Calibre Mining Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Calibre Mining Bundle

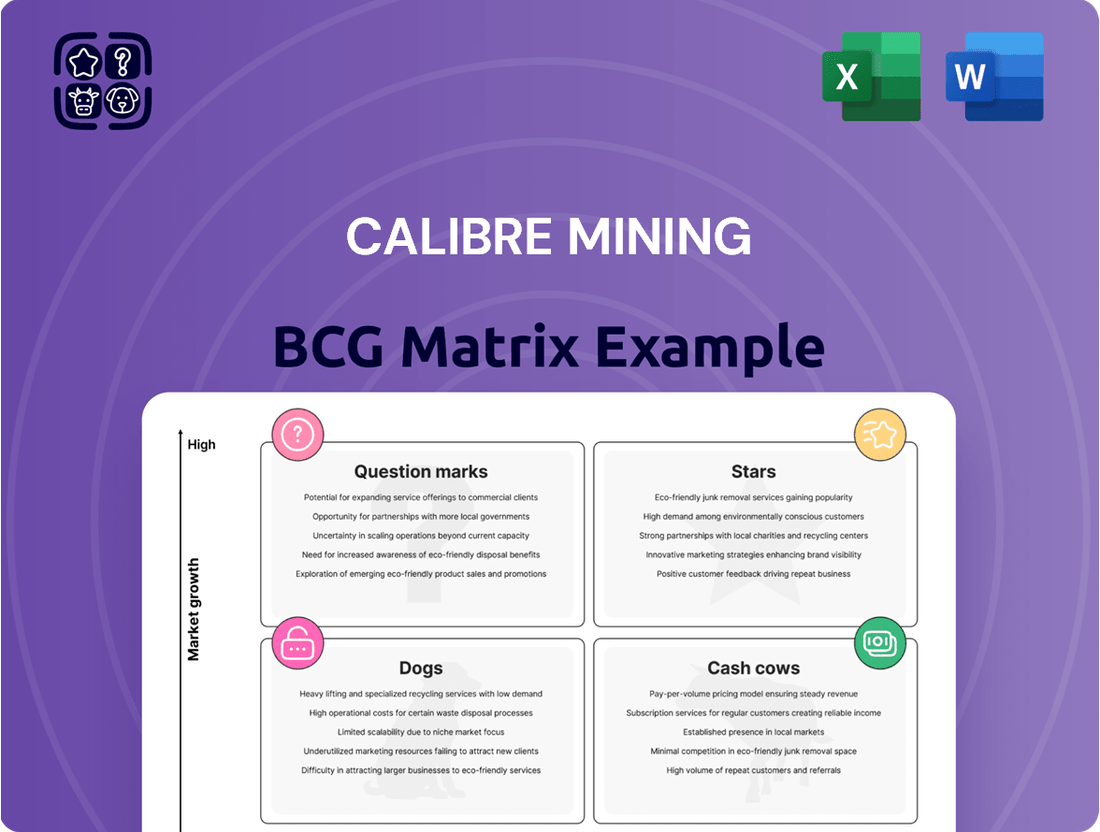

Calibre Mining's current strategic positioning is laid bare in this BCG Matrix preview, highlighting its potential Stars, Cash Cows, Dogs, and Question Marks. Understand where its assets are generating value and where future growth lies.

To truly unlock actionable insights and develop a winning strategy, dive into the full Calibre Mining BCG Matrix. This comprehensive report provides detailed quadrant analysis and data-driven recommendations to guide your investment decisions.

Don't miss out on the complete picture; purchase the full BCG Matrix now and gain a clear roadmap to optimize Calibre Mining's portfolio and secure its future success.

Stars

The Valentine Gold Mine in Newfoundland & Labrador, Canada, is a key growth driver for Calibre Mining. Construction was over 77% complete by July 2024, with first gold anticipated in Q2 2025. This project is projected to operate for 14.3 years, yielding an average of 195,000 ounces of gold annually for the initial 12 years, positioning it as a star asset.

The Eastern Borosi Project (EBP) in Nicaragua is a significant asset for Calibre Mining, characterized by its high-grade open pit and underground potential. This project is strategically positioned to enhance Calibre's overall production profile.

Permitting for the EBP's development and production was secured ahead of the anticipated timeline, demonstrating a streamlined and effective project execution by Calibre Mining. This early approval is a key factor in its contribution to future output.

EBP is engineered to supply ore to Calibre's existing Libertad processing facility. This integration leverages established infrastructure, aiming to drive increases in production, particularly through higher-grade material.

The VTEM gold corridor at Calibre Mining's Limon Mine Complex in Nicaragua is a prime example of a "Star" in the BCG Matrix. In 2023, this corridor saw impressive reserve growth, highlighting its strong market share and high growth potential. This area is a significant focus for Calibre, with ongoing exploration efforts aimed at unlocking further resource expansion and new gold discoveries.

Exploration Programs across Assets

Calibre Mining is actively pursuing ambitious exploration initiatives across its diverse portfolio, with a substantial 130,000 meters of drilling planned for 2024. This extensive program targets resource expansion and new discoveries at its key properties in Newfoundland & Labrador, Nevada, and Nicaragua. The focus is on unlocking untapped potential in areas like the Valentine Lake Shear Zone, aiming to significantly increase the company's mineral resource base.

These exploration efforts are designed to identify and delineate new high-grade zones, building upon recent successes. For instance, drilling in 2024 has already yielded promising results, with several high-grade intercepts reported outside of existing resource estimates, underscoring the significant growth prospects. The company's strategic approach emphasizes targeting underexplored geological settings with the potential for substantial discoveries.

- Aggressive Exploration: Over 130,000 meters of drilling planned for 2024 across Newfoundland & Labrador, Nevada, and Nicaragua.

- Resource Expansion: Programs are specifically designed to grow existing mineral resources and discover new deposits.

- Untapped Potential: Focus on areas like the Valentine Lake Shear Zone, which have significant upside potential.

- High-Grade Discoveries: Recent drilling has confirmed high-grade intercepts outside known resource boundaries, validating the exploration strategy.

Strategic Merger with Equinox Gold

Calibre Mining's strategic merger with Equinox Gold in 2024 creates a formidable player in the Americas, solidifying its position as Canada's second-largest gold producer. This union significantly bolsters the company's scale and operational diversification.

The combined entity is poised for enhanced financial strength, projecting a substantial increase in production capacity. This move is anticipated to unlock considerable value for shareholders through improved operational efficiencies and market presence.

- Enhanced Scale: The merger positions Calibre as a top-tier Americas-focused gold producer.

- Diversification: The combined asset base offers greater geographical and operational diversity.

- Financial Strength: Increased scale is expected to lead to improved financial metrics and access to capital.

- Shareholder Value: The strategic combination aims to drive significant value creation for investors.

The Valentine Gold Mine is a prime example of a Star asset for Calibre Mining. With construction over 77% complete by July 2024 and first gold expected in Q2 2025, it's projected to produce an average of 195,000 ounces annually for its initial 12 years. The VTEM gold corridor at the Limon Mine Complex also demonstrates Star characteristics, showing strong reserve growth in 2023 and high growth potential driven by ongoing exploration.

| Asset | BCG Category | Key Metrics |

|---|---|---|

| Valentine Gold Mine | Star | 77%+ construction complete (July 2024), 195,000 oz/year avg. production (initial 12 yrs), 14.3-year mine life |

| VTEM Gold Corridor (Limon) | Star | Strong reserve growth (2023), high growth potential, ongoing exploration |

What is included in the product

Calibre Mining's BCG Matrix analysis identifies its mining assets as Stars, Cash Cows, Question Marks, or Dogs based on market growth and share.

This framework guides strategic decisions on investing in high-potential Stars, milking Cash Cows, developing Question Marks, or divesting Dogs.

Calibre Mining's BCG Matrix provides a clear, visual snapshot of its portfolio, easing the pain of strategic uncertainty.

Cash Cows

The Libertad Mine Complex is a cornerstone of Calibre Mining's operations in Nicaragua, functioning as its primary processing hub. This facility employs a smart 'Hub-and-Spoke' strategy, efficiently processing ore from various nearby satellite deposits.

With significant surplus processing capacity, Libertad is key to Calibre's strategy of maximizing asset utilization. By processing ore from other deposits, it not only extends its own operational life but also generates a reliable and consistent stream of cash flow.

In 2023, Calibre Mining reported that Libertad produced 80,776 ounces of gold, contributing significantly to the company's overall production. This established and productive operation forms the stable bedrock of Calibre's gold output.

The Limon Mine Complex in Nicaragua stands as a cornerstone for Calibre Mining, consistently delivering gold and significantly bolstering the company's total production. Its operational history showcases robust performance and a commitment to resource expansion, directly contributing to Calibre's impressive operational efficiency.

This complex is a reliable generator of gold, translating into dependable cash flow for Calibre. In 2023, Limon contributed approximately 40,000 ounces of gold to Calibre's total output, underscoring its importance as a cash cow.

The Pavon Central open pit mine, a key component of Calibre Mining's portfolio, has begun operations ahead of its projected timeline. This early commencement means it's already feeding high-grade ore to the Libertad mill, a crucial step in boosting production.

Pavon Central is instrumental in Calibre Mining's strategy for grade-driven production expansion, effectively leveraging the existing capacity at the Libertad mill. In 2023, Calibre Mining reported that Pavon Central contributed significantly to their overall gold production, with the company targeting approximately 200,000 ounces of gold for the year, with Pavon Central playing a vital role in achieving this.

The mine's substantial high-grade reserves are a primary driver of its profitability. This high-grade material translates directly into strong profit margins for Calibre Mining, solidifying Pavon Central's position as a cash cow within the company's operations.

Consistent Gold Production in Nicaragua

Calibre Mining's operations in Nicaragua represent a significant Cash Cow within its portfolio. Since commencing production in Q4 2019, the company has surpassed one million ounces of gold produced in the region. This consistent output underscores the maturity and reliability of these assets.

The Nicaraguan operations are a bedrock of Calibre's financial performance, consistently generating substantial revenue and positive cash flow. This strong, established production base provides a crucial element of financial stability for the company, allowing for strategic reinvestment and debt management.

- Consistent Output: Over 1 million ounces of gold produced in Nicaragua since Q4 2019.

- Revenue Driver: Nicaraguan operations are a primary contributor to Calibre's overall revenue.

- Cash Flow Generation: These assets consistently deliver robust cash flow, supporting financial stability.

- Established Base: The mature production profile offers predictable performance and financial predictability.

Strong Financial Performance and Cash Position

Calibre Mining is experiencing a period of robust financial health, positioning its operations as potential cash cows within its business strategy. The company reported impressive revenue figures and a healthy earnings per share, underscoring its strong market performance.

This financial strength is a direct result of Calibre's unwavering commitment to cost discipline and operational efficiency. These efforts have translated into commendable gross profit margins and a solid EBITDA, demonstrating effective management of its mining activities.

- Strong Revenue Growth: In the first quarter of 2024, Calibre Mining reported revenue of $74.4 million, a significant increase compared to the previous year.

- Healthy Profitability: The company achieved an adjusted EBITDA of $29.1 million in Q1 2024, reflecting its operational efficiency.

- Solid Cash Position: As of March 31, 2024, Calibre Mining held $128.3 million in cash and cash equivalents, providing substantial financial flexibility.

- Reinvestment Capacity: This strong financial footing enables Calibre to confidently reinvest in ongoing growth initiatives and crucial exploration projects.

Calibre Mining's Nicaraguan operations, particularly the Libertad and Limon mine complexes, function as its primary cash cows. These established assets consistently generate substantial gold production and reliable cash flow, forming the financial bedrock of the company. The early commencement of Pavon Central further bolsters this position by feeding high-grade ore into the Libertad mill, enhancing profitability and production expansion.

| Operation | 2023 Gold Production (oz) | Q1 2024 Revenue Contribution (Est.) | Q1 2024 Adjusted EBITDA Contribution (Est.) |

|---|---|---|---|

| Libertad Complex | 80,776 | Significant | Strong |

| Limon Complex | ~40,000 | Reliable | Consistent |

| Pavon Central | Integral to ~200,000 oz target | Growing | Positive |

What You See Is What You Get

Calibre Mining BCG Matrix

The Calibre Mining BCG Matrix you are currently previewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, will be delivered without any watermarks or demo content, ensuring you get a professional and ready-to-use report. You can confidently expect the exact same insightful breakdown of Calibre Mining's business units, allowing for immediate application in your strategic planning or investor presentations.

Dogs

Underperforming smaller deposits within Calibre Mining's portfolio, while not specifically identified, would likely represent operations with lower-grade ore that incur high operating costs relative to the gold produced. These assets would struggle to achieve profitability, potentially consuming more capital than they generate. For instance, if a small deposit had an all-in sustaining cost (AISC) significantly above the prevailing gold price, it would fall into this category.

Calibre Mining's legacy exploration concessions, while holding potential, have seen limited success in recent years. These concessions, held for extended periods, tie up valuable capital and resources without a clear path to production or significant resource discovery. For instance, as of the first quarter of 2024, the company continued to evaluate its portfolio, strategically letting go of certain applications that no longer aligned with its core objectives, demonstrating a proactive approach to managing these legacy assets.

Projects requiring excessive capital for minor returns, if they existed within Calibre Mining's portfolio, would represent significant drains on resources. For instance, an expansion at a low-grade, high-cost mine that only marginally increases output, say by 5,000 ounces annually, while demanding $50 million in new capital, would be a prime example. This would directly contradict Calibre's stated emphasis on disciplined capital allocation and self-funding growth, which is crucial for maintaining financial health and pursuing more promising ventures.

Mines with Declining Grades and High All-in Sustaining Costs (AISC)

Mines with declining grades and high All-in Sustaining Costs (AISC) represent a challenging segment within Calibre Mining's portfolio. These operations, often older or facing geological complexities, struggle to maintain profitability as the economic viability of extracting gold diminishes. This situation necessitates careful management to avoid becoming a drag on overall company performance.

Calibre Mining's strategic emphasis on grade-driven production is designed to proactively address and minimize exposure to this category. By focusing on higher-grade ore bodies, the company aims to ensure that its mining operations are inherently more cost-effective and generate stronger returns. This approach helps to steer clear of scenarios where significant capital is required for diminishing output, a hallmark of mines in this classification.

- Declining Grade Impact: A decrease in gold grades directly translates to more material needing to be processed to yield the same amount of gold, increasing operational expenses per ounce.

- Rising AISC: When AISC rises, it erodes profit margins, especially if the gold price remains stagnant or declines. For example, if AISC for a particular mine segment increased by 15% in 2023 compared to 2022, it would signal a potential shift towards this category if not managed.

- Strategic Mitigation: Calibre's focus on exploration and development of new, high-grade zones is a key strategy to offset the natural depletion and grade decline in older mining areas.

Non-Core Assets Outside Primary Focus Regions

Non-core assets situated beyond Calibre Mining's key operational areas such as Nicaragua, Canada, and Nevada, particularly those not contributing to its gold production or responsible mining strategy, could be classified as question marks or even dogs. These might include exploration properties with low probability of success or assets in unrelated commodities. For instance, if Calibre held a minor stake in a base metals project in a region far from its core expertise, it would fit this category. The company's recent merger activity, emphasizing its commitment to Americas-based gold operations, further supports the idea of divesting such peripheral holdings to sharpen its strategic focus.

Calibre Mining's strategic direction, heavily weighted towards gold in North and Central America, means that any assets falling outside this scope, especially those with limited future potential or requiring significant capital without clear returns, would be candidates for divestment. This approach allows for a more efficient allocation of resources towards their core gold assets, potentially enhancing shareholder value by concentrating on proven or high-potential gold ventures. The company's focus on responsible mining also implies that assets not meeting these criteria might be deemed non-core.

- Divestment Potential: Assets in regions outside Nicaragua, Canada, and Nevada, especially those not aligned with gold production, could be divested.

- Strategic Alignment: Non-core assets may not fit Calibre's focus on gold and responsible mining practices.

- Resource Concentration: Selling these assets allows Calibre to concentrate capital and management attention on its primary gold ventures.

- Merger Impact: Recent mergers reinforce a strategic focus on Americas-based gold operations, making peripheral assets less relevant.

Dogs in Calibre Mining's BCG Matrix would represent assets with low market share and low growth potential, essentially underperforming operations. These could be smaller, marginal mines with high costs or exploration concessions that have yielded no significant discoveries. For example, an asset with an all-in sustaining cost (AISC) consistently above the gold price would be a prime candidate. Calibre's strategic focus on high-grade, self-funded growth actively seeks to minimize the presence of such assets.

Calibre Mining's commitment to its core gold assets in Nicaragua, Canada, and Nevada means that any ventures outside these regions, or those not contributing to its strategic objectives, could be classified as dogs. These might include legacy exploration permits with diminishing prospects or non-core holdings. The company's active portfolio management, including the relinquishment of certain applications in Q1 2024, demonstrates a proactive approach to shedding non-strategic assets.

Mines facing declining ore grades and rising all-in sustaining costs (AISC) would also fall into the dog category. These operations require careful management to prevent them from becoming a financial drain. Calibre's emphasis on grade-driven production is a key strategy to mitigate this risk, ensuring that its operations remain cost-effective and profitable.

Calibre Mining's proactive divestment of non-core assets, particularly those outside its primary operational geographies like Nicaragua, Canada, and Nevada, aligns with classifying them as dogs. This strategy allows for capital and management focus to be redirected towards more promising gold ventures, enhancing overall portfolio performance.

Question Marks

The La Fortuna concession in Nicaragua is a key asset for Calibre Mining, representing a high-potential, undrilled epithermal gold prospect. Its current stage is early exploration, meaning significant investment is needed to unlock its value. Promising fieldwork results in 2024 have fueled optimism for future discoveries and resource growth.

Calibre Mining's strategic focus on La Fortuna aligns with a growth-oriented approach, aiming to transform this early-stage asset into a significant contributor. While specific 2024 drilling expenditure figures for La Fortuna are not yet fully disclosed, the company's overall exploration budget for Nicaragua in 2024 was approximately $15 million, underscoring the commitment to advancing such promising projects.

Recent exploration at Calibre Mining's Valentine Gold Mine in Canada has uncovered significant gold mineralization outside established resource areas, notably at the Frank Zone. These discoveries are considered high-growth prospects, showing promising high-grade drill results that indicate substantial potential.

While these new zones exhibit encouraging grades, their ultimate economic viability and impact on overall production are still under assessment. Calibre Mining is actively investing in further exploration drilling to precisely define the extent and quality of these newly identified resources.

The Volcan gold deposit in Nicaragua is a promising new venture for Calibre Mining, having secured its environmental permits for production. This deposit is designed to bolster Calibre's hub-and-spoke operational model, feeding into the Libertad mill.

While Volcan has a defined open-pit resource, its journey to full commercial production and consistent output contribution is still in its nascent stages. Successful ramp-up and integration are key to unlocking its potential.

Calibre's 2024 operational plans indicate that Volcan is a key growth asset, with initial production expected to commence, contributing to the company's overall gold output targets. For instance, Calibre has stated its intention to ramp up production from its Nicaraguan operations, with Volcan playing a significant role in achieving its 2024 production guidance of 230,000 to 250,000 ounces of gold.

Talavera Gold Deposit (Limon Mine Complex, Nicaragua)

The Talavera Gold Deposit, a recent discovery near Calibre Mining's Limon mine complex, is positioned as a potential 'Question Mark' in the BCG matrix. Its maiden inferred mineral resource estimate, announced in early 2024, shows promising average grades, indicating significant potential. For instance, the initial estimate reported an average grade of 2.43 grams per tonne of gold, highlighting its richness.

As a newly defined resource, Talavera offers the prospect of rapid growth and could provide valuable additional mill feed for the Limon operations. This potential for expansion is a key characteristic of Question Marks. The company is actively pursuing further exploration and drilling to better understand the deposit's full extent and economic viability.

However, Talavera currently requires substantial investment in further delineation and development to move from an inferred resource to a reliable production contributor. This investment need and the inherent uncertainty about its future performance place it firmly in the Question Mark category. Calibre Mining's 2024 exploration program, with a budget of $15 million allocated to Nicaragua, includes significant focus on advancing projects like Talavera.

- Maiden Inferred Resource: The Talavera deposit's initial resource estimate, released in Q1 2024, provides a foundation for future growth.

- Grade Potential: Promising average grades, such as the reported 2.43 g/t gold in the inferred category, suggest economic viability.

- Development Needs: Significant drilling and technical studies are required to upgrade the resource classification and confirm production potential.

- Strategic Importance: Talavera represents a key growth opportunity for Calibre Mining's Nicaraguan operations, potentially bolstering future mill feed.

Potential Phase Two Expansion at Valentine Gold Mine (Canada)

Calibre Mining is actively investigating a potential Phase Two expansion at its Valentine Gold Mine in Canada. This ambitious plan aims to substantially boost the mine's throughput capacity, positioning Calibre as a larger-scale gold producer.

This expansion represents a significant growth opportunity, but it comes with the caveat of substantial future capital investment. Currently, this endeavor remains in the crucial planning and evaluation stages, with a definitive commitment contingent on the success of the initial operational phase.

The Valentine Gold Mine is a cornerstone asset for Calibre. In 2024, the company reported significant progress, with the Valentine Gold Project on track to commence production in the first half of 2025. Initial estimates suggest an average annual production of approximately 190,000 ounces of gold over the first five years of operation.

- Valentine Gold Mine Expansion: Calibre is evaluating a Phase Two expansion to increase throughput.

- Growth Opportunity: This could elevate Calibre to a larger-scale gold producer.

- Capital Investment: Significant future capital is required, and the project is in the planning phase.

- Operational Dependence: Commitment to expansion hinges on the success of the initial phase.

The Talavera Gold Deposit is a prime example of a 'Question Mark' for Calibre Mining. Its maiden inferred resource, announced in early 2024, shows promising grades, with an initial estimate of 2.43 grams per tonne of gold. This new discovery near the Limon mine complex offers potential for rapid growth and additional mill feed, characteristic of Question Marks.

However, Talavera requires substantial investment for further delineation and development to move from an inferred resource to a reliable production contributor. Calibre's 2024 exploration budget of $15 million for Nicaragua includes significant focus on advancing projects like Talavera, highlighting the need for capital to unlock its potential.

The inherent uncertainty regarding its future performance and the significant capital needed to confirm its economic viability firmly place Talavera in the Question Mark category. Calibre is actively pursuing further exploration to better understand the deposit's full extent and economic feasibility.

Talavera represents a key growth opportunity for Calibre's Nicaraguan operations, potentially bolstering future mill feed, but its ultimate success hinges on continued exploration and development investment.

BCG Matrix Data Sources

Our Calibre Mining BCG Matrix is constructed using a blend of company financial disclosures, industry-specific market analysis, and official operational reports to provide a clear strategic overview.