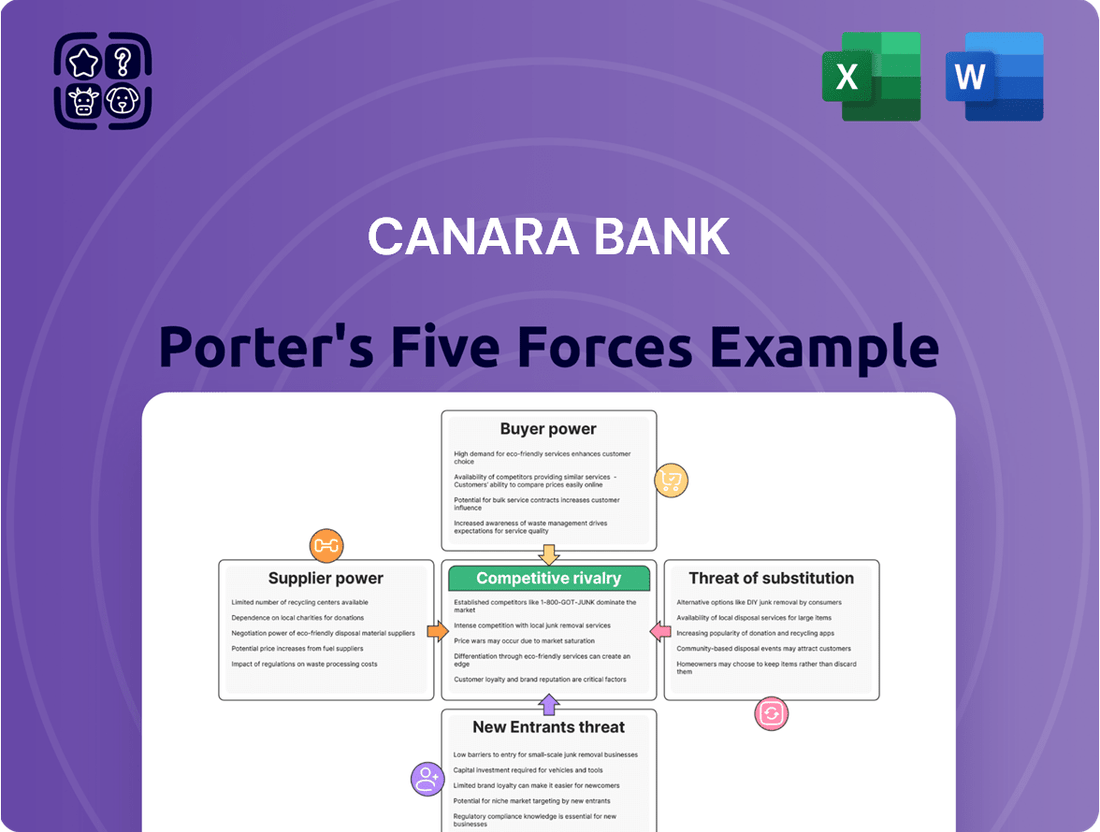

Canara Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canara Bank Bundle

Canara Bank navigates a competitive landscape shaped by moderate buyer power and the persistent threat of new entrants, while supplier power remains relatively low. Understanding these dynamics is crucial for strategic planning.

The complete report reveals the real forces shaping Canara Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Canara Bank's reliance on specialized technology and cybersecurity providers is substantial, as these firms offer critical infrastructure and security solutions. Their niche expertise and the essential nature of their services grant them considerable bargaining power, directly influencing the bank's operational expenses and strategic planning.

The increasing global threat landscape, with cyberattack costs anticipated to hit $10.5 trillion annually by 2025, underscores the vital role and leverage of these technology and security partners, making their services indispensable for Canara Bank's continued operations and data protection.

The availability of skilled banking professionals, particularly in IT, financial analysis, and customer service, forms a critical supplier group for Canara Bank. A scarcity of these professionals or heightened demand within India's competitive banking landscape can drive up salary expenses for the bank.

For instance, in 2023, the demand for digital banking specialists saw a significant surge across the Indian financial sector, leading to increased recruitment costs for banks like Canara. To counter this supplier power, Canara Bank needs to focus on robust employee retention strategies and continuous skill enhancement programs.

Depositors, while customers, are also crucial suppliers of financial capital for Canara Bank. In India's dynamic banking sector, where numerous institutions vie for funds, depositors wield moderate bargaining power. They can shift their savings to banks offering more attractive interest rates or innovative deposit products.

For instance, as of March 2024, Canara Bank offered savings account interest rates typically around 3.00% to 3.50%, while fixed deposit rates varied from approximately 4.50% to 7.00% depending on the tenure. These rates are benchmarked against competitors, highlighting the need for Canara Bank to remain competitive to attract and retain deposits, which are the lifeblood of its lending operations.

Interbank and Wholesale Funding

Canara Bank’s reliance on interbank and wholesale funding markets means suppliers in these areas hold significant bargaining power. These suppliers, often large financial institutions, can dictate terms based on prevailing economic conditions and central bank directives. For instance, the Reserve Bank of India's (RBI) Monetary Policy Committee decisions directly impact liquidity and the cost of funds for banks like Canara.

The bargaining power of suppliers in interbank and wholesale funding is evident in how interest rates fluctuate. When liquidity is tight, or the central bank tightens monetary policy, the cost of borrowing for banks increases. Conversely, accommodative policies can lower these costs. For example, following the RBI's repo rate adjustments, the interbank call money rates also adjust, reflecting the cost of funds for banks.

- Interbank Market Influence: Suppliers in the interbank market can leverage their liquidity positions to influence borrowing costs for banks like Canara.

- Wholesale Funding Terms: The terms for wholesale funding, such as certificates of deposit or commercial paper, are subject to market sentiment and the creditworthiness perception of the borrowing bank.

- RBI Policy Impact: Recent RBI actions, such as changes in the Cash Reserve Ratio (CRR) or Statutory Liquidity Ratio (SLR), directly affect the overall liquidity available in the banking system, thereby impacting the bargaining power of funding suppliers. For instance, a CRR cut generally injects liquidity, potentially softening borrowing costs.

Infrastructure and Utilities

Suppliers of physical infrastructure, like real estate for branches and ATMs, and essential utility services such as electricity and internet, exert a degree of bargaining power. The consistent availability and pricing of these services directly impact Canara Bank's operational efficiency and its capacity for expansion. For instance, securing prime real estate for new branches or maintaining the operational integrity of its existing 6,323 branches and 10,907 ATMs in fiscal year 2023-24 necessitates reliable infrastructure partnerships.

- Real Estate Costs: Fluctuations in commercial property rental rates can influence the bank's overheads for its physical presence.

- Utility Dependence: Consistent and affordable access to electricity and high-speed internet is crucial for seamless digital banking operations and customer service.

- Infrastructure Reliability: The quality and dependability of these foundational services directly affect customer experience and operational continuity.

Suppliers of specialized technology, particularly in cybersecurity and IT infrastructure, hold significant bargaining power due to their niche expertise and the critical nature of their services for Canara Bank. The escalating global threat landscape, with cyberattack costs projected to reach $10.5 trillion annually by 2025, amplifies the leverage of these providers, making them indispensable for operational continuity and data protection.

The availability of skilled banking professionals, especially in IT and digital banking, represents another key supplier group. Scarcity in this talent pool, as seen with the surge in demand for digital specialists in India in 2023, drives up recruitment and salary costs for banks like Canara. To mitigate this, the bank focuses on retention and skill development.

Depositors, as suppliers of financial capital, possess moderate bargaining power in India's competitive banking environment. They can easily shift funds to institutions offering more attractive interest rates, such as Canara Bank's savings rates around 3.00%-3.50% and fixed deposit rates between 4.50%-7.00% as of March 2024, necessitating competitive offerings.

Canara Bank's reliance on interbank and wholesale funding markets means suppliers in these areas, often large financial institutions, can dictate terms influenced by economic conditions and RBI directives. Monetary policy shifts, like repo rate adjustments, directly impact liquidity and borrowing costs, as reflected in interbank call money rates.

| Supplier Group | Bargaining Power | Impact on Canara Bank | Key Factors | Mitigation Strategies |

|---|---|---|---|---|

| Technology & Cybersecurity Providers | High | Increased operational costs, dependence on specialized services | Niche expertise, critical infrastructure, global cyber threats | Long-term contracts, diversification of providers, in-house capabilities |

| Skilled Banking Professionals | Moderate to High | Higher salary expenses, recruitment challenges | Demand for digital skills, competitive talent market | Employee retention programs, skill enhancement, attractive compensation |

| Depositors (Capital Suppliers) | Moderate | Need for competitive interest rates, deposit retention | Availability of alternative investment options, competitor offerings | Attractive deposit schemes, digital banking services, customer loyalty programs |

| Interbank & Wholesale Funders | High | Fluctuating borrowing costs, liquidity management | Monetary policy, market liquidity, creditworthiness perception | Diversified funding sources, strong balance sheet, prudent liquidity management |

What is included in the product

This analysis tailors Porter's Five Forces to Canara Bank, examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes within the Indian banking sector.

Instantly identify and address competitive threats with a clear, actionable breakdown of Canara Bank's Porter's Five Forces.

Gain a strategic advantage by proactively mitigating risks and capitalizing on opportunities within the banking sector.

Customers Bargaining Power

Customers in India's banking sector wield considerable power. With numerous public, private, and foreign banks, plus a host of other financial service providers, consumers have a wealth of options. This extensive choice directly influences how banks like Canara Bank must operate.

The surge in digital banking, with adoption rates hitting 70% in India by 2024, has amplified this customer power. It's now far easier for individuals to switch banks, forcing Canara Bank to remain highly competitive on interest rates and service quality to retain its customer base.

Customers are indeed quite sensitive to the prices banks charge for their services, especially interest rates on loans and deposits, as well as various service fees. This price sensitivity is a significant factor that compels banks like Canara Bank to consistently offer competitive pricing to not only attract new customers but also to hold onto their existing ones. For instance, in 2024, the average savings account interest rate offered by major Indian banks hovered around 3-4%, and any substantial deviation from these benchmarks could easily lead to customers seeking better deals elsewhere.

Customers of Canara Bank, like those at other financial institutions, are increasingly empowered by readily available information. The proliferation of online resources and a general rise in financial literacy mean individuals can easily compare interest rates, fees, and service offerings from various banks. This transparency significantly shifts the balance, allowing customers to negotiate for better terms or switch to competitors offering superior value, thereby increasing their bargaining power.

Diverse Customer Segments

Canara Bank's customer base is incredibly diverse, spanning retail individuals, small and medium-sized enterprises (SMEs), large corporations, and the agricultural sector. This broad reach means customer bargaining power isn't uniform.

While large corporate clients might wield considerable influence due to the volume of their business, the bank's significant presence among lower-income groups and retail depositors suggests a more fragmented and less powerful individual customer base in those segments. For instance, as of March 31, 2024, Canara Bank reported a total customer base exceeding 130 million, highlighting the sheer scale of its retail reach.

- Diverse Customer Base: Canara Bank serves individuals, SMEs, large corporations, and agricultural clients, leading to varied bargaining power.

- Retail Dominance: A substantial portion of the bank's client base consists of individuals, particularly from lower-income groups, which generally exhibit lower individual bargaining power.

- Corporate Influence: Large corporate clients, due to higher transaction volumes and potential for shifting business, may possess greater bargaining power individually.

- Overall Impact: The bank's reliance on a vast retail segment tempers the overall bargaining power of customers, although specific large clients can still exert significant influence.

Impact of Customer Service

The quality of customer service directly impacts how loyal customers are and how satisfied they feel. When a bank like Canara Bank struggles with its service, it gives customers more leverage. They can easily switch to competitors that offer a better banking experience, thereby increasing their bargaining power.

Canara Bank's customer service performance is a key factor in managing this. For instance, while specific recent customer satisfaction scores for Canara Bank's service quality are not publicly detailed for 2024 in a way that allows direct comparison to competitors' service metrics, industry trends highlight the impact. A report from a leading financial services research firm in early 2024 indicated that over 60% of banking customers consider customer service a primary factor when choosing or staying with a bank.

Therefore, for Canara Bank to effectively counter this customer bargaining power, a significant focus on enhancing service quality is essential. This includes faster issue resolution, more personalized interactions, and accessible support channels.

- Customer Service as a Retention Driver: High-quality service is paramount for keeping existing customers and reducing churn.

- Impact of Service Gaps: Deficiencies in customer service can push customers towards competitors offering superior experiences, amplifying their bargaining power.

- Competitive Landscape: In 2024, the banking sector saw continued emphasis on digital and personalized customer service, making it a key differentiator.

- Mitigation Strategy: Improving service delivery is crucial for Canara Bank to lessen the influence customers have through their ability to switch providers.

Canara Bank faces substantial customer bargaining power due to the highly competitive Indian banking landscape and increased digital access, forcing it to offer competitive rates and superior service. While a vast retail customer base generally limits individual power, large corporate clients can exert significant influence. In 2024, with over 130 million customers, Canara Bank must balance the needs of its diverse clientele to maintain market position.

| Customer Segment | Estimated Bargaining Power | Key Drivers |

|---|---|---|

| Retail Individuals | Moderate to Low | Price sensitivity, ease of switching via digital platforms |

| Small & Medium Enterprises (SMEs) | Moderate | Transaction volume, need for tailored services |

| Large Corporations | High | Significant transaction volumes, potential to shift substantial business |

| Agricultural Sector | Low to Moderate | Reliance on specific government schemes, localized service needs |

Full Version Awaits

Canara Bank Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Canara Bank's competitive landscape through Porter's Five Forces, analyzing the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the banking sector. The comprehensive analysis provides actionable insights into Canara Bank's strategic positioning and potential challenges.

Rivalry Among Competitors

Canara Bank navigates a fiercely competitive Indian banking sector, contending with both public sector giants and nimble private players. In 2024, private banks notably accelerated their market share growth by introducing cutting-edge financial solutions and prioritizing enhanced customer service, thereby ratcheting up the competitive pressure.

This intensified rivalry means Canara Bank must continuously innovate and refine its offerings to retain and attract customers. For instance, by the end of fiscal year 2023-24, the net advances of private sector banks saw a robust growth of 15.3%, outpacing the 12.3% growth of public sector banks, highlighting their dynamic market penetration.

Competitive rivalry in the banking sector is intensifying, as shown by the shifting market shares. In 2024, private banks saw their market share grow by an estimated 2-3%. This dynamic pressure necessitates a strategic response from Canara Bank to preserve and expand its standing.

While Canara Bank benefits from a substantial physical footprint, boasting a wide network of branches and ATMs, this advantage must be augmented by robust digital advancements. Staying competitive requires not just physical reach but also a strong digital presence and innovative service delivery.

Competitive rivalry in the banking sector is intensely fueled by ongoing product innovation, especially in digital banking. Competitors are actively using AI for personalized customer experiences, offering digital-only savings accounts, and streamlining loan approvals for speed. For instance, in 2024, many banks reported significant growth in their digital customer base, with some seeing over 70% of transactions occur through digital channels.

To stay competitive, Canara Bank must prioritize substantial investment in its digital service capabilities. This means not just matching but aiming to exceed the innovative digital offerings like instant onboarding and advanced mobile banking features that rivals are deploying to capture market share. The bank's ability to adapt and lead in digital innovation directly impacts its standing against aggressive competitors.

Asset Quality and Profitability Pressures

While the Indian banking sector generally saw improved asset quality and profitability through early 2025, intense competition continues to put pressure on net interest margins (NIMs). This rivalry forces banks to offer more competitive rates on loans and deposits, squeezing their profitability. Canara Bank, for instance, experienced a decline in its NIM in the first quarter of fiscal year 2026, underscoring the persistent challenge of maintaining margins in a crowded marketplace.

Sustaining profitability in such a competitive landscape requires a keen focus on operational efficiency and the development of diverse income streams beyond traditional lending. Banks must actively seek ways to reduce costs and generate revenue from fee-based services, wealth management, or digital offerings to offset NIM compression.

- Competitive Pressure on NIMs: Intensified competition in the Indian banking sector, even with general improvements in asset quality and profitability by early 2025, continues to exert downward pressure on Net Interest Margins (NIMs).

- Canara Bank's NIM Trend: Canara Bank's NIM saw a decline in the first quarter of fiscal year 2026, a clear indicator of the challenges faced in maintaining profitability amidst competitive pressures.

- Strategic Imperatives: To counter NIM compression, banks like Canara Bank must prioritize enhancing operational efficiency and diversifying income sources beyond core lending activities.

Regulatory Landscape

The Reserve Bank of India (RBI) significantly influences the competitive rivalry among banks like Canara Bank. While its regulations aim for stability, they also dictate how banks compete, particularly in areas like digital lending and investments. For instance, new RBI guidelines on digital lending, effective from late 2023, impose stricter compliance measures, requiring banks to invest in robust systems and processes. This can create a barrier for smaller or less technologically advanced players, potentially consolidating market share among larger, well-capitalized institutions.

Compliance with these evolving norms, such as those for digital lending and investments in Alternative Investment Funds (AIFs), demands substantial financial and strategic resources. Canara Bank, like its peers, must allocate capital towards technology upgrades and risk management frameworks to adhere to these directives. In 2023, the banking sector saw increased scrutiny on AIF investments, leading to revised capital adequacy norms that impact how banks deploy capital, thereby shaping competitive strategies.

- RBI's regulatory framework dictates operational parameters for all banks, including Canara Bank.

- Evolving norms, such as those for digital lending, necessitate significant investment in technology and compliance.

- Stricter regulations on AIF investments can alter capital allocation strategies and competitive positioning.

- Compliance burdens can create a competitive advantage for banks with stronger technological and financial capabilities.

Competitive rivalry in India's banking sector is fierce, with private banks increasingly gaining market share by offering innovative digital solutions and superior customer service. This trend was evident in 2024, where private banks' market share saw an estimated 2-3% increase.

Canara Bank must bolster its digital capabilities and operational efficiency to counter this pressure and maintain its profitability. The intense competition, particularly on Net Interest Margins (NIMs), necessitates a strategic focus on diversifying income streams beyond traditional lending.

The Reserve Bank of India's evolving regulatory landscape, especially concerning digital lending and investments in Alternative Investment Funds (AIFs), also shapes competitive dynamics. Banks like Canara Bank need to invest in technology and robust compliance frameworks to navigate these changes effectively, potentially creating an advantage for well-resourced institutions.

| Metric | Canara Bank (FY24) | Private Banks (FY24 Avg.) | Public Sector Banks (FY24 Avg.) |

|---|---|---|---|

| Net Advances Growth | 12.1% | 15.3% | 12.3% |

| Market Share Shift | Stable | +2-3% | -2-3% |

| Digital Transactions % | ~65% | ~70%+ | ~60% |

SSubstitutes Threaten

The most significant threat of substitutes for Canara Bank stems from the rapid evolution of fintech companies and digital payment platforms, particularly those leveraging India's Unified Payments Interface (UPI). These innovative players offer highly convenient and efficient alternatives for core banking functions, including payments, lending, and even investment solutions, directly challenging traditional banking models.

India's remarkable fintech adoption rate, standing at nearly 87% in 2024, underscores the strong preference consumers are developing for these digital-first solutions. This widespread acceptance means that services offered by fintechs, such as instant peer-to-peer transfers and digital wallets, are increasingly seen as direct substitutes for services traditionally provided by banks like Canara Bank.

Non-Banking Financial Companies (NBFCs) present a significant threat of substitutes to traditional banks like Canara Bank. These entities offer a diverse array of financial services, from loans and wealth management to insurance, often with greater flexibility and specialized products. For instance, in 2024, NBFCs continued to gain traction in crucial segments such as Micro, Small, and Medium Enterprise (MSME) lending and personal loans, drawing customers seeking quicker approvals or tailored solutions that traditional banks may not readily provide.

Peer-to-peer (P2P) lending platforms present a significant threat of substitutes for Canara Bank. These platforms directly connect individual and institutional lenders with borrowers, bypassing traditional financial institutions. For instance, platforms like Faircent in India have facilitated significant loan volumes, offering an alternative for individuals and small businesses seeking funding outside conventional banking channels.

The appeal of P2P lending often lies in its potential for faster approval times and more tailored loan terms compared to traditional bank loans. This can be particularly attractive for borrowers who may find it challenging to meet the stringent criteria of established banks. In 2023, the global P2P lending market was valued at over $100 billion, indicating a substantial and growing alternative to bank financing.

Alternative Investment Avenues

Customers increasingly explore investment avenues beyond traditional bank deposits, such as mutual funds, equities, and other market-linked instruments. This trend can divert savings, impacting a bank's reliance on low-cost funding. For instance, in 2023, the Indian mutual fund industry saw substantial inflows, with Assets Under Management (AUM) reaching ₹53.07 trillion by December 2023, indicating a significant shift in investor preference.

Canara Bank must actively compete by offering attractive returns and a diverse range of financial products to retain customer savings. Failing to do so could lead to a diminished deposit base, forcing the bank to seek more expensive funding sources. The bank's net interest margin, a key indicator of profitability, could be pressured if it cannot match the returns offered by alternative investment platforms.

- Growing popularity of mutual funds: Indian mutual fund AUM surged to ₹53.07 trillion by December 2023.

- Diversification of savings: Investors are moving funds from traditional deposits to market-linked instruments.

- Impact on funding costs: A decline in deposits can increase Canara Bank's cost of funds.

- Need for competitive offerings: The bank must provide compelling returns and product variety to retain customer capital.

In-house Financial Solutions by Non-Financial Entities

Large e-commerce players and other non-financial businesses are increasingly embedding financial services directly into their platforms. For instance, many retailers now offer 'Buy Now, Pay Later' (BNPL) options at checkout, acting as a direct substitute for traditional credit products. This trend bypasses traditional banking channels for everyday transactions.

These integrated financial solutions, like digital wallets and point-of-sale financing, offer unparalleled convenience for consumers. They streamline the purchasing process, reducing the perceived need for a separate banking relationship for these specific needs. By 2024, the global BNPL market was projected to reach over $3.6 trillion, highlighting the significant adoption of these alternatives.

- E-commerce integration: Retailers offering BNPL at checkout.

- Digital wallets: Platforms like Apple Pay and Google Pay facilitating payments.

- Convenience factor: Seamless integration into the customer journey.

- Market growth: BNPL market projected to exceed $3.6 trillion globally in 2024.

The threat of substitutes for Canara Bank is substantial, driven by a diverse range of non-traditional financial service providers. Fintech innovations, NBFCs, P2P lending, and integrated e-commerce financial solutions all offer compelling alternatives to conventional banking. These substitutes often provide greater convenience, faster processing, and more tailored offerings, directly challenging Canara Bank's market share and customer loyalty.

| Substitute Category | Key Offerings | 2024/2023 Data Point | Impact on Canara Bank |

|---|---|---|---|

| Fintech & Digital Payments | UPI transactions, digital wallets, instant loans | India's fintech adoption rate ~87% (2024) | Diverts transaction volumes, reduces reliance on bank accounts |

| Non-Banking Financial Companies (NBFCs) | MSME loans, personal loans, wealth management | Continued traction in MSME lending (2024) | Captures specific customer segments seeking flexibility |

| Peer-to-Peer (P2P) Lending | Direct lending/borrowing platforms | Global P2P lending market > $100 billion (2023) | Offers alternative funding channels, bypassing banks |

| Market-Linked Investments | Mutual funds, equities | Indian mutual fund AUM ₹53.07 trillion (Dec 2023) | Reduces low-cost deposit base, impacts funding costs |

| E-commerce Integrated Finance | Buy Now, Pay Later (BNPL), point-of-sale financing | Global BNPL market projected > $3.6 trillion (2024) | Replaces traditional credit products for everyday purchases |

Entrants Threaten

The Indian banking sector presents a formidable barrier to entry due to significant capital requirements. The Reserve Bank of India (RBI) mandates a minimum capital of ₹500 crore for new banking licenses as of 2024. This substantial financial hurdle makes it exceedingly difficult for potential new players to establish themselves and compete effectively.

Stringent regulatory hurdles significantly deter new entrants in the banking sector. The Reserve Bank of India (RBI) imposes rigorous licensing, compliance, and operational standards, making market entry complex and costly. For instance, the proposed amendments under the Banking Laws (Amendment) Act, 2025, are expected to further tighten capital requirements and governance norms, presenting a substantial barrier.

Established public sector banks like Canara Bank enjoy a substantial advantage due to their long-standing brand recognition and the deep trust they've cultivated over decades. This is particularly potent in financial services, where customer confidence is paramount.

Newcomers to the banking sector face a formidable hurdle in replicating this ingrained trust and credibility. For instance, as of March 31, 2024, Canara Bank reported a customer base exceeding 13.5 crore, a testament to its established presence and appeal.

Extensive Branch and ATM Network

Canara Bank's extensive physical footprint, boasting over 9,518 branches and 13,423+ ATMs across India as of 2023, presents a formidable barrier to new entrants. This widespread accessibility and established infrastructure are costly and time-consuming for newcomers to replicate. The sheer scale of Canara Bank's network makes it challenging for any new competitor to achieve comparable reach and customer convenience, thereby deterring potential new entrants.

The threat of new entrants is significantly mitigated by Canara Bank's established distribution channels.

- Vast Network: Over 9,518 branches and 13,423+ ATMs as of 2023.

- Competitive Advantage: Difficult for new players to match scale and accessibility.

- Deterrent Factor: High initial investment required for new entrants to build a similar network.

Customer Acquisition Costs and Loyalty

Customer acquisition costs in banking are a significant barrier for new entrants. Established players like Canara Bank benefit from existing customer relationships and ingrained loyalty, making it challenging for newcomers to gain traction. For instance, in 2023, the average cost to acquire a new retail banking customer in India was estimated to be in the range of ₹1,000 to ₹5,000, depending on the services offered and marketing channels used.

New banks would need to invest heavily in marketing campaigns, attractive introductory offers, and potentially lower fees to lure customers away from trusted institutions. This financial outlay, coupled with the need to build brand recognition and trust, presents a substantial hurdle. Canara Bank, with its extensive branch network and digital offerings, already has a strong foothold, requiring new entrants to offer compelling value propositions to compete effectively.

- High Marketing Spend: New entrants must allocate significant budgets to advertising and promotions to build awareness and attract customers.

- Incentive Programs: Offering attractive interest rates on deposits or lower loan rates can be necessary but impacts profitability.

- Digital Infrastructure Investment: Competing with established digital banking services requires substantial investment in technology and user experience.

- Brand Trust and Reputation: Overcoming the established trust and reputation of banks like Canara Bank takes considerable time and consistent service delivery.

The threat of new entrants in the Indian banking sector, while present, is significantly dampened by substantial capital requirements and stringent regulatory oversight. For instance, the Reserve Bank of India mandates a minimum capital of ₹500 crore for new banking licenses as of 2024, a considerable financial barrier. Furthermore, the extensive branch network and established customer trust of incumbents like Canara Bank, which served over 13.5 crore customers as of March 31, 2024, create high switching costs and brand loyalty that new players find difficult to overcome.

| Factor | Impact on New Entrants | Canara Bank's Position |

|---|---|---|

| Capital Requirements | High barrier (₹500 crore minimum as of 2024) | Established financial strength |

| Regulatory Hurdles | Complex licensing and compliance | Long-standing regulatory compliance |

| Brand Trust & Loyalty | Difficult to build | Over 13.5 crore customers (as of March 2024) |

| Distribution Network | Costly to replicate (9,518+ branches in 2023) | Extensive and accessible |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Canara Bank is built upon a foundation of official company disclosures, including annual reports and investor presentations. We also integrate insights from reputable financial news outlets and industry-specific publications to provide a comprehensive view of the competitive landscape.