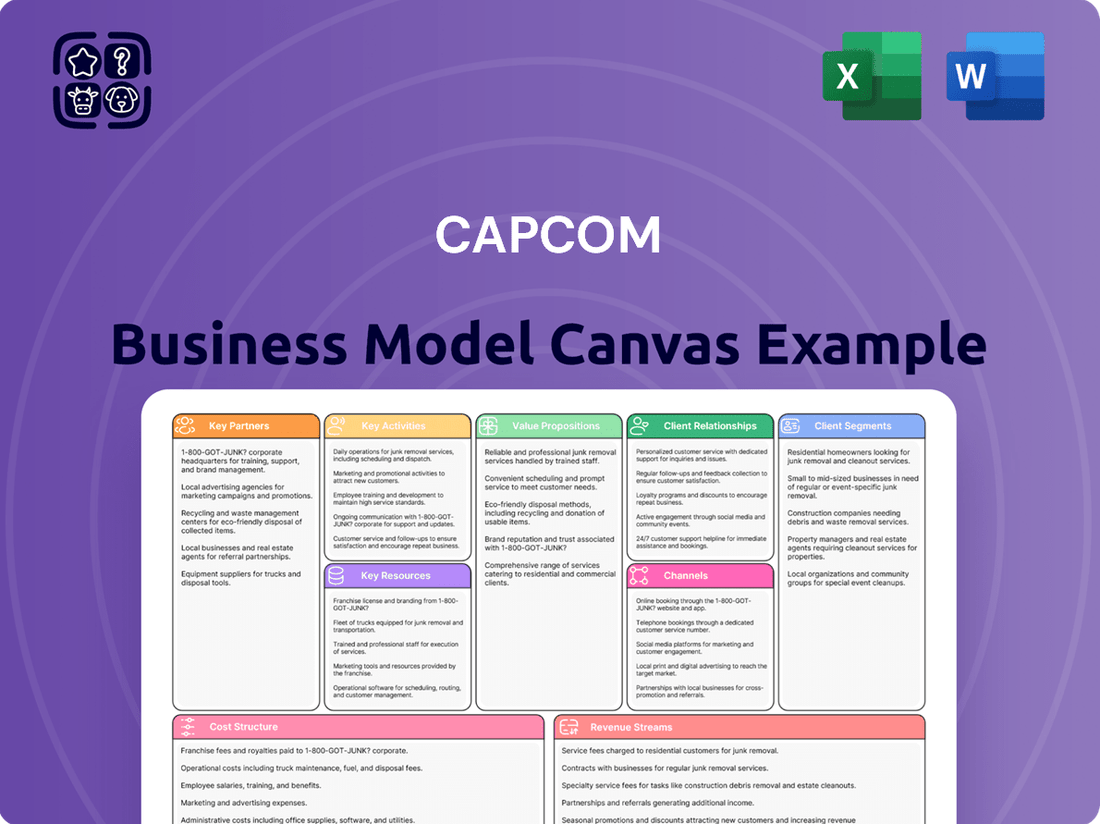

Capcom Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capcom Bundle

Discover the core components that fuel Capcom's dominance in the gaming industry with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Unlock the full strategic blueprint behind Capcom's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Capcom's relationship with platform holders like Sony, Microsoft, and Nintendo is fundamental to its reach. By ensuring games like the highly anticipated Resident Evil 9 and the latest Monster Hunter installment are available on PlayStation, Xbox, and Switch, Capcom accesses millions of gamers. This collaboration is not just about distribution; it involves deep technical integration and joint marketing efforts, boosting game visibility and sales.

Capcom actively collaborates with esports organizations and sponsors to amplify its competitive gaming franchises, notably Street Fighter. These partnerships, including entities like the Esports World Cup Foundation and Suzuki, are crucial for expanding the reach of titles like Street Fighter 6.

Through these alliances, Capcom orchestrates major events such as the Capcom Pro Tour and the Street Fighter League. These tournaments not only offer substantial prize pools, with the Capcom Pro Tour 2023 boasting over $2 million in prize money, but also significantly boost the global profile of Capcom's intellectual property via high-stakes competitive play.

Capcom actively engages merchandising and licensing partners to broaden the reach of its iconic intellectual properties. These collaborations extend beyond video games into diverse media such as film and television, as well as a vast array of consumer products. For example, the Monster Hunter franchise has seen numerous collaborations, including partnerships with apparel brands and food companies, significantly enhancing brand visibility and revenue streams.

Development Studios and Technology Providers

Capcom actively collaborates with external development studios and technology providers to bolster its game creation expertise. This strategic approach includes acquiring studios, such as Minimum Studios Co., Ltd., to integrate specialized talent and technologies. For instance, in fiscal year 2024, Capcom continued to leverage external partnerships to augment its development pipeline and explore innovative tools.

The company is also investigating the integration of cutting-edge technologies like generative AI for asset creation, aiming to streamline production and unlock new creative possibilities. This forward-looking strategy ensures Capcom remains competitive by tapping into specialized skills and advancements in the gaming industry. The fiscal year ending March 31, 2024, saw Capcom invest significantly in research and development, with a portion of these investments likely directed towards such technological explorations and studio integrations.

Key partnerships in this area enable Capcom to:

- Access specialized development talent and intellectual property.

- Accelerate the adoption of new technologies like AI in game production.

- Expand development capacity and manage project risks.

- Enhance the quality and innovation of its game portfolio.

Retail and Digital Distribution Platforms

Capcom's success hinges on robust partnerships with key retail and digital distribution platforms. These collaborations are fundamental to making their vast game library accessible to a global audience.

Digital storefronts like Steam, PlayStation Store, and Xbox Store are paramount, driving the majority of Capcom's revenue. In fiscal year 2024, digital sales continued their dominance, representing over 90% of the company's total sales, underscoring the critical nature of these platform relationships.

These partnerships facilitate:

- Global Reach: Ensuring games are available to consumers across diverse geographic markets.

- Digital Sales Dominance: Capitalizing on the shift towards digital purchases, which are the primary revenue driver.

- Marketing Synergy: Leveraging platform visibility and promotional opportunities to boost game awareness and sales.

- Efficient Distribution: Streamlining the delivery of games to players worldwide, minimizing logistical complexities.

Capcom's strategic alliances with platform holders, esports organizations, and merchandising partners are vital for its business model. These collaborations ensure broad market access, amplified brand presence, and diversified revenue streams.

The company's reliance on digital distribution platforms like Steam, PlayStation Store, and Xbox Store is paramount, with digital sales accounting for over 90% of revenue in fiscal year 2024. This highlights the critical nature of these partnerships for global reach and sales efficiency.

| Partnership Type | Key Partners | Impact on Capcom | Fiscal Year 2024 Data Point |

|---|---|---|---|

| Platform Holders | Sony, Microsoft, Nintendo | Global game distribution and market access | Digital sales >90% of total revenue |

| Esports & Sponsorships | Esports World Cup Foundation, Suzuki | Brand visibility for competitive titles (e.g., Street Fighter 6) | Capcom Pro Tour 2023 prize pool >$2 million |

| Merchandising & Licensing | Apparel brands, food companies | IP extension into diverse media and consumer products | Monster Hunter franchise collaborations |

| Development & Technology | Minimum Studios Co., Ltd. | Augmented development capacity and AI integration exploration | Continued investment in R&D for innovative tools |

What is included in the product

A structured framework detailing Capcom's approach to creating, delivering, and capturing value, focusing on its core gaming franchises and diverse revenue streams.

The Capcom Business Model Canvas offers a structured approach to identify and address strategic gaps, relieving the pain of disorganized planning.

It simplifies complex business strategies into a clear, actionable framework, easing the burden of strategic execution.

Activities

Capcom's primary activities revolve around the meticulous planning and development of engaging video game experiences. This encompasses the creation of entirely new intellectual properties and the continued evolution of beloved franchises such as Resident Evil and Monster Hunter, ensuring a broad appeal.

The company strategically invests in developing sequels and also revitalizes its classic library through remakes and remasters, a strategy that demonstrably resonates with players. For instance, the Resident Evil 4 remake, released in 2023, achieved over 5 million units sold by June 2023, showcasing the enduring market for their revitalized classics.

Capcom actively markets and distributes its interactive entertainment software across the globe, employing diverse channels to connect with a broad player base. This includes robust promotional efforts, a significant focus on digital sales platforms, and maintaining a strong operational presence in crucial international markets.

In fiscal year 2024, Capcom reported net sales of ¥173.7 billion, with a substantial portion driven by its global sales network and effective marketing strategies for titles like Resident Evil 4 Remake and Street Fighter 6.

Capcom's IP management is centered on a 'single content multiple usage' approach, ensuring its beloved franchises like Resident Evil and Monster Hunter reach a wider audience. This strategy is key to maximizing the value derived from each intellectual property.

By extending these IPs into various media, including film adaptations, animated series, and live-action productions, Capcom taps into new revenue streams and reinforces brand recognition. For instance, the Resident Evil franchise has seen continued success in film and television, further solidifying its global appeal.

Furthermore, Capcom actively engages in esports and character merchandising, transforming its game worlds into interactive entertainment and tangible products. This multi-faceted approach not only diversifies income but also deepens fan engagement, a crucial element for sustained growth in the competitive gaming landscape.

Esports Event Organization and Participation

Capcom is deeply invested in the esports ecosystem, actively organizing and participating in premier tournaments. The Capcom Pro Tour for Street Fighter is a prime example, drawing global talent and millions of viewers. In 2023, the Capcom Cup X, the culmination of the Pro Tour, offered a record-breaking $2 million prize pool, showcasing the significant financial commitment and scale of these events.

These esports initiatives serve a dual purpose: they are powerful promotional tools for Capcom's iconic fighting game franchises, like Street Fighter and Resident Evil. By fostering a vibrant competitive scene, Capcom cultivates deep engagement with its player base, ensuring continued interest and brand loyalty. This direct interaction with the competitive gaming community is crucial for maintaining the relevance and appeal of their IPs in a dynamic market.

- Capcom Pro Tour: A global circuit for Street Fighter, culminating in the Capcom Cup.

- Street Fighter League: Team-based competitive events that build narrative and community.

- Brand Visibility: Esports tournaments significantly increase exposure for Capcom's fighting game titles.

- Community Engagement: Direct interaction with the competitive gaming audience fosters loyalty and feedback.

Research and Development Investment

Capcom's commitment to Research and Development is a cornerstone of its business model, ensuring it stays at the forefront of the gaming industry. This involves significant investment in upgrading its development infrastructure and attracting top-tier creative and technical talent. For instance, in fiscal year 2024, Capcom continued to invest heavily in R&D to foster innovation across its diverse portfolio.

A key focus area for R&D is the exploration and integration of cutting-edge technologies. Capcom is actively investigating the potential of generative AI to streamline game development processes, enhance asset creation, and ultimately improve the quality and efficiency of its output. This forward-thinking approach is crucial for maintaining a competitive edge.

- Infrastructure Enhancement: Continuous upgrades to development studios and tools.

- Talent Acquisition: Recruiting skilled developers, artists, and designers.

- Technology Exploration: Investigating and implementing advanced technologies like AI.

- Quality Improvement: Driving innovation to elevate the player experience.

Capcom's key activities are centered on the creation and distribution of high-quality video games, leveraging its strong intellectual properties. This includes developing new titles and revitalizing existing franchises, as demonstrated by the success of remakes like Resident Evil 4.

The company also actively manages its IPs through a multi-platform strategy, extending them into other media and merchandising to maximize their reach and value. Furthermore, Capcom invests in esports and community engagement to promote its games and foster player loyalty.

Significant investment in research and development, including the exploration of new technologies like AI, ensures Capcom remains innovative and competitive in the evolving gaming landscape.

| Activity | Description | Fiscal Year 2024 Impact |

|---|---|---|

| Game Development & IP Management | Creating new games and expanding existing franchises across multiple media. | Net sales of ¥173.7 billion driven by titles like Resident Evil 4 Remake and Street Fighter 6. |

| Global Sales & Marketing | Distributing games worldwide through digital and physical channels, supported by robust promotions. | Contributed significantly to overall revenue by reaching a broad international player base. |

| Esports & Merchandising | Organizing tournaments and developing merchandise to engage fans and build brand loyalty. | Capcom Pro Tour for Street Fighter continues to be a major draw, with significant prize pools and viewership. |

| Research & Development | Investing in new technologies and talent to enhance game quality and development efficiency. | Continued investment in R&D to foster innovation, including exploring generative AI for development processes. |

Delivered as Displayed

Business Model Canvas

The Capcom Business Model Canvas preview you are viewing is an authentic representation of the final deliverable. This means that upon completing your purchase, you will receive the exact same comprehensive document, ready for immediate use. You can be assured that what you see is precisely what you will get, ensuring a transparent and satisfying transaction.

Resources

Capcom's intellectual properties (IPs) are the bedrock of its business model. Its most valuable assets are its globally recognized video game franchises, including titans like Resident Evil, Monster Hunter, Street Fighter, and Mega Man.

These powerful IPs are the primary drivers of Capcom's revenue streams. They fuel not only game sales but also significant income from merchandising, licensing, and even film and TV adaptations, demonstrating their broad commercial appeal.

For fiscal year 2024, Capcom reported record profits, with its Digital Contents segment, heavily reliant on these core IPs, showing exceptional performance. For instance, Monster Hunter World: Iceborne and Resident Evil Village continued to sell strongly, contributing to the company's robust financial results.

Capcom's success hinges on its game development talent, a diverse team of skilled designers, programmers, artists, and sound engineers. This expertise is the bedrock for crafting the high-quality, engaging interactive entertainment that defines their franchises.

To maintain its competitive edge, Capcom consistently invests in human resources and talent acquisition. This focus ensures a robust development pipeline, capable of delivering titles like the critically acclaimed Resident Evil series and the action-packed Monster Hunter franchise, which consistently perform well in the market.

Capcom's RE ENGINE is a cornerstone of its operations, powering titles like Resident Evil Village and Monster Hunter Rise. This advanced proprietary technology allows for efficient development across various platforms, ensuring high-quality visuals and immersive gameplay.

The continuous refinement of the RE ENGINE is crucial for adapting to evolving hardware and player expectations. In fiscal year 2024, Capcom reported strong sales for titles leveraging this engine, demonstrating its direct impact on revenue and market competitiveness.

Global Distribution Network

Capcom leverages a robust global distribution network, crucial for reaching its diverse player base. This includes major digital storefronts like Steam, PlayStation Store, and Xbox Store, which are vital for digital game sales. In fiscal year 2024, Capcom reported that digital sales accounted for a significant portion of its revenue, underscoring the importance of these online channels.

Beyond digital, Capcom also maintains a strong presence in physical retail markets worldwide. This dual approach ensures broad accessibility, catering to players who prefer physical copies of games. The company's ability to effectively manage both digital and physical distribution channels is a cornerstone of its business model, enabling widespread availability and driving sales across different consumer preferences.

- Digital Storefronts: Access to platforms like Steam, PlayStation Store, and Xbox Store is paramount for global digital game delivery and sales.

- Physical Retail: Maintaining relationships with physical retailers ensures games reach consumers who prefer tangible copies.

- Global Reach: This network facilitates widespread availability, contributing to significant revenue streams from diverse markets.

- Fiscal Year 2024 Performance: Digital sales represented a substantial percentage of Capcom's overall revenue, highlighting the network's impact.

Financial Capital

Capcom's robust financial capital is a cornerstone of its business model, allowing for substantial investments in its core game development. This strong financial health, evidenced by significant cash reserves, empowers the company to undertake ambitious, large-scale projects that are crucial for its success in the competitive gaming industry.

The company's consistent profitability and healthy cash position are not just indicators of past success but also vital enablers of future growth strategies. This financial stability provides the necessary foundation for strategic initiatives, including potential acquisitions and extensive marketing campaigns, which are key to maintaining and expanding its market presence.

- Strong Profitability: Capcom reported net sales of ¥173.4 billion (approximately $1.16 billion USD) for the fiscal year ending March 31, 2024, demonstrating sustained revenue generation.

- Healthy Cash Reserves: The company maintained a solid cash and cash equivalents balance, providing significant liquidity to fund new game development and operational expenses.

- Investment Capacity: This financial strength allows Capcom to allocate considerable resources to research and development, ensuring a pipeline of high-quality titles and technological innovation.

Capcom's key resources extend beyond its intellectual property to encompass its skilled workforce and proprietary technology. The company's game development talent, comprising designers, programmers, and artists, is crucial for creating its acclaimed franchises. Furthermore, the RE ENGINE, a proprietary game development engine, allows for efficient, high-quality production across platforms, as demonstrated by its use in titles like Resident Evil Village and Monster Hunter Rise, which contributed to Capcom's strong fiscal year 2024 performance.

Value Propositions

Capcom consistently delivers high-quality, immersive gaming experiences that captivate players. Their focus on strong narratives and compelling gameplay is a cornerstone of their success, evident in franchises like Resident Evil and Monster Hunter. This dedication to quality translates into significant commercial success, with titles like Resident Evil Village achieving over 9 million units shipped as of February 2024.

Capcom offers access to a deep catalog of beloved game franchises, fostering enduring fan loyalty that drives consistent demand for new releases, remasters, and associated merchandise. This allows players to maintain a connection with familiar characters and universes across generations.

For instance, the Resident Evil franchise, a cornerstone of Capcom's intellectual property, saw Resident Evil 4 Remake achieve over 5 million units shipped globally by August 2023, demonstrating the enduring appeal of its iconic titles and the strong market for its established IPs.

Capcom ensures its games reach a vast player base by launching titles across major gaming consoles like PlayStation and Xbox, PC platforms such as Steam, and increasingly on mobile devices. This broad availability strategy is a cornerstone of their business model, maximizing potential revenue streams and player engagement.

In fiscal year 2024, Capcom reported strong digital sales, with over 80% of their total net sales coming from digital downloads. This highlights the success of their multi-platform approach, as digital distribution is key to reaching players on various devices efficiently.

Engaging Esports Ecosystems

Capcom cultivates a dynamic esports ecosystem, notably for its flagship title, Street Fighter. This commitment translates into structured tournaments with substantial prize pools, creating pathways for professional engagement and nurturing a dedicated fan base.

For competitive players and fans, Capcom provides a vibrant and well-supported esports ecosystem, particularly for titles like Street Fighter. This includes organized tournaments, significant prize pools, and opportunities for professional play, fostering a strong community.

The Street Fighter League: Pro-JP 2023 season, for instance, saw strong viewership numbers, with peak concurrent viewers reaching over 70,000 on Twitch, underscoring the engagement within its competitive circuits. This robust infrastructure not only entertains but also drives player retention and brand loyalty.

- Organized Tournaments: Regular, high-stakes competitions like the Capcom Cup and regional leagues.

- Significant Prize Pools: Millions of dollars awarded annually across various Street Fighter tournaments, incentivizing top-tier play.

- Community Building: Fostering interaction and shared passion among players and viewers through events and online platforms.

Expanded Entertainment Beyond Games

Capcom significantly broadens its entertainment reach by leveraging its intellectual properties (IPs) far beyond video games. This includes a robust merchandising arm, with popular franchises like Resident Evil and Monster Hunter generating substantial revenue through toys, apparel, and collectibles. For instance, Capcom reported robust sales across all segments in their fiscal year ending March 31, 2024, with their Consumer segment, which includes game sales and related IP expansion, showing strong performance.

Furthermore, Capcom actively pursues film and television adaptations to deepen fan engagement and capture new demographics. These ventures allow consumers to interact with beloved characters and worlds in new formats, fostering stronger brand loyalty. The success of these cross-media strategies is evident in the continued popularity and sales of their core game titles, demonstrating a synergistic relationship between gaming and other entertainment forms.

- Merchandising: Capcom's extensive product lines, from action figures to apparel, capitalize on the visual appeal and popularity of its game characters.

- Film & TV Adaptations: Strategic partnerships for movies and series extend brand visibility and provide new revenue streams, as seen with ongoing discussions and past successes of franchise adaptations.

- Brand Loyalty: Offering diverse engagement points reinforces fan connection, driving repeat purchases of games and merchandise.

- New Audience Reach: Media adaptations introduce Capcom's IPs to audiences who may not be traditional gamers, expanding the overall consumer base.

Capcom's value proposition centers on delivering high-quality, engaging gaming experiences that leverage deep, established franchises. This focus on quality and IP strength fosters enduring fan loyalty, driving consistent demand for new content and merchandise. Their multi-platform distribution strategy ensures broad accessibility, maximizing player engagement and revenue.

Furthermore, Capcom cultivates a vibrant esports ecosystem, particularly for titles like Street Fighter, which builds community and encourages continued player investment. The company also effectively extends its brand through merchandising and cross-media adaptations, reaching new audiences and reinforcing overall brand loyalty.

| Value Proposition Area | Key Offering | Supporting Data/Examples |

|---|---|---|

| High-Quality Gaming Experiences | Immersive gameplay and strong narratives | Resident Evil Village shipped over 9 million units (as of Feb 2024) |

| Established IP Leverage | Deep catalog of beloved franchises | Resident Evil 4 Remake shipped over 5 million units (by Aug 2023) |

| Broad Accessibility | Multi-platform releases (consoles, PC, mobile) | Over 80% of net sales from digital downloads in FY2024 |

| Esports Ecosystem | Organized tournaments and community building | Street Fighter League: Pro-JP 2023 peaked at over 70,000 Twitch viewers |

| Brand Extension | Merchandising and media adaptations | Strong performance across all segments in FY ending March 31, 2024 |

Customer Relationships

Capcom actively cultivates player loyalty by fostering community engagement through surveys, social media, and direct feedback channels. This approach helps them gauge player sentiment and tailor future game development. For instance, the strong reception to Resident Evil 4 Remake in 2023, which sold over 5 million units by December 2023, demonstrates the impact of listening to player desires.

Capcom fosters deep fan engagement for its competitive titles by hosting live tournaments and streaming events, directly connecting with passionate esports enthusiasts. This strategy is crucial for nurturing and expanding its competitive gaming intellectual properties.

In 2024, Capcom continued to invest heavily in its esports ecosystem, with events like the Capcom Cup X for Street Fighter 6 drawing significant viewership. For instance, the Street Fighter 6 Capcom Cup X in February 2024 boasted a peak viewership of over 100,000 concurrent viewers across various platforms, demonstrating the strong community engagement.

Capcom invests heavily in customer support, offering bug fixes, performance enhancements, and new content through regular game updates. This dedication to post-launch engagement is crucial for maintaining player satisfaction and fostering long-term community loyalty. For instance, in fiscal year 2024, Capcom reported strong sales for titles like Resident Evil 4 Remake and Street Fighter 6, both of which received substantial post-launch support, contributing to their sustained popularity and revenue streams.

Brand Building through Multi-Usage IP Strategy

Capcom cultivates strong customer relationships by leveraging its intellectual property (IP) across a multitude of platforms. This strategy ensures fans can engage with beloved franchises like Monster Hunter and Resident Evil through diverse avenues, fostering deeper brand loyalty.

This multi-usage approach, often termed 'single content multiple usage,' allows customers to interact with their favorite worlds beyond just video games. Think movies, anime, merchandise, and even live exhibitions, all contributing to a richer brand experience.

- Brand Extension: Popular IPs are adapted into films, TV series, merchandise, and theme park attractions, creating multiple touchpoints for consumers.

- Customer Engagement: This broad accessibility deepens fan connections, allowing for sustained interaction and community building around franchises.

- Revenue Diversification: Licensing and merchandise sales provide additional revenue streams, complementing core game sales and strengthening the overall business model.

- IP Value Enhancement: Successful cross-media adaptations amplify the reach and cultural impact of IPs, increasing their long-term value.

Direct-to-Consumer Digital Sales and Promotions

Capcom champions direct-to-consumer engagement through its robust digital sales and promotion strategies. By utilizing platforms like Steam, PlayStation Store, and Xbox Games Store, Capcom bypasses traditional retail to connect directly with its player base, offering timely sales and managing its extensive game catalog.

This digital-first approach facilitates efficient content delivery and enables highly personalized marketing campaigns. Capcom analyzes player purchase trends and in-game behavior to tailor promotions, thereby fostering stronger customer loyalty and driving sales for both new releases and evergreen titles.

- Digital Platform Dominance: Capcom's digital sales strategy is central to its customer relationships, with digital revenue accounting for a significant portion of its overall sales. For the fiscal year ending March 2024, digital sales contributed substantially to Capcom's record-breaking operating income, underscoring the effectiveness of this direct channel.

- Targeted Promotions and Sales: The company frequently runs targeted digital sales events, often tied to specific game anniversaries or seasonal promotions, which demonstrably boost unit sales and engagement. For instance, major sales events in 2024 saw titles like Resident Evil Village and Monster Hunter Rise achieve significant sales uplifts.

- Catalog Management and Longevity: Direct digital sales allow Capcom to effectively manage and promote its back catalog, ensuring older titles remain accessible and continue to generate revenue. This strategy is crucial for maximizing the lifetime value of its intellectual properties.

- Data-Driven Personalization: By leveraging data analytics from digital purchases and gameplay, Capcom can personalize marketing messages and offers, leading to higher conversion rates and improved customer satisfaction. This data-informed approach is key to understanding and catering to diverse player preferences.

Capcom's customer relationships are built on active community engagement and direct feedback, as seen with the success of Resident Evil 4 Remake, which sold over 5 million units by December 2023. They also foster loyalty through extensive post-launch support, including updates and bug fixes, which contributed to strong fiscal year 2024 sales for titles like Street Fighter 6.

| Customer Relationship Strategy | Key Actions | Impact/Data Point |

|---|---|---|

| Community Engagement & Feedback | Surveys, social media interaction, direct feedback channels | Strong reception for Resident Evil 4 Remake (5M+ units by Dec 2023) |

| Esports & Competitive Gaming | Live tournaments, streaming events (e.g., Capcom Cup X) | Street Fighter 6 Capcom Cup X peak viewership over 100,000 in Feb 2024 |

| Post-Launch Support | Regular game updates, bug fixes, performance enhancements | Sustained popularity and revenue for Resident Evil 4 Remake & Street Fighter 6 in FY2024 |

| IP Cross-Media Extension | Films, TV series, merchandise, theme park attractions | Deepens fan connections and diversifies revenue streams |

| Direct-to-Consumer (Digital) | Digital sales platforms, personalized marketing | Significant contribution of digital sales to record operating income in FY2024 |

Channels

Digital distribution platforms like Steam, PlayStation Store, and Xbox Store are absolutely crucial for Capcom. These storefronts are where the vast majority of players purchase their games, offering a direct line to a global audience. This digital-first approach is key to their business model.

In fact, Capcom has reported that over 90% of their sales are now digital. This significant figure underscores how vital these online channels are for reaching consumers across different regions and for making their titles readily accessible. It streamlines the sales process and broadens their market penetration considerably.

Physical retailers, like GameStop and Best Buy, continue to be a vital distribution channel for Capcom's packaged game software. These brick-and-mortar stores cater to a significant segment of consumers who still prefer owning physical copies of their games, contributing to brand visibility and accessibility.

In 2024, physical game sales, while declining globally, still represented a substantial portion of the market, especially for major releases. For instance, NPD Group data from early 2024 indicated that physical game sales still held a considerable share, particularly in certain demographics and regions, underscoring their continued relevance for titles like Capcom's Street Fighter 6 or Resident Evil 4 Remake.

Capcom's official websites and social media channels act as vital direct lines to its global fanbase. These platforms are instrumental in broadcasting new game announcements, providing crucial updates on existing titles, and fostering a sense of community through interactive engagement. They are the cornerstone of Capcom's marketing strategy, building and reinforcing brand loyalty.

In 2024, Capcom continued to leverage these digital touchpoints effectively. The company reported significant engagement across platforms like X (formerly Twitter) and YouTube, with specific game launches generating millions of views and interactions. For instance, the marketing push for titles like Dragon's Dogma 2 saw substantial traffic directed to the official Capcom website, demonstrating the direct impact of social media on driving interest and traffic.

Esports Broadcasts and Events

Esports broadcasts and events serve as crucial channels for Capcom, directly engaging millions of fans worldwide. Tournaments like the Capcom Pro Tour and the recent Esports World Cup are prime examples, showcasing titles such as Street Fighter 6 to a massive, passionate audience. These events not only generate excitement but also drive game sales and brand loyalty.

The reach of these events is substantial. For instance, the 2023 Capcom Pro Tour saw over 100 million total views across its various stages. This massive viewership translates into significant brand exposure and provides a platform for in-game promotions and merchandise sales.

- Capcom Pro Tour Reach: Garnered over 100 million total views in 2023, demonstrating extensive global engagement.

- Esports World Cup Impact: Featured prominent Capcom titles, attracting a large, dedicated esports viewership.

- Platform Diversity: Broadcasts are live across Twitch, YouTube, and other streaming services, maximizing accessibility.

- Revenue Generation: These events indirectly boost game sales, in-game purchases, and sponsorship opportunities.

Licensing and Merchandising Partnerships

Capcom leverages licensing and merchandising partnerships to extend its beloved intellectual properties, like Monster Hunter and Resident Evil, into a vast array of consumer products and entertainment experiences. These collaborations are crucial for brand expansion, allowing Capcom's characters and worlds to connect with audiences through items such as action figures, apparel, and even theme park attractions. This strategy significantly broadens the company's reach beyond its core gaming business.

In 2023, Capcom reported robust performance in its Consumer Products segment, which includes licensing and merchandising, contributing to the company's overall strong financial results. For instance, the company's fiscal year ending March 2024 saw significant revenue growth, partly driven by the successful cross-media promotion of its major game titles, which in turn fuels demand for licensed merchandise.

- Brand Extension: Licensing agreements allow Capcom's IPs to permeate various consumer touchpoints, from toys and collectibles to animated series and live-action films, thereby increasing brand visibility and engagement.

- Revenue Diversification: Merchandising and licensing provide a significant revenue stream independent of direct game sales, offering a more stable and diversified financial model.

- Market Penetration: These partnerships enable Capcom to tap into diverse markets and demographics that may not be reached through gaming alone, reinforcing brand loyalty and attracting new fans.

- IP Reinforcement: Successful merchandise and media tie-ins can reinforce the value and appeal of Capcom's core game franchises, creating a positive feedback loop for both gaming and licensing businesses.

Capcom's distribution strategy is multi-faceted, encompassing digital storefronts, physical retail, direct online engagement, esports, and extensive licensing. This comprehensive approach ensures broad market reach and caters to diverse consumer preferences.

Digital platforms remain paramount, with over 90% of Capcom's sales originating here, highlighting the shift towards online purchases. Physical retail still holds relevance, particularly for dedicated collectors. Direct engagement through social media and official websites builds community and drives interest, while esports events amplify brand visibility and passion, leading to significant viewership and indirect sales. Licensing and merchandising further extend brand reach and revenue streams, reinforcing intellectual property value.

| Channel Type | Key Platforms/Examples | 2023/2024 Relevance | Key Metrics/Impact |

|---|---|---|---|

| Digital Distribution | Steam, PlayStation Store, Xbox Store | Over 90% of sales | Global reach, accessibility, primary revenue driver |

| Physical Retail | GameStop, Best Buy | Still significant for certain demographics/releases | Brand visibility, collector appeal |

| Direct Engagement | Capcom Official Website, X (Twitter), YouTube | Crucial for announcements, updates, community building | High engagement on social media for game launches (e.g., Dragon's Dogma 2) |

| Esports & Events | Capcom Pro Tour, Esports World Cup | Massive global audience engagement | Over 100 million total views for Capcom Pro Tour (2023) |

| Licensing & Merchandising | Apparel, collectibles, theme parks | Significant contributor to overall financial results | Drives brand extension and revenue diversification |

Customer Segments

Capcom's core gamers and enthusiasts are the bedrock of their success, driving demand for flagship franchises like Resident Evil and Monster Hunter. These dedicated players often pre-order new releases and invest heavily in downloadable content and merchandise. For instance, Resident Evil Village, released in 2021, quickly surpassed 10 million units sold by early 2024, demonstrating the enduring appeal and purchasing power of this segment.

Casual gamers represent a significant portion of Capcom's audience, often drawn to titles that are easy to pick up and play, or those tied to highly recognizable franchises. These individuals might not dedicate hours daily but are enticed by strong brand recognition, as seen with the enduring popularity of series like Monster Hunter and Resident Evil. For example, Monster Hunter Rise, released in 2021 and available on multiple platforms, continued to attract a broad player base, demonstrating the appeal of established IPs to this segment.

Esports fans and competitors represent a passionate and engaged customer segment for Capcom, particularly around its flagship fighting game, Street Fighter. This group includes professional players, aspiring talent, and millions of viewers who tune into major tournaments and online leagues. For instance, the Capcom Cup X in 2024 boasted a significant prize pool, drawing immense viewership and highlighting the economic activity within this segment.

Collectors and Merchandise Enthusiasts

Collectors and merchandise enthusiasts represent a dedicated customer base for Capcom, actively seeking out physical game editions, apparel, collectible figures, and other memorabilia. This segment is particularly drawn to the artistic design and nostalgic value embedded within Capcom's iconic franchises like Resident Evil and Monster Hunter. For instance, limited edition physical releases often sell out quickly, demonstrating strong demand. In 2024, Capcom continued to leverage this by offering premium collector's editions for new game launches, often including exclusive art books and detailed figurines.

This segment's engagement goes beyond simple game purchases; they invest in the brand's legacy and aesthetic. Their purchasing decisions are often driven by a desire to own tangible pieces of their favorite game worlds. This loyalty translates into consistent revenue streams from merchandise sales, which complement core game sales. Capcom's strategy often involves releasing new waves of merchandise tied to major game anniversaries or new title releases, capitalizing on this sustained interest.

- Dedicated Fanbase: Consumers who actively purchase physical copies, special editions, and branded merchandise.

- Brand Loyalty: High value placed on the artistic and collectible aspects of Capcom's intellectual properties.

- Revenue Diversification: Merchandise and collectibles contribute significantly to overall sales, alongside game releases.

Global Market (Diverse Geographic Regions)

Capcom's customer base is truly worldwide, with a substantial chunk of its revenue generated outside of Japan. This global reach means they're catering to diverse gaming communities across North America, Europe, and various Asian countries. For instance, in fiscal year 2024, Capcom reported that its overseas markets accounted for a significant majority of its net sales, demonstrating the critical importance of these regions to its overall success.

To effectively serve these varied markets, Capcom invests in localized content and tailored marketing campaigns. This approach ensures that games resonate with local cultures and player preferences, a strategy that has proven successful in driving engagement and sales in regions like India and Brazil, which represent growing opportunities.

- Global Reach: Capcom's sales are heavily influenced by international markets, spanning North America, Europe, and Asia.

- Localization Strategy: The company adapts its games and marketing for diverse cultural preferences in different regions.

- Emerging Markets: Significant growth potential is recognized in developing economies such as India and Brazil.

- Fiscal Year 2024 Performance: Overseas markets were the primary drivers of Capcom's net sales, underscoring their global appeal.

Capcom's customer segments are diverse, ranging from deeply engaged core gamers who drive sales of flagship titles and premium content to a broader base of casual players attracted by strong brand recognition. The company also cultivates a passionate community around esports, particularly for its fighting game franchises like Street Fighter, evidenced by events like the Capcom Cup X in 2024. Furthermore, a significant segment comprises collectors and merchandise enthusiasts who value the artistic and nostalgic aspects of Capcom's intellectual properties, contributing to revenue through physical editions and branded goods.

Geographically, Capcom's customer base is global, with a substantial portion of its sales originating from markets outside Japan, including North America, Europe, and Asia. This worldwide appeal necessitates a localization strategy to cater to diverse cultural preferences and player expectations. Emerging markets like India and Brazil are also recognized as key growth areas for future engagement.

| Customer Segment | Key Characteristics | Example/Evidence |

|---|---|---|

| Core Gamers & Enthusiasts | High engagement, pre-orders, DLC/merchandise investment | Resident Evil Village sales exceeding 10 million units by early 2024 |

| Casual Gamers | Attracted by brand recognition, accessible gameplay | Monster Hunter Rise's broad appeal across multiple platforms |

| Esports Participants & Viewers | Passionate about competitive gaming, especially fighting games | Capcom Cup X 2024 prize pool and viewership |

| Collectors & Merchandise Fans | Seek physical editions, collectibles, apparel | Rapid sell-outs of limited edition physical releases in 2024 |

| Global Audience | Significant sales from North America, Europe, Asia | Overseas markets driving majority of net sales in fiscal year 2024 |

Cost Structure

Capcom's cost structure heavily features research and development (R&D) for new game titles, engines, and technological advancements. This investment is crucial for maintaining their competitive edge in the dynamic gaming industry.

These R&D expenses encompass salaries for their talented development teams, essential software licenses, and the necessary hardware infrastructure. For fiscal year 2024, Capcom reported significant investment in its content pipeline, reflecting these development costs.

Capcom dedicates significant resources to global marketing and advertising, essential for launching new titles and sustaining interest in its established franchises. These expenses cover a wide array of activities, from creating compelling online advertisements and cinematic trailers to participating in major gaming conventions and managing public relations efforts worldwide.

For fiscal year 2024, Capcom reported that selling, general, and administrative expenses, which include marketing and advertising, amounted to approximately 78.4 billion Japanese Yen (roughly $520 million USD based on average exchange rates for the period). This substantial investment underscores the company's commitment to building brand awareness and driving consumer demand across its diverse portfolio.

Capcom faces significant costs through platform royalties, typically around 30% of revenue for digital sales on platforms like PlayStation, Xbox, and Nintendo eShop. Additionally, distribution fees are incurred for physical game sales, impacting the per-unit cost. These expenses are directly tied to the volume of games sold through these channels.

Esports Event Organization and Prize Pools

Capcom's cost structure heavily features expenses tied to esports event organization and substantial prize pools. These include venue rentals, broadcasting rights and production, staffing for events, and the significant financial outlay for competitor prize money, which can reach millions of dollars for major tournaments.

For instance, the Capcom Cup X in 2024 boasted a massive $2 million prize pool, with the champion taking home $1 million. This demonstrates the considerable investment required to attract top talent and generate excitement within the competitive gaming community. Beyond prize money, operational costs for these large-scale events are also substantial.

- Venue Operations: Costs associated with securing and preparing physical locations for live tournaments.

- Broadcasting and Production: Expenses for streaming infrastructure, camera crews, commentators, and online broadcast platforms.

- Staffing: Salaries and fees for event managers, technical support, security, and on-site personnel.

- Prize Pools: Direct financial awards to winning competitors, a major draw for professional players.

General and Administrative Expenses

General and Administrative expenses for Capcom encompass a range of essential operational costs. These include salaries for administrative staff, the cost of maintaining office spaces, and investments in IT infrastructure to support their diverse business operations.

Additional significant components of this cost structure involve legal fees and other overheads crucial for the smooth functioning of Capcom's various gaming segments. For the fiscal year ending March 31, 2024, Capcom reported selling, general and administrative expenses of ¥67,301 million.

- Administrative Salaries: Compensation for non-development, non-marketing staff.

- Office Rent and Utilities: Costs associated with physical office locations.

- IT Infrastructure: Expenses for hardware, software, and network maintenance.

- Legal and Professional Fees: Costs for legal counsel, accounting, and other specialized services.

Capcom's cost structure is heavily influenced by its significant investments in research and development (R&D) for new game titles and technological advancements, alongside substantial global marketing and advertising expenditures to promote its diverse game portfolio. These R&D and marketing efforts are critical for maintaining its competitive position and driving consumer demand in the fast-paced gaming industry.

Key cost drivers also include platform royalties, typically around 30% for digital sales, and distribution fees for physical products, directly impacting profitability per unit sold. Furthermore, Capcom incurs considerable expenses related to organizing major esports events, including substantial prize pools, venue operations, and broadcasting production, as exemplified by the $2 million prize pool for Capcom Cup X in 2024.

| Cost Category | Fiscal Year 2024 (Approximate) | Notes |

|---|---|---|

| Selling, General, and Administrative (SG&A) | ¥78.4 billion (~$520 million USD) | Includes marketing, advertising, administrative salaries, office costs, and IT. |

| SG&A (Detailed Breakdown) | ¥67,301 million | Specific reporting for general and administrative expenses, excluding major marketing campaigns. |

| Esports Prize Pool Example | $2 million (Capcom Cup X) | Highlights significant investment in competitive events to attract talent and engage fans. |

Revenue Streams

Capcom's core revenue engine is fueled by the sale of its video game titles. This encompasses both new, highly anticipated releases and continued sales of their established, popular catalog games. These sales occur across all major gaming platforms, reaching consumers through both digital storefronts and traditional physical retail channels.

In the fiscal year ending March 2024, Capcom reported a robust performance, with net sales reaching ¥175.7 billion (approximately $1.16 billion USD). A significant portion of this revenue is directly attributable to full game sales, underscoring its primary importance to the company's financial success.

Capcom generates significant revenue from Downloadable Content (DLC) and game expansions, effectively extending the commercial life of its popular franchises. This strategy involves selling additional gameplay elements, like new characters, story missions, or cosmetic upgrades, directly to players.

For instance, the Resident Evil 4 Remake's Separate Ways DLC, released in September 2023, added a substantial new story campaign. This type of content not only deepens player engagement but also taps into a lucrative revenue stream, as seen with the strong sales performance of such additions across Capcom's portfolio.

Capcom generates significant income through sponsorships for its esports tournaments, attracting brands looking to connect with a passionate gaming audience. This revenue stream is bolstered by the sale of media rights, allowing broadcasting platforms to air competitive events, further expanding reach and engagement.

The esports industry's rapid growth is directly fueling this revenue. For instance, the global esports market was projected to reach over $1.5 billion in 2023, with sponsorships and media rights forming a substantial portion of that figure, indicating a strong upward trend for Capcom's involvement.

Character Merchandising and Licensing

Capcom generates significant income by licensing its popular intellectual properties (IPs) for a wide array of merchandise. This includes everything from action figures and apparel to video game-themed collectibles, diversifying its revenue streams beyond direct game sales.

Beyond physical goods, licensing extends to media adaptations, such as films and television series. For instance, the Monster Hunter franchise has seen successful adaptations, further monetizing the brand and reaching broader audiences.

In fiscal year 2023, Capcom reported robust performance in its Digital Contents segment, which includes game sales, but its Consumer Products segment, encompassing merchandise and licensing, also plays a crucial role in its overall financial health. While specific figures for merchandising alone are often bundled, the segment’s growth indicates strong consumer demand for licensed products.

- Merchandise Licensing: Income from toys, apparel, collectibles, and other physical goods featuring Capcom characters.

- Media Licensing: Revenue generated from licensing IPs for film, television, and other entertainment adaptations.

- Brand Extension: Diversifies revenue and strengthens brand recognition across various consumer markets.

- IP Monetization: Leverages established franchises like Resident Evil and Street Fighter for ongoing financial returns.

Amusement Equipment and Arcade Operations

Capcom's revenue streams extend beyond video games to include amusement equipment and arcade operations. This diversified approach provides additional avenues for profit and customer engagement.

The amusement equipment segment primarily involves the sale and leasing of pachislo machines, a popular form of Japanese slot machine. These machines are designed with engaging themes and gameplay mechanics, contributing a significant portion to this business unit's sales.

Furthermore, Capcom operates its own arcades, offering a hands-on entertainment experience. These venues feature a variety of arcade games, including some of Capcom's own popular titles, drawing in customers and generating revenue through gameplay and merchandise sales.

- Amusement Equipment: Focuses on pachislo machine sales and leasing.

- Arcade Operations: Operates physical arcades featuring various games.

- Revenue Contribution: Both segments contribute to Capcom's overall sales and profitability.

Capcom's revenue is significantly boosted by its mobile games segment, which includes both new titles and the adaptation of its popular console franchises for mobile platforms. This allows the company to tap into the vast and growing mobile gaming market.

In the fiscal year ending March 2024, Capcom's net sales reached ¥175.7 billion, with its Digital Contents segment, which includes mobile, showing strong performance. This indicates the increasing importance of mobile as a revenue driver alongside its core console and PC offerings.

The company also generates revenue through subscriptions and in-game purchases within its mobile titles. These microtransactions, offering cosmetic items or gameplay advantages, contribute to recurring revenue and player retention.

Capcom's mobile strategy often involves leveraging its established IPs, such as Monster Hunter and Street Fighter, to attract a broad player base. This IP strength is a key factor in the success of its mobile ventures.

| Revenue Stream | Description | Fiscal Year Ending March 2024 Data (Approximate) |

|---|---|---|

| Full Game Sales | Sales of new and catalog video game titles across all platforms. | Net sales of ¥175.7 billion ($1.16 billion USD) primarily driven by game sales. |

| Downloadable Content (DLC) & Expansions | Selling additional gameplay content for existing titles. | Integral to extending game lifecycles and driving ongoing player engagement. |

| Merchandise & IP Licensing | Revenue from physical goods and media adaptations of its franchises. | Consumer Products segment contributes to overall financial health; strong demand for licensed products. |

| Amusement Equipment & Arcades | Sales/leasing of pachislo machines and operation of physical arcades. | Diversifies revenue and provides direct customer engagement. |

| Mobile Games | New mobile titles and adaptations of existing franchises for mobile platforms. | Key growth area leveraging strong IP for a broad player base. |

Business Model Canvas Data Sources

Capcom's Business Model Canvas is informed by a blend of internal financial reports, market research on gaming trends, and analysis of competitor strategies. These data sources provide a comprehensive view of the company's operations and market position.