Calix Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calix Bundle

Calix's competitive landscape is shaped by powerful forces, from the bargaining power of its customers to the threat of new market entrants. Understanding these dynamics is crucial for any stakeholder looking to navigate the telecommunications infrastructure sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Calix’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Calix's reliance on a global supply chain for crucial hardware components and specialized technology means that the concentration of a few key manufacturers can significantly shift bargaining power towards suppliers. This concentration means these specialized suppliers hold considerable sway over pricing and availability.

Despite this, Calix has demonstrated strong supply chain management, earning recognition in 2024 as one of the top companies for supply chain excellence from Resilinc. This highlights their efforts to build resilience and mitigate the risks associated with supplier concentration.

The company's commitment to continuous improvement and sustainability within its supply chain further suggests a proactive strategy to nurture supplier relationships. By focusing on these areas, Calix aims to foster collaborative partnerships that can help balance supplier power.

Calix faces moderate bargaining power from its suppliers, largely due to the specialized nature of its network access and broadband platforms. The complexity and deep integration of Calix's cloud and software solutions with specific hardware components create substantial switching costs for the company. If Calix were to change suppliers for critical hardware elements, it would likely incur significant expenses related to product redesign, re-certification of new components, and potential disruptions leading to product delivery delays.

For instance, in 2024, the telecommunications industry continued to grapple with supply chain vulnerabilities, particularly for advanced semiconductor components. Calix's proactive strategy to mitigate these risks involves significant investment in supply chain stability, including capacity expansion across multiple geographic locations. This diversification aims to reduce reliance on any single supplier and lessen the impact of potential disruptions, thereby managing supplier bargaining power.

While direct forward integration by component suppliers into software or platform solutions is uncommon for Calix, a highly specialized supplier could theoretically attempt this. This would involve them offering services similar to Calix's platform directly to Communications Service Providers (CSPs).

However, Calix's established deep customer relationships, extensive software development expertise, and crucial service integration capabilities present substantial hurdles for any such supplier integration. For instance, Calix reported a customer retention rate of approximately 98% in 2023, highlighting the strength of these relationships.

Calix's comprehensive end-to-end platform, coupled with its managed services, is designed to simplify data utilization and enhance operational efficiency for its CSP clients. This integrated approach makes it difficult for a component supplier to replicate the value proposition.

Uniqueness of Inputs and Differentiation

Suppliers offering unique or proprietary technologies crucial to Calix's advanced broadband access systems and Wi-Fi components wield significant bargaining power. This is particularly true when these inputs are difficult to substitute and are integral to Calix's product differentiation. For instance, specialized semiconductor components or advanced software modules that enable unique performance characteristics in Calix's platforms can give suppliers leverage.

Calix mitigates this supplier power through its own innovation, integrating these specialized technologies into its distinctive platforms like AXOS and Calix Cloud. This integration creates a unique value proposition for Calix's customers, making the overall solution more important than individual components. Calix's reported strong innovation pipeline and customer loyalty, as evidenced by its consistent product development and market adoption, help reduce reliance on any single supplier.

- Supplier Dependence: The degree to which Calix relies on specific suppliers for critical, non-substitutable inputs.

- Input Uniqueness: The extent to which a supplier's product or technology is specialized and difficult for Calix to replicate or source elsewhere.

- Calix's Innovation: Calix's ability to incorporate supplier technologies into differentiated products, thereby increasing the value of the integrated solution.

- Customer Loyalty: Strong customer relationships and brand loyalty can reduce Calix's vulnerability to supplier price increases by providing a stable revenue base.

Impact of Input Costs on Calix's Profitability

Fluctuations in the cost of raw materials or components from suppliers can directly impact Calix's gross margins, particularly given the hardware component of their solutions. This is a key consideration in assessing the bargaining power of suppliers.

Calix has demonstrated resilience in managing these pressures, reporting strong gross margins. For instance, their non-GAAP gross margin reached 56.8% in the second quarter of 2025, indicating effective cost management and value capture even amidst potential supplier cost increases.

- Supplier Cost Sensitivity: Calix's reliance on hardware means that increases in component costs can directly squeeze profit margins.

- Margin Resilience: The company's ability to maintain high gross margins, such as the 56.8% non-GAAP figure in Q2 2025, suggests strong pricing power or efficient sourcing strategies.

- Value Proposition: The value embedded in Calix's solutions likely allows them to absorb some cost increases without significantly impacting profitability.

Calix faces moderate bargaining power from suppliers due to the specialized nature of its network access and broadband platforms, where switching costs for critical hardware are high. Despite this, Calix's 2023 customer retention rate of approximately 98% and its recognition in 2024 for supply chain excellence by Resilinc underscore its ability to manage these relationships effectively.

Suppliers of unique technologies, such as specialized semiconductors, hold leverage, but Calix mitigates this by integrating these into differentiated solutions like AXOS and Calix Cloud, enhancing the overall value proposition. The company's strong innovation pipeline and customer loyalty reduce its dependence on any single supplier.

While fluctuations in component costs can impact margins, Calix demonstrated resilience with a non-GAAP gross margin of 56.8% in Q2 2025, indicating effective cost management and pricing power. This financial performance suggests that Calix can absorb some supplier cost increases without significantly compromising profitability.

| Factor | Impact on Calix | Mitigation Strategy |

| Supplier Concentration | Moderate leverage for specialized component manufacturers. | Supply chain diversification and building strong supplier relationships. |

| Input Uniqueness | Suppliers of proprietary tech have leverage. | Integration into differentiated platforms (AXOS, Calix Cloud) increases solution value. |

| Switching Costs | High for critical hardware, creating dependence. | Focus on innovation and customer loyalty reduces vulnerability. |

| Cost Sensitivity | Component price increases can affect margins. | Strong gross margins (56.8% in Q2 2025) show effective cost management. |

What is included in the product

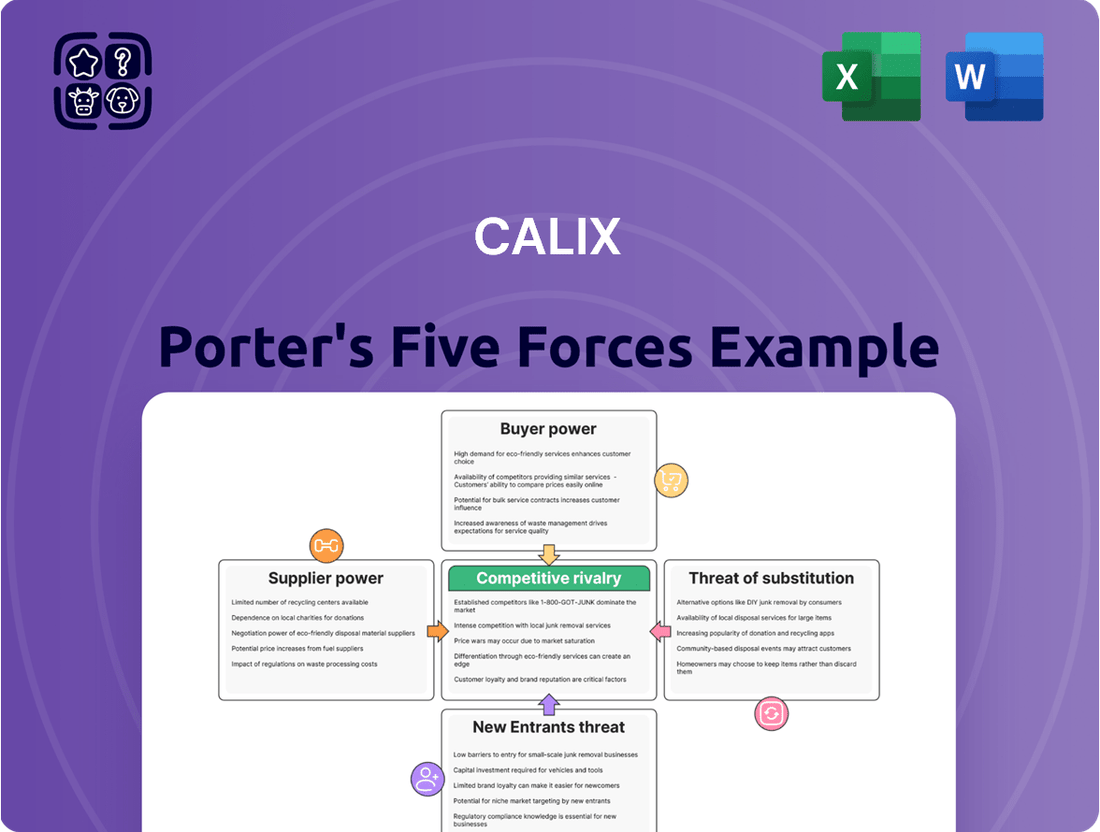

Calix's Porter's Five Forces analysis dissects the competitive intensity within the broadband industry, examining threats from new entrants, the bargaining power of buyers and suppliers, and the influence of substitutes and rival firms.

Effortlessly identify and mitigate competitive threats with a dynamic, visual representation of all five forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Calix's customer base is diverse, comprising Communications Service Providers (CSPs) like municipalities, cable companies, and electric cooperatives. These clients vary significantly in size, from small operations with a few hundred subscribers to larger entities serving up to 250,000. This broad spectrum of customer sizes helps mitigate the impact of any single client's needs or demands.

With around 1,600 active customers, Calix benefits from a wide distribution of its revenue. Crucially, in 2023, 2022, and 2021, no single customer accounted for more than 10% of Calix's total revenue. This lack of over-reliance on any one client significantly dilutes the bargaining power of individual customers.

Customer switching costs are a significant factor in the bargaining power of customers. For Communications Service Providers (CSPs) adopting Calix's integrated cloud and software platforms, systems, and services, these costs can be substantial. They include expenses related to employee training on new systems, the complex process of migrating existing data, and the potential for operational disruptions during the transition. In 2023, the average cost for a large enterprise to switch cloud providers was estimated to be in the millions of dollars, highlighting the financial commitment involved.

Calix actively works to increase these switching costs and enhance customer loyalty through its dedicated 'Success' organization. This team focuses on deepening engagement with CSPs, providing ongoing support for their digital transformation journeys. By integrating Calix solutions further into their daily operations and strategic planning, CSPs become more reliant on the Calix ecosystem, making it more difficult and costly to switch to a competitor.

Customer price sensitivity is a significant factor for Communications Service Providers (CSPs), particularly in the highly competitive broadband sector. They constantly weigh the desire for cutting-edge technology against the imperative of cost management. For instance, in 2024, many CSPs faced pressure to maintain affordable pricing for consumers while simultaneously investing in network upgrades, a balancing act that directly impacts their purchasing decisions for new technology.

Calix addresses this by emphasizing a value proposition that transcends mere cost. Their solutions aim to streamline operations, enhance customer experiences, and foster revenue growth for CSPs. This focus on demonstrable return on investment (ROI), going beyond simple cost reduction, allows Calix to position its offerings as a strategic enabler, justifying a premium price point by showcasing tangible business benefits and long-term value.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large Communications Service Providers (CSPs), represents a key aspect of bargaining power. These large CSPs could potentially develop some of the software or managed services that Calix offers internally. For instance, in 2024, several major telecom operators continued to invest heavily in internal R&D for network management and customer experience platforms.

However, the sheer complexity and the relentless pace of innovation required for modern cloud platforms, advanced broadband access systems, and sophisticated managed services make full backward integration a monumental undertaking for most CSPs. This is especially true for smaller or mid-sized providers who may lack the specialized expertise and resources to match Calix's integrated offerings. Calix's comprehensive, end-to-end platform, covering everything from network provisioning to customer support, presents a significant hurdle for any single customer to replicate effectively.

- Complexity of Calix's Integrated Platform: Calix provides a unified suite of solutions, making it difficult for individual CSPs to develop comparable capabilities across all aspects of broadband service delivery.

- Pace of Innovation: The continuous evolution of cloud technology, AI-driven network optimization, and customer engagement tools necessitates constant investment and specialized talent, which is challenging for CSPs to maintain internally for all functions.

- Resource Constraints for CSPs: While large CSPs have resources, diverting them to replicate Calix's entire offering might not be the most strategic use of capital compared to focusing on core network expansion and service delivery.

- Focus on Core Competencies: Many CSPs prefer to outsource specialized technology development to focus on their primary business of providing connectivity and customer service.

Importance of Calix's Offering to Customer Business

Calix's solutions are critical for Communications Service Providers (CSPs) to offer advanced broadband, Wi-Fi, and connected home services, enabling them to transform their business models and stay competitive. This deep integration means CSPs rely heavily on Calix for their differentiation and subscriber acquisition strategies.

The strategic importance of Calix’s platform directly translates into a stronger bargaining position for Calix. CSPs depend on Calix to innovate and expand their service offerings, which is essential for their growth and market standing. For example, Calix's platforms are integral to delivering multi-gigabit speeds, a key differentiator in the current market.

- Critical Infrastructure: Calix provides the foundational technology for CSPs to deliver essential broadband and Wi-Fi services, making its offerings indispensable.

- Competitive Differentiation: CSPs leverage Calix's innovations to stand out in a crowded market and attract new subscribers.

- Subscriber Growth: Calix's solutions directly enable CSPs to grow their customer base by enhancing service quality and introducing new revenue streams.

Calix's diverse customer base, with no single customer exceeding 10% of revenue in recent years, significantly limits individual customer bargaining power. High switching costs, estimated in the millions for large enterprises, further solidify Calix's position by making it financially prohibitive for clients to move to alternatives. Calix actively mitigates customer power by increasing these switching costs and fostering loyalty through its dedicated support organization, making its integrated platform a strategic imperative for CSPs.

Full Version Awaits

Calix Porter's Five Forces Analysis

This preview showcases the complete Calix Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no discrepancies or missing sections. You can confidently acquire this comprehensive report, ready for immediate application in your strategic decision-making.

Rivalry Among Competitors

The telecommunications sector is a battleground with many players, both old and new, constantly vying for market share. Calix faces formidable competition from tech giants like Cisco, ADTRAN, Nokia, Juniper Networks, and CommScope. These companies offer a wide range of solutions, making the competitive landscape particularly dynamic and challenging for any single player.

The broadband services market is seeing consistent growth, fueled by a rising need for faster internet, the rollout of 5G, and the expansion of fiber optics. This upward trend, alongside swift technological advancements and industry shifts, fosters both chances for expansion and fierce competition for market dominance.

Calix is strategically positioned to leverage government initiatives like the BEAD program, which aims to deploy high-speed internet in underserved areas, as a key driver for its future growth and market penetration.

Calix distinguishes itself by providing comprehensive cloud and software platforms, systems, and services designed to streamline operations for Communications Service Providers (CSPs) and facilitate the delivery of advanced managed services. This integrated approach sets it apart from rivals who might concentrate primarily on hardware or offer less cohesive solutions.

A core differentiator for Calix is its dedication to empowering Broadband Experience Providers (BEPs) through its innovative platform and robust managed services. This focus on the end-user experience, facilitated by their technology, creates a distinct value proposition in the market.

For instance, Calix's recent financial performance in 2024 has shown strong growth, with revenue increasing significantly year-over-year, reflecting the market's positive reception to its differentiated offering. This financial success underscores the effectiveness of their strategy in a competitive landscape.

High Exit Barriers

The telecom software and infrastructure sector presents substantial exit barriers, primarily due to the immense capital required for ongoing research and development, securing and protecting intellectual property, and cultivating deep-rooted customer relationships. This financial commitment makes it exceedingly difficult for companies to divest or leave the market, ensuring that competitors tend to persevere even through economic downturns, thereby intensifying ongoing rivalry.

These high exit barriers mean that companies are deeply invested in the market's future, leading to a persistent competitive landscape. For instance, in 2024, the global telecom software market was valued at approximately $100 billion, with significant portions dedicated to R&D that lock in players. This sustained presence fuels a competitive intensity that is unlikely to abate.

- High R&D Investment: Companies in this space regularly invest billions annually in developing next-generation technologies, making it financially prohibitive to exit.

- Intellectual Property: Patents and proprietary software represent significant assets that are difficult to monetize outside the industry, discouraging divestment.

- Established Customer Relationships: Long-term contracts and integrated service offerings with telecom operators create sticky customer bases, making it challenging for new entrants and for existing players to leave without significant loss.

- Market Reshaping Trends: Emerging trends like asset separation and delayering, while potentially altering competitive dynamics, do not inherently lower the capital required to operate or exit, thus maintaining high barriers.

Industry Consolidation and Strategic Partnerships

The broadband industry is experiencing a notable trend of consolidation, with an increasing number of mergers and acquisitions aimed at achieving greater operational efficiencies and economies of scale. This activity is reshaping the competitive landscape, potentially leading to fewer, larger players dominating the market. For instance, in 2024, several regional broadband providers have been involved in M&A discussions, signaling a move towards a more concentrated market structure.

Calix actively participates in this evolving environment through strategic partnerships. A prime example is its collaboration with altafiber, focusing on climate action initiatives. Such alliances not only bolster Calix's market standing by demonstrating commitment to sustainability but also serve to broaden its operational reach and customer engagement capabilities.

- Industry Consolidation: M&A activity is increasing in the broadband sector as companies pursue scale and efficiency.

- Concentrated Landscape: This consolidation trend is likely to result in a more concentrated competitive environment.

- Strategic Partnerships: Calix leverages partnerships, like the one with altafiber for climate action, to enhance its market position.

- Expanded Reach: These collaborations enable Calix to strengthen its market presence and extend its operational footprint.

Competitive rivalry in the telecommunications sector, where Calix operates, is intense due to numerous established players and new entrants. Companies like Cisco, ADTRAN, Nokia, Juniper Networks, and CommScope offer a broad spectrum of solutions, creating a dynamic market. This fierce competition is further amplified by high exit barriers, stemming from substantial R&D investments, intellectual property protection, and deeply entrenched customer relationships, making it difficult for companies to leave the market.

The broadband services market is experiencing robust growth, driven by increasing demand for higher speeds, 5G deployment, and fiber optic expansion. This growth, coupled with rapid technological evolution, fuels intense competition for market share and dominance. For instance, the global telecom software market was valued at approximately $100 billion in 2024, with significant R&D spending locking in existing players and intensifying rivalry.

Industry consolidation through mergers and acquisitions is a significant trend, aiming for greater efficiency and scale, which is likely to result in a more concentrated competitive landscape. Calix actively engages in strategic partnerships, such as its collaboration with altafiber on climate action, to enhance its market position and operational reach.

| Competitor | Key Offerings | 2024 Market Focus |

| Cisco | Networking hardware, software, security solutions | 5G infrastructure, cloud networking |

| ADTRAN | Broadband access solutions, network equipment | Fiber deployment, residential broadband |

| Nokia | Telecommunications equipment, network services | 5G networks, enterprise solutions |

| Juniper Networks | Networking hardware, software, security | Cloud-native networking, AI-driven operations |

| CommScope | Network infrastructure, connectivity solutions | Fiber optics, wireless infrastructure |

SSubstitutes Threaten

While fiber optics remains the dominant force in broadband revenue, alternative access technologies are increasingly challenging its position. Fixed Wireless Access (FWA) and satellite internet services, such as Starlink, offer viable substitutes for consumers seeking broadband connectivity. This growing availability of alternatives directly impacts the demand for traditional wired broadband solutions.

The growth trajectory of FWA is particularly noteworthy, with projections indicating substantial market expansion. For instance, global FWA connections were estimated to reach over 100 million by the end of 2023, a significant increase from previous years. This rapid adoption signifies a growing willingness among consumers to embrace non-fiber options, thereby posing a direct threat to the market share of fiber-centric providers and technologies like those offered by Calix.

Large Communications Service Providers (CSPs) sometimes consider developing software platforms and services in-house, similar to what Calix offers. For instance, AT&T invested billions in its own network software development, aiming for greater control and customization. However, the significant capital expenditure and ongoing maintenance costs associated with building and updating complex systems can be substantial, often exceeding the cost-effectiveness of relying on specialized vendors like Calix.

Communication Service Providers (CSPs) might consider using more general enterprise software or public cloud services for some operational tasks instead of specialized solutions like those from Calix. This could potentially reduce costs for certain functions.

However, Calix's platforms are specifically designed for broadband providers, offering unique features, seamless integrations, and valuable insights that generic solutions often lack. For instance, Calix's cloud-native platforms, like their Marketing Cloud and Operations Cloud, are built to address the complex, real-time demands of delivering and managing broadband services, something general software is not equipped for.

In 2024, the increasing complexity of network management and customer experience demands for CSPs highlights the value of these specialized platforms. Calix reported strong growth in its cloud subscription revenue, indicating a market trend where CSPs recognize the strategic advantage of purpose-built solutions over generic alternatives for critical operations.

Legacy Hardware-Centric Solutions

Some Communications Service Providers (CSPs) might still favor older, hardware-heavy network setups, shying away from integrated cloud and software. This approach acts as a substitute for Calix's more contemporary, software-defined solutions. For example, in 2023, while many invested in cloud-native architectures, a segment of the market continued to prioritize capital expenditures on physical network upgrades rather than operational expenditure on software platforms.

Calix has strategically moved from a hardware-centric business to a prominent player in cloud and software platforms. This pivot is evident in their financial performance, with a significant portion of their revenue now derived from software and cloud services, demonstrating a market shift away from purely legacy hardware models.

The threat from these legacy hardware-centric solutions is mitigated by the increasing demand for agility and cost-efficiency that software-defined networking offers.

- Continued reliance on traditional hardware by some CSPs.

- Calix's successful transition to cloud and software leadership.

- Market shift favoring agile, software-defined network approaches.

Disaggregated Network Architectures

The rise of disaggregated network architectures, where service providers mix and match components from various vendors, presents a potential threat of substitutes. This approach allows for greater flexibility and can sometimes offer cost advantages by avoiding vendor lock-in. For instance, a provider might opt for a disaggregated approach to build their broadband network, choosing a separate vendor for their optical line terminal (OLT) and another for their management software, rather than a single, integrated solution.

However, Calix's platform strategy is designed to mitigate this threat. While acknowledging the trend towards disaggregation, Calix focuses on simplifying operations even within such diverse environments. Their platform aims to provide a unified management layer and seamless service delivery across these disparate components. This can translate into significant operational efficiencies, reducing the complexity that often accompanies a truly disaggregated network. For example, in 2023, the average cost of network integration for companies adopting disaggregated models was estimated to be higher than for those using integrated platforms, highlighting the operational burden.

- Disaggregation Trend: The increasing adoption of network functions virtualization (NFV) and software-defined networking (SDN) facilitates the use of best-of-breed components from multiple vendors.

- Calix's Value Proposition: Calix's platform aims to abstract the complexity of disaggregated networks, offering simplified management, orchestration, and faster service deployment.

- Operational Cost Consideration: While disaggregation can offer initial component cost savings, the increased complexity in integration and ongoing management can lead to higher total cost of ownership, a point Calix leverages.

- Market Context: As of early 2024, many Tier 1 and Tier 2 service providers are exploring or actively implementing disaggregated strategies, creating a competitive landscape where platform simplification is a key differentiator.

The threat of substitutes for Calix centers on alternative broadband technologies and service delivery models. Fixed Wireless Access (FWA) and satellite internet are gaining traction, offering consumers choices beyond traditional fiber. For instance, global FWA connections surpassed 100 million by the end of 2023, demonstrating a significant shift in consumer preference.

Furthermore, some Communications Service Providers (CSPs) consider in-house software development or using generic enterprise solutions as substitutes for specialized platforms like Calix's. While AT&T’s significant investments in its own network software highlight this trend, the high capital and maintenance costs often make specialized vendors more cost-effective. Calix's cloud-native platforms, like its Marketing Cloud and Operations Cloud, are purpose-built for broadband delivery, offering advantages over generic software.

Disaggregated network architectures, where CSPs mix and match components from different vendors, also pose a threat. This approach can offer flexibility and cost savings by avoiding vendor lock-in. However, the complexity of integration and management in disaggregated networks can lead to higher total costs of ownership. Calix’s platform strategy aims to simplify these complex environments, providing a unified management layer that reduces operational burdens, a crucial factor as many providers explore disaggregated strategies in 2024.

Entrants Threaten

Entering the telecommunications infrastructure and software market, like the one Calix operates in, demands massive upfront capital. This includes extensive research and development, setting up manufacturing capabilities, and establishing a worldwide sales and support infrastructure. For instance, companies in this sector often spend billions on R&D to stay competitive.

Calix itself demonstrates this by heavily investing in innovation, expanding its platform, cloud services, and managed offerings. This commitment to ongoing R&D is crucial for maintaining its market position but also represents a significant financial undertaking. Such substantial investment requirements act as a formidable barrier, effectively deterring many potential new entrants from challenging established players.

The telecommunications sector is a minefield of regulations, with each country and often each region having its own unique set of standards, licenses, and compliance obligations. For any new company looking to enter this space, understanding and adhering to these complex rules represents a substantial hurdle, both in terms of time and financial investment. For instance, obtaining the necessary spectrum licenses in major markets can cost billions, as seen in the 2024 US C-band auction where carriers spent over $45 billion.

These stringent regulatory requirements act as a powerful deterrent to potential new entrants, effectively raising the barrier to entry. Furthermore, the dynamic nature of these regulations means that existing players like Calix must constantly adapt to new compliance demands, which can also be viewed as a threat that impacts operational costs and strategic planning.

Calix has cultivated deep relationships with a wide array of Communications Service Providers (CSPs). Its dedicated 'Success' organization actively works to strengthen these existing partnerships, making it challenging for newcomers to gain a foothold.

The high switching costs and the typically long-term contracts prevalent in the industry present a significant barrier for new entrants aiming to dislodge established players like Calix. Calix's continued growth, evidenced by the addition of 18 new broadband service providers in Q4 2024, underscores the stickiness of its customer base.

Need for Specialized Expertise and Talent

Developing and deploying advanced cloud and software platforms for Communication Service Providers (CSPs) demands a very specific and deep skillset. This includes highly specialized engineering, cutting-edge software development, and intricate telecom industry knowledge. New entrants face a significant hurdle in finding and keeping these expert individuals, making talent acquisition a major barrier.

The telecommunications sector itself acknowledges talent and skills management as a critical risk. For instance, a 2024 report highlighted that the average time to fill highly specialized tech roles in the telecom industry can exceed 60 days, significantly impacting operational readiness and innovation speed for new players.

- Specialized Expertise Required: Cloud architecture, software engineering, and telecommunications protocol knowledge are essential.

- Talent Acquisition Challenge: Attracting and retaining individuals with these niche skills is difficult and costly.

- Industry Risk Factor: Talent management is identified as a key risk for the broader telecommunications industry.

Economies of Scale and Scope

Established players in industries like Calix's often leverage significant economies of scale, which act as a formidable barrier to entry. This means that companies already operating at a large volume can produce goods or services at a lower per-unit cost due to bulk purchasing of raw materials, more efficient production processes, and spread-out research and development expenses. For instance, Calix's ability to secure favorable terms with suppliers and amortize its R&D investments across a larger output base allows it to maintain competitive pricing.

Newcomers would find it challenging to match these cost efficiencies without substantial upfront investment, making it difficult to compete effectively on price or offer a similarly comprehensive suite of products and services. Calix's financial reports often highlight its disciplined approach to managing operating expenses as its revenue grows, demonstrating how it capitalizes on its scale to improve profitability and reinvest in innovation, further solidifying its market position.

The advantage of scale extends beyond cost. It enables established firms to invest more heavily in marketing, distribution networks, and customer support, creating a more robust and appealing offering for consumers. For example, if Calix has a well-established global distribution network, a new entrant would need significant capital and time to replicate that reach, facing higher logistical costs and potentially slower market penetration.

- Economies of Scale: Calix benefits from lower per-unit costs in production and procurement due to its large operational volume.

- R&D Efficiency: Significant R&D investments are spread across a larger output, reducing the per-unit R&D cost for Calix.

- Competitive Pricing: These scale advantages allow Calix to offer competitive pricing, a hurdle for new entrants.

- Operating Expense Leverage: Calix demonstrates effective management of operating expenses as revenue scales, indicating strong cost control at higher volumes.

The threat of new entrants into Calix's market is significantly mitigated by the immense capital requirements for research, development, and establishing a global operational footprint. For instance, telecommunications infrastructure development often necessitates billions in investment, a barrier that deters many potential challengers. Furthermore, the complex and ever-evolving regulatory landscape, including the need for expensive spectrum licenses, as demonstrated by the over $45 billion spent in the 2024 US C-band auction, adds another substantial layer of difficulty for newcomers.

High customer switching costs, fostered by long-term contracts and Calix's strong relationships with Communications Service Providers, create customer stickiness. Calix's addition of 18 new broadband service providers in Q4 2024 highlights this loyalty. Compounding these challenges is the scarcity of specialized talent in cloud architecture, software engineering, and telecom protocols, with filling such roles taking over 60 days on average in the industry according to a 2024 report, making talent acquisition a critical hurdle for any new entrant.

| Barrier | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | High upfront investment for R&D, manufacturing, and sales/support infrastructure. | Billions required for telecom infrastructure development. |

| Regulatory Hurdles | Navigating complex national and regional regulations, licenses, and compliance. | US C-band auction in 2024 saw over $45 billion in spending for spectrum licenses. |

| Customer Relationships & Switching Costs | Deeply established partnerships and long-term contracts make it hard for new players to gain traction. | Calix added 18 new broadband service providers in Q4 2024. |

| Talent Acquisition | Difficulty in finding and retaining individuals with specialized telecom and software skills. | Average time to fill specialized tech roles in telecom can exceed 60 days (2024 report). |

Porter's Five Forces Analysis Data Sources

Our Calix Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, investor presentations, and industry-specific market research to gauge competitive intensity.