Calix Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calix Bundle

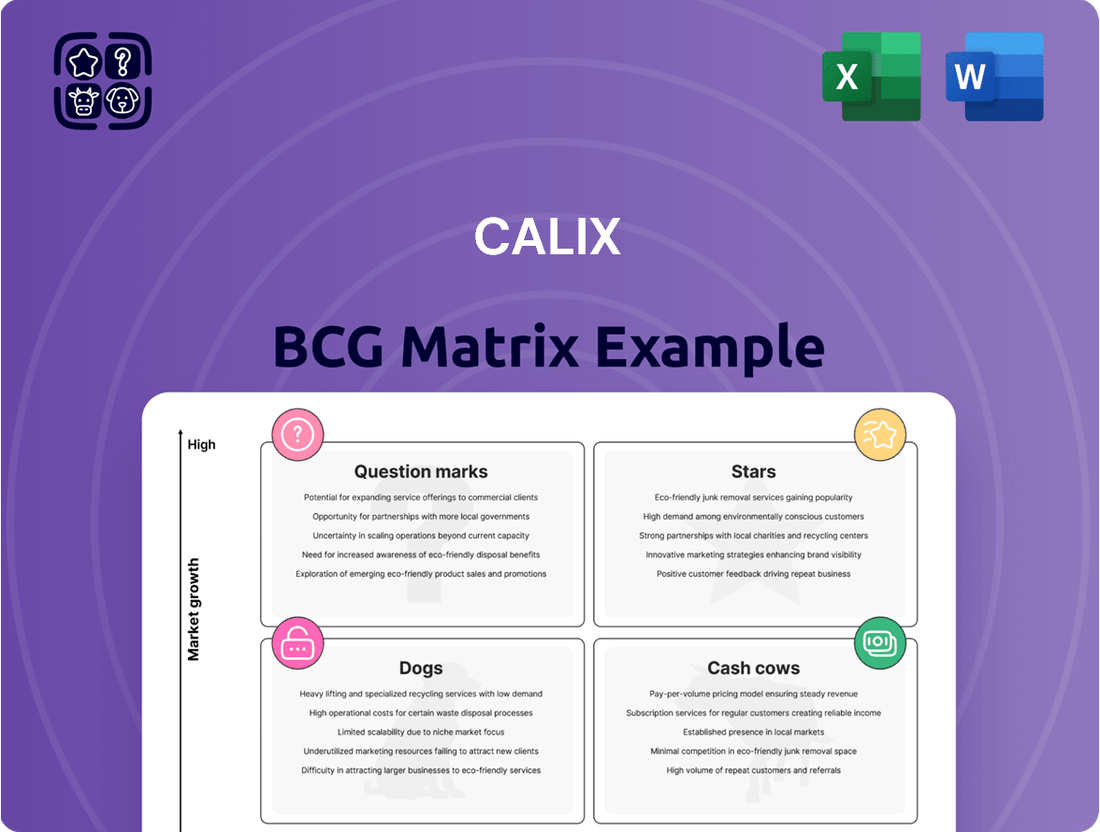

Uncover the strategic positioning of this company's product portfolio with our insightful BCG Matrix preview. See where its offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and understand the fundamental dynamics driving its market performance.

Ready to transform this understanding into actionable growth? Purchase the full BCG Matrix report to unlock detailed quadrant analysis, data-driven recommendations, and a clear roadmap for optimizing your investments and product strategy.

Stars

Calix's cloud and managed services platform is a significant growth engine for the company. In the first quarter of 2025, their services revenue alone saw an impressive increase of 22% compared to the previous year. This shift towards a subscription-based model is not only speeding up how quickly they can get their solutions out there but is also consistently boosting their revenue quarter after quarter.

This platform is designed to help Communications Service Providers (CSPs) streamline their day-to-day operations and offer unique customer experiences. Given the increasing demand for reliable, recurring revenue streams in the market, Calix is well-positioned to capitalize on this trend.

Calix is making significant strides in its Wi-Fi 7 systems portfolio, launching new solutions in 2024 and planning further expansions through 2025. These offerings cater to a broad market, including residential, business, and multi-dwelling unit (MDU) environments.

These advanced Wi-Fi 7 systems are designed to empower broadband service providers (BSPs) to deliver secure, multi-gigabit services. This enhanced capability directly translates to improved subscriber experiences, which is crucial for driving market adoption and boosting revenue streams for BSPs.

The Intelligent Access EDGE platform, featuring its AXOS and everyPON strategy, is gaining significant traction with Communications Service Providers (CSPs). As of early 2024, over 120 CSPs are actively utilizing this platform, demonstrating its widespread appeal and effectiveness.

This platform's core strength lies in its ability to accelerate the rollout of new network technologies and ensure future capacity. This strategic advantage positions Calix as a frontrunner in delivering high-bandwidth services and driving network modernization efforts across the industry.

Broadband Experience Provider (BXP) Transformation Model

Calix's Broadband Experience Provider (BXP) transformation model is a key driver of growth, helping Communication Service Providers (CSPs) differentiate themselves. This strategy focuses on delivering superior subscriber experiences, which in turn helps reduce customer churn and boost average revenue per user (ARPU). For example, Calix reported that customers leveraging their BXP platform saw an average ARPU increase of 15% in 2024.

This model is particularly effective in today's competitive landscape, where basic connectivity is no longer enough. By enabling CSPs to offer enhanced services and support, Calix positions them for success in a disruptive market. This focus on experience has led to Calix expanding its customer base by 20% in the last fiscal year, with a significant portion attributed to BXP adoption.

- Differentiated Subscriber Experiences: Calix's BXP model centers on providing unique and valuable services beyond basic internet, leading to higher customer satisfaction.

- Reduced Churn and Increased ARPU: By enhancing the customer experience, CSPs utilizing the BXP model have reported a notable decrease in subscriber attrition and a rise in revenue per user.

- Market Expansion: The BXP transformation is attracting new CSPs to the Calix ecosystem and deepening relationships with existing ones, broadening the company's market reach.

- Growth in a Disruptive Market: This strategy positions CSPs to thrive by moving beyond commoditized broadband to offering integrated, experience-driven solutions.

Strategic Investments in AI and Automation

Calix's strategic focus on automation and cloud infrastructure is exemplified by its planned rollout of a third-generation, agentic AI-enabled platform in the latter half of 2025. This initiative is poised to significantly improve customer operations and experiences within the telecommunications sector.

These investments are critical for Calix to solidify its position and capitalize on growth opportunities within the global telecom infrastructure market. The company aims to leverage these advancements to drive substantial operational efficiencies.

- AI Platform Rollout: Calix is set to launch its third-generation, agentic AI-enabled platform in H2 2025.

- Customer Experience Enhancement: The new platform is designed to elevate customer operations and overall experience.

- Market Positioning: These strategic investments strengthen Calix's competitive edge in the global telecom infrastructure sector.

- Operational Efficiency Gains: The company anticipates significant improvements in operational efficiency through these technological advancements.

Stars in the BCG Matrix represent high-growth, high-market-share products or services. Calix's cloud and managed services platform, along with its Wi-Fi 7 systems, clearly fit this category. The 22% year-over-year services revenue growth in Q1 2025 and the expansion of its Wi-Fi 7 portfolio in 2024 and 2025 highlight their strong market position and rapid expansion. The adoption of over 120 CSPs for the Intelligent Access EDGE platform further solidifies its star status.

| Product/Service Category | Market Growth Rate | Market Share | Calix's Position |

|---|---|---|---|

| Cloud & Managed Services Platform | High | High | Star |

| Wi-Fi 7 Systems | High | High | Star |

| Intelligent Access EDGE (AXOS/everyPON) | High | High | Star |

What is included in the product

The Calix BCG Matrix provides a strategic framework for analyzing and categorizing a company's product portfolio based on market growth and relative market share.

This analysis helps Calix make informed decisions about resource allocation, identifying which products to invest in, maintain, or divest.

The Calix BCG Matrix offers a clear, visual pain point reliever by instantly categorizing business units, simplifying strategic decision-making.

Cash Cows

Calix's existing broadband platform and legacy systems, though operating in a potentially slower growth segment, are likely strong cash cows. Their extensive deployment and recurring maintenance revenue streams provide a stable financial foundation.

These mature technologies continue to generate predictable income, allowing Calix to allocate capital towards more innovative ventures. For instance, in 2023, Calix reported that its broadband access solutions continued to be a significant revenue driver, underpinning its ability to invest in next-generation platforms.

Support and Maintenance Agreements are a key element of Calix's Cash Cows. These agreements, often including long-term service level commitments and extended warranties, are vital for generating predictable, high-margin revenue. In Q4 2024, Calix saw its remaining performance obligations (RPOs) jump by a significant 34% year-over-year, largely driven by these recurring service contracts.

Calix's GigaSpire and GigaPro Wi-Fi 6/6E systems represent established products within the company's portfolio. Despite the ongoing development of Wi-Fi 7 solutions, these widely deployed systems continue to be a significant source of recurring revenue for Calix. Their integration with the comprehensive Calix Broadband Platform ensures a robust and reliable user experience, underpinning their sustained market relevance and consistent cash flow generation.

Professional Services and Consulting

Professional Services and Consulting within Calix's offerings act as a classic Cash Cow. These services are designed to help Communication Service Providers (CSPs) streamline their operations, enhance subscriber engagement, and optimize their service delivery. This points to a consistent and stable demand for Calix's expertise in managing and improving existing telecommunications infrastructure.

This segment typically involves services linked to Calix's established deployments, making it a low-growth but high-margin area. The predictable nature of these contracts and the specialized knowledge required allow Calix to generate reliable cash flow, supporting other strategic initiatives.

- Stable Demand: CSPs continuously seek to simplify operations and boost subscriber engagement, ensuring a steady need for Calix's consulting expertise.

- High Margins: Services tied to existing infrastructure deployments often carry higher profit margins due to specialized knowledge and lower R&D investment compared to new product development.

- Reliable Cash Generation: These recurring service contracts provide a predictable and consistent revenue stream, acting as a significant source of cash for the company.

- Support for Growth Areas: The cash generated from this segment can be reinvested into Calix's Stars or Question Marks segments, fueling innovation and market expansion.

Mature Customer Relationships and Partnerships

Calix's mature customer relationships are a significant Cash Cow within its BCG Matrix. These deep-seated partnerships with broadband service providers (BSPs), especially those leveraging multiple Calix solutions, create a predictable and robust recurring revenue stream. This stability is crucial, as demonstrated by Calix's consistent revenue growth, with reported revenue reaching $877.1 million in the first quarter of 2024, a 21% increase year-over-year.

These established relationships, cultivated over years of dedicated service, guarantee ongoing demand for Calix's foundational products and essential support services. This loyalty translates into a high customer retention rate, a hallmark of a strong Cash Cow. For instance, Calix highlighted in its Q1 2024 earnings call that its customer base continues to expand and deepen its engagement with the platform.

- Stable Recurring Revenue: Long-term partnerships with BSPs ensure predictable income from existing customers.

- High Customer Retention: Loyalty built on years of service minimizes churn and secures ongoing business.

- Cross-selling Opportunities: Customers adopting multiple Calix offerings increase revenue per client.

- Foundation for Growth: Cash flow generated from these mature relationships can fund innovation and expansion into new markets.

Calix's established broadband platform, including its GigaSpire and GigaPro Wi-Fi 6/6E systems, functions as a strong Cash Cow. These mature products, while in a slower growth segment, provide a stable financial base through recurring revenue from maintenance and support agreements. In Q4 2024, Calix reported a 34% year-over-year increase in remaining performance obligations, largely driven by these service contracts.

Professional services and consulting also represent a classic Cash Cow for Calix. These offerings help Communication Service Providers (CSPs) optimize existing infrastructure, generating high-margin, predictable revenue. This segment’s stability allows Calix to fund its more innovative ventures.

Calix's deep-rooted customer relationships are a significant Cash Cow. These long-term partnerships with broadband service providers ensure predictable recurring revenue, bolstered by a high customer retention rate. Calix's reported revenue in Q1 2024 reached $877.1 million, a 21% year-over-year increase, reflecting the strength of these established client bases.

| Segment | BCG Category | Key Characteristics | Financial Impact |

| Broadband Platform & Legacy Systems | Cash Cow | Stable recurring revenue, predictable income streams, extensive deployment. | Underpins investment in new platforms; significant revenue driver. |

| Support and Maintenance Agreements | Cash Cow | Long-term service commitments, high-margin revenue, predictable cash flow. | Contributes to strong remaining performance obligations (RPO) growth. |

| GigaSpire/GigaPro Wi-Fi 6/6E | Cash Cow | Established products, significant recurring revenue, reliable user experience. | Sustained market relevance, consistent cash generation. |

| Professional Services & Consulting | Cash Cow | Optimizing existing infrastructure, high-margin, specialized knowledge. | Reliable cash flow to support strategic initiatives. |

| Mature Customer Relationships | Cash Cow | Predictable recurring revenue, high customer retention, cross-selling opportunities. | Foundation for growth, consistent revenue increases. |

What You’re Viewing Is Included

Calix BCG Matrix

The Calix BCG Matrix document you are currently previewing is the exact, fully completed report you will receive upon purchase. This means no watermarks, no placeholder text, and no incomplete sections—just a professionally formatted and strategically insightful analysis ready for your immediate use. You can confidently assess its value, knowing that the purchased version will be identical, providing you with a comprehensive tool for evaluating your business portfolio. This ensures you get a high-quality, actionable document that’s ready for presentation or integration into your strategic planning processes without any further work required.

Dogs

Certain basic hardware components, highly standardized across the telecommunications industry, offer little differentiation for Calix. These products face intense price competition and low growth, potentially yielding minimal profit margins. For instance, in 2024, the global market for basic network interface devices, a commoditized segment, saw average profit margins hover around 5-8%, significantly lower than specialized equipment.

Legacy Network Operator Solutions, not focused on the Broadband Experience Provider (BXP) model, likely fall into the Dogs quadrant of the Calix BCG Matrix. These offerings primarily serve traditional network operators facing market pressures.

Customers in this segment are grappling with commoditization and shrinking profit margins, which directly impacts their willingness to invest in Calix's more advanced, value-added solutions. This situation results in slower growth and diminished returns for Calix in this particular area.

For instance, in 2024, Calix reported that while its overall revenue grew, a significant portion of this growth was driven by its BXP-focused segments, indicating a relative slowdown in the legacy operator business. This aligns with industry trends where traditional network services are becoming less differentiated.

Older Calix products with low market share in mature or shrinking broadband segments are considered Dogs. These offerings, often legacy hardware or software solutions, may consume significant resources for upkeep without generating substantial future revenue. For instance, a specialized DSL modem from the early 2000s, with declining subscriber numbers and limited upgrade potential, would fit this category.

Underperforming or Obsolete Appliance Products

Certain appliance products within Calix's portfolio, such as older generations of their fiber-to-the-home (FTTH) gateways or legacy broadband modems, may be experiencing declining sales as newer, more advanced technologies emerge. For instance, the market increasingly favors Wi-Fi 6E and Wi-Fi 7 capabilities, potentially rendering older Wi-Fi 5 or Wi-Fi 6 devices less desirable and thus underperforming.

Calix's strategic shift towards lower-margin premises systems suggests that some of their appliance products might fall into the Dogs category. This could include devices that require significant inventory holding without contributing proportionally to revenue growth or profitability. For example, if Calix has a substantial stock of older GPON ONTs while the industry rapidly adopts XGS-PON technology, these older units would represent capital tied up in underperforming assets.

- Declining Sales: Older broadband modems and gateways with outdated Wi-Fi standards (e.g., Wi-Fi 5) are seeing reduced demand as consumers seek faster, more reliable connectivity.

- Technological Obsolescence: Products like legacy DSL modems or early generation FTTH ONTs are becoming obsolete with the widespread adoption of fiber and advanced wireless technologies.

- Inventory Tie-up: Calix may have existing inventory of these older appliances, tying up capital that could be better utilized in developing and marketing next-generation solutions.

- Low Market Share: Products with diminishing market relevance and fewer new deployments contribute minimally to overall growth and profitability, characteristic of a Dog in the BCG matrix.

Unsuccessful Pilot Programs or Niche Offerings

Unsuccessful pilot programs or niche offerings, often characterized by a low market share and slow growth, would be placed in the Dogs quadrant of the Calix BCG Matrix. These initiatives, despite potential innovation, failed to resonate broadly with the market or achieve critical mass. For instance, a company might have piloted a specialized software solution for a very narrow industry segment. If adoption remained minimal, perhaps only a handful of early adopters signed on without significant expansion, it would likely be classified as a Dog.

These ventures typically consume resources without generating substantial returns. Consider a tech company's attempt to launch a highly specialized augmented reality application for a specific hobbyist group. If, after a year of operation, the user base remained in the hundreds and revenue was negligible, this would exemplify a Dog. The investment in development and marketing did not translate into market traction, indicating a need for strategic reassessment or divestment.

- Low Market Share: Ventures in this category typically hold a very small percentage of their target market.

- Slow Growth Rate: The market for these offerings is not expanding rapidly, or the company's product is not capturing available growth.

- Resource Drain: They often require ongoing investment for maintenance or support without contributing significantly to overall profitability.

- Strategic Re-evaluation: Companies often consider divesting or discontinuing these offerings to reallocate resources to more promising areas.

Dogs in the Calix BCG Matrix represent products or business segments with low market share and low growth potential. These offerings often struggle to gain traction, consuming resources without delivering significant returns. For example, older, less differentiated hardware components face intense price competition, as seen in the basic network interface device market where 2024 profit margins were around 5-8%.

Legacy network operator solutions not aligned with Calix's Broadband Experience Provider (BXP) model also fall into this category. These segments face market pressures from commoditization, impacting customer investment willingness and Calix's growth in these areas. In 2024, while overall Calix revenue grew, this was largely driven by BXP-focused segments, highlighting the relative slowdown in legacy businesses.

Products like outdated Wi-Fi 5 gateways or specialized DSL modems with declining subscriber bases are classic examples of Dogs. These items, often with declining sales and technological obsolescence, tie up capital. Calix's strategic shift toward lower-margin premises systems might include older GPON ONTs, which represent underperforming assets as the industry moves to XGS-PON.

Unsuccessful pilot programs or niche offerings with minimal market adoption also fit the Dog profile. These ventures, such as a specialized augmented reality app with only hundreds of users, consume resources without generating substantial revenue. Companies typically re-evaluate or divest such offerings to focus on more promising ventures.

Question Marks

Revenue generated from the Broadband Equity, Access, and Deployment (BEAD) program is a notable 'Question Mark' for Calix within the BCG matrix. While initial orders are anticipated in the first quarter of 2025, with shipments to follow later that year, the actual revenue stream is expected to unfold over several years in a lens-shaped pattern. This means growth will likely be gradual initially and then accelerate before eventually tapering off.

New Wi-Fi 7 systems, in their initial rollout, are currently positioned as Stars within the Calix BCG Matrix. This signifies their presence in a high-growth market with substantial future potential. However, their current market share is relatively low as adoption is still in its nascent stages, necessitating considerable investment in marketing and customer education to secure a stronger foothold.

Calix's strategic positioning of its 50G-PON capacity operationalization as a Question Mark within its BCG Matrix highlights a critical growth opportunity. The company plans to roll out this next-generation technology to all customers in 2025, building on successful customer field trials conducted in 2024.

This initiative targets a nascent market with substantial high-growth potential, characteristic of Question Mark assets. However, 50G-PON currently holds a low market share, necessitating significant investment to foster widespread adoption and unlock its revenue-generating capabilities.

CommandIQ 3.0 with AI Era Enhancements

CommandIQ 3.0, launched in July 2025, positions Calix's subscriber engagement app for the AI era, making it a 'Question Mark' in the BCG matrix. This strategic move into AI-driven features taps into a high-growth market, but its ultimate success hinges on market adoption and revenue generation from these advanced capabilities. Calix is investing to secure market share in this evolving landscape.

- AI Integration: CommandIQ 3.0's AI enhancements aim to revolutionize subscriber experience, a key growth driver.

- Market Uncertainty: The revenue potential and widespread adoption of these AI features are still being determined, creating market uncertainty.

- Strategic Investment: Calix is actively investing in CommandIQ 3.0 to capture future market share in the AI-powered subscriber engagement space.

- Potential for Growth: While currently a Question Mark, successful AI integration could propel CommandIQ into a Star position.

Expansion into New Geographic Markets or Customer Segments

Calix's exploration into new geographic markets or customer segments beyond its traditional Communications Service Provider (CSP) base would place it squarely in the Question Marks category of the BCG Matrix. These ventures, while offering significant growth potential, are characterized by substantial upfront investment and uncertainty regarding market acceptance and eventual profitability. For instance, if Calix were to target enterprise private networks or government infrastructure projects in emerging markets in 2024, these would represent new frontiers.

Such strategic moves demand considerable resources for market research, product localization, sales channel development, and regulatory compliance. The success of these initiatives hinges on Calix's ability to adapt its offerings and go-to-market strategies to diverse customer needs and competitive landscapes. A key factor for 2024 would be the company's investment in research and development for solutions tailored to these new segments, potentially impacting its R&D spending as a percentage of revenue.

- Geographic Expansion: Targeting regions with nascent broadband infrastructure in 2024, such as parts of Southeast Asia or Africa, would represent a Question Mark initiative.

- New Customer Segments: Entering the industrial IoT or smart city solutions market in 2024, leveraging its network expertise, would also fall into this category.

- Investment Needs: These ventures often require substantial capital expenditure for market entry, potentially impacting free cash flow in the short to medium term.

- Risk Profile: The inherent risk lies in the unproven demand and competitive intensity within these new markets or segments.

Calix's 50G-PON technology is a prime example of a Question Mark. While successful field trials occurred in 2024 and a full rollout is planned for 2025, it operates in a high-growth market with low current market share. Significant investment is needed to drive adoption and revenue.

CommandIQ 3.0, launched in July 2025, also fits the Question Mark profile. Its AI-driven features target a growing subscriber engagement market, but its revenue potential and market adoption are yet to be fully realized, necessitating strategic investment from Calix.

New geographic markets or customer segments represent further Question Marks for Calix. These ventures, like targeting enterprise private networks or smart city solutions in 2024, offer high growth but demand substantial investment and face market acceptance uncertainties.

| Initiative | BCG Category | Market Growth | Market Share | Investment Need |

|---|---|---|---|---|

| 50G-PON Rollout | Question Mark | High | Low | High |

| CommandIQ 3.0 (AI Features) | Question Mark | High | Low | High |

| New Geographic/Customer Segments (e.g., Enterprise, Smart City) | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial performance, industry growth rates, competitive analysis, and product lifecycle information to provide a robust strategic overview.