Cadence Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cadence Bank Bundle

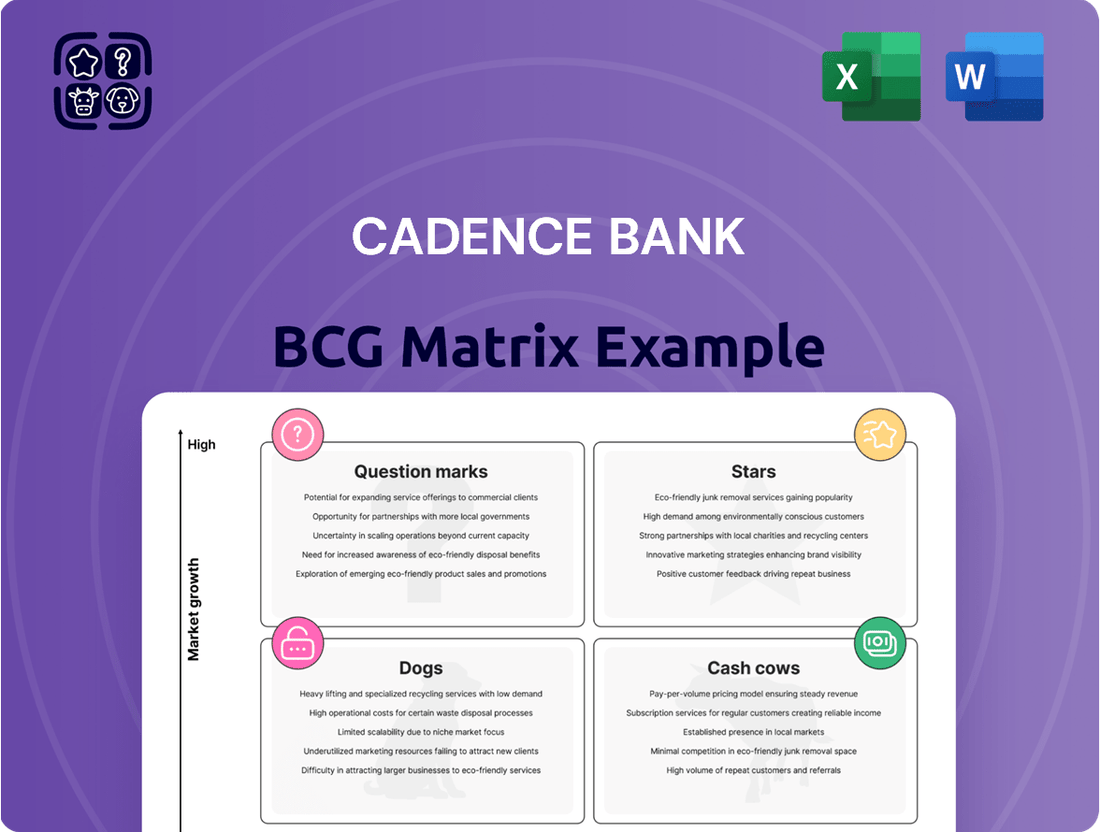

Unlock the strategic potential of Cadence Bank's product portfolio with our insightful BCG Matrix preview. See where their offerings fit as Stars, Cash Cows, Dogs, or Question Marks, and grasp the immediate implications for market share and growth.

Don't let this glimpse be your only insight; purchase the full Cadence Bank BCG Matrix report for a comprehensive analysis, including detailed quadrant placements and actionable recommendations to optimize your investment strategy and drive future success.

Stars

Cadence Bank’s commercial lending, encompassing both Commercial and Industrial (C&I) and Commercial Real Estate (CRE) loans, demonstrates robust organic growth. This strong performance in key lending areas highlights a significant market presence within expanding sectors.

The bank’s deliberate strategic emphasis on C&I and CRE, supported by consistent expansion, firmly places these segments within the Star category of the BCG Matrix. For instance, through the first quarter of 2024, Cadence Bank reported a substantial increase in its commercial loan portfolio, reflecting this strategic focus.

Cadence Bank's Mortgage and Private Banking segments are shining stars in its BCG Matrix. These areas are driving significant net loan growth, with mortgage originations showing robust activity. Private banking, in particular, is a key contributor to noninterest revenue, reflecting strong client relationships and wealth management success.

In 2024, Cadence Bank's mortgage division experienced a notable uptick in originations, contributing positively to its overall loan portfolio expansion. The private banking arm consistently delivered strong noninterest income, underscoring its role in generating fee-based revenue and deepening client engagement. These segments are clearly demonstrating high growth potential and are capturing increasing market share.

Cadence Bank's wealth management services are performing well, bolstered by favorable market trends and internal strategic adjustments. This sector is experiencing robust growth, driven by a rising need for sophisticated financial planning and investment solutions. Cadence is actively investing in this area to capture a larger share of this expanding market.

Treasury Management Solutions

Cadence Bank is strategically bolstering its treasury management services, a move reflecting significant investment in this high-value area. This focus suggests an ambition to capture a larger share of a market critical for businesses seeking efficient financial operations.

The bank's commitment to enhancing its treasury management platform is a clear indicator of its growth strategy, aiming to be a leader in this expanding sector. For businesses, this translates to access to more sophisticated tools for managing cash flow, payments, and liquidity.

- Enhanced Platform: Cadence Bank has invested in upgrading its treasury management technology.

- Market Focus: This investment highlights a strategic push into the growing treasury services market.

- Business Impact: Businesses benefit from improved tools for cash management, payments, and liquidity.

- Competitive Positioning: The bank aims for a leading position by offering robust and advanced solutions.

Strategic Acquisitions in High-Growth Markets

Cadence Bank's strategic acquisitions, like the purchase of First Chatham Bank and Industry Bancshares, are clearly designed to bolster its presence in rapidly expanding economic areas, particularly Texas and Georgia. These moves are not just about getting bigger; they're about smart growth, aiming to capture more market share in regions showing significant promise.

The financial impact of these acquisitions is anticipated to be substantial. By integrating these entities, Cadence Bank expects a meaningful boost to its earnings and a healthy increase in its loan portfolio. This strategy underscores a commitment to leveraging growth opportunities in key markets.

- Acquisition of First Chatham Bank: This move strengthened Cadence Bank's position in Georgia, a state experiencing robust economic development.

- Acquisition of Industry Bancshares: This further solidified Cadence Bank's footprint in Texas, another high-growth market with significant banking potential.

- Projected Earnings Contribution: Both acquisitions are projected to contribute positively to Cadence Bank's overall profitability.

- Loan Growth Impact: The deals are expected to drive significant loan growth, reflecting an increased capacity to serve a wider customer base in these expanding regions.

Cadence Bank's Mortgage and Private Banking segments are clearly positioned as Stars within its BCG Matrix. These areas are demonstrating high growth and strong market share, driving significant net loan growth and contributing substantially to noninterest revenue. The robust activity in mortgage originations and the success of private banking in generating fee-based income highlight their star status.

The bank's wealth management services also fall into the Star category, experiencing healthy growth fueled by market trends and strategic internal adjustments. Cadence's investment in this sector reflects its potential to capture a larger portion of the expanding market for financial planning and investment solutions.

Treasury management services are also a key Star for Cadence Bank. The bank's significant investment in enhancing its treasury management platform signals a strategic push to lead in this critical, high-value market. This focus aims to provide businesses with advanced tools for cash management, payments, and liquidity.

Cadence Bank's strategic acquisitions, such as First Chatham Bank and Industry Bancshares, are designed to bolster its presence in high-growth regions like Texas and Georgia, further solidifying its Star positioning in these markets. These moves are expected to significantly boost earnings and loan portfolio growth.

| Segment | BCG Category | Key Performance Indicators (2024 Data) | Strategic Rationale |

| Mortgage Banking | Star | Robust originations, contributing to loan portfolio expansion. | High growth potential, capturing increasing market share. |

| Private Banking | Star | Strong noninterest income generation, deep client engagement. | Key contributor to fee-based revenue, driven by wealth management success. |

| Wealth Management | Star | Experiencing robust growth driven by market trends and strategic investment. | Capturing a larger share of the expanding financial planning market. |

| Treasury Management | Star | Significant investment in platform enhancement, aiming for market leadership. | Providing advanced tools for cash management, payments, and liquidity. |

| Commercial Lending (C&I & CRE) | Star | Substantial increase in commercial loan portfolio, strong organic growth. | Strategic emphasis on expanding sectors, significant market presence. |

What is included in the product

This BCG Matrix overview for Cadence Bank analyzes its business units, highlighting which to invest in, hold, or divest based on market share and growth.

Provides a clear, visual representation of Cadence Bank's business units, easing the pain of complex portfolio analysis.

Cash Cows

Cadence Bank's core customer deposits are a prime example of a Cash Cow in the BCG Matrix. These deposits are a bedrock of its funding, exhibiting consistent growth and stability. As of the first quarter of 2024, Cadence reported total deposits of $45.2 billion, with a significant portion attributed to these core, low-cost funds.

This stable, mature funding source generates reliable cash flow for Cadence Bank. The low cost of these deposits means they contribute significantly to the bank's profitability without demanding substantial marketing expenditure. This allows Cadence to allocate capital to other strategic areas, reinforcing their Cash Cow status.

Cadence Bank's established retail banking network, boasting over 390 branches across the South and Texas, positions it firmly within the Cash Cows quadrant of the BCG Matrix. This extensive physical footprint supports a stable revenue stream from traditional products like checking and savings accounts, which typically experience low but consistent growth.

The existing Commercial & Industrial (C&I) loan portfolio at Cadence Bank, especially the mature segments with established client ties, functions as a powerful cash cow. These loans consistently generate predictable interest income, requiring minimal additional investment for growth or marketing.

As of the first quarter of 2024, Cadence Bank reported total loans of $23.2 billion, with a significant portion attributed to commercial and industrial loans. This existing portfolio provides a stable revenue stream, allowing the bank to allocate resources to other growth areas.

Fixed-Rate Loan Portfolio (Maturing)

Cadence Bank's fixed-rate loan portfolio, as it matures, represents a classic Cash Cow. As these loans reprice in the current interest rate climate, they are poised to deliver a significant boost to net interest income. This segment, while not experiencing rapid expansion, is a reliable generator of substantial cash flow as repricing takes effect.

- Net Interest Income Potential: With interest rates potentially higher, maturing fixed-rate loans can lead to increased earnings for Cadence Bank.

- Stable Cash Flow Generation: The predictable nature of loan repayments, coupled with repricing opportunities, ensures consistent cash flow.

- Portfolio Repricing: As of Q1 2024, Cadence Bank reported a net interest margin of 2.95%, indicating a favorable environment for repricing assets.

- Strategic Importance: This portfolio provides the stable financial foundation necessary to fund growth initiatives in other areas of the bank.

Card Fee and Service Charge Revenue

Card fee and service charge revenue, while not a high-growth area for Cadence Bank, functions as a stable Cash Cow. This income, derived from credit and debit card usage and other banking services, reflects the bank's established customer base and mature product offerings.

In 2024, Cadence Bank's net interest income, a key indicator of its core lending business, was substantial, underscoring the stability of its overall operations. Fee income, including service charges, complements this by providing a predictable revenue stream, even if it doesn't drive aggressive expansion.

- Stable Income Source: Card fees and service charges offer reliable revenue, supporting overall profitability.

- Mature Customer Relationships: This revenue stream is tied to established customer loyalty and consistent product usage.

- Predictable Cash Flow: The consistent nature of these fees makes them a dependable component of Cadence Bank's financial performance.

Cadence Bank's core customer deposits are a prime example of a Cash Cow in the BCG Matrix, providing stable and consistent funding. As of Q1 2024, these deposits, totaling $45.2 billion, represent a low-cost, reliable revenue generator. This mature funding source fuels profitability and allows for capital allocation to other strategic initiatives.

The bank’s established retail network, with over 390 branches, supports steady revenue from traditional accounts, reinforcing its Cash Cow status. Similarly, the existing Commercial & Industrial loan portfolio, particularly with long-standing clients, generates predictable interest income with minimal need for new investment.

Cadence Bank's fixed-rate loan portfolio, as it matures, is a significant cash cow, especially with current interest rate trends. The Q1 2024 net interest margin of 2.95% highlights the potential for increased earnings through repricing. This segment offers stable cash flow and financial bedrock for growth.

Card fee and service charge revenue, though not a high-growth area, acts as a stable cash cow for Cadence Bank. This income, derived from its established customer base, complements net interest income and provides a predictable revenue stream, contributing to overall financial stability.

| Metric | Q1 2024 Value | Implication for Cash Cows |

| Total Deposits | $45.2 billion | Core deposits are a stable, low-cost funding source. |

| Net Interest Margin | 2.95% | Favorable environment for repricing assets, boosting income from loans. |

| Total Loans | $23.2 billion | Existing loan portfolio, especially C&I, provides predictable interest income. |

Delivered as Shown

Cadence Bank BCG Matrix

The Cadence Bank BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no surprises – just a professionally designed and analysis-ready strategic tool. You'll gain access to the complete Cadence Bank BCG Matrix, ready for immediate editing, printing, or integration into your business planning and presentations. This is the actual report, crafted for strategic clarity, that will be yours to leverage for informed decision-making.

Dogs

Underperforming legacy branches, often found in stagnant or declining markets, represent a significant challenge. These locations typically exhibit low transaction volumes and disproportionately high operating costs, consuming valuable resources without generating substantial growth or market share. For instance, a 2024 analysis might reveal that certain older branches, particularly those in areas experiencing population decline, have seen their customer transaction volumes drop by over 15% year-over-year, while their operational expenses remain stubbornly high.

These branches are prime candidates for strategic review, potentially leading to optimization efforts such as consolidation, relocation to more viable areas, or even divestiture. The decision hinges on whether the cost to maintain these underperforming assets outweighs their current or potential future contribution to Cadence Bank's overall performance. In 2024, many financial institutions are actively evaluating such locations, with some reporting that closing or repurposing just 5% of their underperforming branches can free up millions in annual operating expenses.

Certain low-margin, high-maintenance customer segments, requiring a disproportionately high level of service or resources while yielding low profit margins, could be categorized as Dogs within Cadence Bank's BCG Matrix. These relationships might not be contributing positively to overall profitability, potentially even draining resources. For instance, a segment of small business clients requiring extensive personalized support and frequent transaction adjustments, while maintaining minimal account balances, could fit this description.

Before its recent technology upgrades, Cadence Bank likely operated with legacy systems that demanded significant financial outlay for maintenance. These outdated infrastructures, requiring constant upkeep, would have been a drain on resources, consuming substantial cash without contributing to market share growth or offering a competitive edge.

Non-Core or Divested Business Units (e.g., payroll processing)

Cadence Bank has strategically divested non-core business units, such as its payroll processing operations. This move aligns with the bank's focus on optimizing its portfolio and shedding assets that may have been underperforming or did not fit its long-term strategic vision. Such divestitures are common in portfolio management to enhance efficiency and concentrate resources on core revenue-generating activities.

These divested units, often classified as 'Dogs' in the BCG Matrix framework, typically exhibit low market share and low market growth. For instance, in 2024, many regional banks have been reassessing their ancillary services, with some exiting non-essential operations to streamline their business models. While specific figures for Cadence Bank's payroll processing divestiture aren't publicly detailed, similar transactions in the financial services sector often aim to improve profitability ratios and reduce operational complexity.

- Divestment of Payroll Processing: Cadence Bank has exited its payroll processing business.

- Strategic Rationale: This action is aimed at improving overall efficiency and refocusing on core banking operations.

- BCG Matrix Classification: Such units are typically categorized as 'Dogs' due to low market share and growth potential.

- Industry Trend: In 2024, financial institutions are increasingly reviewing and divesting non-core assets to enhance strategic alignment and financial performance.

Highly Criticized or Classified Loan Portfolios

While Cadence Bank has made strides in reducing criticized and classified loans, any segments that remain problematic, particularly those with dim recovery outlooks, would likely fall into the Cash Cow category of the BCG Matrix. These loans, despite their potential for future recovery, currently represent a drain on resources.

These types of loans tie up valuable capital that could be deployed in more profitable ventures. Furthermore, they demand considerable management oversight and resources, diverting attention from growth opportunities without yielding commensurate returns. For instance, as of the first quarter of 2024, Cadence Bank reported a net charge-off ratio of 0.31%, indicating a managed level of loan losses, but the focus remains on improving this further.

- Persistent criticized loans tie up capital.

- Low recovery prospects limit returns.

- Significant management attention is required.

- Net charge-off ratio for Q1 2024 was 0.31%.

Units classified as 'Dogs' under the BCG Matrix, such as Cadence Bank's divested payroll processing operations, represent businesses with low market share and low growth potential. These segments often require significant resources for maintenance without generating substantial returns. For example, in 2024, many financial institutions are shedding non-core services to improve efficiency, mirroring Cadence Bank's strategic exit from payroll processing.

The strategic divestment of these 'Dog' units allows Cadence Bank to reallocate capital and management focus toward more promising areas of its business. This pruning of underperforming assets is a common tactic in portfolio management to boost overall profitability and streamline operations. Such moves are critical for maintaining a competitive edge in the evolving financial services landscape.

The decision to divest is often driven by the high cost of maintaining these low-yield operations. In 2024, the financial sector has seen a trend of banks exiting ancillary services, with some reporting that divesting just a few underperforming units can free up millions in annual operating expenses. This focus on core strengths is vital for long-term success.

The payroll processing unit, once a part of Cadence Bank, likely exhibited characteristics of a 'Dog' by having a limited market share and minimal growth prospects in a competitive environment. This aligns with industry trends where financial institutions are increasingly streamlining their offerings to concentrate on high-margin, high-growth core banking activities.

Question Marks

Cadence Bank's emerging digital banking solutions, including its mobile app and online platforms, along with strategic fintech collaborations, are positioned as potential stars in its BCG matrix. These areas exhibit high growth potential as consumer adoption of digital financial services continues to surge. For instance, the global digital banking market was valued at approximately $20.5 billion in 2023 and is projected to reach over $50 billion by 2030, showcasing the significant opportunity.

However, these digital initiatives may currently represent question marks, requiring substantial investment to gain traction and market share against established digital players. Cadence Bank's commitment to enhancing its digital offerings, evidenced by ongoing platform development and customer experience improvements, is crucial for transforming these question marks into stars. The bank's focus on user-friendly interfaces and innovative features aims to capture a larger portion of the rapidly expanding digital banking landscape.

Cadence Bank's recent acquisitions, such as First Chatham Bank and Industry Bancshares, have opened up new geographic markets. These regions, while possessing high growth potential, currently hold a relatively small market share for Cadence. This positions them as Question Marks within the BCG matrix, requiring careful strategic planning and investment to nurture their growth and potentially elevate them to Star status.

Exploring highly specialized lending areas like renewable energy project finance or niche technology equipment financing presents a significant growth opportunity for Cadence Bank. These sectors, often characterized by complex deal structures and unique risk profiles, are experiencing rapid expansion. For instance, the global renewable energy market saw investments exceeding $1.7 trillion in 2023, a testament to its robust growth trajectory.

Developing expertise in these specialized niches requires targeted investment in talent and tailored marketing strategies. Cadence Bank's current presence in these areas is limited, meaning a strategic push is needed to capture market share. Success here hinges on building a deep understanding of the specific industries and effectively communicating the bank's capabilities to potential clients in these high-growth segments.

Innovative, Untested Product Offerings

Innovative, untested product offerings for Cadence Bank would represent potential future growth drivers, but their market acceptance and profitability are currently unknown. These could include novel digital banking solutions, specialized lending products for emerging industries, or unique investment platforms. For instance, if Cadence Bank were to launch a new AI-powered financial advisory service, its initial adoption rate would be a key indicator.

The success of these ventures hinges on significant investment in research, development, and aggressive marketing campaigns. According to industry reports from early 2024, financial institutions are allocating considerable resources to fintech innovation, with some investing upwards of 15% of their IT budgets into new digital product development. Cadence Bank's commitment to these types of products would place them in a high-risk, high-reward position.

- Emerging Digital Services: Piloting new mobile payment integrations or personalized budgeting apps.

- Niche Lending Products: Developing specialized loans for sectors like renewable energy or biotechnology.

- Investment Platform Innovations: Introducing fractional share trading or ESG-focused investment portfolios.

- Customer Acquisition Costs: High initial marketing spend to educate and attract users to these new offerings.

Expansion into New Customer Demographics

Expanding into new customer demographics, such as Gen Z or underserved small businesses, presents a prime opportunity for Cadence Bank to capture untapped market share. This strategic move aligns with a high-growth potential, mirroring the characteristics of a star or question mark in the BCG matrix depending on current market penetration. For instance, by 2024, approximately 45% of Gen Z consumers expressed a preference for digital-first banking solutions, a segment Cadence Bank could actively court with enhanced mobile offerings and specialized financial literacy tools.

However, this expansion necessitates substantial upfront investment. Cadence Bank would need to allocate significant resources towards in-depth market research to understand the unique needs and preferences of these new demographics. Product development, including the creation of tailored accounts, loan products, or advisory services, will be crucial. Furthermore, aggressive and targeted marketing campaigns will be essential to build brand awareness and attract these new customer segments.

- Targeting Gen Z: This demographic, known for its digital savviness, represents a significant growth area. In 2024, it's estimated that over 70% of Gen Z actively use mobile banking apps for their financial needs.

- Underserved Small Businesses: Focusing on niche markets or businesses in emerging sectors can unlock new revenue streams. Many small businesses, particularly those in technology or creative industries, are seeking flexible banking partners.

- Investment Requirements: Significant capital will be needed for market analysis, which can cost upwards of $50,000 to $100,000 for comprehensive studies, and for developing and marketing new digital platforms.

- Potential Market Share: Initial market share in a new demographic is typically low, often starting below 5%, but can grow substantially with successful execution of the strategy.

Cadence Bank's ventures into new, specialized lending areas, such as financing for renewable energy projects or technology equipment, represent classic Question Marks in the BCG matrix. These sectors offer substantial growth potential, with global renewable energy investments alone exceeding $1.7 trillion in 2023. However, Cadence Bank's current market share in these niches is limited, necessitating significant investment in expertise and targeted marketing to gain traction.

Similarly, innovative but unproven product offerings, like AI-driven financial advice or fractional share trading platforms, also fall into the Question Mark category. While these could be future growth drivers, their market acceptance and profitability are uncertain. Financial institutions are investing heavily in fintech innovation, with some dedicating over 15% of IT budgets to new digital products, highlighting the high-risk, high-reward nature of these ventures for Cadence Bank.

Expanding into new customer demographics, such as Gen Z or underserved small businesses, also positions Cadence Bank's efforts as Question Marks. For instance, around 45% of Gen Z consumers preferred digital-first banking in 2024. Capturing these segments requires substantial investment in market research, tailored product development, and aggressive marketing to build brand awareness and attract these new customer bases, which often start with a market share below 5%.

| Area | BCG Category | Growth Potential | Market Share | Investment Need |

| Specialized Lending (e.g., Renewables) | Question Mark | High | Low | High |

| Innovative Digital Products | Question Mark | High | Low/Untested | High |

| New Customer Demographics (e.g., Gen Z) | Question Mark | High | Low | High |

BCG Matrix Data Sources

Our Cadence Bank BCG Matrix is constructed using a blend of internal financial statements, publicly available market research, and industry-specific growth projections to offer a comprehensive view.