In 2024, for example, a significant portion of major corporations have set ambitious net-zero targets, directly influencing their procurement decisions for energy services.

- ESG Focus: Customers are actively seeking suppliers with verifiable ESG commitments, giving them leverage to negotiate terms favorable to their sustainability objectives.

- Low-Carbon Preference: The demand for low-carbon energy solutions allows customers to choose among providers, increasing their bargaining power by selecting those offering cleaner alternatives.

- Corporate Targets: Major corporations are setting aggressive sustainability goals, such as net-zero emissions by 2040 or 2050, which translates into greater influence over their energy suppliers.

While individual residential customers have limited bargaining power due to regulated rates and the essential nature of electricity, large industrial and commercial clients, along with government entities, wield significant influence. These major buyers can negotiate favorable terms due to their substantial purchase volumes and the availability of alternative energy solutions. For instance, the increasing focus on ESG factors in 2024 means that corporate clients with net-zero targets can leverage their demand for clean energy to secure better contract conditions from providers like Capstone Infrastructure.

| Customer Segment | Bargaining Power Factors | Impact on Capstone Infrastructure |

|---|---|---|

| Residential Customers | Low (regulated rates, essential service, high switching costs) | Minimal direct price negotiation leverage. |

| Large Industrial/Commercial Customers | High (volume purchases, price sensitivity, potential alternatives) | Ability to negotiate lower prices, longer contracts, and specific service levels. |

| Government Entities/Utilities (e.g., BC Hydro) | High (procurement processes, scale of purchase, competitive bidding) | Influence pricing, contract terms, and project viability through competitive tenders. |

What You See Is What You Get

Capstone Infrastructure Porter's Five Forces Analysis

This preview displays the complete Capstone Infrastructure Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the sector. The document you are currently viewing is precisely the same, professionally formatted analysis that will be delivered to you immediately upon purchase. You can be confident that no placeholders or samples are presented; what you see is the final, ready-to-use report for your strategic planning needs.

Rivalry Among Competitors

The North American infrastructure and power generation landscape is densely populated with well-established companies. Capstone Infrastructure faces competition from major utilities, independent power producers, and broad-spectrum energy firms, all vying for the same development opportunities and market share.

This intense rivalry means Capstone must constantly innovate and secure advantageous project bids to maintain its competitive edge. For instance, in 2023, the total installed capacity of renewable energy in North America surpassed 300 GW, highlighting the significant market activity and the number of players involved.

The renewable energy sector in Canada and North America is booming, with significant investments pouring in to meet ambitious decarbonization targets. This rapid expansion naturally attracts more companies, leading to heightened competitive rivalry.

For Capstone Infrastructure, this means facing numerous competitors in the wind, solar, and hydro segments. For instance, by the end of 2023, Canada's installed renewable electricity capacity reached over 100 GW, with wind and solar making up substantial portions, indicating a crowded marketplace.

The infrastructure and power generation sectors are inherently capital-intensive, demanding substantial upfront investments. For instance, the average cost to build a utility-scale solar farm in the US can range from $1 million to $2 million per megawatt. This high barrier to entry means only well-financed entities can compete, intensifying the struggle for limited, high-return projects and crucial financing.

Differentiation Based on Project Pipeline and Operational Efficiency

Capstone Infrastructure, like its peers, actively differentiates itself by cultivating a strong project pipeline and demonstrating superior operational efficiency. This focus is crucial for winning competitive bids, such as those from BC Hydro for new power generation projects. Companies that can reliably secure and execute a diverse range of projects, while maintaining high uptime and cost-effectiveness, gain a significant edge.

The intensity of rivalry is amplified by the need for continuous innovation in project execution and operational management. For instance, in 2024, renewable energy developers are increasingly judged not just on the capacity of their proposed projects, but on their demonstrated ability to manage construction timelines and operational costs effectively. Success in these complex bidding environments directly impacts market share and future growth opportunities.

- Project Pipeline Strength: Companies with a proven track record of securing and developing new projects, especially in the renewable energy sector, demonstrate a competitive advantage.

- Operational Efficiency Metrics: Factors like plant uptime, cost per megawatt-hour, and maintenance expenditures are key differentiators in operational performance.

- Competitive Bidding Success: Winning bids in regulated markets, such as BC Hydro's procurement processes, often hinges on a combination of pipeline robustness and operational execution capabilities.

- Diversified Portfolio Management: The ability to efficiently manage a range of infrastructure assets, from hydro to wind, enhances a company's overall competitive standing.

Regulatory and Policy Landscape Influence

The competitive rivalry within the infrastructure sector, particularly concerning Capstone Infrastructure, is significantly shaped by the dynamic regulatory and policy landscape. Government policies, incentives, and evolving frameworks for energy transition and infrastructure development directly influence how companies compete. For instance, a company's ability to secure contracts or access funding often hinges on its alignment with specific clean energy mandates or government-backed financing programs.

Navigating these policies strategically can create substantial competitive advantages. Companies that proactively adapt to or anticipate changes in regulations, such as carbon pricing mechanisms or renewable energy targets, can position themselves favorably. Conversely, those slow to adapt may face disadvantages. For example, in 2024, many jurisdictions are implementing or strengthening policies aimed at decarbonizing the energy sector, potentially favoring companies with significant renewable energy portfolios.

- Policy Alignment: Companies heavily invested in renewable energy projects, aligned with 2024 government targets for solar and wind power expansion, often gain preferential treatment in project bidding and financing.

- Incentive Structures: The availability and design of tax credits, subsidies, and grants for green infrastructure in 2024 directly impact the cost competitiveness and return on investment for new projects.

- Regulatory Uncertainty: Fluctuations or ambiguities in regulatory frameworks, such as changes in permitting processes or environmental standards, can introduce risks and affect long-term investment decisions for all players.

- Market Access: Policies that mandate grid access for renewable sources or establish capacity markets can open new revenue streams and competitive opportunities for infrastructure developers.

The competitive rivalry within the infrastructure sector is intense, with Capstone Infrastructure facing numerous established players in power generation and utilities. Success hinges on securing advantageous project bids and demonstrating operational efficiency, especially as North America's renewable energy capacity, exceeding 300 GW by 2023, continues to grow. This expansion fuels competition, with companies like Capstone needing to differentiate through strong project pipelines and cost-effective operations to thrive in a market where capital investment is significant.

| Competitor Type | Key Differentiators | 2023/2024 Market Trend Impact |

| Major Utilities | Existing grid infrastructure, established customer base | Increasing focus on renewable integration, potential for new project development |

| Independent Power Producers (IPPs) | Project development expertise, specialized technology focus | Aggressive pursuit of renewable energy contracts, driving down PPA prices |

| Broad-Spectrum Energy Firms | Diversified energy portfolios, significant financial backing | Strategic investment in renewables and energy transition technologies |

SSubstitutes Threaten

While Capstone Infrastructure Corporation is firmly planted in the renewable energy sector, traditional fossil fuel generation, including natural gas, coal, and oil, still presents a form of substitution. These sources can fulfill baseload power needs or bridge gaps when renewable energy output is inconsistent.

However, the global momentum towards decarbonization, coupled with the implementation of carbon pricing mechanisms, is actively eroding the long-term viability and competitive edge of fossil fuel-based power generation. For instance, in 2024, many regions saw continued increases in carbon taxes, making fossil fuel electricity generation more expensive relative to renewables.

Improvements in energy efficiency and demand-side management (DSM) programs present a growing threat by reducing the need for new power generation. For instance, in 2024, many utilities are expanding DSM initiatives, offering incentives for customers to adopt energy-saving technologies, which directly curtails electricity demand.

This trend can impact Capstone Infrastructure by lowering the overall consumption of electricity, thereby potentially reducing the volume of power they need to generate and sell. As consumers and industries become more adept at managing their energy use, the market for new generation capacity, and by extension Capstone's core business, faces indirect substitution.

Advancements in energy storage, like large-scale batteries, and emerging solutions such as green hydrogen present a significant threat of substitution for traditional grid infrastructure and specific power generation methods. For instance, by the end of 2023, global battery energy storage capacity reached approximately 50 GW, a substantial increase from previous years, highlighting the growing viability of these alternatives.

Capstone Infrastructure's active exploration and integration of battery energy storage into its portfolio demonstrates a clear acknowledgment of this evolving threat. This strategic move suggests Capstone is working to mitigate the impact of substitutes by potentially offering these very solutions, thereby transforming a threat into an opportunity.

Distributed Generation and Rooftop Solar

Distributed generation, especially rooftop solar, presents a growing threat to traditional utility models like Capstone Infrastructure. For many commercial and residential customers, these distributed sources offer a viable alternative to purchasing power directly from the grid. This shift can lead to reduced overall demand for utility-scale electricity, impacting revenue streams for companies operating large-scale generation assets.

The increasing affordability and accessibility of rooftop solar are key drivers of this trend. In 2024, the levelized cost of energy for utility-scale solar PV has continued to decline, making it more competitive. For instance, reports from early 2024 indicated that solar costs have fallen significantly over the past decade, making it an attractive option for end-users looking to reduce their electricity bills and gain energy independence.

- Reduced Grid Demand: Widespread adoption of rooftop solar directly siphons demand away from the traditional grid, affecting the volume of electricity Capstone Infrastructure needs to supply from its utility-scale projects.

- Customer Choice and Competition: Distributed generation empowers end-users with more choices, creating a competitive pressure that utilities must address.

- Impact on Revenue: A decline in overall grid demand can translate to lower revenue for utility operators, potentially affecting the profitability of infrastructure investments.

- Policy and Incentives: Government policies and incentives supporting distributed generation further accelerate its adoption, amplifying the threat.

Nuclear Power and Large-Scale Hydro Expansion

Beyond Capstone Infrastructure's current hydroelectric assets, nuclear power and new large-scale hydro projects pose a significant threat of substitution. These alternatives offer non-intermittent power generation, directly competing with other renewable sources in meeting provincial and national electricity demands. Canada's extensive existing hydroelectric capacity further amplifies this competitive pressure.

For instance, Ontario, a key market for Capstone, has been actively investing in nuclear power. As of early 2024, the Darlington Nuclear Generating Station continues its refurbishment project, aiming to extend its operational life and ensure a stable, baseload power source. This commitment to nuclear underscores its role as a potent substitute for other generation types.

- Nuclear Power: Offers reliable, non-intermittent baseload power, a direct alternative to hydro and other renewables.

- Large-Scale Hydro Expansion: While capital-intensive, new hydro projects can significantly increase supply, impacting the market share of existing and other renewable sources.

- Provincial Energy Strategies: Government policies favoring or investing in nuclear or new hydro directly influence the competitive landscape for Capstone's assets.

The threat of substitutes for Capstone Infrastructure is multifaceted, encompassing both established and emerging energy technologies. While fossil fuels remain a substitute, their long-term viability is diminishing due to decarbonization efforts and rising carbon costs, with many regions in 2024 increasing carbon taxes. Energy efficiency and demand-side management programs are also growing threats, as seen with utilities expanding incentives for energy-saving technologies in 2024, directly reducing overall electricity demand.

Advancements in energy storage, such as battery systems, and new solutions like green hydrogen are significant substitutes, with global battery energy storage capacity reaching approximately 50 GW by the end of 2023. Distributed generation, particularly rooftop solar, is another key substitute; the declining cost of solar PV, with significant price drops reported by early 2024, makes it an attractive alternative for consumers seeking energy independence.

Furthermore, nuclear power and new large-scale hydroelectric projects present substantial substitution threats, offering non-intermittent power. Ontario's ongoing refurbishment of the Darlington Nuclear Generating Station, aiming to extend its operational life as of early 2024, highlights the commitment to nuclear as a reliable baseload substitute.

| Substitute Technology | Key Characteristic | 2024 Impact/Trend | Capstone's Response |

| Fossil Fuels (Natural Gas, Coal, Oil) | Baseload power, bridging intermittency | Eroding viability due to decarbonization, increased carbon taxes | Indirectly impacted by policy shifts |

| Energy Efficiency & Demand-Side Management (DSM) | Reduces overall electricity demand | Utilities expanding DSM initiatives with customer incentives | Lower demand for generated power |

| Energy Storage (Batteries) | Grid stability, managing intermittency | Global capacity ~50 GW by end of 2023 | Integrating battery storage into portfolio |

| Distributed Generation (Rooftop Solar) | Customer energy independence, reduced grid reliance | Declining costs, increased affordability | Potential reduction in utility-scale demand |

| Nuclear Power | Reliable, non-intermittent baseload power | Ongoing refurbishment projects (e.g., Darlington Nuclear Station) | Direct competition for baseload supply |

| Large-Scale Hydro Expansion | Significant renewable power supply | Capital-intensive but increases overall supply | Competition from existing and new hydro projects |

Entrants Threaten

The infrastructure and power generation sector, where Capstone Infrastructure operates, demands substantial upfront capital. Developing projects like wind farms or utility grids can easily require billions of dollars for land acquisition, construction, and technology. For instance, a large-scale solar farm project can cost upwards of $100 million to $200 million, while a new power plant can run into the billions.

These high capital requirements act as a significant barrier to entry. Only well-established companies with access to substantial funding or those with strong financial backing can realistically consider entering this market. This financial hurdle effectively deters smaller or less capitalized potential competitors from challenging incumbent firms like Capstone Infrastructure.

The energy and utility sectors are notoriously complex when it comes to regulations and permits. Think about it – these industries are essential for society, so governments at all levels, from federal to local, have a lot of say in how they operate. This means newcomers face a maze of intricate rules and lengthy approval processes.

Navigating these regulatory hurdles isn't just a matter of filling out forms; it demands specialized expertise and a significant investment of time. For instance, obtaining permits for a new power generation facility can take years, involving environmental impact assessments, public consultations, and adherence to numerous safety standards. This complexity acts as a powerful deterrent, making it incredibly difficult for new companies to even get their foot in the door.

In 2024, the average time to secure all necessary permits for a new large-scale renewable energy project in North America could easily exceed two to three years, with associated costs running into millions of dollars. This substantial barrier effectively shields established players like Capstone Infrastructure from immediate threats by new, less experienced entrants.

Established players in the infrastructure sector, such as Capstone, leverage significant economies of scale. This means they can spread costs across a larger number of projects, making their per-unit costs lower. For instance, bulk purchasing of materials or more efficient deployment of specialized equipment for multiple developments significantly reduces expenses compared to a new entrant starting from scratch.

The experience curve is another formidable barrier. Capstone's years of operation have allowed them to refine processes, optimize project timelines, and build deep expertise in risk management and regulatory compliance. This accumulated knowledge, often translating into faster project completion and reduced operational inefficiencies, is something new competitors would take considerable time and investment to replicate.

In 2024, the average large-scale infrastructure project requires billions in upfront capital. New entrants face immense difficulty in securing financing at competitive rates, a hurdle that established firms with proven track records and strong balance sheets, like Capstone, can more readily overcome. This financial disparity directly impacts the cost competitiveness of new ventures.

Access to Transmission Infrastructure and Land

New power generation projects, including those by Capstone Infrastructure, depend heavily on access to existing transmission grids to get electricity to customers. Finding suitable land for these projects is also a significant hurdle. These requirements can be difficult and take a long time to sort out, as grid connections are often limited or need major improvements, and the best spots for development can be hard to come by.

In 2024, the demand for grid connections continued to be a bottleneck for renewable energy projects. For instance, in the United States, the backlog of proposed generation and storage projects seeking grid interconnection reached over 14,000 gigawatts by the end of 2023, a substantial increase from previous years. This highlights the challenge of integrating new capacity into an aging and often constrained transmission system.

- Grid Connection Bottlenecks: The sheer volume of projects seeking to connect to the grid in 2024 created significant delays, with interconnection queues extending for years in many regions.

- Transmission Upgrade Costs: The need for substantial upgrades to existing transmission infrastructure to accommodate new generation, particularly renewables, adds considerable cost and time to project development.

- Land Availability and Permitting: Securing suitable land for large-scale power generation facilities, especially those requiring extensive transmission rights-of-way, remains a challenge due to zoning, environmental regulations, and community opposition.

Strong Incumbent Relationships and Offtake Agreements

Existing players like Capstone Infrastructure benefit from deeply entrenched relationships with utilities and government bodies, often solidified through long-term power purchase agreements (PPAs) and service contracts. These established connections and the resulting contracted revenue streams present a substantial barrier for new entrants seeking to secure consistent demand for their energy output.

For instance, in 2024, Capstone Infrastructure continued to leverage its extensive network of PPAs, which underpin its stable cash flows. These agreements, some extending for decades, provide new entrants with limited opportunities to break into established markets without significant upfront investment in securing their own long-term offtake commitments.

- Long-term PPAs: Capstone's existing portfolio is heavily reliant on long-dated PPAs, securing revenue and limiting immediate market access for newcomers.

- Government Contracts: Many infrastructure projects involve government concessions or contracts, which are typically awarded to incumbent or well-established players.

- Customer Loyalty: Utilities and industrial clients often prioritize reliability and proven track records, making it difficult for new, unproven entities to displace established suppliers.

- Regulatory Hurdles: Navigating complex regulatory frameworks can be more challenging and costly for new entrants compared to incumbents with established compliance processes.

The threat of new entrants for Capstone Infrastructure is considerably low due to immense capital requirements, with projects often costing billions. For example, in 2024, securing permits for a new large-scale renewable energy project could take over two years and cost millions. This financial and regulatory complexity, coupled with established economies of scale and experience curves, significantly deters new competition.

Furthermore, access to critical infrastructure like transmission grids presents a major obstacle. In 2024, the backlog for grid interconnections in the US exceeded 14,000 gigawatts, highlighting the difficulty new projects face in connecting to the network. The need for transmission upgrades also adds substantial costs, making it challenging for new players to compete on cost-effectiveness.

Established relationships with utilities and government bodies, often cemented by long-term power purchase agreements (PPAs), further solidify Capstone's market position. These existing contracts, some spanning decades, limit market access for newcomers who struggle to secure similar long-term offtake commitments. Customer loyalty and the preference for proven reliability also favor incumbents.

| Barrier to Entry | Impact on New Entrants | 2024 Data/Example |

|---|---|---|

| High Capital Requirements | Significant financial hurdle, limiting potential entrants to well-funded organizations. | Large-scale solar farm projects can cost $100M-$200M; new power plants cost billions. |

| Regulatory Complexity & Permitting | Lengthy and intricate approval processes requiring specialized expertise and time. | Permitting for new power generation facilities can take years; average time for renewable projects in North America exceeds 2-3 years. |

| Economies of Scale & Experience Curve | New entrants lack cost advantages and operational efficiencies gained by incumbents over time. | Established firms can spread costs across multiple projects, reducing per-unit expenses. |

| Grid Access & Transmission Limitations | Difficulty in securing connections to existing grids and the high cost of necessary upgrades. | US grid interconnection backlog exceeded 14,000 GW by end of 2023. |

| Entrenched Relationships & PPAs | Limited market access due to existing long-term contracts held by incumbents. | Capstone's revenue is underpinned by extensive, long-dated PPAs. |

Porter's Five Forces Analysis Data Sources

Our Capstone Infrastructure Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry-specific trade publications, and reports from reputable market research firms to provide a comprehensive view of the competitive landscape.