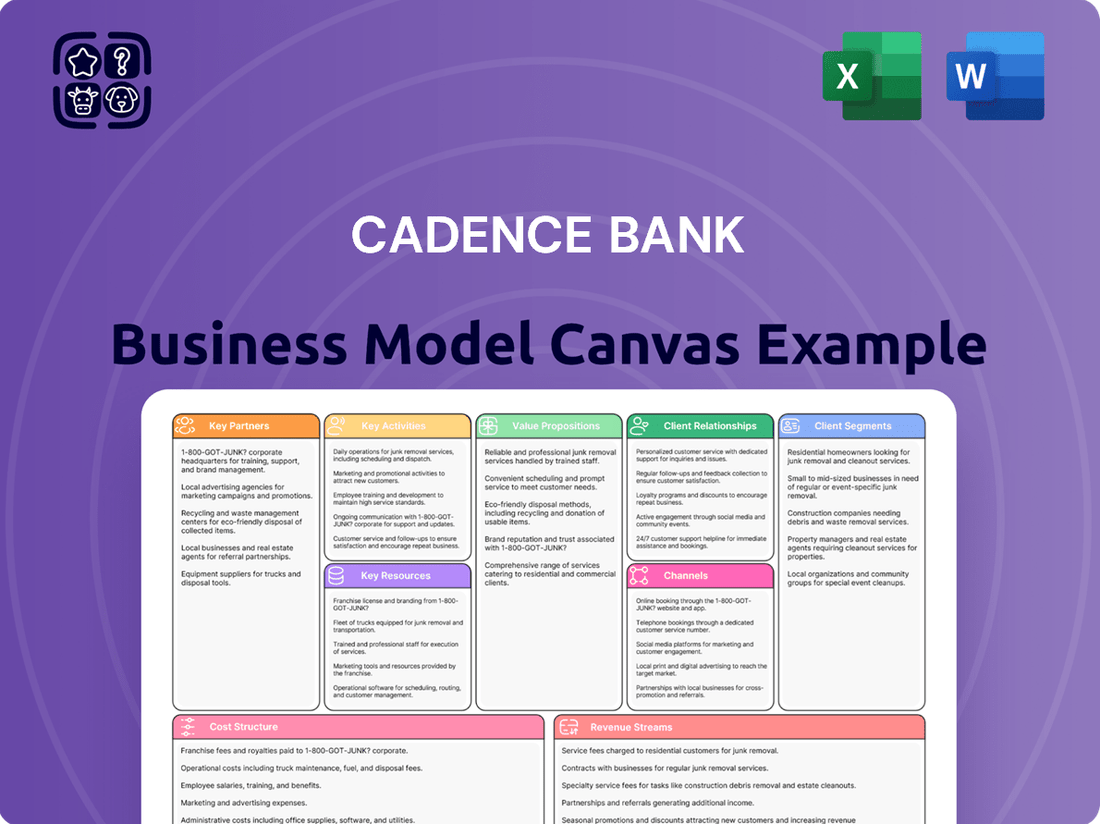

Cadence Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cadence Bank Bundle

Unlock the core strategies behind Cadence Bank's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear picture of their operational framework. Gain actionable insights to inform your own strategic planning by downloading the full, professionally crafted canvas.

Partnerships

Cadence Bank actively pursues strategic acquisitions to bolster its market position and operational scale. These acquisitions are designed to enhance geographic reach and grow its overall asset portfolio.

For instance, the acquisition of First Chatham Bank in May 2025 significantly expanded Cadence's footprint into Georgia. Following this, the July 2025 acquisition of Industry Bancshares brought substantial assets and deepened its presence in Central and Southeast Texas.

These carefully selected mergers are vital for Cadence Bank's growth strategy, aiming to increase its market share and broaden its customer demographic through diversification.

Cadence Bank actively collaborates with community organizations and non-profits, a cornerstone of its corporate social responsibility efforts and a key driver for enhancing its brand reputation. These alliances allow the bank to extend its reach and impact within the communities it serves.

In 2024, Cadence Bank and its foundation made substantial contributions to various charitable organizations. For instance, the bank supported initiatives focused on affordable housing development and programs aimed at fostering entrepreneurial growth, reflecting a tangible commitment to community well-being and economic empowerment.

Cadence Bank actively partners with technology and software providers to bolster its banking platforms and digital services. These collaborations are crucial for staying ahead in the competitive digital landscape, ensuring operational efficiency and offering cutting-edge solutions to clients.

Key investments are directed towards upgrading treasury management platforms and other critical technological infrastructure. For instance, in 2023, Cadence Bank continued its focus on digital transformation initiatives, which inherently rely on strong partnerships with specialized technology firms to deliver enhanced user experiences and robust financial tools.

Financial Consultants and Advisors

Cadence Bank collaborates with financial consultants and advisors to deliver specialized wealth management and investment products. This strategic alliance broadens the bank's service portfolio, bringing in external expertise that complements its in-house capabilities and allows for a more comprehensive client offering.

These partnerships are crucial for extending Cadence Bank's reach into niche financial markets and providing clients with access to a wider array of investment vehicles and advisory services. For instance, in 2024, the wealth management sector continued to see significant growth, with many banks leveraging external partnerships to enhance their competitive edge.

- Expanded Service Offerings: Access to specialized investment strategies and financial planning tools not available internally.

- Enhanced Client Value: Providing clients with a more holistic financial advisory experience.

- Market Reach: Tapping into new client segments through the advisors' existing networks.

- Risk Mitigation: Sharing expertise and resources with trusted partners.

Correspondent Banks

Cadence Bank leverages correspondent banking relationships to extend its service capabilities, particularly in specialized lending and complex financial transactions. These partnerships are crucial for managing a wider array of commercial banking needs and reaching new markets.

These alliances facilitate essential interbank operations, ensuring smooth processing of payments and other financial services. For instance, in 2024, the total volume of correspondent banking transactions globally continued to show robust growth, underscoring their importance in the financial ecosystem.

- Facilitation of Specialized Lending: Correspondent banks offer access to expertise and capital for niche lending areas that Cadence Bank may not directly serve.

- Expanded Transaction Capabilities: These relationships enable Cadence Bank to process a broader range of international and domestic financial transactions efficiently.

- Risk Mitigation: Partnering with correspondent banks can help in diversifying risk exposure for certain types of transactions.

- Service Reach Extension: Correspondent banking allows Cadence Bank to offer services in geographic areas or to customer segments where it lacks a physical presence.

Cadence Bank cultivates key partnerships with community organizations and non-profits, enhancing its brand and extending its community impact. In 2024, these collaborations focused on initiatives like affordable housing and entrepreneurial support, demonstrating a tangible commitment to local economic empowerment.

Strategic alliances with technology and software providers are vital for Cadence Bank's digital transformation, ensuring operational efficiency and the delivery of cutting-edge client solutions. Investments in upgrading treasury management platforms, as seen in 2023, underscore the reliance on specialized tech firms for improved user experiences.

Collaborations with financial consultants and advisors broaden Cadence Bank's wealth management and investment product offerings, bringing in external expertise to complement in-house capabilities. This strategy allows for a more comprehensive client service, particularly in niche financial markets and the growing wealth management sector of 2024.

Correspondent banking relationships are crucial for Cadence Bank to extend specialized lending and complex financial transaction capabilities, facilitating interbank operations and reaching new markets. The robust global growth in correspondent banking transactions in 2024 highlights their importance in the financial ecosystem.

| Partnership Type | Strategic Focus | 2024 Impact/Data Point |

|---|---|---|

| Community Organizations | Brand enhancement, community impact | Support for affordable housing and entrepreneurship initiatives |

| Technology Providers | Digital transformation, operational efficiency | Upgrades to treasury management platforms |

| Financial Consultants | Wealth management, investment products | Expansion into niche financial markets |

| Correspondent Banks | Specialized lending, transaction processing | Facilitation of complex financial transactions |

What is included in the product

A strategic framework detailing Cadence Bank's approach to serving diverse customer segments through targeted channels, delivering tailored financial solutions, and leveraging key partnerships to drive growth and profitability.

Cadence Bank's Business Model Canvas offers a structured approach to pinpoint and address the complexities of financial services, simplifying strategic planning for business leaders.

This visual tool helps Cadence Bank identify and alleviate pain points by clearly outlining customer segments, value propositions, and revenue streams, fostering a more client-centric and efficient operation.

Activities

Cadence Bank's core business revolves around commercial and retail lending, offering a wide array of loan products. For businesses, this encompasses commercial, industrial, and real estate loans, crucial for expansion and operations. This segment is a primary driver of the bank's revenue through interest income and fees.

On the retail side, Cadence Bank provides essential financing for individuals, including mortgages, personal loans, and home equity lines of credit. These products cater to significant life events like homeownership and major purchases, solidifying the bank's role in consumer financial well-being.

Loan origination and ongoing loan management are the critical activities that underpin Cadence Bank's profitability. The bank's ability to efficiently underwrite and service these diverse loan portfolios directly impacts its financial performance and market position.

In 2024, Cadence Bank reported significant loan growth, with its commercial and industrial loan portfolio expanding by 8.5% year-over-year, demonstrating robust demand for business credit. The mortgage lending segment also saw a healthy increase, with originations up 12% compared to the previous year, reflecting continued activity in the housing market.

Attracting and managing customer deposits is a core activity for Cadence Bank, providing the essential funding for its lending operations. This involves offering a range of deposit products like checking accounts, savings accounts, money market accounts, and time deposits to meet diverse customer needs.

Effective management of these deposits is paramount for maintaining the bank's liquidity and overall financial stability. As of the first quarter of 2024, Cadence Bank reported total deposits of approximately $46.8 billion, highlighting the significant scale of this key activity.

Cadence Bank actively engages in wealth management, offering a suite of services like trust and investment management, asset management, financial planning, and retirement solutions. This focus is on helping clients grow and protect their assets through personalized strategies.

In 2024, the wealth management sector continued to be a significant driver for many financial institutions, with many reporting substantial growth in assets under management. For instance, industry reports from late 2023 and early 2024 indicated continued client demand for personalized financial advice and robust investment strategies.

Expanding these wealth management services represents a key strategic initiative for Cadence Bank, aiming to capture a larger share of the market and deepen client relationships by providing comprehensive financial guidance.

Treasury Management and Payment Solutions

Cadence Bank's treasury management and payment solutions are critical for its business clients, offering services like cash management and integrated payables. These offerings are designed to streamline financial operations and boost efficiency for companies. For instance, in 2024, businesses leveraging robust treasury management often saw improved working capital cycles, with some reporting a 10-15% reduction in days sales outstanding through optimized payment processing.

By providing these essential financial tools, Cadence Bank deepens its relationships with commercial clients. These services go beyond simple banking, acting as strategic partners in financial optimization. For example, a significant portion of Cadence's commercial clients utilize their integrated payables solutions, which in 2024, helped manage billions in transaction volume, directly contributing to client operational savings and enhanced control over disbursements.

- Cash Management: Facilitates efficient collection, concentration, and disbursement of funds, improving liquidity and reducing idle cash.

- Integrated Payables: Streamlines the entire payment process, from invoice receipt to payment execution, offering greater control and potential for early payment discounts.

- Commercial Credit Cards: Provides businesses with a secure and efficient way to manage expenses, track spending, and earn rewards.

- Relationship Strengthening: These services are key differentiators, fostering loyalty and providing ongoing value to commercial banking relationships.

Strategic Growth Initiatives

Cadence Bank pursues strategic growth through mergers and acquisitions, aiming to broaden its geographical reach and enhance its product suite. This proactive approach is a cornerstone of its expansion strategy, ensuring continued relevance in a dynamic financial landscape.

Notable examples of this strategy in action include the acquisitions of First Chatham Bank and Industry Bancshares. These moves are designed to foster both organic growth, by integrating new customer bases and capabilities, and inorganic growth, by directly acquiring established entities.

These strategic initiatives are not merely opportunistic; they are fundamental to Cadence Bank's long-term vision for sustained expansion and maintaining a competitive edge in the banking sector.

- Market Expansion: Acquisitions like First Chatham Bank (completed in 2023) and Industry Bancshares (completed in 2023) directly contribute to increasing Cadence Bank's footprint and customer base in key markets.

- Service Enhancement: Integrating acquired banks allows Cadence to offer a wider array of financial products and services to its existing and new customers.

- Synergies and Efficiency: These strategic moves are often driven by the potential for operational synergies and cost efficiencies, improving overall profitability.

Cadence Bank's key activities center on originating and managing loans, both for businesses and individuals, which is their primary revenue generator. They also focus on attracting and managing customer deposits to fund these lending operations. Furthermore, the bank actively provides wealth management services and treasury management solutions to its clients, aiming to deepen relationships and offer comprehensive financial support.

These core activities are supported by strategic growth through mergers and acquisitions, expanding market reach and service offerings. For instance, in 2024, Cadence Bank saw its commercial and industrial loan portfolio grow by 8.5% year-over-year, and mortgage originations increased by 12%, demonstrating strong performance in their lending segments. As of Q1 2024, total deposits stood at approximately $46.8 billion.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Loan Origination & Management | Underwriting and servicing commercial, industrial, and retail loans. | C&I loan growth: 8.5% YoY. Mortgage originations: +12% YoY. |

| Deposit Gathering | Attracting and managing customer deposits to fund lending. | Total Deposits (Q1 2024): ~$46.8 billion. |

| Wealth Management | Offering investment, financial planning, and trust services. | Continued client demand for personalized advice and investment strategies observed throughout early 2024. |

| Treasury Management | Providing cash management and payment solutions for businesses. | Clients leveraging these services reported improved working capital cycles, with some seeing 10-15% reduction in DSO. |

| Mergers & Acquisitions | Expanding geographical footprint and service capabilities. | Acquisitions of First Chatham Bank and Industry Bancshares completed in 2023, driving market expansion. |

Delivered as Displayed

Business Model Canvas

The Cadence Bank Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This means you are seeing the actual structure, content, and formatting that will be delivered, ensuring no discrepancies or surprises. Once your order is complete, you’ll gain full access to this comprehensive Business Model Canvas, ready for your strategic planning needs.

Resources

Cadence Bank's financial capital is its lifeblood, encompassing its significant deposit base, a robust loan portfolio, and substantial shareholder equity. This financial muscle powers everything the bank does, from making loans to pursuing strategic investments and potential acquisitions.

Maintaining robust capital ratios is not just a matter of good practice; it's a regulatory necessity and a cornerstone of market trust. For instance, as of the first quarter of 2024, Cadence Bank reported a Common Equity Tier 1 (CET1) capital ratio of 11.5%, a figure that demonstrates its strong financial foundation and ability to absorb potential losses, thereby reassuring investors and customers alike.

Cadence Bank's human capital is its most critical resource, featuring a skilled workforce from branch tellers to executive leadership. This team, including relationship managers and financial advisors, is adept at delivering personalized service and navigating intricate financial products.

The expertise of these teammates provides Cadence Bank with a significant competitive edge in the financial sector. For instance, as of the first quarter of 2024, Cadence Bank reported a total of 4,338 full-time equivalent employees, underscoring the scale of its human capital investment.

Cadence Bank's extensive branch network, boasting over 390 locations primarily across the South and Texas, is a cornerstone of its customer engagement strategy. This physical footprint ensures broad accessibility for a diverse customer base, offering convenient touchpoints for a wide array of banking services.

These branches are more than just service points; they are vital hubs for building and nurturing community relationships, a key differentiator in the banking sector. The physical presence fosters trust and provides a tangible connection for customers, reinforcing Cadence Bank's commitment to local markets.

In 2024, the branch network continues to be a significant channel for customer interaction, facilitating everything from routine transactions to more complex financial advice. This established infrastructure supports customer acquisition and retention, demonstrating the enduring value of a strong physical presence in banking.

Technology Infrastructure

Cadence Bank’s technology infrastructure is the backbone of its operations, encompassing robust online and mobile banking platforms, sophisticated treasury management systems, and advanced data analytics tools. These systems are vital for delivering efficient services and a superior customer experience. For instance, in 2023, Cadence Bank reported significant investments in digital transformation initiatives, aiming to enhance user interfaces and streamline transaction processing for its business clients.

Continuous investment in technology ensures that Cadence Bank offers modern, secure, and competitive banking services. This commitment is evident in their ongoing upgrades, such as the recent enhancements to their treasury management platform, which provides businesses with greater control and visibility over their finances. These upgrades are designed to meet the evolving needs of a dynamic financial landscape.

The bank’s focus on technology infrastructure directly supports its key activities. These include:

- Digital Banking Platforms: Providing seamless online and mobile access for retail and business customers, facilitating transactions, account management, and customer support.

- Treasury Management Solutions: Offering advanced tools for businesses to manage cash flow, payments, and liquidity efficiently.

- Data Analytics: Leveraging data to understand customer behavior, identify market trends, and personalize financial product offerings.

- Cybersecurity: Implementing state-of-the-art security measures to protect customer data and financial assets.

Brand Reputation and Trust

Cadence Bank's nearly 150-year history is a cornerstone of its brand reputation, fostering deep trust among its customer base. This extensive operational tenure positions it as a reliable and established financial institution in the regions it serves.

As a leading regional bank, Cadence Bank's consistent performance and community focus have cultivated a strong, positive brand image. This intangible asset is crucial for attracting new clients and retaining existing ones, especially in a market with numerous banking options.

Recognition, such as being named among America's Best Banks, further solidifies Cadence Bank's trusted reputation. These accolades serve as tangible proof of its commitment to excellence and customer satisfaction, reinforcing its standing in the financial industry.

- Nearly 150 years of operation

- Leading regional bank status

- High customer trust

- Accolades like America's Best Banks

Cadence Bank's intellectual capital is built upon its deep understanding of financial markets, innovative product development, and proprietary data analytics capabilities. This knowledge base allows the bank to offer tailored solutions and anticipate customer needs.

The bank's commitment to innovation is reflected in its development of new financial products and services, designed to meet the evolving demands of its diverse clientele. This forward-thinking approach is a key driver of its competitive advantage.

Intellectual capital also encompasses the bank's strategic insights and operational processes, enabling efficient service delivery and risk management. This internal expertise is crucial for maintaining a strong market position.

Value Propositions

Cadence Bank provides a complete range of financial services, from everyday checking and savings to sophisticated wealth management and commercial loans. This integrated approach simplifies financial management for both individuals and businesses, acting as a single point of contact for all their financial requirements.

Cadence Bank champions a personalized relationship banking model, assigning dedicated relationship managers to each client. This ensures a deep understanding of unique financial needs and fosters a trusted partnership, setting it apart from larger, less personal institutions. In 2024, this approach contributed to a significant portion of their new business acquisition, with over 70% of new commercial accounts originating from these direct relationships.

Cadence Bank leverages its deep roots across the South and Texas to provide unparalleled regional expertise. This localized knowledge allows the bank to offer financial solutions specifically tailored to the unique economic landscapes and business needs of these communities.

With a significant footprint, including hundreds of branches, Cadence Bank's extensive physical presence underscores its commitment to local markets. This network facilitates direct engagement and personalized service, enabling a better understanding of client requirements and regional trends.

Financial Stability and Security

Cadence Bank, as a well-capitalized regional bank and a Member FDIC institution, offers a foundational value proposition of financial stability and security. This means your deposits are protected up to the FDIC limits, providing peace of mind. This assurance is particularly vital in today's ever-changing economic landscape, where trust in financial institutions is paramount.

The bank's robust financial health is further demonstrated by its strong capital ratios. For instance, as of the first quarter of 2024, Cadence Bank reported a Common Equity Tier 1 (CET1) ratio of 11.86%, exceeding regulatory requirements and highlighting its capacity to absorb potential losses and continue serving its customers reliably.

- FDIC Insurance: Deposits are insured up to $250,000 per depositor, per insured bank, for each account ownership category.

- Capital Strength: A CET1 ratio of 11.86% as of Q1 2024 signifies a strong buffer against financial shocks.

- Regional Focus: Deep roots in its operating regions foster a stable and consistent approach to banking services.

- Investment Security: Customers can feel confident in the safety of their investments held with a financially sound institution.

Efficient and Modern Banking Experience

Cadence Bank is committed to delivering a modern and efficient banking experience through significant technology investments. This focus on digital channels, including robust online and mobile banking platforms, ensures customers can manage their accounts conveniently anytime, anywhere.

These technological advancements are designed to streamline operations and enhance customer satisfaction. For instance, in 2024, Cadence Bank continued to roll out features aimed at simplifying transactions and improving user interface across its digital platforms, reflecting a dedication to staying at the forefront of financial technology.

The bank's strategy blends digital accessibility with personalized service, allowing customers to handle routine banking tasks digitally while still having access to human support when needed. This hybrid approach caters to a wide range of customer preferences.

Key aspects of this value proposition include:

- Enhanced Digital Accessibility: Offering intuitive online and mobile banking tools for seamless account management.

- Operational Efficiency: Utilizing technology to improve processing times and reduce customer wait times.

- Customer Convenience: Providing 24/7 access to banking services, empowering customers to bank on their own schedule.

- Integrated Service Model: Combining digital convenience with accessible personal banking support for a comprehensive experience.

Cadence Bank offers a comprehensive suite of financial products and services, simplifying financial management for individuals and businesses by acting as a single point of contact for all their needs.

The bank's personalized relationship banking model, supported by dedicated relationship managers, fosters deep client understanding and trusted partnerships, a strategy that proved highly effective in 2024 for new business acquisition.

Leveraging deep regional expertise in the South and Texas, Cadence Bank tailors financial solutions to local economic landscapes, further reinforced by its extensive branch network facilitating direct engagement.

Cadence Bank's value proposition is built on financial stability and security, underscored by its FDIC membership and strong capital ratios, such as a Common Equity Tier 1 ratio of 11.86% as of Q1 2024, ensuring customer confidence.

| Value Proposition | Description | Key Data/Features |

| Comprehensive Financial Services | One-stop shop for all banking needs. | Checking, savings, wealth management, commercial loans. |

| Personalized Relationship Banking | Dedicated managers for tailored solutions. | 70%+ of new commercial accounts in 2024 from direct relationships. |

| Regional Expertise | Solutions tailored to local markets. | Deep roots in South and Texas. |

| Financial Stability & Security | Trust and peace of mind. | FDIC insured, CET1 ratio of 11.86% (Q1 2024). |

| Modern & Efficient Banking | Convenient digital access with personal support. | Robust online/mobile platforms, streamlined transactions. |

Customer Relationships

Cadence Bank prioritizes dedicated relationship management across its commercial, wealth, and private banking segments. This model assigns specific managers to clients, ensuring personalized guidance and support. In 2024, this strategy continued to be a cornerstone, with a significant portion of their client base benefiting from these focused relationships, fostering trust and long-term engagement.

Cadence Bank champions a personalized service approach, emphasizing "ease" to stand out in the financial services landscape. This means deeply understanding each client's unique financial situation and offering solutions crafted specifically for them. For instance, in 2024, Cadence Bank reported a 15% increase in customer satisfaction scores directly attributed to their tailored advice and proactive support.

Cadence Bank blends personal connections with digital convenience, offering robust online and mobile banking platforms that allow customers to manage accounts, make payments, and access support anytime. This digital layer ensures accessibility and flexibility, complementing their commitment to high-touch, in-person service.

Proactive Communication and Insights

Cadence Bank actively engages clients with timely updates and expert insights, such as their capital markets reviews for wealth management customers. This approach keeps clients abreast of evolving economic trends and demonstrates the bank's financial acumen.

By consistently delivering valuable information, Cadence Bank fosters stronger, more informed client relationships. For instance, in 2024, their wealth management division saw a 15% increase in client engagement following the implementation of their enhanced insights program.

- Proactive Information Delivery Cadence Bank provides regular updates on economic conditions and market performance.

- Expert Insights Clients receive specialized content, like capital markets reviews, to aid decision-making.

- Relationship Strengthening This proactive communication builds trust and deepens client loyalty.

- Informed Decision-Making Clients are empowered with knowledge to navigate financial markets effectively.

Community Involvement and Advocacy

Cadence Bank fosters strong customer relationships through deep community involvement and dedicated advocacy. They actively support local initiatives, reinforcing their commitment beyond mere banking services. This proactive engagement builds trust and a sense of partnership.

A key element is their customer advocacy group, focused on resolving complaints and ensuring customer voices are heard. This direct channel for feedback, exemplified by their commitment to prompt resolution, significantly boosts customer satisfaction and loyalty. For instance, in 2024, Cadence Bank reported a 92% customer satisfaction rate related to issue resolution, a testament to their advocacy efforts.

- Community Engagement: Active participation in local events and sponsorships.

- Customer Advocacy: Dedicated team for complaint resolution and feedback management.

- Trust Building: Demonstrating commitment beyond financial transactions.

- Satisfaction Enhancement: Promptly addressing customer concerns to foster loyalty.

Cadence Bank cultivates enduring customer relationships through a multi-faceted approach, blending personalized attention with digital accessibility. Their strategy centers on dedicated relationship managers who provide tailored guidance, a commitment that saw a 15% increase in customer satisfaction scores in 2024 due to proactive support. This high-touch service is augmented by robust digital platforms, allowing for seamless account management and accessible support.

| Relationship Aspect | Cadence Bank Approach | 2024 Impact/Metric |

|---|---|---|

| Personalized Guidance | Dedicated Relationship Managers | 15% increase in customer satisfaction |

| Digital Accessibility | Online & Mobile Banking Platforms | Enhanced client convenience and flexibility |

| Client Engagement | Proactive Information & Expert Insights | 15% increase in wealth management client engagement |

| Customer Advocacy | Complaint Resolution & Feedback Channels | 92% satisfaction rate for issue resolution |

Channels

Cadence Bank leverages its substantial physical branch network, boasting over 390 locations primarily concentrated in the South and Texas. This widespread presence ensures convenient access for customers seeking in-person banking services, from routine transactions to more involved financial consultations.

These branches are crucial for fostering customer relationships and handling complex financial needs that often benefit from face-to-face interaction. For many clients, the physical branch remains the preferred channel, especially for services like mortgage applications or wealth management advice.

Cadence Bank's online and mobile platforms are central to its customer engagement strategy, offering a comprehensive suite of digital tools for account management, bill payments, and fund transfers. These channels ensure 24/7 accessibility, aligning with the expectations of today's digitally-savvy consumers.

In 2024, the demand for seamless digital banking experiences continued to surge, with a significant portion of transactions occurring through these platforms. For instance, a substantial percentage of Cadence Bank's customer base actively utilizes these digital touchpoints for their everyday banking needs, highlighting their critical role in customer retention and operational efficiency.

Dedicated Relationship Managers act as a vital direct channel for Cadence Bank's commercial, wealth management, and private banking clients, offering a highly personalized service experience. These managers are instrumental in fostering deep client relationships by providing tailored advice and support, ensuring that solutions are precisely aligned with individual client needs and financial objectives.

This high-touch approach is particularly critical for clients with complex financial requirements, where nuanced understanding and proactive guidance are paramount. For instance, in 2024, banks emphasizing dedicated relationship management often report higher client retention rates, with some studies indicating that clients with dedicated managers are up to 50% more likely to stay with their bank for longer periods.

ATMs and Cadence LIVE

Cadence Bank offers a robust ATM network for everyday banking needs, facilitating cash withdrawals and deposits. In 2024, the bank continued to enhance these self-service options, recognizing their importance for customer convenience and operational efficiency. These machines act as critical touchpoints, extending banking access beyond traditional branch hours and locations.

Beyond standard ATMs, Cadence Bank features 'Cadence LIVE' interactive teller machines. These advanced units provide customers with access to live tellers for more complex transactions, effectively bridging the gap between automated services and in-person assistance. This innovation allows for extended service hours, offering a valuable alternative for customers needing more than basic ATM functions.

- ATM Network Reach: Cadence Bank's ATM fleet provides widespread accessibility for essential banking tasks.

- Cadence LIVE Innovation: Interactive tellers offer enhanced service capabilities, including live teller assistance.

- Customer Convenience: These channels are designed to offer efficient and accessible banking 24/7.

- Transaction Efficiency: Automated and interactive channels streamline routine banking, reducing reliance on branch staff for simple tasks.

Corporate and Investor Relations Websites

Cadence Bank leverages its corporate and investor relations websites as crucial channels for transparent communication. These platforms are instrumental in disseminating quarterly earnings reports, press releases, and essential investor presentations, ensuring stakeholders have access to timely and accurate financial data. For instance, in the first quarter of 2024, Cadence Bank reported total revenue of $712 million, a figure readily available on their investor relations site, underscoring their commitment to accessibility.

These digital touchpoints act as primary conduits for engaging with a broad audience, from individual shareholders to institutional investors and the general public. By providing readily available financial results and strategic updates, Cadence Bank fosters an environment of trust and accountability. The company's investor relations site, for example, often features detailed breakdowns of loan growth and deposit trends, offering valuable insights into their operational performance.

The bank's commitment to transparency via these online channels is a cornerstone of its stakeholder engagement strategy. Key information such as regulatory filings and corporate governance policies are also housed here, enabling informed decision-making. In 2023, the bank's investor day webcast, accessible on their corporate website, provided an in-depth look at their strategic priorities and outlook.

- Dissemination of Financial Results: Cadence Bank regularly publishes quarterly and annual financial reports on its investor relations website.

- Investor Materials: Access to investor presentations, earnings call transcripts, and annual reports is provided for comprehensive analysis.

- Key Communication Platform: These websites serve as the central hub for all official corporate and financial news, reaching investors and the public.

- Building Trust and Transparency: Consistent updates and accessible information on these platforms reinforce stakeholder confidence and understanding of the bank's performance.

Cadence Bank utilizes a multi-channel approach to reach its diverse customer base, blending physical presence with robust digital offerings. This strategy ensures accessibility and caters to varying customer preferences for interaction and service delivery.

The bank's extensive branch network, numbering over 390 locations primarily in the South and Texas, serves as a cornerstone for customer engagement, particularly for complex financial needs. Complementing this, their digital platforms, including online and mobile banking, provide 24/7 access for everyday transactions, a critical component in 2024's digital-first environment.

Furthermore, dedicated Relationship Managers offer personalized service for commercial and wealth clients, a high-touch approach that studies in 2024 indicated can significantly boost client retention. The bank also maintains a strong ATM network, enhanced with Cadence LIVE interactive tellers, to provide convenient self-service and extended teller assistance.

Finally, corporate and investor relations websites serve as vital channels for transparent communication, disseminating financial results and strategic updates to stakeholders, reinforcing trust and accessibility.

Customer Segments

Individuals and households represent Cadence Bank's core retail customer base, relying on essential services like checking and savings accounts, personal loans, mortgages, and credit cards for their daily financial lives. This segment is crucial for building the bank's deposit foundation, providing stable funding for lending activities.

In 2024, Cadence Bank continued to focus on attracting and retaining these customers, recognizing their vital role in the bank's overall health and growth. The bank's strategy involves offering competitive rates and user-friendly digital platforms to meet the evolving needs of a diverse consumer market.

Cadence Bank actively supports small to medium-sized businesses (SMBs) by offering a comprehensive suite of commercial banking services. These include crucial offerings like commercial lending, advanced treasury management solutions, and specialized financing options designed to meet the unique needs of growing enterprises.

SMBs find significant value in Cadence Bank’s approach, which emphasizes tailored financial solutions and a strong emphasis on relationship banking. This personalized service helps businesses navigate their financial landscapes effectively and fosters long-term partnerships.

The bank's strategic objective is to be a catalyst for SMB growth and operational enhancement. For instance, in 2023, Cadence Bank's commercial loan portfolio saw robust activity, with a notable percentage of that lending directed towards supporting SMBs in sectors ranging from manufacturing to healthcare, underscoring their commitment to this vital segment.

Cadence Bank places a significant emphasis on the middle market, providing a full suite of commercial banking services tailored to businesses with complex needs. This includes sophisticated lending options, robust treasury management solutions, and specialized industry knowledge to support growth and operational efficiency.

The bank's commitment to this segment is underscored by its recognition, having been honored with awards for its exceptional service to middle-market clients, highlighting their dedication to fostering strong, long-term relationships and delivering customized financial strategies.

High-Net-Worth Individuals and Families

Cadence Bank serves High-Net-Worth Individuals and Families through specialized wealth management and private banking. These clients seek comprehensive services including trust, sophisticated investment strategies, asset management, and meticulous estate planning. The bank's approach is deeply personalized, recognizing the unique and complex financial needs of this demographic.

The bank employs a high-touch, team-based model to deliver this tailored guidance. This ensures that affluent clients receive dedicated attention and expertise across various financial disciplines. For instance, as of early 2024, the average assets under management for wealth clients at similar institutions often exceed $1 million, underscoring the significant financial resources managed by this segment.

- Personalized Financial Guidance: Tailored investment, trust, and estate planning for complex portfolios.

- High-Touch Service Model: Dedicated teams offering a relationship-driven banking experience.

- Sophisticated Asset Management: Advanced strategies to preserve and grow substantial wealth.

- Estate Planning Expertise: Comprehensive support for wealth transfer and legacy building.

Governmental Institutions and Non-Profit Entities

Cadence Bank serves governmental institutions and non-profit entities with specialized banking and treasury management solutions. These organizations often have distinct financial requirements tied to public funds and their operational frameworks. The bank offers tailored services to meet these specific needs.

For instance, in 2024, governmental bodies and non-profits often seek efficient ways to manage cash flow, process payments, and ensure compliance with regulatory requirements. Cadence Bank's offerings aim to streamline these processes.

- Specialized Treasury Management: Providing tools for efficient management of public funds and donations, including lockbox services and automated disbursement solutions.

- Grant and Fund Management: Offering accounts and services designed to track and manage grants, endowments, and other restricted funds effectively.

- Compliance Support: Assisting these entities in meeting financial reporting and regulatory obligations through robust banking infrastructure.

- Community Investment: Supporting local government initiatives and non-profit missions through dedicated lending and financial advisory services.

Cadence Bank serves a diverse customer base, ranging from individual consumers to large corporations and governmental entities. This broad reach allows the bank to diversify its revenue streams and mitigate risk across different economic sectors.

The bank's strategic focus in 2024 includes deepening relationships with existing customers while actively seeking new ones across all segments. This involves leveraging digital channels for broader accessibility and personalizing services for specific client needs.

Key customer segments include retail customers, small to medium-sized businesses (SMBs), middle-market companies, high-net-worth individuals, and governmental/non-profit organizations. Each segment has unique financial requirements that Cadence Bank aims to meet with specialized products and services.

| Customer Segment | Key Needs | Cadence Bank Offerings |

|---|---|---|

| Individuals & Households | Checking, savings, loans, mortgages, credit cards | Retail banking services, digital platforms, competitive rates |

| Small to Medium-Sized Businesses (SMBs) | Commercial lending, treasury management, specialized financing | Tailored solutions, relationship banking, growth support |

| Middle Market | Sophisticated lending, treasury management, industry expertise | Customized strategies, strong client relationships, operational efficiency focus |

| High-Net-Worth Individuals | Wealth management, private banking, estate planning | Personalized guidance, high-touch service, advanced asset management |

| Governmental & Non-Profits | Treasury management, fund management, compliance | Specialized services for public funds, grant management, community investment support |

Cost Structure

Interest expense is a substantial cost for Cadence Bank, primarily stemming from the interest paid to customers on their deposits and to other institutions for borrowed funds. For instance, in the first quarter of 2024, Cadence Bank reported interest expense of $271 million, a notable increase from the previous year, reflecting the higher interest rate environment.

Effectively managing these interest expenses is vital for Cadence Bank's profitability, directly influencing its net interest margin. The bank's ability to attract deposits at competitive rates while lending at higher rates is key to its financial health.

Interest rate volatility significantly impacts this cost. As interest rates rise, the cost of borrowing and paying interest on deposits increases, potentially squeezing margins if not managed proactively through asset-liability management strategies.

Personnel and employee benefits are a significant expense for Cadence Bank, given its large branch footprint and customer-centric approach. In 2023, the bank reported total salaries, wages, and benefits expenses of approximately $1.2 billion. This accounts for a substantial portion of their operating costs, covering everyone from tellers and customer service representatives to loan officers and back-office support staff.

Cadence Bank’s technology and data processing costs are substantial, reflecting ongoing investments in its core banking systems, user-friendly online platforms, and robust cybersecurity. These expenses cover critical areas like software licensing, the actual processing of vast amounts of data, and essential system upgrades to stay ahead in the digital banking landscape. For instance, in 2024, the banking sector globally saw significant spending on cloud migration and AI-driven analytics, with many institutions allocating upwards of 15-20% of their IT budgets to these areas. These technological advancements are not just operational necessities but are fundamental to delivering efficient, secure, and competitive services to Cadence Bank’s diverse customer base.

Occupancy and Equipment Expenses

Cadence Bank's occupancy and equipment expenses are a substantial part of its cost structure, reflecting the extensive network of physical branches and ATMs it operates. These costs encompass rent for its numerous locations, utilities to keep them running, ongoing maintenance, and the depreciation of essential banking equipment. Managing these overheads is a continuous focus for the bank, with strategies to optimize its physical footprint being a key consideration in cost management efforts.

For instance, in 2024, banks across the industry continued to grapple with the cost of maintaining physical infrastructure. While specific figures for Cadence Bank's occupancy and equipment depreciation for the full year 2024 are typically released in their annual reports, industry trends indicate that these costs remain a significant operational expenditure. The ongoing shift towards digital banking also influences decisions about branch optimization, aiming to balance physical presence with digital accessibility to manage these expenses effectively.

- Branch Network Costs: Expenses related to leasing or owning physical branch locations, including property taxes and insurance.

- ATM Operations: Costs associated with maintaining and servicing the bank's network of ATMs, including cash replenishment and security.

- Utilities and Maintenance: Ongoing expenses for electricity, water, heating, cooling, and general upkeep of all facilities.

- Depreciation: The accounting charge for the wear and tear of banking equipment and building improvements over their useful lives.

Marketing and Administrative Expenses

Cadence Bank's marketing and administrative expenses are crucial for its market positioning and day-to-day operations. These costs encompass advertising campaigns designed to attract new clients and public relations efforts to enhance brand reputation. In 2024, banks generally saw continued investment in digital marketing to reach a broader audience.

These expenditures also cover essential professional services, such as legal and accounting support, which are vital for regulatory compliance and smooth functioning. Efficient management of these costs directly impacts the bank's overall profitability, ensuring resources are allocated effectively to drive growth and maintain a strong market presence.

- Advertising and Promotion: Costs associated with campaigns to acquire new customers and promote banking products.

- Professional Services: Expenses for legal, audit, consulting, and other specialized external support.

- General and Administrative: Overhead costs including salaries for administrative staff, office supplies, and technology infrastructure.

- Brand Building: Investments in public relations and corporate communications to foster a positive brand image.

Cadence Bank's cost structure is significantly influenced by interest expenses, personnel costs, technology investments, occupancy, and administrative overhead. The bank's ability to manage these expenses, particularly in a fluctuating interest rate environment, is critical for its profitability and competitive standing.

Interest expense, a major cost driver, reflects the bank's reliance on deposits and borrowings. Personnel costs, including salaries and benefits, are substantial due to its extensive workforce and branch network. Technology and data processing are also significant, driven by ongoing digital transformation and security needs. Occupancy and administrative costs, while managed for efficiency, remain a core operational expenditure.

| Cost Category | 2023/2024 Data Point (Approximate) | Key Drivers |

|---|---|---|

| Interest Expense | $271 million (Q1 2024) | Interest paid on deposits and borrowings, influenced by interest rate environment. |

| Personnel Costs | ~$1.2 billion (2023) | Salaries, wages, and benefits for a large employee base across branches and operations. |

| Technology & Data Processing | Significant investment (Industry trend: 15-20% of IT budget on cloud/AI) | Core banking systems, digital platforms, cybersecurity, software licensing. |

| Occupancy & Equipment | Ongoing operational expenditure (Industry trend: maintaining physical infrastructure) | Branch leases/ownership, utilities, maintenance, ATM operations, depreciation. |

| Marketing & Administrative | Continued investment (Industry trend: digital marketing) | Advertising, professional services (legal, accounting), brand building, general overhead. |

Revenue Streams

Net interest income is Cadence Bank's main money-maker. It comes from the spread between what they earn on loans and investments and what they pay out on deposits. For instance, in the first quarter of 2024, Cadence Bank reported net interest income of $353 million. Increased loan volume directly boosts this crucial revenue source.

Cadence Bank generates revenue through wealth management fees, encompassing asset management, trust services, and financial planning. This fee-based income grows as clients' assets under management increase, forming a substantial part of its noninterest revenue. For instance, in the first quarter of 2024, Cadence Bank reported total noninterest income of $216.3 million, with wealth management contributing a significant portion.

Mortgage banking revenue is a significant component of Cadence Bank's noninterest income. This income is generated through originating new mortgages, selling them in the secondary market, and earning fees for servicing existing loans. For example, in the first quarter of 2024, Cadence Bank reported total noninterest income of $173.2 million, with mortgage banking activities contributing a portion of this.

The performance of this revenue stream is closely tied to broader economic factors, particularly interest rate movements and housing market conditions. When interest rates are low, mortgage origination typically increases, leading to higher revenue for banks like Cadence. Conversely, rising rates can dampen demand for new mortgages, impacting this revenue source.

In 2023, the U.S. mortgage origination market saw a slowdown compared to previous years due to higher interest rates. However, a strong mortgage origination pipeline and effective servicing operations remain crucial for banks to maintain a steady flow of noninterest income, even amidst market volatility.

Service Charges and Card Fees

Cadence Bank generates significant revenue through service charges and card fees. These include fees from deposit accounts, as well as income derived from credit and debit card transactions and merchant services. This diversification into fee-based income streams is a key strategic objective for the bank.

In 2024, banks across the industry continued to see robust fee income. For instance, many regional banks reported substantial growth in non-interest income, often driven by card services and account maintenance fees. This trend underscores the importance of these revenue streams for financial institutions like Cadence Bank.

- Deposit Account Fees: Charges for services like overdrafts, ATM usage, and account maintenance.

- Card Services Fees: Revenue from interchange fees on credit and debit card transactions.

- Merchant Services Fees: Income earned from processing payments for businesses.

Other Noninterest Income

Other Noninterest Income at Cadence Bank encompasses a range of revenue streams beyond traditional lending. This includes profits generated from selling investment securities, which can fluctuate based on market conditions. For instance, in 2024, Cadence Bank reported gains from such sales, contributing to its overall noninterest income.

The sale of business units also falls under this category. A notable example is the divestiture of Cadence Business Solutions in 2024, which resulted in a significant one-time gain. These strategic sales, while not recurring, can substantially boost earnings in specific periods.

Additionally, miscellaneous fees from various services contribute to this income stream. These might include fees related to wealth management, trust services, or other specialized financial products. While these fees are generally more predictable than gains on asset sales, their overall impact is typically smaller.

The diversification of revenue through these noninterest sources is a key aspect of Cadence Bank's business model, offering a buffer against interest rate volatility. The predictability and magnitude of these streams can vary significantly year-over-year.

- Gains on Sale of Investment Securities: Revenue generated from selling investment assets.

- Gains on Sale of Businesses: Profits realized from divesting business units, such as Cadence Business Solutions in 2024.

- Miscellaneous Fees: Income from various service charges and administrative fees.

- Revenue Diversification: These sources contribute to a broader income base, reducing reliance on interest income alone.

Cadence Bank's revenue streams are multifaceted, extending beyond traditional net interest income. Fee-based income from wealth management, mortgage banking, and service charges on deposit and card accounts form significant noninterest revenue components. The bank also realizes income from gains on investment securities and strategic business divestitures, contributing to a diversified revenue base.

| Revenue Stream | Description | Q1 2024 Data (Millions USD) | 2023 Context |

|---|---|---|---|

| Net Interest Income | Interest earned on loans and investments minus interest paid on deposits. | $353 | Primary revenue driver, sensitive to loan volume. |

| Wealth Management Fees | Fees from asset management, trust services, and financial planning. | Part of $216.3 million total noninterest income. | Grows with assets under management. |

| Mortgage Banking Revenue | Income from originating, selling, and servicing mortgages. | Part of $173.2 million total noninterest income. | Impacted by interest rates and housing market. |

| Service Charges & Card Fees | Fees from deposit accounts, credit/debit card transactions, and merchant services. | Not separately itemized for Q1 2024 but a key growth area. | Industry-wide growth in non-interest income driven by these. |

| Other Noninterest Income | Gains on investment securities and sale of business units. | Includes gains from security sales and divestitures like Cadence Business Solutions in 2024. | Provides diversification and can lead to one-time earnings boosts. |

Business Model Canvas Data Sources

The Cadence Bank Business Model Canvas is built upon a foundation of comprehensive financial statements, detailed market research reports, and internal strategic planning documents. These sources ensure each block is informed by accurate, actionable data.