Calibre Mining Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calibre Mining Bundle

Calibre Mining navigates a competitive landscape shaped by the bargaining power of its suppliers and the intensity of rivalry within the gold mining sector. Understanding these forces is crucial for strategic planning.

The full analysis reveals the real forces shaping Calibre Mining’s industry—from supplier influence to the threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The mining sector, including companies like Calibre Mining, heavily depends on a limited number of specialized suppliers for critical equipment, technology, and skilled labor. Major manufacturers of heavy mining machinery, such as Caterpillar and Komatsu, along with providers of advanced geological and operational software, often function within oligopolistic market structures. This concentration of suppliers grants them considerable bargaining power, as mining firms have few alternative sources for these essential inputs, potentially driving up costs for Calibre.

Calibre Mining faces significant supplier power due to high switching costs for critical mining equipment and specialized services. The financial implications of changing suppliers can be substantial, encompassing the purchase of new machinery, extensive staff retraining, and the inevitable operational downtime that accompanies such transitions. This reality significantly curtails Calibre's ability to negotiate favorable terms, effectively bolstering the leverage of its existing suppliers.

Suppliers providing unique or specialized inputs, like proprietary mining chemicals or advanced exploration technology, hold significant bargaining power. If Calibre Mining relies heavily on these inputs for operational efficiency or to maintain its competitive edge, these suppliers can dictate higher prices. This leverage extends to both tangible goods and intellectual property.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, while generally low in the capital-intensive gold mining sector, could still influence bargaining power. If a supplier could realistically enter the gold mining business, their leverage would increase. This scenario is constrained by the substantial financial outlays and specialized knowledge needed for mining operations.

However, for specific niche services or critical processing components, this threat might be more plausible. For instance, a specialized chemical supplier for ore processing might consider integrating if the market conditions were favorable and the barriers to entry for that specific service were lower.

- Limited Feasibility: The immense capital required for gold extraction, often in the billions of dollars, makes forward integration by most suppliers impractical. For example, establishing a new gold mine can cost upwards of $500 million to $1 billion.

- Niche Opportunities: Suppliers of highly specialized equipment or proprietary processing technologies might possess a greater, albeit still limited, potential for forward integration into specific aspects of mining or refining.

- Supplier Dependence: If a mining company is heavily reliant on a single supplier for a critical input, and that supplier has the capacity and expertise, the supplier's bargaining power is enhanced, even without explicit forward integration.

Labor Union Strength and Availability of Skilled Labor

The bargaining power of labor as a supplier for Calibre Mining is influenced by the availability of skilled workers and the strength of labor unions. In regions like Nicaragua, where Calibre operates, a shortage of specialized mining talent can significantly empower labor. This scarcity means that skilled employees have more leverage in negotiating wages and working conditions, potentially driving up labor costs for the company.

While Nicaragua's labor market features a substantial informal sector, the availability of highly skilled mining professionals might be limited. This limited supply of specialized expertise further enhances the bargaining power of these workers. If unions are active and well-organized in Calibre's operating areas, they can collectively negotiate for better terms, adding another layer to supplier power.

- Skilled Labor Scarcity: Limited availability of specialized mining roles in operating regions increases labor's bargaining power.

- Union Influence: Strong labor unions can negotiate for higher wages and improved benefits, impacting Calibre's labor costs.

- Nicaragua's Labor Market: A significant informal sector contrasts with potentially scarce skilled mining labor, shifting power dynamics.

Calibre Mining faces considerable bargaining power from its suppliers, particularly for specialized mining equipment and proprietary technologies. The high cost and complexity of these inputs mean Calibre has limited alternatives, allowing suppliers to command higher prices and favorable terms. This dynamic is further amplified by the significant switching costs associated with changing suppliers, which can involve substantial capital investment and operational disruption.

| Supplier Type | Impact on Calibre Mining | Example Data (Illustrative) |

|---|---|---|

| Heavy Mining Equipment Manufacturers | High bargaining power due to limited competition and high capital costs for alternatives. | A new large-scale mining haul truck can cost upwards of $500,000 to $1 million. |

| Specialized Technology Providers (e.g., geological software) | Significant power when solutions are proprietary and critical for operational efficiency. | Annual licensing fees for advanced exploration software can range from tens of thousands to hundreds of thousands of dollars. |

| Skilled Labor | Moderate to high power, especially in regions with a deficit of specialized mining expertise. | In 2024, experienced mine engineers could command salaries exceeding $150,000 annually, plus benefits. |

What is included in the product

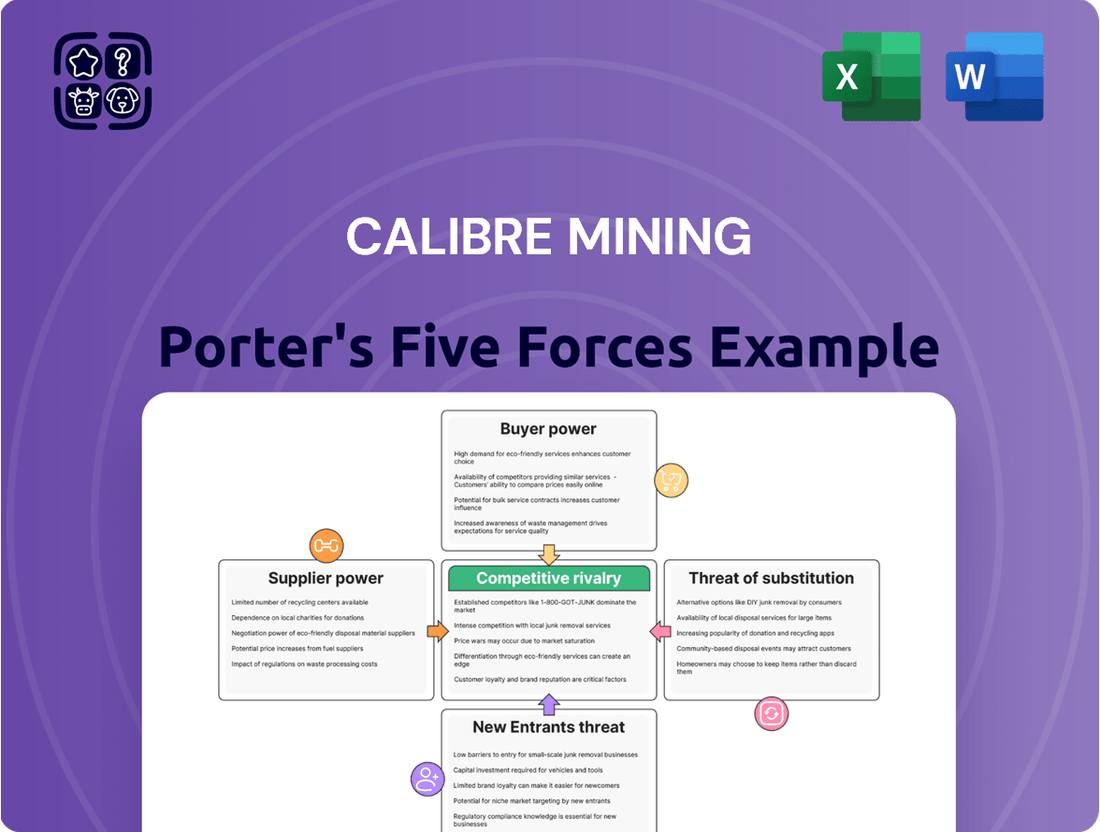

This analysis dissects Calibre Mining's competitive environment by examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the gold mining sector.

Calibre Mining's Porter's Five Forces analysis provides a clear, one-sheet summary of all five forces—perfect for quick decision-making regarding competitive pressures.

Customers Bargaining Power

Calibre Mining's primary product, gold, is a globally traded commodity, meaning its customers are diverse and widespread. This customer base includes central banks, large institutional investors, jewelry makers, and individual consumers, all purchasing gold on the open market.

The sheer number and variety of these buyers create a highly fragmented customer base for Calibre. This fragmentation significantly diminishes the bargaining power of any single customer or even a small group of customers, as they cannot collectively exert enough pressure to influence the price Calibre receives for its gold.

As a gold producer, Calibre Mining operates within a global commodity market, positioning it as a price taker. The prevailing market price for gold is dictated by broad international forces, including supply and demand dynamics, geopolitical stability, and overall economic sentiment, rather than by direct negotiations with individual buyers. For instance, in early 2024, gold prices fluctuated significantly, reaching highs of over $2,300 per ounce, a level determined by global economic outlook and central bank policies, not by Calibre's pricing power.

Customers have significant bargaining power due to low switching costs. Since gold is a homogenous commodity, buyers can easily move between Calibre Mining and other suppliers without incurring substantial costs or experiencing a difference in product quality. This ease of switching directly limits any individual customer's ability to negotiate better terms with Calibre Mining.

The value of gold to the end-user is not typically tied to its source. This means that a customer seeking to purchase gold is unlikely to prioritize one mine's output over another based on origin alone, further strengthening the customer's position. For instance, in 2024, global gold demand remained robust, with jewelry and investment sectors showing strong performance, indicating a competitive market where suppliers must cater to customer preferences and price sensitivity.

Customer's Price Sensitivity

Customer price sensitivity for gold, while present in jewelry and industrial sectors, is less impactful for investment-driven demand. For Calibre Mining, this means that while the retail price of gold jewelry can be influenced by consumer budgets, the demand from investors is more tied to global economic conditions and currency movements, rather than direct price negotiations with the company.

In 2023, the average gold price hovered around $1,977 per ounce, showing resilience despite some market volatility. This stability, driven by central bank buying and safe-haven demand, suggests that the investment segment of the market is less prone to immediate price-driven purchasing decisions compared to consumer goods.

- Investment Demand: Driven by macroeconomic factors like inflation, interest rates, and geopolitical stability, not direct price haggling with producers.

- Jewelry/Industrial Demand: More susceptible to price fluctuations, impacting consumer purchasing decisions and manufacturing costs.

- Gold Price Trends (2023): Averaged around $1,977/ounce, indicating a strong underlying demand that can absorb price variations.

- Calibre's Position: As a producer, Calibre benefits from overall market demand rather than negotiating prices with individual end-consumers.

Limited Threat of Backward Integration by Customers

The threat of customers backward integrating into gold mining is exceptionally low for Calibre Mining. This is primarily due to the substantial capital investment, sophisticated technical knowledge, and complex regulatory frameworks inherent in mining operations. For instance, establishing a new gold mine can cost hundreds of millions, if not billions, of dollars, a barrier most jewelry manufacturers or individual investors cannot overcome.

This lack of backward integration capability significantly diminishes the bargaining power of Calibre's customers. They are largely reliant on Calibre and other mining companies for their gold supply, making it difficult for them to dictate terms or exert undue pressure on pricing.

- High Capital Requirements: Developing a gold mine requires immense upfront investment, often exceeding $500 million for a medium-sized operation.

- Specialized Expertise: Gold mining demands highly specialized geological, engineering, and operational skills that are not readily available to downstream customers.

- Regulatory Hurdles: Navigating environmental permits, mining rights, and safety regulations is a significant undertaking, deterring potential entrants.

Calibre Mining's customers, ranging from central banks to jewelry makers, have limited bargaining power due to the highly fragmented nature of the global gold market. As a price taker, Calibre sells gold at prevailing market rates, influenced by macroeconomic factors rather than individual buyer negotiations.

The low switching costs for gold buyers, coupled with the commodity's homogenous nature, prevent customers from leveraging their position to secure better terms. Furthermore, the immense capital and technical expertise required for gold mining effectively eliminate the threat of backward integration by customers.

| Customer Type | Influence on Price | Switching Costs | Backward Integration Threat |

| Central Banks/Institutional Investors | Low (Market Driven) | Very Low | Extremely Low |

| Jewelry Manufacturers | Moderate (Price Sensitive) | Low | Extremely Low |

| Individual Consumers | Low (Retail Driven) | Low | Extremely Low |

Full Version Awaits

Calibre Mining Porter's Five Forces Analysis

This preview showcases the comprehensive Calibre Mining Porter's Five Forces Analysis, presenting the exact document you'll receive immediately after purchase. It details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the gold mining sector. You're looking at the actual document, ensuring no surprises, as you’ll get instant access to this fully formatted and ready-to-use analysis upon completing your purchase.

Rivalry Among Competitors

The gold mining landscape features a spectrum of companies, from giants like Newmont and Barrick Gold to a multitude of smaller, emerging miners. Calibre Mining, as a mid-tier producer, faces competition from these larger entities possessing significant financial muscle and broader operational footprints.

Following its merger with Equinox Gold, Calibre has ascended to become Canada's second-largest gold producer. However, this enhanced position still places it within a global arena where formidable competition persists from major international players.

The gold mining industry's growth is closely tied to the fluctuating price of gold and the success of new exploration efforts. While gold prices have shown robust increases, boosting company profits, the discovery of new, high-grade deposits isn't always consistent. For instance, in 2023, the average gold price hovered around $1,974 per ounce, a significant jump from previous years, which incentivizes production. However, a downturn in gold prices or a scarcity of new discoveries could heighten competition among mining firms for existing resources and market share.

Gold's nature as a commodity means that products from different mining companies are essentially the same, leading to fierce price competition. Buyers often make decisions based solely on the lowest price and immediate availability.

This lack of product differentiation makes companies like Calibre Mining highly susceptible to fluctuations in the global gold price. For instance, the average realized gold price for Calibre Mining in 2023 was $1,932 per ounce, a figure directly impacting their revenue and profitability.

High Exit Barriers

Calibre Mining operates in an industry characterized by high exit barriers, primarily due to the substantial investments required for mining operations. These include significant fixed costs associated with exploration, development, and infrastructure, alongside long development cycles that can span years before generating revenue. Furthermore, companies face considerable environmental rehabilitation obligations, which can be very costly to fulfill upon mine closure.

These high exit barriers mean that mining companies, including Calibre Mining, may continue to operate even when market conditions are unfavorable or commodity prices are low. The need to cover ongoing fixed costs incentivizes them to maintain production, which in turn can intensify competitive rivalry. This situation can lead to oversupply in the market, putting downward pressure on prices and affecting profitability for all players involved.

For instance, the capital expenditure for a new gold mine can range from hundreds of millions to over a billion dollars. In 2024, the average all-in sustaining cost for gold producers, a key metric reflecting operational efficiency, hovered around $1,300 per ounce. This means that even with gold prices fluctuating, companies must continue to produce to amortize these massive upfront costs, contributing to a persistently competitive landscape.

- Substantial Fixed Costs: Mining ventures demand significant upfront capital for equipment, infrastructure, and exploration, creating a high cost of entry and exit.

- Long Development Cycles: The time from discovery to production can take many years, locking in capital and making it difficult to pivot away from a project.

- Environmental Obligations: Companies are legally and ethically bound to rehabilitate mine sites, incurring substantial costs that must be factored into long-term planning and exit strategies.

- Continued Operation During Downturns: To recoup initial investments and cover fixed costs, firms may keep mines operational even in low-price environments, intensifying competition.

Strategic Objectives of Competitors

Competitors in the gold mining sector are driven by diverse strategic objectives, from aggressively maximizing production volumes to strategically acquiring new assets that bolster their portfolios. For instance, major players like Barrick Gold and Newmont Corporation are continuously evaluating opportunities for expansion and consolidation to achieve economies of scale and enhance operational efficiency. This pursuit of scale is evident in the significant M&A activity observed in recent years; for example, the proposed acquisition of Newcrest Mining by Newmont for approximately $19 billion, announced in early 2023, highlights a clear strategic imperative for consolidation.

The industry’s dynamic is further shaped by a strong emphasis on cost reduction, a critical factor in maintaining profitability, especially during periods of fluctuating commodity prices. Companies are investing in advanced technologies and optimizing their supply chains to lower their all-in sustaining costs. In 2023, the average all-in sustaining cost for gold producers hovered around $1,300 per ounce, making efficient operations a key differentiator.

- Maximizing Production: Many competitors aim to increase their annual gold output to capture greater market share and benefit from economies of scale.

- Asset Acquisition: A significant strategic objective involves acquiring promising exploration properties or existing mines to expand reserves and production capacity.

- Cost Optimization: Reducing operational expenses, including exploration, development, and production costs, is paramount for profitability and competitiveness.

- Industry Consolidation: The trend towards mergers and acquisitions reflects a strategic push for greater efficiency, financial strength, and market influence among leading firms.

Calibre Mining operates in a highly competitive gold mining sector where companies, regardless of size, vie for market share and profitability. The industry is characterized by a constant drive to increase production and acquire new assets, as seen with major players pursuing consolidation. For instance, the average all-in sustaining cost for gold producers in 2024 remained a critical benchmark, with many firms striving to keep it below $1,300 per ounce to maintain margins.

The lack of product differentiation in gold means that price is a primary competitive factor, making companies like Calibre Mining highly sensitive to market fluctuations. Companies are also intensely focused on cost optimization, investing in technology to lower operational expenses. This competitive pressure is amplified by high exit barriers, such as substantial fixed costs and environmental obligations, which compel firms to continue production even in challenging market conditions, potentially leading to oversupply.

| Competitor Strategy | Impact on Rivalry | Example (2023-2024 Data) |

|---|---|---|

| Maximizing Production & Asset Acquisition | Increases competitive intensity as firms seek scale and resource control. | Newmont's acquisition of Newcrest Mining (approx. $19 billion, announced early 2023) |

| Cost Optimization | Differentiates firms based on operational efficiency. | Average all-in sustaining costs for gold producers around $1,300/oz in 2023-2024 |

| Price Sensitivity (Commodity Nature) | Leads to direct price competition, impacting profitability. | Average gold price ~$1,974/oz in 2023; Calibre's realized price ~$1,932/oz in 2023 |

SSubstitutes Threaten

The threat of substitutes for Calibre Mining's gold production is significant, primarily stemming from other investment vehicles that also serve as stores of value. Gold's appeal as a safe-haven asset places it in direct competition with assets like U.S. Treasury bonds, which saw yields fluctuate throughout 2024, impacting their attractiveness relative to gold. For instance, the 10-year Treasury yield ranged from approximately 3.9% to over 4.7% during the year, influencing investor decisions.

Other precious metals, such as silver and platinum, also present a direct substitute threat. While gold often leads, shifts in industrial demand or speculative interest can make these metals more appealing. For example, platinum prices experienced volatility in 2024, influenced by automotive sector demand and supply concerns, creating a dynamic competitive landscape for investor capital.

Changing investor sentiment poses a significant threat of substitutes for Calibre Mining. If other asset classes, like technology stocks or real estate, begin offering more attractive perceived returns, investors might shift their capital away from gold. This reallocation of funds directly impacts the demand for gold, which in turn can affect Calibre Mining's revenue streams.

Gold's status as a safe-haven asset means its demand is closely tied to global economic uncertainty and overall market confidence. For instance, during periods of high economic stability and growth, investor appetite for riskier assets often increases, potentially drawing capital away from gold. In 2023, while gold prices showed resilience, the broader equity markets, particularly in tech, saw significant gains, illustrating this dynamic.

Technological advancements in sectors like electronics could theoretically reduce gold's demand if cheaper, more efficient alternatives emerge for its industrial applications. For instance, research into advanced conductive materials might lessen reliance on gold in certain high-tech components, though this remains a niche concern compared to gold's primary role as a store of value.

Emergence of Digital Currencies

The emergence of digital currencies and blockchain technology presents a potential long-term threat to traditional stores of value like gold. While still in its early stages, this technological shift could eventually offer alternative mediums of exchange and value preservation, impacting gold's established role. For instance, by early 2024, the total market capitalization of cryptocurrencies had surpassed $1.5 trillion, indicating significant, albeit volatile, growth in this sector.

However, it is crucial to note that this threat is currently nascent and faces substantial hurdles. Regulatory uncertainties and the need for widespread adoption remain significant barriers for digital currencies to truly substitute gold's long-standing position as a safe-haven asset. The volatility observed in the crypto market, with Bitcoin experiencing significant price swings throughout 2023 and into 2024, further highlights its current limitations as a stable alternative.

- Nascent Threat: Digital currencies are still developing, with significant regulatory and adoption challenges to overcome.

- Alternative Store of Value: Blockchain technology offers a potential, though unproven, alternative to gold's traditional role.

- Market Capitalization Growth: The cryptocurrency market cap exceeded $1.5 trillion by early 2024, indicating growing investor interest.

- Volatility and Stability Concerns: The inherent volatility of digital assets, as seen in 2023-2024 price movements, limits their current appeal as a stable store of value compared to gold.

Government Policies and Regulations

Government policies, such as changes in monetary policy, can significantly impact the appeal of gold as an investment relative to other options. For instance, interest rate hikes by central banks, like the US Federal Reserve, can make interest-bearing assets more attractive, potentially drawing capital away from gold. In 2024, many central banks continued to navigate inflation, with interest rate decisions playing a crucial role in global capital flows.

Regulations affecting investment vehicles for gold, such as ETFs or futures markets, can also alter its attractiveness. Stricter regulations or taxes on gold holdings could diminish its appeal. Conversely, policies that promote or protect gold as a safe-haven asset might bolster its position against substitutes. The regulatory landscape for precious metals is constantly evolving, influencing investor sentiment and capital allocation.

Policies that favor alternative asset classes, such as renewable energy investments or technology stocks, can divert significant capital away from traditional safe havens like gold. For example, government incentives for green technology in 2024 encouraged substantial investment in those sectors. This strategic redirection of funds means that gold faces a competitive threat from government-supported investment avenues.

- Monetary Policy Impact: Interest rate changes directly affect the opportunity cost of holding non-yielding assets like gold.

- Regulatory Environment: Rules governing gold trading and ownership can make it more or less accessible and appealing compared to other investments.

- Fiscal Incentives: Government support for specific industries can draw investment capital that might otherwise flow into gold.

- Geopolitical Stability: Policies aimed at fostering international trade and stability can reduce the demand for gold as a safe-haven asset.

The threat of substitutes for Calibre Mining's gold production is multifaceted, encompassing financial instruments and alternative commodities. Gold competes with other safe-haven assets like U.S. Treasury bonds, whose yields in 2024 fluctuated between approximately 3.9% and over 4.7%, influencing investor preference. Silver and platinum also pose a threat, with platinum prices experiencing volatility in 2024 due to automotive sector demand and supply issues.

Investor sentiment is a key driver, with shifts towards other asset classes like technology stocks or real estate potentially diverting capital from gold. For instance, while gold remained resilient, tech stocks saw significant gains in 2023, illustrating this dynamic. Furthermore, the burgeoning cryptocurrency market, with a total market capitalization exceeding $1.5 trillion by early 2024, presents a nascent but growing alternative store of value, despite its inherent volatility throughout 2023-2024.

| Substitute Asset | 2024 Yield/Performance Indicator | Key Influencing Factors |

|---|---|---|

| U.S. Treasury Bonds (10-year) | Approx. 3.9% - 4.7% | Monetary policy, inflation expectations |

| Silver | Price volatility | Industrial demand, speculative interest |

| Platinum | Price volatility | Automotive sector demand, supply constraints |

| Technology Stocks | Strong performance in 2023 | Innovation, economic growth outlook |

| Cryptocurrencies (e.g., Bitcoin) | Market Cap > $1.5 trillion (early 2024) | Regulatory developments, adoption rates, volatility |

Entrants Threaten

The gold mining industry presents a formidable barrier to new entrants due to exceptionally high capital requirements. Establishing a new gold mine, from initial exploration and feasibility studies to mine construction and processing plant setup, can easily run into hundreds of millions, if not billions, of dollars. For instance, the development phase for a large-scale gold mine often requires upfront investment exceeding $500 million, a sum that deters many potential competitors.

Calibre Mining's own operational scale underscores this challenge. The company's flagship Valentine Gold Mine in Newfoundland and Labrador, Canada, is projected to involve significant capital expenditure, with initial construction and development costs estimated in the hundreds of millions of dollars. This substantial financial commitment for even a single project demonstrates the sheer scale of investment needed to compete effectively, serving as a powerful deterrent for smaller or less capitalized entities looking to enter the market.

The mining sector is notoriously complex, demanding extensive environmental permits, social licenses to operate, and rigorous safety compliance. For instance, in 2024, obtaining a new mining permit in many jurisdictions can take several years and involve multiple government agencies, significantly increasing upfront costs and timelines for potential new entrants.

Navigating these intricate regulatory frameworks, particularly in regions like Nicaragua where Calibre Mining operates, acts as a substantial barrier. The sheer effort and expense involved in securing approvals for exploration, development, and operation deter many smaller or less capitalized companies from entering the market.

New companies entering the gold mining sector face significant hurdles in securing access to proven and probable mineral reserves. These valuable assets are typically controlled by established players with long histories of exploration and acquisition. For instance, as of the first quarter of 2024, Calibre Mining reported a substantial increase in its gold reserves, underscoring the difficulty for newcomers to gain comparable footing.

Furthermore, the specialized expertise required for efficient gold exploration, extraction, and processing is a considerable barrier. This knowledge is cultivated over years of hands-on experience and technological development, making it difficult for new entrants to match the operational capabilities of incumbent firms. Calibre Mining's ongoing success in Nicaragua, demonstrated by its consistent resource expansion efforts throughout 2023 and into 2024, highlights the deep operational know-how that new competitors would need to replicate.

Economies of Scale and Cost Advantages of Incumbents

Established mining companies like Calibre Mining inherently possess significant economies of scale, which translate into substantial cost advantages. These advantages stem from their ability to spread fixed costs over larger production volumes, negotiate better prices for raw materials and equipment due to bulk purchasing, and leverage optimized infrastructure and logistical networks. For instance, in 2023, Calibre Mining reported a total gold production of 216,766 ounces, a volume that allows for more efficient operational management compared to a smaller, nascent operation.

New entrants into the mining sector would likely face considerably higher per-unit costs, especially in the initial phases of development. Without achieving comparable scales of operation, they would struggle to match the procurement power and operational efficiencies enjoyed by incumbents. This cost disparity makes it challenging for newcomers to compete effectively on price, a critical factor in the commodity-driven gold market.

Calibre Mining has consistently demonstrated a strong focus on cost discipline, a strategy that further solidifies its competitive position against potential new entrants. This commitment to efficiency ensures that their cost of production remains competitive, creating a formidable barrier for any new player looking to gain market share. For example, Calibre’s all-in sustaining costs (AISCs) have remained a key performance indicator, with 2023 AISCs reported at $1,313 per ounce, showcasing their ability to manage expenses effectively within the industry.

- Economies of Scale: Calibre benefits from lower per-unit costs due to large-scale production, procurement, and infrastructure.

- Cost Advantages: Bulk purchasing power and optimized logistics give Calibre an edge over smaller operations.

- New Entrant Challenges: Start-up mining ventures face higher initial costs until they can achieve similar operational scales.

- Calibre's Cost Discipline: Focus on efficient operations, as evidenced by competitive AISCs, strengthens its market position.

Geopolitical and Country-Specific Risks

Operating in jurisdictions like Nicaragua presents significant geopolitical and country-specific risks. These can include unpredictable shifts in government policies, the potential for social unrest, and the ever-present threat of resource nationalism. Such factors can act as a substantial deterrent for potential new entrants who often seek more stable and predictable mining environments.

For instance, changes in mining regulations or tax regimes, which can occur with political transitions, directly impact the profitability and operational feasibility for any company, new or established. In 2023, Nicaragua's Ease of Doing Business ranking, while not directly a mining-specific indicator, still reflects the broader regulatory landscape that new entrants must navigate.

- Geopolitical Instability: Nicaragua has experienced periods of political instability, which can lead to policy uncertainty and affect foreign investment.

- Regulatory Environment: Changes in mining laws, environmental regulations, or taxation policies can significantly alter the cost structure and risk profile for new entrants.

- Social License to Operate: Gaining and maintaining community support is crucial, and social unrest or opposition can create significant hurdles for new projects.

- Resource Nationalism: Governments may implement policies aimed at increasing state control or benefits from natural resources, potentially impacting the profitability of new ventures.

The threat of new entrants in the gold mining sector, impacting Calibre Mining, is generally low due to substantial barriers. High capital requirements, estimated at over $500 million for large-scale projects, deter many. For example, the development of Calibre's Valentine Gold Mine involves hundreds of millions in upfront investment.

Complex regulatory landscapes, including lengthy permit processes that can take years in 2024, add significant costs and time delays. Additionally, securing access to proven mineral reserves is difficult, as these are often held by established players like Calibre, which reported increased reserves in Q1 2024.

Economies of scale provide established companies with cost advantages. Calibre's 2023 production of 216,766 ounces allows for greater efficiency compared to newcomers. Their cost discipline, with 2023 AISCs at $1,313 per ounce, further solidifies their competitive edge against potential entrants who face higher initial per-unit costs.

Porter's Five Forces Analysis Data Sources

Our Calibre Mining Porter's Five Forces analysis is built upon a foundation of verified data, including the company's annual reports, SEC filings, and industry-specific market research reports. We also incorporate insights from financial analyst reports and macroeconomic data to provide a comprehensive understanding of the competitive landscape.