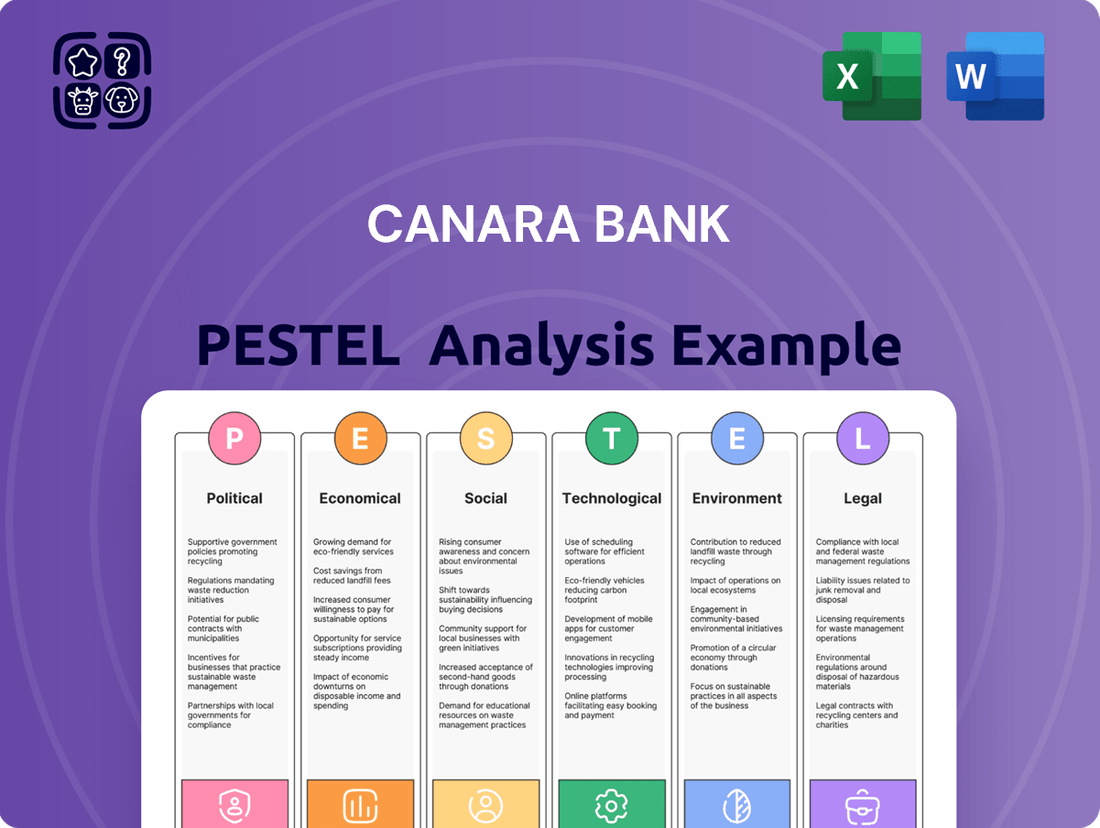

Canara Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canara Bank Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Canara Bank's trajectory. Our PESTLE analysis provides a comprehensive overview of these external forces, empowering you to anticipate challenges and capitalize on opportunities. Gain a strategic advantage by understanding the full landscape. Download the complete PESTLE analysis now for actionable intelligence.

Political factors

As a public sector undertaking, Canara Bank is deeply affected by the Indian government's directives on the financial industry. New legislation like the Banking Laws (Amendment) Act, 2025, is designed to bolster governance, protect account holders, and elevate audit standards within public sector banks. These regulatory shifts directly shape Canara Bank's operational structure and strategic planning.

The Indian government and the Reserve Bank of India (RBI) are actively promoting financial inclusion. Initiatives like the Pradhan Mantri Jan Dhan Yojana (PMJDY) have significantly expanded access to banking services, with over 50 crore accounts opened by early 2024. The RBI's Financial Inclusion Index, which stood at 60.1 in March 2023, also reflects this growing trend.

Canara Bank plays a crucial role in these efforts, particularly by extending its reach into rural and underserved regions. This focus impacts its strategic decisions regarding branch network expansion and the development of tailored financial products designed to serve a broader customer base, including those previously excluded from formal banking channels.

The Reserve Bank of India (RBI) plays a crucial role in overseeing public sector banks like Canara Bank. Its prudential norms, which dictate how banks recognize income, classify assets, and set aside provisions for potential losses, directly influence the bank's financial stability and how it manages risk. For instance, in the fiscal year ending March 2024, the RBI's continued focus on asset quality improvement and robust provisioning measures, as seen in its supervisory actions on certain banks, underscores the importance of compliance for Canara Bank's operational framework.

Privatization and Consolidation Talks

While Canara Bank operates as a public sector undertaking, ongoing discussions about privatization and consolidation within India's banking landscape present a significant political factor. These broader policy directions can shape Canara Bank's strategic outlook and competitive standing, even without direct privatization mandates.

The Indian government's stance on banking sector reforms, including potential mergers or divestments, remains a key political consideration. For instance, the government has previously indicated a willingness to explore consolidation to create stronger, more resilient banking entities, a trend that could indirectly impact Canara Bank's future.

- Government Policy Direction: The political climate and evolving government policies on public sector bank ownership and structure are crucial.

- Market Consolidation Trends: Broader consolidation in the Indian banking sector, driven by political will or economic necessity, could influence Canara Bank's strategic options.

- Investor Sentiment: Speculation and political discourse around privatization can affect investor confidence and the bank's valuation.

- Regulatory Environment: Political decisions on banking sector regulation and supervision directly impact operational frameworks for all banks, including Canara Bank.

Geopolitical Stability and Trade Agreements

India's geopolitical stability is a cornerstone for Canara Bank's operations. A secure environment encourages foreign direct investment, which in turn fuels economic growth and provides opportunities for the banking sector. For instance, India's continued engagement in trade discussions, like the ongoing Free Trade Agreement (FTA) negotiations with the United Kingdom, signals a commitment to global economic integration. This can lead to increased cross-border financial flows and enhanced treasury operations for banks like Canara.

The stability of India's political landscape directly correlates with investor confidence. When the nation is perceived as stable, both domestic and international investors are more likely to deploy capital, leading to a more robust economic climate. This positively impacts the banking sector through increased lending opportunities and improved asset quality. Canara Bank, with its significant international presence, benefits from a predictable geopolitical environment that supports its global banking and treasury activities.

Key geopolitical and trade-related factors influencing Canara Bank include:

- India's ongoing FTA negotiations with key trading partners, such as the UK, aiming to boost bilateral trade and investment flows.

- The nation's proactive role in regional security initiatives, contributing to a stable environment for economic activity.

- Government policies promoting ease of doing business and attracting foreign capital, which directly supports banking sector growth.

Government policies directly shape Canara Bank's operational framework, with new legislation like the Banking Laws (Amendment) Act, 2025, aiming to enhance governance and audit standards. The push for financial inclusion, evidenced by over 50 crore accounts opened under PMJDY by early 2024, sees Canara Bank expanding into underserved regions, influencing its branch network and product development strategies.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental factors influencing Canara Bank, covering political stability, economic trends, social demographics, technological advancements, environmental regulations, and legal frameworks.

It provides strategic insights into how these forces shape the bank's operational landscape, identifying potential threats and opportunities for informed decision-making.

A concise PESTLE analysis for Canara Bank, presented in a clear, summarized format, acts as a pain point reliever by streamlining complex external factors for efficient strategic decision-making.

Economic factors

The Reserve Bank of India's (RBI) monetary policy, particularly adjustments to the repo rate, significantly shapes Canara Bank's financial landscape. Changes in the repo rate directly influence the bank's lending and deposit rates, thereby impacting its net interest margins (NIMs). For instance, a lower repo rate can stimulate credit demand, potentially boosting loan volumes for Canara Bank.

As of June 2025, the RBI's decision to reduce the repo rate to 5.50% presents both opportunities and challenges for Canara Bank. This move is intended to encourage borrowing across the economy, which could translate into increased business for the bank. However, it also puts pressure on the bank to manage its funding costs effectively to maintain healthy profitability.

Canara Bank's financial health is intrinsically linked to India's broader credit expansion and the caliber of its loan portfolio. A robust credit environment fuels demand for banking services, directly benefiting institutions like Canara Bank.

Public sector banks, including Canara Bank, have demonstrably strengthened their asset quality. For instance, the Gross Non-Performing Assets (GNPA) ratio for public sector banks, as reported by the Reserve Bank of India, has seen a consistent decline, reaching approximately 3.2% by the end of September 2023. This improvement significantly bolsters profitability and enhances capital adequacy ratios, providing a stronger foundation for future growth and lending.

India's economic growth trajectory significantly impacts Canara Bank. For FY2024-25, real GDP growth is projected at a strong 6.5%, with a similar 6.5% expected for FY2025-26. This robust expansion fuels consumer spending and business investment, directly translating to increased demand for banking services like loans and deposits.

Inflationary pressures also play a crucial role. While specific inflation targets for India in 2024-2025 are subject to ongoing economic developments, managing inflation is key for maintaining purchasing power and stable economic conditions. Moderate inflation supports healthy demand, whereas high inflation can dampen consumer sentiment and increase borrowing costs, affecting loan demand and profitability for banks like Canara.

Deposit Growth and Liquidity

Canara Bank's ability to attract and retain customer deposits is a cornerstone of its financial health, directly fueling its lending operations. In FY23, Canara Bank reported a robust 11.5% year-on-year growth in total deposits, reaching ₹12.73 lakh crore. However, the economic landscape presents ongoing challenges, with intense competition for these crucial funds and the sensitivity of deposit mobilization to fluctuating interest rates.

The Reserve Bank of India (RBI) plays a pivotal role in managing the overall liquidity within the banking system. Its policy adjustments, including changes to the repo rate and cash reserve ratio (CRR), directly influence the cost and availability of funds for banks like Canara. For instance, during periods of tight liquidity, the RBI might inject funds to ease conditions, impacting the interest rate environment for deposits.

- Deposit Growth: Canara Bank's total deposits stood at ₹12.73 lakh crore as of March 31, 2023, marking an 11.5% increase from the previous fiscal year.

- Competitive Landscape: The banking sector faces significant competition for retail and corporate deposits, putting pressure on interest rates offered.

- Interest Rate Sensitivity: Changes in the RBI's policy rates directly affect the cost of borrowing for banks and influence their ability to attract deposits.

- Liquidity Management: The RBI's monetary policy actions, such as open market operations and CRR adjustments, are critical in maintaining systemic liquidity and influencing bank funding costs.

Global Economic Conditions

Global economic conditions significantly shape India's financial landscape, directly impacting banks like Canara Bank. Forecasts for global GDP growth and the state of international trade relations are crucial indicators. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight uptick from 2023, signaling a more stable international environment. This stability can translate into increased foreign investment and trade for India, bolstering its economic growth.

Fears of trade wars, which had previously cast a shadow over global economic prospects, have shown signs of receding. This easing of tensions is beneficial as it encourages greater cross-border commerce. A healthier global trade environment generally leads to higher demand for Indian exports and can attract more foreign capital, thereby supporting domestic economic expansion and creating a more favorable operating environment for the Indian banking sector.

- Global GDP Growth Forecast: The IMF estimated global growth at 3.2% for 2024.

- Trade Relations: Easing trade war concerns contribute to a more predictable international business climate.

- Impact on India: Improved global conditions can boost Indian exports and foreign investment inflows.

- Banking Sector Influence: A stronger Indian economy, driven by global factors, generally benefits the banking industry through increased credit demand and lower non-performing assets.

India's robust economic growth, projected at 6.5% for FY2024-25 and FY2025-26, directly fuels demand for Canara Bank's services, boosting loan and deposit volumes. While the RBI's repo rate cuts, like the one to 5.50% in June 2025, aim to stimulate borrowing, they also necessitate careful management of funding costs to maintain profitability. The banking sector's improving asset quality, with GNPA ratios for public sector banks around 3.2% by September 2023, strengthens Canara Bank's financial foundation. Global economic stability, with IMF forecasting 3.2% global growth in 2024, further supports India's economy through increased trade and investment, creating a favorable environment for the bank.

| Economic Factor | Impact on Canara Bank | Relevant Data (as of latest available) |

| GDP Growth | Drives demand for loans and banking services. | India projected at 6.5% for FY2024-25 and FY2025-26. |

| Monetary Policy (Repo Rate) | Influences lending rates, deposit rates, and NIMs. | RBI repo rate at 5.50% as of June 2025. |

| Asset Quality | Enhances profitability and capital adequacy. | Public Sector Banks' GNPA ratio ~3.2% (Sept 2023). |

| Global Economic Conditions | Impacts foreign investment and trade, supporting domestic growth. | Global GDP growth forecast at 3.2% for 2024 (IMF). |

Full Version Awaits

Canara Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Canara Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic decisions. Understand the complete picture of external influences shaping Canara Bank's future.

Sociological factors

India's push for financial inclusion is bringing more people, especially from rural areas, into formal banking. As of March 2024, over 50 crore Jan Dhan accounts have been opened, indicating a significant expansion of the banking network. This trend requires Canara Bank to offer user-friendly products and actively participate in financial literacy programs to cater to this expanding customer base.

Indian consumers, particularly the younger, digitally native demographic, are rapidly shifting towards online and mobile banking platforms. This trend is underscored by the fact that as of Q1 2024, over 70% of banking transactions in India were conducted through digital channels, a significant jump from previous years.

Canara Bank must prioritize enhancing its digital offerings to meet these evolving consumer expectations. This includes ensuring a smooth, intuitive user experience across its mobile app and internet banking services, which is crucial for customer retention and attracting new clients in a competitive market.

India's urbanization is accelerating, with the urban population projected to reach 43.2% by 2030, according to the National Institute of Urban Affairs. This demographic shift creates a significant opportunity for Canara Bank to expand its reach to a growing middle class and a youthful demographic eager for financial services like retail loans, wealth management, and investment products. The bank must adapt its branch network and digital presence to effectively serve these evolving customer needs.

Trust and Reputation in Public Sector Banks

As a public sector bank, Canara Bank benefits from a foundational level of public trust, often seen as a safer bet compared to private institutions. This perception is vital for attracting and retaining a broad customer base. For instance, as of March 2024, Canara Bank reported a robust customer base exceeding 13 crore, a testament to its established reputation.

Maintaining this trust is paramount, particularly with the rise in digital transactions and the associated cybersecurity threats. Canara Bank's commitment to transparent operations and ethical conduct directly impacts its reputation. In the fiscal year 2023-24, the bank emphasized strengthening its digital security infrastructure to safeguard customer data and build confidence.

The bank's performance and public perception are closely linked to its adherence to regulatory standards and its responsiveness to customer needs. Positive customer service experiences and effective grievance redressal mechanisms are key sociological factors that bolster its standing. Canara Bank's digital initiatives, such as enhanced mobile banking features launched in late 2024, aim to improve customer satisfaction and reinforce trust.

Key aspects influencing trust and reputation include:

- Perceived Stability: Public sector banks are generally viewed as more stable due to government backing, which appeals to risk-averse customers.

- Transparency and Ethics: Open communication about policies and a commitment to fair practices are essential for maintaining public confidence.

- Customer Service Excellence: Efficient and helpful customer support, both online and offline, directly impacts satisfaction and loyalty.

- Digital Security: Robust cybersecurity measures are critical to protect customers from fraud and ensure the integrity of their financial data.

Employment Trends and Income Levels

Overall employment trends and rising income levels in India significantly bolster the financial sector. As more people find stable jobs and earn higher wages, there's a natural increase in savings, a greater propensity to invest, and a stronger demand for credit products. This directly impacts Canara Bank by expanding its potential deposit base and creating more lending opportunities across various customer segments, contributing to the bank's overall growth and the economic health of its clientele.

Key employment and income statistics for India in 2024 and early 2025 underscore this trend:

- Unemployment Rate: Projected to remain around 7-8% in 2024, with a gradual decline anticipated in 2025 as economic activity picks up.

- Nominal GDP Growth: Expected to be robust, around 9-10% in FY2024-25, driving income growth.

- Per Capita Income: Continues its upward trajectory, indicating increased disposable income for a larger segment of the population.

- Formal Sector Employment: Saw a steady increase in 2024, particularly in services and manufacturing, leading to more individuals with access to formal banking services.

Shifting consumer preferences are a major sociological factor for Canara Bank. The increasing digital adoption, with over 70% of banking transactions in India occurring online as of Q1 2024, necessitates a strong digital presence. Furthermore, a growing emphasis on financial literacy, driven by initiatives like the expansion of Jan Dhan accounts (over 50 crore by March 2024), requires banks to offer accessible and understandable products.

Technological factors

The Indian banking sector is experiencing a significant digital overhaul, with institutions like Canara Bank heavily investing in cutting-edge technologies. This transformation focuses on boosting operational efficiency and elevating the customer experience, a crucial differentiator in today's market. By embracing digital solutions, banks aim to streamline processes and offer more personalized services.

To stay competitive, Canara Bank must prioritize continuous upgrades to its digital infrastructure. This includes adopting advanced technologies such as Artificial Intelligence (AI) and sophisticated data analytics. Leveraging platforms like the Unified Payments Interface (UPI) is also paramount, as evidenced by UPI's transaction volume, which reached over 12 billion transactions in the fiscal year 2023-24, demonstrating its widespread adoption and importance in digital payments.

As banks like Canara Bank increasingly operate on digital platforms, cybersecurity has become a paramount concern. The Indian financial sector, in particular, has witnessed a significant rise in advanced cyber threats. These include sophisticated phishing schemes, the emerging danger of deepfakes, and disruptive ransomware attacks, all of which pose substantial risks to financial institutions.

Canara Bank, like its peers, must proactively address these evolving threats. This necessitates substantial investment in cutting-edge cybersecurity infrastructure and protocols. Such investments are crucial not only for safeguarding sensitive customer data but also for preserving the bank's reputation and maintaining customer trust in an increasingly digitalized banking environment.

The banking sector is rapidly integrating Artificial Intelligence (AI) and Machine Learning (ML) to streamline operations and enhance customer experiences. Canara Bank can harness these advancements for hyper-personalized services and robust risk management. For instance, by Q1 2024, many leading banks reported significant improvements in fraud detection rates, with AI-powered systems identifying suspicious transactions with up to 90% accuracy, a substantial leap from traditional methods.

Leveraging AI and ML allows Canara Bank to move towards more predictive risk assessment and improved operational efficiency. This includes automating tasks, optimizing resource allocation, and gaining deeper insights from vast datasets. By the end of 2024, it's projected that AI in banking will contribute to cost savings of over 20% through process automation and enhanced decision-making capabilities.

Mobile Banking and Payment Systems

The increasing reliance on mobile banking and digital payment platforms, such as India's Unified Payments Interface (UPI), fundamentally alters how banking services are accessed and utilized. Canara Bank needs to ensure its mobile offerings are intuitive, robustly secured, and provide a full spectrum of banking functions to meet the escalating consumer preference for digital transactions.

By the end of 2024, UPI transactions in India were projected to surpass 150 billion, highlighting a significant shift towards digital payments. Canara Bank's ability to innovate and enhance its mobile banking app, offering features like instant loan approvals and personalized financial management tools, will be crucial for retaining and attracting customers in this evolving landscape.

- User Experience: Canara Bank's mobile app must be exceptionally easy to navigate, even for less tech-savvy users.

- Security Features: Implementing advanced security protocols, including biometric authentication and multi-factor verification, is paramount to building customer trust.

- Service Integration: The app should seamlessly integrate services like account management, fund transfers, bill payments, investments, and loan applications.

- Digital Adoption: Canara Bank reported a significant increase in digital transactions, with mobile banking channels showing robust growth, reflecting the broader market trend.

Cloud Computing and Data Analytics

Cloud computing provides Canara Bank with enhanced scalability and operational efficiency, allowing for flexible resource allocation and reduced infrastructure costs. This shift supports agile banking services and faster deployment of new digital products. In 2024, the global cloud computing market in financial services was projected to reach significant figures, indicating a strong trend towards cloud adoption.

Advanced data analytics is crucial for Canara Bank to gain deeper insights into customer behavior, risk management, and market dynamics. By leveraging these tools, the bank can tailor personalized financial products and services, thereby improving customer engagement and loyalty. For instance, predictive analytics can help identify potential loan defaults or cross-selling opportunities.

These technological advancements empower Canara Bank to make more informed, data-driven strategic decisions. This includes optimizing marketing campaigns, enhancing cybersecurity measures, and identifying new revenue streams. The bank's investment in digital transformation, including cloud and analytics capabilities, is a key driver for its competitive edge in the evolving financial landscape.

- Scalability and Efficiency: Cloud adoption allows for dynamic scaling of IT resources, adapting to fluctuating demand and reducing operational overhead.

- Customer Insights: Data analytics enables granular understanding of customer preferences, leading to personalized product offerings and improved service delivery.

- Data-Driven Decision Making: Utilizing analytics for risk assessment, fraud detection, and market trend analysis supports strategic planning and resource allocation.

- Digital Transformation: Investment in cloud and analytics is central to Canara Bank's strategy for modernizing operations and enhancing its digital banking presence.

Technological advancements are fundamentally reshaping the banking landscape, pushing institutions like Canara Bank to embrace digital transformation for enhanced efficiency and customer experience. The increasing adoption of AI and advanced data analytics is enabling hyper-personalized services and more robust risk management, with AI systems now achieving up to 90% accuracy in fraud detection by early 2024.

Canara Bank's strategic focus on cloud computing and data analytics is crucial for scalability, operational efficiency, and gaining deeper customer insights. This digital push is vital for staying competitive, especially with UPI transactions projected to exceed 150 billion by the end of 2024, underscoring the rapid shift towards digital payments in India.

| Technology Area | Key Impact for Canara Bank | Relevant 2024/2025 Data/Trend |

|---|---|---|

| AI & Machine Learning | Enhanced fraud detection, hyper-personalized services, predictive risk assessment | AI in banking projected to yield over 20% cost savings by end of 2024 through automation. |

| Cloud Computing | Scalability, operational efficiency, faster digital product deployment | Global financial services cloud market showing significant growth trends in 2024. |

| Data Analytics | Deeper customer insights, personalized product offerings, improved risk management | Predictive analytics aiding in identifying loan defaults and cross-selling opportunities. |

| Digital Payments (UPI) | Increased transaction volumes, shift in customer banking preferences | UPI transactions projected to surpass 150 billion by end of 2024 in India. |

Legal factors

Canara Bank navigates a complex legal landscape shaped by the Reserve Bank of India Act, 1934, and the Banking Regulation Act, 1949. These foundational laws dictate operational standards, capital adequacy, and customer protection measures.

The Banking Laws (Amendment) Act, 2025, for instance, has introduced significant shifts, particularly concerning corporate governance and the management of unclaimed deposits. These amendments necessitate proactive adjustments in Canara Bank's internal policies and compliance mechanisms to ensure adherence, impacting everything from board composition to fund management protocols.

Canara Bank, like all financial institutions, operates under stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations designed to combat financial crime. These rules require rigorous customer identification and ongoing transaction monitoring, which can be complex and resource-intensive. Adherence to these evolving norms is critical for Canara Bank to avoid significant penalties and maintain its operational license.

Consumer protection laws in India are continuously evolving, with a strong focus on safeguarding financial service users. Canara Bank must remain vigilant in ensuring its offerings, including loan products and digital services, adhere to regulations like the Consumer Protection Act, 2019, and Reserve Bank of India (RBI) guidelines on fair practices. For instance, the RBI's recent directives on digital lending practices highlight the need for transparency in fees and charges, a critical area for Canara Bank to manage to prevent customer dissatisfaction and potential penalties.

Data Privacy and Cybersecurity Laws

The digital transformation in banking makes data privacy and cybersecurity paramount for Canara Bank. Compliance with evolving regulations around data handling, storage, and usage is essential to safeguard sensitive customer information and maintain trust. For instance, India's Digital Personal Data Protection Act, 2023, mandates stringent consent mechanisms and data breach notification protocols, impacting how Canara Bank manages its vast customer data. Failure to adhere can result in significant penalties and reputational damage.

Canara Bank must navigate a complex web of legal frameworks governing data protection and cybersecurity. These laws dictate how customer data is collected, processed, stored, and shared, requiring robust internal controls and regular audits. The Reserve Bank of India (RBI) also issues directives on cybersecurity preparedness and incident response, which are critical for a financial institution. As of early 2024, the focus remains on strengthening data localization requirements and enhancing penalties for non-compliance, directly affecting Canara Bank's operational procedures.

- Data Protection Compliance: Adherence to the Digital Personal Data Protection Act, 2023, and RBI guidelines on data privacy.

- Cybersecurity Mandates: Implementing RBI's cybersecurity framework, including regular vulnerability assessments and penetration testing.

- Incident Reporting: Establishing clear protocols for reporting data breaches and cyber incidents to regulatory authorities within stipulated timelines.

- Cross-border Data Flows: Ensuring compliance with regulations governing the transfer of data outside India, if applicable to Canara Bank's operations.

Corporate Governance Standards

Canara Bank, like all public sector banks in India, operates within a stringent legal framework that dictates corporate governance standards. These regulations cover crucial areas such as the composition of the bank's board of directors, the process for appointing and remunerating auditors, and the mechanisms for ensuring accountability at all levels of management. For instance, the Reserve Bank of India (RBI) has specific guidelines on board independence and the roles of various committees, which Canara Bank must adhere to.

The recently enacted Banking Laws (Amendment) Act, 2025, is poised to further refine these governance requirements. This legislation introduces enhanced disclosure norms and strengthens the oversight powers of regulatory bodies. Consequently, Canara Bank will need to adapt its internal governance structures and audit practices to align with these updated legal mandates, potentially impacting its operational efficiency and risk management frameworks. The Act also emphasizes greater transparency in financial reporting, a critical aspect for investor confidence.

- Board Composition: Adherence to RBI guidelines on independent directors and committee structures.

- Auditor Remuneration: Compliance with new regulations on auditor appointment and fee structures as per the 2025 Act.

- Accountability Frameworks: Strengthening internal controls and reporting lines to meet enhanced accountability standards.

- Disclosure Norms: Implementing stricter disclosure requirements mandated by the Banking Laws (Amendment) Act, 2025.

Canara Bank's legal compliance is heavily influenced by evolving consumer protection laws, particularly the Consumer Protection Act, 2019, and RBI directives on fair practices. Recent RBI guidelines on digital lending, effective from 2024, emphasize enhanced transparency in fees and charges, directly impacting Canara Bank's digital product offerings and customer communication strategies. Failure to comply can lead to customer complaints and regulatory scrutiny.

Environmental factors

The global and national focus on climate change is intensifying, driving a significant rise in demand for green finance and sustainable banking. This trend presents both opportunities and challenges for financial institutions like Canara Bank.

In response, Canara Bank is anticipated to expand its offerings of green loans and increase funding for renewable energy projects. Aligning with environmental, social, and governance (ESG) principles is becoming crucial for long-term financial health. For instance, by the end of fiscal year 2023, India's renewable energy capacity had reached over 179 GW, indicating a substantial market for green financing.

Financial institutions in India, including Canara Bank, are facing growing pressure to adopt and report on Environmental, Social, and Governance (ESG) practices. This trend is driven by evolving stakeholder expectations and a tightening regulatory landscape.

Canara Bank is thus compelled to develop comprehensive ESG frameworks, conduct thorough assessments of climate-related financial risks, and potentially issue dedicated ESG reports. Meeting these demands is crucial for maintaining investor confidence and ensuring compliance with emerging guidelines, reflecting a significant shift towards sustainable finance.

Canara Bank, like other major financial institutions, has an environmental footprint stemming from its operations, including energy use in branches and data centers, waste produced, and paper consumed for transactions and reports. In 2023, the banking sector in India saw a growing emphasis on sustainability, with many banks exploring ways to reduce their carbon emissions.

To mitigate this, Canara Bank can adopt several eco-friendly strategies. This includes investing in energy-efficient technologies for its offices, exploring renewable energy sources like solar power for its facilities, and implementing robust waste reduction and recycling programs. For instance, a significant portion of operational costs can be tied to energy, and improvements here directly impact both environmental and financial performance.

Sustainable Development Goals (SDGs) Alignment

India's ambitious commitment to the UN's Sustainable Development Goals (SDGs) and its pledge to achieve Net Zero emissions by 2070 are significantly reshaping the banking landscape. This national agenda directly influences financial institutions like Canara Bank to prioritize and support sustainable development initiatives through their operations and lending portfolios.

Canara Bank plays a crucial role in this transition by aligning its lending practices with environmental, social, and governance (ESG) principles. The bank's corporate social responsibility (CSR) activities are increasingly focused on contributing to these broader national and global environmental objectives, such as promoting renewable energy and sustainable agriculture.

- SDG Alignment: Canara Bank's lending to sectors contributing to SDG 7 (Affordable and Clean Energy) and SDG 13 (Climate Action) is a key focus.

- Net Zero Contribution: The bank's financing of green projects and its own operational efficiency measures support India's 2070 Net Zero target.

- Sustainable Finance Growth: As of FY23, Canara Bank reported a significant increase in its green finance portfolio, reflecting growing market demand and policy impetus.

- CSR Impact: Initiatives in areas like afforestation and water conservation directly address environmental SDGs, enhancing the bank's sustainability credentials.

Risk Management of Environmental Factors

Canara Bank, like all financial institutions, faces growing environmental risks that demand robust management. These risks are broadly categorized into physical risks, such as damage to properties from extreme weather events impacting loan collateral, and transition risks, arising from policy shifts and market sentiment changes affecting carbon-intensive sectors. For instance, the Reserve Bank of India (RBI) has been actively encouraging banks to incorporate climate risk into their frameworks, with a significant portion of Indian banks reporting climate risk considerations in their 2023-24 disclosures.

Integrating these environmental factors is crucial for Canara Bank's long-term stability and strategic planning. The bank must develop methodologies to assess and quantify potential losses stemming from climate-related events and policy changes. This proactive approach helps in safeguarding assets and ensuring business continuity in an evolving regulatory and physical landscape.

- Physical Risks: Increased frequency and severity of natural disasters like floods and heatwaves can directly impact Canara Bank's loan portfolio through damage to mortgaged properties and business disruptions for borrowers.

- Transition Risks: Policy changes aimed at decarbonization could devalue assets in sectors heavily reliant on fossil fuels, potentially leading to loan defaults and credit losses for the bank.

- Regulatory Scrutiny: Global and domestic regulators, including the RBI, are increasingly focusing on climate-related financial disclosures and risk management practices, necessitating compliance and transparency from banks like Canara.

- Reputational Impact: A bank's perceived inaction on climate change can affect its brand image and customer loyalty, especially among environmentally conscious stakeholders.

Canara Bank, like its peers, must navigate the increasing demand for green finance, driven by India's commitment to Net Zero by 2070 and a growing renewable energy sector. The bank's proactive stance in expanding green loan offerings and funding renewable projects, such as its significant increase in green finance portfolio by FY23, directly supports these national environmental goals.

The bank's operational footprint necessitates eco-friendly strategies, including energy efficiency and waste reduction, to align with sustainability principles and mitigate its own environmental impact. Furthermore, Canara Bank must actively manage both physical risks, like extreme weather events impacting collateral, and transition risks, stemming from policy shifts affecting carbon-intensive industries, as highlighted by increasing RBI guidance on climate risk management.

| Environmental Factor | Impact on Canara Bank | Key Data/Trends (2023-2025) |

|---|---|---|

| Climate Change & Green Finance | Increased demand for green loans and sustainable products. | India's renewable energy capacity exceeded 179 GW by FY23. Canara Bank's green finance portfolio saw significant growth in FY23. |

| Operational Footprint | Need for energy efficiency, waste reduction, and renewable energy adoption. | Growing emphasis on reducing carbon emissions across the Indian banking sector in 2023. |

| Climate-Related Risks | Exposure to physical risks (extreme weather) and transition risks (policy changes). | RBI encouraging banks to integrate climate risk into frameworks; many banks reported climate risk considerations in 2023-24 disclosures. |

| Regulatory & Stakeholder Pressure | Mandatory ESG reporting and adherence to sustainability guidelines. | Evolving stakeholder expectations and a tightening regulatory landscape for ESG practices. |

PESTLE Analysis Data Sources

Our Canara Bank PESTLE Analysis is built on a comprehensive review of data from official Indian government sources, Reserve Bank of India (RBI) reports, and reputable financial news outlets. We incorporate insights from economic surveys, industry-specific publications, and technological trend analyses to ensure a well-rounded perspective.