Calibre Mining Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calibre Mining Bundle

Calibre Mining's marketing strategy is a masterclass in leveraging its product's value, competitive pricing, strategic placement of resources, and targeted promotion to solidify its market position.

Discover how Calibre Mining's product innovation, cost-effective pricing, efficient supply chain, and impactful communication campaigns create a winning formula.

Unlock the full potential of Calibre Mining's marketing mix by exploring its product development, pricing strategies, distribution networks, and promotional activities in detail.

Gain a comprehensive understanding of Calibre Mining's 4Ps – from its high-quality gold production to its strategic market access and investor relations – with our in-depth analysis.

Dive deeper into Calibre Mining's marketing success; our complete analysis provides actionable insights into their product, price, place, and promotion, empowering your own strategies.

Product

Calibre Mining's core product is gold, a tangible commodity extracted through its extensive exploration, development, and operational endeavors. This gold is the fundamental offering presented to the global market, forming the bedrock of the company's value proposition.

The company demonstrated robust performance in 2024, producing 242,487 ounces of gold. This figure not only met but surpassed its adjusted production guidance, underscoring its consistent ability to deliver on its primary product commitment.

Calibre Mining's product offering centers on the ongoing operation and development of its gold mines, providing tangible assets and a continuous stream of output for its stakeholders. This includes its established mines and processing facilities in Nicaragua, demonstrating consistent production.

The company's portfolio also features the Pan Mine in Nevada, USA, contributing to its operational footprint in North America. A key growth driver is the significant Valentine Gold Mine project in Newfoundland & Labrador, Canada, which is poised to become a major contributor to Calibre's production profile.

For the first quarter of 2024, Calibre Mining reported total gold production of 46,256 ounces, with the Valentine Gold Mine contributing 15,676 ounces during its initial ramp-up phase. This highlights the tangible output and development progress across its key operational assets.

Calibre Mining's product is fundamentally its significant mineral reserves and resources. As of December 31, 2023, the company boasted over 4.1 million ounces of proven and probable gold reserves. This substantial mineral endowment is the bedrock of its future production capacity and long-term value proposition.

Beyond reserves, Calibre also holds considerable measured and indicated mineral resources, further bolstering its asset base and future exploration potential. These resources represent ounces that are not yet classified as reserves but have a higher likelihood of conversion, reinforcing the company's growth outlook.

Exploration and Growth Opportunities

Calibre Mining’s exploration strategy is a cornerstone of its product development, focusing on identifying and expanding gold deposits. This proactive approach ensures a robust pipeline of future production, directly impacting its long-term product availability and market position.

A significant driver of this growth is the company's substantial investment in drilling. For instance, the ambitious 100,000-meter drill program at its Valentine project is designed to significantly boost resource estimates and uncover new mineralization. This commitment to exploration is crucial for maintaining a competitive edge and delivering sustained value to stakeholders.

- Valentine Project Drill Program: A 100,000-meter drill program is underway to expand resources and discover new gold deposits.

- Resource Expansion Focus: The company’s exploration efforts are geared towards increasing its proven and probable gold reserves.

- Sustained Gold Supply: Investment in exploration directly supports the long-term continuity and growth of Calibre’s primary product, gold.

Responsible Mining Practices

Calibre Mining's product extends beyond the physical gold to encompass its dedication to responsible mining, environmental care, and social accountability. The company actively promotes sustainable value creation for its shareholders, the communities where it operates, and all involved stakeholders, as evidenced in its yearly Sustainability Reports.

This strong emphasis on Environmental, Social, and Governance (ESG) factors significantly boosts the perceived value and ethical reputation of its gold offerings in today's discerning market. For instance, in 2023, Calibre reported a 15% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to its 2022 baseline, demonstrating tangible progress in its environmental stewardship.

- Environmental Stewardship Calibre Mining prioritizes minimizing its environmental footprint through initiatives like water management and biodiversity conservation.

- Social Responsibility The company invests in local communities through employment, education, and infrastructure development programs.

- Governance Excellence Strong corporate governance ensures transparency, ethical conduct, and accountability across all operations.

- ESG Reporting Calibre's commitment is transparently communicated through annual sustainability reports, detailing progress and future targets.

Calibre Mining's product is primarily gold, extracted from its mining operations. The company's 2024 production reached 242,487 ounces, exceeding guidance. Key assets include mines in Nicaragua and the developing Valentine Gold Mine in Canada, which produced 15,676 ounces in Q1 2024.

| Asset | Location | 2024 Production (ounces) | Resource (Moz) |

|---|---|---|---|

| Nicaragua Operations | Nicaragua | 226,811 | N/A (Reserves part of consolidated total) |

| Valentine Gold Mine | Newfoundland & Labrador, Canada | 15,676 (Q1 2024) | 3.4 (Proven & Probable as of Dec 31, 2023) |

| Pan Mine | Nevada, USA | N/A (Production data not separately specified for 2024 in provided context) | N/A (Reserves part of consolidated total) |

What is included in the product

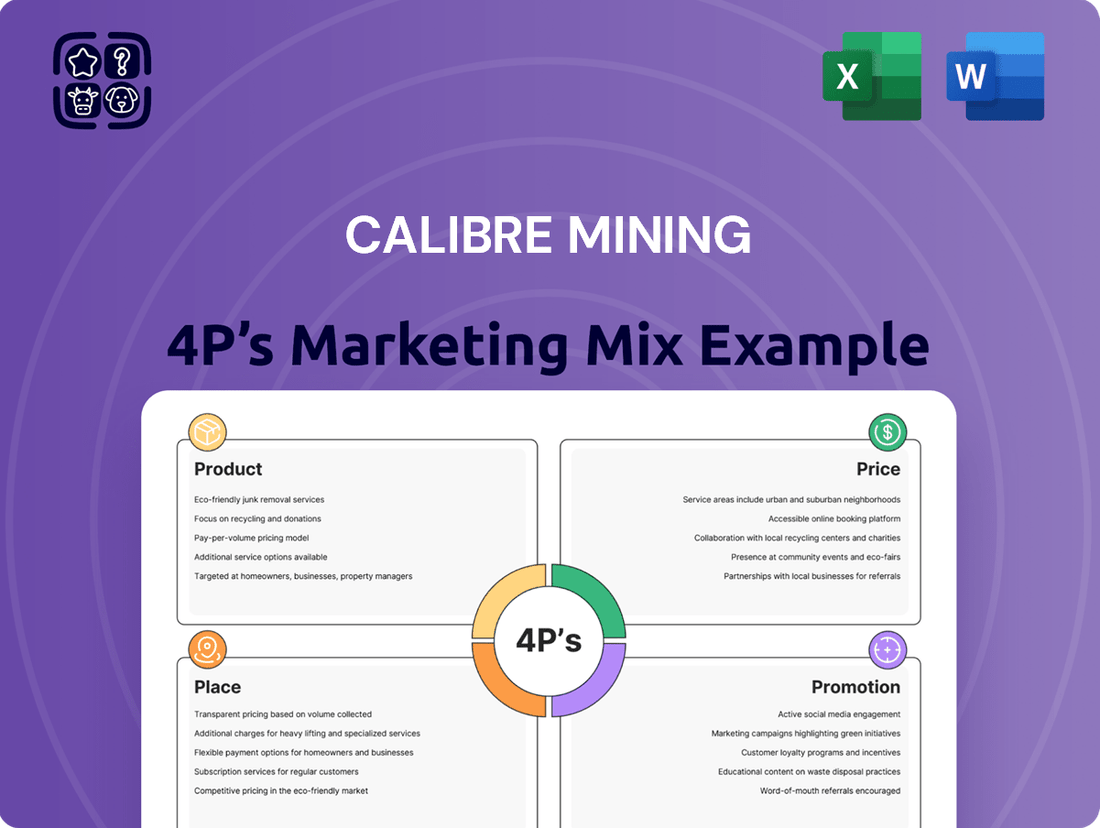

This analysis delves into Calibre Mining's marketing mix, examining their product offerings, pricing strategies, distribution channels, and promotional activities to understand their market positioning.

It offers a comprehensive overview of Calibre Mining's marketing approach, providing insights into how they compete in the mining sector.

Calibre Mining's 4Ps Marketing Mix Analysis provides a clear roadmap to address market challenges and optimize customer engagement.

This structured approach helps alleviate concerns about market penetration and brand positioning by clearly defining actionable strategies.

Place

Calibre Mining's primary operating region is Nicaragua, where it has established a strong foothold with multiple gold mines and processing facilities. This Central American nation serves as the cornerstone of the company's production strategy.

The company's commitment to Nicaragua is underscored by its significant production milestone, having achieved one million ounces of gold production in the country since the fourth quarter of 2019. This demonstrates a consistent and robust operational presence.

In 2023, Calibre Mining reported a total gold production of 225,128 ounces, with the vast majority originating from its Nicaraguan operations, highlighting the region's critical importance to its overall output and financial performance.

Calibre Mining's strategic North American expansion is a key element of its marketing mix. The company has established a significant presence with assets in Nevada, USA, and is actively developing the Valentine Gold Mine in Newfoundland & Labrador, Canada. This geographical diversification is designed to bolster operational stability and unlock future growth opportunities.

Calibre Mining's refined gold finds its place directly within the global commodity market, a straightforward sales channel. This direct-to-market approach means the company's financial performance is intimately linked to the fluctuating prices of gold on the international stage. For instance, in the first quarter of 2024, Calibre reported selling approximately 37,318 ounces of gold, with an average realized price of $2,057 per ounce, underscoring the direct impact of market prices on their revenue generation.

Distribution Channels for Gold

Gold, unlike typical consumer goods, flows through specialized channels. Calibre Mining, as a producer, primarily sells its output to gold refiners. These refiners then supply a global network of buyers, including central banks, institutional investors, and industrial consumers.

For Calibre Mining, their distribution strategy is about efficiently connecting their mined gold to these established downstream markets. The company's focus is on delivering high-quality doré bars, which are then processed further by specialized entities.

The global gold market is substantial, with demand driven by several key sectors. In 2024, central banks continued to be significant buyers, with net purchases by official sector institutions remaining robust. Institutional investors, through ETFs and futures markets, also represent a major outlet for newly mined gold. Industrial demand, while smaller, is consistent, particularly from the electronics and dentistry sectors.

- Refiners: The first step in the distribution chain after mining, where raw gold is purified.

- Central Banks: Major purchasers of gold for reserve asset diversification.

- Institutional Investors: Entities like pension funds and asset managers who invest in gold via various financial instruments.

- Industrial Users: Sectors like electronics and dentistry that utilize gold's unique properties.

Strategic Mergers and Portfolio Diversification

The strategic merger with Equinox Gold in early 2024 fundamentally reshaped Calibre Mining's 'place' in the market. This combination created a formidable Americas-focused gold producer, significantly enhancing its geographical diversification and operational scale. The new entity now boasts a robust portfolio of producing mines and development projects spanning five countries, offering a more resilient and geographically balanced operational footprint.

This consolidation is more than just an increase in assets; it represents a strategic repositioning to capture greater market share and operational efficiencies. The expanded presence across diverse mining jurisdictions provides Calibre with a wider array of opportunities and mitigates risks associated with single-country operations. This diversification is crucial for long-term stability and growth in the cyclical gold mining industry.

Key aspects of this strategic 'place' enhancement include:

- Expanded Geographic Footprint: Operations now extend across five countries, reducing reliance on any single jurisdiction.

- Diversified Asset Base: A broader mix of operating mines and development projects offers varied production profiles and growth potential.

- Enhanced Market Presence: The combined entity is positioned as a leading mid-tier gold producer in the Americas.

- Synergistic Opportunities: Potential for operational synergies and cost savings across the enlarged portfolio.

As of the first quarter of 2024, post-merger, Calibre Mining reported a combined production profile that solidifies its position in the industry. This strategic move directly addresses the 'place' element of the marketing mix by creating a more substantial and geographically diverse operational base, thereby increasing its appeal to investors and stakeholders seeking exposure to a well-positioned gold producer.

Calibre Mining's place in the market has been significantly amplified by its strategic merger with Equinox Gold in early 2024. This consolidation has created a more geographically diversified and operationally scaled gold producer across the Americas, now spanning five countries.

The expanded footprint reduces single-jurisdiction risk and enhances market presence, positioning the combined entity as a leading mid-tier gold producer. This strategic repositioning directly impacts Calibre's place by offering a more robust and appealing investment profile.

As of Q1 2024, post-merger, Calibre's consolidated production profile reinforces its strengthened position in the global gold market, making its place more significant for investors and stakeholders.

| Metric | Q1 2024 (Post-Merger) | Previous Year (Calibre Standalone) |

|---|---|---|

| Total Production (Ounces) | ~100,000+ (combined estimate) | 58,071 |

| Geographic Reach | 5 Countries | 2 Countries (Nicaragua, USA) |

| Market Position | Enhanced Mid-Tier Americas Producer | Emerging Producer in Americas |

What You Preview Is What You Download

Calibre Mining 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Calibre Mining 4P's Marketing Mix Analysis covers all essential elements, ensuring you get the complete picture immediately.

Promotion

Calibre Mining prioritizes strong investor relations, a key element in its marketing mix, to clearly convey its operational performance, strategic direction, and financial stability. This proactive communication aims to build trust and provide transparency for its diverse investor base, which includes individual investors and financial professionals.

The company actively engages with stakeholders through quarterly earnings calls, where management discusses financial results and operational updates, often referencing key production figures and cost metrics. For example, in Q1 2024, Calibre reported consolidated gold production of 66,978 ounces and a cash cost of $1,161 per ounce, demonstrating its operational efficiency.

Detailed financial reports, including annual and quarterly filings, are readily available, offering in-depth insights into the company's financial health, including revenue, profitability, and balance sheet strength. Investor presentations further distill this information, highlighting growth catalysts and future outlook, such as the projected increase in production at its Limón-Guadalupe complex.

Calibre Mining consistently utilizes news releases to keep stakeholders informed about significant achievements. For instance, their updates frequently highlight production figures and exploration breakthroughs.

Key corporate developments, such as the ongoing progress at the Valentine Gold Mine and the strategic Equinox Gold merger, are communicated through these releases. This proactive approach ensures market transparency and provides crucial data for investors.

In 2024, Calibre's strategic communications have been vital in detailing advancements like the significant progress at the Valentine Gold Mine, which is on track to commence production in early 2025, and the successful integration following the Equinox Gold merger.

Calibre Mining actively communicates its dedication to responsible operations through its annual Sustainability Reports and its first Climate Report released in 2024. These documents detail the company's progress in environmental protection, social engagement, and strong governance practices.

These reports are crucial for attracting investors who increasingly focus on Environmental, Social, and Governance (ESG) criteria. For instance, Calibre's 2023 Sustainability Report showcased a 15% reduction in water intensity compared to 2022, demonstrating tangible environmental improvements.

Strategic Growth Narrative

Calibre Mining's promotional strategy centers on its evolution into a diversified, mid-tier gold producer, highlighting a robust pipeline of development and exploration projects. This narrative underscores a commitment to consistent growth and operational efficiency, aiming to deliver significant value to shareholders.

The company's messaging emphasizes its strategic positioning for sustained expansion and its ability to unlock further shareholder value through its project portfolio. This focus on a clear growth trajectory and efficient production is designed to resonate with investors seeking reliable returns.

- Diversified Production: Calibre's operational base is expanding, with recent production figures demonstrating this growth. For instance, in Q1 2024, the company reported a significant increase in gold ounces produced, reflecting its successful operational management.

- Exploration Upside: The company actively promotes its exploration successes, showcasing the potential for future resource growth. Recent exploration results from its Nicaraguan operations have indicated promising new gold discoveries, adding to the company's long-term value proposition.

- Shareholder Value Focus: Calibre consistently communicates its strategy to maximize shareholder returns through efficient operations and strategic capital allocation. This is supported by its financial performance, with positive cash flow generation reported throughout 2024, enabling reinvestment in growth initiatives.

Online Presence and Media Engagement

Calibre Mining actively manages its online presence, using its corporate website as a central hub for operational updates and financial reporting. This digital strategy is crucial for disseminating information to a wide range of stakeholders.

Engagement with financial news platforms and media outlets further amplifies Calibre Mining's reach. By participating in these channels, the company ensures its narrative on performance and strategic initiatives is accessible to investors and the broader financial community.

For instance, as of the first quarter of 2024, Calibre Mining reported a robust production of 31,147 ounces of gold, a testament to their operational execution. This kind of data is readily available and highlighted through their media engagement efforts.

- Website as a Core Information Hub: Calibre Mining's corporate website serves as the primary source for detailed operational data, financial statements, and strategic updates, ensuring transparency and accessibility.

- Media Engagement for Broader Reach: Proactive engagement with financial news platforms and media outlets extends the company's message, reaching a wider audience of potential investors and industry observers.

- Q1 2024 Production Highlights: The company's first quarter 2024 results, including the production of 31,147 ounces of gold, are effectively communicated through these online and media channels to demonstrate operational performance.

- Information Accessibility: This multi-faceted approach to online presence and media engagement ensures that critical information regarding Calibre Mining's operations, financial health, and future direction is widely and easily accessible.

Calibre Mining's promotional efforts focus on showcasing its transformation into a diversified, mid-tier gold producer with a strong development and exploration pipeline. This narrative highlights consistent growth and operational efficiency to create shareholder value.

The company actively communicates its strategic positioning for sustained expansion and its potential to unlock further value through its project portfolio, emphasizing a clear growth trajectory and efficient production to attract investors seeking reliable returns.

Key promotional activities include investor relations, regular earnings calls, detailed financial reports, and proactive news releases highlighting production figures and exploration successes, such as the significant progress at the Valentine Gold Mine. Their online presence and media engagement further amplify these messages, ensuring broad accessibility of critical operational and financial data.

Calibre's commitment to responsible operations is also a key promotional pillar, evidenced by its annual Sustainability Reports and its first Climate Report in 2024, detailing progress in ESG criteria, such as a 15% reduction in water intensity in 2023.

| Metric | Q1 2024 | Q1 2023 | Change |

|---|---|---|---|

| Consolidated Gold Production (oz) | 66,978 | 54,788 | +22.3% |

| Cash Cost per Ounce ($) | 1,161 | 1,250 | -7.1% |

| Revenue ($ million) | 127.5 | 102.1 | +24.9% |

Price

Calibre Mining's pricing strategy for its gold output is intrinsically tied to the global market's fluctuating price for the precious metal. As a producer selling refined gold directly, its revenue stream is a direct reflection of these commodity price movements.

For instance, the average realized gold price for Calibre Mining in the first quarter of 2024 was $2,077 per ounce, demonstrating the direct correlation between its sales and market conditions. This means that significant price swings in the gold market, driven by factors like inflation, geopolitical events, and central bank policies, directly impact Calibre's top-line revenue and profitability.

While the global price of gold dictates revenue, Calibre Mining's strategic advantage lies in its rigorous cost management. The company prioritizes operational efficiency to maximize profitability on each ounce produced.

Calibre Mining consistently reports its Total Cash Costs (TCC) and All-In Sustaining Costs (AISC) per ounce. For instance, in the first quarter of 2024, Calibre reported TCC of $1,052 per ounce and AISC of $1,423 per ounce, showcasing a commitment to controlling expenditures and improving financial performance.

Calibre Mining's pricing strategy is fundamentally geared towards maximizing shareholder value. This is achieved by focusing on efficient production and robust financial performance, directly influenced by prevailing market gold prices. The company prioritizes disciplined capital allocation, strategically reinvesting in projects that promise accretive growth and enhanced returns for its investors.

Capital Investment and Financing

Capital investment and financing are critical components of Calibre Mining's 'price' strategy. This involves the substantial capital required for exploration activities, bringing new mines into production, and making strategic acquisitions to expand their portfolio. Calibre Mining demonstrates a strong financial footing by ensuring its key projects are fully funded, which is crucial for managing the significant expenditures inherent in the mining sector.

For instance, the company's commitment to fully funding its operations, including the development of the Valentine Gold Mine, highlights a disciplined approach to capital allocation. This ensures that operational continuity and growth are not hampered by funding shortfalls.

- Valentine Gold Mine: Calibre Mining has secured significant financing for this flagship project, aiming for production commencement in early 2025.

- Exploration Expenditures: In 2024, Calibre allocated approximately $25 million for exploration across its Nicaraguan and Canadian assets, demonstrating ongoing investment in future resource growth.

- Acquisition Strategy: The company has a history of strategic acquisitions, such as the purchase of the Eastern Borosi project, which are financed through a combination of cash, debt, and equity.

- Capital Allocation: Total capital expenditures for 2024 are projected to be around $150 million, covering development, sustaining capital, and exploration across all projects.

Financial Performance Metrics

Calibre Mining's financial performance, a key component of its pricing strategy, is best understood through its revenue generation and profitability. The company's ability to convert its gold production into tangible financial results directly impacts its market valuation and investor confidence.

For fiscal year 2024, Calibre Mining achieved significant financial milestones. The company reported $574.4 million in revenue derived from its gold sales, demonstrating a solid market demand for its product. This revenue figure is a direct reflection of its operational efficiency and the prevailing gold prices during the period.

Beyond top-line revenue, Calibre Mining also showcased strong operational cash flow generation. This metric is vital as it indicates the company's capacity to fund its operations, invest in growth, and potentially return value to shareholders without relying heavily on external financing. The positive cash flow underscores the financial health and sustainability of its mining operations.

- Revenue: $574.4 million in gold sales for FY 2024.

- Profitability: Strong operating cash flow generation, indicating efficient operations.

- Value Creation: Financial performance directly influences market perception and investment attractiveness.

Calibre Mining's pricing is fundamentally dictated by the global gold market, with its realized price directly mirroring commodity fluctuations. The company's strategy emphasizes cost control to maximize profit margins on each ounce sold, a critical factor given the inherent volatility of precious metal prices.

For instance, Calibre reported a Total Cash Cost of $1,052 per ounce and All-In Sustaining Costs of $1,423 per ounce in Q1 2024, highlighting their focus on efficient production. This operational discipline allows them to capitalize effectively on market price movements.

The company's financial performance, including $574.4 million in revenue for FY 2024, underscores its ability to translate production into tangible financial results, directly impacting investor confidence and valuation.

| Metric | Q1 2024 | FY 2024 |

|---|---|---|

| Average Realized Gold Price (per ounce) | $2,077 | N/A |

| Total Cash Costs (per ounce) | $1,052 | N/A |

| All-In Sustaining Costs (per ounce) | $1,423 | N/A |

| Revenue (Gold Sales) | N/A | $574.4 million |

4P's Marketing Mix Analysis Data Sources

Our Calibre Mining 4P's analysis leverages a robust blend of official company disclosures, including SEC filings, annual reports, and investor presentations. We also incorporate insights from industry reports and competitive analyses to provide a comprehensive view of their marketing strategies.