Canaccord Genuity Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canaccord Genuity Bundle

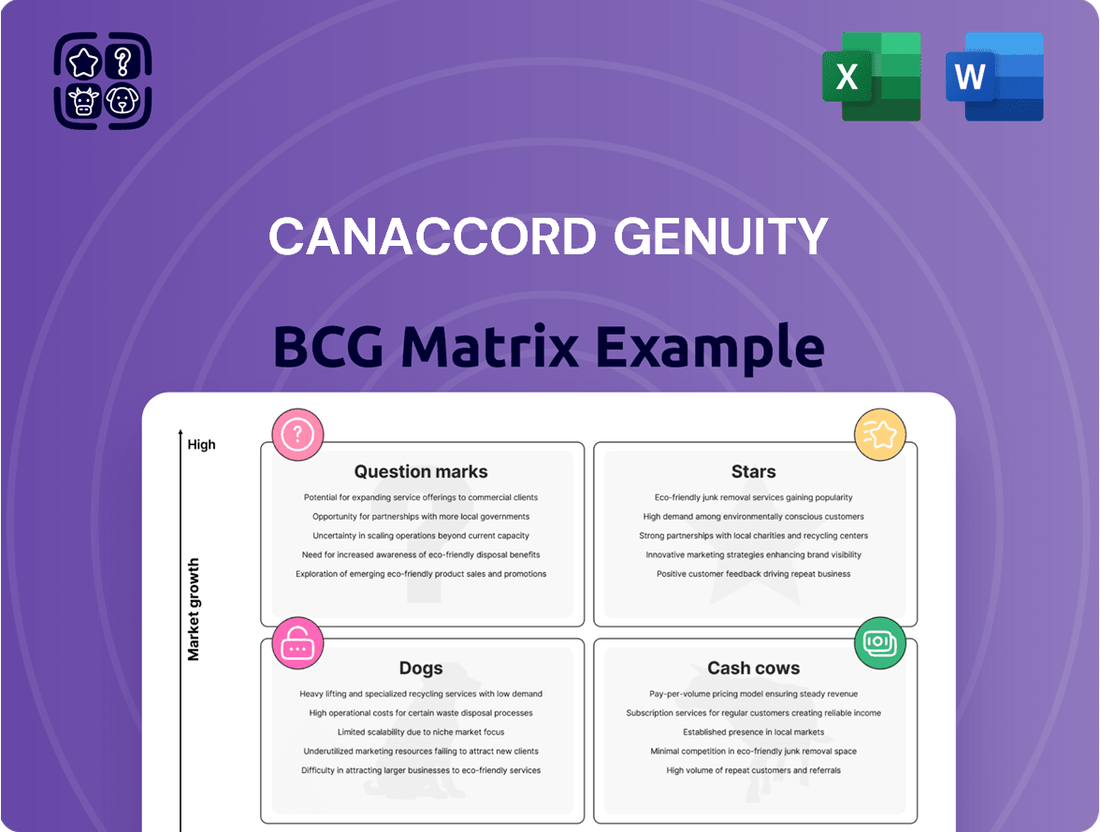

Unlock the strategic potential of Canaccord Genuity's BCG Matrix analysis for this company. See at a glance which products are driving growth (Stars), generating consistent revenue (Cash Cows), lagging behind (Dogs), or present future opportunities (Question Marks). Purchase the full report for a comprehensive breakdown and actionable insights to optimize your portfolio.

Stars

Canaccord Genuity's global wealth management division is a star performer, showcasing exceptional growth. In fiscal 2025, the segment posted record quarterly revenue of $238.9 million and an annual record of $904.8 million, marking substantial 19.4% and 17.0% year-over-year jumps.

This robust revenue expansion is mirrored by a significant increase in client assets. As of March 31, 2025, total client assets under management hit a new high of $120.4 billion, up 15.9% from the previous year.

The wealth management sector in the UK and Crown Dependencies is a star performer, boasting client assets of £35.9 billion as of the close of 2024. This represents a healthy 6.6% growth compared to the previous year, underscoring the segment's robust expansion and appeal.

Further solidifying its leading position, this segment achieved record quarterly revenue of £64.6 million in the third quarter of fiscal year 2025. This figure signifies a substantial 7.3% year-over-year increase, highlighting strong client engagement and successful market penetration within a dynamic environment.

Canaccord Genuity's Australian wealth management segment is a strong performer, exhibiting significant growth. In the fourth quarter of 2024, this division brought in C$21.2 million in revenue, marking a robust 31.3% jump year-over-year. This indicates a healthy expansion and increasing market penetration for their services in Australia.

Further underscoring this positive trend, client assets under management in Australia surged by 31.3% from March 31, 2024, reaching AUD 9.4 billion (approximately $8.4 billion) by March 31, 2025. This substantial asset growth reflects strong client confidence and the successful acquisition of new business within the region, positioning it as a key growth driver.

Investment Banking Advisory Services

Canaccord Genuity's Investment Banking Advisory Services are a significant contributor to its overall performance, showcasing strong growth and market presence. For fiscal year 2025, this segment experienced a remarkable surge in revenue, reaching $305.0 million, a substantial 32.7% increase compared to the previous year. This impressive performance positions the advisory services as the third highest revenue-generating business line in its history.

This robust expansion in advisory fees, especially within the capital markets division, underscores Canaccord Genuity's strong market share. The growth is indicative of a favorable market environment and the firm's ability to capitalize on opportunities within buoyant segments.

- Fiscal 2025 Advisory Revenue: $305.0 million

- Year-over-Year Growth: 32.7% increase

- Historical Performance: Third highest annual revenue on record

- Key Driver: Strong performance in capital markets division

US Capital Markets in Growth Sectors

Canaccord Genuity's US investment banking division saw a robust performance in 2024, with transaction volumes climbing by almost 20% over the previous year. This growth was primarily fueled by strong M&A activity and steady performance in equity capital markets (ECM). The firm's strategic emphasis on high-growth sectors continues to yield significant results.

The investment bank's market leadership is particularly evident in sectors such as technology, healthcare, sustainability, and consumer goods. These areas represent the Stars in the BCG Matrix context, characterized by both high growth rates and substantial market share for Canaccord Genuity.

- Technology: Continued strong deal flow in software, cloud services, and cybersecurity.

- Healthcare: Active M&A and ECM in biopharmaceuticals, medical devices, and healthcare IT.

- Sustainability: Growing advisory and capital raising for renewable energy and cleantech companies.

- Consumer: Engagement in e-commerce, direct-to-consumer brands, and evolving retail models.

Canaccord Genuity's wealth management divisions, particularly in the UK and Australia, along with its investment banking advisory services, are clear Stars within the BCG Matrix. These segments demonstrate high growth and strong market share, as evidenced by record revenues and significant increases in client assets throughout fiscal year 2025 and calendar year 2024.

The global wealth management segment achieved record quarterly revenue of $238.9 million in fiscal 2025, a 19.4% year-over-year increase, and ended March 31, 2025, with $120.4 billion in client assets, up 15.9%. The UK wealth management arm held £35.9 billion in client assets by the end of 2024, a 6.6% rise, while Australia's wealth management division saw its revenue jump 31.3% year-over-year in Q4 2024, reaching AUD 9.4 billion in client assets by March 31, 2025.

Canaccord Genuity's Investment Banking Advisory Services are also a Star, generating $305.0 million in revenue for fiscal year 2025, a 32.7% increase, making it the third highest revenue-generating business line historically. This growth is driven by strong performance in capital markets, particularly in high-growth sectors like technology and healthcare, where transaction volumes in the US investment banking division climbed nearly 20% in 2024.

| Segment | Metric | Value (FY25 unless noted) | Year-over-Year Growth | BCG Category |

|---|---|---|---|---|

| Global Wealth Management | Quarterly Revenue | $238.9 million | 19.4% | Star |

| Global Wealth Management | Client Assets (as of Mar 31, 2025) | $120.4 billion | 15.9% | Star |

| UK Wealth Management | Client Assets (as of Dec 31, 2024) | £35.9 billion | 6.6% | Star |

| UK Wealth Management | Quarterly Revenue (Q3 FY25) | £64.6 million | 7.3% | Star |

| Australian Wealth Management | Revenue (Q4 2024) | C$21.2 million | 31.3% | Star |

| Australian Wealth Management | Client Assets (as of Mar 31, 2025) | AUD 9.4 billion | 31.3% | Star |

| Investment Banking Advisory Services | Annual Revenue | $305.0 million | 32.7% | Star |

| US Investment Banking | Transaction Volumes (2024) | Up almost 20% | N/A | Star |

What is included in the product

The Canaccord Genuity BCG Matrix categorizes business units by market share and growth, offering strategic guidance.

The Canaccord Genuity BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex portfolio analysis.

Cash Cows

Canaccord Genuity's established North American Wealth Management segment is a prime example of a Cash Cow. This division brought in $100.4 million in revenue during the fourth fiscal quarter of 2025, marking a significant 29.4% jump from the previous year. For the full fiscal year 2025, revenue climbed to $374.8 million, a 25.7% increase.

The segment manages a substantial $42.7 billion in client assets as of March 31, 2025. This large, stable asset base, coupled with consistent revenue generation, indicates a mature business that reliably produces strong cash flow with relatively low investment needs.

Canaccord Genuity's wealth management segment is increasingly leaning on fee-based revenue, a strategic move that insulates it from the volatility of transaction volumes. This shift cultivates a more predictable and dependable income, a hallmark of a cash cow.

In the fourth quarter of 2024, this strategy bore fruit. Fee-related revenue saw a substantial 21.7% increase year-over-year. Crucially, these fees represented 49.5% of the total wealth management revenue in Canada, underscoring their growing importance as a stable income engine.

Canaccord Genuity's wealth management operations represent a significant cash cow within its BCG Matrix. In fiscal year 2025, this segment was the primary revenue generator, contributing 52% of the company's total earnings. This robust performance is driven by a stable, asset-based income model that effectively cushions the impact of market fluctuations in other business areas.

The consistent generation of cash is further underscored by record client assets and revenues within the wealth management division. This segment consistently produces more cash than it requires for operations and growth, solidifying its position as a dependable source of funding for the broader organization.

Consistent Contributions from Mature Capital Markets Segments

Established capital markets segments, such as principal trading and institutional sales and trading desks, serve as consistent cash cows for firms like Canaccord Genuity. These areas leverage deep client relationships and a steady flow of business, providing reliable revenue streams even during periods of lower new issue activity. In 2024, these mature segments are expected to continue their role as stable contributors.

These segments are fortified by a global platform, enabling them to generate consistent revenue regardless of the cyclical nature of new issue markets. This global reach is crucial for maintaining a steady income base.

- Principal Trading: Continues to be a stable income source, benefiting from established market access.

- Institutional Sales & Trading: Leverages long-standing relationships for consistent flow business.

- Global Platform: Supports reliable contributions even when new issue activity is slow.

- 2024 Outlook: These mature segments are projected to maintain their role as steady cash generators.

Long-standing Client Relationships

Canaccord Genuity's emphasis on long-standing client relationships, established since its 1950 founding, underpins its status as a Cash Cow. This focus cultivates a loyal customer base in both wealth management and capital markets, ensuring a predictable revenue stream. These enduring connections minimize client acquisition costs, contributing to stable and consistent profitability.

The company's commitment to client retention translates into tangible financial benefits. For instance, in its fiscal year ending March 31, 2024, Canaccord Genuity reported significant recurring revenue from its wealth management segment. This segment, a direct beneficiary of strong client relationships, represented a substantial portion of the firm's overall revenue, demonstrating the power of these long-term partnerships.

- Stable Revenue Generation: Long-term relationships provide a predictable income base, reducing reliance on volatile new business acquisition.

- Lower Acquisition Costs: Retaining existing clients is typically far less expensive than acquiring new ones, boosting profit margins.

- Referral Engine: Satisfied, long-term clients often become advocates, generating valuable organic growth through referrals.

- Resilience in Market Downturns: Loyal clients tend to stick with trusted advisors even during challenging market conditions, offering a buffer against economic volatility.

Cash Cows, like Canaccord Genuity's North American Wealth Management segment, are mature businesses with high market share and low growth prospects. They generate more cash than they consume, providing stable profits and funding for other ventures. This segment's consistent revenue, driven by a substantial asset base and increasing fee-based income, exemplifies its cash cow status.

The wealth management division's robust performance, contributing 52% of total earnings in fiscal year 2025, highlights its role as a dependable cash generator. Its ability to produce excess cash, even with minimal investment needs, solidifies its position as a key financial pillar for the organization.

Mature capital markets segments also function as cash cows, leveraging established client relationships and global platforms for consistent revenue. These areas, including principal trading and institutional sales, offer reliable income streams, acting as steady contributors even in fluctuating market conditions.

| Segment | FY2025 Revenue | YoY Growth | Client Assets (as of Mar 31, 2025) | % of Total Revenue (FY2025) |

| Wealth Management (North America) | $374.8 million | 25.7% | $42.7 billion | 52% |

| Principal Trading & Institutional Sales | (Not explicitly stated, but implied stable contributor) | (Implied stable) | (Not explicitly stated) | (Implied significant contributor) |

Delivered as Shown

Canaccord Genuity BCG Matrix

The Canaccord Genuity BCG Matrix preview you are currently viewing is the exact, fully formatted report you will receive upon purchase. This comprehensive document, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a polished and professional analysis ready for immediate application. You can confidently expect the same high-quality, actionable insights in the purchased version, empowering your strategic planning and business development efforts. This is the genuine article, ready to be integrated into your critical business discussions and presentations without any further modifications.

Dogs

Canaccord Genuity's decision in April 2025 to sell its U.S. wholesale market making business to Cantor highlights this segment as a 'Dog' within their BCG framework. The company explicitly stated this business was outside its strategic core, indicating it was a drain on resources without contributing to their main objectives. This divestiture underscores a move to streamline operations and concentrate on more profitable, strategically aligned areas.

Canaccord Genuity's North American commissions and fees revenue saw a downturn, decreasing by 2.8% in Q4 fiscal 2025 compared to the previous year. For the entire fiscal year 2025, this revenue stream experienced a 5.7% decline.

This contraction is largely attributed to reduced activity within North American operations. Such a trend in a typically transaction-based revenue source, especially within a developed market, signals a segment facing low growth prospects and potentially a shrinking market position, aligning with the characteristics of a 'Dog' in the BCG matrix.

Underperforming or non-strategic operational areas are like the weak links in a company's chain. These are the parts of the business that aren't pulling their weight, consuming resources without generating significant returns. Think of them as the "dogs" in the BCG matrix – they have low market share and low growth potential.

For instance, if a company has a division that consistently loses money and doesn't align with its core strategy or future growth plans, it would fall into this category. These areas often require substantial investment to maintain but offer little in the way of future upside. Identifying and addressing these segments is crucial for optimizing overall business performance.

Certain Transactional Brokerage Activities with Reduced Activity

Certain transactional brokerage activities, especially those highly sensitive to market fluctuations and lacking strong ties to advisory or wealth management services, have seen reduced engagement. These segments, often characterized by lower customer stickiness and cyclicality, can be categorized as Dogs within the BCG framework if they are not actively gaining market share.

For instance, while the broader financial services sector might show resilience, specific areas like pure execution-only trading desks or certain types of structured product sales can experience significant downturns during economic slowdowns. In 2024, many firms reported that while overall revenues saw growth, the contribution from these specific transactional areas remained relatively flat or declined, particularly in regions experiencing heightened economic uncertainty or regulatory shifts impacting fee structures.

- Subdued Transactional Volumes: Markets in 2024 saw a noticeable dip in activity for certain fee-based transactional services, especially those not bundled with broader client relationships.

- Market Sensitivity: These activities are highly susceptible to economic cycles; a downturn can significantly reduce their revenue-generating capacity.

- Lack of Advisory Integration: Brokerage activities not integrated with advisory or wealth management services tend to be less sticky and more prone to client attrition during volatile periods.

- Potential for Market Share Erosion: If these segments are not actively growing or innovating, they risk losing ground to more integrated or specialized competitors.

Any Discontinued or Divested Minor Business Lines

Canaccord Genuity has strategically streamlined its operations, focusing on its core investment banking and wealth management segments. This has led to the divestiture or phasing out of certain minor business lines that no longer align with this sharpened focus. For instance, the company's decision to sell its market-making business in late 2023 exemplifies this trend, allowing for greater concentration of resources on high-growth areas.

While specific details on all minor business lines undergoing review are not publicly disclosed, the overarching strategy suggests a continued evaluation of niche services. Any operations that do not contribute significantly to the primary revenue streams or strategic objectives are likely candidates for divestiture or discontinuation. This proactive approach ensures capital and management attention are directed towards areas with the greatest potential for growth and profitability.

- Divestiture of Non-Core Assets: Canaccord Genuity has been actively pruning its portfolio to concentrate on its core strengths in investment banking and wealth management.

- Focus on Strategic Alignment: Minor business lines that are not synergistic with the company's primary strategic objectives are being evaluated for divestment or discontinuation.

- Resource Optimization: The company aims to optimize resource allocation by divesting or phasing out operations that do not contribute significantly to its overall growth strategy.

- Market-Making Sale: A notable example of this strategy was the sale of its market-making business, signaling a clear intent to streamline operations.

Dogs represent business units with low market share and low growth potential, consuming resources without significant returns. Canaccord Genuity's sale of its U.S. wholesale market making business in April 2025 exemplifies this, as it was deemed outside their strategic core. This move highlights a commitment to shedding underperforming segments to focus on more profitable and strategically aligned areas.

The decline in Canaccord Genuity's North American commissions and fees revenue by 2.8% in Q4 fiscal 2025 and 5.7% for the full fiscal year 2025 further illustrates the challenges in segments with low growth prospects. Reduced market activity in these areas, particularly those lacking advisory integration, signals a 'Dog' status, where market share erosion is a risk without active innovation or strategic repositioning.

Divesting non-core assets and optimizing resource allocation are key strategies for companies like Canaccord Genuity when dealing with 'Dog' segments. This proactive approach ensures that capital and management attention are directed towards areas with higher growth and profitability potential, as seen in their focus on investment banking and wealth management.

In 2024, many financial firms observed that while overall revenues might have grown, specific transactional areas, especially those sensitive to market fluctuations and lacking strong client relationships, remained flat or declined. This performance reinforces the classification of such segments as 'Dogs' within the BCG matrix, necessitating strategic decisions like divestiture.

Question Marks

Canaccord Genuity has strategically bolstered its wealth management division through key acquisitions, notably Intelligent Capital in April 2024 and the completed acquisition of Cantab Asset Management Ltd. in October 2024. These moves are designed to expand its presence in growing markets, particularly within the UK financial planning sector.

While these newly acquired entities represent significant growth potential, they are currently in the integration phase and require ongoing investment. This strategic deployment of capital is essential for market share expansion and aligning them within Canaccord's broader wealth management framework, positioning them as potential future stars within the BCG matrix.

Canaccord Genuity's U.S. Capital Markets business significantly bolstered its energy transition advisory capabilities in November 2024 through a strategic collaboration with Carbon Reduction Capital LLC (CRC-IB). This partnership positions Canaccord to capitalize on the burgeoning energy transition market, a sector experiencing rapid growth and innovation.

This collaboration is a key move for Canaccord Genuity to expand its specialized advisory services and increase its market share within the high-potential energy transition sector. By joining forces with CRC-IB, a recognized leader in investment banking and advisory for this space, Canaccord gains access to a wealth of expertise and a robust network.

Canaccord Genuity is strategically investing in its financial planning capabilities, recognizing this as a key growth area within financial services. This move aims to broaden its service offerings and foster organic expansion.

These investments, however, demand substantial upfront capital and considerable effort to achieve significant market penetration, positioning them as Question Marks within the BCG Matrix. The company is building specialist expertise to cater to evolving client needs in this expanding segment.

New Technology Initiatives for Client Engagement

Canaccord Genuity's commitment to technological advancement is evident in its ongoing initiatives designed to elevate client engagement. These investments are crucial for meeting evolving client demands and streamlining operations. For instance, in 2024, the firm reported a significant increase in digital client interactions, with over 60% of advisory meetings conducted virtually, highlighting the adoption of new engagement platforms.

These technology-driven efforts are strategically aimed at improving the overall client experience, attracting a broader client base, and fostering sustainable growth. While the long-term effects on market share and profitability are still being assessed, early indicators suggest positive traction. The firm’s investment in AI-powered client relationship management tools, for example, is projected to enhance personalized service delivery.

- Enhanced Digital Platforms: Development of intuitive client portals offering real-time portfolio access and personalized market insights.

- AI-Powered Advisory Tools: Implementation of artificial intelligence to provide clients with tailored investment recommendations and market analysis.

- Virtual Communication Enhancements: Upgrades to video conferencing and secure messaging systems to facilitate seamless remote client interactions.

- Data Analytics for Personalization: Leveraging advanced analytics to understand client behavior and preferences, enabling more targeted engagement strategies.

Aggressive Recruitment in Canadian Wealth Management

Canaccord Genuity is actively investing in its Canadian wealth management operations, driven by a strategy to capture profitable growth. This includes a significant push for aggressive recruitment, aiming to onboard new advisors and established teams.

This talent acquisition is a key component of their plan to expand client assets and market share within Canada's dynamic wealth management landscape. The firm recognizes the need for substantial investment to achieve these ambitious goals in a competitive environment.

- Talent Acquisition: Canaccord Genuity is prioritizing the recruitment of experienced financial advisors and teams in Canada.

- Growth Strategy: The aggressive recruitment is directly linked to the firm's objective of increasing client assets and overall market share.

- Market Dynamics: Canada's wealth management sector presents a growing yet highly competitive market, necessitating strategic investments in talent.

- Investment Requirement: Realizing the full potential of this growth strategy requires significant upfront investment in human capital and infrastructure.

Canaccord Genuity's investments in its financial planning capabilities and technology-driven client engagement initiatives are currently classified as Question Marks. These areas show promise for future growth but require substantial investment and time to establish a strong market position. The success of these ventures hinges on effectively converting potential into market share and profitability.

The firm's strategic focus on expanding its financial planning services, for example, necessitates significant upfront capital and considerable effort to achieve meaningful market penetration. Similarly, while technology investments are enhancing client engagement, their long-term impact on market share and profitability is still under evaluation, with early indicators suggesting positive momentum.

These initiatives, though promising, are in their nascent stages and carry inherent risks, reflecting their Question Mark status. Canaccord Genuity is actively building specialist expertise and leveraging AI tools to navigate these evolving segments, aiming to transform these investments into future Stars.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.