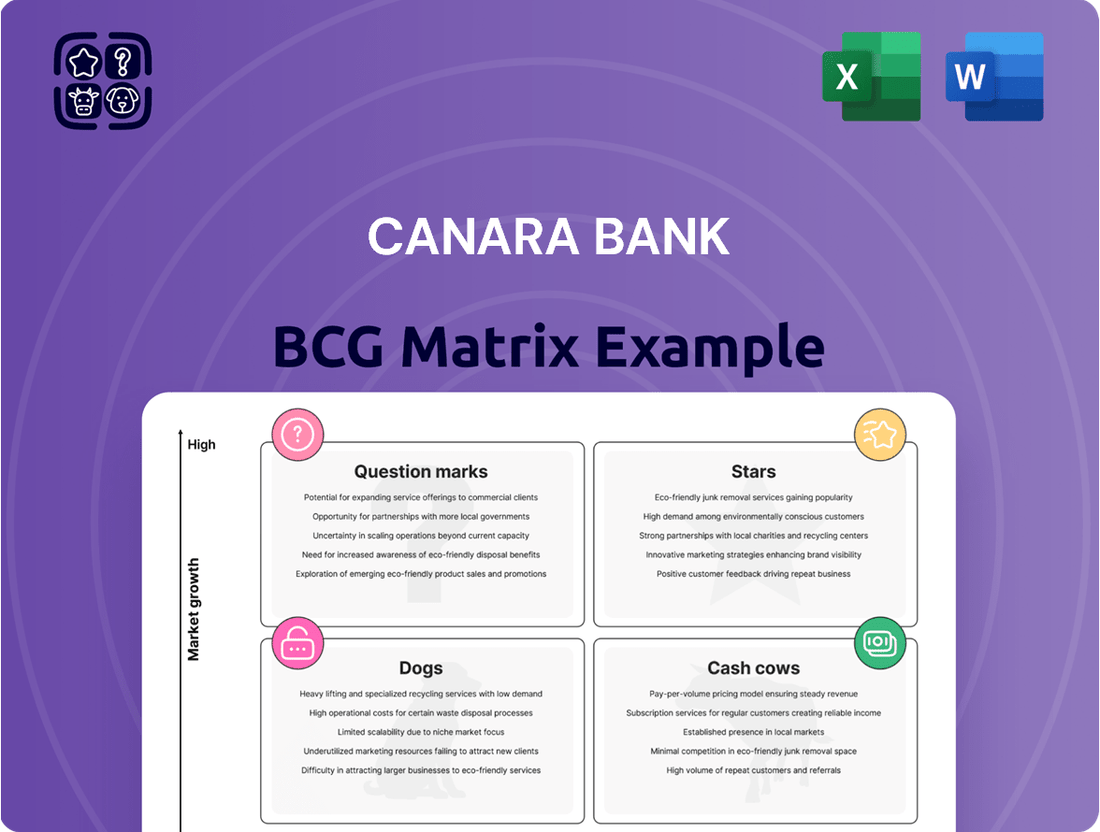

Canara Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canara Bank Bundle

Curious about Canara Bank's strategic positioning? Our BCG Matrix analysis offers a glimpse into their product portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand where their strengths lie and where opportunities for growth exist.

Don't miss out on the complete picture! Purchase the full Canara Bank BCG Matrix report for detailed quadrant placements, data-backed recommendations, and a clear roadmap to optimize their banking products and services. Gain the strategic clarity you need to make informed decisions.

Stars

Canara Bank's retail and agricultural loan portfolio is a significant contributor to its overall growth. In the first quarter of fiscal year 2026 (Q1 FY26), the bank saw a strong 14.90% year-on-year increase in its Retail, Agriculture, and MSME (RAM) credit segment. This demonstrates the bank's success in expanding its reach within these crucial areas.

Within this RAM segment, retail credit experienced particularly impressive growth, surging by 33.92% in Q1 FY26. This substantial expansion highlights the bank's increasing penetration in the retail market, likely driven by strong demand for products like housing and vehicle loans. This segment is clearly a major engine for Canara Bank's expanding loan book.

Canara Bank's secured personal loans, especially gold loans, are a star performer. The portfolio has surged to ₹1.91 lakh crore, with growth rates between 30% and 35%. This segment offers attractive yields and reduced risk, making it a key growth engine for the bank.

Looking ahead, Canara Bank has set an ambitious target of achieving 20% growth in its gold loan portfolio for the fiscal year 2026. This focus underscores the strategic importance of gold-backed lending in the bank's overall product strategy.

Canara Bank has demonstrated a robust improvement in its asset quality. As of June 2025, the Gross Non-Performing Assets (GNPA) ratio stood at a healthy 2.69%, a notable decrease from previous periods. This downward trend is further underscored by the Net Non-Performing Assets (NNPA) ratio, which has fallen to 0.63%.

This significant reduction in bad loans is a testament to the bank's effective risk management strategies. Coupled with strong profitability figures, these asset quality improvements signal a resilient core business that is capably navigating a dynamic and expanding market environment.

Overall Profitability and Business Expansion

Canara Bank's impressive financial growth in Q1 FY26 firmly places its core operations within the 'Stars' category of the BCG Matrix. The bank reported a substantial 21.69% year-on-year increase in net profit, reaching ₹4,752 crore, a testament to its expanding business. This surge was fueled by a healthy 10.98% year-on-year growth in global business, indicating strong momentum in both deposit mobilization and credit disbursement.

The bank's strategic focus on expanding its customer base and increasing its market share in key segments has clearly paid off. This robust performance underscores Canara Bank's position as a dominant player in a growing market, requiring continued investment to maintain its leadership and capitalize on future opportunities.

- Net Profit Growth: 21.69% YoY in Q1 FY26.

- Global Business Growth: 10.98% YoY.

- Key Drivers: Robust expansion in deposits and advances.

- BCG Matrix Classification: Stars, indicating high growth and high market share.

Focus on RAM Segment

Canara Bank's strategic focus on the RAM segment, encompassing Retail, Agriculture, and MSME sectors, has been a significant driver of its growth. This segment experienced a notable expansion of nearly 15% in the first quarter of fiscal year 2026.

This deliberate concentration allows Canara Bank to effectively tap into burgeoning credit markets that are vital to India's economic landscape. The bank anticipates sustained momentum, projecting a healthy 14% growth for this segment throughout fiscal year 2026.

- Retail, Agriculture, and MSME (RAM) segment growth: Nearly 15% in Q1 FY26.

- Strategic advantage: Capturing high-growth credit markets crucial for the Indian economy.

- Projected FY26 growth: Expected to be 14% for the RAM segment.

Canara Bank's core operations, particularly its profit growth and overall business expansion, firmly place it in the 'Stars' category of the BCG Matrix. The bank's net profit saw a substantial 21.69% year-on-year increase in Q1 FY26, reaching ₹4,752 crore. This impressive performance is supported by a healthy 10.98% year-on-year growth in global business, driven by strong deposit and advance growth.

The bank's strategic focus on high-growth segments like retail credit, which surged by 33.92% in Q1 FY26, and its secured personal loans, especially gold loans, further solidify its 'Star' status. These areas exhibit strong market demand and offer attractive yields, indicating Canara Bank's ability to capture market share in expanding sectors.

The bank's commitment to maintaining high growth rates in key areas, such as the projected 14% growth for the RAM segment in FY26, demonstrates its strategy to invest in and nurture these high-performing business units.

| Metric | Q1 FY26 Performance | Significance for BCG Matrix |

|---|---|---|

| Net Profit Growth (YoY) | 21.69% | Indicates strong profitability and market position. |

| Global Business Growth (YoY) | 10.98% | Reflects expanding market presence and customer base. |

| Retail Credit Growth (YoY) | 33.92% | Highlights success in a high-demand, growing market segment. |

| RAM Segment Growth (Q1 FY26) | ~15% | Demonstrates effective penetration into crucial economic sectors. |

What is included in the product

Highlights which Canara Bank business units to invest in, hold, or divest based on market share and growth.

Canara Bank's BCG Matrix offers a clear, one-page overview of its business units, alleviating the pain of complex financial analysis.

Cash Cows

Canara Bank's extensive branch and ATM network, comprising 9,816 branches and 9,715 ATMs as of December 2024, solidifies its position as a cash cow. This widespread physical footprint ensures consistent customer engagement and deposit generation.

This robust infrastructure acts as a stable revenue generator for traditional banking services, requiring minimal incremental investment for ongoing operations. The sheer scale of its network allows for broad customer reach and consistent income streams.

Canara Bank's stable deposit base acts as a strong foundation, a true cash cow. In the first quarter of fiscal year 2026, the bank saw its global deposits climb by a healthy 9.92% year-on-year, reaching an impressive ₹14,67,655 crore. This growth underscores the reliability and depth of its funding sources.

This substantial and consistent inflow of funds, with domestic deposits alone rising by 8.74%, provides Canara Bank with a low-cost and dependable source for its lending activities. Such a robust deposit base is crucial for generating a steady net interest income, a key driver of profitability for any financial institution.

Canara Bank actively supports government financial inclusion programs, consistently surpassing targets for priority sector lending. For instance, in FY2023, the bank achieved a priority sector lending (PSL) of 63.5% against a target of 40%, demonstrating strong commitment.

These schemes, though perhaps not high-growth individually, cultivate a broad customer base and foster enduring relationships. This broad reach provides a stable, predictable revenue stream and ensures compliance with regulatory mandates, solidifying their position as a cash cow.

Corporate Banking (Selective Lending)

Canara Bank's Corporate Banking (Selective Lending) segment acts as a Cash Cow within its business portfolio. While not aggressively pursuing market share through rate competition, the bank maintains a substantial corporate loan book that saw approximately 10% growth. This strategy prioritizes the quality of lending and profitability, ensuring a consistent income stream from its existing corporate clientele without incurring high promotional expenses.

This focus on selective lending allows Canara Bank to generate stable earnings from its corporate relationships.

- Stable Income Generation: The bank's selective approach to corporate lending, avoiding aggressive rate wars, ensures consistent revenue from established relationships.

- Profitability Focus: Prioritizing quality over volume in its corporate loan book leads to a focus on profitable lending activities.

- Controlled Growth: A 10% growth in the corporate loan book indicates healthy expansion without overextending.

Core Banking Operations and Fee-Based Income

Canara Bank's core banking operations, including savings and current accounts, fixed deposits, and treasury activities, are a significant source of stable net interest income. These traditional services form the bedrock of the bank's consistent profitability.

Fee-based income is also a growing contributor, demonstrating robust performance. In the first quarter of fiscal year 2026, this segment saw a healthy increase of 16.39%, further bolstering the bank's overall financial stability.

- Core Banking: Traditional deposit and lending services provide consistent net interest income.

- Fee-Based Income Growth: Increased by 16.39% in Q1 FY26, enhancing profitability.

- Stable Profitability: The combination of net interest and fee income drives reliable earnings.

- Cash Cow Status: These operations represent established, high-performing business units for Canara Bank.

Canara Bank's extensive branch and ATM network, coupled with a stable deposit base, firmly establishes its core banking operations as a cash cow. These traditional services, including savings, current accounts, and fixed deposits, consistently generate reliable net interest income. The bank's fee-based income also shows robust growth, further solidifying the stable profitability of these established business units.

| Business Segment | Description | Key Financial Indicator (Q1 FY26) | Cash Cow Attribute |

| Branch & ATM Network | 9,816 branches & 9,715 ATMs (Dec 2024) | Consistent customer engagement & deposit generation | Widespread physical footprint ensures stable revenue |

| Deposit Base | ₹14,67,655 crore global deposits (Q1 FY26) | 9.92% year-on-year growth | Low-cost, dependable funding for lending |

| Core Banking & Fee Income | Net interest income from traditional services | Fee-based income up 16.39% (Q1 FY26) | Stable profitability and reliable earnings |

What You See Is What You Get

Canara Bank BCG Matrix

The Canara Bank BCG Matrix preview you are viewing is the definitive, unwatermarked document you will receive upon purchase, offering a complete strategic overview of its business units. This comprehensive analysis is meticulously prepared, ensuring you gain immediate access to a fully formatted and actionable report for informed decision-making. You're not just seeing a sample; you're experiencing the exact Canara Bank BCG Matrix that will be yours to utilize for immediate strategic planning and competitive assessment. Once purchased, this professionally designed file is instantly downloadable, ready for integration into your business development initiatives or presentations.

Dogs

While Canara Bank has made substantial strides in improving its asset quality, some legacy non-performing assets (NPAs) from earlier periods might still be present. These older NPAs, especially those with poor recovery potential, can consume valuable capital and management attention without generating significant returns, impacting overall profitability.

As of March 31, 2024, Canara Bank's Gross NPA ratio stood at a healthy 4.39%, a notable improvement. However, the presence of even a small percentage of legacy NPAs, particularly those categorized as doubtful or loss assets, represents a challenge that requires ongoing management and resolution strategies to unlock capital and enhance financial performance.

Within Canara Bank's lending operations, certain niche loan portfolios might be classified as 'dogs'. These are typically very small or specialized segments that haven't grown as expected or operate in stagnant industries. For instance, a portfolio focused on a very specific type of agricultural equipment financing that has seen declining demand could fall into this category.

These 'dog' portfolios are often characterized by low growth rates and a minimal share of the bank's overall loan book. They might also require significant management oversight and resources relative to the profits they generate, making them a drag on overall performance. While specific data for Canara Bank's niche portfolios isn't publicly detailed in this context, such segments are common across the banking sector.

Outdated digital platforms at Canara Bank, if any exist, would likely be classified as 'dogs' in the BCG Matrix. These are older systems that haven't kept pace with technological advancements, making them less user-friendly. For instance, if a legacy mobile banking app is slow or lacks essential features compared to competitors, it could deter customer adoption and potentially lead to churn.

While Canara Bank has been actively investing in digital transformation, the presence of legacy systems that are not fully integrated or are cumbersome to navigate would place them in this category. Such platforms represent a drain on resources without generating significant returns or market share in the digital banking space. For example, if customer complaints regarding the usability of certain online services remain high, it signals a potential 'dog' that needs attention.

Inefficient International Operations (if any)

Canara Bank, while expanding its international footprint, might have certain overseas branches operating in markets with limited growth potential. If these operations consistently show lower profitability or market share compared to their peers, they could be considered dogs in the BCG matrix. This means they require continuous investment but offer minimal strategic returns, potentially draining resources that could be better allocated elsewhere.

For instance, if a specific overseas branch in a mature, low-growth economy is not generating sufficient returns on capital, it fits the 'dog' profile. Such units often necessitate ongoing operational support and capital infusion without a clear path to significant market share expansion or profitability improvement.

- Underperforming International Branches: Operations in markets with low growth and declining profitability.

- Resource Drain: These units consume capital and management attention without substantial strategic benefits.

- Strategic Review Needed: A decision on divestment or significant restructuring may be warranted for such operations.

Selectively Avoided Corporate Lending Segments

Canara Bank's strategic decision to selectively avoid certain corporate lending segments, even at the cost of immediate business volume, points to a deliberate effort to steer clear of rate wars. This suggests these specific sub-segments are characterized by thin margins and intense competition, making them less attractive for the bank's profitability goals.

The bank's minimal involvement in these areas implies a low market share within what could be a segment of the corporate lending market experiencing sluggish growth or oversaturation. For instance, in 2024, while overall corporate loan growth might have shown some dynamism, Canara Bank likely focused its resources on higher-yield opportunities.

- Low-Margin Focus: Canara Bank prioritizes avoiding segments where competition drives down lending rates to unprofitable levels.

- Strategic Withdrawal: The bank's limited participation in these areas reflects a conscious choice to conserve capital and focus on more lucrative business.

- Market Share Dynamics: A low market share in these avoided segments suggests they are not core to Canara Bank's growth strategy.

- Competitive Landscape: These segments are likely dominated by players willing to operate on lower margins, a strategy Canara Bank is actively sidestepping.

Certain niche loan portfolios within Canara Bank, like those in declining industries or with very low demand, can be classified as 'dogs'. These segments typically exhibit slow growth and a small share of the bank's overall lending, requiring disproportionate management attention relative to their profitability.

Outdated digital platforms, if not yet fully upgraded or integrated, also fit the 'dog' category. These systems can be less user-friendly, leading to customer dissatisfaction and potential attrition, thus representing a resource drain without contributing significantly to market share in the digital space.

Overseas branches in stagnant markets with consistently low profitability would also be considered 'dogs'. These operations might consume capital and require ongoing support without offering substantial strategic returns or opportunities for significant growth.

Canara Bank's strategic avoidance of certain low-margin corporate lending segments, where competition is fierce and growth is sluggish, indicates these areas are treated as 'dogs'. The bank's minimal participation signifies a conscious decision to focus resources on more profitable opportunities rather than engaging in rate wars.

Question Marks

Canara Bank's recent digital product launches – Canara Heal, Canara Angel, and Canara MyMoney – represent strategic moves into specialized and evolving market segments. Canara Heal targets the growing healthcare financing need, while Canara Angel aims to attract women with tailored savings solutions. Canara MyMoney simplifies access to funds against term deposits, enhancing liquidity for customers.

These offerings are currently positioned as question marks in the BCG matrix. While they address identified market opportunities and have significant growth potential, their market share is nascent. For instance, as of early 2024, digital loan disbursements are a growing segment, but these specific products are in their initial adoption phase, necessitating substantial investment in marketing and customer acquisition to gain traction and climb the matrix.

Canara Bank's Canara UPI 123PAY ASI and its collaboration with RBIH for Unified Lending Interface (ULI) integration represent significant strategic moves into high-growth digital credit access and financial inclusion. These initiatives are designed to capture a growing segment of the Indian market that is increasingly adopting digital payment and lending solutions.

While these platforms show strong potential, their current market share within the broader digital payments and lending landscape is still emerging. For instance, UPI transaction volume in India reached an astounding 13.42 billion transactions in the first quarter of 2024, highlighting the sheer scale of digital adoption, a market Canara's newer offerings aim to tap into.

Canara Bank is investing heavily in a new digital credit card platform, aiming to issue 15 lakh cards in FY26, a slight increase from 14 lakh in FY25. This ambitious expansion into a rapidly growing Indian credit card market, where the bank currently holds a modest share, positions this initiative as a 'question mark' in the BCG matrix. It represents a significant investment with the potential for substantial future returns if successful in capturing market share.

AI/ML Model Deployment and Data Analytics

Canara Bank's strategic investment in 50 AI/ML models across functions like upselling, cross-selling, and NPA prediction, coupled with the establishment of a dedicated Data and Analytics Centre, positions it in a high-growth potential quadrant. This focus on advanced analytics is crucial for optimizing operations and enhancing customer engagement.

While the bank has made significant strides in building these capabilities, the direct impact on market share and profitability is still in its nascent stages of realization. The success of these AI/ML initiatives will be a key determinant of Canara Bank's future competitive standing.

- AI/ML Investment: Development of 50 AI/ML models for key banking functions.

- Data Infrastructure: Establishment of a dedicated Data and Analytics Centre.

- Growth Potential: High-growth area for operational optimization and customer engagement.

- Evolving Impact: Market share and profitability impact still developing.

IPO of Canara Robeco Asset Management Company and Canara HSBC Life Insurance

Canara Bank is strategically looking to list its subsidiaries, Canara Robeco Asset Management Company (AMC) and Canara HSBC Life Insurance. This move, particularly the planned stake sale in Canara Robeco AMC, signals an effort to leverage the robust growth observed in both the asset management and life insurance industries. These sectors are widely recognized as high-potential markets, offering significant opportunities for expansion and profitability.

The decision to pursue IPOs for these entities is a clear indicator of Canara Bank's strategy to unlock value and potentially inject capital for further growth. By tapping into public markets, the bank aims to capitalize on the current investor appetite for financial services companies, especially those operating in expanding sectors.

The classification of Canara Robeco AMC and Canara HSBC Life Insurance within the BCG Matrix will heavily depend on the outcome of these IPOs and their subsequent performance. If they achieve substantial market share gains and demonstrate strong growth, they would likely be positioned as Stars. Conversely, if growth falters or market share stagnates post-listing, their classification could shift.

- Canara Robeco AMC IPO: The IPO aims to capitalize on the Indian asset management industry, which saw Assets Under Management (AUM) grow significantly. For instance, as of March 2024, the Indian mutual fund industry AUM stood at over INR 50 lakh crore.

- Canara HSBC Life Insurance IPO: This listing targets the expanding Indian life insurance sector. The sector's premium collection has shown consistent year-on-year growth, with new business premium for private life insurers reaching substantial figures in FY24.

- Strategic Rationale: The IPOs are expected to provide Canara Bank with capital to strengthen its own balance sheet and allow the subsidiaries to pursue independent growth strategies, potentially enhancing their market competitiveness.

- Future BCG Classification: The success of these ventures, measured by market share and revenue growth in the coming years, will dictate whether they evolve into Stars (high growth, high market share) or face other classifications within the BCG framework.

Canara Bank's new digital initiatives, like Canara Heal, Canara Angel, and Canara MyMoney, are currently in their early stages. These products are designed to tap into growing market needs, but their market share is still minimal. Significant investment in marketing and customer acquisition is required for these offerings to gain traction and move beyond the question mark phase.

Similarly, Canara UPI 123PAY ASI and the ULI integration are positioned as question marks. Despite the massive growth in UPI transactions, with over 13.42 billion in Q1 2024, Canara's specific offerings are in their infancy. Their success hinges on capturing a share of this rapidly expanding digital payments and lending ecosystem.

The bank's new digital credit card platform, aiming for 15 lakh issuances in FY26, also fits the question mark category. While the Indian credit card market is expanding, Canara Bank's current market share in this segment is modest. The success of this ambitious expansion will determine its future positioning.

The investment in 50 AI/ML models and a dedicated Data and Analytics Centre represents a strategic move into a high-potential area. However, the direct impact on market share and profitability from these advanced analytics capabilities is still developing, keeping them in the question mark quadrant for now.

Canara Robeco AMC and Canara HSBC Life Insurance are also considered question marks pending their IPOs. Their future classification as Stars or other categories will depend on their market share growth and performance post-listing, especially given the significant AUM in the asset management sector (over INR 50 lakh crore as of March 2024).

BCG Matrix Data Sources

Our Canara Bank BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.