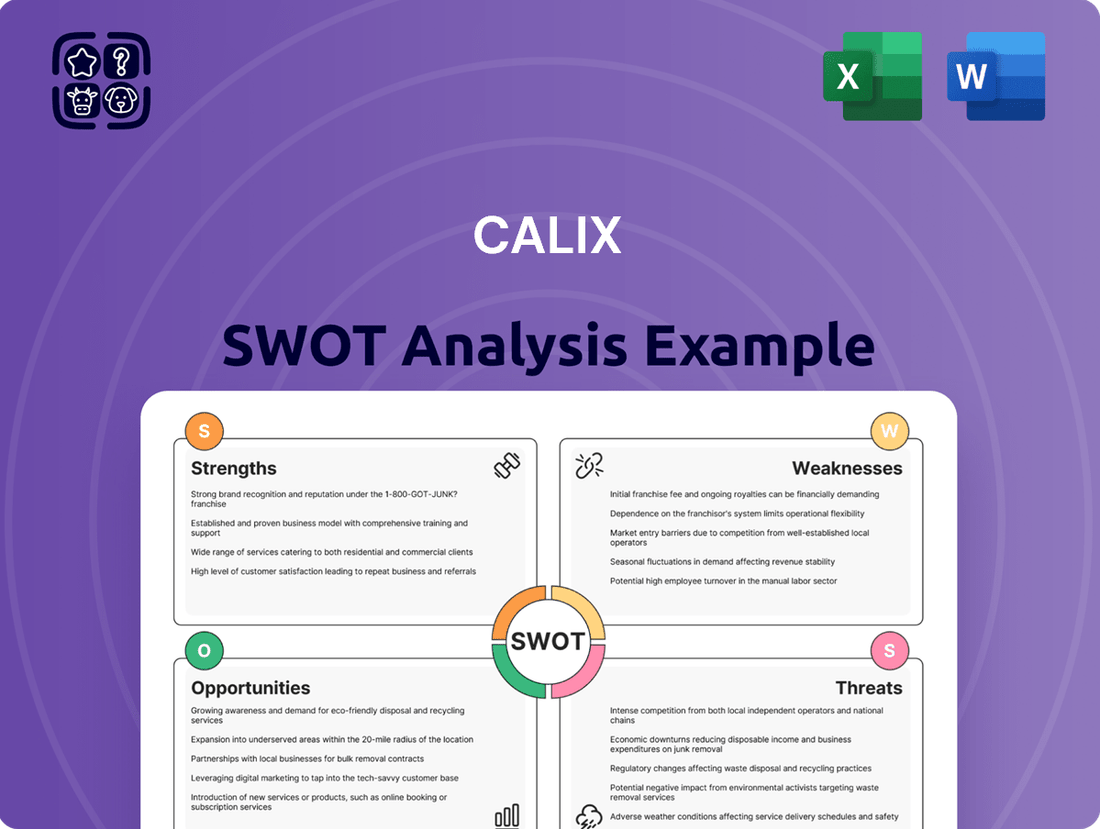

Calix SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calix Bundle

Calix is strategically positioned with strong technological innovation and a growing customer base, but faces intense competition and evolving market demands. Understanding these internal capabilities and external pressures is crucial for navigating the dynamic telecommunications landscape.

Want the full story behind Calix's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Calix's strategic pivot to a platform-driven model has been a significant strength. This transition from a hardware focus to a cloud and software-centric approach has unlocked substantial recurring revenue, boosting gross margins. For instance, in Q1 2024, Calix reported a 29% year-over-year increase in RPO to $1.2 billion, underscoring the growing customer commitments to its subscription services.

The company's integrated platform, encompassing Calix Cloud, Intelligent Access, and Unlimited Subscriber solutions, offers a comprehensive, end-to-end offering. This simplifies complex operational challenges and significantly elevates the subscriber experience for communications service providers, a key differentiator in the market.

Calix stands out for its relentless innovation in broadband technology, consistently rolling out cutting-edge solutions like Wi-Fi 7 systems and 50G-PON capabilities. This allows Communications Service Providers (CSPs) to deliver superior broadband, Wi-Fi, and connected home experiences to their subscribers. For instance, in the first quarter of 2024, Calix reported a 14% year-over-year increase in revenue, partly driven by the adoption of these advanced technologies.

Beyond hardware, Calix excels in managed services, with offerings like SmartTown enabling CSPs to tap into new revenue streams by extending advanced broadband and smart community solutions to businesses and municipalities. This strategic expansion diversifies revenue and strengthens customer relationships, as evidenced by their growing base of managed services customers in 2024.

The company's commitment to a predictable 91-day innovation release cycle is a significant strength, empowering CSPs to confidently plan, deploy, and market new services, ensuring they remain competitive in a rapidly evolving market.

Calix exhibits remarkable financial resilience, underscored by its impressive performance in 2023. The company achieved record gross margins and sustained positive free cash flow, demonstrating its ability to generate strong returns even in a dynamic market. For instance, in Q4 2023, Calix reported a 63% gross margin, a significant increase from the previous year.

This financial strength is a direct result of the company's unwavering commitment to operational discipline and effective cost management. These efforts have translated into enhanced profitability, allowing Calix to weather industry fluctuations with greater stability. The company's strategic focus on efficiency has been a key driver of its sustained success.

Furthermore, Calix maintains a robust cash position, bolstered by disciplined capital allocation strategies. This financial prudence equips the company with the flexibility to effectively navigate market uncertainties and capitalize on promising strategic growth opportunities, ensuring long-term stability and expansion potential.

Customer-Centric Approach and Market Insights

Calix's dedication to a customer-centric approach is a significant strength, particularly demonstrated through its Broadband Experience Provider (BXP) transformation. This initiative directly assists Communications Service Providers (CSPs) in not only differentiating their services but also in cultivating greater value. This focus on customer success is reflected in their reported customer satisfaction improvements.

The company actively provides actionable market intelligence via Calix Market Insights. This empowers their clients with the data necessary to make informed decisions and maintain a competitive edge in dynamic market landscapes. Calix's customer success organization plays a crucial role in this, offering essential guidance and support.

- Customer-Centric Strategy: Calix's BXP transformation helps CSPs differentiate services and grow value.

- Market Intelligence: Calix Market Insights enables data-driven decision-making for clients.

- Customer Success: Dedicated support leads to measurable improvements in customer satisfaction.

Strategic Positioning for Future Growth

Calix is strategically positioned to benefit from major market tailwinds, particularly government initiatives such as the Broadband Equity, Access, and Deployment (BEAD) program. This program, with its substantial funding, is poised to accelerate broadband infrastructure development across the US, presenting a significant revenue opportunity for Calix.

The company's proactive investment in advanced technologies, including its agentic AI capabilities, further strengthens its competitive edge. These AI integrations are designed to streamline operations for its customers and broaden the addressable market, driving future growth and increasing customer value.

- BEAD Program Impact: The BEAD program, allocating $42.45 billion for broadband expansion, directly supports Calix's market strategy.

- AI-Driven Efficiency: Calix's platform leverages AI to improve network management and customer experience, a key differentiator.

- Market Expansion: Continued innovation in AI is expected to open new avenues for service delivery and revenue generation.

Calix's platform-centric approach, with a strong emphasis on recurring revenue and cloud-based solutions, has significantly boosted its financial performance. This strategic shift is evident in its growing RPO, which reached $1.2 billion in Q1 2024, showcasing increased customer commitment to subscription services.

The company's integrated platform simplifies operations for Communications Service Providers (CSPs) and enhances the end-user experience, creating a distinct competitive advantage. Coupled with continuous innovation in broadband technologies like Wi-Fi 7 and 50G-PON, Calix empowers CSPs to deliver superior services, contributing to a 14% year-over-year revenue increase in Q1 2024.

Calix demonstrates robust financial health, marked by record gross margins and consistent positive free cash flow, exemplified by a 63% gross margin in Q4 2023. This financial stability is supported by disciplined cost management and a strong cash position, enabling strategic investments and market navigation.

The company's customer-centric strategy, including its Broadband Experience Provider (BXP) transformation and provision of market intelligence through Calix Market Insights, fosters strong client relationships and satisfaction. Furthermore, Calix is well-positioned to capitalize on government initiatives like the BEAD program, which allocates substantial funding for broadband expansion, and its AI investments are expanding its addressable market.

| Metric | Q1 2024 | Q4 2023 | Year-over-Year Growth (Q1 2024) |

|---|---|---|---|

| RPO | $1.2 billion | N/A | 29% |

| Gross Margin | N/A | 63% | Significant Increase |

| Revenue | N/A | N/A | 14% |

What is included in the product

Analyzes Calix’s competitive position through key internal and external factors, detailing its strengths in market leadership, weaknesses in operational scaling, opportunities in broadband expansion, and threats from evolving technology.

Offers a clear, actionable framework to identify and leverage Calix's strengths, mitigating weaknesses and capitalizing on opportunities for enhanced competitive advantage.

Weaknesses

Calix's business model is closely tied to the spending habits and investment plans of communications service providers (CSPs). When CSPs ramp up their capital expenditures, especially for broadband infrastructure upgrades, Calix benefits. However, any hesitation or slowdown in these investments can directly affect Calix's revenue streams and overall growth prospects.

This reliance creates a concentrated market risk for Calix. For instance, if a major CSP client decides to delay or reduce its network modernization projects, it could have a significant, disproportionate impact on Calix's financial performance. This makes Calix particularly sensitive to the economic health and strategic priorities of its CSP customer base.

The broadband equipment and software arena is intensely competitive, with giants like Nokia and Ericsson alongside nimble newcomers constantly vying for dominance. Calix, despite its robust platform, faces the perpetual challenge of standing out and fending off rivals, which can put a strain on its pricing power and profit margins.

In 2023, Calix reported revenue of $1.07 billion, a testament to its market presence, yet this figure is set against a backdrop where larger competitors often leverage greater scale and broader product portfolios, creating a constant need for Calix to innovate and demonstrate unique value to its customers.

Calix's profitability can be significantly impacted by its product and customer mix. For instance, a greater emphasis on lower-margin premises systems, compared to higher-margin software and services, can naturally reduce overall gross margins. This was observed in recent periods where shifts in sales composition directly influenced the company's profitability metrics.

Furthermore, changes in the customer base, such as an increase in revenue generated from larger or medium-sized clients, can also put pressure on gross margins. While these larger clients might represent substantial revenue, they often negotiate more competitive pricing, affecting the margin per sale.

Lingering Net Losses Despite Revenue Growth

Despite robust revenue expansion, Calix has continued to post net losses. For instance, the company reported a net loss of $10.8 million for the first quarter of 2024, a notable improvement from a $30.5 million loss in the same period of 2023. This suggests ongoing efforts to translate sales growth into consistent profitability.

While the narrowing losses are a positive signal, the persistent deficit can be a point of caution for investors prioritizing immediate bottom-line returns. The company's focus on reinvestment and market expansion, while driving revenue, is still impacting its ability to achieve sustained net income.

- Revenue Growth vs. Net Loss: Calix demonstrated strong revenue growth, with Q1 2024 revenue reaching $297.2 million, up 25% year-over-year.

- Improving but Persistent Losses: The net loss for Q1 2024 was $10.8 million, a significant reduction from $30.5 million in Q1 2023.

- Investor Focus on Profitability: The continued net losses, even if decreasing, may concern investors seeking immediate profitability.

- Strategic Reinvestment Impact: The company's investment in growth initiatives is a key factor in the ongoing net losses.

Potential Supply Chain and Geopolitical Risks

Calix's reliance on external partners for manufacturing and component sourcing creates vulnerabilities. The company's 2023 annual report highlighted that a significant portion of its product costs are tied to third-party suppliers, making it susceptible to their operational issues.

Ongoing global supply chain disruptions, including shipping delays and component shortages, could impede Calix's ability to meet demand, impacting revenue growth. For instance, the semiconductor industry faced persistent supply constraints through 2023 and into early 2024, a key area for Calix's technology.

Geopolitical instability and trade policy shifts, such as potential tariffs on electronic components or finished goods, represent a direct threat to Calix's profitability. These factors could lead to increased cost of goods sold, necessitating adjustments to pricing strategies and careful management of international supplier relationships.

- Supplier Dependence: Calix relies on a limited number of key third-party manufacturers and vendors for critical components.

- Supply Chain Volatility: Persistent global supply chain challenges, including logistics and component availability, pose a risk of production delays and increased lead times.

- Geopolitical Impact: Evolving geopolitical tensions and trade policies can introduce new tariffs and import/export restrictions, potentially raising costs and affecting market access.

- Cost Pressures: Increased costs associated with tariffs, shipping, and raw materials could negatively impact Calix's gross margins if not effectively passed on to customers or mitigated through strategic sourcing.

Calix's profitability is directly influenced by its product mix, with lower-margin premises systems impacting overall gross margins compared to higher-margin software and services. Shifts in sales composition, like an increased contribution from larger clients who often negotiate more competitive pricing, can also pressure these margins. Despite revenue growth, the company has continued to report net losses, such as the $10.8 million loss in Q1 2024, indicating that strategic reinvestment is still a factor in its bottom line.

The company's dependence on external partners for manufacturing and component sourcing creates significant vulnerabilities. Persistent global supply chain disruptions, including shipping delays and component shortages, particularly in semiconductors, can impede Calix's ability to meet demand. Furthermore, geopolitical instability and evolving trade policies introduce risks of increased costs due to tariffs and import/export restrictions, potentially impacting profitability if these costs cannot be effectively passed on to customers.

| Weakness | Description | Impact | Example/Data Point |

| Product Mix Impact on Margins | Higher proportion of lower-margin premises systems sales relative to software and services. | Reduced overall gross profit margins. | Shift in sales composition towards premises systems can lower gross margins. |

| Customer Pricing Negotiation | Larger or medium-sized clients often negotiate more competitive pricing. | Pressure on per-sale margins, even with substantial revenue. | Increased revenue from larger clients can dilute average selling prices. |

| Persistent Net Losses | Continued net losses despite revenue growth, due to strategic reinvestment. | May concern investors prioritizing immediate profitability. | Q1 2024 Net Loss: $10.8 million (improved from $30.5 million in Q1 2023). |

| Supplier Dependence | Reliance on a limited number of third-party manufacturers and vendors for critical components. | Vulnerability to supplier operational issues and supply chain disruptions. | Significant portion of product costs tied to third-party suppliers. |

| Supply Chain Volatility | Susceptibility to global supply chain challenges like logistics and component availability. | Risk of production delays, increased lead times, and inability to meet demand. | Semiconductor industry constraints through 2023-2024 impacting component availability. |

| Geopolitical and Trade Policy Risks | Exposure to evolving geopolitical tensions and trade policies. | Potential for increased costs from tariffs, import/export restrictions, affecting market access and profitability. | Tariffs on electronic components could raise cost of goods sold. |

What You See Is What You Get

Calix SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt of the complete report, showcasing its structure and depth. Unlock the full, detailed analysis by completing your purchase.

Opportunities

The broadband industry is rapidly evolving, with service providers shifting from simply delivering internet to becoming Broadband Experience Providers (BXPs). This transformation is a major opportunity for Calix, as it allows them to offer more than just speed, focusing instead on enhanced subscriber experiences and value-added services. This strategic pivot is crucial for providers aiming to boost their Average Revenue Per User (ARPU) and foster greater customer loyalty.

Calix's platform is well-positioned to capitalize on this trend. By equipping Communication Service Providers (CSPs) with the tools to deliver these differentiated experiences, Calix can solidify its market position and drive growth. For instance, the increasing demand for managed Wi-Fi and smart home services, areas where Calix excels, directly supports this BXP evolution, with the managed Wi-Fi market alone projected to reach $25.1 billion by 2027, growing at a CAGR of 11.2%.

Government funding initiatives like the Broadband Equity, Access, and Deployment (BEAD) program are a significant tailwind for broadband infrastructure expansion. This program, with an allocated $42.45 billion, is specifically designed to bring high-speed internet to unserved and underserved communities, a key market for Calix's solutions.

Calix is strategically positioned to capitalize on this substantial government investment. The company anticipates that these initiatives will translate into meaningful order volumes beginning in early 2025, providing a clear pathway for revenue growth and market share expansion in the coming years.

The increasing adoption of Calix's cloud and managed services by Communications Service Providers (CSPs) is a significant growth opportunity. This shift is evident as CSPs increasingly rely on these platforms for network operations and customer experience management.

These subscription-based offerings are crucial because they generate more predictable and higher-margin revenue streams compared to traditional hardware sales. This directly contributes to Calix's financial stability and fuels its expansion efforts.

For instance, Calix reported that its cloud and managed services revenue saw substantial growth in 2023, reflecting CSPs' commitment to these solutions. This trend is expected to continue into 2024 and 2025 as more providers embrace digital transformation.

Advancements in AI and Next-Generation Technologies

Calix's strategic focus on AI, particularly agentic AI, and next-generation connectivity like Wi-Fi 7 and 50G-PON presents significant growth opportunities. These innovations empower Communications Service Providers (CSPs) to offer superior customer experiences and differentiate their services in a competitive landscape. For instance, by integrating AI, CSPs can automate network management and personalize subscriber interactions, driving efficiency and satisfaction.

The ongoing development and deployment of these advanced technologies position Calix as a key enabler for CSPs aiming to capture new revenue streams. The demand for faster, more reliable, and intelligent network services is rapidly increasing, fueled by applications like augmented reality, virtual reality, and the Internet of Things (IoT). Calix's platform is designed to meet these evolving demands.

- AI-Driven Network Optimization: Calix's AI capabilities allow CSPs to proactively identify and resolve network issues, improving service quality and reducing operational costs.

- Enhanced Subscriber Experience: Technologies like Wi-Fi 7 offer faster speeds and lower latency, enabling richer multimedia experiences and supporting more connected devices per household.

- New Service Monetization: 50G-PON technology opens doors for CSPs to offer higher bandwidth services, catering to businesses and demanding consumer applications, thereby creating new monetization opportunities.

- Market Leadership: By staying at the forefront of technological innovation, Calix helps its CSP customers maintain a competitive edge and attract a larger subscriber base.

Strategic Partnerships and Market Penetration

Calix has a significant opportunity to deepen its strategic partnerships with major telecommunications providers. These collaborations are crucial for expanding its market reach and securing a larger customer base through new acquisitions. For instance, in the first quarter of 2024, Calix reported a 19% year-over-year increase in its total customer count, highlighting the success of its current expansion efforts.

By strengthening these alliances, Calix can achieve greater revenue stability and enhance its agility in adapting to changing customer demands. This improved responsiveness is vital in the fast-paced telecommunications sector. The company's focus on expanding its network access solutions is a key driver, with significant investments in fiber-to-the-home (FTTH) technologies expected to fuel growth throughout 2024 and 2025.

- Expanded Network Access: Collaborations with telecom giants can unlock access to new subscriber bases.

- Revenue Diversification: Partnerships can lead to more predictable and stable revenue streams.

- Enhanced Customer Insight: Deeper relationships provide valuable data for product development and service improvements.

- Competitive Edge: Stronger partnerships can create barriers to entry for competitors.

Calix is well-positioned to benefit from the shift towards Broadband Experience Providers (BXPs), enabling Communication Service Providers (CSPs) to offer enhanced subscriber experiences and value-added services. The company's platform supports this evolution, with the managed Wi-Fi market projected to reach $25.1 billion by 2027, growing at an 11.2% CAGR.

Government funding, particularly the $42.45 billion BEAD program, presents a significant opportunity for Calix as it drives broadband infrastructure expansion in underserved areas. Calix anticipates these initiatives will lead to substantial order volumes starting in early 2025, bolstering revenue and market share.

The increasing adoption of Calix's cloud and managed services by CSPs offers a key growth avenue, generating predictable, higher-margin revenue. This trend is supported by Calix's substantial revenue growth in these segments during 2023, a trajectory expected to continue through 2024 and 2025.

Calix's focus on AI, Wi-Fi 7, and 50G-PON technologies allows CSPs to differentiate their offerings and create new revenue streams, catering to the growing demand for advanced connectivity solutions. These innovations are crucial for CSPs aiming to meet the needs of applications like AR, VR, and IoT.

Deepening strategic partnerships with major telecommunications providers is another significant opportunity for Calix, aiming to expand market reach and customer acquisition. The company's customer count saw a 19% year-over-year increase in Q1 2024, underscoring the effectiveness of its current expansion strategies.

Threats

The broadband and networking sector is a crowded space, with established giants and nimble newcomers constantly vying for dominance. This fierce competition often translates into aggressive pricing strategies, squeezing profit margins for companies like Calix.

For instance, in 2024, the ongoing demand for faster internet speeds fuels new entrants and pushes existing players to innovate and compete on price, directly impacting Calix's ability to command premium pricing and maintain its profitability.

Economic slowdowns or uncertainties can lead Communications Service Providers (CSPs) to reduce their capital expenditures on network infrastructure and upgrades. This directly impacts Calix's sales volume and revenue, as its business is closely tied to the investment cycles of its customers.

For instance, if a recession hits, CSPs might delay new fiber deployments or 5G buildouts, projects that are crucial for Calix's growth. In 2023, while Calix saw strong demand, a significant economic downturn in 2024 or 2025 could temper this, as companies prioritize cost savings over new network investments.

The telecommunications industry's relentless pace of technological advancement presents a significant threat of obsolescence for Calix. Companies must constantly innovate to avoid their offerings becoming outdated. For instance, the shift towards next-generation fiber and advanced wireless technologies requires substantial and ongoing R&D investment.

Calix faces the risk that its current product lines could be superseded by newer, more efficient solutions from competitors if it fails to keep pace. This could directly impact market share and revenue streams. The company's ability to adapt its platforms to emerging standards, such as advancements in Wi-Fi 7 or future 5G/6G capabilities, is crucial for sustained relevance and demand.

Supply Chain Disruptions and Geopolitical Instability

Global supply chain vulnerabilities, amplified by geopolitical tensions and trade disputes, pose a significant threat to Calix. These factors can interrupt the flow of essential components and finished goods, directly impacting production schedules and delivery timelines. For instance, the ongoing semiconductor shortage, which persisted through 2023 and into early 2024, has affected numerous technology companies, including those in the telecommunications infrastructure sector, potentially increasing lead times and manufacturing costs for Calix's network equipment.

Calix's reliance on third-party manufacturers further heightens its exposure to these supply chain risks. Disruptions at these external facilities, whether due to natural disasters, labor issues, or geopolitical events, can directly impede Calix's ability to meet customer demand. The company's 2023 annual report highlighted continued efforts to diversify its supplier base, but the inherent dependence remains a vulnerability. Trade tariffs or export restrictions imposed by various nations could also escalate costs and limit market access, directly impacting revenue streams.

- Increased Costs: Tariffs and shipping delays can raise the cost of raw materials and finished products.

- Production Delays: Geopolitical events can disrupt manufacturing operations and component availability.

- Revenue Impact: Inability to deliver products on time due to supply chain issues can lead to lost sales and customer dissatisfaction.

Regulatory Changes and Policy Shifts

Changes in telecommunications regulations, such as shifts in net neutrality rules or spectrum allocation policies, could significantly affect Calix's go-to-market strategies and the competitiveness of its solutions. For instance, evolving data privacy regulations in key markets like the EU or the US might necessitate costly adjustments to service offerings and data handling practices, impacting operational efficiency.

Policy shifts concerning broadband funding, like potential reductions or reallocations in government subsidies for network deployment, could directly influence the demand for Calix's access network technologies. While programs like the US Broadband Equity, Access, and Deployment (BEAD) program, which allocated $42.5 billion, have been a boon, any future uncertainty or changes in their eligibility criteria or disbursement pace present a tangible threat to revenue streams tied to these initiatives.

- Regulatory Uncertainty: Evolving data privacy laws and cybersecurity mandates in North America and Europe could increase compliance costs and operational complexity for Calix.

- Funding Program Volatility: Dependence on government broadband funding programs, such as the BEAD initiative, creates risk if funding levels decrease or eligibility requirements change, impacting projected sales.

- Antitrust Scrutiny: Increased regulatory scrutiny on large technology providers, potentially extending to network infrastructure companies, could lead to new compliance burdens or market access limitations.

Calix faces intense competition, with rivals constantly pushing for lower prices, which can squeeze profit margins. Economic downturns also pose a threat, as service providers might cut back on network upgrades, directly impacting Calix's sales. Furthermore, the rapid pace of technological change means Calix must continuously invest in research and development to avoid its products becoming obsolete.

Supply chain disruptions, exacerbated by geopolitical tensions, can lead to increased costs and production delays. Regulatory changes, including data privacy laws and shifts in broadband funding, also present uncertainties that could affect Calix's revenue and operational strategies. For instance, while the BEAD program has been beneficial, any changes to its structure could impact future sales projections.

| Threat Category | Specific Risk | Potential Impact | 2024/2025 Data/Trend |

| Competition | Aggressive pricing by rivals | Reduced profit margins | Continued price pressure observed in early 2024, with major competitors announcing new cost-effective solutions. |

| Economic Factors | Reduced CSP capital expenditure | Lower sales volume and revenue | Analyst reports in late 2023 and early 2024 indicated cautious spending by some telecom operators due to inflation and interest rate concerns. |

| Technological Obsolescence | Failure to keep pace with new standards | Loss of market share | Significant R&D investment is required to support emerging standards like Wi-Fi 7 and future 5G advancements, a trend expected to intensify through 2025. |

| Supply Chain | Geopolitical disruptions, component shortages | Increased costs, production delays | Semiconductor availability remained a concern through early 2024, impacting lead times for network equipment. Diversification efforts are ongoing but dependence remains. |

| Regulatory Environment | Evolving data privacy laws, funding program changes | Increased compliance costs, revenue volatility | The US BEAD program's rollout pace and eligibility adjustments are closely watched. New data privacy mandates in Europe could add compliance overhead. |

SWOT Analysis Data Sources

This Calix SWOT analysis is built upon a robust foundation of data, including publicly available financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded strategic perspective.