Canaccord Genuity Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canaccord Genuity Bundle

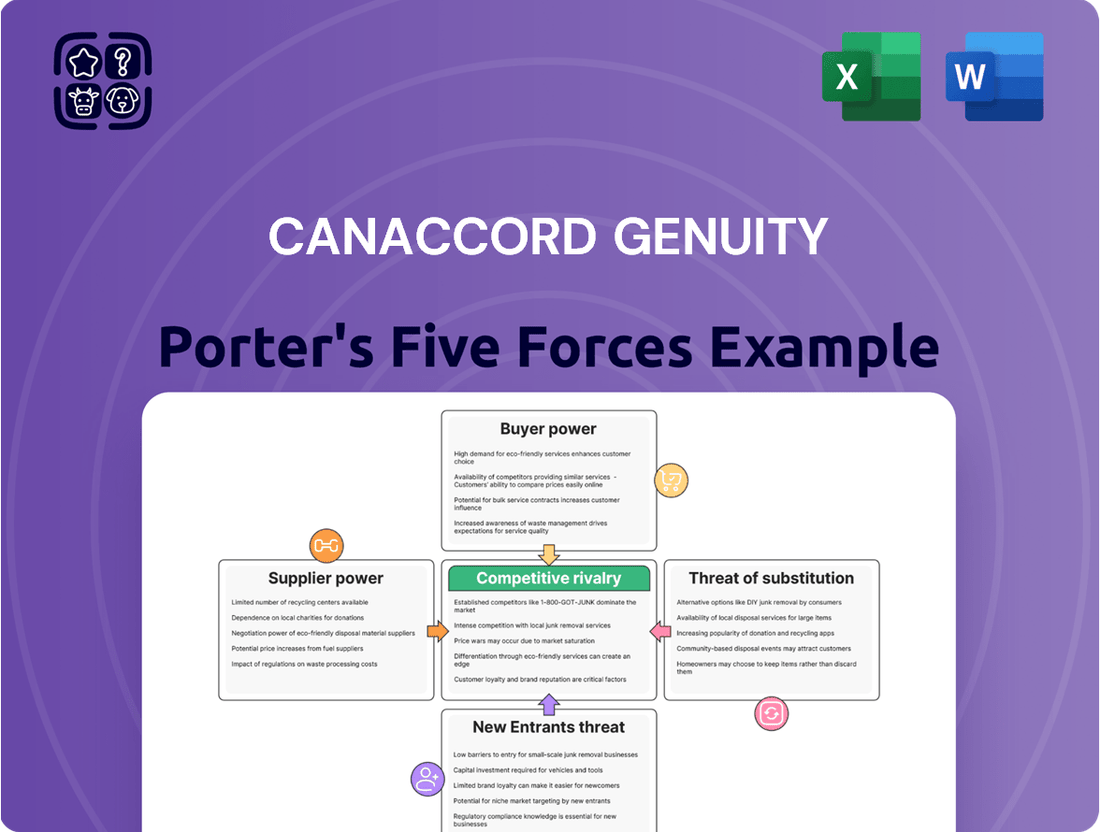

Canaccord Genuity’s competitive landscape is shaped by powerful forces, from the bargaining power of clients to the threat of innovative substitutes. Understanding these dynamics is crucial for navigating the financial services sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Canaccord Genuity’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The wealth management and capital markets sectors are heavily dependent on sophisticated financial technology. A key factor influencing supplier power is the limited pool of truly high-quality and specialized technology providers. This scarcity can significantly amplify their leverage.

For firms like Canaccord Genuity, this limited supply of advanced fintech solutions means they may encounter elevated costs or less advantageous contract terms for critical software and operational platforms. For instance, the global fintech market was valued at over $1.3 trillion in 2023 and is projected to grow substantially, yet the providers of truly cutting-edge, niche solutions remain concentrated.

Canaccord Genuity, like many financial services firms, is highly dependent on specialized talent. Professionals in investment banking, wealth management, and capital markets possess unique skills that are crucial for the firm's operations.

The availability of individuals with senior or niche expertise in these fields can be quite limited. This scarcity directly translates into significant bargaining power for these highly skilled employees, influencing their demands for compensation and benefits.

Suppliers of financial market data and information services wield significant influence. Their offerings are vital for Canaccord Genuity's ability to make sound investment recommendations and conduct thorough market analysis. For instance, Bloomberg, a major data provider, reported revenue of $11.2 billion in 2023, highlighting the scale and importance of these services.

Regulatory and Compliance Service Providers

Regulatory and compliance service providers hold significant sway in the financial services sector. The industry's intricate web of regulations, from anti-money laundering (AML) to data privacy, necessitates specialized expertise. Firms like Ernst & Young and Deloitte, which offer extensive compliance consulting, saw their financial advisory revenues grow significantly in 2024, reflecting the ongoing demand. The potential penalties for non-compliance, which can run into millions of dollars, further amplify the bargaining power of these essential suppliers.

The specialized knowledge and critical nature of regulatory consulting, compliance software solutions, and legal advisory services are key drivers of supplier power. For instance, the global RegTech market, which provides technology solutions for regulatory compliance, was projected to reach over $20 billion in 2024, indicating substantial investment and reliance on these specialized services. The cost and complexity associated with building in-house compliance capabilities mean that financial institutions often rely heavily on external providers, granting these suppliers considerable leverage.

- High Switching Costs: Financial institutions face substantial costs and operational disruptions when changing compliance service providers due to the integration of new systems and retraining of staff.

- Essential Service Provision: Regulatory compliance is not optional; it's a fundamental requirement for operating in the financial sector, making these services indispensable.

- Concentration of Expertise: A limited number of highly specialized firms possess the deep knowledge and experience required to navigate complex regulatory landscapes, reducing the number of viable alternatives.

- Risk of Non-Compliance: The severe financial and reputational damage associated with regulatory breaches empowers suppliers who guarantee adherence and mitigate these risks.

Infrastructure and Connectivity Providers

For global financial operations, robust infrastructure and connectivity are non-negotiable. This includes high-speed data networks, secure cloud computing services, and reliable telecommunications. Canaccord Genuity, like other firms in the sector, relies heavily on these services to execute trades, manage client data, and maintain communication across its worldwide offices.

The bargaining power of infrastructure and connectivity providers can be significant if the market offers limited options for the required quality and scale. For instance, as of early 2024, the global cloud computing market is dominated by a few major players like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These providers can leverage their market share to influence pricing and service terms.

- Limited Alternatives: The concentration in the global high-speed data and cloud services market means Canaccord Genuity may face few viable alternatives for the specific security, speed, and global reach it requires.

- High Switching Costs: Migrating complex financial systems and vast amounts of data between providers is costly and time-consuming, further solidifying the power of incumbent suppliers.

- Essential Service: The critical nature of these services for daily operations means Canaccord Genuity has little room for disruption, making it more susceptible to supplier demands.

- Market Concentration: In 2023, the top three global cloud providers held over 60% of the market share, indicating a significant concentration of power among a handful of infrastructure suppliers.

The bargaining power of suppliers for Canaccord Genuity is notably influenced by the concentration of specialized fintech providers and the critical nature of their services. High switching costs and the essentiality of regulatory compliance also amplify supplier leverage.

The limited number of providers offering cutting-edge financial technology solutions means Canaccord Genuity may face higher costs and less favorable terms. For example, the global fintech market, while vast, sees specialized solutions concentrated among fewer players, impacting negotiation power.

Suppliers of essential financial data, such as Bloomberg, which reported $11.2 billion in revenue in 2023, hold significant influence due to the indispensable nature of their information for investment decisions.

Regulatory and compliance service providers, including major consulting firms, also possess strong bargaining power. The global RegTech market's projected growth to over $20 billion in 2024 underscores the reliance on these specialized services to navigate complex regulations and avoid substantial penalties.

What is included in the product

This analysis unpacks the competitive forces impacting Canaccord Genuity, detailing threats from new entrants, substitutes, buyer and supplier power, and existing rivals.

Instantly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

High-net-worth and institutional clients, a key demographic for Canaccord Genuity, wield significant bargaining power due to their demand for personalized financial strategies. These sophisticated clients expect bespoke solutions, often leveraging advanced technologies like AI and data analytics for hyper-personalization.

The ability of these clients to readily seek out firms that offer tailored services, rather than accepting standardized offerings, directly amplifies their influence. This preference for customization means firms must adapt their service models to meet these exacting demands, or risk losing valuable business.

For many of Canaccord Genuity's financial products, like standard brokerage accounts or some wealth management services, customers face minimal hurdles when switching to a competitor. This low barrier to entry means clients can easily move their assets, which inherently strengthens their bargaining position.

This ability to switch readily empowers customers to demand better pricing, enhanced service levels, or more favorable terms from Canaccord Genuity. In 2024, the trend of digital onboarding and account transfers further reduced these switching costs, making it even easier for clients to explore alternatives.

The financial services sector is brimming with options, from global behemoths to specialized boutiques and agile digital players. This sheer volume of providers, each vying for client business in areas like investment banking, wealth management, and capital markets, directly empowers customers. For instance, in 2024, the global fintech market size was projected to reach over $1.1 trillion, highlighting the expanding landscape of service providers and the increased choice available to consumers.

With such a diverse marketplace, clients are not tied to a single institution. They can readily compare fees, service quality, and product offerings across numerous firms. This ease of comparison and the low switching costs for many services mean clients hold significant bargaining power, able to demand better terms or simply move their business if they feel undervalued or underserved.

Price Sensitivity for Commoditized Services

While Canaccord Genuity provides highly specialized financial services, certain aspects of wealth management and capital markets can be viewed as more commoditized, especially by clients prioritizing cost above all else. This price sensitivity, particularly evident among larger institutional clients, can exert considerable pressure on Canaccord Genuity's profit margins.

For instance, in 2024, the average fee for basic wealth management services across the industry saw a slight downward trend as digital platforms offered lower-cost alternatives. This intensified competition means that clients, especially those with substantial assets, actively seek competitive pricing, forcing firms like Canaccord Genuity to justify their value proposition beyond mere cost.

- Price Sensitivity: Clients, particularly institutional ones, may shop around for the best rates on services that are perceived as standard.

- Margin Pressure: Increased competition on price can directly impact Canaccord Genuity's profitability.

- Value Proposition: Firms must clearly articulate unique benefits to differentiate from lower-cost, commoditized offerings.

Access to Information and Robo-Advisors

Clients now possess unprecedented access to financial information and sophisticated tools, significantly amplifying their bargaining power. The proliferation of online resources, from educational websites to detailed market data, empowers individuals to conduct their own research and understand investment options more thoroughly. This informed client base is less reliant on traditional advisory services and can more readily identify and negotiate for better terms or alternative solutions.

The rise of robo-advisors and self-service investment platforms further tilts the scales. These digital solutions offer automated portfolio management and financial advice at a fraction of the cost of traditional human advisors. For instance, by mid-2024, the assets under management for leading robo-advisors in the US alone were projected to exceed $2 trillion, indicating a substantial shift in how individuals manage their wealth. This trend provides clients with a viable, lower-cost alternative, forcing traditional firms to compete on price and service quality.

- Informed Clients: Increased access to online financial data and educational resources allows clients to better understand investment products and market trends.

- Robo-Advisor Growth: The significant adoption of robo-advisors, with assets under management in the trillions by 2024, presents a direct, lower-cost alternative to traditional financial advice.

- Self-Service Platforms: The availability of user-friendly self-service investment platforms enables clients to manage portions of their portfolios independently, reducing reliance on intermediaries.

- Price Sensitivity: Clients can easily compare fees and performance across different providers, leading to increased price sensitivity and a demand for more competitive offerings.

Clients, especially those with substantial assets, possess significant bargaining power due to the sheer volume of financial service providers available. This competitive landscape, fueled by fintech innovation, means clients can easily compare offerings and switch if dissatisfied, putting pressure on firms like Canaccord Genuity to deliver superior value. The global fintech market's projected growth to over $1.1 trillion by 2024 underscores this expanding array of choices for consumers.

The increasing commoditization of certain financial services, coupled with clients' growing price sensitivity, directly impacts Canaccord Genuity's profitability. As digital platforms offer lower-cost alternatives, clients are more inclined to seek competitive pricing, forcing firms to justify their value beyond mere cost. For instance, the average fee for basic wealth management saw a slight decline in 2024 due to this competitive pressure.

Clients are now better informed, thanks to readily available financial data and educational resources, and have access to lower-cost alternatives like robo-advisors. By mid-2024, US robo-advisors managed over $2 trillion in assets, demonstrating a clear shift towards more accessible financial management. This empowers clients to negotiate better terms or manage investments independently, reducing reliance on traditional intermediaries.

Full Version Awaits

Canaccord Genuity Porter's Five Forces Analysis

This preview showcases the complete Canaccord Genuity Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and no hidden content. You can confidently expect this exact, professionally formatted analysis to be available for download the moment your transaction is complete.

Rivalry Among Competitors

Canaccord Genuity navigates a competitive arena populated by major global financial institutions. These giants, offering comprehensive investment banking, wealth management, and capital markets services, possess significant advantages. For instance, in 2024, many of these larger players reported substantial revenue growth, with some exceeding $10 billion annually, showcasing their immense scale and market penetration.

The sheer resources, established brand equity, and extensive client networks of these global behemoths create a formidable competitive barrier. This intensifies the pressure on firms like Canaccord Genuity, demanding strategic differentiation and specialized expertise to capture market share in a crowded financial services landscape.

The financial services landscape is increasingly characterized by the growing influence of boutique and independent firms. These specialized entities often carve out significant market share by offering highly tailored services and deep expertise in specific niches, directly challenging larger, more generalized players like Canaccord Genuity. For instance, the wealth management sector has seen a surge in independent advisors, with many firms reporting strong asset growth in recent years, reflecting client demand for personalized attention.

Rapid technological advancements, especially in areas like artificial intelligence and big data analytics, are fueling fierce competition within the financial services sector. These innovations are reshaping how firms interact with clients and manage operations, demanding significant and ongoing investment to stay ahead.

Canaccord Genuity, like its peers, faces pressure to continually upgrade its technological infrastructure. For instance, the global fintech market was valued at over $110 billion in 2023 and is projected to grow significantly, underscoring the imperative for firms to invest in digital platforms and automated processes to enhance client experience and operational efficiency.

Geographic and Sectoral Focus

Canaccord Genuity's strategic focus on growth sectors and emerging companies across North America, Europe, Asia, and Australia naturally places it in direct competition with firms possessing strong regional footholds or specialized expertise within these dynamic industries. This geographic and sectoral concentration intensifies rivalry for lucrative mandates and client acquisition.

The competitive landscape is shaped by players who may boast a more established local presence or a deeper specialization in particular high-growth sectors, creating a challenging environment for Canaccord Genuity. For instance, in the biotechnology sector, a key growth area for Canaccord, specialized boutique firms often compete fiercely for initial public offerings (IPOs) and follow-on offerings. In 2024, the global IPO market saw varied performance across regions, with North America generally leading in deal volume, highlighting the importance of local market penetration.

- Regional Strengths: Competitors with a dominant presence in specific regions, such as a strong European biotech investment bank, can leverage local networks and regulatory knowledge more effectively.

- Sectoral Specialization: Firms deeply embedded in niche growth sectors, like renewable energy technology or artificial intelligence, often possess superior client relationships and deal flow within those verticals.

- Deal Flow Competition: In 2024, the competition for advisory roles on significant M&A transactions within technology and healthcare was particularly acute, with many firms vying for a limited number of high-profile mandates.

- Client Acquisition: Winning mandates often depends on a firm's track record and reputation within a specific growth sector and geographic market, making it a constant battle for market share.

Consolidation and M&A Activity

The financial services sector is actively consolidating, with mergers and acquisitions (M&A) creating larger, more formidable competitors. This trend means firms like Canaccord Genuity face intensifying competition from entities with broader service offerings and greater market penetration.

For instance, in 2024, the financial advisory space saw continued M&A, with notable deals aimed at increasing scale and client reach. These consolidations often result in enhanced operational efficiencies and expanded capital bases for the acquiring firms, directly impacting the competitive landscape for independent players.

- Increased Scale: Mergers allow firms to achieve greater economies of scale, reducing per-unit costs and enabling more aggressive pricing.

- Expanded Capabilities: Acquired firms often bring new technologies, product lines, or geographic reach, creating more comprehensive service packages.

- Market Share Growth: Consolidation directly leads to increased market share for the combined entities, concentrating market power.

- Heightened Pressure: Canaccord Genuity must adapt to these larger, more integrated competitors who can leverage their combined resources to attract and retain clients.

Canaccord Genuity faces intense competition from both large, established global financial institutions and specialized boutique firms. These larger players benefit from significant scale, brand recognition, and extensive client networks, often reporting revenues in the billions, as seen with many major banks in 2024. Meanwhile, niche firms excel by offering highly tailored services and deep expertise in specific sectors, such as biotechnology or renewable energy, directly challenging larger competitors for lucrative mandates.

Technological advancements are a key driver of competition, pushing all firms to invest heavily in AI and data analytics. The global fintech market, valued at over $110 billion in 2023, highlights the necessity of digital platforms for client engagement and operational efficiency. Furthermore, ongoing consolidation within the financial services sector is creating larger, more integrated competitors, forcing firms like Canaccord Genuity to continually adapt and differentiate their offerings to maintain market share.

| Competitor Type | Key Strengths | Impact on Canaccord Genuity |

|---|---|---|

| Global Financial Institutions | Scale, Brand Equity, Extensive Networks | Intensified pressure, demand for differentiation |

| Boutique/Independent Firms | Niche Expertise, Tailored Services | Direct competition for specialized mandates |

| Consolidated Entities | Economies of Scale, Expanded Capabilities | Need for strategic adaptation and resource leverage |

SSubstitutes Threaten

The rise of user-friendly online brokerage platforms and sophisticated self-service investment tools presents a substantial substitute threat to traditional financial advisory services like those offered by Canaccord Genuity. These digital platforms empower individual investors, and even some smaller businesses, to manage their portfolios directly, bypassing the need for intermediaries.

For instance, by mid-2024, platforms like Robinhood and Charles Schwab reported millions of active users, with many executing trades without financial advisor input. This trend indicates a growing segment of the market that can fulfill its investment needs through technology alone, reducing reliance on established firms.

Robo-advisors present a significant threat of substitutes for traditional wealth management services, offering automated, algorithm-driven investment management at a lower cost. This appeals to investors, particularly younger demographics, who prioritize digital convenience and fee minimization. For instance, the robo-advisor market saw substantial growth, with assets under management reaching hundreds of billions globally by 2024, demonstrating their increasing market penetration and appeal as a cost-effective alternative.

For companies needing capital, private equity and direct lending are increasingly stepping in as alternatives to traditional investment banking routes like issuing stocks or bonds. These alternative markets have seen substantial growth, providing flexible and faster ways to raise funds.

The private debt market, for instance, has been a significant growth area. By the end of 2023, global private debt assets under management were estimated to be approaching $2 trillion, demonstrating its increasing importance as a substitute for traditional bank loans and public debt markets.

Internal Corporate Finance Departments

Larger corporations often possess robust internal corporate finance departments. These departments can perform a range of functions, from managing day-to-day financial operations to executing complex capital raising and merger and acquisition (M&A) activities. This internal capability directly substitutes for many services traditionally offered by external investment banks.

For instance, in 2024, a significant number of Fortune 500 companies continued to bolster their in-house M&A teams, reducing reliance on external advisors for smaller or more routine transactions. This trend is driven by cost-efficiency and the desire for greater control over sensitive strategic information.

- Internal expertise reduces the need for external advisory fees.

- Sophisticated treasury and capital markets teams can manage debt and equity issuance internally.

- In-house M&A teams can conduct initial due diligence and deal structuring, lessening reliance on investment bankers for early-stage work.

Blockchain and Decentralized Finance (DeFi)

Emerging technologies like blockchain and decentralized finance (DeFi) present a potential long-term threat of substitution by offering alternative avenues for capital formation and asset management. These innovations could disintermediate traditional financial institutions, enabling peer-to-peer transactions and novel investment vehicles.

While still in early stages, the growth of DeFi is notable. By the end of 2024, the total value locked (TVL) in DeFi protocols reached over $100 billion, indicating increasing adoption and a growing ecosystem that could eventually rival traditional finance.

- DeFi Growth: Total Value Locked (TVL) in DeFi surpassed $100 billion in 2024.

- Alternative Capital: Blockchain facilitates new models for fundraising, like Initial Coin Offerings (ICOs) and Security Token Offerings (STOs).

- Asset Management: Decentralized exchanges (DEXs) and yield farming protocols offer alternative ways to manage and grow assets.

- Intermediation Bypass: DeFi aims to reduce reliance on banks and other financial intermediaries for services like lending and borrowing.

The threat of substitutes for traditional financial advisory services is significant, with digital platforms and robo-advisors offering lower-cost, accessible alternatives. These digital solutions empower investors to manage their own portfolios, bypassing intermediaries. Furthermore, alternative financing methods like private debt and in-house corporate finance capabilities reduce reliance on traditional investment banking services, indicating a shifting landscape where direct or alternative channels are increasingly viable.

| Substitute Type | Key Characteristics | Market Penetration/Growth (as of mid-2024/end-2023) | Impact on Traditional Services |

|---|---|---|---|

| Online Brokerages & Self-Service Tools | User-friendly interfaces, direct trade execution, lower fees | Millions of active users on platforms like Robinhood and Charles Schwab | Reduces demand for basic brokerage and advisory services |

| Robo-Advisors | Automated, algorithm-driven investment management, cost-effective | Global Assets Under Management in hundreds of billions | Threatens traditional wealth management, especially for fee-sensitive clients |

| Private Debt & Direct Lending | Flexible, faster capital raising than traditional debt markets | Global private debt AUM approaching $2 trillion (end-2023) | Substitute for corporate bond issuance and bank loans |

| In-house Corporate Finance | Internal M&A teams, treasury functions managing capital markets | Continued bolstering of in-house M&A teams by Fortune 500 companies (2024) | Reduces need for external investment banking for routine transactions |

| Blockchain & DeFi | Decentralized finance, peer-to-peer transactions, alternative investment vehicles | Total Value Locked (TVL) in DeFi over $100 billion (end-2024) | Potential long-term disintermediation of financial institutions |

Entrants Threaten

Entering the financial services industry, particularly in areas like investment banking and wealth management, demands significant capital. For instance, in 2024, many jurisdictions require new financial institutions to maintain minimum capital adequacy ratios, often in the tens or hundreds of millions of dollars, to ensure solvency and protect clients.

These substantial upfront investments, covering regulatory compliance, technology infrastructure, and operational setup, create a formidable barrier. New firms must demonstrate robust financial backing to gain trust and compete effectively, a hurdle that deters many potential entrants.

Stringent regulatory compliance and licensing present a substantial barrier to entry in the financial services sector. Firms must navigate complex frameworks like Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, which require significant investment in technology and personnel. For instance, in 2024, the Financial Industry Regulatory Authority (FINRA) in the U.S. continued to emphasize robust compliance programs, with ongoing examinations focusing on areas such as cybersecurity and suitability.

Brand reputation and trust are critical barriers to entry in financial services. Building this takes years, with firms like Canaccord Genuity leveraging decades of client relationships and a proven track record. For instance, as of early 2024, Canaccord Genuity reported a significant global client base, underscoring the trust they have cultivated.

New entrants struggle to replicate this established credibility. Gaining market share requires not just competitive pricing but also demonstrating reliability and expertise, which new firms often lack. This makes it challenging for them to attract clients away from established, trusted institutions.

Access to Talent and Expertise

New entrants face a significant hurdle in attracting and retaining experienced professionals, particularly those with specialized knowledge in investment banking, wealth management, and capital markets. Established firms often leverage their reputation and existing infrastructure to offer more competitive compensation packages and clearer career progression, making it difficult for newcomers to poach top talent.

For instance, in 2024, the demand for skilled financial analysts and advisors remained high, with average salaries for experienced professionals in these fields often exceeding $150,000 annually, plus bonuses. This creates a substantial cost barrier for new firms looking to build a competitive team.

- Talent Acquisition Costs: New entrants must invest heavily in recruitment and compensation to attract experienced professionals away from established players.

- Retention Challenges: Retaining top talent requires ongoing investment in competitive benefits, professional development, and a strong corporate culture, which can be difficult for nascent firms to establish.

- Expertise Gap: A lack of experienced personnel can lead to a gap in crucial expertise, impacting the quality of services offered and client trust.

- Competitive Compensation: In 2024, the average base salary for a senior investment banker in major financial hubs was around $200,000, with total compensation potentially reaching $500,000 or more, a significant hurdle for new entrants.

Technological Investment and Infrastructure

The threat of new entrants in the financial services sector, particularly concerning technological investment and infrastructure, remains significant, though nuanced. While advancements in cloud computing and open-source software can reduce initial setup costs for some digital services, establishing truly competitive and secure platforms demands substantial capital outlay. New players must invest heavily in robust, scalable digital infrastructure, advanced cybersecurity measures, and sophisticated data analytics capabilities to offer services comparable to incumbents.

For instance, in 2024, the global cybersecurity market was projected to reach over $200 billion, highlighting the immense investment required just to secure digital operations. New entrants aiming to compete in areas like wealth management or digital banking need to build or acquire these complex systems from the ground up. This includes not only the front-end user experience but also the back-end processing, compliance, and data management systems, which are critical for trust and regulatory adherence. Without these, a new entrant’s offerings are likely to be perceived as less secure or less capable, limiting their market penetration.

Consider the following key infrastructure investments for new entrants:

- Cloud Infrastructure: Significant investment in scalable and secure cloud solutions, such as those offered by AWS, Azure, or Google Cloud, is essential for handling fluctuating demand and data storage.

- Cybersecurity: Building state-of-the-art cybersecurity defenses to protect against sophisticated cyber threats is paramount, with companies like Palo Alto Networks or CrowdStrike providing advanced solutions that require substantial integration costs.

- Data Analytics Platforms: Implementing powerful data analytics tools and AI capabilities to gain insights into customer behavior, market trends, and risk management, often involving platforms from providers like Snowflake or Databricks.

- Regulatory Compliance Technology: Investing in RegTech solutions to ensure adherence to evolving financial regulations, which can be a significant upfront and ongoing expense.

The threat of new entrants in financial services is moderated by substantial capital requirements for licensing, technology, and compliance. For instance, in 2024, establishing a new bank often necessitates hundreds of millions of dollars in initial capital. This financial barrier, coupled with the need for robust regulatory adherence, significantly limits the number of viable new players.

Building brand trust and attracting top talent are also critical challenges for newcomers. Established firms like Canaccord Genuity benefit from decades of client relationships and a strong reputation, making it difficult for new entrants to gain market share. In 2024, the high demand and competitive salaries for experienced financial professionals, often exceeding $150,000 annually plus bonuses, further elevate the cost of entry.

| Barrier | 2024 Impact | Example Cost/Requirement |

|---|---|---|

| Capital Requirements | High | Minimum capital adequacy ratios in millions of dollars for new financial institutions. |

| Regulatory Compliance | High | Significant investment in KYC/AML technology and personnel; FINRA compliance focus. |

| Brand Reputation & Trust | High | Decades of client relationships and proven track record; difficult to replicate. |

| Talent Acquisition & Retention | High | Average senior investment banker salary ~$200,000 base, total comp potentially $500,000+; recruitment costs. |

| Technological Infrastructure | High | Investment in cloud, cybersecurity (global market >$200 billion in 2024), data analytics, and RegTech. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, encompassing financial statements, investor presentations, and industry-specific market research reports. This blend ensures a comprehensive understanding of competitive dynamics.