Calix PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calix Bundle

Navigate the complex external forces shaping Calix's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting their operations and market position. Equip yourself with actionable intelligence to refine your strategy and anticipate industry shifts. Download the full report now and gain a critical competitive advantage.

Political factors

Government initiatives like the Broadband Equity, Access, and Deployment (BEAD) program are a major driver for companies like Calix. This program, part of the Infrastructure Investment and Jobs Act, has allocated $42.45 billion to expand broadband access across the U.S. These substantial investments empower Communications Service Providers (CSPs) to upgrade and build out their networks, directly increasing the demand for Calix's broadband platforms and services.

The telecommunications regulatory environment significantly shapes the operational landscape for Communication Service Providers (CSPs), Calix's primary customer base. Licensing, operational standards, and service obligations are all dictated by governmental bodies, influencing how CSPs invest in and deploy network infrastructure.

For instance, regulatory shifts regarding net neutrality or spectrum allocation can compel CSPs to re-evaluate their network architectures and service offerings. In 2024, ongoing discussions and potential policy changes in areas like broadband deployment mandates and digital divide initiatives continue to influence CSP capital expenditure plans, which directly impacts Calix's sales cycles and product roadmap for broadband access solutions.

Global trade policies and geopolitical tensions significantly impact Calix's operations. For instance, the ongoing trade disputes between major economies could lead to increased tariffs on components, raising manufacturing costs for Calix's network infrastructure solutions. The company's reliance on a global supply chain means that disruptions due to political instability or new trade barriers in key markets, such as the EU or Asia, could affect product availability and pricing.

Data Sovereignty and Security Mandates

Governments worldwide are tightening regulations around data sovereignty and security, directly impacting telecommunications providers and their technology partners like Calix. These mandates dictate where data must be stored and processed, often requiring it to remain within national borders, particularly for sensitive infrastructure. For instance, in 2024, the European Union continued to emphasize data localization for critical services, influencing how cloud-based solutions are deployed.

These stringent requirements necessitate that Calix's cloud and software offerings adhere to rigorous compliance standards. This means product development must prioritize features that enable data segregation, encryption, and secure access controls, ensuring clients can meet their national obligations. By 2025, the global spending on cybersecurity solutions for critical infrastructure is projected to exceed $20 billion, highlighting the market's demand for compliant technologies.

- Data Localization: Mandates requiring data to be stored and processed within a specific country's borders.

- Enhanced Security Certifications: Increased demand for certifications like ISO 27001 and country-specific security accreditations.

- Compliance Costs: Investment needed by Calix to ensure its platforms meet diverse and evolving governmental data protection rules.

- Market Access: Ability to serve national markets is contingent on meeting these data sovereignty and security mandates.

Political Stability in Key Markets

Political stability in Calix's key operating regions and among its CSP customers significantly impacts its business. For instance, in the United States, a major market for Calix, the Biden administration's focus on broadband expansion, supported by legislation like the Infrastructure Investment and Jobs Act (IIJA) allocating $65 billion for broadband deployment, generally supports Calix's growth. However, shifts in political priorities or economic policies in these nations could affect infrastructure spending and regulatory frameworks.

Instability can directly disrupt Calix's revenue. Consider the potential impact of geopolitical tensions or domestic unrest in countries where significant CSP investments are planned. Such events could lead to project delays, increased operational costs, or even a re-evaluation of capital allocation by CSPs, directly affecting Calix's sales pipeline and order volumes.

Calix monitors political developments closely. For example, changes in government in Australia, another key market, could alter the pace and direction of national broadband initiatives, a primary driver for Calix's business there. The company's ability to navigate these political landscapes is crucial for maintaining investment confidence and ensuring business continuity.

- US Infrastructure Investment: The IIJA continues to drive broadband deployment, a positive for Calix.

- Global Market Sensitivity: Political shifts in countries like Australia can influence CSP investment decisions.

- Regulatory Uncertainty: Changes in government can lead to evolving regulatory priorities affecting network build-outs.

- Economic Impact: Political instability can trigger economic downturns, impacting CSPs' ability to fund projects.

Government funding, particularly initiatives like the US Broadband Equity, Access, and Deployment (BEAD) program, continues to be a significant catalyst for Calix. This program, with its substantial allocation of $42.45 billion, directly fuels CSPs' network expansion efforts, thereby boosting demand for Calix's solutions. Regulatory frameworks, including net neutrality and spectrum allocation policies, also shape CSP investment strategies, influencing Calix's product development and sales cycles.

Data sovereignty and security regulations are increasingly critical, compelling Calix to ensure its cloud and software platforms meet stringent compliance standards. For instance, the EU's continued emphasis on data localization in 2024 necessitates that Calix's offerings facilitate secure data handling within national borders. Global cybersecurity spending for critical infrastructure is projected to surpass $20 billion by 2025, underscoring the market's need for compliant technologies.

Political stability in key markets like the United States, where the Infrastructure Investment and Jobs Act (IIJA) supports broadband deployment, generally benefits Calix. However, shifts in government priorities or geopolitical tensions can introduce uncertainty, potentially delaying projects and impacting CSP capital expenditure. For example, changes in national broadband initiatives in countries like Australia can directly influence Calix's business prospects.

| Factor | Description | Impact on Calix | 2024/2025 Data Point |

|---|---|---|---|

| Government Funding | US BEAD Program and IIJA | Drives CSP network build-out, increasing demand for Calix platforms. | BEAD: $42.45 billion allocated for broadband expansion. |

| Regulatory Environment | Net neutrality, spectrum allocation, data sovereignty | Influences CSP investment, network architecture, and Calix's product roadmap. | EU data localization mandates continue to shape cloud solution deployment. |

| Geopolitical Stability | Trade policies, political unrest | Can disrupt supply chains, increase costs, and affect CSP project timelines. | Global cybersecurity spending for critical infrastructure projected to exceed $20 billion by 2025. |

| Political Shifts | Changes in government priorities | Can alter national broadband initiatives and impact CSP capital allocation. | Monitoring of broadband policy changes in key markets like Australia. |

What is included in the product

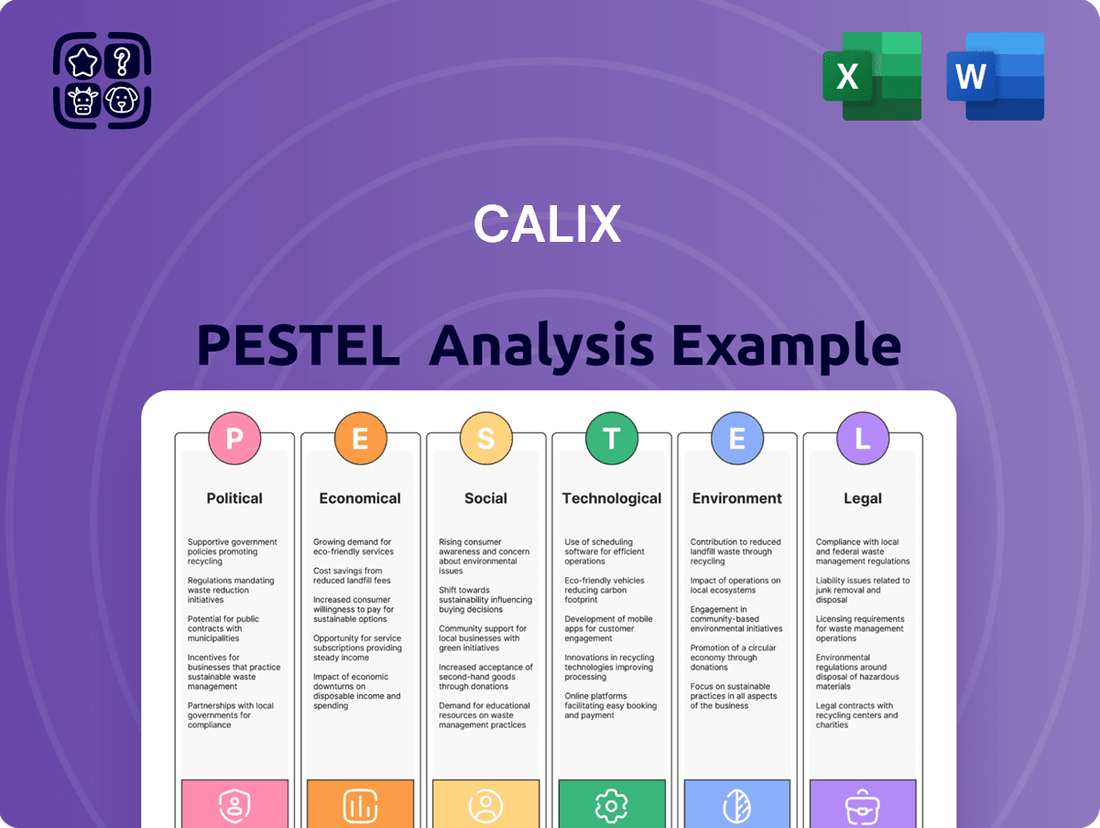

The Calix PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operating landscape.

This comprehensive evaluation provides actionable insights for strategic decision-making by identifying key external influences and their potential opportunities and threats.

Provides a clear, actionable framework that helps leadership teams identify and mitigate external threats, thereby reducing the anxiety associated with market uncertainty.

Economic factors

Global economic growth directly influences the spending power of Communication Service Providers (CSPs). In 2024, the International Monetary Fund (IMF) projected global growth at 3.2%, a steady rate that supports CSPs' willingness to invest in network infrastructure and technology upgrades. This trend is expected to continue into 2025, positively impacting demand for Calix's solutions.

Conversely, recessionary pressures can significantly curtail CSP capital expenditures. Should global economic conditions deteriorate, leading to reduced consumer and business spending, CSPs might delay or scale back network expansion projects. This would directly affect Calix's revenue streams as clients postpone or decrease their investment in new platforms and services.

Rising inflation in 2024 and projected into 2025 poses a direct challenge to Calix by increasing its operational expenses. Costs for essential inputs like semiconductors, raw materials, and skilled labor have seen upward pressure, potentially impacting Calix's gross margins if these increases cannot be fully passed on to customers. For instance, the Consumer Price Index (CPI) in the US saw a notable increase throughout 2023 and early 2024, indicating a broader inflationary environment that affects supply chains.

Simultaneously, fluctuating interest rates, particularly the Federal Reserve's policy adjustments in 2023 and ongoing considerations for 2024, affect both Calix and its clients. Higher borrowing costs can deter Calix from pursuing strategic acquisitions or R&D investments, while also making it more expensive for Communications Service Providers (CSPs) to finance the large-scale network upgrades that utilize Calix's solutions. This economic climate can lead to a slowdown in project timelines as CSPs re-evaluate their capital expenditure plans.

The communications service provider (CSP) market is intensely competitive, pushing companies to innovate and streamline operations. Calix directly addresses this by offering solutions that help CSPs differentiate their services and improve efficiency. For instance, in 2024, the ongoing build-out of 5G networks and fiber infrastructure by numerous providers globally intensifies this competitive landscape, making service quality and cost management paramount.

However, this fierce competition also creates pricing pressure. CSPs, looking to gain an edge, often seek the most cost-effective solutions. This reality directly influences Calix's pricing strategies as they must balance the value of their advanced technology against the market's demand for affordability, impacting their revenue streams and market share dynamics.

Broadband Infrastructure Investment Cycles

Calix's revenue is significantly influenced by the cyclical nature of broadband infrastructure investments made by Communications Service Providers (CSPs). These investment cycles are often triggered by the introduction of new technologies, such as the ongoing expansion of fiber-to-the-home (FTTH) networks and the development of 5G mobile backhaul, which require substantial upgrades to existing infrastructure.

Government initiatives play a crucial role in accelerating these investment cycles. For instance, in the United States, the Broadband Equity, Access, and Deployment (BEAD) program, part of the Infrastructure Investment and Jobs Act, allocated $42.45 billion in funding to states and territories for broadband deployment. This program is designed to bridge the digital divide and is expected to drive significant capital expenditures by CSPs in underserved areas throughout 2024 and 2025, directly benefiting Calix's business.

Subscriber demand for enhanced broadband services, including higher speeds and increased bandwidth for streaming, gaming, and remote work, also fuels these investment cycles. As consumers continue to rely more heavily on digital services, CSPs are compelled to upgrade their networks to meet these evolving demands. This sustained demand ensures a relatively consistent, albeit cyclical, need for the network equipment and software solutions that Calix provides.

- Fiber Deployment: Global FTTH connections are projected to reach over 1 billion by the end of 2024, indicating robust investment in fiber infrastructure.

- 5G Rollout: CSPs are investing heavily in 5G, with global capital expenditures expected to exceed $200 billion annually in the coming years, requiring advanced broadband backhaul solutions.

- Government Funding: Programs like the BEAD initiative in the US are injecting billions into rural broadband expansion, creating a strong near-term demand for infrastructure upgrades.

Foreign Exchange Rate Volatility

As a global player, Calix is significantly exposed to foreign exchange rate volatility. Fluctuations in currency values directly impact the reported revenue from international sales and the cost of sourcing components or services from abroad. For instance, a strengthening US dollar against other major currencies could make Calix's products more expensive for international buyers, potentially dampening demand.

These currency shifts can have a material effect on Calix's overall profitability and its competitive positioning in various geographical markets. For example, if the Euro weakens considerably against the dollar, revenue generated from European sales, when converted back to USD, would be lower, impacting the company's bottom line. Conversely, a weaker dollar could boost overseas earnings when translated back into USD.

Consider the following impacts:

- Revenue Translation: For the fiscal year ended December 31, 2023, Calix reported net sales of $874.3 million. A portion of this revenue is generated in currencies other than the US dollar. If these foreign currencies depreciate against the USD, the reported USD equivalent of those sales will be lower.

- Cost of Goods Sold: Calix sources materials and potentially manufactures components globally. If the USD strengthens, the cost of these imported inputs decreases, which could positively impact gross margins. However, the opposite is true if the USD weakens.

- Competitive Landscape: Exchange rate movements can alter the price competitiveness of Calix's products relative to local competitors in international markets. A strong dollar can make it harder for Calix to compete on price in countries with weaker currencies.

- Hedging Strategies: Companies like Calix often employ financial instruments to hedge against currency risks. The effectiveness and cost of these hedging strategies can influence the net impact of foreign exchange volatility on financial performance.

Global economic growth is a key driver for Calix, as it directly impacts the spending capacity of Communication Service Providers (CSPs). The IMF projected global growth at 3.2% for 2024, a figure expected to persist into 2025, supporting CSP investment in network upgrades and technologies.

Inflationary pressures, evident in rising consumer prices throughout 2023 and into 2024, increase Calix's operational costs for materials and labor, potentially squeezing profit margins if these costs cannot be fully passed on to customers.

Interest rate policies, particularly those from the Federal Reserve, influence both Calix's investment capacity and CSPs' ability to finance large network projects, potentially slowing down deployment timelines.

The competitive environment within the CSP market compels companies to innovate, a need Calix addresses with its efficiency-boosting solutions, especially as 5G and fiber build-outs intensify competition in 2024.

Government funding, such as the $42.45 billion allocated through the US BEAD program, is a significant catalyst for broadband infrastructure investment, creating substantial opportunities for Calix throughout 2024 and 2025.

Strong subscriber demand for faster, more reliable internet services, driven by streaming, gaming, and remote work, continually pushes CSPs to upgrade their networks, ensuring a consistent need for Calix's solutions.

Calix's international sales are subject to foreign exchange rate volatility; for example, a stronger US dollar can make its products more expensive for overseas buyers, impacting demand and profitability.

| Economic Factor | Impact on Calix | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Global Economic Growth | Influences CSP investment in network upgrades and technology. | IMF projected 3.2% global growth for 2024, expected to continue into 2025. |

| Inflation | Increases operational costs for Calix (materials, labor). | Continued upward pressure on CPI in major economies. |

| Interest Rates | Affects Calix's R&D/acquisition costs and CSP financing of projects. | Central banks considering rate adjustments in 2024/2025. |

| Foreign Exchange Rates | Impacts revenue translation and cost of goods sold for international sales. | USD strength/weakness affects competitiveness and reported earnings. |

Full Version Awaits

Calix PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Calix PESTLE analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

You'll gain valuable insights into Calix's strategic positioning and potential challenges and opportunities.

Sociological factors

Societal reliance on robust internet is escalating, with a significant portion of the global population now depending on high-speed connectivity for essential activities like remote work, online learning, and digital entertainment. For instance, in 2024, an estimated 66% of the global workforce engaged in some form of remote work, highlighting this trend.

This pervasive demand compels Communication Service Providers (CSPs) to continuously enhance their network infrastructure and introduce cutting-edge services. This directly fuels the market for advanced broadband and Wi-Fi solutions, such as those offered by Calix, as consumers and businesses alike seek faster and more dependable connections.

The enduring move to remote and hybrid work models, accelerated by events in 2020, has fundamentally reshaped how and where people connect. This shift means millions of households now rely on their home internet for critical work functions, demanding higher speeds and reliability than ever before. For instance, a Pew Research Center study in early 2024 indicated that roughly 60% of U.S. workers were still working remotely at least part of the time, a significant increase from pre-pandemic levels.

This sustained demand places a premium on the quality of broadband and the connected home experience. Calix's solutions, designed to empower Communications Service Providers (CSPs) to deliver exceptional network performance and seamless in-home Wi-Fi, are therefore increasingly vital. CSPs are investing heavily to meet this need, with global broadband infrastructure spending projected to reach over $100 billion in 2024, according to industry analysts.

Consumers are increasingly embracing smart home technology, with a significant rise in the adoption of Internet of Things (IoT) devices. This trend means more households are relying on robust and sophisticated in-home Wi-Fi networks to manage these interconnected devices, from smart thermostats to security cameras. For instance, by the end of 2024, it's projected that over 300 million smart home devices will be in use in the US alone, highlighting the growing demand for seamless connectivity solutions.

Calix's platforms are well-positioned to capitalize on this sociological shift. By offering advanced Wi-Fi management and enabling enhanced connected home experiences, Calix directly addresses the needs of consumers who are investing in and depending on their smart home ecosystems. This growing reliance on connected living creates a substantial market opportunity for companies like Calix that provide the underlying infrastructure and services.

Addressing the Digital Divide

Societal pressure and government initiatives are actively working to bridge the digital divide, aiming for equitable broadband access across all communities. This creates substantial opportunities for Calix as Communications Service Providers (CSPs) are often motivated by these programs to deploy Calix’s solutions. These deployments are crucial for expanding network coverage into underserved and unserved regions.

In the United States, for instance, the Broadband Equity, Access, and Deployment (BEAD) Program, part of the Infrastructure Investment and Jobs Act, allocated $42.45 billion to states and territories for broadband deployment. This funding directly supports CSPs in extending their reach, thereby increasing demand for Calix’s network infrastructure and service management platforms. Calix’s ability to enable efficient deployment and management of these expanded networks positions it as a key partner in these national efforts.

- Bridging the Digital Divide: Societal and governmental push for universal broadband access.

- Government Funding: Initiatives like the US BEAD program provide billions to CSPs for network expansion.

- Calix's Role: Enabling CSPs to efficiently deploy and manage networks in underserved areas.

- Market Opportunity: Increased demand for Calix solutions driven by these expansion efforts.

Changing Consumer Expectations for Digital Experiences

Subscribers today demand digital interactions that are smooth, tailored, and anticipate their needs. This includes easy self-service tools and smart customer support. For instance, a 2024 report indicated that 70% of consumers expect a company to anticipate their needs, a significant jump from previous years.

Calix's cloud and software solutions are designed to help Communications Service Providers (CSPs) meet these heightened expectations. By streamlining operations and facilitating unique service offerings, Calix enables CSPs to deliver the personalized and proactive digital experiences customers now consider standard. This is crucial as customer retention in the telecom sector is heavily influenced by digital engagement quality.

- Digital Experience Expectations: Consumers increasingly expect intuitive, personalized, and proactive digital interfaces from service providers, mirroring their experiences with leading tech companies.

- Self-Service Demand: A strong preference for self-service options continues to grow, with studies in early 2025 showing that over 60% of customer service interactions are initiated through digital self-help channels.

- Calix's Role: Calix platforms enable CSPs to automate processes and offer advanced digital tools, allowing them to provide the seamless, on-demand service customers expect.

The increasing reliance on digital connectivity for work, education, and entertainment has fundamentally changed consumer expectations. By 2024, over 60% of US workers were still working remotely at least part-time, underscoring the demand for reliable home internet. This societal shift directly benefits Calix by increasing the need for advanced broadband and Wi-Fi solutions from Communications Service Providers (CSPs).

Furthermore, the proliferation of smart home devices, with projections of over 300 million in US households by the end of 2024, necessitates robust in-home network management. Calix's platforms are designed to enhance these connected experiences, aligning with consumer adoption of IoT technologies.

Societal demand for equitable internet access, coupled with government initiatives like the US BEAD program ($42.45 billion allocated), drives CSP investment in network expansion. Calix plays a crucial role in enabling CSPs to efficiently deploy and manage these expanded networks, particularly in underserved areas.

Consumers now expect seamless, personalized digital interactions, with a significant portion preferring self-service options. By early 2025, over 60% of customer service interactions were initiated digitally. Calix's software solutions empower CSPs to meet these expectations, fostering stronger customer relationships.

| Sociological Factor | Impact on CSPs | Calix's Solution Alignment | 2024/2025 Data Point |

|---|---|---|---|

| Remote/Hybrid Work | Increased demand for high-speed, reliable home internet. | Provides advanced broadband and Wi-Fi solutions. | 60% of US workers remote part-time (early 2024). |

| Smart Home Adoption | Need for robust in-home network management for IoT devices. | Offers enhanced connected home experiences and Wi-Fi management. | 300M+ US smart home devices projected (end of 2024). |

| Digital Divide & Equity | Government funding incentivizes network expansion into underserved areas. | Enables efficient deployment and management of expanded networks. | $42.45B US BEAD program for broadband deployment. |

| Digital Customer Experience | Expectation of personalized, proactive, and self-service interactions. | Provides cloud and software solutions for streamlined operations and digital tools. | 60%+ customer service interactions initiated digitally (early 2025). |

Technological factors

Calix's business is intrinsically linked to the ongoing advancements and widespread rollout of fiber optic and 5G technologies. These next-generation networks are the backbone for the services Calix's customers, Communications Service Providers (CSPs), offer.

As CSPs increasingly migrate their infrastructure to these high-capacity, low-latency networks, the need for sophisticated systems and software to manage and optimize them grows. This directly fuels demand for Calix's specialized solutions, which are designed precisely for these advanced network environments.

For instance, the global 5G infrastructure market was valued at approximately $31.4 billion in 2023 and is projected to reach $137.8 billion by 2030, showing a compound annual growth rate of 23.5%. Similarly, fiber optic broadband subscriptions continue to climb, with global subscriptions reaching over 250 million in early 2024, demonstrating the strong market pull for the very technologies Calix supports.

The telecommunications industry is witnessing a significant technological shift, with cloud-native network functions becoming increasingly prevalent. This evolution allows for greater agility and scalability in network operations. Calix's platforms are designed to leverage these cloud-native architectures, directly supporting this industry trend.

The rise of edge computing is another crucial technological factor, particularly for applications demanding ultra-low latency. By bringing processing closer to the end-user, edge computing enables faster response times for services like real-time gaming and advanced IoT applications. Calix's strategy embraces this by providing solutions that can be deployed at the network edge.

In 2024, the global cloud computing market was valued at over $600 billion, with significant growth projected as more network functions transition to the cloud. This underscores the strategic importance of Calix's focus on cloud and software platforms, as it positions the company to capitalize on this expanding market by enabling Communication Service Providers (CSPs) to virtualize and automate their networks efficiently.

Cybersecurity threats are becoming increasingly complex, demanding that Calix integrate advanced security into its network solutions and connected devices. This is crucial for protecting Communications Service Providers (CSPs) and their customers' data.

Calix’s commitment to innovation in cybersecurity is a significant competitive advantage. For example, in 2024, the company continued to enhance its platform's ability to detect and mitigate emerging threats, ensuring the integrity of broadband networks.

The financial impact of breaches is substantial; the average cost of a data breach in 2023 reached $4.45 million globally, according to IBM. This underscores the critical need for Calix to provide reliable security, safeguarding its clients from significant financial and reputational damage.

Integration of Artificial Intelligence and Machine Learning

The telecommunications sector is undergoing a significant shift with the integration of artificial intelligence (AI) and machine learning (ML). These technologies are being applied across various functions, from automating network operations to predicting equipment failures and optimizing service delivery. Calix, a key player, is leveraging AI/ML within its platforms to enable Communication Service Providers (CSPs) to streamline their operations and offer more intelligent, personalized services to their customers.

Calix's approach is designed to simplify complex network management for CSPs. For instance, AI-driven predictive maintenance can reduce downtime by identifying potential issues before they impact service, a crucial factor in maintaining customer satisfaction. Furthermore, the optimization of service delivery through AI can lead to more efficient resource allocation and improved network performance, directly impacting the end-user experience.

- Network Automation: AI/ML is reducing manual intervention in network management, leading to faster issue resolution and improved efficiency.

- Predictive Maintenance: By analyzing data patterns, AI can forecast equipment failures, allowing for proactive repairs and minimizing service disruptions.

- Service Optimization: ML algorithms enhance service delivery by dynamically adjusting network resources based on real-time demand and usage patterns.

- Enhanced Customer Experience: AI-powered tools are used for personalized service offerings and proactive customer support, boosting satisfaction and loyalty.

Software-Defined Networking (SDN) and Network Function Virtualization (NFV) Adoption

The widespread adoption of Software-Defined Networking (SDN) and Network Function Virtualization (NFV) is fundamentally reshaping the telecommunications landscape, driving greater agility and efficiency. This industry-wide shift empowers Communication Service Providers (CSPs) to manage their networks with increased flexibility, scalability, and cost-effectiveness, moving away from rigid, hardware-centric architectures. Calix's strategic focus on a software-centric approach, coupled with its robust cloud platforms, is instrumental in supporting CSPs through this critical transition, enabling them to modernize their infrastructure and evolve their business models.

Calix's platforms are specifically engineered to leverage the benefits of SDN and NFV, allowing CSPs to abstract network functions from underlying hardware. This facilitates dynamic service provisioning, automated network operations, and the rapid introduction of new services, which is crucial in today's competitive market. For instance, the increasing demand for high-bandwidth services, such as 5G and enhanced broadband, necessitates a more programmable and adaptable network infrastructure that SDN and NFV provide. By 2024, the global SDN market was projected to reach over $20 billion, highlighting the significant investment and commitment to these technologies.

- SDN/NFV adoption is accelerating: Industry reports indicate a significant year-over-year growth in SDN/NFV deployments by CSPs aiming for operational efficiency.

- Calix's cloud-native architecture: This design is inherently suited to the virtualized and software-defined nature of modern networks, reducing CapEx and OpEx for CSPs.

- Enabling new service innovation: The flexibility offered by SDN/NFV allows CSPs to quickly roll out and manage services like advanced Wi-Fi, IoT connectivity, and fiber-to-the-home (FTTH) offerings.

- Market growth projections: The global NFV market is expected to see continued strong growth, with projections indicating it will exceed $60 billion by 2025, underscoring the strategic importance of these technologies.

Technological advancements in fiber optics and 5G are critical drivers for Calix, as these networks form the foundation for its customers' services. The increasing adoption of cloud-native architectures and edge computing further amplifies the need for Calix's agile and scalable solutions. Moreover, the integration of AI/ML into network operations and the widespread adoption of SDN/NFV are reshaping the telecommunications landscape, presenting significant opportunities for Calix to provide innovative and efficient platforms.

Legal factors

Calix operates in a sector heavily shaped by telecommunications and broadband-specific legislation. Laws dictating network infrastructure build-out, service quality standards, and fair competition directly influence the strategies of Calix's Communications Service Provider (CSP) clients. For instance, the US Broadband Equity, Access, and Deployment (BEAD) program, part of the Infrastructure Investment and Jobs Act, allocated $42.5 billion in 2024 to expand broadband access, creating significant opportunities and compliance demands for CSPs and their technology partners like Calix.

Global data privacy laws such as GDPR and CCPA, along with evolving regional regulations, create substantial compliance challenges for Communications Service Providers (CSPs) and their technology collaborators. Calix must guarantee its cloud-based platforms and services enable CSPs to meet these mandates concerning the collection, storage, and utilization of subscriber data.

In 2024, the global data privacy market is projected to reach $3.4 billion, highlighting the increasing importance and complexity of compliance for companies like Calix. Failure to adhere to these stringent regulations can result in significant fines, with GDPR penalties potentially reaching 4% of annual global revenue or €20 million, whichever is higher.

Protecting Calix's proprietary software, hardware designs, and technological innovations through patents and other intellectual property rights is vital for maintaining its competitive advantage. For instance, in 2023, Calix reported significant investment in research and development, a portion of which is directly tied to securing and expanding its IP portfolio. Legal frameworks surrounding IP are critical for preventing infringement and fostering continued innovation in the telecommunications sector.

Antitrust and Competition Laws

Calix operates within a global landscape governed by stringent antitrust and competition laws. These regulations are designed to prevent monopolistic practices and ensure a level playing field for all market participants. For instance, the European Union's competition rules, enforced by the European Commission, scrutinize mergers and acquisitions that could significantly reduce competition. In 2024, the US Federal Trade Commission (FTC) continued its active enforcement, challenging several large technology mergers, signaling ongoing regulatory scrutiny of market consolidation.

Navigating these complex legal frameworks directly impacts Calix's strategic decisions regarding market entry, partnerships, and potential acquisitions. The company must ensure its business development strategies align with regulations in key markets like North America, Europe, and Asia. Failure to comply can result in substantial fines and divestitures, impacting financial performance and market access. For example, in 2023, a significant fine was levied against a major tech company for anticompetitive practices, highlighting the severe consequences of non-compliance.

- Regulatory Scrutiny: Calix must proactively assess its market practices against global antitrust regulations to avoid penalties.

- Merger & Acquisition Impact: Competition laws significantly influence Calix's inorganic growth strategies, requiring careful due diligence.

- Market Access: Compliance ensures continued access to key markets and prevents potential disruptions to business operations.

- Enforcement Trends: Staying abreast of enforcement actions by bodies like the FTC and European Commission is crucial for risk management.

Contractual Obligations and Service Level Agreements (SLAs)

Calix's reliance on contractual obligations and Service Level Agreements (SLAs) with Communications Service Providers (CSPs) underscores the critical legal framework supporting its operations. These agreements are legally binding, dictating performance standards, reliability benchmarks, and crucial support structures that directly impact Calix's revenue and customer satisfaction. For instance, in 2024, the telecommunications industry saw increased scrutiny on SLA compliance, with penalties for non-performance becoming more stringent, impacting providers like Calix who guarantee uptime and service quality.

Ensuring that these contractual terms are meticulously drafted, unambiguous, and compliant with evolving telecommunications regulations is paramount. This proactive legal approach helps Calix effectively manage customer expectations and significantly mitigates potential legal disputes or financial penalties. A key aspect for Calix in 2025 will be adapting to new data privacy regulations that may influence the data sharing clauses within these SLAs.

- Legal Enforceability: Contracts with CSPs are legally binding, ensuring Calix's service commitments are upheld.

- SLA Detail: Agreements specify performance, reliability, and support, crucial for maintaining customer trust.

- Risk Mitigation: Clear, compliant terms reduce legal exposure and manage customer expectations effectively.

- Regulatory Adaptation: Staying abreast of evolving telecom and data privacy laws is vital for contract validity in 2024-2025.

Calix's operations are significantly influenced by government funding and regulatory policies aimed at expanding broadband access. Initiatives like the 2024 BEAD program, allocating $42.5 billion, create both opportunities and compliance burdens for Calix and its clients. Furthermore, evolving data privacy laws, such as GDPR and CCPA, necessitate robust data protection measures on Calix's cloud platforms, with the global data privacy market projected to reach $3.4 billion in 2024, underscoring compliance importance.

Intellectual property law is critical for Calix's competitive edge, protecting its innovations through patents. The company's 2023 R&D investments are closely tied to expanding this IP portfolio. Antitrust and competition laws, actively enforced by bodies like the FTC in 2024, also shape Calix's market strategies, particularly concerning mergers and acquisitions to prevent anticompetitive practices.

Contractual agreements and Service Level Agreements (SLAs) are fundamental to Calix's business relationships with Communications Service Providers. These legally binding documents, which faced increased scrutiny in 2024 for performance and reliability, require meticulous drafting to align with evolving telecom and data privacy regulations, ensuring risk mitigation and customer satisfaction.

Environmental factors

Growing environmental awareness is placing significant pressure on telecommunications companies and data centers to reduce their energy usage. This trend presents a direct opportunity for Calix to provide innovative, energy-efficient solutions and platforms. By helping Communications Service Providers (CSPs) lower their carbon footprint, Calix can align with evolving sustainability mandates and customer expectations.

Stricter e-waste regulations, like the EU's Waste Electrical and Electronic Equipment (WEEE) Directive, are pushing companies like Calix to consider product end-of-life management. This means designing for durability and recyclability is no longer optional, impacting sourcing and manufacturing costs. For instance, the global e-waste generated reached 62 million tonnes in 2020 and is projected to hit 74 million tonnes by 2030, highlighting the scale of this challenge and the growing regulatory pressure.

Communication Service Providers (CSPs) are increasingly prioritizing ambitious Corporate Social Responsibility (CSR) and sustainability targets. A significant focus is on reducing their environmental footprint, with many aiming for net-zero emissions and promoting greener operational practices. For instance, AT&T announced in 2024 its commitment to achieving carbon neutrality in its Scope 1 and 2 emissions by 2035, building on its 2023 progress of reducing these emissions by 47% compared to a 2019 baseline.

This heightened emphasis on environmental stewardship directly translates into a growing demand for technology partners like Calix. CSPs are actively seeking solutions that not only enhance network performance but also contribute to their sustainability objectives. This includes a preference for products designed with energy efficiency in mind and companies that demonstrate sustainable business practices throughout their value chain, aligning with the evolving expectations of regulators, investors, and customers.

Impact of Climate Change on Network Resilience

Climate change is increasingly leading to more extreme weather events, such as hurricanes, floods, and wildfires. These events directly threaten the physical infrastructure that underpins telecommunications networks, potentially causing widespread outages. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters.

While Calix's core business is in software and cloud-based platforms for broadband service providers, its offerings play a role in enhancing network resilience against these environmental challenges. Their solutions can provide advanced network monitoring and management tools, allowing Communication Service Providers (CSPs) to detect and respond to disruptions more effectively. Furthermore, Calix's technology can support CSPs in the deployment of more resilient network architectures.

- Increased frequency of extreme weather events: NOAA data shows a significant rise in billion-dollar weather disasters annually.

- Infrastructure vulnerability: Physical network components are susceptible to damage from floods, high winds, and fires.

- Calix's indirect role: Software and cloud platforms enable better network management and support the deployment of more robust infrastructure.

- Resilience through technology: Calix's solutions can help CSPs mitigate the impact of climate-related disruptions.

Demand for Green Technology and Sustainable Innovations

The increasing global emphasis on environmental responsibility fuels a robust market demand for 'green' technology solutions designed to reduce ecological footprints. Calix is well-positioned to capitalize on this trend by developing and championing innovations that offer both superior performance and tangible environmental benefits, thereby aligning with worldwide sustainability objectives and the transition to a greener economy.

This growing demand translates into significant market opportunities. For instance, the global green technology and sustainability market was valued at approximately $11.5 billion in 2023 and is projected to grow substantially, with estimates suggesting a compound annual growth rate (CAGR) of over 20% in the coming years. Calix's commitment to developing sustainable solutions, such as its advanced materials for carbon capture and utilization, directly addresses this expanding market need. This focus allows the company to differentiate itself by offering products that not only meet performance benchmarks but also contribute positively to environmental goals.

- Growing Market for Green Tech: The global green technology and sustainability market is experiencing rapid expansion, driven by environmental concerns and regulatory pressures.

- Calix's Differentiation: Calix can leverage its expertise in developing high-performance, environmentally friendly solutions to capture market share.

- Alignment with Global Goals: By focusing on sustainability, Calix aligns with international efforts to combat climate change and promote a circular economy.

- Financial Impact: This strategic alignment is expected to drive revenue growth and enhance brand reputation in the increasingly conscious marketplace.

The increasing frequency of extreme weather events, such as those documented by NOAA with 28 billion-dollar disasters in the U.S. in 2023, poses a direct threat to the physical infrastructure of telecommunications networks. This vulnerability necessitates greater network resilience, a need that Calix's software and cloud platforms can help address through advanced monitoring and management capabilities.

Environmental regulations, like the EU's WEEE Directive, are pushing for better e-waste management, impacting product design and manufacturing for companies like Calix. With global e-waste projected to reach 74 million tonnes by 2030, the focus on durability and recyclability is becoming paramount for operational sustainability.

Communications Service Providers (CSPs) are actively pursuing ambitious sustainability targets, with companies like AT&T aiming for carbon neutrality by 2035, demonstrating a clear market demand for energy-efficient solutions. Calix can capitalize on this by providing platforms that help CSPs reduce their energy consumption and overall environmental footprint.

The global green technology and sustainability market, valued at approximately $11.5 billion in 2023 and growing at over 20% CAGR, presents a significant opportunity for Calix. By developing environmentally friendly innovations, Calix can align with global sustainability objectives and capture market share in this rapidly expanding sector.

| Environmental Factor | Impact on Telecom Infrastructure | Calix's Role/Opportunity | Relevant Data/Example |

| Extreme Weather Events | Damage to physical network components, leading to outages. | Enhance network resilience through monitoring and management software. | 28 billion-dollar weather disasters in the U.S. in 2023 (NOAA). |

| E-waste Regulations | Need for durable, recyclable product design; increased compliance costs. | Develop sustainable product lifecycle management solutions. | Global e-waste projected to reach 74 million tonnes by 2030. |

| Sustainability Mandates | Demand for energy-efficient operations and reduced carbon footprint. | Provide energy-saving platforms and solutions for CSPs. | AT&T's 2035 carbon neutrality goal. |

| Green Technology Demand | Growing market for eco-friendly solutions. | Innovate and champion high-performance, green technology. | Global green tech market valued at $11.5 billion in 2023, >20% CAGR. |

PESTLE Analysis Data Sources

Our Calix PESTLE Analysis is meticulously constructed using a blend of public and proprietary data, ensuring comprehensive coverage of the macro-environmental factors impacting the telecommunications industry. We integrate insights from government regulatory bodies, market research firms, economic databases, and technology trend reports to provide a robust and accurate assessment.