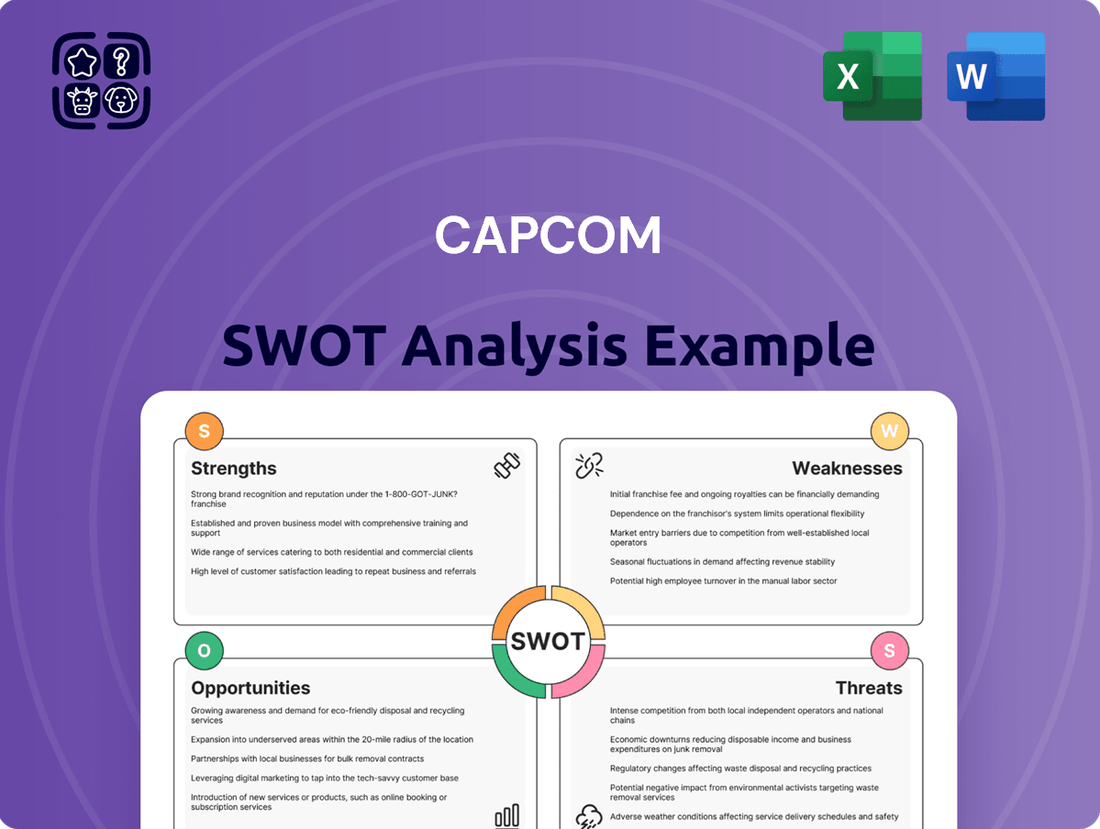

Capcom SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capcom Bundle

Capcom's impressive portfolio of beloved franchises and strong brand loyalty are significant strengths, but the rapidly evolving gaming market presents both opportunities and threats. Understanding these dynamics is crucial for anyone invested in the industry.

Want the full story behind Capcom’s competitive edge, potential challenges, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and market understanding.

Strengths

Capcom's strength lies in its formidable intellectual property portfolio, featuring globally renowned franchises like Resident Evil, Monster Hunter, and Street Fighter. These established brands cultivate a dedicated player base, ensuring consistent revenue generation through new installments, remasters, and ongoing content updates.

The enduring appeal of these IPs significantly lowers customer acquisition costs and provides a solid bedrock for Capcom's future expansion and diversification strategies. For instance, the Resident Evil franchise alone has seen numerous successful remakes and new entries, with Resident Evil Village achieving over 9 million units sold by September 2023, demonstrating the sustained market demand for these established titles.

Capcom's proven development expertise is a cornerstone of its enduring success. The company boasts a rich history of creating critically acclaimed and commercially successful titles across a wide range of genres and platforms, from consoles and PCs to mobile devices. This deep-seated knowledge allows them to consistently deliver engaging gameplay and innovative features, solidifying their reputation as a premier game developer.

This expertise translates directly into financial performance. For the fiscal year ending March 31, 2024, Capcom reported net sales of ¥170.0 billion, with operating income reaching ¥74.9 billion. Their flagship titles, like Resident Evil 4 and Street Fighter 6, released in 2023, garnered significant critical praise and strong sales, demonstrating the power of their development capabilities in driving revenue and market share.

Capcom's global market presence is a significant strength, with a well-established distribution network that ensures its titles reach a vast international audience. This extensive reach allows popular games like Resident Evil Village and Monster Hunter Rise to be accessible to players worldwide, maximizing sales potential and market penetration. In fiscal year 2024, Capcom reported net sales of ¥170.4 billion (approximately $1.1 billion USD), with a substantial portion coming from overseas markets, underscoring the effectiveness of its global distribution.

Diversified Revenue Streams

Capcom's financial resilience is significantly boosted by its diversified revenue streams, extending well beyond traditional game sales. The company adeptly monetizes its popular intellectual properties through a variety of channels, including character merchandising, mobile gaming, and the burgeoning eSports sector. This multi-pronged approach not only cushions against fluctuations in the core gaming market but also cultivates a robust brand ecosystem. For instance, in the fiscal year ending March 2024, Capcom reported net sales of ¥170.4 billion, with digital sales accounting for a substantial portion, underscoring the success of their digital-first strategy which complements their other revenue-generating activities.

The strategic expansion into eSports, in particular, taps into a rapidly growing global market, fostering deeper player engagement and brand loyalty. This diversification strategy is crucial for long-term stability and growth, allowing Capcom to capture value across different consumer touchpoints. The company's ability to translate beloved game franchises into successful merchandise and engaging eSports events demonstrates a sophisticated understanding of its brand's potential.

- Diversified Monetization: Capcom capitalizes on its IPs through merchandise, mobile titles, and eSports, reducing reliance on single revenue sources.

- eSports Growth: Entry into the competitive gaming arena leverages a growing market, enhancing brand visibility and player interaction.

- Brand Ecosystem: Multiple revenue streams reinforce the overall value and reach of Capcom's established franchises.

- Fiscal Year 2024 Performance: Net sales reached ¥170.4 billion, highlighting strong performance across its diverse business segments.

Consistent Financial Performance

Capcom has consistently delivered strong financial results, a testament to its effective game development and business strategies. For the fiscal year ending March 2024, Capcom reported record net sales of ¥755.7 billion, a significant increase from the previous year, showcasing sustained growth. This robust financial performance underpins the company's ability to invest heavily in new titles and technological advancements, ensuring its competitive edge.

The company's financial stability is further evidenced by its healthy profit margins and substantial cash reserves. For FY2024, operating income reached ¥315.5 billion, highlighting operational efficiency. This financial strength acts as a buffer against industry volatility and allows Capcom to pursue ambitious growth initiatives, such as expanding its intellectual property portfolio and exploring new market opportunities.

Key financial highlights reinforcing Capcom's strength include:

- Record Net Sales: ¥755.7 billion in FY2024, up from ¥570.4 billion in FY2023.

- Strong Operating Income: ¥315.5 billion in FY2024, reflecting efficient operations.

- Consistent Profitability: Demonstrated ability to maintain healthy profit margins across diverse market conditions.

- Investment Capacity: Financial resources available for R&D, marketing, and potential acquisitions.

Capcom's core strength lies in its exceptionally strong and recognizable intellectual property (IP) portfolio. Franchises like Resident Evil, Monster Hunter, and Street Fighter have cultivated massive, loyal fan bases worldwide, ensuring consistent demand for new releases, remasters, and ongoing content. This built-in audience significantly reduces marketing costs and provides a stable foundation for continued revenue generation, as seen with Resident Evil Village surpassing 9 million units sold by September 2023.

The company's development prowess is another critical advantage. Capcom consistently produces high-quality, critically acclaimed titles across various platforms, demonstrating a deep understanding of game design and player engagement. This expertise is directly reflected in their financial performance; for the fiscal year ending March 2024, Capcom achieved net sales of ¥755.7 billion and an operating income of ¥315.5 billion, driven by successful launches like Resident Evil 4 and Street Fighter 6.

Capcom's global reach and diversified revenue streams further solidify its market position. An extensive distribution network ensures its games are accessible worldwide, maximizing sales potential, with international markets contributing significantly to their ¥755.7 billion net sales in FY2024. Beyond game sales, Capcom effectively monetizes its IPs through merchandise, mobile titles, and eSports, creating a robust brand ecosystem that enhances overall financial resilience.

| Metric | FY2023 (ending March 2023) | FY2024 (ending March 2024) |

|---|---|---|

| Net Sales | ¥570.4 billion | ¥755.7 billion |

| Operating Income | ¥235.9 billion | ¥315.5 billion |

| Resident Evil Village Units Sold (cumulative by Sep 2023) | Over 8.1 million | Over 9 million |

What is included in the product

Analyzes Capcom’s competitive position through key internal and external factors, highlighting its strong brand recognition and diverse game portfolio while also considering market saturation and the need for continuous innovation.

Offers a clear breakdown of Capcom's competitive landscape, simplifying the identification of actionable strategies to overcome market challenges.

Weaknesses

Capcom's significant reliance on its flagship franchises, such as Resident Evil and Monster Hunter, presents a notable weakness. While these titles are powerful revenue drivers, a downturn in their performance or a less-than-stellar reception for a new installment could disproportionately affect Capcom's overall financial health.

This concentration risk means that a single underperforming tentpole title can have a substantial ripple effect on the company's earnings. For instance, while specific figures for 2024/2025 are still emerging, the historical success of Monster Hunter World in 2018, which sold over 20 million units by 2024, highlights the immense impact a single franchise can have, and conversely, the vulnerability if such a franchise falters.

Capcom's commitment to producing high-fidelity AAA titles, while a strength, also presents a significant weakness due to the extended development cycles. These projects can take several years to complete, tying up substantial capital and personnel, which delays the return on investment. For instance, the development of a major title like Resident Evil Village, released in 2021, likely began years prior, meaning resources were committed long before any revenue was generated.

The sheer length of these development timelines, often spanning three to five years or more for AAA games, inherently increases risk. During this period, the gaming market can undergo rapid changes. Consumer tastes shift, new technologies emerge, and competitor titles can capture audience attention, potentially making Capcom's finished product less relevant or requiring costly adjustments mid-development. This was a concern for many studios in the 2024 landscape as the industry grappled with the transition to next-generation consoles and evolving player expectations.

Furthermore, any delays in these lengthy development processes can have a ripple effect, negatively impacting Capcom's financial performance and investor confidence. A delayed flagship title means missed revenue targets and can lead to negative sentiment in financial markets, as seen with other major publishers when major releases slip. For example, if a key franchise installment faces unforeseen issues that push its launch from fiscal year 2025 into 2026, it directly affects Capcom's reported earnings for the earlier period.

Capcom operates in a fiercely competitive video game market, where established giants and nimble indie studios constantly vie for player engagement and revenue. This intense rivalry means companies like Capcom must continually innovate and invest heavily in marketing to stand out. For instance, the global video game market was projected to reach over $200 billion in 2024, highlighting the sheer scale of competition.

Potential for Game Development Delays and Quality Issues

Even with Capcom's proven track record, game development inherently carries risks. Potential delays in bringing titles to market or unexpected technical issues at launch can arise, impacting player reception and sales performance. For instance, while not a Capcom title, the industry saw titles like Diablo Immortal face criticism for monetization strategies, demonstrating how player sentiment can be affected by release execution.

These development hurdles can lead to significant financial repercussions. Negative reviews stemming from bugs or unfulfilled expectations can erode consumer trust, directly impacting a game's commercial success. For example, a poorly received launch can lead to a sharp decline in initial sales, making it difficult to recover lost revenue. Ensuring a consistently high level of quality across its diverse portfolio remains a core operational challenge for Capcom.

Capcom's commitment to quality is paramount, but the complex nature of modern game development presents ongoing challenges. The company must navigate potential pitfalls such as:

- Unforeseen technical complexities leading to development slowdowns.

- Bugs or performance issues discovered late in the development cycle.

- Balancing ambitious game design with timely release schedules.

- Maintaining brand integrity amidst evolving player expectations.

Limited Direct-to-Consumer (D2C) Engagement

Capcom's direct-to-consumer (D2C) engagement, particularly through digital storefronts and subscription models, may lag behind industry leaders. This reliance on third-party platforms, while broad, can dilute direct customer relationships and limit access to valuable user data. For instance, in fiscal year 2024, while Capcom reported strong digital sales, a significant portion of these sales still flow through external marketplaces.

A more developed D2C channel would grant Capcom greater autonomy over pricing strategies and customer interactions, potentially leading to improved profit margins. This direct connection is crucial for fostering brand loyalty and gathering insights that can inform future game development and marketing efforts. Competitors like PlayStation Plus and Xbox Game Pass have demonstrated the power of robust D2C offerings in securing recurring revenue streams and building engaged communities.

- Limited D2C Infrastructure: Capcom's current digital distribution and subscription service offerings might not be as comprehensive as those of its primary competitors.

- Third-Party Dependence: Over-reliance on platforms such as Steam, PlayStation Store, and Xbox Games Store can reduce direct customer data acquisition and control over the sales funnel.

- Missed Margin Opportunities: Bypassing intermediaries through a stronger D2C presence could unlock higher profit margins on digital sales.

- Reduced Customer Insight: A less developed D2C channel can hinder Capcom's ability to gather granular customer data, which is vital for personalized marketing and product development.

Capcom's heavy dependence on a few key franchises, like Resident Evil and Monster Hunter, creates a significant vulnerability. If these major titles underperform or fail to resonate with players, it can severely impact the company's financial results. For example, the continued success of Monster Hunter World, which had sold over 20 million units by early 2024, underscores the immense financial leverage of a single franchise, and the risk associated with such concentration.

Preview the Actual Deliverable

Capcom SWOT Analysis

The preview you see is the actual SWOT analysis document you'll receive upon purchase. This ensures you know exactly what you're getting—a comprehensive and professional assessment of Capcom's market position.

Opportunities

Emerging markets present a significant growth avenue for Capcom, with regions like Asia, Latin America, and Africa showing increasing internet penetration and rising disposable incomes. The global gaming market in these areas is projected to see substantial growth, with mobile gaming in Southeast Asia alone expected to reach over $10 billion by 2025, according to Statista.

Capcom can capitalize on this by strategically deploying its well-established intellectual properties, such as Resident Evil and Monster Hunter, adapting content and distribution models to resonate with local tastes and affordability. This strategic push could unlock considerable new revenue streams and expand its global player base significantly.

The mobile gaming market is a significant growth area, projected to reach $272 billion by 2027, according to Statista. Capcom can leverage this by creating mobile versions of its established franchises, like Monster Hunter, to capture a wider audience and generate substantial revenue. This strategic move aligns with the increasing demand for high-quality gaming experiences on smartphones and tablets.

eSports continues its ascent as a major entertainment sector, with global revenue expected to hit $1.7 billion in 2024, as reported by Newzoo. Capcom has a prime opportunity to invest more heavily in its competitive gaming circuits, such as the Street Fighter League, to drive player engagement and brand loyalty. Expanding participation in and sponsorship of major eSports tournaments will further solidify Capcom's presence in this dynamic and lucrative market.

Capcom's extensive library of beloved characters and compelling narratives, such as Resident Evil and Monster Hunter, presents a significant opportunity for expansion into multimedia and transmedia ventures. This includes developing films, television series, animated content, and even theme park experiences, which can introduce these franchises to entirely new demographics.

Successful transmedia adaptations have a proven track record of boosting brand recognition and generating substantial revenue beyond core game sales. For instance, the Resident Evil film franchise has grossed over $1.2 billion globally, demonstrating the financial upside of extending IPs into diverse entertainment sectors.

By strategically leveraging its intellectual property (IP) across various platforms, Capcom can cultivate a more robust and interconnected brand ecosystem. This approach not only diversifies income but also deepens fan engagement, creating a more resilient business model.

Adoption of New Technologies (VR/AR, Cloud Gaming)

The gaming industry's rapid technological advancement, particularly in VR, AR, and cloud gaming, offers significant avenues for Capcom to explore. By developing immersive content for these platforms, Capcom can tap into new markets and cater to a growing audience seeking cutting-edge interactive experiences.

Capcom's strategic investment in VR and cloud gaming technologies can solidify its position as an innovator. For instance, the global cloud gaming market was valued at approximately USD 10.2 billion in 2023 and is projected to reach USD 109.5 billion by 2030, growing at a CAGR of 39.7% according to some market analyses. This growth trajectory highlights the potential for companies like Capcom to gain a substantial market share by offering high-quality games on these platforms.

- VR/AR Content Development: Creating exclusive titles or adapting existing popular franchises for VR and AR hardware can attract early adopters and establish a strong presence in these emerging sectors.

- Cloud Gaming Partnerships: Collaborating with cloud gaming service providers can expand Capcom's reach, allowing more players to access its games without requiring high-end hardware.

- Technological Leadership: Early adoption and innovation in these areas can differentiate Capcom from competitors and foster brand loyalty among tech-forward gamers.

Strategic Partnerships and Acquisitions

Capcom could significantly enhance its market position by forging strategic alliances with leading technology firms, media conglomerates, or even by acquiring promising smaller game development studios. These collaborations can unlock new technological capabilities, bring in fresh talent, and open doors to previously untapped markets. For example, a partnership with a cloud gaming provider could expand reach, while acquiring a studio with expertise in emerging genres could diversify Capcom's IP portfolio.

Such strategic moves are crucial for staying competitive in the rapidly evolving gaming landscape. In 2024, the global video game market is projected to reach over $200 billion, highlighting the immense potential for growth through strategic expansion.

- Accelerated Development: Partnerships can streamline game creation processes by sharing resources and expertise.

- Expanded Distribution: Collaborations can provide access to new platforms and player bases.

- IP Diversification: Acquisitions offer opportunities to integrate new intellectual properties and specialized development skills.

- Market Access: Entering new territories or demographics becomes more feasible through strategic alliances.

Capcom has a substantial opportunity to expand its reach into emerging markets, where increasing internet access and disposable income are driving gaming growth. Southeast Asia's mobile gaming market alone is anticipated to surpass $10 billion by 2025, according to Statista, presenting a prime area for Capcom to leverage its popular franchises.

Furthermore, the company can capitalize on the booming mobile gaming sector, projected to hit $272 billion by 2027. By adapting its established IPs like Monster Hunter for mobile platforms, Capcom can tap into a wider audience and generate significant new revenue streams.

The company is also well-positioned to benefit from the continued rise of eSports, with global revenues expected to reach $1.7 billion in 2024. Investing further in competitive circuits like the Street Fighter League can boost player engagement and brand loyalty, solidifying its presence in this lucrative market.

Capcom's rich portfolio of intellectual property, including Resident Evil and Monster Hunter, offers fertile ground for expansion into multimedia ventures like films and television. The Resident Evil film series' global gross exceeding $1.2 billion underscores the financial potential of extending these beloved brands beyond gaming.

The company can also lead in adopting new technologies like VR, AR, and cloud gaming, with the cloud gaming market alone projected for substantial growth from USD 10.2 billion in 2023 to USD 109.5 billion by 2030. Strategic partnerships and acquisitions further present avenues for accelerated development, expanded distribution, and IP diversification in the dynamic gaming industry.

Threats

Capcom operates in a highly competitive landscape, facing formidable rivals such as Sony, Microsoft, Nintendo, Electronic Arts, and Tencent. These major players command substantial financial resources and boast extensive game portfolios, allowing them to invest heavily in talent acquisition and marketing. This creates a challenging environment where Capcom must constantly innovate to maintain its market position and profitability.

Piracy remains a persistent challenge for Capcom, impacting potential sales, especially for its PC releases. While the company invests in digital rights management, the ease of unauthorized distribution, particularly through online channels, continues to be a concern.

The financial impact of game piracy is substantial industry-wide. For instance, in 2023, studies indicated that the global video game market lost billions of dollars due to piracy, a figure that directly affects revenue streams for developers like Capcom.

The video game industry moves at lightning speed, and Capcom must constantly invest in new technology and development to keep up. For instance, the transition to next-generation consoles like the PlayStation 5 and Xbox Series X/S, launched in late 2020, requires significant R&D to leverage their full capabilities. Failing to innovate quickly could mean their games feel outdated compared to competitors.

Economic Downturns Affecting Consumer Spending

Global economic slowdowns can directly curb discretionary spending, impacting sales of entertainment products like video games. For instance, a significant contraction in consumer confidence, as seen in periods of recession, could lead consumers to cut back on non-essential purchases, directly affecting Capcom's revenue streams from new game releases and in-game purchases.

The threat is amplified by rising inflation, which erodes disposable income. In 2024, many economies are grappling with persistent inflation, meaning consumers have less money available for leisure activities. This could translate to fewer premium game purchases or a shift towards less expensive entertainment options.

Capcom must remain vigilant about macroeconomic indicators. A notable example of this threat's impact was observed during the 2008 financial crisis, which saw a general slowdown in consumer spending across various sectors, including entertainment. While the gaming industry has shown resilience, prolonged economic hardship remains a significant external risk.

- Decreased Discretionary Spending: Economic downturns reduce the amount of money consumers have available for non-essential items like video games.

- Lower Engagement with Premium Content: Consumers may opt for free-to-play games or delay purchases of higher-priced titles and downloadable content.

- Impact on Sales Forecasts: Unfavorable economic conditions can necessitate adjustments to sales projections and revenue targets.

Reputational Damage from Game Quality or Controversies

Reputational damage remains a significant threat for Capcom, particularly concerning game quality and content controversies. Negative public perception, fueled by issues like game bugs, controversial themes, or poor handling of player feedback, can directly impact sales and brand loyalty. In 2024, the gaming industry continues to see swift dissemination of negative news via social media, making player trust and investor confidence fragile. For instance, a poorly received launch, like the initial state of some major game releases across the industry in late 2023 and early 2024, often leads to immediate stock price drops and sustained community backlash.

Maintaining exceptionally high quality standards across all titles and fostering transparent communication with the player base are therefore critical defensive strategies for Capcom. This proactive approach helps mitigate the rapid spread of negative sentiment that can erode brand equity. For example, companies that have faced backlash for unfinished games in 2023 and 2024 have seen significant drops in player engagement and revenue in subsequent quarters.

- Brand Erosion: Negative perceptions from buggy releases or controversial content can quickly tarnish Capcom's image, impacting future sales.

- Social Media Amplification: In 2024, social media platforms accelerate the spread of negative news, potentially damaging player trust and investor confidence within hours.

- Financial Impact: Reputational damage can lead to decreased sales, reduced player engagement, and a negative impact on Capcom's stock performance, as seen with industry peers facing similar challenges.

- Mitigation Strategy: Consistent high-quality game development and open communication channels are essential to counter these threats and maintain a positive brand image.

Capcom faces intense competition from industry giants like Sony, Microsoft, Nintendo, Electronic Arts, and Tencent, who possess vast financial resources and extensive game libraries. Piracy continues to be a significant threat, particularly for PC releases, with industry-wide losses estimated in the billions of dollars annually, impacting Capcom's potential revenue streams. The rapid pace of technological advancement necessitates continuous investment in R&D to ensure games remain competitive, as seen with the ongoing adoption of next-generation console capabilities. Furthermore, global economic slowdowns and persistent inflation in 2024 reduce consumer discretionary spending, potentially affecting sales of premium titles and in-game purchases.

| Threat Category | Description | Impact Example (2023-2024) | Mitigation Focus |

| Competition | Rivals with greater financial resources and established portfolios. | Market share pressure, need for continuous innovation. | Product differentiation, strong IP utilization. |

| Piracy | Unauthorized distribution of games, especially on PC. | Billions lost industry-wide annually, affecting revenue. | Digital Rights Management (DRM), community engagement. |

| Technological Obsolescence | Need for rapid R&D to keep pace with new hardware. | Risk of games feeling outdated compared to competitors. | Investment in next-gen development, engine upgrades. |

| Economic Downturns | Reduced consumer spending on non-essential entertainment. | Lower sales of premium games and microtransactions. | Diversified revenue streams, flexible pricing models. |

SWOT Analysis Data Sources

This Capcom SWOT analysis is built upon a robust foundation of data, drawing from official financial statements, comprehensive market research reports, and expert industry analysis to provide a well-rounded strategic perspective.