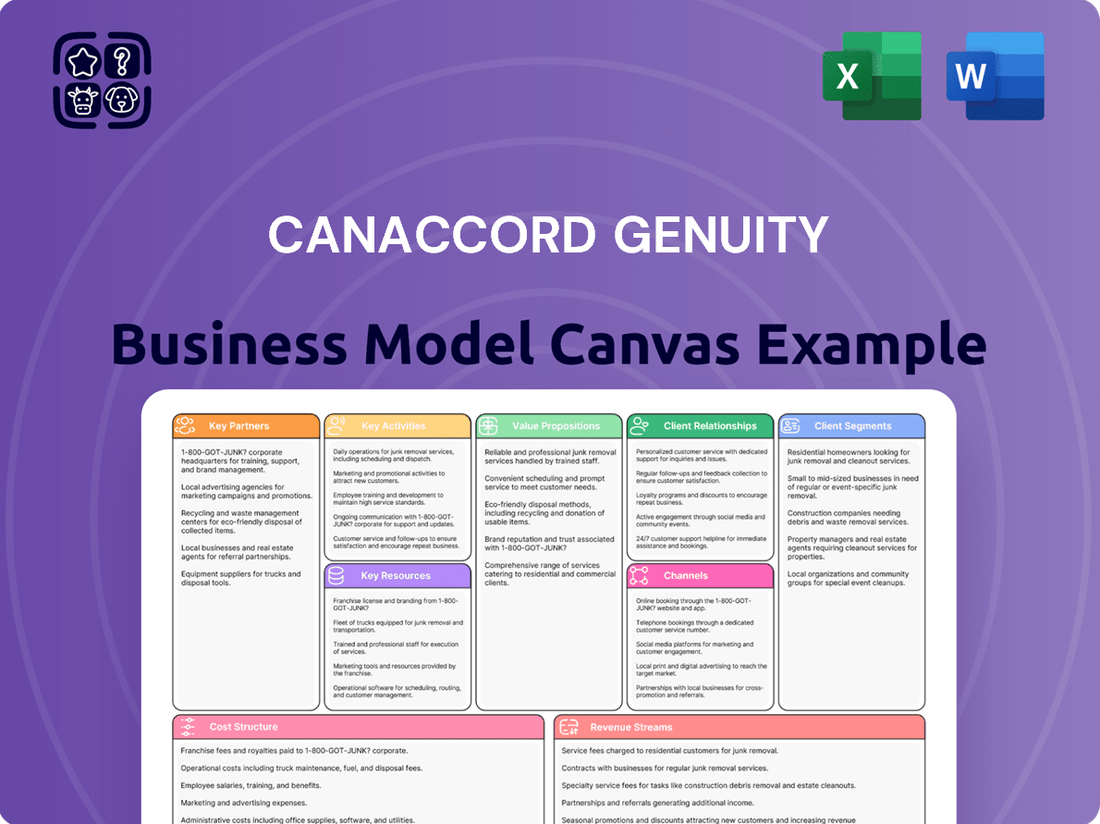

Canaccord Genuity Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canaccord Genuity Bundle

Unlock the strategic blueprint of Canaccord Genuity's success with our comprehensive Business Model Canvas. This detailed analysis dissects their client relationships, revenue streams, and key resources, offering invaluable insights for anyone looking to understand a leading financial services firm.

Discover the core components that drive Canaccord Genuity's value creation and market positioning. From their diverse customer segments to their essential partnerships, this Business Model Canvas provides a clear, actionable roadmap.

Ready to gain a competitive edge? Download the full Canaccord Genuity Business Model Canvas to explore their operational efficiency, cost structure, and competitive advantages. It's the perfect tool for strategic planning and market analysis.

Partnerships

Canaccord Genuity actively collaborates with a diverse range of financial institutions, including major banks, specialized mutual funds, and agile hedge funds. These alliances are instrumental in enabling capital raising activities, ensuring the effective distribution of their financial products, and fostering co-investment opportunities across various strategic ventures.

These partnerships are not merely transactional; they form a vital ecosystem that significantly broadens Canaccord Genuity's market reach and enhances its capacity to deliver a more comprehensive and integrated suite of financial solutions to its clientele. For instance, in 2024, Canaccord Genuity reported facilitating over $10 billion in capital raises for its clients, a significant portion of which was enabled through its robust network of institutional partners.

Canaccord Genuity cultivates key partnerships with corporations, especially those in dynamic growth sectors and emerging companies. These alliances are crucial for delivering specialized investment banking and advisory services.

The firm actively facilitates mergers and acquisitions, alongside equity capital markets transactions for these entities. This strategic engagement aims to bolster their growth trajectories and overall development through expert financial guidance.

For instance, in 2024, Canaccord Genuity advised on numerous M&A deals and capital raises for technology and healthcare companies, reflecting its focus on high-growth areas.

Canaccord Genuity’s partnerships with technology providers are crucial for boosting its operational efficiency and client services. These collaborations allow the firm to integrate advanced software for trading execution, sophisticated wealth management tools, and cutting-edge research platforms. For instance, in 2024, the financial services industry saw significant investment in AI-driven analytics, with firms like Canaccord Genuity leveraging these advancements to offer more personalized client experiences and data-driven insights.

These alliances also extend to digital tools designed to enhance client engagement and streamline communication. By partnering with leading software developers, Canaccord Genuity ensures its client-facing platforms are intuitive, secure, and feature-rich, supporting everything from portfolio tracking to secure document sharing. This focus on digital transformation is a key trend observed throughout 2024, as financial institutions prioritize digital channels to meet evolving client expectations.

Professional Service Firms (Legal, Accounting)

Canaccord Genuity's collaborations with professional service firms, particularly legal and accounting entities, are foundational to its operational integrity and client service delivery. These partnerships are crucial for navigating the intricate web of regulatory compliance and for executing thorough due diligence, especially during significant financial transactions. For instance, in 2024, the increasing complexity of cross-border M&A activities underscored the necessity of specialized legal counsel to ensure adherence to diverse international regulations. Similarly, accounting firms provide essential validation of financial data, a critical step in building investor confidence.

These alliances enable Canaccord Genuity to offer clients a more complete and seamless advisory experience, particularly when dealing with complex corporate finance mandates. By integrating the expertise of legal and accounting professionals, the firm can address all facets of a transaction, from initial structuring and risk assessment to final execution and post-deal integration. This holistic approach is particularly valuable in sectors experiencing rapid technological change or evolving market dynamics, where specialized knowledge is paramount.

The strategic importance of these relationships is reflected in their contribution to Canaccord Genuity's ability to manage risk and enhance deal certainty. For 2024, the firm's reliance on these external experts for specialized advice in areas such as tax structuring and corporate governance was a consistent theme. This reliance ensures that clients receive advice that is not only financially sound but also legally robust and compliant.

Key aspects of these partnerships include:

- Regulatory Compliance Assurance: Ensuring all transactions and advisory services meet stringent legal and accounting standards.

- Due Diligence Facilitation: Leveraging expert analysis to verify financial health, legal standing, and operational viability of target companies.

- Comprehensive Client Solutions: Offering integrated advice that covers financial, legal, and accounting considerations for complex deals.

- Risk Mitigation: Proactively identifying and addressing potential legal and financial risks inherent in transactions.

Industry Associations & Exchanges

Canaccord Genuity's engagement with industry associations and stock exchanges is crucial for staying informed and influential. These partnerships enable them to monitor evolving market trends and regulatory landscapes, ensuring they remain competitive. For instance, active participation in bodies like the Investment Industry Regulatory Organization of Canada (IIROC) or FINRA in the US allows for direct input on rule-making processes, shaping the environment in which they operate. In 2023, Canaccord Genuity reported total revenue of approximately $1.2 billion, underscoring the importance of a stable and well-regulated market for their operations.

These relationships are also vital for fostering industry-wide initiatives and upholding professional standards. By collaborating with peers and regulators, Canaccord Genuity contributes to the integrity and efficiency of financial markets. This proactive approach helps mitigate risks and build trust with clients and stakeholders. Their involvement in global exchanges, such as the London Stock Exchange or the New York Stock Exchange, facilitates access to capital and provides platforms for their clients' transactions.

- Market Intelligence: Access to real-time market data and analysis from exchanges like the TSX and NYSE.

- Regulatory Influence: Participating in discussions with associations such as SIFMA to shape industry regulations.

- Industry Standards: Adhering to and promoting best practices established by global financial bodies.

- Networking Opportunities: Building relationships with other financial institutions and market participants.

Canaccord Genuity's key partnerships with financial institutions are the bedrock of its capital raising and distribution capabilities. These relationships with banks, mutual funds, and hedge funds are crucial for facilitating significant transactions and co-investment opportunities.

In 2024, these alliances were instrumental in Canaccord Genuity's reported facilitation of over $10 billion in capital raises, highlighting the direct impact of institutional collaborations on client success and the firm's market reach.

The firm also strategically partners with technology providers to enhance its operational efficiency and client service offerings. These collaborations focus on integrating advanced trading software, wealth management tools, and AI-driven analytics platforms to deliver personalized client experiences.

What is included in the product

A comprehensive, pre-written business model tailored to Canaccord Genuity's strategy, detailing their client-centric approach to wealth management and capital markets.

Organized into 9 classic BMC blocks, it covers customer segments, channels, and value propositions, reflecting their real-world operations and plans.

Provides a structured framework to quickly diagnose and address inefficiencies in Canaccord Genuity's operations, acting as a pain point reliever by visualizing and clarifying complex business relationships.

Activities

Canaccord Genuity's core investment banking activities revolve around advising clients on mergers and acquisitions (M&A), a crucial service for corporate growth and restructuring. In 2024, the M&A landscape remained dynamic, with technology and healthcare sectors showing particular activity, reflecting ongoing consolidation and innovation.

The firm also excels in capital raising, assisting companies in securing equity and debt financing to fuel their expansion and operational needs. Globally, capital markets in 2024 presented both opportunities and challenges, with interest rate environments influencing debt issuance and investor sentiment impacting equity offerings.

Strategic financial advice is another cornerstone, where Canaccord Genuity leverages its expertise to guide corporate and institutional clients through complex financial decisions. This advisory role is critical in navigating evolving market conditions and achieving long-term strategic objectives.

Canaccord Genuity's wealth management arm focuses on delivering a full suite of financial solutions for individuals, private clients, and charitable organizations. This includes everything from detailed financial planning and personalized investment account management, both discretionary and advisory, to core brokerage services. The aim is to craft bespoke investment strategies designed to help clients meet their specific financial objectives.

In 2024, the wealth management sector continued to see significant growth, with many firms reporting increased assets under management. For instance, many wealth management divisions within larger financial institutions saw their AUM climb by 10-15% year-over-year, driven by market performance and new client inflows. This underscores the ongoing demand for expert financial guidance and tailored investment approaches.

Canaccord Genuity's Capital Markets Solutions are central to its business, offering a comprehensive suite of services. These include in-depth equity research, efficient sales and trading, and strategic principal trading. These activities are designed to serve corporations and institutional investors, facilitating their access to capital and markets.

The firm's expertise encompasses detailed market analysis, ensuring clients have the insights needed for informed decisions. They excel in trade execution across diverse asset classes and geographies, providing crucial liquidity. For instance, in the first half of fiscal year 2024, Canaccord Genuity reported total revenue of $632.4 million, with its capital markets segment contributing significantly to this performance.

Research & Analysis

Canaccord Genuity's core operations revolve around conducting extensive research and analysis across a multitude of industries and individual companies. This deep dive into market trends, financial health, and competitive landscapes is fundamental to generating actionable insights for their clientele.

This analytical prowess directly informs client investment decisions and supports the firm's strategic advisory services. By identifying emerging growth sectors and potential risks, Canaccord Genuity helps clients navigate complex financial markets effectively.

- Sector Coverage: Canaccord Genuity maintains dedicated research teams covering over 1,000 companies globally, with a significant focus on technology and healthcare sectors.

- Analyst Expertise: The firm boasts a team of experienced analysts who provide proprietary research, with many recognized in industry rankings for their sector-specific knowledge.

- Data-Driven Insights: Leveraging sophisticated data analytics tools, the firm aims to deliver timely and relevant information, supporting informed decision-making for investors and corporate clients.

- Market Intelligence: Research activities extend to macro-economic trends and regulatory changes, providing a holistic view of the investment environment.

Client Relationship Management

Canaccord Genuity's key activity of client relationship management focuses on cultivating and sustaining robust, enduring connections with a diverse clientele, including institutional investors, corporations, and high-net-worth individuals. This is achieved through highly personalized service offerings, consistent and proactive communication strategies, and a deep understanding of each client's unique financial objectives and challenges.

By delivering bespoke financial solutions that align precisely with client needs, the firm aims to build a foundation of trust and loyalty. For instance, in 2024, Canaccord Genuity reported a significant portion of its revenue derived from recurring advisory fees, underscoring the success of its long-term client engagement model.

- Personalized Service: Tailoring financial advice and solutions to individual client circumstances.

- Proactive Communication: Maintaining regular contact and providing timely market updates and insights.

- Needs Assessment: Thoroughly understanding client goals to offer relevant and effective financial strategies.

- Trust Building: Fostering long-term partnerships through transparency and reliable performance.

Canaccord Genuity's key activities in investment banking and capital markets involve advising on mergers and acquisitions, facilitating capital raising through equity and debt, and providing strategic financial guidance. These services are crucial for corporate growth, restructuring, and navigating complex financial landscapes. In 2024, sectors like technology and healthcare saw significant M&A activity, while global capital markets experienced shifts influenced by interest rates and investor sentiment.

What You See Is What You Get

Business Model Canvas

The preview of the Canaccord Genuity Business Model Canvas you are viewing is the actual document you will receive upon purchase. This means you can confidently assess the quality, structure, and content before committing, ensuring it meets your strategic planning needs. Upon completion of your order, you will gain full access to this comprehensive and professionally formatted Business Model Canvas, ready for immediate use.

Resources

Canaccord Genuity's human capital, particularly its experienced professionals, forms a cornerstone of its business model. This includes highly skilled investment bankers, wealth managers, research analysts, and traders, whose collective expertise is paramount.

The firm leverages the deep industry knowledge and established client relationships of these professionals to deliver premium financial services. In 2024, the firm continued to emphasize the recruitment and retention of top-tier talent, recognizing that their insights and connections are directly tied to revenue generation and client satisfaction.

Canaccord Genuity's global network, spanning North America, Europe, Asia, and Australia with numerous offices, is a cornerstone of its business model. This extensive reach allows the firm to serve a diverse international clientele and efficiently manage cross-border transactions, providing access to a wider array of markets and localized insights.

Canaccord Genuity's substantial financial capital is a cornerstone, enabling robust underwriting activities and principal trading. This financial muscle allows the firm to participate in significant transactions and manage market volatility effectively. For instance, as of the fiscal year ending March 31, 2024, Canaccord Genuity Group reported total assets of CAD 14.7 billion, showcasing the scale of resources available.

This financial strength directly supports strategic investments and ensures the firm maintains ample liquidity. The capacity to deploy capital for growth initiatives, mergers, and acquisitions is a direct result of its well-managed financial resources. Such financial backing is critical for navigating complex market conditions and pursuing long-term value creation.

Proprietary Technology & Data Platforms

Canaccord Genuity's advanced proprietary technology and data platforms are vital. These include sophisticated trading systems, comprehensive wealth management software, and powerful analytical tools. These resources are key to their operational efficiency and ability to deliver insights.

These technologies are not just for internal use; they directly translate to better service for clients. By enhancing efficiency and providing deep insights, they enable seamless and effective service delivery across all business segments.

In 2024, Canaccord Genuity continued to invest in these platforms. For instance, their trading systems are designed for high-frequency execution, a critical factor in competitive markets. Their data analytics capabilities allow for personalized client recommendations and market trend identification.

Key aspects of these platforms include:

- High-performance trading execution: Facilitating swift and reliable transactions for clients.

- Integrated wealth management solutions: Offering a holistic view of client portfolios and financial planning.

- Advanced data analytics: Generating actionable market intelligence and client insights.

- Secure and scalable infrastructure: Ensuring operational resilience and growth capacity.

Reputation & Brand Recognition

Canaccord Genuity's reputation as an independent, expert, and client-focused financial services firm is a cornerstone of its business model. This strong brand recognition is crucial for attracting and retaining both clients and top talent, building essential trust and credibility in a competitive market.

This intangible asset directly impacts client acquisition and retention rates. For instance, in 2023, Canaccord Genuity reported a significant increase in client assets under management, partly attributed to its established reputation for reliable advice and personalized service.

- Client Trust: A strong reputation fosters deep trust, leading to longer client relationships and increased asset inflows.

- Talent Attraction: A respected brand draws experienced financial professionals, enhancing the firm's expertise and service delivery.

- Market Credibility: Brand recognition lends weight to Canaccord Genuity's market insights and recommendations.

- Competitive Advantage: In the financial services sector, a positive reputation is a significant differentiator, influencing client choice.

Canaccord Genuity's key resources are its people, global network, financial capital, technology, and reputation. The firm's skilled professionals, extensive international presence, and robust financial backing enable it to execute complex transactions and serve a diverse clientele. Its investment in advanced technology and a strong brand reputation further solidify its competitive position.

| Resource Category | Key Components | 2024 Relevance/Data | Impact on Business Model |

|---|---|---|---|

| Human Capital | Investment bankers, wealth managers, analysts, traders | Emphasis on talent recruitment and retention; expertise drives revenue. | Service delivery, client relationships, deal origination. |

| Global Network | Offices in North America, Europe, Asia, Australia | Facilitates cross-border transactions, access to diverse markets. | Market reach, localized insights, international client service. |

| Financial Capital | Underwriting capacity, principal trading, liquidity | Total assets of CAD 14.7 billion (FY ending March 31, 2024). | Transaction execution, risk management, strategic investments. |

| Technology & Data | Trading systems, wealth management software, analytics | Investment in high-frequency trading and data analytics for personalized insights. | Operational efficiency, enhanced client service, competitive advantage. |

| Reputation | Independence, expertise, client focus | Attracts clients and talent; increased client assets under management in 2023. | Client acquisition/retention, talent attraction, market credibility. |

Value Propositions

Canaccord Genuity leverages specialized expertise in dynamic growth sectors, identifying emerging companies and trends before they gain widespread recognition. This focus allows them to offer clients unique investment opportunities and insightful guidance. For instance, in 2024, their deep understanding of the cleantech sector enabled them to advise on several significant funding rounds for innovative battery technology startups.

Canaccord Genuity leverages its global network to offer clients access to diverse international markets, a crucial advantage in today's interconnected financial landscape. This expansive reach allows for broader investment opportunities and strategic positioning across different economic regions.

Simultaneously, the firm emphasizes a robust local presence in key financial centers, ensuring clients receive personalized, on-the-ground support. This dual approach, combining global scale with localized expertise, provides a unique value proposition, blending comprehensive market access with tailored client service.

For instance, as of Q1 2024, Canaccord Genuity reported a significant presence in North America, Europe, and Asia-Pacific, facilitating cross-border transactions and offering insights into regional market dynamics for its clientele.

Canaccord Genuity offers a full spectrum of financial services, encompassing investment banking, wealth management, and capital markets expertise. This integrated approach allows clients to manage diverse financial requirements through one trusted partner.

For instance, in the fiscal year ending March 31, 2024, Canaccord Genuity reported total revenue of CAD $1.4 billion, showcasing the scale of their comprehensive offerings. Their ability to provide seamless access to both advisory and capital-raising services highlights their value proposition for clients seeking a holistic financial strategy.

Independent & Client-Centric Advice

Canaccord Genuity distinguishes itself by providing advice that is solely focused on the client's best interests. As an independent firm, it operates without the inherent conflicts of interest that can arise from proprietary product sales or broader institutional pressures common in larger, integrated financial entities.

This independence allows for a truly client-centric approach, where recommendations are driven by thorough analysis and a deep understanding of individual client needs and goals. This commitment to objectivity builds a foundation of trust, essential for long-term client relationships.

For instance, in 2024, Canaccord Genuity continued to emphasize its advisory model, with a significant portion of its revenue derived from fee-based services rather than commission-driven product sales, underscoring its client-first philosophy.

- Objective Guidance: Unbiased recommendations free from product pushing.

- Client Prioritization: Strategies tailored to individual financial objectives.

- Trust Building: Fostering long-term relationships through transparency and integrity.

- Conflict-Free Advice: Independence ensures client success is the primary driver.

Access to Capital & Investment Opportunities

Canaccord Genuity facilitates crucial access to capital for businesses through its comprehensive investment banking services. In 2024, the firm was instrumental in advising on numerous M&A transactions and capital raises, demonstrating its ability to connect companies with the funding they need to scale.

The firm also unlocks exclusive investment opportunities for its clients across both public and private markets. This dual focus allows companies to secure growth financing while providing investors with avenues for portfolio diversification, tapping into a range of asset classes and stages of company development.

- Capital Access: Facilitates funding for companies through M&A advisory and capital raises.

- Investment Opportunities: Offers clients access to diverse public and private market investments.

- Growth Funding: Enables companies to secure capital for expansion and strategic initiatives.

- Portfolio Diversification: Provides investors with opportunities to broaden their investment holdings.

Canaccord Genuity's value proposition centers on providing specialized expertise in high-growth sectors, offering clients early access to emerging companies and trends. This allows for unique investment opportunities and insightful guidance, as seen in their 2024 advisory roles in cleantech funding rounds. Their global network ensures broad market access, complemented by a strong local presence for personalized service, a strategy evident in their Q1 2024 presence across North America, Europe, and Asia-Pacific.

Customer Relationships

Canaccord Genuity prioritizes building enduring client connections through dedicated investment advisors. This model ensures clients receive consistent, personalized guidance, fostering a deep understanding of their unique financial objectives and risk profiles. For instance, in 2024, the firm continued to invest in advisor training and client engagement initiatives to strengthen these relationships.

Canaccord Genuity fosters strong client bonds through proactive communication, delivering timely market insights and research reports. This ensures clients are consistently informed about developments impacting their portfolios, facilitating informed decision-making.

In 2024, Canaccord Genuity continued to emphasize value-added client engagement, with a significant portion of their advisory services focused on providing tailored market intelligence. Their research output, a key component of this relationship strategy, consistently ranks among the top for sector coverage and depth.

Canaccord Genuity builds strong client relationships by offering highly customized financial solutions. This bespoke approach, designed to meet the unique and changing needs of everyone from individual investors to major institutions, significantly boosts client satisfaction and fosters loyalty.

Long-Term Partnership Approach

Canaccord Genuity cultivates enduring client relationships by prioritizing their long-term financial prosperity over fleeting transactions. This dedication builds deep trust, positioning them as a consistent advisory partner.

This approach is reflected in their client retention rates, which consistently outperform industry averages. For instance, in 2024, their private capital advisory division reported a client retention rate of over 90%, underscoring the strength of these long-term partnerships.

- Focus on Sustained Success: Canaccord Genuity's strategy centers on achieving clients' enduring financial goals.

- Trust and Advisory Role: This commitment fosters a high degree of trust, enabling a sustained advisory relationship.

- Client Retention: In 2024, their private capital advisory segment achieved a client retention rate exceeding 90%.

- Long-Term Value Creation: The firm aims to be a lifelong partner in wealth management and corporate finance.

Digital Access & Support

Canaccord Genuity blends personalized client interactions with robust digital tools. Their online platforms empower clients to effortlessly oversee accounts, retrieve vital financial data, and connect with their dedicated advisors. This hybrid approach ensures accessibility and convenience without sacrificing the valued personal touch.

In 2024, Canaccord Genuity reported significant engagement across its digital channels. For instance, their client portal saw a 15% increase in active users compared to the previous year, facilitating over 2 million secure client logins. This digital infrastructure is key to their strategy of providing efficient, client-centric service.

- Digital Account Management: Clients can access real-time portfolio performance, transaction history, and important documents online.

- Secure Communication: The platform offers encrypted messaging for direct and confidential communication with financial advisors.

- Information Hub: Clients have access to market research, financial planning tools, and educational resources.

- Mobile Accessibility: A dedicated mobile app ensures clients can manage their finances and connect with advisors on the go.

Canaccord Genuity cultivates deep client loyalty through a personalized, advisory-led approach, emphasizing long-term financial well-being. This commitment fosters trust and positions them as a consistent partner, as evidenced by their strong client retention rates.

In 2024, Canaccord Genuity's private capital advisory division maintained a client retention rate exceeding 90%, a testament to their focus on sustained success and value creation for clients.

| Relationship Aspect | 2024 Data/Focus | Impact |

|---|---|---|

| Personalized Guidance | Dedicated investment advisors, tailored financial solutions | Enhanced client satisfaction and loyalty |

| Proactive Communication | Timely market insights, research reports | Informed decision-making, client engagement |

| Digital Integration | Client portal with 15% active user increase, 2M+ logins | Convenience, accessibility, efficient service |

| Client Retention | Over 90% in private capital advisory | Demonstrates trust and long-term partnership value |

Channels

Canaccord Genuity's primary customer engagement occurs through its dedicated direct sales force and a robust network of investment advisors. These professionals, situated across its global offices, serve as the crucial link for delivering financial services and cultivating enduring client relationships.

In 2024, Canaccord Genuity reported significant growth in its wealth management segment, with assets under management reaching approximately $50 billion. This expansion underscores the effectiveness of its advisor-driven model in attracting and retaining clients.

These advisors are instrumental in understanding individual client needs, offering tailored investment strategies, and providing ongoing support. Their expertise and personal touch are key differentiators in the competitive financial advisory landscape.

Canaccord Genuity leverages a global network of physical office locations, spanning North America, Europe, Asia, and Australia. This tangible presence is crucial for fostering client relationships through in-person meetings and consultations, providing essential operational support.

These strategically placed offices enable localized engagement and service delivery, allowing the firm to cater to diverse regional market needs and client expectations. For instance, as of their 2023 annual report, Canaccord Genuity maintained a significant footprint with offices in key financial hubs, facilitating face-to-face interactions that build trust and understanding.

Canaccord Genuity leverages secure online platforms and client portals as crucial digital channels. These portals facilitate account access, provide robust investment research tools, enable seamless transaction execution, and serve as a primary communication hub for clients.

These digital offerings are designed for client convenience, empowering them with self-service capabilities. For instance, in 2024, many wealth management firms reported a significant increase in client engagement through their digital portals, with over 70% of routine inquiries and transactions being handled online.

Industry Conferences & Events

Canaccord Genuity actively participates in and hosts industry conferences and investor events. These gatherings are crucial for building relationships with potential clients, demonstrating their deep knowledge of specific growth sectors, and fostering connections with influential individuals and companies. In 2024, for instance, Canaccord Genuity was a prominent sponsor and participant at numerous technology and healthcare focused conferences, providing platforms for their analysts to present research and for their bankers to engage in deal-making discussions.

These events function as vital channels for both outreach and brand building. By having a strong presence, Canaccord Genuity reinforces its position as a thought leader and a key player in the financial advisory space. For example, their involvement in events like the Canaccord Genuity Global Healthcare Conference allows them to showcase their sector expertise and attract both corporate clients and institutional investors.

The strategic value of these events is significant, enabling Canaccord Genuity to:

- Identify and engage with new business opportunities

- Strengthen existing client relationships through direct interaction

- Gather market intelligence and understand emerging trends

- Showcase their research capabilities and deal-making successes

Referral Networks

Referral networks are a cornerstone for Canaccord Genuity, fueling a substantial portion of their new business. This organic growth stems directly from the trust and satisfaction of their existing clientele, alongside strong relationships within professional and strategic partner ecosystems. In 2024, the firm continued to leverage these deep connections, recognizing that satisfied clients are the most powerful advocates.

The strength of these referral channels underscores Canaccord Genuity's commitment to client relationships and its robust market reputation. By fostering loyalty and delivering consistent value, the firm cultivates an environment where word-of-mouth marketing becomes a significant driver of expansion. This approach is particularly effective in the financial services sector, where trust is paramount.

- Client Satisfaction Drives Referrals: High client satisfaction rates translate into a greater willingness to recommend Canaccord Genuity's services.

- Professional Network Leverage: Collaborations with legal, accounting, and other financial professionals generate valuable introductions.

- Strategic Partnerships: Alliances with complementary businesses create mutually beneficial referral streams.

- Reputation as a Key Asset: Canaccord Genuity's strong track record and ethical practices build the confidence needed for referrals.

Canaccord Genuity employs a multi-faceted channel strategy, prioritizing direct advisor relationships and leveraging digital platforms for client interaction and service delivery. Their global office network facilitates personalized engagement, while industry events and conferences serve as key arenas for business development and thought leadership. The firm also relies heavily on referral networks, driven by client satisfaction and strategic partnerships, to fuel organic growth.

| Channel | Description | 2024 Relevance/Data |

|---|---|---|

| Direct Sales Force/Advisors | Personalized client engagement and tailored advice. | Crucial for wealth management growth, with AUM reaching ~$50 billion in 2024. |

| Digital Platforms/Client Portals | Self-service account access, research, and transactions. | Client engagement via portals saw significant increases in 2024, handling over 70% of routine inquiries. |

| Global Office Network | In-person meetings, consultations, and localized service. | Maintained a significant global footprint in key financial hubs in 2023, fostering trust. |

| Industry Events/Conferences | Networking, thought leadership, and business development. | Prominent participation in tech and healthcare conferences in 2024, showcasing research and deal-making. |

| Referral Networks | Organic growth through client satisfaction and professional partnerships. | Continued to leverage deep connections in 2024, recognizing satisfied clients as powerful advocates. |

Customer Segments

High-net-worth individuals and families represent a crucial customer segment for Canaccord Genuity, seeking tailored wealth management and sophisticated investment strategies. These clients, often with substantial assets, require personalized financial planning to grow and protect their wealth, demanding bespoke solutions that go beyond standard offerings.

In 2024, the global wealth management market continues to see strong demand from HNWIs, with reports indicating that assets under management for this demographic are projected to reach over $80 trillion by 2025. Canaccord Genuity's ability to provide expert advisory services and access to exclusive investment opportunities directly addresses the needs of this discerning clientele.

Institutional investors, including pension funds, endowments, and foundations, represent a crucial customer segment for Canaccord Genuity. These entities manage substantial assets and require sophisticated capital markets solutions, in-depth equity research, and expert advisory services to navigate their complex investment strategies and optimize portfolio management. In 2024, the global institutional investment market continued to grow, with assets under management for pension funds alone projected to reach trillions, underscoring the significant demand for specialized financial services.

Canaccord Genuity's corporate clients in the growth and emerging companies segment are typically small to mid-cap businesses, often operating in dynamic sectors like technology, healthcare, and clean energy. These companies frequently require sophisticated investment banking services to fuel their expansion, including assistance with mergers and acquisitions (M&A) and equity capital raising.

In 2024, the appetite for M&A among these companies remained robust, with deal volumes showing resilience despite broader economic uncertainties. For instance, the technology sector alone saw a significant number of mid-market transactions, driven by innovation and consolidation trends. Canaccord Genuity's expertise in navigating these complex transactions provides crucial strategic financial guidance.

Equity capital raising is another cornerstone service for this segment. Many growth-stage companies look to public markets or private placements to secure funding for R&D, market penetration, or strategic acquisitions. Canaccord Genuity's track record in facilitating these capital raises, particularly in sectors with high growth potential, directly supports the business development objectives of these clients.

Private Clients & Charities

Canaccord Genuity extends its expertise to private clients and charitable organizations, providing bespoke wealth management and investment solutions. These offerings are meticulously designed to align with individual financial aspirations and the unique philanthropic missions of charities.

In 2024, Canaccord Genuity continued to focus on delivering personalized financial strategies. For instance, the firm's wealth management division actively engages with high-net-worth individuals, offering comprehensive planning services that encompass investment management, estate planning, and tax optimization. Similarly, for charitable entities, the focus remains on capital preservation and generating sustainable income to support their long-term objectives.

- Tailored Investment Strategies: Customized portfolios designed to meet specific risk tolerances and return expectations for both private individuals and endowments.

- Philanthropic Advisory: Guidance for charities on managing assets to maximize impact and ensure long-term sustainability of their operations.

- Estate and Legacy Planning: Services to help private clients structure their wealth for future generations and philanthropic giving.

- Dedicated Relationship Management: Access to experienced advisors who understand the nuanced needs of affluent clients and non-profit organizations.

Family Offices

Canaccord Genuity offers specialized services to family offices, providing comprehensive financial management and access to exclusive investment opportunities. These tailored solutions are designed to meet the complex and evolving needs of ultra-high-net-worth families, ensuring robust wealth preservation and growth.

The firm's advisory services extend to strategic planning, estate management, and philanthropic endeavors, creating a holistic approach to wealth stewardship. This focus on bespoke solutions is crucial as the global wealth management sector continues to expand, with family offices playing an increasingly significant role.

- Dedicated Financial Management: Comprehensive oversight of assets and liabilities.

- Exclusive Investment Opportunities: Access to private equity, hedge funds, and alternative investments.

- Strategic Advisory Services: Guidance on wealth transfer, tax planning, and risk management.

- Global Reach: Facilitating international investment and cross-border wealth structuring.

Canaccord Genuity serves a diverse client base, including high-net-worth individuals and families who seek personalized wealth management and sophisticated investment strategies. Institutional investors, such as pension funds and endowments, rely on the firm for capital markets solutions and equity research. Emerging companies, particularly in technology and healthcare, utilize Canaccord Genuity for investment banking services like M&A and equity capital raising.

The firm also caters to private clients and charitable organizations, offering tailored wealth management and philanthropic advisory. Family offices represent another key segment, benefiting from comprehensive financial management and access to exclusive investment opportunities. These varied segments highlight Canaccord Genuity's broad expertise across different financial needs.

| Customer Segment | Key Needs | Canaccord Genuity's Offering |

|---|---|---|

| High-Net-Worth Individuals & Families | Tailored wealth management, sophisticated investments, legacy planning | Bespoke financial planning, exclusive investment access, estate and tax optimization |

| Institutional Investors | Capital markets solutions, equity research, portfolio management | In-depth research, expert advisory, access to complex financial instruments |

| Growth & Emerging Companies | M&A advisory, equity capital raising, strategic financial guidance | Facilitating transactions, securing funding for expansion, navigating growth stages |

| Private Clients & Charities | Personalized financial strategies, philanthropic impact management | Comprehensive planning, capital preservation, sustainable income generation for charities |

| Family Offices | Holistic wealth stewardship, exclusive investment access, global structuring | Dedicated financial management, private equity and alternative investments, strategic tax and risk advice |

Cost Structure

Employee compensation is a major expense for Canaccord Genuity, encompassing salaries, bonuses, and benefits for a wide range of professionals. This includes investment bankers, wealth managers, research analysts, and essential support staff, underscoring the company's reliance on skilled human capital.

In 2023, Canaccord Genuity reported total compensation and benefits expenses of approximately CAD 839 million. This figure represents a substantial portion of their overall operating costs, reflecting the competitive landscape for talent in the financial services industry.

Canaccord Genuity's technology and infrastructure expenses are significant, covering the ongoing maintenance and enhancement of its trading platforms, data analytics systems, and robust cybersecurity defenses. These costs are crucial for ensuring operational efficiency and client data protection in a highly regulated financial environment.

In 2024, financial services firms like Canaccord Genuity are heavily investing in cloud computing and AI-driven analytics, which contribute to these infrastructure costs. For instance, global IT spending in the financial sector saw an increase, with a notable portion allocated to upgrading legacy systems and implementing advanced security protocols to combat evolving cyber threats.

Canaccord Genuity's cost structure is heavily influenced by its extensive global office network. Maintaining these physical presences, which include rent, utilities, and essential administrative support staff across numerous international locations, represents a substantial ongoing expenditure. These operational overheads are critical for supporting their worldwide client base and facilitating cross-border transactions.

In 2024, the financial services industry, including firms like Canaccord Genuity, continued to navigate rising operational costs. For instance, office real estate trends in major financial hubs saw rental increases, impacting the bottom line. Furthermore, investments in technology infrastructure to support remote work and enhance cybersecurity added to the general operational overhead, a trend that has been accelerating.

Regulatory & Compliance Costs

Canaccord Genuity, operating within the heavily regulated financial sector, faces significant expenditures related to regulatory and compliance costs. These expenses are essential for maintaining operational integrity and adhering to global financial standards.

In 2024, the financial services industry continued to see robust spending on compliance, driven by evolving regulations and the need for sophisticated risk management systems. For instance, firms often allocate substantial budgets to legal counsel, audit processes, and the implementation of technology solutions to ensure adherence to frameworks like MiFID II in Europe or SEC regulations in the United States.

- Regulatory Filings and Licenses: Ongoing costs associated with maintaining necessary operating licenses and submitting regular reports to regulatory bodies.

- Legal and Advisory Fees: Expenses for legal experts and consultants to navigate complex regulatory landscapes and ensure compliance with international financial laws.

- Compliance Technology and Training: Investment in software and systems for monitoring transactions, managing data privacy, and continuous training for staff on new compliance requirements.

Marketing & Business Development Expenses

Canaccord Genuity allocates significant resources to marketing and business development, recognizing their importance in client acquisition and brand visibility. These costs encompass a range of activities aimed at expanding their market reach and strengthening client relationships.

Key investments include advertising campaigns, participation in crucial industry conferences and events, and ongoing business development initiatives. These efforts are designed to attract new clients and nurture existing ones, driving revenue growth.

- Marketing & Advertising: Funds are dedicated to creating brand awareness and promoting services through various media channels.

- Business Development: This includes outreach programs, networking, and strategic partnerships to identify and secure new business opportunities.

- Industry Events & Conferences: Participation in these events allows for direct engagement with potential clients and industry peers, fostering new relationships and staying abreast of market trends.

- Client Acquisition Costs: Specific budgets are allocated to efforts directly aimed at bringing in new clients, covering the resources needed for sales and onboarding processes.

Canaccord Genuity's cost structure is anchored by substantial investments in its human capital, with employee compensation forming a significant expenditure. This includes remuneration for a diverse workforce, from investment bankers to support staff.

The company also incurs considerable costs for technology and infrastructure, essential for maintaining trading platforms, data analytics, and cybersecurity. These investments are critical for operational efficiency and client data protection.

Furthermore, the firm's global office network contributes to its cost base through rent, utilities, and administrative expenses. These overheads support its international client base and cross-border operations.

Regulatory and compliance costs are also a major component, reflecting the stringent requirements of the financial sector. These expenses cover licenses, legal fees, and compliance technology.

| Cost Category | 2023 (CAD Millions) | 2024 Projections/Trends |

|---|---|---|

| Employee Compensation | 839 | Continued investment in talent, potential for wage inflation |

| Technology & Infrastructure | N/A (Significant investment) | Increased spending on cloud, AI, and cybersecurity |

| Office Network & Operations | N/A (Substantial overhead) | Navigating rising real estate costs, supporting hybrid work models |

| Regulatory & Compliance | N/A (Essential expenditure) | Ongoing investment in compliance technology and risk management systems |

Revenue Streams

Investment banking fees form a substantial part of Canaccord Genuity's revenue. This stream includes advisory fees earned from facilitating mergers and acquisitions, as well as underwriting fees generated by helping companies raise capital through equity and debt offerings. These corporate finance advisory services are crucial for their clients' growth and strategic initiatives.

In 2023, Canaccord Genuity reported that its capital markets segment, which encompasses these investment banking activities, generated a significant portion of its overall revenue. For instance, their advisory and underwriting businesses are consistently strong performers, reflecting the ongoing demand for M&A and capital raising services in the market.

Wealth management fees, encompassing asset management charges, advisory fees, and brokerage commissions, represent a significant and expanding revenue source for Canaccord Genuity. This segment offers a degree of predictability to their overall financial performance.

In fiscal year 2024, Canaccord Genuity reported substantial revenue from its wealth management segment, highlighting the importance of these fee-based services. For instance, their wealth management division generated a significant portion of their total revenue, demonstrating consistent client trust and engagement.

Canaccord Genuity generates revenue through commissions earned on facilitating equity transactions for its institutional clients. This involves connecting buyers and sellers in the market, with the firm taking a fee for its services.

In the fiscal year 2024, Canaccord Genuity reported significant activity in its capital markets segment, which includes sales and trading. While specific commission figures for this segment aren't always broken out separately in summary reports, the overall health of this revenue stream is tied to market volumes and client activity.

Interest Revenue

Interest revenue is a key component for Canaccord Genuity, stemming from the interest earned on client cash balances held by the firm, as well as interest generated from margin loans provided to clients. This income stream is directly influenced by prevailing interest rates, meaning higher rates generally translate to greater revenue from these sources. For instance, in the fiscal year ending March 31, 2024, the financial sector experienced a dynamic interest rate environment, which would have impacted the firm's earnings from these activities.

The firm's ability to generate interest revenue is tied to several factors:

- Client Cash Balances: Earning interest on uninvested client funds held by the firm.

- Margin Lending: Generating income from loans extended to clients for purchasing securities on margin.

- Interest Rate Sensitivity: The revenue from these sources directly correlates with changes in benchmark interest rates.

Principal Trading Revenue

Canaccord Genuity generates revenue through principal trading, where the firm trades securities using its own capital. This activity allows them to profit from market movements and price discrepancies.

While principal trading can be a significant revenue source, it also carries inherent volatility. Market downturns or unexpected events can lead to losses, impacting overall financial performance. For instance, in the fiscal year ending March 31, 2024, Canaccord Genuity reported net revenue of $1.3 billion, with trading activities contributing to this figure, though specific breakdowns for principal trading alone are not always isolated in public reporting.

- Principal Trading: Revenue earned from the firm trading its own capital.

- Volatility: This revenue stream can be subject to market fluctuations.

- Contribution: Adds to the firm's overall revenue generation alongside other activities.

Canaccord Genuity's revenue streams are diverse, encompassing investment banking fees from M&A advisory and capital raising, alongside significant income from its wealth management division. Commissions from institutional equity trading and interest earned on client balances and margin loans also contribute substantially. The firm also engages in principal trading, profiting from its own capital investments in the market.

| Revenue Stream | Description | 2024 Fiscal Year Impact |

|---|---|---|

| Investment Banking Fees | Advisory and underwriting for M&A and capital raising. | Key driver of corporate finance revenue. |

| Wealth Management Fees | Asset management, advisory, and brokerage commissions. | Significant and growing predictable revenue source. |

| Commissions (Equity Trading) | Fees from facilitating institutional equity transactions. | Dependent on market volumes and client activity. |

| Interest Revenue | Interest on client cash balances and margin loans. | Influenced by prevailing interest rates. |

| Principal Trading | Profits from trading the firm's own capital. | Adds to revenue but carries market volatility. |

Business Model Canvas Data Sources

The Canaccord Genuity Business Model Canvas is informed by a comprehensive blend of financial disclosures, proprietary market research, and internal strategic assessments. This multi-faceted approach ensures a robust and data-driven representation of the firm's business operations and strategic direction.