Capcom Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Capcom Bundle

Curious about Capcom's product portfolio? Our preview highlights how their iconic franchises like Resident Evil and Monster Hunter might be positioned as Stars or Cash Cows, while newer or less successful titles could be Question Marks or Dogs.

To truly understand Capcom's strategic landscape and unlock actionable insights for investment and resource allocation, you need the full BCG Matrix.

Purchase the complete report for a detailed quadrant breakdown, data-backed recommendations, and a clear roadmap to capitalize on their strengths and mitigate weaknesses in the competitive gaming market.

Stars

Monster Hunter Wilds, launched in February 2025, has rapidly ascended to become Capcom's fastest-selling title, achieving an impressive 10.1 million units sold by March 31, 2025. This performance highlights a robust market appetite and significant growth trajectory for the Monster Hunter series within the current fiscal year. The game's exceptional performance is a key contributor to Capcom's record-breaking profits.

Resident Evil 4 Remake has cemented its status as a star within Capcom's portfolio, achieving over 9.9 million sales by March 31, 2025, and swiftly surpassing 10 million units by April 2025. This makes it the fastest-selling title in the Resident Evil franchise's history.

This modern reimagining of a beloved classic demonstrates exceptional market dominance within the survival horror genre. Its robust sales figures directly fuel Capcom's ongoing revenue expansion, underscoring its importance as a key growth driver.

Street Fighter 6 is a strong contender in Capcom's portfolio, likely positioned as a Star. By March 31, 2025, it had already sold over 4.6 million units, and this figure climbed past 5 million by June 2025. This performance demonstrates significant market share within the competitive fighting game genre.

The game's continued success is fueled by regular content additions and a robust eSports ecosystem, reinforcing its high growth and market leadership. Capcom's ambitious target of over 10 million lifetime sales further underscores its potential as a high-performing asset for the company.

Dragon's Dogma 2

Dragon's Dogma 2 demonstrates robust performance, selling 3.7 million units by March 31, 2025, and achieving 3 million units within its first two months. This rapid adoption highlights its strong market presence in the expanding action RPG genre.

- Market Position: Dragon's Dogma 2 is classified as a Star within Capcom's BCG Matrix due to its high growth potential and strong market share in the action RPG segment.

- Sales Performance: The game achieved 3 million unit sales within two months of release and reached 3.7 million by March 31, 2025, indicating significant commercial success.

- Revenue Contribution: Its substantial sales figures position it as a key revenue generator for Capcom, contributing significantly to the company's financial performance in the current fiscal year.

- Future Outlook: Continued investment and support are expected to further solidify its Star status, capitalizing on the growing demand for high-quality action RPG experiences.

Capcom's Digital Contents Business

Capcom's Digital Contents segment, a powerhouse of new releases and its extensive back catalog, consistently fuels the company's revenue and profit growth. In fiscal year 2024, this segment achieved an impressive 90.1% of its sales through digital channels, underscoring the success of its distribution strategy.

This focus on digital delivery, coupled with the strength of its major intellectual properties, allows Capcom to maintain a commanding market share across various gaming platforms. The segment's performance in FY2024 demonstrates its position as a high-growth, high-share business unit, driving significant financial expansion for Capcom.

- Digital sales reached 90.1% in FY2024.

- Major IP releases contribute to high market share.

- The segment shows strong financial growth.

- Digital Contents is a high-growth, high-share unit.

Monster Hunter Wilds and Resident Evil 4 Remake are clear Stars, with sales exceeding 10 million units each by mid-2025. Street Fighter 6 is also a Star, having surpassed 5 million units by June 2025 and showing strong growth potential. Dragon's Dogma 2, with 3.7 million units sold by March 2025, is also positioned as a Star due to its rapid market penetration in the action RPG genre.

| Title | Sales (approx. by June 2025) | BCG Category |

|---|---|---|

| Monster Hunter Wilds | 10.1 million+ | Star |

| Resident Evil 4 Remake | 10 million+ | Star |

| Street Fighter 6 | 5 million+ | Star |

| Dragon's Dogma 2 | 3.7 million+ | Star |

What is included in the product

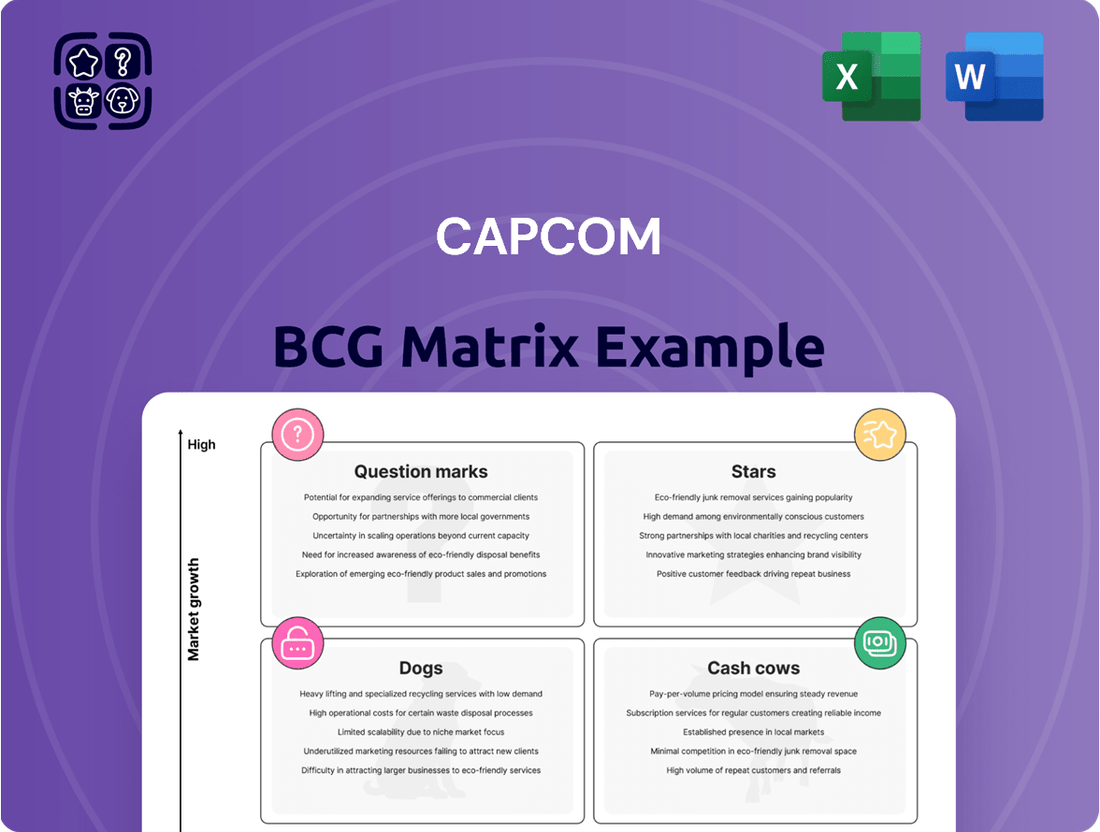

The Capcom BCG Matrix analyzes its game portfolio, categorizing titles as Stars, Cash Cows, Question Marks, or Dogs to guide investment and resource allocation.

A clear BCG Matrix visual instantly clarifies which Capcom game franchises are cash cows, stars, question marks, or dogs, easing the pain of strategic resource allocation.

Cash Cows

Monster Hunter: World stands as Capcom's undisputed bestseller, boasting over 21.5 million units sold as of March 31, 2025. This remarkable sales figure underscores its enduring appeal and its consistent contribution to Capcom's revenue stream through ongoing catalog sales.

Despite its age, Monster Hunter: World continues to be a significant cash cow for Capcom. Its revenue generation is further boosted by the anticipation and sales uplift from newer Monster Hunter titles, requiring minimal new investment while consistently providing substantial returns.

Resident Evil 2 Remake stands as a prime example of a Cash Cow for Capcom, having achieved remarkable sales figures. By March 31, 2025, it had sold over 15.4 million units, solidifying its position as a consistent revenue generator.

This success translates into a stable cash flow for Capcom, as the remake's strong reputation and enduring popularity mean it requires minimal ongoing marketing investment. Its reliable performance makes it a dependable source of income within Capcom's diverse product lineup.

Resident Evil Village stands as a prime example of a Cash Cow for Capcom. By March 31, 2025, it had surpassed 11.3 million units sold, with that figure climbing to 12.3 million by June 2025, demonstrating its enduring sales power.

This title commands a significant market share within the horror gaming segment, consistently generating substantial revenue. Its established success means it requires minimal additional marketing spend to maintain its strong performance, solidifying its role as a reliable income stream.

Devil May Cry 5

Devil May Cry 5 continues to be a significant cash cow for Capcom. By March 31, 2025, the game had achieved impressive sales of over 9.1 million units. This upward trend persisted, reaching 10.5 million units sold by June 2025.

The resurgence in interest, partly fueled by cross-media efforts such as the popular Netflix anime adaptation, has solidified its position. This sustained demand, even as a mature title, guarantees a robust and consistent stream of revenue for the company, making it a dependable profit generator.

- Sales Milestone: Over 9.1 million units by March 31, 2025, and 10.5 million by June 2025.

- Revenue Driver: Mature status combined with renewed interest ensures strong, steady cash flow.

- Strategic Value: Reliable contributor to Capcom's overall profitability.

Capcom's Catalog Sales Strategy

Capcom's deliberate strategy of consistently promoting and selling its vast library of established, successful video games is a significant driver of its financial success, effectively functioning as a cash cow.

This approach capitalizes on the enduring appeal of its intellectual property, generating ongoing revenue with comparatively minor incremental development expenses. In fiscal year 2024, Capcom's catalog sales reached an impressive 39.49 million unit sales, underscoring the potency of this strategy in maximizing the value of its existing brands.

- Catalog Sales as a Cash Cow: Capcom's focus on its back catalog is a prime example of a cash cow strategy.

- FY2024 Performance: The company achieved 39.49 million unit sales from its catalog in fiscal year 2024.

- Leveraging IP: This strategy effectively utilizes existing intellectual property to create sustained revenue streams.

- Cost Efficiency: Promoting older titles involves lower development costs compared to new releases, boosting profitability.

Capcom's established titles like Monster Hunter: World and Resident Evil 2 Remake are prime examples of cash cows. These games, having achieved significant sales milestones, continue to generate substantial and consistent revenue with minimal new investment. Their enduring popularity and strong brand recognition ensure they remain profitable assets within Capcom's portfolio.

Resident Evil Village and Devil May Cry 5 also function as cash cows, demonstrating sustained sales performance. By leveraging their established fan bases and, in Devil May Cry 5's case, cross-media synergy, these titles provide a reliable income stream. Capcom's strategic focus on its catalog sales, which reached 39.49 million units in fiscal year 2024, highlights the effectiveness of this approach in maximizing profitability from existing intellectual property.

| Title | Units Sold (approx. June 2025) | Cash Cow Status |

|---|---|---|

| Monster Hunter: World | 21.5 million+ | High |

| Resident Evil 2 Remake | 15.4 million+ | High |

| Resident Evil Village | 12.3 million+ | High |

| Devil May Cry 5 | 10.5 million+ | High |

Full Transparency, Always

Capcom BCG Matrix

The Capcom BCG Matrix preview you are seeing is the identical document you will receive upon purchase, ensuring complete transparency and immediate usability. This comprehensive analysis, detailing Capcom's product portfolio within the Stars, Cash Cows, Question Marks, and Dogs categories, is fully formatted and ready for your strategic decision-making. You'll gain immediate access to this professionally designed report, allowing you to seamlessly integrate its insights into your business planning and competitive analysis without any further modifications or watermarks.

Dogs

Exoprimal, despite its initial launch attracting over 1 million players, has unfortunately landed in the "Dog" quadrant of Capcom's BCG Matrix. As of July 2024, its concurrent player count on Steam has dwindled to a mere 6-77 players. This sharp decline signifies a product with very low market share.

Further reinforcing its "Dog" status, Capcom has confirmed no new seasonal content will be released after Season 4. This decision strongly suggests a lack of perceived return on investment and a product experiencing declining growth. Consequently, Exoprimal represents a significant underperformer within Capcom's portfolio.

Older, un-remastered titles from less popular Capcom series often find themselves in the Dogs quadrant of the BCG Matrix. These games, while part of a rich history, typically see very low sales figures in the current market, with their market share being minimal. For instance, many titles from the early 2000s that haven't been re-released or remastered are unlikely to contribute significantly to Capcom's overall revenue in 2024, often just covering their basic maintenance costs if any.

Specific older arcade titles with limited home console or digital presence would likely fall into the Dogs category within Capcom's BCG Matrix. These games, while potentially holding historical significance, exhibit very low market share and growth in the current gaming landscape.

Their relevance is primarily nostalgic rather than a significant driver of current revenue for Capcom. For instance, a title like Capcom's "Black Tiger," released in 1987, has seen very limited official re-releases or digital storefront availability compared to more popular franchises, placing it firmly in the low-growth, low-share quadrant.

Less Successful Experimental Mobile Titles

Capcom's mobile gaming portfolio, while featuring successes like Monster Hunter Now, also includes titles that struggled to gain significant player bases or were ultimately discontinued. These less successful experimental ventures would fall into the Dogs quadrant of the BCG matrix, characterized by low market share and low market growth.

For instance, games that required ongoing development or server maintenance despite minimal player engagement could become cash traps. This means they consume valuable resources, including developer time and operational costs, without generating substantial revenue or contributing to Capcom's overall profitability. While specific financial data for every discontinued Capcom mobile title isn't publicly detailed, the strategic implication is clear: these represent underperforming assets.

- Low Market Share: Experimental mobile titles that failed to gain traction represent a small slice of the overall mobile gaming market.

- Low Market Growth: These games often operate in saturated or declining niches, offering little prospect for future expansion.

- Cash Trap Potential: Continued investment in support or servers for these titles drains resources that could be allocated to more promising ventures.

- Resource Diversion: The focus on maintaining these underperforming games detracts from innovation and the development of potentially high-growth opportunities.

Physical-Only Releases from Past Console Generations

Physical-only releases from past console generations, like many of Capcom's early titles, would fall into the Dogs category of the BCG Matrix. These games, while perhaps holding nostalgic value, have virtually no market share in today's digital-dominant gaming landscape. Their limited accessibility and lack of modern ports mean they generate minimal to no revenue.

Consider the significant shift in game distribution. In 2024, the vast majority of game sales occur through digital storefronts. Physical media sales for older consoles have dwindled to a niche collector's market. For instance, while exact figures for Capcom's specific legacy physical-only titles are not publicly broken down, the overall decline in physical game sales for older consoles is a clear indicator.

- Dormant Assets: Games exclusive to outdated physical formats without digital re-releases are effectively dormant assets.

- Zero Market Share: In the current digital-first market, these titles possess negligible market share.

- No Growth Potential: Without ports or digital availability, there's no realistic growth potential for these games.

- Divestiture Candidates: They are prime candidates for being phased out or potentially sold off if there's any niche collector interest.

Products in the "Dog" quadrant, like certain older or underperforming Capcom titles, exhibit low market share and minimal growth prospects. These games often struggle to attract new players and generate very little revenue, sometimes only covering basic maintenance costs.

Capcom's strategy often involves either phasing out these underperformers or, in rare cases, re-releasing them as remasters to gauge potential renewed interest. However, the general trend for "Dogs" is a lack of significant investment due to poor market performance.

For instance, many legacy Capcom titles that have not received modern ports or digital re-releases in 2024 would fit this category, holding little sway in the current gaming market and representing a small fraction of Capcom's overall sales.

These titles are characterized by their low sales figures and limited player engagement, making them a drain on resources if not managed carefully. Their primary value might be historical or nostalgic rather than commercial.

| Product Example | Market Share (Estimated) | Market Growth (Estimated) | Capcom Strategy |

|---|---|---|---|

| Exoprimal (Post-Season 4) | Very Low | Declining | No new content, potential discontinuation |

| Un-remastered Legacy Titles (e.g., early 2000s) | Negligible | Stagnant/Declining | Minimal investment, potential divestiture |

| Discontinued Mobile Games | Very Low | None | Phased out, resource drain |

| Physical-Only Older Console Titles | Virtually Zero | None | Dormant assets, no market presence |

Question Marks

Pragmata, a brand-new sci-fi action-adventure IP from Capcom, is poised to enter the high-growth gaming market with a projected 2026 release. As a newcomer, it currently holds zero market share, positioning it as a classic Question Mark in the BCG Matrix. This means Pragmata requires substantial investment in development and marketing to build brand recognition and capture a significant audience in a competitive landscape.

Resident Evil Requiem, slated for a February 2026 release, is positioned as a Question Mark within Capcom's BCG Matrix. This new mainline entry aims to capitalize on the robust and growing horror game market, a sector that has shown consistent expansion.

While the Resident Evil franchise as a whole is a well-established Cash Cow, generating significant and stable revenue for Capcom, Requiem itself starts with zero market share. Its future classification hinges entirely on its performance upon launch, making it a speculative investment with high potential but also significant risk.

Onimusha: Way of the Sword and Onimusha 2 Remaster, slated for 2025/2026, represent Capcom's strategic re-entry into a beloved, albeit dormant, franchise. These titles are positioned to capitalize on the robust demand for remasters and new installments within established gaming series, a market that saw significant growth in 2023 with titles like Resident Evil 4 Remake achieving critical and commercial success, selling over 5 million units by the end of 2023.

Currently, their market share is negligible as they are pre-release products, necessitating substantial investment in marketing and development to re-engage existing fans and attract a new demographic. This investment phase places them in the Question Mark quadrant of the BCG matrix, with the potential to ascend to Star status if they successfully capture market attention and sales, mirroring the trajectory of other successful Capcom remasters.

Okami Sequel Project

The potential Okami sequel, slated for a 2026 release, represents Capcom's strategic investment in a niche but critically acclaimed franchise. This positions it as a Question Mark within the BCG matrix, operating in the high-growth market for distinctive action-adventure titles.

While the genre itself shows strong potential, Okami’s historical market share has been relatively modest, necessitating substantial marketing and development focus to achieve breakout success. Capcom's commitment to this IP, despite its smaller scale, signals a belief in its untapped commercial viability.

- Market Growth: The action-adventure genre continues to see robust growth, with global revenues projected to reach over $25 billion by 2027, indicating a favorable market for new entries.

- IP Investment: Okami's cult following and unique artistic style provide a strong foundation, but breaking into the mainstream requires significant brand building and player acquisition strategies.

- Competitive Landscape: The success of titles like Elden Ring, which blended unique art direction with challenging gameplay, demonstrates the market's appetite for innovative experiences, but also highlights the high bar for quality and differentiation.

- Strategic Focus: For the Okami sequel to transition from a Question Mark to a Star, Capcom will need to deliver exceptional gameplay, leverage effective marketing campaigns, and potentially explore broader platform availability to maximize its market penetration.

Kunitsu-Gami: Path of the Goddess

Kunitsu-Gami: Path of the Goddess, a new intellectual property from Capcom, is positioned as a potential Star or Question Mark within the BCG Matrix. Its launch as a Nintendo Switch 2 title in June 2025 places it in a rapidly expanding gaming market, a segment that saw global revenue reach an estimated $225 billion in 2024.

As a new IP, Kunitsu-Gami begins with a low market share, necessitating significant investment in marketing and development to capture audience attention. The success of new game launches in 2024, with many titles exceeding 1 million units sold within their first month, highlights the competitive landscape and the need for strong initial performance.

- Market Growth: Enters a high-growth gaming market, projected to continue its upward trajectory through 2025.

- Market Share: Starts with a low market share, typical for new intellectual properties.

- Strategic Imperative: Requires strong initial sales and positive critical reception to avoid becoming a Dog.

- Investment: Capcom's commitment to new IPs suggests a strategy to diversify its portfolio and tap into emerging trends.

Question Marks represent new products or IPs with low market share in high-growth markets. Capcom's upcoming titles like Pragmata, Resident Evil Requiem, Onimusha remasters, the potential Okami sequel, and Kunitsu-Gami: Path of the Goddess all fit this description. These ventures require significant investment to build brand awareness and capture market share, with their future success dependent on strong initial performance and strategic marketing to transition from Question Marks to Stars.

| Product/IP | Market Growth | Current Market Share | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| Pragmata | High (Sci-Fi Action-Adventure) | Zero | Substantial (Development & Marketing) | Star or Dog |

| Resident Evil Requiem | High (Horror Games) | Zero | Substantial (Development & Marketing) | Star or Dog |

| Onimusha Remasters | High (Remasters/Revivals) | Negligible (Pre-release) | Significant (Marketing & Development) | Star or Dog |

| Okami Sequel | High (Action-Adventure) | Modest (Historical) | High (Marketing & Development) | Star or Dog |

| Kunitsu-Gami: Path of the Goddess | High (General Gaming Market) | Low (New IP) | Significant (Marketing & Development) | Star or Dog |

BCG Matrix Data Sources

Our Capcom BCG Matrix is built on verified market intelligence, combining financial data from Capcom's official reports, industry research on the gaming sector, and expert commentary on market trends to ensure reliable insights.