Capcom PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capcom Bundle

Capcom operates in a dynamic global market, influenced by a complex interplay of political stability, economic fluctuations, and evolving social trends. Understanding these external forces is crucial for anticipating challenges and capitalizing on opportunities in the gaming industry. Our PESTLE analysis dives deep into these factors, offering a clear roadmap for strategic decision-making. Unlock actionable insights that can shape your competitive advantage. Purchase the full PESTLE analysis for Capcom now and gain the foresight you need.

Political factors

Governments worldwide, particularly in major markets like China and Japan, implement stringent regulations on video game content. These rules often target themes, depictions of violence, and monetization strategies such as loot boxes, directly affecting Capcom's game design and market entry. For instance, Japan's Computer Entertainment Rating Organization (CERO) assigns age ratings that are crucial for game distribution, influencing how games are marketed and sold.

The global esports market is projected to reach $2.76 billion in 2025, according to Newzoo, highlighting its significant economic impact. However, this growth is accompanied by a complex regulatory landscape. Countries worldwide are grappling with how to regulate prize money distribution, the burgeoning esports betting sector, and the professional licensing of players, creating a patchwork of rules that Capcom must navigate.

In Japan, where esports is gaining traction, legal ambiguities surrounding cash prizes necessitate careful planning for tournament organizers and publishers like Capcom to ensure compliance. For instance, understanding the specific tax implications and legal frameworks for prize pools is crucial for avoiding potential issues and fostering a sustainable competitive environment.

Governments are increasingly recognizing esports as a legitimate industry, leading to greater support through initiatives like dedicated infrastructure development and promotional events. This evolving recognition presents a tangible opportunity for Capcom to expand its engagement with the esports community, potentially through sponsoring tournaments, developing platform-specific competitive titles, or leveraging government-backed esports initiatives to reach wider audiences.

Capcom's reliance on its creative output makes robust intellectual property (IP) protection absolutely essential. Their valuable assets are the copyrights on game titles like Resident Evil and Street Fighter, trademarks for characters, and patents for unique gameplay mechanics. Without strong IP laws, these creations are vulnerable to unauthorized use and replication.

The global nature of game distribution presents significant challenges for IP enforcement. Capcom must navigate varying legal frameworks across numerous countries to combat piracy and infringement. For instance, ongoing discussions and legal precedents surrounding AI-generated content in 2024 and 2025 necessitate continuous adaptation of their protection strategies to safeguard against new forms of IP theft.

International Trade Policies and Tariffs

Capcom's global reach, spanning over 230 countries and regions, makes it particularly sensitive to shifts in international trade policies and tariffs. Changes in these agreements can directly impact the cost of manufacturing and distributing physical game copies and hardware, influencing Capcom's profitability. For instance, a sudden imposition of tariffs on electronics imported into key markets could increase the cost of consoles or physical game units, potentially dampening consumer demand.

Geopolitical tensions also play a significant role, affecting market access and consumer sentiment. For example, trade disputes or political instability in a major region could lead to restricted market access or a negative perception of foreign products, directly impacting Capcom's sales and revenue streams. The company's reliance on a diverse global customer base means that localized trade friction can have widespread financial consequences.

- Impact of Tariffs: Increased tariffs on imported goods, such as gaming consoles or physical media components, can raise production costs for Capcom, potentially leading to higher retail prices or reduced profit margins.

- Trade Agreement Changes: Modifications to existing trade agreements, like the USMCA or EU trade pacts, could alter import/export duties and regulations, affecting the flow of Capcom's products across borders.

- Geopolitical Risk: Escalating geopolitical tensions in regions where Capcom has a significant market presence can disrupt supply chains, impact consumer spending due to economic uncertainty, and even lead to market access limitations.

Data Privacy and Consumer Protection Laws

Capcom operates in an environment where data privacy and consumer protection laws are increasingly stringent. With the digital nature of gaming and the vast amounts of user data collected, compliance with regulations like the EU's General Data Protection Regulation (GDPR) and similar regional laws is paramount. Failure to adhere can result in significant fines and damage to brand reputation.

Ensuring compliance is crucial for maintaining consumer trust, particularly regarding personal information, in-game transactions, and online community interactions. Capcom's commitment to these regulations directly impacts its ability to operate globally and foster positive relationships with its player base.

- GDPR fines can reach up to 4% of annual global revenue or €20 million, whichever is higher, underscoring the financial risk of non-compliance.

- Consumer protection laws often mandate transparency in pricing, clear terms of service, and fair dispute resolution processes for digital goods and services.

- In 2024, ongoing discussions around AI's impact on data privacy are likely to lead to new or updated regulations that Capcom will need to monitor and adapt to.

Government regulations on game content, such as age ratings and restrictions on monetization, directly influence Capcom's product development and market access. For example, Japan's CERO ratings are critical for game distribution, shaping how titles are marketed and sold within a key market.

The evolving legal landscape for esports, including prize money distribution and player licensing, presents both challenges and opportunities for Capcom. Navigating these diverse regulations is essential for fostering a sustainable competitive gaming environment.

Capcom's robust intellectual property (IP) protection is vital, with its valuable assets like Resident Evil and Street Fighter facing threats from piracy and unauthorized use. The company must adapt its strategies to combat new forms of IP theft, especially with ongoing discussions around AI-generated content in 2024 and 2025.

International trade policies and geopolitical tensions significantly impact Capcom's global operations. Tariffs on imported goods and trade disputes can increase costs, affect market access, and influence consumer sentiment, directly impacting sales and revenue streams.

What is included in the product

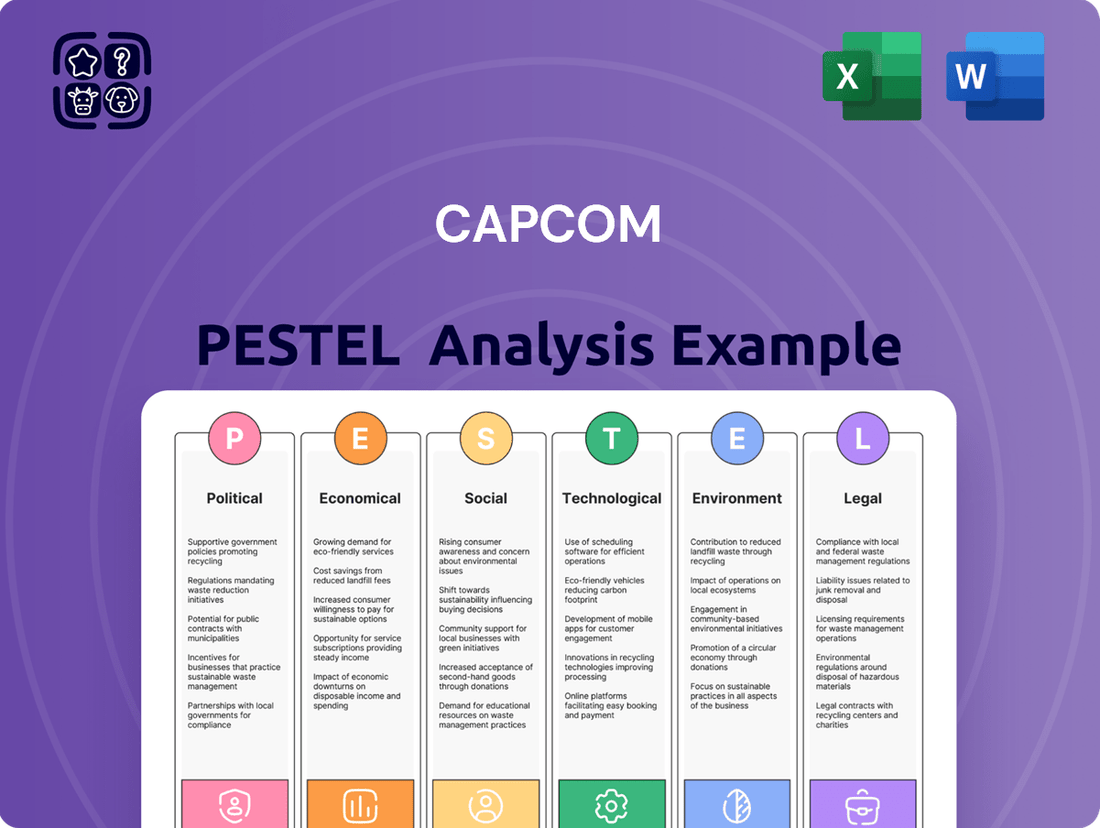

This Capcom PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operations and strategic planning.

It provides actionable insights for stakeholders to navigate the dynamic external landscape and capitalize on emerging opportunities.

A clear, actionable Capcom PESTLE analysis provides a vital framework to anticipate and mitigate external threats, thereby reducing the anxiety and uncertainty associated with market shifts and regulatory changes.

Economic factors

The health of the global economy significantly influences consumer spending on entertainment, including video games. Factors like inflation and potential recessionary pressures can directly affect disposable income. For instance, in 2024, while some regions may experience moderate inflation, the overall global economic growth is projected to remain steady, supporting consumer spending on leisure activities.

Capcom's performance indicates resilience to economic fluctuations. Despite varying global economic conditions, the company reported strong financial results for the fiscal year ending March 31, 2024, with net sales reaching ¥650 billion, up 14.5% year-on-year. This demonstrates an ability to maintain consumer engagement even when disposable income is pressured.

Currency exchange rate fluctuations significantly affect Capcom, a Japanese company with substantial international sales. For instance, a weaker Yen can boost the profitability of games sold in foreign markets when converted back to Yen. Capcom has previously noted its operating income is sensitive to these currency movements, with specific projections often detailed in their financial reports.

In fiscal year 2024, Capcom reported that a 1 Yen depreciation against the US Dollar could positively impact operating income by approximately 1.4 billion Yen, while a similar move against the Euro could add around 0.5 billion Yen. This highlights the direct financial impact of currency shifts on their bottom line.

The ongoing transition from physical to digital game sales significantly alters industry revenue streams, offering Capcom enhanced profit margins thanks to reduced distribution expenses. This digital shift is exemplified by Capcom's performance; for the fiscal year ending March 2024, digital sales represented a substantial 84.6% of total net sales, a testament to their strategic focus.

Subscription services are also increasingly influencing consumer behavior regarding game access and payment. Capcom's emphasis on digital distribution has yielded impressive results, with digital sales volume consistently growing and its back catalog of games contributing robust, high-margin revenue.

Esports Market Growth and Commercialization

The global esports market is booming, with revenues projected to hit $2.19 billion in 2024, a significant increase from previous years, according to Newzoo. This economic expansion, fueled by sponsorships, media rights, and growing viewership, directly benefits Capcom. Its established competitive franchises, such as Street Fighter, can capitalize on this trend through enhanced merchandising, tournament participation, and broader brand engagement.

Capcom's ability to leverage the esports ecosystem is substantial. The increasing popularity of esports means larger audiences for tournaments and events featuring Capcom titles, translating into higher advertising and sponsorship potential. For instance, the Street Fighter League has seen growing viewership and sponsor interest, demonstrating the economic viability of competitive gaming for the company.

The market's continued growth trajectory offers ongoing economic advantages. Projections suggest the esports audience will surpass 600 million viewers by 2024, creating a vast consumer base for Capcom's products and related merchandise. This expanding reach provides a robust economic foundation for Capcom's esports initiatives.

- Global esports revenue is expected to reach $2.19 billion in 2024.

- The esports audience is projected to exceed 600 million viewers by 2024.

- Sponsorships and media rights are key revenue drivers in the esports market.

- Capcom's competitive titles like Street Fighter benefit from this growth through increased engagement and commercial opportunities.

Research and Development Investment Costs

Developing cutting-edge, graphically rich AAA video games demands substantial investment in research and development. This includes attracting top talent, adopting new technologies, and upgrading infrastructure. For instance, Capcom's commitment to high-quality content is reflected in its increasing R&D expenditures, which reached ¥23.8 billion in the fiscal year ending March 31, 2024, a notable increase from ¥19.6 billion in the prior year.

These escalating development costs can put pressure on profit margins unless sales performance is robust and production processes are efficient. Capcom is strategically expanding its development capacity, including the construction of new facilities, to better meet the market's growing demand for premium gaming experiences.

- Rising R&D Expenditure: Capcom's R&D investment grew to ¥23.8 billion in FY2024, demonstrating a commitment to technological advancement and game quality.

- Talent and Technology Focus: Significant portions of R&D are allocated to acquiring skilled personnel and integrating novel technologies for game creation.

- Capacity Expansion: The company is investing in new infrastructure, such as additional development facilities, to support increased production of high-fidelity games.

- Profitability Challenge: Higher development costs necessitate strong sales performance to maintain healthy profit margins.

Economic stability and consumer purchasing power are paramount for Capcom's sales. While global economic growth is projected to be steady in 2024, inflation and potential recessions could impact disposable income for entertainment. Capcom's strong performance, with net sales of ¥650 billion in FY2024, up 14.5%, shows resilience even with economic pressures.

Currency fluctuations significantly impact Capcom's international earnings. A weaker Yen, for instance, boosts profits from overseas sales when repatriated. Capcom's operating income is sensitive to these shifts; a 1 Yen depreciation against the USD could add approximately ¥1.4 billion to operating income in FY2024.

The digital shift in game sales, with 84.6% of Capcom's net sales in FY2024 coming from digital, enhances profit margins by reducing distribution costs. This trend, alongside subscription services, supports consistent revenue from Capcom's back catalog.

The booming esports market, projected to reach $2.19 billion in 2024 with over 600 million viewers, offers substantial economic opportunities for Capcom's competitive titles like Street Fighter through sponsorships and increased engagement.

| Economic Factor | Capcom Impact | 2024/2025 Data Point |

| Global Economic Growth | Influences consumer spending on games | Projected steady growth in 2024 |

| Inflation/Recession | Affects disposable income | Potential impact on leisure spending |

| Currency Exchange Rates | Impacts international revenue translation | 1 JPY depreciation vs USD could add ¥1.4bn to operating income (FY2024) |

| Digital Sales Transition | Increases profit margins | 84.6% of net sales in FY2024 were digital |

| Esports Market Growth | Creates new revenue streams and brand engagement | Global esports revenue projected at $2.19bn in 2024; audience >600m |

Same Document Delivered

Capcom PESTLE Analysis

The preview you see here is the exact, fully completed Capcom PESTLE Analysis document you will receive after purchase. It's ready for immediate use, offering a comprehensive overview of the political, economic, social, technological, legal, and environmental factors impacting Capcom.

Sociological factors

The gaming landscape is broadening significantly, with more people of all ages, genders, and backgrounds diving into video games. This diversification is a major shift. For instance, in 2024, the global games market is projected to reach $200 billion, with mobile gaming accounting for a substantial portion, demonstrating its reach into new demographics.

Capcom's success hinges on its ability to connect with these varied players. This means adapting game design, marketing, and accessibility features to resonate with different tastes, whether it's through classic franchises or new mobile-first experiences. Understanding these evolving consumer preferences is key to unlocking new market segments and maintaining relevance.

Social media platforms like X (formerly Twitter) and TikTok, alongside streaming services such as Twitch and YouTube, are crucial for how players discover and engage with Capcom's titles. In 2024, for instance, the success of games like Monster Hunter: Wilds' trailers was amplified through viral sharing on these platforms, directly impacting pre-release hype and subsequent sales figures. Effective influencer collaborations can drive significant player acquisition, as seen with the continued popularity of the Resident Evil series, where streamers often showcase new content and gameplay, fostering a strong community around the franchise.

The rapid dissemination of information on these channels means that positive community sentiment, often cultivated through developer interaction and responsive updates, can dramatically boost a game's longevity and profitability. Conversely, negative feedback or perceived issues, such as those encountered with certain online game launches, can spread just as quickly, potentially deterring new players and impacting long-term revenue. Capcom's own Capcom Creators Program, launched to support content creators, highlights their strategic use of these online communities to foster goodwill and organic promotion, with many creators generating millions of views for Capcom-related content.

The explosive growth of esports has transformed gaming into a spectator sport, with millions tuning in to watch professional players compete. This trend is a significant sociological shift, creating new communities and consumption patterns around video games. In 2024, the global esports market was valued at approximately $1.5 billion, with projections indicating continued strong growth through 2025.

Capcom is strategically positioned to benefit from this burgeoning esports culture. Its iconic franchises, particularly Street Fighter, are already deeply embedded in the competitive gaming scene, attracting both players and viewers. The visibility gained through professional tournaments and streaming platforms for games like Street Fighter 6 significantly boosts brand recognition and player engagement.

Work-Life Balance and Gaming Habits

Societal shifts towards remote and hybrid work arrangements are significantly reshaping how individuals integrate gaming into their lives. This flexibility allows for more varied playtime, potentially increasing engagement during non-traditional hours and fueling demand for titles that cater to different time commitments. For instance, a 2024 report indicated that 35% of gamers now play during their lunch breaks or between work tasks, a notable increase from previous years.

The growing demand for games that accommodate diverse schedules is evident. This trend supports a market for both quick, mobile-friendly gaming sessions and more involved, immersive experiences on consoles and PCs. In 2025, the mobile gaming sector alone is projected to generate over $130 billion globally, underscoring the appeal of accessible gaming options.

The widespread availability of games across multiple platforms further enhances this lifestyle flexibility. Players can seamlessly transition between devices, fitting gaming into commutes, downtime, or dedicated leisure periods. This cross-platform accessibility is a key driver in maintaining consistent player engagement in an increasingly fragmented leisure time landscape.

Key observations include:

- Increased gaming during work breaks: 35% of gamers reported playing during lunch or between work tasks in 2024.

- Growth of mobile gaming: The mobile gaming sector is expected to exceed $130 billion globally in 2025.

- Demand for diverse game formats: A rise in popularity for both short, accessible mobile games and longer, immersive console/PC titles.

- Cross-platform play: The ability to play across multiple devices supports flexible gaming habits.

Cultural Acceptance and Perception of Gaming

The societal view of video games as a legitimate form of entertainment and even art is steadily growing. This shift is crucial for companies like Capcom, as it broadens their potential audience and reduces the stigma often associated with gaming. For instance, in 2024, the global games market was projected to reach $200 billion, a significant portion of which is driven by this increasing acceptance.

A more positive perception directly translates to greater mainstream integration. This means games are more likely to be featured in diverse media, and parental attitudes are becoming more favorable, recognizing gaming's potential for skill development and social interaction. This evolving acceptance is essential for continued market expansion beyond the core gaming demographic.

The increasing acceptance fuels market growth by attracting new player segments and fostering a more supportive environment for game development and marketing. This trend is evident in the rising number of casual gamers and the growing popularity of esports, which further legitimizes gaming as a cultural force.

- Growing Acceptance: Video games are increasingly recognized as art and legitimate entertainment.

- Market Expansion: Positive perception opens doors to wider audiences and new demographics.

- Reduced Stigma: Lessening negative stereotypes encourages broader societal engagement with gaming.

- Mainstream Integration: Increased media representation and positive parental views boost industry legitimacy.

The gaming demographic is rapidly diversifying, with more individuals of all ages and backgrounds embracing video games, a trend highlighted by the global games market's projected $200 billion valuation in 2024. This broadens Capcom's potential player base significantly, necessitating adaptable game design and marketing strategies to appeal to varied tastes and preferences. Social media and streaming platforms are now indispensable for game discovery and community engagement, as exemplified by the viral success of trailers for titles like Monster Hunter: Wilds in 2024, directly influencing pre-release anticipation and sales.

The rise of esports has transformed gaming into a spectator event, with the global esports market valued at approximately $1.5 billion in 2024 and poised for continued growth. Capcom's iconic franchises, especially Street Fighter, are well-positioned to capitalize on this trend, enhancing brand recognition and player involvement through competitive gaming events.

Societal shifts towards flexible work arrangements allow for more varied gaming times, increasing engagement during non-traditional hours and driving demand for games that fit diverse schedules. This is supported by the mobile gaming sector's projected $130 billion global revenue in 2025, underscoring the appeal of accessible gaming options. The increasing societal acceptance of video games as legitimate entertainment, reflected in the $200 billion global games market projection for 2024, further expands Capcom's audience and reduces associated stigma.

Technological factors

Continuous innovation in game engines, such as Capcom's proprietary RE Engine, alongside advancements in animation software and development tools, directly fuels the creation of more visually impressive, intricate, and immersive gaming experiences. These technological leaps not only elevate the quality and performance of games across diverse platforms but also contribute to streamlining development timelines and reducing associated costs.

Capcom's commitment to research and development is evident in its substantial investments aimed at harnessing these evolving technologies. For instance, the company reported R&D expenses of ¥31.3 billion in fiscal year 2024, a significant portion of which is allocated to improving development capabilities and exploring new technological frontiers in game creation.

Cloud gaming is making high-fidelity gaming accessible to more people, removing the need for expensive PCs or consoles. This shift means developers like Capcom must adapt their games for seamless streaming, potentially opening up new revenue streams. For instance, by mid-2024, cloud gaming services continued to expand their reach, with major players reporting significant user growth, indicating a growing market for games optimized for this technology.

Artificial intelligence is fundamentally reshaping game development, enabling more lifelike non-player characters and dynamic narratives. For Capcom, AI integration can lead to more immersive experiences and efficient development cycles. For instance, AI-powered tools are increasingly used in game testing, with companies reporting significant reductions in bug-finding time.

Growth of Mobile Gaming and Cross-Platform Play

The mobile gaming sector remains the dominant and fastest-growing part of the overall gaming market. This expansion is fueled by increasing smartphone adoption worldwide and the ease of accessing games on these devices. For instance, in 2023, mobile gaming revenue was projected to reach over $107 billion, solidifying its leading position.

Cross-platform play, which allows players to engage with each other regardless of their device, is increasingly becoming an expected feature. This necessitates game development that optimizes performance across a wide range of hardware specifications. Capcom's strategic focus on digital distribution and its commitment to releasing titles on multiple platforms directly addresses these evolving technological demands.

- Mobile gaming revenue is expected to exceed $107 billion in 2023.

- Cross-platform play is a key driver for player engagement and retention.

- Capcom's multi-platform releases align with the trend towards accessible gaming experiences.

Emergence of Virtual Reality (VR) and Augmented Reality (AR)

Virtual Reality (VR) and Augmented Reality (AR) present exciting new avenues for deeply engaging gaming experiences, even if they currently cater to a smaller audience. As the hardware for these technologies continues to advance and become more accessible, Capcom can explore novel interactive entertainment possibilities. This will necessitate strategic investments in specialized development talent and the creation of unique VR/AR content.

The market for VR and AR is projected for substantial expansion. For instance, the global VR/AR market was valued at approximately $30.4 billion in 2023 and is anticipated to reach $367.1 billion by 2030, growing at a compound annual growth rate (CAGR) of 43.7% during this period. This growth trajectory suggests a significant future opportunity for companies like Capcom to innovate within this space.

The potential impact on Capcom's business model includes:

- New Revenue Streams: Development of exclusive VR/AR titles or integration of AR elements into existing franchises like Resident Evil or Monster Hunter.

- Enhanced Player Engagement: Offering more immersive and interactive gameplay that could lead to higher player retention and satisfaction.

- Technological Investment: Requiring upfront capital for R&D, specialized hardware, and skilled personnel in VR/AR development.

- Market Differentiation: Establishing a strong presence in emerging VR/AR gaming markets, potentially capturing early market share.

Technological advancements are a primary driver for Capcom's operational efficiency and product innovation. The company's continued investment in its proprietary RE Engine, for example, allows for the creation of visually stunning and technically sophisticated games. Capcom's R&D spending hit ¥31.3 billion in fiscal year 2024, underscoring its commitment to leveraging cutting-edge technology.

Emerging technologies like cloud gaming and AI are reshaping player access and game development. Cloud gaming expands reach by lowering hardware barriers, while AI enhances gameplay realism and development efficiency. These trends necessitate adaptable development strategies to cater to diverse platforms and player expectations.

The rise of VR/AR presents a significant, albeit currently niche, opportunity for immersive gaming experiences. With the global VR/AR market projected to grow from $30.4 billion in 2023 to $367.1 billion by 2030, Capcom is positioned to explore new revenue streams and player engagement models in these burgeoning sectors.

| Technology Area | Impact on Capcom | Key Data/Trend |

|---|---|---|

| Game Engines (RE Engine) | Enhanced visual fidelity, streamlined development. | Capcom's R&D expenses: ¥31.3 billion (FY2024). |

| Cloud Gaming | Expanded player base, new revenue models. | Growing user adoption across major cloud gaming services (mid-2024). |

| Artificial Intelligence (AI) | More realistic NPCs, efficient development/testing. | AI tools reduce bug-finding time in game testing. |

| Virtual/Augmented Reality (VR/AR) | New immersive experiences, potential market differentiation. | Global VR/AR market valued at $30.4 billion (2023), projected to reach $367.1 billion by 2030 (CAGR 43.7%). |

Legal factors

Capcom's business heavily relies on protecting its intellectual property, encompassing game code, beloved characters like Ryu and Mega Man, engaging storylines, and memorable music. This protection is crucial for maintaining brand integrity and revenue streams.

Navigating the global landscape of copyright law is a continuous challenge, especially with the rise of digital distribution and the ease of content replication. Capcom actively works to combat piracy, which can significantly impact sales and profitability.

The company also faces evolving threats from unauthorized use of its intellectual property, including fan-created content and, increasingly, AI-generated works that may infringe on existing copyrights. A robust and proactive IP strategy is therefore essential for safeguarding Capcom's valuable assets and ensuring continued financial success.

Capcom navigates a complex web of consumer protection laws, particularly concerning in-game transactions and loot box mechanics, which are under increasing scrutiny globally. For instance, in 2024, several European countries continued to debate and refine regulations around the gambling-like aspects of video games, potentially impacting monetization strategies.

Data privacy is paramount, with regulations like GDPR and CCPA demanding rigorous data handling. Capcom must ensure user data is protected, with breaches potentially leading to substantial fines; in 2023, the average cost of a data breach reached $4.45 million globally, a figure that underscores the financial risk.

Furthermore, evolving legislation such as updates to COPPA in the US directly influences how companies interact with younger demographics, requiring careful consideration of age-appropriate content and data collection practices for minors.

The legal framework for esports, particularly regarding prize money and betting, is a patchwork quilt that differs greatly from one country to another. This means Capcom must navigate a complex web of regulations when organizing or sponsoring tournaments.

In Japan, for example, laws such as the Amusement Businesses Law and the Unjustifiable Premiums and Misleading Representations Act directly impact how prize pools can be structured. These regulations are designed to prevent illegal gambling, so careful legal planning is essential to ensure Capcom's esports initiatives remain compliant and avoid any unintended legal pitfalls.

Content Rating and Censorship Laws

Capcom navigates a complex web of content rating and censorship laws globally. For instance, Japan's CERO rating system and North America's ESRB are crucial for legal distribution, often requiring adjustments to game content. In 2024, regulatory bodies continue to scrutinize game content, impacting market access and development costs.

These legal frameworks directly influence game development and marketing strategies. Capcom must ensure compliance with age restrictions and content guidelines, which can lead to regional variations in their releases. Failure to adhere can result in significant fines or outright bans, impacting revenue streams from key markets.

- Global Compliance: Adherence to rating boards like CERO (Japan) and ESRB (North America) is mandatory for market entry.

- Content Modifications: Censorship laws may necessitate altering game content, affecting artistic intent and development timelines.

- Market Access: Non-compliance can lead to game bans or restricted releases, limiting Capcom's global sales potential.

- 2024 Landscape: Evolving digital content regulations require continuous monitoring and adaptation by Capcom.

Labor Laws and Employee Rights

Capcom, as a global employer, must navigate a complex web of labor laws in Japan and other operating regions. These regulations cover everything from fair wages and safe working conditions to fundamental employee rights, impacting how the company manages its workforce. For instance, in Japan, the Labor Standards Act sets minimum wage requirements and dictates working hour limits, while the Equal Employment Opportunity Law addresses gender equality.

Adherence to these legal frameworks is crucial for Capcom’s talent acquisition and retention strategies. Initiatives focused on narrowing the gender pay gap, such as those aimed at increasing female representation in management roles, and the promotion of robust parental leave policies are vital for fostering a positive employer brand. For example, in 2023, Japanese companies were encouraged to report on gender pay gap data, a trend Capcom is likely monitoring closely.

- Fair Wage Compliance: Adherence to minimum wage laws and fair compensation practices in all operating countries.

- Working Conditions: Ensuring safe, healthy, and legally compliant work environments for all employees.

- Employee Rights: Upholding rights related to non-discrimination, equal opportunity, and collective bargaining.

- Parental Leave Policies: Offering and promoting parental leave to support work-life balance and employee well-being.

Capcom's legal obligations extend to the intricate world of intellectual property, requiring robust protection for its game code, iconic characters, and creative content. Navigating global copyright laws and combating digital piracy are ongoing challenges, especially with the rise of AI-generated works potentially infringing on existing IP. The company must maintain a proactive strategy to safeguard its valuable assets and revenue streams.

Environmental factors

The video game industry, from development studios to the vast data centers powering online play and cloud services, consumes substantial energy. This includes the manufacturing of consoles and other hardware, contributing to a significant carbon footprint for companies like Capcom.

Capcom is increasingly expected to address its environmental impact. This involves a push towards more energy-efficient operational practices. For instance, adopting renewable energy sources for its facilities and optimizing game code to reduce power consumption during gameplay are key strategies being explored and implemented.

The global gaming market's energy consumption is a growing concern, with data center energy use alone projected to rise significantly. By 2025, data centers are anticipated to account for a substantial portion of global electricity consumption, highlighting the urgency for companies like Capcom to invest in sustainability.

The gaming industry, including companies like Capcom, generates significant electronic waste (e-waste) from the production and disposal of consoles, PCs, and accessories. Globally, e-waste is a growing concern, with estimates suggesting over 50 million metric tons were generated in 2023 alone, a figure projected to rise. This environmental factor presents a challenge and an opportunity for Capcom to influence sustainable practices.

Capcom can mitigate its contribution to e-waste by prioritizing digital game sales over physical media, which reduces the need for plastic packaging and manufacturing of discs. Furthermore, by actively engaging in industry collaborations to advocate for and adopt more sustainable hardware manufacturing processes, Capcom can encourage a broader shift towards environmentally responsible product lifecycles, aligning with growing consumer and regulatory pressures for greener technology.

The environmental footprint of physical game releases, particularly concerning packaging materials and the logistics of their supply chains, is a significant consideration for Capcom. The company is actively addressing this by setting ambitious goals for its packaging.

Capcom has committed to achieving 100% use of recyclable materials in its physical game packaging by the year 2025. This initiative underscores a growing emphasis on more sustainable operational practices within the gaming industry.

Resource Scarcity and Ethical Sourcing

The gaming industry, including software developers like Capcom, is increasingly aware of resource scarcity. The production of gaming consoles and other hardware requires materials such as rare earth elements, whose extraction can be environmentally damaging and raise ethical concerns. For instance, cobalt, a key component in batteries, has faced scrutiny over mining practices, with estimates suggesting that over 70% of the world's cobalt supply comes from the Democratic Republic of Congo, a region with documented labor issues.

While Capcom's core business is software, these hardware dependencies create an indirect environmental and ethical challenge for the company. As consumers and regulators push for greater sustainability, hardware manufacturers are investing in more efficient production methods and exploring alternative materials. This industry-wide shift towards responsible sourcing and resource efficiency could influence platform availability and the overall cost structure of gaming hardware, ultimately impacting Capcom's market reach and revenue streams.

Key considerations for Capcom and the broader gaming ecosystem include:

- Dependence on finite resources: Gaming hardware relies on materials like lithium, cobalt, and various metals, many of which are non-renewable and concentrated in specific geopolitical regions.

- Ethical sourcing challenges: The mining of certain raw materials, particularly those used in batteries and electronics, has been linked to human rights abuses and environmental degradation.

- Industry-wide sustainability push: Major hardware manufacturers are setting targets for recycled content and reduced carbon footprints in their supply chains, a trend that will likely extend to software packaging and distribution methods.

- Impact on platform costs: Increased scrutiny and regulation around resource extraction and ethical sourcing could lead to higher production costs for gaming hardware, potentially affecting consumer purchasing power and game sales.

Climate Change and Environmental Awareness

Growing global awareness of climate change is increasingly shaping consumer behavior, including within the gaming industry. Gamers are showing a greater preference for companies that actively demonstrate environmental responsibility. This trend presents an opportunity for Capcom to bolster its brand image and attract a more environmentally conscious player base by highlighting its sustainability efforts.

Capcom can leverage this by communicating its commitment to eco-friendly practices. For instance, the company could detail initiatives such as reducing energy consumption in its offices and data centers, or exploring sustainable materials for physical game packaging. Some major gaming studios have already begun implementing carbon-neutral policies, setting a precedent for the industry.

- Consumer Preference Shift: A significant portion of consumers, including gamers, are actively seeking out brands with strong environmental credentials.

- Brand Reputation Enhancement: Demonstrating sustainability can differentiate Capcom in a competitive market and foster positive brand perception.

- Industry Trends: The adoption of carbon-neutral policies by some gaming companies indicates a growing industry-wide focus on environmental impact.

Capcom faces increasing pressure to address its environmental footprint, particularly concerning energy consumption in data centers and hardware manufacturing, which is projected to rise significantly by 2025. The company is actively pursuing energy-efficient practices and exploring renewable energy sources to mitigate its impact.

Electronic waste is another critical environmental factor, with global e-waste projected to exceed 50 million metric tons in 2023. Capcom is working to reduce this by prioritizing digital sales and advocating for sustainable hardware production, aiming for 100% recyclable packaging by 2025.

Resource scarcity, especially for materials like cobalt in gaming hardware, presents indirect challenges. Ethical sourcing and the environmental impact of extraction are growing concerns, potentially influencing hardware costs and availability, which in turn can affect Capcom's market dynamics.

PESTLE Analysis Data Sources

Our Capcom PESTLE Analysis is informed by data from reputable industry publications, financial reports, and government regulatory bodies. We meticulously gather insights on political stability, economic trends, technological advancements, and societal shifts impacting the gaming industry.