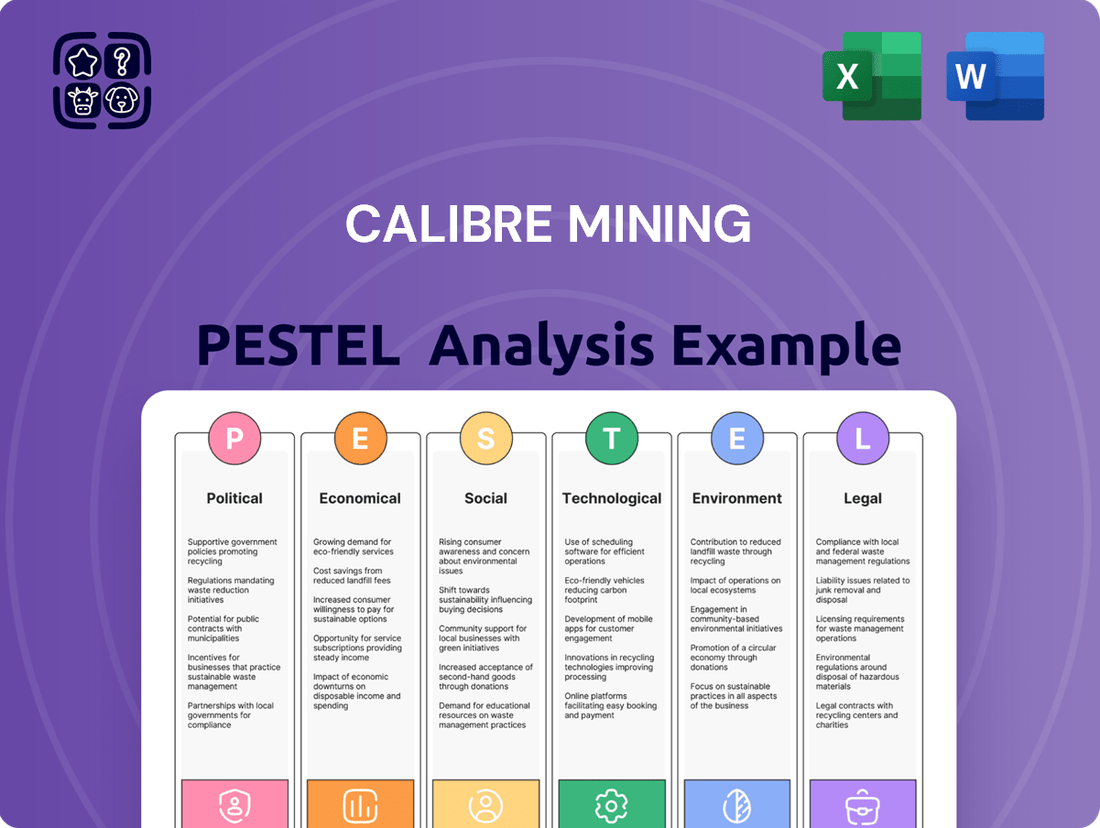

Calibre Mining PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calibre Mining Bundle

Unlock the critical external factors shaping Calibre Mining's journey with our comprehensive PESTLE analysis. From navigating evolving political landscapes to understanding economic volatilities and technological advancements, this report provides the vital context you need. Don't just react to market shifts; anticipate them. Download the full PESTLE analysis now to gain a strategic advantage and make informed decisions for your own business.

Political factors

Calibre Mining's operations in Nicaragua are deeply intertwined with the political landscape, particularly the stability and policies of the Ortega-Murillo government. This administration has actively promoted mining as a vital economic driver, evidenced by its consistent efforts to foster foreign investment through streamlined mining laws and regulations over the last three decades.

The government's pro-mining stance has created an environment generally favorable for expansion, but this comes with inherent risks. The authoritarian nature of the regime and its history of suppressing dissent introduce a layer of political uncertainty that can impact long-term operational planning and investor confidence.

U.S. sanctions targeting Nicaragua's gold sector, initiated in 2022 and impacting state-owned ENIMIENAS, create a significant political hurdle for Calibre Mining. Despite the intent to restrict access to U.S. financial systems, enforcement has proven difficult, with the U.S. still being Nicaragua's primary gold buyer in 2023, importing approximately $3.1 billion worth of gold from the country.

As a Canadian entity with U.S. operations and investors, Calibre Mining is exposed to these sanctions. However, the company has successfully secured new mining concessions, indicating a nuanced application of these restrictions and potentially highlighting opportunities for continued operation within the sector.

Nicaragua's deepening strategic alliance with China, particularly since 2021, is reshaping the foreign investment landscape in the mining sector. This shift could potentially offer new avenues for financing and trade, providing the Nicaraguan government with increased resilience against U.S. sanctions. Calibre Mining operates within this evolving geopolitical context, where new partnerships could influence the regulatory and operational environment.

Indigenous Rights and Government Repression

The Nicaraguan government's push for mining expansion has raised serious concerns about indigenous rights, with allegations of repression against those protesting these projects. Activists highlight that mining concessions frequently overlap with protected indigenous lands, and that required prior consultation processes are often bypassed or manipulated.

This political environment, where government security forces have been used to quell opposition, might reduce the immediate risk of protest-related operational disruptions for companies like Calibre Mining. However, it simultaneously introduces significant ethical considerations and potential reputational damage.

For instance, in 2024, reports indicated continued government efforts to facilitate mining operations, sometimes in areas with strong indigenous opposition. The government's stance often prioritizes economic development through resource extraction, potentially at the expense of established indigenous land rights and environmental protections.

- Indigenous Land Overlap: Mining concessions granted by the Nicaraguan government have been reported to overlap with territories designated for indigenous communities, raising legal and ethical questions.

- Consultation Process Issues: Claims persist that the mandatory prior consultation with indigenous communities before project approval is often superficial or disregarded entirely.

- Government Repression of Dissent: Security forces have been deployed to manage or suppress protests against mining activities, creating a tense political climate for both communities and operating companies.

Regulatory Enforcement and Corruption

Nicaragua's regulatory environment presents a nuanced challenge for Calibre Mining. While regulations exist, allegations suggest inconsistent enforcement, particularly concerning environmental standards like waste disposal and chemical storage in the mining sector. This laxity, though potentially reducing immediate operational hurdles, carries significant reputational risks for companies like Calibre, drawing scrutiny over their commitment to responsible mining practices.

Concerns about corruption within the Nicaraguan mining sector add another layer of complexity. Such issues can create an uneven playing field and raise questions about the integrity of permits and operational approvals. For Calibre Mining, navigating this landscape requires robust due diligence and a steadfast commitment to transparent and ethical operations to mitigate potential backlash and maintain stakeholder trust.

The potential for reputational damage is amplified by global investor expectations for Environmental, Social, and Governance (ESG) compliance. Reports from organizations like the Inter-American Commission on Human Rights have highlighted governance challenges in Latin America, underscoring the importance of proactive risk management. Calibre Mining's adherence to international best practices, even in a less stringently enforced domestic environment, is crucial for its long-term sustainability and market perception.

Calibre Mining's political landscape in Nicaragua is shaped by the government's strong support for mining, aiming to boost the economy. However, the authoritarian nature of the current administration and its human rights record create underlying instability and potential risks for foreign investors. The nation's growing ties with China, particularly since 2021, offer alternative financing avenues and could mitigate the impact of U.S. sanctions, which, despite attempts to restrict Nicaragua's gold sector, saw the U.S. remain the primary buyer in 2023, importing approximately $3.1 billion worth of gold.

| Factor | Description | Impact on Calibre Mining |

|---|---|---|

| Government Support for Mining | The Ortega-Murillo administration actively promotes mining as a key economic sector, offering favorable regulations and incentives to attract foreign investment. | Creates a generally supportive operating environment, facilitating access to concessions and resources. |

| Political Stability & Governance | The authoritarian regime's human rights record and suppression of dissent introduce political uncertainty and can affect long-term investor confidence. | Requires careful risk assessment and mitigation strategies to navigate potential instability and maintain a positive international reputation. |

| U.S. Sanctions & Enforcement | Sanctions targeting Nicaragua's gold sector, imposed in 2022, pose a challenge, though enforcement has been complex, with the U.S. still being a major gold buyer. | Exposes Calibre, as a Canadian company with U.S. investors, to indirect risks, necessitating vigilance regarding compliance and market access. |

| Geopolitical Alliances (China) | Nicaragua's deepening strategic alliance with China since 2021 could provide alternative financing and trade opportunities, potentially insulating the country from U.S. pressures. | May offer new avenues for capital and market diversification, influencing the regulatory and operational framework within which Calibre operates. |

What is included in the product

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal factors impacting Calibre Mining, providing a comprehensive overview of its operating landscape.

A concise PESTLE analysis for Calibre Mining, presented in a clear and simple language, serves as a pain point reliver by making complex external factors easily digestible for all stakeholders during planning sessions.

Economic factors

Calibre Mining's profitability is intrinsically linked to the global price of gold. Recent trends show a significant upward trajectory, with projections indicating continued strength through 2025, potentially seeing prices climb towards $3,000 per ounce. This economic environment offers a substantial advantage, bolstering the company's revenue streams and enabling increased investment in exploration activities.

This favorable gold price environment acts as a powerful economic tailwind for Calibre Mining. It directly supports the company's ability to generate revenue and underpins strategic decisions regarding exploration and development projects. Such conditions are crucial for sustaining growth and enhancing shareholder value in the mining sector.

However, it's important to acknowledge the inherent cyclicality of commodity markets. While current economic factors favor higher gold prices, future downturns are a possibility that could negatively affect Calibre Mining's financial performance and operational planning. Prudent financial management must account for these potential market shifts.

Nicaragua's economy has shown strong performance, with the mining sector playing an increasingly vital role. In 2023, mining contributed approximately 5% to the nation's Gross Domestic Product (GDP) and a significant 13% to its industrial GDP, highlighting its importance as a growth engine.

The sustained high international demand for minerals, particularly gold, is a major tailwind for Calibre Mining's operations in Nicaragua. This favorable market condition, coupled with the Nicaraguan government's strategic emphasis on mining as a primary export sector, creates a supportive economic landscape for the company's expansion and profitability.

While gold prices have been supportive, Calibre Mining continues to navigate the complexities of its total cash costs and all-in sustaining costs for gold production. These ongoing operational expenditures are key metrics for profitability.

Despite some easing in producer cost pressures, such as those related to fuel, labor, and steel, effective management of these expenses remains paramount. Controlling operational expenditures is vital for ensuring healthy profit margins in the current economic climate.

For instance, in the first quarter of 2024, Calibre Mining reported an all-in sustaining cost of $1,336 per ounce of gold, a slight increase from the previous year, highlighting the persistent need for cost efficiency. Maintaining this focus is essential for maximizing shareholder value.

Foreign Direct Investment and Access to Financing

Foreign direct investment (FDI) in Nicaragua saw a notable increase, reaching an estimated $2.5 billion in 2024, with a significant portion directed towards the mining sector. However, this inflow is intrinsically linked to global commodity prices and the willingness of international lenders to provide capital. The landscape of external financing is becoming more constrained, as international financial institutions have largely halted new lending to Nicaragua.

The impact of this shrinking external financing pool is projected to intensify, with most existing external funding expected to conclude by 2025. This trend directly influences the accessibility of capital for new ventures or the expansion of existing operations within the country.

Consequently, companies like Calibre Mining, which possess a robust cash reserve and the capacity for self-funding, are better positioned to navigate this challenging financial environment. Their ability to finance projects internally becomes a critical advantage.

- FDI in Nicaragua: Reached $2.5 billion in 2024, primarily in mining.

- Lending Landscape: International financial institutions have largely stopped new loans.

- Financing Wind-Down: Most external financing expected to cease by 2025.

- Calibre's Advantage: Strong cash position and self-funding capabilities are crucial.

Diversification and Project Development

Calibre Mining is actively diversifying its operational footprint, with a significant strategic move being the development of the Valentine Gold Mine in Newfoundland and Labrador, Canada. This project is slated for initial production in the second quarter of 2025.

This expansion is designed to transform Calibre into a multi-asset, diversified mid-tier gold producer. The aim is to mitigate risks associated with concentrating operations in a single geographic area, particularly in Nicaragua.

By developing a more balanced portfolio, Calibre anticipates improved economic stability and a stronger growth trajectory. This diversification will provide a crucial hedge against potential regional economic downturns or political instability that could impact its Nicaraguan assets.

- Valentine Gold Mine: Expected production start in Q2 2025, Canada.

- Strategic Goal: Transition to a multi-asset, diversified mid-tier gold producer.

- Risk Mitigation: Reduce reliance on Nicaragua operations.

- Economic Impact: Enhance stability and growth through diversification.

The economic outlook for gold remains robust, with prices projected to potentially reach $3,000 per ounce by 2025, significantly benefiting Calibre Mining's revenue. Nicaragua's mining sector is a growing contributor to its GDP, accounting for 5% in 2023, underscoring the importance of this industry for the nation's economy.

Calibre Mining's all-in sustaining costs were $1,336 per ounce in Q1 2024, a slight increase year-over-year, emphasizing the ongoing need for cost management. The company's strategic diversification into Canada with the Valentine Gold Mine, set to begin production in Q2 2025, aims to enhance economic stability by reducing reliance on its Nicaraguan operations.

| Economic Factor | 2024/2025 Data/Projection | Impact on Calibre Mining |

|---|---|---|

| Gold Price | Projected to reach $3,000/oz by 2025 | Increased revenue potential, supports exploration investment |

| Nicaragua Mining GDP Contribution | 5% of national GDP (2023) | Highlights sector importance, potential for government support |

| Calibre's All-in Sustaining Costs | $1,336/oz (Q1 2024) | Requires continued focus on operational efficiency for profitability |

| Valentine Gold Mine Production Start | Q2 2025 | Diversification benefit, reduced geographic risk |

Preview Before You Purchase

Calibre Mining PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Calibre Mining covers all key political, economic, social, technological, legal, and environmental factors impacting the company. Gain immediate access to this detailed report to inform your strategic decisions.

Sociological factors

Calibre Mining prioritizes robust community engagement, viewing a social license to operate as fundamental to its success. The company actively fosters partnerships with Indigenous communities in Nicaragua, for instance, recognizing that local support is paramount for sustainable mining operations. This commitment is demonstrated through investments in local infrastructure and social programs, aiming to ensure that the benefits of mining extend to the communities themselves.

The expansion of mining concessions in Nicaragua, particularly those encroaching on indigenous territories, presents critical human rights concerns, including potential displacement and increased violence. Reports from 2023 and early 2024 highlight a disturbing trend of escalating conflict, with indigenous leaders facing threats and a lack of meaningful engagement from mining companies regarding their land rights.

While Calibre Mining reported in its 2023 sustainability disclosures that it had assessed 100% of its Nicaraguan operations for human rights impacts, the broader landscape of mining in Nicaragua continues to be scrutinized. The Nicaraguan government's policies have been criticized for prioritizing resource extraction over the protection of indigenous communal lands, creating a challenging environment for upholding human rights in line with international standards.

Calibre Mining significantly bolsters local economies through direct employment, with a notable emphasis on hiring nationals and individuals from surrounding communities. For instance, in 2023, Calibre Mining reported that over 90% of its workforce across its Nicaraguan operations were local hires, directly injecting wages into these areas.

Municipalities hosting industrial mining operations often see tangible improvements in socio-economic indicators. Research indicates that areas with active mining can experience reduced multi-dimensional poverty rates by as much as 15% compared to non-mining regions, alongside a substantial increase in per capita tax revenues, which can be reinvested into local infrastructure and services.

The economic value generated extends beyond wages, encompassing local procurement. Calibre Mining's commitment to sourcing goods and services locally in 2023 amounted to $45 million, further stimulating regional businesses and creating a multiplier effect within the local economy.

Health and Safety Standards

Calibre Mining places paramount importance on the health and safety of its employees, recognizing it as a core social responsibility. This commitment is demonstrated through its operational performance, with the company reporting zero fatalities in recent periods.

Furthermore, Calibre Mining has achieved a substantial reduction in its Lost Time Injury Frequency Rate (LTIFR). For instance, in 2023, the company reported an LTIFR of 0.70 per 200,000 hours worked, a notable improvement from previous years.

Maintaining these stringent safety standards is not only crucial for the well-being of its workforce but also directly impacts operational continuity. High safety performance bolsters employee morale, reduces disruptions, and is vital for preserving Calibre Mining's reputation within the industry and among stakeholders.

- Zero Fatalities: Calibre Mining has maintained a zero-fatality record, underscoring its dedication to workplace safety.

- Reduced LTIFR: The company achieved a Lost Time Injury Frequency Rate of 0.70 in 2023, showcasing a significant improvement in safety performance.

- Operational Continuity: Adherence to high safety standards ensures uninterrupted operations and minimizes risks.

- Reputation Management: Strong safety records are essential for building and maintaining trust with employees, communities, and investors.

Grievance Mechanisms and Stakeholder Relations

Calibre Mining prioritizes effective grievance resolution and transparent stakeholder engagement to foster positive community relations. The company reported a significant success rate in resolving community grievances, with a focus on enhancing response times. This commitment to addressing community concerns is fundamental to mitigating social conflicts and ensuring operational continuity.

In 2023, Calibre Mining actively engaged with local communities, holding numerous meetings and consultations. Their efforts to streamline grievance reporting and resolution mechanisms are ongoing, aiming to improve efficiency and stakeholder satisfaction. These proactive measures are essential for building trust and maintaining a stable operating environment.

- Community Engagement: Calibre Mining's commitment to open dialogue with local communities is a cornerstone of their social license to operate.

- Grievance Resolution: The company has demonstrated a strong track record in addressing and resolving community grievances, aiming for prompt and effective solutions.

- Operational Stability: Robust grievance mechanisms are crucial for preventing disruptions and ensuring the long-term sustainability of mining operations.

- Response Times: Calibre Mining is actively working to reduce response times for community concerns, enhancing transparency and accountability.

Calibre Mining's social license to operate is deeply intertwined with its community engagement, particularly with Indigenous groups in Nicaragua. The company's focus on local hiring, with over 90% of its Nicaraguan workforce being local hires in 2023, directly injects wages into regional economies. This commitment extends to local procurement, where Calibre spent $45 million on local goods and services in 2023, further stimulating regional businesses and creating a multiplier effect.

The company prioritizes employee health and safety, evidenced by zero fatalities and a significant reduction in its Lost Time Injury Frequency Rate (LTIFR) to 0.70 per 200,000 hours worked in 2023. These safety standards are crucial for operational continuity and maintaining a positive reputation among stakeholders.

Calibre Mining also emphasizes effective grievance resolution, actively engaging with communities through numerous meetings and consultations in 2023. Their ongoing efforts to streamline grievance reporting and resolution mechanisms are vital for building trust and ensuring stable operations.

| Sociological Factor | Calibre Mining's Approach/Impact | Key Data (2023/Early 2024) |

|---|---|---|

| Community Relations & Social License | Prioritizes partnerships with Indigenous communities, viewing local support as fundamental. | Investments in local infrastructure and social programs. |

| Local Employment & Economic Impact | Focuses on hiring nationals and individuals from surrounding communities. | Over 90% of Nicaraguan workforce were local hires. |

| Local Procurement | Commitment to sourcing goods and services locally. | $45 million spent on local procurement. |

| Health & Safety | Core social responsibility with stringent standards. | Zero fatalities reported; LTIFR of 0.70 per 200,000 hours worked. |

| Grievance Resolution | Effective mechanisms for transparent stakeholder engagement. | Streamlining reporting and resolution to improve efficiency and satisfaction. |

Technological factors

Technological advancements, particularly in artificial intelligence and machine learning, are revolutionizing mineral exploration. These tools allow for more accurate mapping and resource estimation, significantly speeding up the process and lowering costs. For instance, AI can analyze vast geological datasets to identify promising exploration targets with greater precision.

Calibre Mining is leveraging these innovations by reinvesting heavily in exploration. The company has outlined ambitious drilling programs for its properties in Newfoundland, Nevada, and Nicaragua. These initiatives are designed to not only uncover new mineral deposits but also to expand the known resources at their existing sites, aiming for enhanced discovery rates.

The mining sector is rapidly embracing automation, with technologies like autonomous haul trucks and robotic drilling becoming more prevalent. These advancements significantly boost safety by keeping personnel out of dangerous zones and enhance productivity through consistent, high-quality operations. Calibre Mining can capitalize on these trends to streamline its extraction methods, aiming for greater operational efficiency.

Innovations like sensor-based sorting and selective mining are revolutionizing ore extraction. These technologies allow for the precise identification and separation of valuable minerals, significantly boosting recovery rates. For instance, advancements in gravity separation techniques are enabling companies to process lower-grade ores more economically.

The adoption of these precision methods is crucial for enhancing resource efficiency and reducing the environmental footprint of mining operations. By minimizing waste rock and energy consumption, Calibre Mining can achieve greater operational sustainability. In 2023, the global mining industry saw increased investment in automation and digital technologies, with a focus on improving yield and reducing costs, a trend expected to continue through 2025.

Digital Transformation and Data Analytics

The mining industry is undergoing a significant digital transformation, with companies like Calibre Mining increasingly leveraging advanced technologies. This includes the integration of satellite imaging for exploration and monitoring, sophisticated data analytics for operational optimization, and the widespread use of connected devices, often referred to as the Internet of Things (IoT), to gather real-time operational data. For instance, by Q1 2024, many mining operations reported a noticeable uptick in efficiency gains through the implementation of digital twins and predictive maintenance algorithms, reducing downtime by as much as 15% year-over-year.

Artificial intelligence (AI) and machine learning are at the forefront of this digital shift, enabling mining operations to become more autonomous and efficient. AI-powered systems can continuously analyze vast datasets to fine-tune extraction processes, predict equipment failures before they occur, and enhance safety protocols by identifying potential hazards in real-time. Calibre's strategic investments in digital solutions are aimed at capitalizing on these advancements, with a focus on improving resource recovery rates and reducing operational costs.

- Real-time Monitoring: Deployment of IoT sensors across mining sites allows for continuous tracking of equipment performance, environmental conditions, and worker safety, providing immediate insights for proactive management.

- Predictive Maintenance: AI algorithms analyze sensor data to forecast equipment failures, enabling scheduled maintenance that minimizes costly unplanned downtime, a key factor in operational continuity.

- Process Optimization: Advanced analytics help in optimizing drilling, blasting, and hauling operations, leading to improved resource utilization and increased throughput.

- Enhanced Safety: Digital tools, including AI-driven hazard detection and remote monitoring, contribute to a safer working environment by mitigating risks associated with mining operations.

Sustainable Mining Technologies

Technological advancements are increasingly vital for achieving sustainability in the mining sector. Innovations like in-situ leaching and biomining offer lower-impact extraction methods, while sophisticated water management systems are enabling significant water recycling, with some operations achieving over 90% water recovery.

Calibre Mining can bolster its commitment to responsible mining by integrating green chemistry principles and water-efficient technologies. This strategic adoption aims to substantially reduce its environmental impact, aligning with global trends towards eco-conscious resource extraction.

Key technological areas for enhancing sustainability include:

- Advancements in tailings management: Technologies reducing water content and improving stability, such as filtered dry stacking.

- Electrification of mining fleets: Transitioning to electric vehicles and equipment to cut greenhouse gas emissions and noise pollution.

- Digitalization and AI: Utilizing data analytics and artificial intelligence for optimized resource utilization and predictive maintenance, thereby minimizing waste and energy consumption.

Technological advancements are reshaping mining, with AI and automation driving efficiency and safety. Calibre Mining is investing in exploration technologies, aiming to boost discovery rates and optimize operations. The company can further leverage automation, predictive maintenance, and advanced sorting techniques to improve resource recovery and reduce environmental impact, aligning with industry trends toward digital transformation and sustainability.

The mining sector's digital transformation is accelerating, with significant investments in AI, IoT, and data analytics expected to continue through 2025. These technologies are enhancing real-time monitoring, predictive maintenance, and process optimization, leading to tangible efficiency gains. For instance, by Q1 2024, many mining operations reported up to a 15% reduction in downtime due to these digital solutions.

Sustainability is also a key driver of technological adoption in mining. Innovations in tailings management, fleet electrification, and resource-efficient extraction methods are crucial for reducing environmental footprints. Calibre Mining's strategic integration of these green technologies can enhance its commitment to responsible resource extraction.

| Technology Area | Impact on Mining | Calibre Mining Relevance | Industry Trend (2024-2025) |

|---|---|---|---|

| AI & Machine Learning | Enhanced exploration, predictive maintenance, process optimization | Improving resource recovery, reducing operational costs | Continued growth in AI adoption for efficiency |

| Automation & Robotics | Increased safety, higher productivity, reduced labor costs | Streamlining extraction methods, enhancing operational efficiency | Growing deployment of autonomous haul trucks and drilling |

| Digitalization (IoT, Data Analytics) | Real-time monitoring, improved decision-making, operational visibility | Leveraging data for exploration and operational insights | Focus on digital twins and predictive analytics |

| Green Technologies | Reduced environmental impact, water conservation, lower emissions | Bolstering commitment to responsible mining practices | Increased investment in electrification and water recycling |

Legal factors

Calibre Mining operates within Nicaragua's legal framework for mining, a system that has historically offered incentives, such as tax exemptions, to draw in foreign investment. This legal structure is key to how the company functions and plans for the future.

Despite the complexities of international sanctions impacting the region, Calibre Mining has successfully secured additional mining concessions in Nicaragua. This expansion highlights the company's ability to navigate the national legal processes for acquiring and maintaining these crucial operating rights.

The company's ongoing success is intrinsically linked to its deep understanding and adept management of Nicaragua's specific mining laws and concession acquisition procedures. These legal elements are foundational to Calibre Mining's operational continuity and strategic growth within the country.

Calibre Mining must meticulously adhere to international sanctions, particularly those impacting Nicaragua's gold sector. These U.S. sanctions theoretically limit access to American financial services, creating a complex legal landscape for companies operating within the country.

Despite these restrictions, the United States continues to be a significant importer of Nicaraguan gold, underscoring the intricate nature of compliance. For Calibre, maintaining operations necessitates robust legal strategies and thorough due diligence to ensure full adherence to evolving international regulations.

Calibre Mining must navigate Nicaragua's environmental regulations, which, despite past criticisms regarding enforcement, mandate federal environmental assessment approvals for projects like the Berry Pit at Valentine. This requires diligent compliance to secure necessary permits and maintain operational legality.

Failure to adhere to these environmental laws can lead to significant legal repercussions and jeopardize Calibre's social license to operate, impacting its ability to conduct business effectively in the region.

Labor Laws and Workforce Regulations

Calibre Mining must strictly adhere to Nicaragua's labor laws, covering everything from hiring practices and wage standards to workplace safety and employee benefits. This legal framework dictates the terms of employment and is crucial for maintaining operational legitimacy. For instance, Nicaraguan labor law mandates specific notice periods for termination and outlines minimum wage requirements, which can fluctuate annually based on economic conditions.

The company's commitment to employing a high percentage of its workforce from Nicaragua and local communities directly engages these labor statutes. In 2023, Calibre Mining reported that approximately 95% of its workforce was Nicaraguan, underscoring its reliance on and adherence to national employment regulations.

Failure to comply with these labor laws can result in significant legal repercussions. These may include financial penalties, back-pay claims, and potential operational disruptions due to labor disputes or government sanctions. Such non-compliance also poses a substantial risk to Calibre Mining's reputation, impacting its social license to operate and investor confidence.

- Adherence to Nicaraguan Labor Statutes: Calibre Mining's operations are governed by national labor laws concerning employment contracts, wages, working hours, and workplace safety.

- High National Workforce Percentage: In 2023, Calibre Mining maintained a workforce composition of approximately 95% Nicaraguan nationals, demonstrating a deep integration with and reliance on local labor regulations.

- Risk of Non-Compliance: Violations of labor laws can lead to legal disputes, government penalties, and significant reputational damage, impacting stakeholder relations and operational continuity.

- Impact on Social License: Demonstrating consistent compliance with labor laws is vital for maintaining Calibre Mining's social license to operate and fostering positive relationships with local communities and employees.

Corporate Governance and Transparency Standards

Calibre Mining, as a company listed on the Toronto Stock Exchange, must adhere to stringent international corporate governance and transparency standards. This includes the regular filing of comprehensive annual reports and submitting to rigorous international audits, ensuring accountability to stakeholders. For instance, in its 2023 annual filings, Calibre highlighted its commitment to these principles.

The company's legal framework is further reinforced by its adherence to its Code of Business Conduct, which mandates compliance with anti-corruption legislation such as Canada's Corruption of Foreign Public Officials Act (CFPOA). This commitment is vital for maintaining its operational licenses and fostering trust with investors and regulatory bodies.

Furthermore, Calibre's alignment with the World Gold Council's Responsible Gold Mining Principles demonstrates its dedication to ethical and sustainable practices. This conformance is not merely a matter of reputation but a critical legal and operational requirement, particularly in jurisdictions with evolving ESG (Environmental, Social, and Governance) regulations.

- Compliance with CFPOA: Calibre's commitment to anti-corruption laws like Canada's CFPOA is a cornerstone of its legal standing.

- International Audits: As a Canadian-listed entity, the company undergoes regular international audits to ensure financial transparency.

- Responsible Gold Mining Principles: Conformance with these principles underscores adherence to international ethical and operational standards.

- Annual Reporting: Timely and accurate filing of annual reports is a legal obligation and a key indicator of corporate governance.

Calibre Mining's operations are deeply intertwined with Nicaragua's legal framework, which includes specific mining laws and concession acquisition processes. The company's ability to secure new concessions demonstrates its proficiency in navigating these national legal requirements. Furthermore, adherence to international sanctions, particularly those impacting Nicaragua's gold sector, is critical for Calibre's continued operations and access to financial services.

Environmental regulations in Nicaragua mandate federal environmental assessment approvals for projects, requiring Calibre to maintain diligent compliance to avoid legal repercussions and preserve its social license to operate. Similarly, strict adherence to Nicaraguan labor laws, covering wages, safety, and hiring practices, is essential, as evidenced by Calibre's 2023 workforce composition of approximately 95% Nicaraguan nationals. Non-compliance in labor matters can lead to penalties, disputes, and reputational damage.

As a Toronto Stock Exchange-listed company, Calibre must also comply with international corporate governance and transparency standards, including rigorous audits and timely annual reporting. Its commitment to anti-corruption legislation, such as Canada's Corruption of Foreign Public Officials Act (CFPOA), and alignment with the World Gold Council's Responsible Gold Mining Principles, further solidifies its legal and ethical standing.

Environmental factors

Mining operations inherently require substantial land use, potentially leading to deforestation, a significant concern in Nicaragua where Calibre Mining operates. The rapid expansion of mining concessions in the region raises questions about the thoroughness of environmental impact assessments and the protection of sensitive ecosystems.

Calibre Mining has publicly committed to reforestation and carbon sequestration initiatives within Nicaragua. These efforts are designed to counteract the environmental footprint associated with their mining activities, demonstrating a focus on mitigating land use impacts.

Mining is a thirsty business, and Calibre Mining, like others in Nicaragua, faces significant challenges in managing its water use and preventing pollution. The industry's reliance on water for various processes, coupled with the risk of contamination from waste disposal and chemical storage, makes robust water management crucial. Recent reports from the Nicaraguan mining sector have highlighted incidents of chemical leaks, underscoring the potential environmental impact.

Fortunately, advancements in mining technology are offering solutions. Modern operations are increasingly adopting sophisticated water recycling systems, which significantly reduce overall water consumption and mitigate environmental risks. For Calibre, implementing these advanced recycling technologies is key to minimizing its ecological footprint and ensuring responsible operations.

Calibre's commitment to sustainability hinges on developing and executing comprehensive water management strategies. This proactive approach is essential not only for regulatory compliance but also for maintaining social license to operate and safeguarding the delicate ecosystems in its operating regions. The company's 2024 sustainability report, for instance, details investments in water treatment facilities aimed at reducing effluent discharge quality.

The mining industry, including Calibre Mining, faces substantial environmental hurdles with the generation of waste rock and tailings. For example, in 2023, the global mining sector produced billions of tonnes of waste, highlighting the scale of this issue. Innovations are emerging, such as transforming tailings into construction materials and developing technologies to extract valuable critical minerals from these byproducts, offering potential avenues for resource recovery and waste reduction.

Calibre Mining's operational strategy must prioritize minimizing waste output and implementing robust, environmentally responsible methods for the disposal or recycling of all mining byproducts. This focus is crucial for regulatory compliance and maintaining social license to operate, especially as environmental scrutiny intensifies. Sustainable waste management practices are becoming a key differentiator for mining companies seeking long-term viability.

Energy Consumption and Carbon Footprint

Mining is inherently energy-hungry, with a historical reliance on fossil fuels that significantly impacts greenhouse gas emissions. However, the sector is actively shifting gears, increasingly incorporating renewable energy like solar, wind, and hydro. Electrifying mining equipment is also a key strategy for lowering carbon footprints.

Calibre Mining is demonstrating this shift through tangible actions. Their inaugural Climate Report, released in 2024, details their commitment to emission reduction. For instance, they reported a 10% reduction in Scope 1 and 2 greenhouse gas emissions intensity in 2023 compared to 2022, a move that aligns them with broader global sustainability objectives.

- Energy Intensity: Mining operations are among the most energy-intensive industrial activities globally.

- Renewable Integration: Companies like Calibre are investing in solar power projects at their mines, aiming to supplement traditional energy sources.

- Emission Reduction Goals: Calibre has set targets to reduce its overall carbon footprint by 25% by 2030, building on their 2023 progress.

- Electrification Trends: The industry-wide push towards electric haul trucks and excavators is expected to further decrease reliance on diesel fuel.

Biodiversity Protection and Environmental Stewardship

Protecting biodiversity and ecosystems is increasingly critical in sustainable mining operations, particularly with concerns surrounding mining expansion near Nicaragua's protected areas and indigenous lands. Calibre Mining demonstrates its commitment to environmental stewardship through initiatives like growing trees for reforestation efforts and its Artisanal and Small-Scale Miners (ASM) Ore Purchase Program, which aims to curb mercury usage.

These proactive measures are vital for minimizing ecological disruption. For instance, in 2023, Calibre reported planting over 10,000 trees as part of its reforestation programs, contributing to habitat restoration and carbon sequestration.

- Biodiversity Focus: Growing scrutiny on mining's impact on sensitive ecosystems, especially in Nicaragua.

- Reforestation Efforts: Calibre actively engages in tree planting, with over 10,000 trees planted in 2023.

- Mercury Reduction: The ASM Ore Purchase Program is designed to prevent mercury contamination.

- Ecological Minimization: Implementing strategies to reduce the environmental footprint of mining activities is paramount.

Calibre Mining's operations in Nicaragua are significantly influenced by environmental regulations and the growing global demand for sustainable practices. The company's approach to land use, water management, waste disposal, and energy consumption directly impacts its social license to operate and its long-term viability. Increased focus on biodiversity protection and emission reduction is reshaping industry standards.

The company's 2024 sustainability report highlights investments in advanced water treatment facilities, aiming to reduce effluent discharge quality and comply with stricter environmental standards. Furthermore, Calibre's commitment to reforestation, evidenced by planting over 10,000 trees in 2023, demonstrates a proactive stance on mitigating its land use impact and contributing to carbon sequestration efforts.

Calibre's 2024 Climate Report detailed a 10% reduction in Scope 1 and 2 greenhouse gas emissions intensity in 2023, a key metric in the industry's transition towards lower-carbon operations. These efforts are crucial as environmental, social, and governance (ESG) factors become increasingly important for investor confidence and regulatory compliance.

| Environmental Factor | Calibre Mining's Action/Impact | Relevant Data (2023-2024) |

| Land Use & Deforestation | Reforestation initiatives, managing land concessions | Planted over 10,000 trees in 2023 |

| Water Management | Water recycling, treatment facilities | Investments in water treatment facilities detailed in 2024 report |

| Waste Management | Minimizing waste, exploring recycling | Global mining sector produced billions of tonnes of waste in 2023 |

| Energy Consumption & Emissions | Renewable energy integration, emission reduction targets | 10% reduction in Scope 1 & 2 GHG emissions intensity (2023 vs 2022) |

| Biodiversity Protection | Protecting ecosystems, reducing mercury usage | ASM Ore Purchase Program to curb mercury |

PESTLE Analysis Data Sources

Our Calibre Mining PESTLE Analysis is grounded in data from reputable sources including government regulatory bodies, international financial institutions, and leading mining industry publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors influencing the company's operations and strategic decisions.