Canara Bank Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canara Bank Bundle

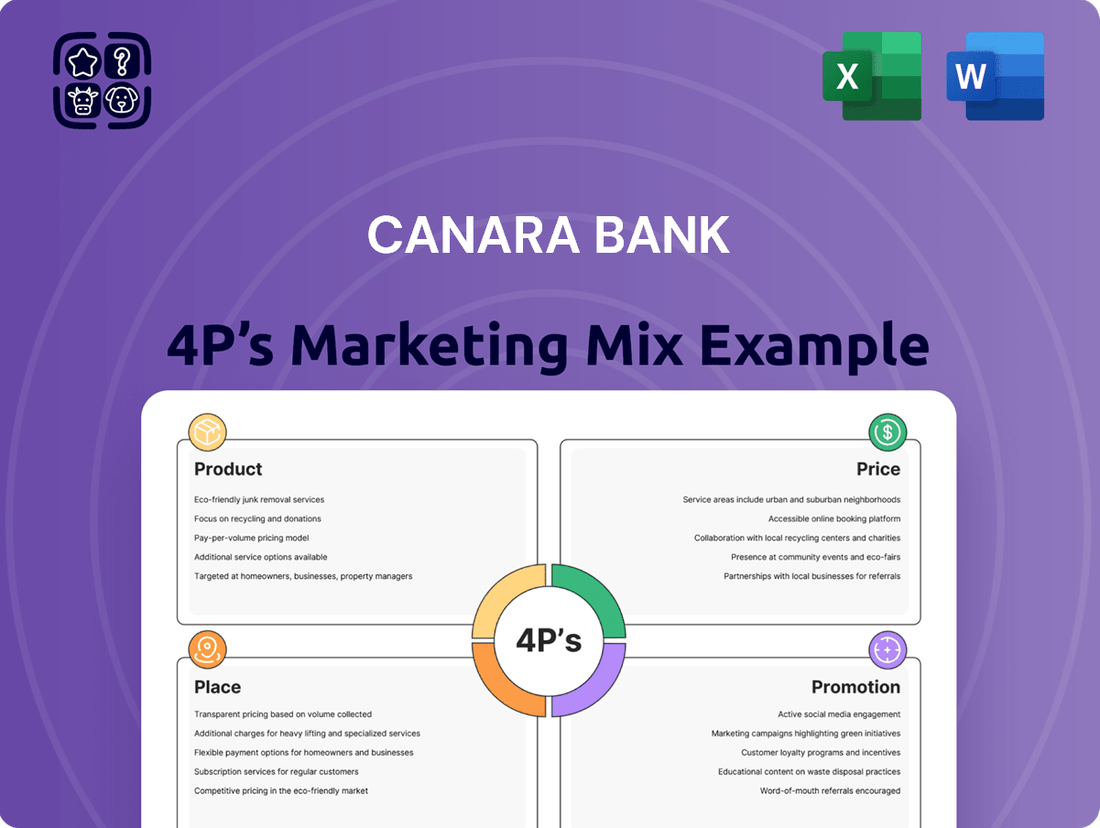

Canara Bank's marketing mix is a dynamic interplay of its diverse product portfolio, competitive pricing, extensive branch network, and targeted promotional campaigns. Understanding how these elements converge is key to grasping their market strategy.

Want to dissect Canara Bank's approach to product innovation, pricing strategies, distribution channels, and promotional effectiveness? Get the full, in-depth 4Ps Marketing Mix Analysis, offering actionable insights for your own business or academic pursuits.

Product

Canara Bank's product strategy for retail and corporate banking is robust, providing a wide array of services from basic savings accounts to complex corporate finance solutions. This caters to individuals, SMEs, large businesses, and the crucial agricultural sector, ensuring broad market penetration. As of March 31, 2024, Canara Bank reported a total business of ₹23,08,211 crore, demonstrating the scale of its product reach.

The bank emphasizes evolving its product suite to stay competitive. This includes digital banking solutions and specialized loan products designed for different segments. For instance, their focus on MSMEs is evident in their dedicated loan schemes, supporting economic growth. In FY24, Canara Bank's Net Interest Income grew by 11.07% to ₹37,668 crore.

Canara Bank offers a comprehensive suite of loan and advance products designed to meet diverse financial needs. This includes personal loans, home loans, education loans, vehicle loans, and various business loans. The bank's strategic focus on the retail, agriculture, and MSME (RAM) segments is evident, with notable growth in housing and vehicle financing. For instance, as of Q3 FY24, Canara Bank reported a robust 12.5% year-on-year growth in retail credit, with housing loans showing a significant uptick.

Further diversifying its offerings, Canara Bank has a strong presence in specialized lending. The bank provides gold-backed personal loans, a product particularly popular in metro cities, offering quick liquidity to customers. This segment, along with other retail advances, contributes to the bank's overall credit portfolio expansion. By Q3 FY24, the bank's MSME segment also saw healthy growth, underscoring its commitment to supporting small and medium enterprises.

Canara Bank's Product strategy for deposit and investment solutions is robust, offering a diverse range of options to meet varied customer needs. This includes traditional savings vehicles like fixed deposits and recurring deposits, alongside specialized products such as tax-saving deposits, all designed to yield competitive interest rates.

Beyond basic savings, the bank extends its product offering into investment services, facilitating access to mutual funds, government securities, and bonds. This strategic move empowers customers to build diversified financial portfolios, aiming for enhanced returns and financial growth.

As of the latest available data for the fiscal year ending March 31, 2024, Canara Bank reported a significant increase in its total deposits, reaching ₹13.48 lakh crore, indicating strong customer trust and product uptake. The bank's focus on both deposit mobilization and investment advisory services underscores its commitment to being a comprehensive financial partner.

Digital Banking and NRI Services

Canara Bank's Product strategy for digital banking and NRI services focuses on enhancing customer convenience and accessibility. The bank offers robust internet and mobile banking platforms, facilitating seamless online transactions for all customers. This digital push aims to streamline banking processes and provide 24/7 access to financial services.

For Non-Resident Indians (NRIs), Canara Bank provides a comprehensive suite of specialized banking and financial services. These offerings are tailored to address the unique needs of this demographic, ensuring they have access to a full range of products and dedicated support, regardless of their location.

- Digital Penetration: Canara Bank reported a significant increase in digital transactions, with mobile banking transactions growing by over 30% in the fiscal year ending March 2024.

- NRI Customer Base: The bank serves over 5 million NRI customers, reflecting a strong focus on this segment.

- Digital Adoption: As of early 2025, over 70% of Canara Bank's active customer base utilizes digital channels for their banking needs.

- NRI Service Expansion: In 2024, Canara Bank launched new digital tools specifically for NRIs, including instant account opening and personalized investment advisory services.

Credit Cards and Insurance Offerings

Canara Bank provides a diverse range of credit cards designed to meet varied customer requirements. These cards offer attractive benefits like reward points, cashback, and discounts, enhancing the purchasing experience. The bank is committed to expanding its digital credit card platform, projecting a substantial rise in card issuances.

Furthermore, Canara Bank extends its financial product portfolio through strategic partnerships with leading insurance providers. This collaboration allows customers to access a comprehensive suite of life, health, and general insurance solutions, ensuring holistic financial security. This integrated approach underscores Canara Bank's commitment to offering a complete financial ecosystem.

- Credit Card Benefits: Reward points, cashback, and discounts are key features designed to attract and retain customers.

- Digital Expansion: A focus on a full-fledged digital platform aims to streamline credit card acquisition and management, targeting significant growth in issuances.

- Insurance Tie-ups: Collaborations with insurance companies offer life, health, and general insurance products, providing a one-stop financial solution.

- Customer Value: These offerings collectively aim to enhance customer value by providing convenient access to a broad spectrum of financial products and benefits.

Canara Bank's product portfolio is extensive, covering retail, corporate, agricultural, and MSME segments with a diverse range of deposit, loan, and investment solutions. The bank actively enhances its digital offerings and provides specialized services for NRIs, alongside credit cards and insurance products through partnerships. This broad product strategy, supported by strong financial performance, aims to meet the varied needs of its customer base.

| Product Category | Key Offerings | As of March 31, 2024 | FY24 Performance Highlight | 2024/2025 Focus |

| Deposits & Investments | Savings, Fixed Deposits, Recurring Deposits, Mutual Funds, Govt. Securities | Total Deposits: ₹13.48 lakh crore | Net Interest Income grew 11.07% to ₹37,668 crore | Expanding investment advisory services |

| Loans & Advances | Personal, Home, Vehicle, Education, Business Loans, Gold Loans | Total Business: ₹23,08,211 crore | Retail credit grew 12.5% YoY (Q3 FY24) | Strengthening MSME and retail lending |

| Digital & NRI Services | Mobile & Internet Banking, NRI Accounts, Digital Tools | Over 5 million NRI customers | Mobile banking transactions grew >30% (FY24) | Enhancing digital tools for NRIs, >70% digital adoption (early 2025) |

| Credit Cards & Insurance | Reward Cards, Cashback Cards, Life, Health, General Insurance | N/A (Focus on digital platform growth) | N/A (Focus on partnerships) | Expanding digital credit card platform, strategic insurance tie-ups |

What is included in the product

This analysis provides a comprehensive deep dive into Canara Bank's Product, Price, Place, and Promotion strategies, offering actionable insights for marketers and strategists.

It grounds Canara Bank's marketing positioning in actual brand practices and competitive context, making it ideal for benchmarking and strategic planning.

Condenses Canara Bank's 4Ps marketing mix into actionable insights, alleviating the pain of complex strategic planning by providing a clear, concise overview of how each element addresses customer needs and competitive pressures.

Place

Canara Bank boasts an extensive physical branch network, a cornerstone of its marketing strategy. As of March 31, 2025, this network spanned an impressive 9,849 branches, strategically positioned to cater to a broad spectrum of customers across rural, semi-urban, urban, and metropolitan regions of India. This widespread presence underscores the bank's dedication to ensuring accessibility for all segments of its customer base.

The bank's commitment to expanding its physical footprint is evident in its forward-looking plans. For the fiscal year 2025, Canara Bank aims to further bolster its reach by opening an additional 250 branches. This initiative is designed to enhance deposit mobilization and solidify its presence in key growth areas, reinforcing its position as a trusted financial institution.

Canara Bank enhances customer convenience through an extensive network of ATMs and cash recyclers, complementing its physical branches. As of March 31, 2025, the bank operated 9,579 ATMs across India, offering 24/7 access to essential banking transactions like cash withdrawals and balance inquiries.

These widespread touchpoints are crucial for Canara Bank's accessibility strategy, enabling customers to manage their finances efficiently beyond traditional banking hours. The presence of cash recyclers further streamlines deposit and withdrawal processes, adding another layer of service optimization.

Canara Bank's commitment to robust digital channels is evident in its comprehensive internet and mobile banking platforms. These services empower customers to perform a vast array of transactions, from fund transfers to account management, entirely online, reflecting a significant shift towards digital accessibility. By the end of fiscal year 2024, Canara Bank reported a substantial increase in its digital transaction volume, with mobile banking transactions alone growing by over 30% compared to the previous year, underscoring the effectiveness of its digital distribution strategy.

Strategic Expansion and Business Correspondent Network

Canara Bank is actively pursuing strategic expansion, focusing on peri-urban locations identified for their strong MSME lending potential. The bank is leveraging data analytics to pinpoint optimal branch locations, ensuring a data-driven approach to its physical growth.

To enhance its reach into remote and underserved regions, Canara Bank has substantially grown its Business Correspondent (BC) network. This expansion is crucial for improving deposit mobilization and delivering essential banking services to populations that might otherwise lack access.

- Branch Network Growth: Canara Bank aims to strategically place new branches in peri-urban areas with high MSME lending opportunities.

- Data-Driven Location Selection: The bank utilizes data analytics to identify the most promising locations for its new branches.

- BC Network Expansion: A significant increase in the Business Correspondent network is in place to serve remote areas.

- Financial Inclusion: The BC network facilitates the delivery of basic banking services, thereby promoting financial inclusion.

International Presence

Canara Bank extends its reach beyond India, establishing a presence in crucial international financial centers. This global network includes branches in London, New York, and Dubai, alongside an International Banking Unit (IBU) strategically located in Gift City, India's first International Financial Services Centre (IFSC).

This international footprint is vital for serving Non-Resident Indians (NRIs) and supporting businesses engaged in international trade. As of the first quarter of fiscal year 2024-25, Canara Bank reported a significant increase in its international business, with overseas advances growing by approximately 10% year-on-year, demonstrating the growing importance of these operations.

- Global Reach: Branches in London, New York, Dubai, and an IBU in Gift City.

- Customer Focus: Catering to the banking needs of NRIs.

- Business Facilitation: Supporting international trade and financial operations.

- Growth Indicator: Overseas advances saw a 10% year-on-year increase in Q1 FY25.

Canara Bank's 'Place' strategy focuses on maximizing accessibility through a multi-channel approach. This includes an extensive physical branch network, complemented by a robust ATM and cash recycler presence, alongside strong digital platforms. The bank also strategically expands its reach into underserved areas via Business Correspondents and maintains an international presence to serve global customers and trade.

| Channel | Count (as of March 31, 2025) | Strategic Focus |

|---|---|---|

| Branches | 9,849 | Rural, semi-urban, urban, metropolitan reach; peri-urban MSME focus |

| ATMs/Cash Recyclers | 9,579 | 24/7 accessibility, transaction convenience |

| Digital Platforms | N/A (Services) | Online transactions, account management, mobile banking growth |

| Business Correspondents | Significant Growth | Remote/underserved areas, financial inclusion |

| International Branches | London, New York, Dubai, Gift City (IBU) | NRIs, international trade support |

Same Document Delivered

Canara Bank 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. It details Canara Bank's strategic approach to Product, Price, Place, and Promotion, offering a comprehensive overview of their marketing mix. This analysis is complete and ready for your immediate use.

Promotion

Canara Bank is significantly boosting its digital engagement, actively participating on platforms like Facebook, Instagram, X, LinkedIn, and YouTube. This comprehensive approach aims to reach a broader audience, particularly younger demographics, and solidify its image as an innovative financial institution.

To achieve this, the bank has partnered with Goldmine Advertising, entrusting them with the development and execution of its social and digital media strategies. This collaboration focuses on creating compelling content, fostering community interaction, and diligently managing the bank's online reputation.

Canara Bank's strategic use of social media, guided by its 2025-26 policy, aims to significantly boost its digital presence. This policy targets enhancing brand image and showcasing its technological advancements to a wider audience.

Key objectives include effectively communicating product and service information, alongside publicizing new campaigns and launches. This structured approach ensures consistent messaging and efficient market penetration in the digital sphere, aiming to reach Canara Bank's projected 15% increase in digital customer acquisition for the fiscal year 2025-26.

Canara Bank is actively investing in technology for customer outreach, utilizing AI and ML to enhance engagement and personalize promotions. This strategic move aims to refine customer interactions by developing sophisticated models for upselling and cross-selling banking products, proactively predicting customer churn, and ultimately boosting fee income. For instance, the bank's focus on AI/ML is expected to contribute to its digital revenue streams, which have seen significant growth, with digital channels accounting for a substantial portion of retail loan disbursements in recent fiscal years.

Public Relations and Brand Building Initiatives

Canara Bank actively cultivates its public image through strategic public relations, reinforcing its standing as a leading public sector bank. These efforts are crucial for building and sustaining brand equity in a competitive financial landscape.

The bank's commitment to excellence is highlighted by its recognition in industry awards. For instance, in 2025, Canara Bank received accolades for its advancements in 'IT Risk & Cyber Security Initiatives' and its dedication to 'Excellence in Training'.

Such awards directly bolster Canara Bank's public perception, showcasing its operational strengths and innovative spirit. These recognitions serve as tangible proof points that enhance trust and reinforce the bank's reputation among stakeholders.

Key PR and Brand Building Highlights for Canara Bank:

- Industry Award Recognition: Achievements in areas like IT Risk & Cyber Security and Training Excellence in 2025.

- Brand Equity Enhancement: Positive public perception fostered through consistent award wins and industry participation.

- Reputation Reinforcement: Showcasing proficiency and innovation to build stakeholder confidence.

- Stakeholder Engagement: Public relations activities aimed at maintaining strong relationships with customers and the broader community.

Traditional Advertising and Financial Literacy

Canara Bank strategically employs traditional advertising, notably newspaper ads, to cast a wide net across India, complementing its digital push. This approach ensures reach to demographics less engaged with online platforms. While TV ads are reserved for targeted, state-specific campaigns, the bank's commitment to financial literacy remains a cornerstone of its communication strategy, aiming to educate its broad customer base on banking products and services.

As of early 2024, Canara Bank reported a significant digital transaction volume, yet its traditional advertising spend, particularly in print, continues to be substantial for mass outreach. For instance, in the fiscal year 2023-24, the bank allocated a notable portion of its marketing budget to print media to reinforce brand presence and product awareness across diverse geographies. This dual strategy acknowledges the varied media consumption habits of the Indian populace.

- Newspaper Advertisements: A primary channel for broad reach across India, reinforcing brand presence and product information.

- Television Advertisements: Utilized selectively for state-specific campaigns, allowing for targeted messaging.

- Financial Literacy Initiatives: Integral to Canara Bank's public sector role, educating customers on banking products and services.

- Digital vs. Traditional Balance: Maintaining a mix to cater to a diverse customer base with varying media preferences.

Canara Bank's promotional strategy is multifaceted, blending digital outreach with traditional advertising to maximize market penetration. The bank's active presence on social media platforms like Facebook, Instagram, X, LinkedIn, and YouTube, supported by a 2025-26 digital policy, aims to enhance brand image and showcase technological advancements. This digital push is further bolstered by AI and ML investments to personalize customer interactions and drive fee income, with digital channels already contributing significantly to retail loan disbursements.

Simultaneously, Canara Bank maintains a strong traditional advertising presence, particularly through newspaper ads, to reach a wider Indian audience. This complements targeted state-specific TV campaigns and a core commitment to financial literacy. The bank's marketing budget for fiscal year 2023-24 reflected a substantial allocation to print media, underscoring the importance of this channel for broad brand reinforcement and product awareness across diverse geographical regions.

Industry awards, such as those received in 2025 for IT Risk & Cyber Security and Excellence in Training, serve as crucial promotional tools, reinforcing Canara Bank's reputation and building stakeholder confidence. These recognitions validate the bank's operational strengths and innovative spirit, directly contributing to its brand equity and public perception in a competitive financial sector.

The bank's promotional efforts are designed to effectively communicate product and service information, alongside publicizing new campaigns and launches, with a goal of achieving a projected 15% increase in digital customer acquisition for fiscal year 2025-26. This structured approach ensures consistent messaging and efficient market penetration through a balanced mix of digital and traditional media channels.

| Promotional Channel | Objective | Key Activities | Target Audience | Fiscal Year Focus (2024-2025) |

|---|---|---|---|---|

| Digital Media (Social Media, AI/ML) | Enhance brand image, customer engagement, digital acquisition | Content creation, community interaction, personalized promotions, upselling/cross-selling | Broader audience, younger demographics, existing customers | Targeting 15% digital customer acquisition growth; AI/ML for revenue streams |

| Traditional Media (Newspapers, TV) | Broad market reach, brand reinforcement, targeted messaging | Newspaper ads, state-specific TV campaigns | General population, less digitally engaged demographics | Significant print media allocation for broad outreach; selective TV for regional focus |

| Public Relations & Awards | Build brand equity, reinforce reputation, stakeholder confidence | Securing industry awards, positive media coverage | All stakeholders, general public | Highlighting IT Risk & Cyber Security, Training Excellence achievements |

Price

Canara Bank actively works to offer competitive interest rates across its deposit portfolio, a key strategy to draw in and keep customers. This focus on attractive rates for products like fixed deposits and savings accounts is central to its pricing strategy.

As of July 2025, Canara Bank's fixed deposit rates for the general public are between 3.50% and 6.60% per annum. Senior citizens benefit from higher rates, ranging from 4.00% to 7.10% per annum. Special offerings, such as the 'Canara 444 days' scheme, are designed to provide even more attractive yields, demonstrating the bank's commitment to customer value while ensuring financial viability.

Canara Bank provides a variety of loan options with interest rates tailored to be competitive. As of July 2025, gold loan interest rates commence at 9.25% per annum, offering an accessible borrowing avenue.

For housing needs, home loan interest rates from Canara Bank, as of June 2025, span between 7.40% and 10.25% per annum, catering to different borrower profiles and loan amounts.

Personal loans are also available, with interest rates typically starting at 10.70% per annum and potentially reaching up to 16.15% per annum, influenced by the specific scheme and the applicant's financial standing.

Effective June 1, 2025, Canara Bank has eliminated minimum balance charges for all savings accounts. This pricing strategy is designed to attract and retain a broader customer base, particularly those who may have been deterred by previous fees. This move is expected to enhance customer loyalty and increase transaction volumes across its digital and physical channels.

Tiered and Value-Based Pricing Structures

Canara Bank utilizes tiered pricing for products like savings accounts, with fees adjusted based on account balance or transaction volume. For instance, in early 2024, average savings account balances across the Indian banking sector hovered around ₹40,000, indicating a significant customer base where tiered structures could apply.

The bank also employs value-based pricing for premium offerings such as wealth management and bespoke banking solutions. This strategy aligns pricing with the perceived enhanced benefits and personalized advisory services, catering to customers seeking specialized financial guidance.

Examples of Canara Bank's pricing strategies include:

- Tiered Savings Account Fees: Charges vary based on maintaining minimum balance thresholds, a common practice that impacts millions of account holders.

- Value-Based Wealth Management: Fees are structured around the assets under management and the complexity of investment portfolios, reflecting expert advisory services.

- Transaction Fee Differentiation: Different customer segments, like seniors or students, may receive preferential transaction fee structures, a common approach in retail banking.

- Loan Interest Rate Bands: Interest rates on loans are often tiered based on credit scores and loan amounts, providing differentiated pricing for varying risk profiles.

Transparent Service Charges and Fees

Canara Bank emphasizes transparent service charges and fees across its diverse banking offerings, particularly for non-credit and non-forex transactions. This commitment ensures customers have a clear understanding of all associated costs, fostering trust and informed decision-making. For instance, detailed breakdowns of charges for cheque returns, standing instructions, and other miscellaneous services are readily accessible, empowering customers with complete financial clarity.

The bank's approach to pricing is built on openness, allowing customers to easily navigate and comprehend the fee structure for various banking operations. This transparency is a key element in building strong customer relationships by removing ambiguity around service costs.

- Clear Fee Structure: All service charges, including those for non-credit and non-forex activities, are clearly outlined.

- Accessible Information: Details on fees for cheque returns, standing instructions, and other miscellaneous services are readily available to customers.

- Customer Empowerment: This transparency ensures customers are fully aware of the costs involved in their banking transactions.

Canara Bank's pricing strategy focuses on competitive rates for deposits and loans, alongside transparent fee structures for various services. This approach aims to attract and retain a broad customer base by offering value and clarity.

The bank adjusts interest rates based on product type, customer segment, and prevailing market conditions, ensuring both customer appeal and financial viability.

For instance, as of July 2025, fixed deposit rates range from 3.50% to 6.60% for the general public and 4.00% to 7.10% for senior citizens, with special schemes offering enhanced yields.

Loan products also feature competitive rates, with gold loans starting at 9.25% per annum and home loans between 7.40% and 10.25% as of June 2025.

| Product/Service | Pricing Detail (as of July 2025 unless specified) | Key Feature |

|---|---|---|

| Fixed Deposits (General Public) | 3.50% - 6.60% p.a. | Competitive yield to attract deposits |

| Fixed Deposits (Senior Citizens) | 4.00% - 7.10% p.a. | Higher rates for senior citizens |

| Gold Loans | Starting from 9.25% p.a. | Accessible borrowing option |

| Home Loans | 7.40% - 10.25% p.a. (as of June 2025) | Caters to diverse borrower profiles |

| Personal Loans | Starting from 10.70% p.a. | Variable rates based on scheme and applicant |

| Savings Accounts | No minimum balance charges (effective June 1, 2025) | Broadens customer base, enhances loyalty |

4P's Marketing Mix Analysis Data Sources

Our Canara Bank 4P's analysis is built using verified, up-to-date information on company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.