Bystronic PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bystronic Bundle

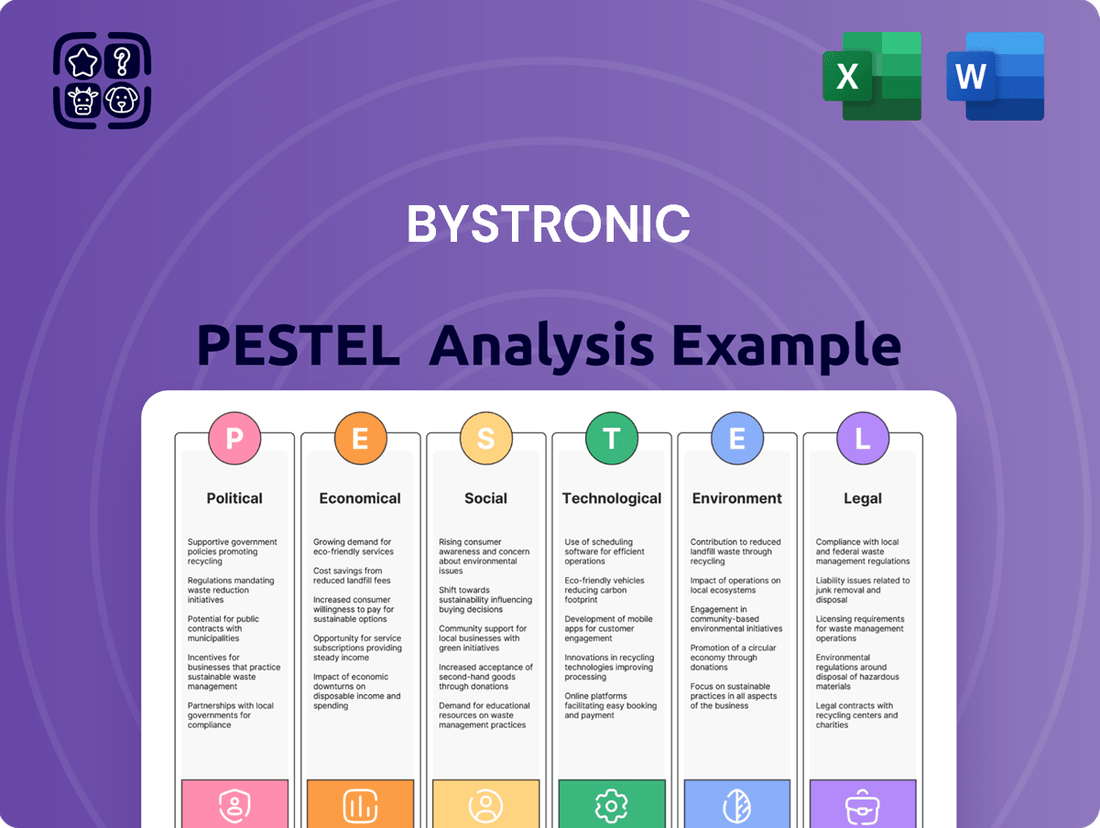

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Bystronic's future. Our meticulously researched PESTLE analysis provides the strategic intelligence you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now to gain a competitive advantage.

Political factors

Global geopolitical uncertainties and evolving trade policies, such as tariff increases by the US administration and retaliatory measures by other countries, directly impact Bystronic's international operations and supply chains. For instance, the US imposed tariffs on steel and aluminum imports in 2018, which could affect raw material costs for manufacturing. These policies can lead to increased costs and disruptions, affecting profitability and market access. The company needs to monitor and adapt to these shifts to maintain its global competitiveness.

Governments globally are actively championing Industry 4.0 and smart manufacturing, offering incentives that foster a supportive political climate for companies like Bystronic. These initiatives directly align with Bystronic's automation and integrated software offerings, positioning them favorably.

For instance, China's "Made in China 2025" initiative, a key driver for smart manufacturing adoption, has seen significant investment, creating robust demand for advanced automation solutions. This strong governmental push for digital transformation in manufacturing sectors is a critical factor for Bystronic's growth prospects in key markets.

Political stability in Bystronic's key manufacturing locations, such as Switzerland and China, directly impacts its operational continuity. For instance, Switzerland's consistent political climate fosters a reliable environment for Bystronic's advanced manufacturing. Conversely, potential policy shifts or trade disputes affecting regions like China, a significant market and production base, could introduce supply chain vulnerabilities. Bystronic's strategy to maintain a diversified global presence, with facilities in Europe, Asia, and North America, helps to buffer against localized political instability.

Industrial Policy and Reshoring Trends

Governments worldwide are increasingly emphasizing industrial policy to bolster domestic manufacturing and encourage reshoring. For instance, the United States' Inflation Reduction Act of 2022, with its significant incentives for clean energy manufacturing, signals a strong push towards onshoring critical supply chains. This focus directly impacts manufacturing investment decisions, potentially creating new markets for Bystronic in regions prioritizing local production capabilities.

This reshoring trend presents a dual-edged sword for companies like Bystronic. On one hand, it opens avenues for growth in markets actively seeking to build or expand their local manufacturing capacity, potentially increasing demand for Bystronic's advanced laser cutting and bending solutions. On the other hand, it could lead to heightened competition as more domestic players emerge and supply chain dynamics shift, requiring strategic adaptation.

- US Industrial Policy: The US government allocated over $300 billion in the Inflation Reduction Act towards boosting domestic manufacturing, particularly in green technologies, by 2030.

- Reshoring Drivers: Supply chain vulnerabilities exposed during the COVID-19 pandemic and geopolitical tensions are key drivers for reshoring initiatives globally.

- Market Impact: Increased local production mandates can lead to higher demand for automated manufacturing equipment like Bystronic's, but also attract new competitors focused on domestic markets.

- Supply Chain Evolution: Companies are re-evaluating global supply chains, with a growing preference for regionalized or localized production hubs, impacting logistics and sourcing strategies.

International Relations and Market Access

The current geopolitical climate significantly shapes Bystronic's ability to access global markets. For instance, the ongoing trade tensions between major economic blocs in 2024 and early 2025 could introduce tariffs or non-tariff barriers, impacting the cost and efficiency of Bystronic's international operations and sales. Strong diplomatic relationships, conversely, can smooth the path for market entry and expansion.

Bystronic's global footprint means it is directly exposed to shifts in international relations. As of late 2024, several regions are experiencing heightened political instability, which can disrupt supply chains and dampen demand for capital goods like Bystronic's advanced machinery. Navigating these complexities is crucial for maintaining market access and operational continuity.

- Trade Agreements: The status and evolution of international trade agreements, such as those involving the European Union and key Asian markets, directly influence Bystronic's import and export capabilities.

- Geopolitical Risk: Regions with elevated geopolitical risk, potentially including parts of Eastern Europe and the Middle East in 2024-2025, can present challenges to market penetration and investment.

- Sanctions and Embargoes: The imposition or lifting of international sanctions can create or remove significant market opportunities and operational constraints for companies like Bystronic.

- Political Stability: The overall political stability within Bystronic's key operating regions, such as Switzerland, China, and the United States, underpins consistent market access and business planning.

Governmental support for advanced manufacturing, particularly Industry 4.0 initiatives, presents significant opportunities for Bystronic. For example, by 2025, many nations are expected to have implemented or expanded programs offering tax credits and subsidies for adopting automated production technologies, directly benefiting Bystronic's automated solutions. This political push for domestic industrial growth, as seen in the US with over $300 billion allocated to boosting manufacturing by 2030, encourages reshoring and creates demand for sophisticated machinery.

Conversely, geopolitical tensions and trade policy shifts remain critical factors. Evolving trade agreements and potential tariffs between major economic blocs in 2024-2025 can impact Bystronic's global supply chains and market access, increasing operational costs. Political instability in key operating regions also poses risks, necessitating a diversified global presence to mitigate disruptions and ensure consistent market access.

| Political Factor | Impact on Bystronic | Example/Data Point (2024-2025 focus) |

| Industry 4.0 Promotion | Increased demand for automation and smart manufacturing solutions | Governmental incentives for adopting advanced manufacturing technologies are expected to grow, with many countries enhancing tax credits and subsidies for automation adoption by 2025. |

| Reshoring Initiatives | Opportunities in markets building local production capacity | US Inflation Reduction Act (2022) allocates over $300 billion to boost domestic manufacturing, signaling a trend that could increase demand for Bystronic's equipment in North America. |

| Geopolitical Tensions/Trade Policy | Supply chain disruptions and increased operational costs | Ongoing trade disputes between major economic blocs in 2024-2025 may lead to tariffs and non-tariff barriers affecting Bystronic's international sales and logistics. |

| Political Stability | Operational continuity and market access | Political stability in Switzerland, China, and the US is crucial; instability in any key region could disrupt operations and dampen demand for capital goods. |

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Bystronic, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to guide strategic decision-making and identify potential opportunities and threats within its operating landscape.

A clear, actionable summary of Bystronic's PESTLE factors, enabling teams to quickly identify and address external threats and opportunities, thus alleviating strategic planning anxieties.

Economic factors

The pace of global economic recovery directly impacts the demand for Bystronic's advanced manufacturing equipment. A robust recovery typically fuels increased investment in production capacity, boosting sales of laser cutting systems and press brakes. However, a hesitant recovery can dampen this enthusiasm, as businesses become more cautious about capital expenditures.

Geopolitical tensions and economic uncertainties have created a challenging environment, affecting market demand for capital goods. For Bystronic, this translated into a noticeable impact on net sales during the first half of 2025. Despite these headwinds, there are encouraging signs of stabilization in order intake, suggesting a potential shift in market sentiment.

The investment climate within the manufacturing sector, especially in key areas like automotive, aerospace, and construction, significantly influences Bystronic's sales performance. These industries are major consumers of advanced metal processing machinery.

While the industrial automation market faced a general slowdown through 2024 and into early 2025, a projected rebound is expected. This resurgence is largely fueled by ongoing innovation and the widespread adoption of digital transformation strategies across manufacturing.

This anticipated recovery in industrial automation, driven by technological advancements, is poised to positively impact Bystronic's future order intake and overall market position.

Currency fluctuations are a significant concern for Bystronic. As a global player, the company's profitability is directly influenced by exchange rate movements, especially the strength of the Swiss franc. This impacts how much revenue is reported from sales in other currencies and the cost of parts sourced internationally.

For instance, in 2023, the Swiss franc remained relatively strong against major currencies. This can make Bystronic's products more expensive for customers in countries with weaker currencies, potentially dampening demand. Conversely, a weaker franc could boost reported profits from foreign sales.

Managing this currency risk is an ongoing effort for Bystronic. The company likely employs various hedging strategies to mitigate the impact of volatile exchange rates on its financial performance, aiming to stabilize earnings amidst global economic shifts.

Cost of Raw Materials and Supply Chain Resilience

The cost of raw materials like steel and aluminum significantly impacts Bystronic's manufacturing expenses. For instance, global steel prices saw considerable fluctuations in late 2023 and early 2024, with some benchmarks showing year-on-year increases of over 10% depending on the specific grade and region, directly affecting Bystronic's cost of goods sold.

Supply chain disruptions and the move towards nearshoring present a dual-edged sword. While nearshoring can reduce lead times and enhance resilience, it may also initially increase production costs due to potentially higher labor or setup expenses in new locations. For example, a report from late 2024 indicated that companies actively diversifying their supply chains experienced an average increase in logistics costs by 5-8% in the short term, even as they aimed for long-term stability.

Bystronic's ability to navigate these economic factors hinges on strategic sourcing and robust supply chain management. The company's focus on operational efficiency and supplier relationships is crucial for mitigating the impact of raw material price volatility and adapting to evolving global trade dynamics.

- Raw Material Price Volatility: Global steel prices, a key input for Bystronic, experienced upward pressure in late 2023 and early 2024, with some indices rising by more than 10% year-on-year, directly impacting production costs.

- Supply Chain Transformation: Trends like nearshoring, while beneficial for long-term resilience, can introduce short-term cost increases, with logistics expenses potentially rising by 5-8% for companies undergoing such shifts, as observed in 2024.

- Cost-Effectiveness and Stability: Bystronic's strategic sourcing and supply chain management are vital for maintaining competitive pricing and operational continuity amidst these economic shifts.

Operating Result and Cost Savings

Bystronic's financial performance through early 2025 has been shaped by a demanding market. The company reported an operating loss, underscoring the headwinds faced. This situation prompted decisive action.

To counter these challenges, Bystronic initiated a significant restructuring program in autumn 2024. This strategic move was designed to enhance operational efficiency and reduce expenses. The impact of these measures is already becoming evident.

The cost savings realized from the restructuring have positively influenced the operating result. This turnaround signals a commitment to navigating economic difficulties through disciplined cost management and operational improvements. The company is actively working to strengthen its financial position.

- 2024 Operating Result: Marked by an operating loss due to market pressures.

- Restructuring Initiation: Autumn 2024 saw the commencement of a key efficiency program.

- Cost Savings: Significant reductions achieved, directly impacting profitability.

- Improved Operating Result: Demonstrates the positive effect of cost-saving measures.

Global economic recovery pace directly influences demand for Bystronic's advanced manufacturing equipment, with robust growth stimulating investment in production capacity. Geopolitical tensions and economic uncertainties have impacted Bystronic's net sales in early 2025, though order intake shows signs of stabilization.

Currency fluctuations, particularly the strength of the Swiss franc, significantly affect Bystronic's profitability and product pricing for international customers. Raw material price volatility, such as steel and aluminum, also directly impacts manufacturing expenses and cost of goods sold.

Bystronic initiated a restructuring program in autumn 2024 to enhance operational efficiency and reduce expenses, which has positively impacted its operating result through cost savings.

| Economic Factor | Impact on Bystronic | Data/Observation (2023-2025) |

|---|---|---|

| Global Economic Recovery | Demand for capital goods | Hesitant recovery in early 2025 impacting capital expenditure. |

| Geopolitical Tensions | Market demand for capital goods | Noticeable impact on net sales (H1 2025), but order intake stabilizing. |

| Currency Exchange Rates (CHF) | Profitability, product pricing | Strong CHF in 2023 made products more expensive internationally. |

| Raw Material Prices (Steel) | Manufacturing costs | Prices rose over 10% year-on-year in late 2023/early 2024. |

| Restructuring Program | Operational efficiency, costs | Initiated autumn 2024; led to cost savings and improved operating result. |

What You See Is What You Get

Bystronic PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Bystronic offers a deep dive into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

The ongoing global shortage of skilled manufacturing labor is a critical sociological challenge. This scarcity directly fuels demand for automated solutions, positioning companies like Bystronic to benefit as businesses increasingly turn to technology to overcome labor deficits and boost output. For instance, in 2024, reports indicated that over 60% of manufacturers in the US were experiencing difficulties finding qualified workers.

To capitalize on this trend, Bystronic must actively engage in workforce development. This includes investing in training programs to upskill existing employees and attract new talent capable of operating and maintaining advanced automation systems. Successful adoption of Bystronic's cutting-edge technology hinges on a technically proficient workforce, ensuring that the benefits of automation are fully realized by their clients.

Customers increasingly expect highly personalized products, driving the need for manufacturers to offer greater customization. This shift means production lines must be agile enough to handle diverse specifications efficiently. For instance, the global market for mass customization is projected to reach $130 billion by 2025, highlighting this significant trend.

This demand for personalization directly influences the adoption of advanced manufacturing technologies. Companies like Bystronic, which provide solutions for optimizing material and data flow, are well-positioned to support manufacturers in adapting to these evolving customer expectations. Their automated systems enable quicker changeovers between product variants, a crucial capability in today's market.

As automation advances, workplace safety in manufacturing settings is paramount, especially with the rise of human-robot collaboration. Bystronic's solutions must prioritize intuitive design and robust safety features to ensure workers feel secure and can effectively partner with automated systems. For instance, in 2024, the International Federation of Robotics reported a significant increase in collaborative robot (cobot) installations, highlighting the growing need for safe integration.

Attraction and Retention of Talent

Attracting and keeping skilled workers, particularly in fields like high-tech manufacturing, software, and customer support, is crucial for Bystronic's ongoing success. As of late 2024, the demand for specialized manufacturing talent remains high globally, with reports indicating a significant skills gap in advanced automation roles.

Bystronic's commitment to smart manufacturing and cutting-edge technology positions it favorably to draw in top talent. For instance, in 2024, companies showcasing innovation in Industry 4.0 solutions reported a 15% higher applicant conversion rate for technical positions compared to those with less advanced operations.

- Global demand for advanced manufacturing skills continues to outpace supply in 2024.

- Bystronic's technological leadership is a key differentiator in attracting tech-savvy professionals.

- Companies investing in digital transformation are seeing improved recruitment outcomes for specialized roles.

- Retention strategies often focus on opportunities for professional development in emerging technologies.

Social Acceptance of Automation

Societal acceptance of automation is a key factor for Bystronic. Growing public acceptance of automation in manufacturing, driven by efficiency gains, is generally positive. However, concerns about job displacement remain a significant consideration. For instance, a 2024 survey indicated that while 65% of consumers believe automation improves product quality, 40% expressed worry about its impact on employment in their local communities.

Bystronic must navigate these perceptions by highlighting how its solutions augment human workers rather than simply replace them. Initiatives focusing on reskilling and upskilling the workforce are crucial. The company's commitment to developing user-friendly interfaces and collaborative robot systems can help foster this acceptance. By demonstrating how automation enhances productivity and creates new, higher-skilled roles, Bystronic can mitigate negative public sentiment.

- Increased Automation Acceptance: Public perception increasingly favors automation for efficiency and quality improvements.

- Job Displacement Concerns: A significant portion of the public still worries about automation's impact on employment.

- Reskilling Initiatives: Companies like Bystronic need to invest in training programs to address skill gaps created by automation.

- Augmented Workforce: Emphasizing how technology complements human capabilities is vital for broader social acceptance.

The global manufacturing sector continues to grapple with a significant shortage of skilled labor, a trend that intensified in 2024. This scarcity directly boosts the demand for automated solutions, positioning companies like Bystronic to thrive as businesses seek technological answers to workforce deficits and production bottlenecks. For example, a late 2024 industry report found that over 60% of manufacturers surveyed were struggling to find qualified personnel.

Customer expectations for highly personalized products are also on the rise, necessitating more agile and adaptable production lines. The market for mass customization was projected to reach $130 billion by 2025, underscoring this critical shift. Bystronic's solutions, which optimize material and data flow, are instrumental in helping manufacturers meet these diverse specification demands efficiently.

Societal acceptance of automation presents a nuanced landscape for Bystronic. While efficiency gains are widely acknowledged, with a 2024 survey showing 65% of consumers believing automation improves product quality, concerns about job displacement persist. Approximately 40% of those surveyed expressed anxiety about automation's impact on local employment, highlighting the need for clear communication about augmented workforces.

| Sociological Factor | Impact on Bystronic | Supporting Data (2024/2025) |

|---|---|---|

| Skilled Labor Shortage | Increased demand for automation solutions | >60% of US manufacturers reported difficulty finding qualified workers in 2024. |

| Demand for Personalization | Need for agile, customizable production | Global mass customization market projected to reach $130 billion by 2025. |

| Societal Acceptance of Automation | Opportunity to highlight augmented workforce, mitigate job displacement fears | 65% of consumers see automation improving product quality; 40% worry about job impact (2024 survey). |

Technological factors

Bystronic benefits from ongoing improvements in laser cutting, such as ultra-high power fiber lasers and enhanced precision. These advancements translate to faster, more accurate, and energy-efficient material processing, directly boosting Bystronic's product capabilities.

The integration of hybrid laser systems, which combine laser and mechanical processing, further expands the application scope and efficiency for Bystronic's customers. This innovation allows for more complex cuts and improved material utilization.

Press brake technology is also seeing significant evolution, with advancements in automation, bending speed, and user-friendliness. Bystronic's investment in these areas ensures their machines remain competitive, offering greater throughput and reduced setup times for manufacturers.

The integration of AI, IoT, and smart manufacturing is revolutionizing the metal fabrication industry, with companies like Bystronic at the forefront. The widespread adoption of these technologies allows for real-time data monitoring, predictive maintenance, and significant optimization of production processes. For instance, the global smart manufacturing market was valued at approximately $257.7 billion in 2023 and is projected to reach $795.7 billion by 2030, demonstrating a strong growth trajectory.

The increasing adoption of automation and robotics is a major technological shift in sheet metal processing. Bystronic is at the forefront, integrating robotic systems with their laser cutting and bending machines to create highly automated solutions. This trend is driven by the industry's need for greater efficiency and fully automated value chains.

For instance, in 2023, the global industrial robotics market was valued at approximately $60 billion, with significant growth expected in manufacturing sectors like sheet metal fabrication. Bystronic's automated bending cells and material handling systems directly address this demand, enabling customers to achieve higher throughput and reduced labor costs.

Software and Digitalization of the Workflow

Bystronic is heavily investing in advanced software and digital tools to streamline its customers' entire workflow. This focus on digitalization aims to improve efficiency and reduce waste across the material and data handling process. For instance, the company's BySoft Suite offers integrated solutions for design, planning, and production management.

The integration of cloud-based platforms and AI-powered optimization is a key technological driver for Bystronic. These advancements allow for seamless data flow from CAD/CAM systems directly to the machinery, enhancing production planning and real-time decision-making. This digital transformation is crucial for staying competitive in the evolving manufacturing landscape.

- BySoft Suite: Bystronic's integrated software platform for design, planning, and production.

- Cloud Integration: Enabling seamless data access and collaboration across the production chain.

- AI-Powered Optimization: Enhancing efficiency, reducing scrap, and improving output quality.

- Digital Workflow: Aiming for a fully digitized material and data flow from order to finished product.

Digital Twin Technology and Predictive Maintenance

Digital twin technology is rapidly advancing, enabling complex simulations and predictive maintenance. This allows companies to virtually replicate physical assets, testing scenarios and anticipating potential failures before they occur. For Bystronic, this means developing more intelligent machinery that can proactively alert users to maintenance needs, thereby minimizing costly downtime.

The adoption of digital twins is projected to grow significantly. For instance, the global digital twin market was valued at approximately USD 6.7 billion in 2023 and is expected to reach USD 65.9 billion by 2030, growing at a CAGR of 38.4% during the forecast period. This growth underscores the increasing demand for solutions that enhance operational efficiency and reduce risk.

Bystronic can harness this trend to offer enhanced services, such as remote diagnostics and performance optimization based on real-time data from digital twins. This capability directly translates to improved customer satisfaction by ensuring their Bystronic machines operate at peak performance, reducing unexpected interruptions and maximizing their production output.

- Digital twins enable intricate simulations for product design and testing.

- Predictive maintenance powered by digital twins reduces operational downtime.

- The global digital twin market is experiencing substantial growth, projected to exceed USD 65 billion by 2030.

- Bystronic can leverage this technology to offer advanced, proactive service solutions to its customers.

Technological advancements in laser cutting, such as ultra-high power fiber lasers, are enhancing Bystronic's product capabilities by enabling faster, more accurate, and energy-efficient material processing. The company is also integrating hybrid laser systems, which combine laser and mechanical processing, to broaden application scope and improve material utilization for its clients.

The sheet metal fabrication industry is experiencing a significant shift towards automation and robotics, with Bystronic leading the integration of robotic systems into their laser cutting and bending machines. This trend is fueled by the industry's pursuit of greater efficiency and fully automated value chains, addressing the need for reduced labor costs and higher throughput.

Bystronic is also heavily invested in digital transformation, focusing on advanced software and cloud-based platforms powered by AI. This strategy aims to streamline customer workflows, enabling seamless data flow from design to production and facilitating real-time decision-making, which is critical for maintaining a competitive edge in the evolving manufacturing landscape.

Digital twin technology is another key area of focus, allowing for complex simulations and predictive maintenance to minimize downtime. With the global digital twin market projected to reach over $65 billion by 2030, Bystronic is positioned to offer enhanced services like remote diagnostics, ensuring optimal machine performance and customer satisfaction.

Legal factors

Environmental regulations are tightening globally, impacting manufacturing sectors like Bystronic's. For instance, the EU's Green Deal aims for climate neutrality by 2050, necessitating significant shifts in industrial practices. This means Bystronic and its clients must adapt to stricter rules on emissions, waste reduction, and energy consumption, potentially increasing operational costs but also driving innovation in sustainable technologies.

Compliance with standards such as ISO 14001 for environmental management and ISO 50001 for energy management is increasingly becoming a prerequisite for market access and customer trust. Furthermore, the scrutiny of substances like per- and polyfluoroalkyl substances (PFAS) is intensifying, requiring manufacturers to re-evaluate material sourcing and product design to eliminate or minimize their use, a challenge Bystronic is actively addressing in its product development.

Bystronic's sophisticated machinery, like their advanced laser cutting systems and press brakes, must meet rigorous product safety and certification standards across diverse global markets. This necessitates strict adherence to directives such as the EU Machinery Directive, ensuring electrical safety in line with IEC standards, and obtaining any specific industry certifications crucial for market entry and customer confidence.

Protecting intellectual property rights, including patents for its cutting-edge laser and automation technologies, trademarks for its brand, and software copyrights, is paramount for Bystronic's continued competitive edge. Global variations in intellectual property laws necessitate a dynamic and comprehensive strategy to shield its proprietary solutions from infringement and maintain market leadership.

Data Privacy and Cybersecurity Regulations

As Bystronic enhances its digital offerings, including IoT and cloud solutions, navigating complex data privacy laws like the GDPR is crucial. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to €20 million or 4% of global annual turnover, whichever is higher. This necessitates stringent data protection protocols and transparent data handling practices.

Cybersecurity is equally vital, with increasing interconnectedness creating new vulnerabilities. The global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the financial and operational risks associated with security breaches. Bystronic must invest in advanced cybersecurity measures to safeguard its intellectual property and customer data, ensuring the integrity of its smart factory solutions.

- GDPR Fines: Up to 4% of global annual turnover or €20 million.

- Global Cybercrime Costs: Projected to reach $10.5 trillion annually by 2025.

- Data Breach Impact: Significant reputational damage and loss of customer trust.

International Trade Laws and Tariffs

International trade laws and tariffs significantly influence Bystronic's global operations. For instance, the United States imposed tariffs on steel and aluminum imports, which can increase raw material costs for Bystronic's manufacturing facilities or finished goods imported into the US. Navigating these varying international trade regulations, including customs procedures and the terms of free trade agreements, is crucial for managing expenses and ensuring efficient cross-border movement of products and components.

Bystronic must stay abreast of evolving trade policies to mitigate potential disruptions and optimize its supply chain. For example, changes in import duties or export restrictions in key markets like the European Union or China could directly impact Bystronic's profitability and market access.

- Tariff Impact: Tariffs on key materials like steel can increase production costs for Bystronic's machinery. For example, a 25% tariff on imported steel could add millions to the cost of goods sold if not adequately hedged or passed on.

- Trade Agreements: Bystronic benefits from trade agreements that reduce or eliminate tariffs between countries, facilitating smoother import and export of components and finished machines.

- Regulatory Compliance: Adherence to diverse international trade laws, including export controls and sanctions, is essential to avoid penalties and maintain market access.

Legal frameworks surrounding product safety and compliance are critical for Bystronic's global operations. Adherence to directives like the EU Machinery Directive and standards from bodies such as the International Electrotechnical Commission (IEC) ensures their advanced machinery, including laser cutting and bending solutions, meets rigorous safety requirements in diverse markets. This commitment to compliance underpins market access and customer trust.

Intellectual property protection is a cornerstone of Bystronic's competitive strategy, safeguarding patents for their innovative laser and automation technologies, trademarks, and software. Navigating the varying landscape of global intellectual property laws is essential to prevent infringement and maintain their technological leadership.

Data privacy regulations, such as the General Data Protection Regulation (GDPR), impose significant obligations on Bystronic's digital offerings, including IoT and cloud solutions. Non-compliance can lead to substantial fines, with GDPR penalties potentially reaching up to 4% of global annual turnover or €20 million, emphasizing the need for robust data protection protocols.

Cybersecurity is paramount, with the global cost of cybercrime projected to reach $10.5 trillion annually by 2025. Bystronic must implement advanced security measures to protect its intellectual property and customer data, ensuring the integrity of its smart factory solutions against increasing digital threats.

Environmental factors

The global imperative to slash carbon emissions and achieve net-zero targets is reshaping the manufacturing landscape, directly influencing companies like Bystronic. This shift necessitates a fundamental re-evaluation of operational practices and product lifecycles.

Bystronic is demonstrating a strong commitment to this transition, actively working to decrease its Scope 1, 2, and 3 carbon emissions. The company has established concrete targets for 2030, underscoring its dedication to a sustainable future. For instance, in 2023, Bystronic reported a 15% reduction in Scope 1 and 2 emissions compared to their 2021 baseline.

Moreover, Bystronic is proactively driving decarbonization within the sheet metal processing sector. They are achieving this by developing and promoting energy-efficient machinery and integrating eco-design principles into their product development, aiming to minimize environmental impact throughout the value chain.

Bystronic is deeply committed to enhancing energy and resource efficiency across its product lines. This focus translates into developing machinery that consumes less power, a critical consideration given rising global energy costs. For instance, their cutting and bending solutions are engineered for optimized energy usage, aiming to reduce the operational footprint for their clients.

Furthermore, Bystronic leverages advanced software to minimize material waste, ensuring that customers get the most out of every sheet metal input. This not only benefits the environment by reducing scrap but also directly impacts customer profitability. The company is also actively exploring the use of materials that require less energy to process, aligning with broader sustainability trends in manufacturing.

Bystronic is increasingly focused on waste reduction, integrating circular economy principles into its operations. This includes robust recycling programs, the reuse of spare parts, and the refurbishment of existing machinery to extend their lifespan. Optimizing material utilization within their production processes is also a key strategy.

The company has set an ambitious target to reduce its overall waste generation by 20% by the year 2030. This initiative directly supports the growing global movement and industry-wide shift towards more sustainable, circular economic models, reflecting a commitment to environmental responsibility.

Sustainable Product Design and Lifecycle Management

Integrating eco-design principles into product development is a crucial environmental factor for companies like Bystronic. This involves considering the environmental impact from the initial concept stage, aiming to minimize resource consumption and waste generation. For instance, Bystronic's focus on modular design allows for easier upgrades and repairs, directly contributing to extending the product's service life. This approach not only benefits the environment but also offers economic advantages to customers by reducing the need for premature replacements.

Designing for recyclability is another key environmental consideration. Bystronic's efforts in this area mean that at the end of a machine's operational life, its components can be more easily disassembled and recycled. This circular economy approach helps in recovering valuable materials and reducing the amount of waste sent to landfills. The company's commitment to these practices directly addresses growing regulatory pressures and customer demand for more sustainable manufacturing solutions.

Bystronic's dedication to sustainable product design and lifecycle management is reflected in their efforts to reduce their overall environmental footprint. This commitment is increasingly important in the manufacturing sector, where companies are expected to demonstrate tangible progress in sustainability. For example, by 2023, many industrial equipment manufacturers reported significant reductions in energy consumption for their new product lines due to improved design efficiencies.

Key aspects of Bystronic's environmental strategy include:

- Eco-design integration: Embedding environmental considerations into the earliest stages of product conception and development.

- Extended service life: Designing machines for durability, repairability, and modular upgrades to prolong their operational lifespan.

- Recyclability focus: Engineering products with materials and construction methods that facilitate easier disassembly and recycling at end-of-life.

- Reduced footprint: Actively working to minimize resource use, emissions, and waste throughout the entire product lifecycle.

Water Management and Pollution Control

While carbon emissions often take center stage, Bystronic must also focus on responsible water management and pollution control. This is especially true for industries like metal finishing, which can generate wastewater. Ensuring operations and products minimize environmental pollution is a key responsibility.

For instance, in 2024, the European Union's Water Framework Directive continues to set stringent standards for water quality. Companies like Bystronic are expected to adhere to these regulations, which often involve treating wastewater to remove harmful substances before discharge. Failure to comply can result in significant fines and reputational damage.

- Regulatory Compliance: Adhering to evolving water quality standards, such as those set by the EU's Water Framework Directive, is crucial for Bystronic.

- Wastewater Treatment: Implementing effective wastewater treatment processes for metal finishing operations is necessary to prevent pollution.

- Sustainable Practices: Bystronic's commitment to minimizing environmental impact includes responsible water usage and discharge management across its value chain.

- Industry Benchmarking: In 2025, industry leaders are increasingly adopting advanced water recycling technologies, aiming to reduce freshwater intake by up to 30% in manufacturing processes.

Bystronic is actively addressing environmental concerns by focusing on carbon emission reduction and resource efficiency. The company aims to cut its Scope 1, 2, and 3 emissions, with a 15% reduction in Scope 1 and 2 achieved by 2023 compared to a 2021 baseline.

Their product development emphasizes energy-efficient machinery and eco-design principles, including modularity for extended service life and recyclability. Bystronic also targets a 20% waste reduction by 2030, integrating circular economy practices like recycling and refurbishment.

Responsible water management and pollution control are also critical, with adherence to regulations like the EU's Water Framework Directive. By 2025, industry leaders are adopting water recycling technologies, aiming for up to a 30% reduction in freshwater intake.

| Environmental Factor | Bystronic's Action/Target | Relevant Data/Year |

|---|---|---|

| Carbon Emissions Reduction | Reduce Scope 1, 2, & 3 emissions | 15% reduction in Scope 1 & 2 by 2023 (vs. 2021 baseline) |

| Resource Efficiency | Develop energy-efficient machinery | Optimized energy usage in cutting and bending solutions |

| Waste Reduction | Integrate circular economy principles | Target: 20% waste reduction by 2030 |

| Water Management | Adhere to water quality standards | Compliance with EU Water Framework Directive; industry trend: up to 30% freshwater reduction via recycling by 2025 |

PESTLE Analysis Data Sources

Our PESTLE analysis for Bystronic is built on a robust foundation of data from key industry associations, financial market reports, and technological innovation trackers. We meticulously gather insights on political stability, economic forecasts, and evolving social trends to provide a comprehensive view.