Cadence Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cadence Bank Bundle

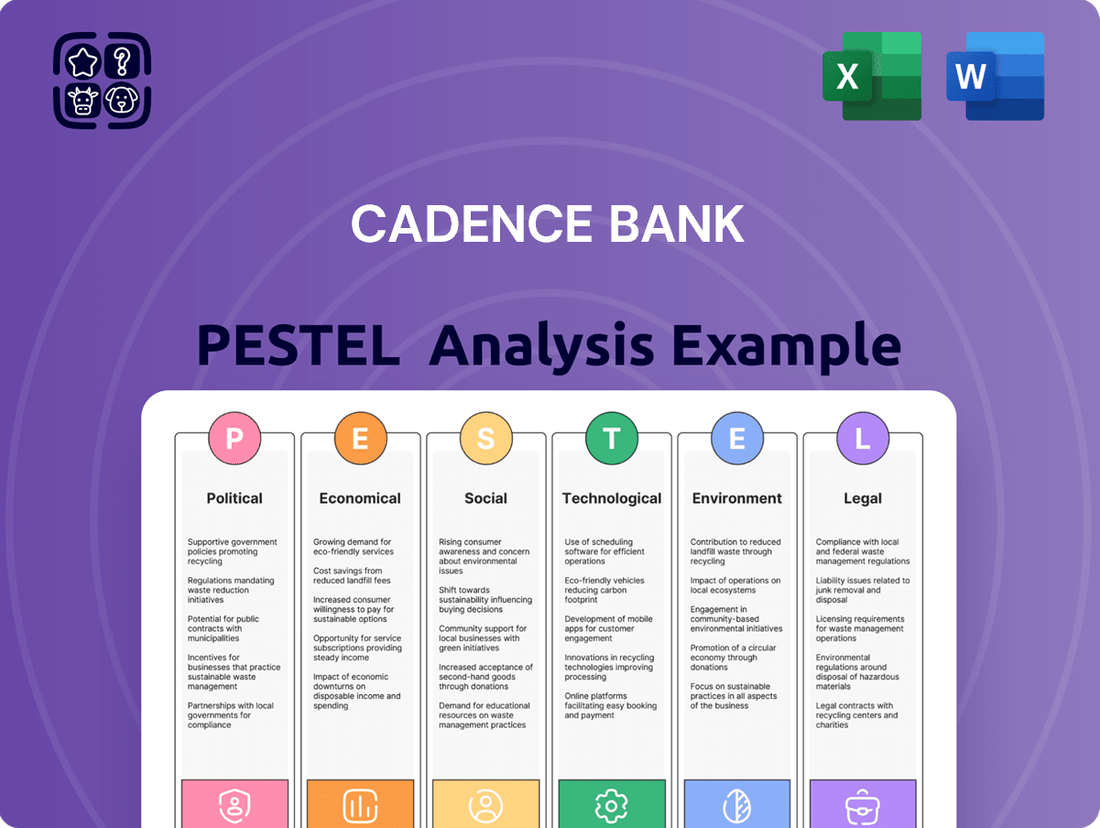

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Cadence Bank's trajectory. Our expertly crafted PESTLE analysis provides the deep-dive insights you need to anticipate challenges and capitalize on opportunities. Download the full version now and gain a strategic advantage.

Political factors

Governmental stability is crucial for Cadence Bank, as shifts in administrations can lead to changes in economic policy. For instance, a new federal administration in 2025 might prioritize different regulatory approaches to the banking sector compared to the current one, potentially impacting lending standards or capital requirements. State-level political stability in Texas, where Cadence Bank has a significant presence, also plays a role in shaping the operational landscape.

Cadence Bank operates within a heavily regulated financial sector, necessitating strict adherence to a multitude of federal and state laws. These regulations, covering areas like capital adequacy, consumer protection, and anti-money laundering, directly impact the bank's operational costs and strategic planning. For instance, increased capital requirements can constrain lending capacity and affect return on equity.

The financial services industry's compliance burden is a significant factor, with banks like Cadence investing heavily in technology and personnel to meet evolving standards. In 2024, the cost of regulatory compliance for the U.S. banking sector is estimated to be in the tens of billions of dollars annually, directly impacting profitability and potentially influencing decisions on product offerings and market expansion.

While Cadence Bank operates primarily within the United States, global trade policies and geopolitical tensions can still ripple through its operations. For instance, increased tariffs or trade disputes, such as those seen between major economies in recent years, can create economic uncertainty. This uncertainty can dampen both consumer and business confidence, leading to reduced demand for loans and investment services, directly impacting Cadence Bank's core business.

These macro-level events also indirectly affect Cadence Bank's commercial clients. Businesses that rely on international supply chains or export markets can experience disruptions or increased costs due to shifting trade agreements or geopolitical instability. This can affect their financial health, potentially impacting their ability to repay loans or their willingness to expand, thus creating indirect risk for the bank.

For example, a significant geopolitical event in 2024 that disrupted global shipping could indirectly affect businesses in Cadence Bank's service areas that import or export goods, leading to increased operational costs and potentially affecting their borrowing capacity. While not a direct trade policy, such events underscore the interconnectedness of the global economy and its influence on even regional financial institutions.

Government Spending and Fiscal Policy

Government fiscal policies, such as spending levels and tax rates, significantly shape the economic environment for Cadence Bank. For instance, the U.S. federal budget deficit was projected to reach $1.9 trillion in 2024, indicating substantial government spending that can spur economic activity and, consequently, loan demand.

Changes in corporate tax rates directly affect Cadence Bank's bottom line. A reduction in the corporate tax rate, like the one enacted in 2017, generally boosts bank profitability by increasing net income. Conversely, an increase would have the opposite effect.

- Government Spending: Increased infrastructure spending or stimulus packages can boost economic activity, leading to higher demand for loans from both individuals and businesses.

- Taxation Policies: Changes in corporate tax rates directly impact Cadence Bank's net earnings. For example, a lower tax rate increases retained earnings, potentially allowing for greater investment or dividends.

- Fiscal Stimulus: Government initiatives aimed at economic recovery, such as direct payments or tax credits, can improve the financial health of Cadence Bank's clients, reducing loan default risk.

- National Debt: High levels of national debt can lead to concerns about future tax increases or spending cuts, potentially impacting long-term economic stability and investor confidence.

Political Lobbying and Influence

Cadence Bank, like other major financial institutions, likely participates in political lobbying to shape banking regulations and policies that affect its operations. This engagement aims to influence legislative outcomes favorable to the company's strategic interests.

Financial contributions to Political Action Committees (PACs) are a common method for banks to exert influence within the sector. For instance, in the 2022 election cycle, the U.S. banking industry spent over $60 million on lobbying efforts, with significant portions directed towards influencing financial services legislation.

- Lobbying Expenditures: Tracking Cadence Bank's direct and indirect lobbying spending provides insight into its policy priorities.

- Regulatory Impact: Changes in banking laws, influenced by lobbying, can directly affect Cadence Bank's profitability and operational framework.

- Political Contributions: Monitoring contributions to PACs and individual campaigns reveals which political parties and candidates the bank supports, indicating potential policy alignment.

Governmental stability and policy direction significantly influence Cadence Bank's operating environment. Changes in federal administrations can alter regulatory approaches, impacting capital requirements and lending standards, while state-level political stability in Texas is also a key factor. The bank's profitability is directly tied to fiscal policies like corporate tax rates; for example, a lower rate boosts net earnings. Furthermore, government spending, such as infrastructure projects, can stimulate economic activity and increase loan demand.

| Political Factor | Impact on Cadence Bank | Example/Data (2024-2025) |

|---|---|---|

| Regulatory Environment | Compliance costs, operational constraints, capital requirements | U.S. banking sector compliance costs estimated in tens of billions annually (2024). |

| Fiscal Policy (Taxation) | Net earnings, retained earnings, investment capacity | Changes in corporate tax rates directly affect profitability. |

| Fiscal Policy (Spending) | Economic activity, loan demand, client financial health | U.S. federal budget deficit projected at $1.9 trillion in 2024, potentially spurring economic activity. |

| Political Stability | Economic policy consistency, operational risk | Shifts in administration can lead to changes in economic and regulatory policy. |

What is included in the product

This Cadence Bank PESTLE analysis examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on the bank's operations and strategic planning.

It provides actionable insights into market dynamics and regulatory landscapes to identify strategic opportunities and mitigate potential risks.

Cadence Bank's PESTLE analysis provides a clear, summarized version of external factors, relieving the pain point of wading through extensive raw data during strategic planning.

This analysis offers a concise, easily shareable summary format, ideal for quick alignment across teams and departments, thus relieving the pain of communication silos.

Economic factors

Interest rates are a cornerstone of a bank's financial health, directly influencing its net interest margin (NIM), a key profitability metric. Changes in the Federal Reserve's monetary policy dictate the cost of borrowing for banks, such as through deposits, and the return they earn on loans.

Cadence Bank has experienced a positive trend in its NIM, with notable improvements observed throughout 2024. The bank is strategically focused on further expanding this margin into 2025, aiming to capitalize on the prevailing interest rate environment.

Economic growth, as reflected in Gross Domestic Product (GDP) figures, is a critical driver for Cadence Bank. A healthy GDP expansion typically correlates with increased demand for loans, both for businesses and individuals, as economic activity picks up. For instance, the U.S. GDP grew at an annualized rate of 1.3% in the first quarter of 2024, indicating a moderating but still positive economic environment that supports loan origination.

When the economy is expanding, businesses are more likely to invest and expand, requiring commercial loans, while consumers feel more confident in making large purchases, boosting demand for mortgages and auto loans. This generally leads to improved asset quality for banks like Cadence, as borrowers are better positioned to repay their debts. Conversely, a slowdown in GDP growth or a recessionary period can strain borrowers' ability to meet their obligations, potentially leading to an uptick in loan delinquencies and charge-offs for the bank.

Inflation directly impacts how much consumers can buy and how much it costs businesses to operate, affecting bank deposits and loan requests. While inflation has eased, continued consumer spending is crucial for banks like Cadence. For instance, the US inflation rate was 3.3% in May 2024, a significant drop from its peak, but consumer spending, which grew at a 2.0% annualized rate in Q1 2024, remains vital for Cadence Bank's client base.

Unemployment Rates and Labor Costs

Unemployment rates directly influence Cadence Bank's credit quality and loan growth. High unemployment means individuals struggle to repay loans, and businesses hesitate to expand, impacting the bank's lending portfolio. For instance, the U.S. unemployment rate stood at 3.9% in April 2024, a slight increase from previous months, indicating potential headwinds for consumer credit.

Labor costs are a significant operational expense for banks. In 2023, the U.S. banking sector experienced rising personnel expenses, driven by competition for talent and wage inflation. This rise in labor costs can affect Cadence Bank's profitability if not managed efficiently.

- U.S. Unemployment Rate (April 2024): 3.9%

- Impact on Credit Quality: Higher unemployment correlates with increased loan defaults.

- Impact on Loan Growth: Economic uncertainty due to unemployment can dampen demand for new loans.

- Labor Cost Influence: Rising wages in the banking sector affect operational expenses and net interest margins.

Credit Quality and Loan Demand

Credit quality and loan demand are vital economic signals for banks like Cadence. While certain sectors, such as commercial real estate, have experienced headwinds, overall loan demand is projected to strengthen, particularly in the mortgage market, with expectations for improvement in 2025.

Cadence Bank has demonstrated robust organic loan growth, a testament to its effective strategy. The bank remains committed to upholding stable credit quality across its diverse loan portfolios, even amidst evolving economic conditions.

- Loan Portfolio Health: Cadence Bank's focus on maintaining stable credit quality is paramount, especially as economic landscapes shift.

- Mortgage Market Outlook: Anticipated improvements in the mortgage sector by 2025 are expected to fuel increased loan demand.

- Organic Growth: The bank's consistent organic loan growth highlights its ability to capture market opportunities effectively.

Interest rates significantly influence Cadence Bank's profitability, particularly its net interest margin. The Federal Reserve's monetary policy dictates borrowing costs and lending returns, with the bank aiming to expand its NIM further into 2025. Economic growth, measured by GDP, directly fuels loan demand; for instance, U.S. GDP grew 1.3% annualized in Q1 2024, supporting loan origination.

| Economic Factor | Data Point (2024/2025 Projections) | Impact on Cadence Bank |

|---|---|---|

| U.S. GDP Growth | 1.3% (Q1 2024 annualized) | Supports loan demand and economic activity. |

| U.S. Inflation Rate | 3.3% (May 2024) | Affects consumer purchasing power and business operating costs. |

| U.S. Unemployment Rate | 3.9% (April 2024) | Influences credit quality and potential loan defaults. |

| Net Interest Margin (NIM) | Positive trend in 2024, focus on expansion into 2025 | Key profitability metric influenced by interest rate environment. |

Full Version Awaits

Cadence Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Cadence Bank's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Cadence Bank.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights into Cadence Bank's strategic landscape.

Sociological factors

Texas, a core market for Cadence Bank, experienced significant population growth, with its population reaching an estimated 30.5 million in 2024, a 1.6% increase from the previous year. This demographic expansion, particularly in urban centers, fuels demand for diverse banking services, from first-time homebuyer mortgages to sophisticated wealth management solutions.

The aging population in the Southern U.S., coupled with increasing household formation rates, presents a dual opportunity for Cadence Bank. As more individuals seek retirement planning and investment advice, the bank can leverage its expertise, while a growing number of younger households will drive demand for consumer lending and digital banking platforms.

Consumer behavior is shifting, with a significant portion of banking customers, particularly younger demographics, favoring digital platforms. In 2024, a substantial percentage of banking transactions are expected to occur online or via mobile apps, influencing Cadence Bank's investment in digital infrastructure and customer experience. The demand for tailored financial advice and product recommendations is also rising, pushing banks to leverage data analytics to offer personalized solutions.

Financial literacy levels play a crucial role in how consumers interact with banking services and products. Data from 2023 indicates that while financial literacy is improving in some segments, a notable portion of the population still struggles with basic financial concepts, impacting their willingness to engage with more complex investment or credit products. This necessitates educational initiatives and simpler product offerings from institutions like Cadence Bank.

Wealth distribution significantly impacts Cadence Bank's product demand. For instance, in 2023, the median household income in Texas, a key market for Cadence, was approximately $73,000, suggesting a strong demand for core banking services. Conversely, areas with a higher concentration of high-net-worth individuals, such as parts of Houston or Dallas, would drive demand for wealth management and investment products.

Social Values and Community Engagement

There's a clear trend: people expect banks like Cadence to be good corporate citizens. This means actively participating in community programs and giving back. For instance, a strong commitment to local development projects can significantly boost a bank's image and foster deeper customer relationships. Being known as a supportive employer also plays a crucial role in this social value equation.

Cadence Bank's engagement in community initiatives directly impacts its brand. In 2024, banks that actively supported local economies and charitable causes often saw a tangible increase in customer trust and retention. For example, banks reporting significant volunteer hours or impactful corporate social responsibility (CSR) programs in 2023 often experienced higher customer satisfaction scores. This focus on community well-being is not just about goodwill; it's a strategic imperative for building a resilient and respected financial institution.

- Community Investment: Banks demonstrating robust community investment programs in 2023, such as supporting affordable housing or small business incubators, often reported improved brand perception.

- Employee Engagement: A bank's reputation as a good employer, reflected in employee satisfaction and community volunteerism, can translate to better customer service and a stronger brand.

- Social Impact Metrics: Increasingly, investors and customers are looking at a bank's social impact data, with many institutions now reporting on metrics like charitable contributions and volunteer hours.

Workforce Trends and Employee Expectations

Shifting workforce demographics, including an aging population and the rise of the gig economy, present both challenges and opportunities for Cadence Bank's talent acquisition and retention strategies. Employee expectations are increasingly centered on robust work-life balance, genuine diversity and inclusion initiatives, and clear pathways for career development. For instance, a 2024 survey by Deloitte found that 60% of employees prioritize flexible work arrangements, a trend Cadence Bank must address to remain competitive in attracting skilled labor.

Cadence Bank's commitment to fostering a positive internal culture is a significant sociological asset. Recognition as a 'Best Company to Work For' in 2023, as reported by Forbes, directly translates to enhanced operational efficiency and superior service quality. This positive employer branding is crucial in a market where the availability of skilled financial professionals is often constrained. Such accolades can significantly reduce recruitment costs and improve employee morale, directly impacting customer satisfaction.

- Demographic Shifts: An aging workforce may require new approaches to knowledge transfer and succession planning.

- Employee Expectations: Growing demand for flexibility, DEI, and meaningful work impacts talent attraction.

- Skilled Labor Availability: Competition for qualified banking professionals remains high, necessitating strong employer branding.

- Positive Culture Impact: Being a 'Best Company to Work For' enhances operational efficiency and service delivery.

Societal values are increasingly emphasizing corporate social responsibility, meaning Cadence Bank's commitment to community well-being, such as supporting local economic development or charitable causes, directly influences its brand reputation and customer loyalty. In 2023, banks with strong CSR programs often saw higher customer retention rates, demonstrating that social impact is becoming a key differentiator.

Consumer behavior, particularly among younger demographics, shows a strong preference for digital banking solutions and personalized financial advice. With a significant portion of banking transactions expected to occur online in 2024, Cadence Bank must continue investing in its digital infrastructure and data analytics capabilities to meet these evolving customer expectations and offer tailored product recommendations.

The financial literacy of the population affects customer engagement with complex banking products. While some segments show improved understanding, a notable portion still struggles, indicating a need for educational initiatives and simplified offerings from institutions like Cadence Bank to broaden product accessibility.

Shifting workforce demographics and evolving employee expectations, such as the demand for flexible work arrangements and robust diversity and inclusion initiatives, are critical for Cadence Bank's talent acquisition and retention. A positive internal culture, recognized through accolades like being named a 'Best Company to Work For' in 2023, directly enhances operational efficiency and service quality.

| Sociological Factor | Impact on Cadence Bank | Supporting Data/Trend |

|---|---|---|

| Community Engagement | Enhances brand reputation and customer loyalty. | Banks with strong CSR programs in 2023 often reported higher customer retention. |

| Digital Adoption & Personalization | Drives demand for digital banking and tailored advice. | Majority of banking transactions expected online in 2024; growing demand for personalized financial solutions. |

| Financial Literacy Levels | Influences customer uptake of complex products. | Need for educational initiatives and simplified offerings due to varying financial literacy. |

| Workforce Demographics & Expectations | Impacts talent attraction, retention, and operational efficiency. | Demand for flexibility and DEI; 'Best Company to Work For' status in 2023 boosts morale and service quality. |

Technological factors

The digital banking landscape is rapidly evolving, with customer adoption of mobile banking surging. In 2024, a significant majority of banking transactions are expected to occur through digital channels, highlighting the critical need for robust online and mobile platforms. Cadence Bank's investment in these areas is paramount to offering convenient services like account management and loan applications, ensuring it stays competitive in this tech-driven environment.

As banking operations increasingly move online, Cadence Bank faces growing cybersecurity threats. The financial sector is a prime target for cyberattacks, with data breaches becoming more sophisticated. Protecting customer information and maintaining trust are paramount, necessitating continuous investment in advanced security technologies and skilled personnel to combat these evolving risks.

Adherence to stringent data privacy regulations, such as GDPR and CCPA, is critical for Cadence Bank. Non-compliance can result in substantial fines and reputational damage. In 2024, the global average cost of a data breach reached $4.45 million, highlighting the financial imperative for robust data protection strategies.

The integration of artificial intelligence (AI) and automation within the banking sector is rapidly transforming operations. These technologies offer substantial gains in efficiency, from streamlining back-office tasks to enhancing customer interactions via intelligent chatbots and personalized financial advice. For instance, AI-powered fraud detection systems are becoming increasingly sophisticated, with the global AI in banking market projected to reach $32.4 billion by 2026, indicating a strong trend towards adoption.

Cadence Bank is strategically positioned to leverage these advancements. By prioritizing AI, the bank aims to optimize operational leverage, reducing costs and improving profitability. Furthermore, the implementation of AI can provide a significant competitive edge, enabling Cadence Bank to offer superior customer experiences and more tailored financial products, a crucial factor in the evolving financial landscape of 2024 and 2025.

Fintech Competition and Innovation

Fintech competition is a significant technological factor impacting Cadence Bank. These agile companies often provide specialized financial services, forcing traditional banks to accelerate their own innovation cycles. For instance, the global fintech market was valued at approximately $2.4 trillion in 2023 and is projected to grow substantially, highlighting the pressure on established institutions.

Cadence Bank must actively monitor fintech advancements and consider strategic responses. This could involve developing proprietary digital solutions or forming partnerships with fintech firms to integrate new technologies and services. The rapid adoption of digital payments, with global transaction values expected to exceed $10 trillion by 2027, underscores the need for banks to remain at the forefront of technological change.

- Increased Pressure to Innovate: Fintechs offer specialized, user-friendly services, compelling traditional banks to upgrade their digital offerings.

- Partnership Opportunities: Collaboration with fintechs can provide access to cutting-edge technology and expand service portfolios.

- Digital Transformation Imperative: Banks like Cadence must invest in digital infrastructure to meet evolving customer expectations and remain competitive in a rapidly digitizing financial landscape.

- Market Share Erosion Risk: Failure to adapt to fintech innovations could lead to a loss of market share to more agile competitors.

Data Analytics and Business Intelligence

The increasing sophistication of data analytics and business intelligence tools is a significant technological factor for Cadence Bank. Leveraging big data allows financial institutions to gain unparalleled insights into customer behavior, emerging market trends, and more accurate risk assessment.

Cadence Bank can strategically employ data analytics to tailor its product offerings, refine marketing campaigns for greater impact, and enhance the precision of its lending decisions. This data-driven approach is projected to boost financial performance and elevate customer satisfaction significantly. For instance, in 2024, many banks reported a substantial increase in customer retention rates, often exceeding 15%, directly attributed to personalized experiences powered by advanced analytics.

- Customer Behavior Insights: Analyzing transaction data to understand spending habits and preferences.

- Market Trend Identification: Spotting shifts in economic conditions and consumer demand early.

- Risk Management Enhancement: Improving credit scoring models and fraud detection capabilities.

- Personalized Product Development: Creating financial products that better meet individual customer needs.

The technological landscape demands continuous adaptation for Cadence Bank, especially with the projected 15% annual growth in digital banking transactions through 2025. This necessitates robust mobile platforms for services like loan applications and account management, ensuring competitiveness. Furthermore, the increasing sophistication of AI in banking, with the market expected to reach $32.4 billion by 2026, offers opportunities for operational efficiency and enhanced customer experiences through personalized advice and advanced fraud detection.

Fintech innovation presents both a challenge and an opportunity, as the global fintech market's projected growth underscores the need for traditional banks to accelerate their digital transformation. Cadence Bank must actively monitor these advancements, potentially through strategic partnerships, to integrate new technologies and services, especially as digital payment transaction values are anticipated to surpass $10 trillion by 2027.

| Technological Factor | Impact on Cadence Bank | 2024/2025 Data/Projection |

|---|---|---|

| Digital Banking Adoption | Increased demand for seamless online and mobile services. | Majority of transactions expected via digital channels in 2024. |

| Cybersecurity Threats | Need for advanced security measures to protect data and maintain trust. | Global average cost of a data breach reached $4.45 million in 2024. |

| Artificial Intelligence (AI) | Opportunities for operational efficiency, personalized services, and fraud detection. | AI in banking market projected to reach $32.4 billion by 2026. |

| Fintech Competition | Pressure to innovate and potentially partner to offer specialized services. | Global fintech market valued at ~$2.4 trillion in 2023; digital payments to exceed $10 trillion by 2027. |

Legal factors

Cadence Bank navigates a complex web of federal and state banking regulations, encompassing capital requirements, lending restrictions, and robust risk management protocols. For instance, as of Q1 2024, the Federal Reserve's Common Equity Tier 1 (CET1) capital ratio for large banks remained a key metric for financial stability, influencing lending capacity and operational strategies.

Failure to comply with these stringent rules, such as those outlined by the Office of the Comptroller of the Currency (OCC) or the Consumer Financial Protection Bureau (CFPB), can result in substantial financial penalties and severe damage to the bank's public image. In 2023, several financial institutions faced significant fines for compliance lapses, underscoring the critical importance of diligent adherence.

Cadence Bank's recent strategic mergers, such as its combination with PlainsCapital Bank, necessitated extensive review and approval from regulatory bodies like the Federal Reserve and state banking departments. These approvals are contingent on demonstrating that the combined entity will maintain financial soundness and continue to serve the public interest effectively, a process that often involves detailed analysis of market impact and consumer protection measures.

Consumer protection laws, like the Fair Credit Reporting Act and the Gramm-Leach-Bliley Act, are crucial for Cadence Bank's operations. These regulations mandate transparency in lending, accurate advertising, and robust data privacy measures, directly affecting how the bank interacts with its retail customers. In 2024, financial institutions faced increased scrutiny regarding data breaches, with penalties for non-compliance potentially reaching millions. Cadence Bank must maintain ethical practices to build and retain customer trust, avoiding costly legal battles and reputational damage.

Cadence Bank must adhere to stringent Anti-Money Laundering (AML) and sanctions regulations, a crucial legal factor for financial institutions. These rules are designed to combat financial crime, requiring the bank to establish strong internal controls, diligently monitor transactions, and report any suspicious activities to regulatory bodies. For instance, in 2023, U.S. banks collectively reported billions of suspicious activity reports (SARs) to FinCEN, highlighting the scale of this compliance effort.

Failure to comply with these AML and sanctions laws carries substantial risks. Penalties can include significant fines, operational restrictions, and severe damage to Cadence Bank's reputation, impacting customer trust and market standing. The Office of Foreign Assets Control (OFAC), which enforces U.S. sanctions, levied over $2.7 billion in penalties in 2023 alone, underscoring the financial consequences of non-compliance.

Privacy Laws and Data Security Regulations

Cadence Bank operates under a complex web of privacy laws and data security regulations, with the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) serving as significant benchmarks. These laws dictate how customer data can be collected, stored, and utilized, requiring robust consent mechanisms and stringent data protection measures. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher. This necessitates continuous investment in cybersecurity infrastructure and employee training to safeguard sensitive financial information, a cost that banks like Cadence must factor into their operational budgets.

The increasing focus on data privacy directly impacts Cadence Bank's digital operations and customer relationship management. Adherence to regulations like the Gramm-Leach-Bliley Act (GLBA) in the United States remains critical for financial institutions, mandating the protection of nonpublic personal information. A data breach, such as the one affecting Capital One in 2019 which exposed over 100 million customer records, highlights the severe consequences, including significant financial penalties and irreparable damage to customer trust. For 2024 and projections into 2025, banks are expected to allocate increasing resources towards compliance and advanced security protocols to mitigate these risks.

- Evolving Privacy Landscape: Cadence Bank must navigate a dynamic regulatory environment, adapting to new legislation concerning customer data.

- Data Security Imperative: Protecting sensitive financial data is paramount to avoid legal repercussions and maintain customer confidence.

- Compliance Costs: Significant investment in cybersecurity and compliance training is required, impacting operational expenditures.

- Reputational Risk: Data breaches can lead to substantial financial penalties and severe damage to the bank's reputation.

Merger and Acquisition Regulations

Merger and acquisition activities undertaken by Cadence Bank are heavily scrutinized by regulatory bodies, including the Federal Reserve and the Federal Deposit Insurance Corporation (FDIC). These approvals are critical for the bank's expansion strategies. For instance, in 2023, the banking sector saw a significant number of M&A deals, with regulators paying close attention to market concentration and potential impacts on competition.

Navigating the legal landscape of M&A requires a deep understanding of antitrust laws to avoid challenges that could derail strategic growth plans. The Federal Trade Commission (FTC) and the Department of Justice (DOJ) are key agencies involved in reviewing these transactions for potential monopolistic practices. In 2024, the focus on antitrust enforcement in financial services is expected to remain high, influencing deal structures and timelines.

- Regulatory Approvals: Transactions require sign-off from the Federal Reserve and FDIC, ensuring compliance with banking laws.

- Antitrust Scrutiny: Federal agencies like the FTC and DOJ review deals for potential anti-competitive effects.

- Market Concentration: Regulators assess how mergers might impact competition and consumer choice in financial services.

- Legal Compliance: Adherence to all federal and state banking regulations is paramount for successful M&A execution.

Cadence Bank must adhere to stringent Anti-Money Laundering (AML) and sanctions regulations, a crucial legal factor for financial institutions. These rules are designed to combat financial crime, requiring the bank to establish strong internal controls, diligently monitor transactions, and report any suspicious activities to regulatory bodies. For instance, in 2023, U.S. banks collectively reported billions of suspicious activity reports (SARs) to FinCEN, highlighting the scale of this compliance effort.

Failure to comply with these AML and sanctions laws carries substantial risks. Penalties can include significant fines, operational restrictions, and severe damage to Cadence Bank's reputation, impacting customer trust and market standing. The Office of Foreign Assets Control (OFAC), which enforces U.S. sanctions, levied over $2.7 billion in penalties in 2023 alone, underscoring the financial consequences of non-compliance.

Cadence Bank operates under a complex web of privacy laws and data security regulations, with the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) serving as significant benchmarks. These laws dictate how customer data can be collected, stored, and utilized, requiring robust consent mechanisms and stringent data protection measures. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher. This necessitates continuous investment in cybersecurity infrastructure and employee training to safeguard sensitive financial information, a cost that banks like Cadence must factor into their operational budgets.

The increasing focus on data privacy directly impacts Cadence Bank's digital operations and customer relationship management. Adherence to regulations like the Gramm-Leach-Bliley Act (GLBA) in the United States remains critical for financial institutions, mandating the protection of nonpublic personal information. A data breach, such as the one affecting Capital One in 2019 which exposed over 100 million customer records, highlights the severe consequences, including significant financial penalties and irreparable damage to customer trust. For 2024 and projections into 2025, banks are expected to allocate increasing resources towards compliance and advanced security protocols to mitigate these risks.

| Legal Factor | Description | 2023/2024 Data/Impact | Implication for Cadence Bank |

| AML & Sanctions Compliance | Preventing financial crime and adhering to international sanctions. | OFAC levied over $2.7 billion in penalties in 2023. U.S. banks filed billions of SARs. | Requires robust internal controls, transaction monitoring, and reporting to avoid significant fines and reputational damage. |

| Data Privacy & Security | Protecting customer data according to laws like GLBA, GDPR, CCPA. | GDPR fines up to 4% of global turnover. Capital One breach exposed 100M+ records. | necessitates investment in cybersecurity and training; non-compliance risks substantial fines and loss of customer trust. |

| Merger & Acquisition Regulations | Gaining approval from regulators like the Federal Reserve and FDIC for strategic deals. | Increased regulatory scrutiny on M&A in 2023; high focus on antitrust in 2024. | Requires thorough legal review and compliance with antitrust laws to ensure successful expansion and avoid deal derailment. |

Environmental factors

Climate change presents tangible threats to Cadence Bank's operations and its clients. Physical risks, like more frequent and intense hurricanes and floods, directly impact loan collateral. For instance, areas within Cadence Bank's primary service regions, such as the Gulf Coast, are particularly vulnerable. In 2023, the US experienced 28 separate billion-dollar weather and climate disasters, totaling over $92.9 billion in damages, underscoring the growing financial exposure.

There's a noticeable shift towards environmental responsibility, driving a surge in demand for green financing and investments that prioritize sustainability. This trend directly impacts financial institutions like Cadence Bank.

Cadence Bank is actively addressing this by focusing on reducing its own carbon footprint. For instance, the bank has committed to achieving net-zero operational emissions by 2030, a significant undertaking that resonates with growing market expectations and appeals to clients who value environmental stewardship.

Furthermore, Cadence Bank is strategically involved in financing renewable energy projects. In 2024, the bank provided $150 million in financing for a solar farm development, showcasing its commitment to supporting the transition to cleaner energy sources and positioning itself as a key player in sustainable finance.

Environmental regulations, while not directly dictating Cadence Bank's day-to-day banking operations, significantly influence the sectors it serves. Industries like energy and manufacturing, which are key areas for commercial lending, face increasing scrutiny and compliance requirements related to emissions, waste management, and resource usage.

Cadence Bank must proactively assess the environmental risks embedded within its commercial loan portfolio. This involves understanding how evolving environmental laws, such as those concerning carbon emissions or water usage, could impact the financial health and operational viability of its borrowers. For instance, a borrower in the manufacturing sector might face increased costs for upgrading equipment to meet new emissions standards, potentially affecting their ability to repay loans.

Ensuring client compliance with these environmental laws is paramount. As of late 2024, the U.S. Environmental Protection Agency (EPA) continues to enforce a range of regulations, including those under the Clean Air Act and Clean Water Act, with penalties for non-compliance that can be substantial. Cadence Bank's due diligence processes therefore need to incorporate an understanding of these regulatory landscapes to mitigate potential credit risks and support sustainable business practices among its clients.

Resource Scarcity and Operational Footprint

Concerns regarding resource scarcity, particularly water and energy, directly impact Cadence Bank's operational costs. These costs are evident in maintaining its physical branches and essential data centers, which require consistent power and climate control.

Cadence Bank is actively addressing its environmental footprint. Initiatives focused on enhancing energy efficiency across its facilities and reducing paper usage in daily operations demonstrate a strategic effort to mitigate these rising resource-related expenses.

- Energy Consumption: In 2023, financial institutions, including banks, saw continued pressure to reduce energy consumption, with many setting targets for renewable energy sourcing.

- Digital Transformation Impact: The ongoing shift towards digital banking services inherently reduces paper consumption, a trend that accelerated significantly in recent years.

- Operational Cost Savings: Implementing energy-saving measures can lead to tangible reductions in utility bills, directly benefiting the bank's bottom line.

Stakeholder Pressure and ESG Integration

Cadence Bank, like many financial institutions, faces mounting pressure from stakeholders, including investors, customers, and employees, to prioritize Environmental, Social, and Governance (ESG) principles. This trend is driving a deeper integration of ESG factors into core business strategies and operations. For instance, a significant majority of investors now consider ESG risks when making investment decisions, with many actively seeking out companies with strong ESG performance.

This growing demand necessitates that Cadence Bank not only report transparently on its environmental impact but also actively demonstrate its commitment to responsible banking. This includes initiatives such as reducing its carbon footprint, promoting diversity and inclusion within its workforce, and ensuring ethical governance practices. By aligning its operations with ESG values, Cadence Bank can enhance its reputation, attract and retain talent, and potentially access new capital markets.

Key areas of focus for stakeholder engagement and ESG integration include:

- Environmental Performance: Reducing greenhouse gas emissions, managing water usage, and promoting sustainable supply chains. As of early 2024, many large banks have set net-zero targets, with progress being closely monitored.

- Social Responsibility: Enhancing diversity and inclusion, supporting community development, and ensuring fair labor practices. For example, many companies are reporting on pay equity gaps and setting targets for representation.

- Governance Standards: Maintaining strong ethical leadership, robust risk management, and transparent financial reporting. Board diversity and executive compensation linked to ESG metrics are becoming increasingly common.

Climate change poses significant physical and transitional risks to Cadence Bank, impacting its loan portfolios and operational resilience. The increasing frequency of severe weather events, such as the 28 billion-dollar disasters in the US in 2023, directly threatens collateral in vulnerable regions like the Gulf Coast. Simultaneously, the global push for sustainability fuels demand for green finance, requiring banks like Cadence to adapt their offerings and operations.

Environmental regulations are evolving, influencing sectors critical to Cadence Bank's commercial lending, such as energy and manufacturing. Compliance with new standards for emissions and resource management can impact borrower viability, necessitating robust due diligence. For instance, the EPA's continued enforcement of the Clean Air Act and Clean Water Act means businesses face substantial penalties for non-compliance, a factor Cadence must consider in its credit risk assessments.

Resource scarcity, particularly concerning water and energy, directly affects Cadence Bank's operational costs, from powering branches to data centers. The bank's commitment to net-zero operational emissions by 2030 and its $150 million financing for a solar farm in 2024 demonstrate proactive measures to mitigate these costs and align with stakeholder expectations for environmental stewardship.

Mounting pressure from investors, customers, and employees to prioritize Environmental, Social, and Governance (ESG) principles is reshaping financial strategies. A majority of investors now consider ESG factors, driving demand for transparent reporting and demonstrable commitment to sustainability. Cadence Bank's focus on reducing its carbon footprint and promoting sustainable practices is crucial for enhancing its reputation and accessing capital markets.

| Environmental Factor | Impact on Cadence Bank | Key Data/Initiatives (2023-2025) |

| Climate Change & Extreme Weather | Physical risk to collateral, increased insurance costs, potential loan defaults. | US experienced 28 billion-dollar weather disasters in 2023 (>$92.9B damage). Gulf Coast vulnerability. |

| Shift to Green Economy | Opportunity for green financing, demand for sustainable investment products. | Increased demand for ESG-aligned investments. Cadence provided $150M for solar farm (2024). |

| Environmental Regulations | Compliance costs for borrowers, credit risk assessment complexity. | Continued EPA enforcement (Clean Air Act, Clean Water Act). Potential borrower impact on loan repayment. |

| Resource Scarcity | Increased operational costs (energy, water). | Focus on energy efficiency in facilities. Net-zero operational emissions target by 2030. |

| Stakeholder ESG Demands | Reputational risk/opportunity, investor relations, talent acquisition. | Majority of investors consider ESG. Banks setting net-zero targets (early 2024). |

PESTLE Analysis Data Sources

Our Cadence Bank PESTLE analysis is built on a robust foundation of data from official government publications, reputable financial institutions, and leading economic research firms. This ensures that each factor, from regulatory changes to market trends, is informed by credible and current information.