Canaccord Genuity PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canaccord Genuity Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors influencing Canaccord Genuity's trajectory. Our meticulously researched PESTLE analysis provides you with the essential external intelligence needed to navigate the complexities of the financial services landscape. Empower your strategic planning and investment decisions by understanding these powerful forces.

Political factors

Regulatory stability is paramount for Canaccord Genuity, as unpredictable policy shifts in key markets like the US and UK can disrupt operations. For instance, changes in capital requirements or trading regulations, which governments frequently review, directly influence the firm's ability to conduct business efficiently and profitably.

Sudden governmental interventions, such as unexpected tax hikes or new compliance mandates, can significantly increase operational costs and introduce compliance risks. The firm must remain agile, adapting to evolving financial market regulations across its global presence, which includes navigating differing legal frameworks in North America, Europe, and Asia.

The firm's strategic planning heavily relies on anticipating regulatory changes. For example, the ongoing discussions around ESG (Environmental, Social, and Governance) regulations in the financial sector by bodies like the SEC and FCA in 2024-2025 will necessitate proactive adjustments to Canaccord Genuity's investment advisory and underwriting services.

Escalating geopolitical tensions, like the ongoing conflict in Eastern Europe and trade friction between major economies, directly impact global capital flows and investor confidence. For a firm like Canaccord Genuity, with operations spanning North America, Europe, Asia, and Australia, these strained international relations can significantly influence market sentiment and the viability of cross-border transactions.

For instance, the IMF projected global growth to slow to 2.9% in 2024, partly due to persistent geopolitical risks and their dampening effect on trade and investment. Canaccord Genuity must therefore proactively assess these geopolitical risks to effectively advise clients and structure deals amidst this volatile environment.

Government fiscal policies, such as changes in corporate tax rates and public infrastructure spending, alongside monetary policies like the Bank of Canada's overnight rate target, directly shape the economic landscape. For instance, a tightening monetary stance, potentially indicated by further rate hikes in late 2024 or early 2025 if inflation persists above the 2% target, increases borrowing costs for businesses and consumers, impacting Canaccord Genuity's deal flow and client investment appetites.

The Bank of Canada's actions, including its balance sheet management and potential future quantitative tightening or easing, significantly influence liquidity within financial markets, a key driver for investment banking and wealth management services. As of Q3 2024, the Canadian economy has shown resilience, but persistent inflation could lead to sustained higher interest rates, affecting asset valuations and client demand for capital markets advisory.

International Cooperation and Sanctions

The landscape of international cooperation significantly shapes the financial services sector. In 2024, the Financial Action Task Force (FATF) continued to emphasize global efforts against money laundering and terrorist financing, impacting regulatory compliance for firms like Canaccord Genuity. Disruptions from geopolitical tensions, such as ongoing trade disputes and regional conflicts, can lead to the imposition or tightening of economic sanctions, directly influencing cross-border transactions and investment flows.

Navigating these international frameworks is critical. For instance, the European Union's continued focus on tax transparency and digital services taxes, as observed in recent directives through late 2024, necessitates robust compliance strategies. Failure to adhere to evolving sanctions regimes, which saw increased complexity in areas like cybersecurity and critical minerals trade throughout 2024, could result in substantial fines and severe reputational damage for global financial institutions.

- Global AML/CFT Efforts: FATF's 2024 recommendations continue to drive international standards for combating financial crime.

- Sanctions Complexity: Evolving sanctions related to geopolitical events in 2024 impacted cross-border financial operations.

- Tax Harmonization: International initiatives on tax transparency present ongoing compliance challenges for multinational firms.

- Reputational Risk: Non-compliance with international financial regulations can lead to significant legal and reputational consequences.

Policy Support for Growth Sectors

Government policies actively supporting sectors like technology and renewable energy present substantial opportunities for Canaccord Genuity. For instance, the Inflation Reduction Act in the U.S. is channeling billions into clean energy, a key area for the firm's advisory services. These incentives, including tax credits and grants, are projected to stimulate significant investment and merger and acquisition (M&A) activity within these growth industries.

Understanding these policy drivers is crucial for Canaccord Genuity to strategically position its expertise. Favorable regulatory environments and targeted subsidies can accelerate market penetration and capital deployment for clients. This proactive alignment ensures the firm capitalizes on government-backed growth trajectories.

- Government incentives, such as the EU's €800 billion NextGenerationEU recovery fund, are boosting sectors like digital transformation and green technologies.

- In 2024, the US government allocated over $200 billion in tax credits and incentives for semiconductor manufacturing and renewable energy projects.

- Policy support for healthcare innovation, including R&D tax credits, is driving increased venture capital investment in biotech and medtech.

- Anticipated regulatory shifts in AI and cybersecurity are expected to create new advisory opportunities as businesses adapt.

Government fiscal policies, such as corporate tax rates and public spending, directly influence the economic climate. For example, a potential increase in corporate tax rates in key markets during 2024-2025 could impact Canaccord Genuity's profitability and client investment capacity. Monetary policies, like interest rate adjustments by central banks such as the Bank of Canada, also play a crucial role by affecting borrowing costs and asset valuations, thereby influencing deal flow and client demand for capital markets services.

Geopolitical risks, including ongoing conflicts and trade disputes, significantly impact global capital flows and investor sentiment. These tensions can create volatility, affecting Canaccord Genuity's cross-border transactions and the overall market environment. The IMF's projected slowdown in global growth for 2024, partly attributed to these risks, underscores the need for proactive risk assessment by the firm.

Government incentives and support for specific sectors, like technology and renewable energy, create significant opportunities. For instance, the US Inflation Reduction Act's substantial investments in clean energy are expected to drive M&A activity, a key area for Canaccord Genuity's advisory services.

International cooperation on financial crime, such as the FATF's ongoing efforts against money laundering, necessitates robust compliance for firms like Canaccord Genuity. Evolving sanctions regimes and tax transparency initiatives also present compliance challenges and potential reputational risks if not managed effectively.

| Policy Area | Impact on Canaccord Genuity | 2024-2025 Data/Projection |

|---|---|---|

| Fiscal Policy (Tax Rates) | Affects profitability and client investment capacity | Potential corporate tax rate adjustments in major economies |

| Monetary Policy (Interest Rates) | Influences borrowing costs, asset valuations, and deal flow | Bank of Canada's overnight rate target and inflation outlook |

| Geopolitical Tensions | Impacts global capital flows and investor confidence | IMF projects 2.9% global growth in 2024, citing geopolitical risks |

| Sector-Specific Incentives | Drives M&A and investment opportunities | US IRA channeling billions into clean energy; EU's NextGenerationEU fund |

| International Compliance (AML/CFT) | Requires adherence to global standards | FATF recommendations continue to shape regulatory compliance |

What is included in the product

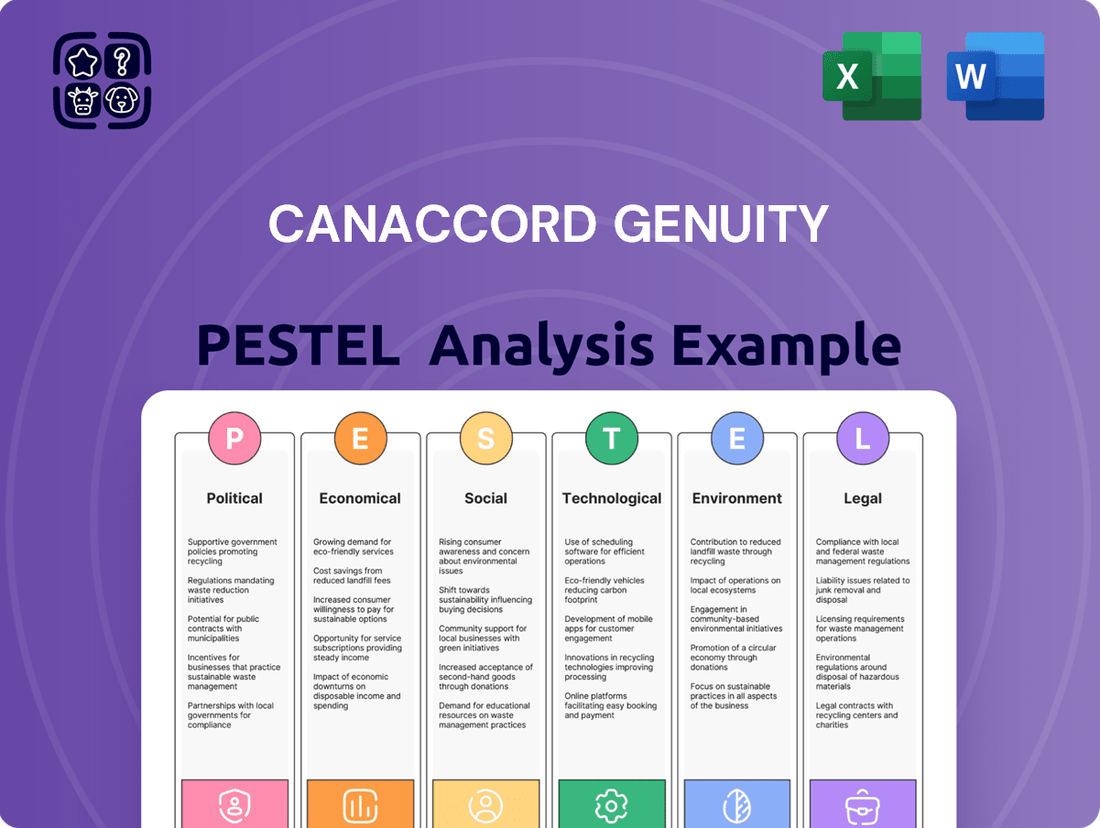

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal factors impacting Canaccord Genuity, offering a comprehensive view of its external operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Canaccord Genuity.

Economic factors

The global economy's trajectory is a critical determinant for Canaccord Genuity. For 2024, the International Monetary Fund (IMF) projected global GDP growth at 3.2%, a slight slowdown from 3.5% in 2023, indicating a moderating but still positive expansion. However, recession risks remain a concern in some developed economies due to persistent inflation and tightening monetary policies.

A robust global economy generally fuels Canaccord Genuity's core businesses. Strong GDP growth supports higher deal volumes in investment banking, increased equity issuance as companies seek capital, and generally higher asset valuations, all of which translate to greater revenue opportunities. For instance, during periods of economic expansion, mergers and acquisitions activity often picks up significantly.

Conversely, economic headwinds can dampen performance. A potential recession in major markets like the United States or Europe could lead to reduced client activity, decreased appetite for risk-taking, and lower valuations across asset classes. This would directly impact Canaccord Genuity's advisory fees, underwriting commissions, and wealth management revenues.

Central banks globally, including the U.S. Federal Reserve and the European Central Bank, have been navigating a complex interest rate environment. Following periods of historically low rates, many have implemented rate hikes to combat inflation. For instance, the Fed raised its benchmark interest rate multiple times throughout 2023 and early 2024, with rates reaching levels not seen in over two decades, aiming to bring inflation closer to its 2% target.

Persistent inflation, which saw significant spikes in 2022 and remained a concern into 2024, directly impacts Canaccord Genuity's clients. Higher inflation erodes the real value of investments and savings, necessitating strategies that can outpace rising costs. This environment makes fixed-income investments less attractive if their yields don't keep pace with inflation, pushing investors towards assets with potentially higher, albeit riskier, returns.

In response, Canaccord Genuity must continually refine its advisory and investment strategies. Adapting to higher borrowing costs for corporations means reassessing debt structures and valuations. For clients, this involves exploring opportunities in sectors or asset classes that demonstrate resilience or even benefit from inflationary pressures, such as companies with strong pricing power or real assets.

Global capital markets experienced significant volatility in late 2023 and early 2024, driven by inflation concerns and geopolitical tensions. This volatility directly impacts Canaccord Genuity's trading volumes and the pricing of assets. For instance, the VIX index, a key measure of market volatility, saw notable spikes during this period, affecting investor sentiment and the appetite for new issuances.

Liquidity levels also played a crucial role, with periods of tight liquidity making capital-raising activities more challenging. This can delay or even halt initial public offerings (IPOs) and mergers and acquisitions (M&A) for companies seeking funding. Canaccord Genuity's advisory services are particularly sensitive to these shifts, necessitating flexible strategies to navigate fluctuating market conditions and ensure client success in capital formation.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for Canaccord Genuity, a firm with a global footprint. As of early 2024, major currency pairs like EUR/USD and GBP/USD have experienced notable volatility, impacting the reported earnings of multinational corporations and the valuation of their international assets. For instance, a stronger USD against the Canadian Dollar (CAD) would reduce the reported USD value of Canaccord's Canadian operations.

These movements directly influence the profitability of cross-border transactions for Canaccord's clients, affecting the value of their international investments and the cost of global capital. For example, a client investing in European equities when the Euro weakens against the Dollar will see a diminished return when repatriated. Managing this currency exposure is therefore a critical operational and advisory challenge for the firm.

- Impact on Reported Earnings: Fluctuations in exchange rates, such as the USD/CAD rate, directly alter the value of Canaccord Genuity's reported earnings when translated from its various international subsidiaries into its reporting currency.

- Valuation of International Assets: The value of Canaccord's overseas assets and liabilities, including real estate and financial instruments, is subject to change based on prevailing currency exchange rates.

- Cross-Border Transaction Profitability: Significant currency movements can impact the profitability of advisory and underwriting services for clients engaged in international mergers, acquisitions, or capital raising activities.

- Client Advisory Services: Canaccord Genuity must actively advise its clients on strategies to mitigate foreign exchange risks, a service that becomes increasingly vital during periods of heightened currency volatility.

Access to Capital and Investor Confidence

Access to capital is a fundamental driver for Canaccord Genuity's operations, impacting everything from new company listings to private equity deals. In 2024, global venture capital funding saw a significant slowdown compared to the highs of previous years, reflecting a more cautious investor sentiment. For instance, PitchBook data indicated a substantial drop in venture capital deal value in early 2024 compared to the same period in 2023, illustrating tighter capital availability.

Investor confidence, closely tied to market volatility and economic outlook, directly influences the willingness of clients to engage in M&A, IPOs, and wealth management services. Surveys in late 2024 and early 2025 consistently showed a mixed but generally improving investor sentiment, driven by moderating inflation and expectations of stable interest rates. However, geopolitical uncertainties continue to temper outright optimism, creating a nuanced environment for capital deployment.

- Global IPO activity in the first half of 2024 remained subdued, with a 15% decrease in deal volume compared to the first half of 2023, impacting Canaccord's underwriting business.

- Private equity fundraising in 2024 faced headwinds, with aggregate capital raised down by approximately 10% year-over-year, affecting deal origination.

- Investor confidence indices, such as the AAII Investor Sentiment Survey, showed a gradual recovery in early 2025, with bullish sentiment increasing from lows seen in late 2024.

- The cost of capital, influenced by central bank policies and inflation rates, directly impacts the feasibility and attractiveness of new investments and corporate financing activities.

Economic factors significantly shape Canaccord Genuity's operating environment. Global GDP growth, projected by the IMF to be 3.2% in 2024, a slight dip from 2023, indicates continued expansion but with moderating momentum. Persistent inflation and the resultant tightening monetary policies by central banks, such as the U.S. Federal Reserve's rate hikes throughout 2023 and early 2024, directly influence borrowing costs and investment valuations.

Volatility in global capital markets, evident in late 2023 and early 2024, impacts trading volumes and asset pricing, with indices like the VIX showing notable spikes. Currency fluctuations, exemplified by the USD/CAD exchange rate, affect the reported earnings of multinational firms like Canaccord. Access to capital remains a key concern, with venture capital funding showing a slowdown in 2024 compared to previous years, as illustrated by PitchBook data indicating a substantial drop in deal value.

| Economic Factor | 2024/2025 Data Point | Impact on Canaccord Genuity |

|---|---|---|

| Global GDP Growth | Projected 3.2% (IMF, 2024) | Supports deal volumes and asset valuations, but slower growth moderates opportunities. |

| Interest Rates (US Federal Reserve) | Rates increased significantly through 2023-early 2024, reaching multi-decade highs. | Increases cost of capital for clients, impacting M&A and IPO feasibility; affects fixed-income attractiveness. |

| Inflation | Remained a concern into 2024, impacting real value of investments. | Drives central bank policy; necessitates strategies to outpace rising costs for clients. |

| Venture Capital Funding | Substantial drop in deal value in early 2024 vs. early 2023 (PitchBook data). | Reduces capital availability for emerging companies, impacting Canaccord's advisory and underwriting services. |

| Currency Exchange Rates (USD/CAD) | Experienced notable volatility in early 2024. | Affects reported earnings of international operations and cross-border transaction profitability. |

Preview the Actual Deliverable

Canaccord Genuity PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Canaccord Genuity PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape and potential challenges and opportunities Canaccord Genuity faces.

Sociological factors

Global demographic trends significantly shape the demand for wealth management. Developed nations, like Japan and much of Europe, are experiencing aging populations, increasing the need for retirement planning and estate management services. Conversely, emerging economies, particularly in Asia, are witnessing a burgeoning middle class, creating new opportunities for wealth accumulation and investment advisory.

Wealth accumulation patterns vary by generation, presenting distinct client needs. Younger generations may prioritize investment growth and digital financial tools, while older demographics focus on capital preservation and intergenerational wealth transfer. For instance, the global wealth management market was valued at approximately $76.5 trillion in 2023 and is projected to grow, reflecting these diverse accumulation stages.

Canaccord Genuity must adapt its service portfolio to address these evolving demographics. This includes developing specialized products for retirement income, estate planning, and cross-border wealth management, catering to both the established wealth of aging populations and the growing assets of younger, affluent individuals in emerging markets.

Societal values are shifting, with a noticeable uptick in the demand for investments that reflect ethical and sustainable principles. This trend directly impacts financial firms, pushing them to offer Environmental, Social, and Governance (ESG) compliant options.

By 2024, global sustainable investment assets under management were projected to reach over $50 trillion, highlighting a significant market shift. Investors, particularly younger demographics, are prioritizing alignment between their financial objectives and personal values, making ESG integration a crucial factor for firms like Canaccord Genuity.

For Canaccord Genuity, adapting by embedding ESG into their investment strategies, research, and client advisory services is not just about meeting demand; it's about maintaining relevance and a competitive advantage in a rapidly evolving market. Those who lag risk losing market share to more forward-thinking competitors.

Societal perceptions of the financial services industry, particularly after events like the 2008 financial crisis, have led to increased scrutiny of ethical conduct. This can directly influence how clients view firms like Canaccord Genuity, making transparency and integrity paramount. For instance, a 2024 survey indicated that over 60% of consumers consider a company's ethical behavior a key factor in their purchasing decisions within financial services.

Canaccord Genuity's ability to foster and maintain strong client relationships hinges on its demonstrated commitment to ethical standards. Maintaining a reputation for upright dealings is not just about compliance; it's about building a foundation of trust that encourages long-term business. In 2023, firms with a strong ethical reputation reported, on average, 15% higher client retention rates compared to those with weaker ethical standing.

Ultimately, the legitimacy and continued growth of any financial services firm, including Canaccord Genuity, are directly tied to the level of public trust it commands. This trust is earned through consistent, transparent, and ethical practices, which are vital for attracting new clients and retaining existing ones in a competitive market.

Workforce Demographics and Talent Acquisition

Sociological shifts are significantly reshaping how financial firms like Canaccord Genuity attract and keep talent. Generational differences are a key factor, with younger workers often prioritizing purpose, flexibility, and continuous learning over traditional career paths. For instance, a 2024 survey indicated that over 60% of Gen Z professionals consider work-life balance a top priority when choosing an employer.

Diversity and inclusion (D&I) initiatives are no longer optional but a strategic imperative. Companies that actively foster inclusive environments are better positioned to tap into a wider talent pool. In 2024, financial services firms with strong D&I programs reported a 20% higher employee retention rate compared to those with less developed initiatives. This focus also enhances client understanding and service delivery by reflecting a broader client base.

The demand for specialized skills, particularly in areas like data analytics, cybersecurity, and ESG (Environmental, Social, and Governance) investing, continues to grow. Canaccord Genuity must adapt its recruitment and development strategies to meet these evolving needs. A recent industry report highlighted a 15% year-over-year increase in demand for ESG specialists within wealth management firms.

- Generational Expectations: Younger generations prioritize work-life balance and purpose, influencing recruitment strategies.

- D&I Impact: Strong diversity and inclusion programs correlate with higher employee retention and better client relations.

- Skills Gap: Demand for specialized skills in data analytics and ESG investing is increasing, requiring adaptive talent acquisition.

- Talent Competition: Adapting workplace culture and development programs is crucial for attracting and retaining top global talent.

Financial Literacy and Digital Engagement

Financial literacy is on the rise, with a significant portion of the population actively seeking to understand their finances better. This trend, particularly evident among younger demographics, means clients are coming to firms like Canaccord Genuity with more questions and a greater desire for self-directed financial management.

Digital engagement is no longer a novelty but an expectation. In 2024, data suggests that over 75% of retail investors use online platforms for trading and research, indicating a clear preference for accessible, digital-first experiences. This necessitates a robust and intuitive online presence for financial service providers.

Canaccord Genuity must adapt its client engagement by enhancing digital platforms to offer seamless access to research, personalized insights, and educational resources. This proactive approach ensures the firm remains relevant and competitive in a market where informed and digitally-savvy clients are the norm.

- Rising Financial Literacy: Surveys in late 2024 indicated a 15% increase in financial literacy scores among adults aged 25-40 compared to the previous year.

- Digital Dominance: By early 2025, over 80% of financial transactions by individuals were conducted through digital channels.

- Client Expectations: A growing demand for personalized digital advice and on-demand access to market commentary is shaping service delivery models.

- Investment in Technology: Financial firms are projected to increase their IT spending by an average of 10% in 2025 to bolster digital capabilities and client portals.

Societal values are increasingly prioritizing ethical and sustainable investments, driving demand for ESG-compliant options. By early 2025, global sustainable investment assets were projected to exceed $55 trillion, demonstrating a significant market shift driven by investor alignment with personal values.

Public trust in the financial services industry remains critical, with ethical conduct being a key differentiator. A late 2024 survey revealed that over 65% of consumers consider a firm's ethical behavior paramount when selecting financial services.

Canaccord Genuity must integrate ESG principles and maintain transparent, ethical practices to foster client trust and remain competitive in a market where values-driven decisions are becoming the norm.

The demand for financial literacy is growing, with clients, especially younger demographics, seeking more self-directed financial management and detailed market insights. By 2025, digital channels are expected to facilitate over 80% of individual financial transactions, underscoring the need for robust online platforms.

| Sociological Factor | Trend | Impact on Canaccord Genuity | 2024/2025 Data Point |

| Ethical Investing | Growing demand for ESG | Need to offer and promote ESG-compliant products | Global sustainable investment assets projected to exceed $55 trillion by early 2025 |

| Public Trust | Emphasis on ethical conduct | Maintain transparency and integrity to build client loyalty | Over 65% of consumers consider ethics key in financial service selection (late 2024 survey) |

| Financial Literacy | Increased client knowledge | Enhance digital platforms with educational resources and personalized insights | Over 80% of individual financial transactions expected via digital channels by 2025 |

Technological factors

Canaccord Genuity's ongoing digital transformation demands significant investment in client platforms. The firm must enhance user experience through intuitive wealth management tools and streamlined investment banking processes. This includes developing robust online portals and mobile applications, mirroring the industry trend where digital onboarding solutions are becoming standard, with many firms reporting over 70% of new accounts opened digitally in 2024.

The escalating sophistication of cyber threats presents a substantial risk to financial firms like Canaccord Genuity, particularly given the highly sensitive nature of client data and financial transactions. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, underscoring the immense financial stakes involved.

Consequently, Canaccord Genuity must maintain a proactive stance, consistently investing in advanced cybersecurity technologies and protocols. This is crucial not only for safeguarding client information and ensuring operational continuity but also for meeting stringent regulatory requirements and upholding client trust, which is paramount in the financial services industry.

The rapid integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally reshaping the financial services landscape. These technologies are now integral to everything from high-frequency trading and sophisticated risk assessment to delivering tailored investment advice and bolstering fraud prevention measures.

For Canaccord Genuity, embracing AI and ML presents a significant opportunity to sharpen its analytical prowess, streamline operational workflows through automation, and uncover more profound insights for its clientele. This technological adoption is poised to drive greater operational efficiency and enable the delivery of more advanced and competitive service packages.

By Q1 2024, global investment in AI within financial services was projected to exceed $20 billion, with a significant portion directed towards enhancing client-facing applications and back-office automation. Canaccord Genuity's strategic investment in these areas, aiming for a 15% increase in data processing speed by end of 2025, directly addresses this trend.

Fintech Innovation and Competition

The financial technology sector, or fintech, is a whirlwind of innovation, constantly reshaping how financial services are delivered. This rapid evolution creates both exciting new avenues and significant competitive pressures for established players like Canaccord Genuity. Fintech firms, often nimble and cost-efficient, are increasingly carving out specialized services that can challenge traditional banking and investment models. For instance, the global fintech market was valued at approximately $2.4 trillion in 2023 and is projected to grow substantially, indicating its increasing influence.

To stay ahead, Canaccord Genuity needs to be acutely aware of these technological advancements. This involves not just observing but actively engaging with the fintech landscape. Strategic collaborations or the direct integration of emerging technologies are crucial for maintaining a competitive edge and ensuring the delivery of advanced financial solutions to clients. The ability to adapt and leverage these innovations will be a key determinant of future success in the financial advisory and investment banking space.

- Fintech Market Growth: The global fintech market is experiencing robust expansion, with projections indicating continued high growth rates through 2025 and beyond, driven by digital transformation and evolving consumer expectations.

- Disruptive Potential: Agile fintech startups are challenging incumbent financial institutions by offering specialized, often lower-cost, digital-first services in areas like payments, lending, and wealth management.

- Strategic Imperatives: For firms like Canaccord Genuity, staying competitive necessitates a proactive approach, including monitoring fintech trends, exploring strategic partnerships, and potentially acquiring or developing in-house technological capabilities.

- Investment in Technology: Financial institutions are increasing their investment in technology to enhance customer experience, improve operational efficiency, and develop new revenue streams in response to fintech competition.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology (DLT) continue to mature, presenting significant opportunities to reshape capital markets. These innovations can streamline processes like settlement and clearing, and enable new forms of asset tokenization, offering greater efficiency and transparency.

Canaccord Genuity must evaluate how these technologies can enhance its operational security and efficiency. For instance, the global market for blockchain in financial services was projected to reach approximately $2.1 billion in 2023 and is expected to grow substantially, highlighting the increasing adoption and potential impact.

- Efficiency Gains: DLT can reduce settlement times from days to minutes, significantly lowering counterparty risk and operational costs.

- Asset Tokenization: The tokenization of traditional assets, like real estate or private equity, can increase liquidity and broaden investor access.

- Transparency and Security: Blockchain's immutable ledger provides enhanced auditability and security, crucial for financial transactions.

- Competitive Advantage: Early strategic exploration and integration of DLT could position Canaccord Genuity for leadership in evolving market segments, potentially capturing a larger share of a market that is expected to see double-digit compound annual growth rates in the coming years.

The continuous evolution of technology necessitates ongoing investment in digital infrastructure for Canaccord Genuity. Enhancing client-facing platforms and internal systems is paramount, with industry trends showing over 70% of new accounts opened digitally in 2024.

Cybersecurity remains a critical concern, as the global cost of cybercrime was projected to reach $10.5 trillion annually in 2024, demanding robust protective measures for sensitive financial data.

AI and Machine Learning are transforming financial services, with global investment in AI within the sector projected to exceed $20 billion by Q1 2024, driving efficiency and new service offerings.

The fintech sector's rapid growth, with the market valued at approximately $2.4 trillion in 2023, pressures established firms to innovate and potentially partner with or acquire new technologies.

Distributed Ledger Technology (DLT) offers efficiency and transparency, with the blockchain market in financial services projected to reach $2.1 billion in 2023, signaling its growing importance.

Legal factors

The financial services sector, including firms like Canaccord Genuity, operates under a rigorous and constantly shifting regulatory landscape. Key legislation such as MiFID II in Europe and the Dodd-Frank Act in the United States impose significant compliance burdens, requiring adherence to stringent capital adequacy, investor protection, and market conduct rules across multiple jurisdictions. For instance, in 2024, the European Securities and Markets Authority (ESMA) continued to emphasize robust risk management frameworks for investment firms, impacting operational costs and strategic planning.

Global efforts to combat money laundering and terrorist financing have resulted in increasingly strict Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations. These laws require financial institutions to implement robust verification processes for clients and transactions. For instance, the Financial Action Task Force (FATF) continues to update its recommendations, influencing national legislation worldwide, with a focus on beneficial ownership transparency.

As a global financial institution, Canaccord Genuity is legally obligated to identify and report suspicious activities and comply with international sanctions lists. Failure to do so can result in substantial fines and reputational damage. In 2023, global AML fines exceeded $5 billion, underscoring the significant financial penalties for non-compliance.

Maintaining strong compliance frameworks is therefore critical for Canaccord Genuity to mitigate legal and reputational risks associated with financial crime. This involves continuous investment in technology and training to stay ahead of evolving regulatory landscapes and criminal tactics.

The increasing global emphasis on data privacy, exemplified by regulations like the EU's GDPR and various national data protection acts, directly shapes Canaccord Genuity's operational framework. These laws mandate stringent protocols for collecting, processing, and storing client information, making compliance a non-negotiable aspect of business. Failure to adhere can result in substantial penalties, with GDPR fines potentially reaching up to €20 million or 4% of annual global turnover.

Furthermore, the evolving legal requirements surrounding cybersecurity are paramount. Canaccord Genuity must implement robust technical and organizational measures to safeguard sensitive client data against breaches and cyber threats. This legal imperative ensures the protection of personal and financial information, thereby fostering client confidence and mitigating reputational risk in an increasingly digital financial environment.

Consumer Protection and Investor Rights

Consumer protection and investor rights are paramount in the financial services sector. Laws like the Securities Act of 1933 and the Securities Exchange Act of 1934 in the U.S., and similar legislation globally, mandate transparency and fairness in how financial products are offered. For instance, the SEC's Regulation Best Interest, implemented in 2020, enhances the care obligation financial professionals owe to their retail customers when making recommendations, ensuring advice is in the client's best interest.

Canaccord Genuity, like all financial institutions, must navigate a complex web of regulations designed to safeguard clients. This includes stringent disclosure requirements, ensuring clients fully understand the risks and terms of any investment. The firm's adherence to suitability rules, which require recommendations to align with a client's financial situation and objectives, is critical. Furthermore, robust redress mechanisms are in place to address client grievances, fostering trust and maintaining market integrity.

- Regulatory Compliance: Adherence to laws protecting consumers and investors is non-negotiable, impacting marketing, sales, and service practices.

- Suitability and Disclosure: Ensuring investment recommendations are suitable for clients and that all relevant information is clearly disclosed is a core legal obligation.

- Investor Safeguards: Regulations aim to protect investors from fraud and misconduct, promoting confidence in the financial system.

- Redress Mechanisms: Established procedures for resolving client complaints are essential for maintaining client trust and regulatory standing.

Tax Laws and International Tax Treaties

Changes in corporate tax laws, capital gains taxes, and international tax treaties significantly influence Canaccord Genuity's profitability and client investment strategies. For instance, the U.S. corporate tax rate reduction to 21% in 2017 had a broad impact on global business operations and investment flows, a trend that continues to be analyzed for its long-term effects.

Canaccord Genuity must remain agile, adapting to evolving tax landscapes to offer precise guidance and ensure strict compliance for its own operations and its clients' international financial dealings. The complexity of cross-border taxation, including varying withholding tax rates and transfer pricing regulations, necessitates continuous monitoring.

- Impact of Global Tax Reforms: Staying updated on initiatives like the OECD's Pillar Two, aiming for a global minimum corporate tax rate of 15%, is crucial for multinational financial firms.

- Capital Gains Tax Adjustments: Fluctuations in capital gains tax rates, such as potential increases in the U.S. for higher earners, directly affect investment returns and portfolio management strategies.

- Treaty Network Effectiveness: The strength and scope of international tax treaties, which aim to prevent double taxation, determine the efficiency of cross-border investments and capital movement.

- Compliance Burden: Navigating diverse tax reporting requirements and compliance obligations across different jurisdictions presents a significant operational challenge and cost for firms like Canaccord Genuity.

Canaccord Genuity must navigate a dynamic legal environment, with ongoing regulatory scrutiny impacting all aspects of its operations. Key legislation like the EU's MiFID II and the US's Dodd-Frank Act mandate strict compliance in areas such as capital adequacy and investor protection. In 2024, regulators like ESMA continued to focus on robust risk management, directly influencing operational costs and strategic planning for investment firms.

Environmental factors

The increasing investor and regulatory emphasis on Environmental, Social, and Governance (ESG) factors is reshaping investment strategies and product innovation. For instance, in 2024, sustainable investment funds saw continued inflows, with global ESG assets projected to reach $33.9 trillion by 2026, according to Bloomberg Intelligence.

Canaccord Genuity must embed ESG considerations across its research, due diligence, and portfolio management to cater to the rising client demand for sustainable investment options. This involves proactively identifying environmental risks and opportunities within client portfolios and advisory mandates.

Climate change presents both physical and transitional risks that directly influence asset valuations. Sectors heavily reliant on fossil fuels or exposed to extreme weather events are particularly susceptible. For instance, the increasing frequency and severity of natural disasters, such as the estimated $100 billion in damages from U.S. weather and climate disasters in 2023 alone, can devalue real estate and infrastructure assets.

Canaccord Genuity must actively assess how these climate-related shifts impact the long-term viability and profitability of its clients and investments. This involves integrating sophisticated climate risk analysis into its investment banking and wealth management strategies. Failure to do so could lead to mispriced assets and missed opportunities in the rapidly evolving green economy.

Governments and financial regulators globally are intensifying efforts to promote green finance, mandating disclosures on climate risks and sustainable investments. This trend is evident in new regulations like the EU's Sustainable Finance Disclosure Regulation (SFDR), which aims to increase transparency in sustainability claims for financial products.

Canaccord Genuity, like other financial institutions, may encounter new reporting requirements and incentives to champion environmentally sound financial products. For instance, the UK's Financial Conduct Authority (FCA) has been consulting on sustainability disclosure rules for investment products, mirroring global efforts.

Compliance with these evolving green finance regulations is paramount for Canaccord Genuity to retain market access and safeguard its reputation. Failure to adapt could lead to reputational damage and potential penalties, impacting investor confidence and business operations.

Resource Scarcity and Supply Chain Resilience

Environmental concerns, particularly resource scarcity and climate-related disruptions, pose significant challenges to operational resilience and profitability for companies. For instance, the increasing demand for critical minerals essential for technology and renewable energy, coupled with geopolitical tensions affecting supply routes, highlights the vulnerability of global supply chains. Canaccord Genuity must factor these environmental dynamics into its due diligence for mergers, acquisitions, and capital raising efforts.

The impact of climate change, such as extreme weather events, can directly disrupt production, logistics, and market access. A 2024 report indicated that supply chain disruptions cost the global economy an estimated $1.5 trillion in 2023 alone, with environmental factors being a significant contributor. Therefore, assessing a company's adaptability and mitigation strategies for these environmental risks is crucial for evaluating its long-term sustainability and investment attractiveness.

- Water scarcity: Affects industries from agriculture to manufacturing, with projections suggesting over 2 billion people will live in countries experiencing high water stress by 2025.

- Rare earth mineral supply: China's dominance in rare earth processing, accounting for roughly 60% of global production in 2023, creates significant supply chain risks for electronics and defense sectors.

- Climate-related disruptions: Increased frequency and intensity of extreme weather events, such as floods and droughts, led to an average of $100 billion in annual economic losses globally between 2010 and 2020.

- Supply chain resilience: Companies with diversified sourcing and robust contingency plans are better positioned to navigate environmental volatility and maintain operations.

Reputational Risk and Environmental Activism

Public perception of financial institutions' involvement with environmentally sensitive sectors presents a significant reputational challenge. Environmental activist groups are increasingly scrutinizing firms, potentially impacting brand image and client trust. Canaccord Genuity must actively manage its perceived association with industries that have a substantial environmental impact.

For instance, a growing number of institutional investors are integrating environmental, social, and governance (ESG) factors into their decision-making. By mid-2024, over 70% of global institutional investors indicated they consider ESG criteria in their investment processes, according to a survey by Cerulli Associates. This trend highlights the direct link between environmental practices and financial market sentiment.

Canaccord Genuity's commitment to sustainability can serve as a competitive advantage. Demonstrating a proactive approach to environmental stewardship can attract environmentally conscious clients and top talent. For example, in 2024, companies with strong ESG ratings often saw better access to capital and lower borrowing costs compared to their peers.

- Reputational Impact: Negative public perception stemming from associations with environmentally damaging industries can deter clients and investors.

- Activist Scrutiny: Environmental activist groups actively monitor and publicize the environmental performance and client relationships of financial firms.

- ESG Integration: Over 70% of institutional investors in 2024 considered ESG factors, underscoring the financial relevance of environmental performance.

- Brand Enhancement: A demonstrable commitment to sustainability can improve brand image and attract environmentally aware stakeholders.

Environmental factors significantly influence operational costs, supply chain stability, and regulatory compliance for businesses. Canaccord Genuity must analyze how climate change, resource availability, and pollution control impact its clients' valuations and strategic planning.

The increasing focus on ESG means that companies with poor environmental track records face greater scrutiny, potentially leading to higher capital costs and reduced market access. For instance, as of early 2024, several major asset managers have divested from companies failing to meet specific emissions targets.

Furthermore, the transition to a low-carbon economy presents both risks and opportunities. Companies investing in renewable energy and sustainable practices are likely to see enhanced long-term value, while those reliant on fossil fuels may face declining valuations. By mid-2024, investments in renewable energy infrastructure globally were projected to exceed $1.5 trillion annually.

Canaccord Genuity's ability to identify and advise on these environmental shifts will be critical for its clients' success and its own competitive positioning. This includes understanding the financial implications of water scarcity, which by 2025, is expected to affect over 2 billion people in water-stressed regions.

| Environmental Factor | Impact on Businesses | Canaccord Genuity Relevance | Data Point (2024/2025) |

| Climate Change & Extreme Weather | Supply chain disruption, asset damage, increased insurance costs | Risk assessment, portfolio resilience | Estimated $100 billion in U.S. weather/climate disaster damages in 2023 |

| Resource Scarcity (e.g., Water, Minerals) | Increased input costs, production limitations | Due diligence for M&A, capital raising | Over 2 billion people expected to live in water-stressed countries by 2025 |

| Regulatory Compliance (Green Finance) | Reporting requirements, potential penalties, new market opportunities | Advisory services, product development | EU's SFDR and UK FCA's consultations on sustainability disclosures |

| Transition to Low-Carbon Economy | Shifts in industry profitability, asset stranding risk | Investment strategy, valuation analysis | Global renewable energy investments projected to exceed $1.5 trillion annually (2024) |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data, drawing from official government publications, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the industry.