Bystronic Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bystronic Bundle

Bystronic operates in a landscape shaped by intense rivalry, significant buyer power, and the looming threat of substitutes. Understanding these forces is crucial for navigating the sheet metal processing industry effectively.

The complete report reveals the real forces shaping Bystronic’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Bystronic's reliance on highly specialized components for its advanced laser cutting systems and press brakes means suppliers of these niche parts can wield considerable bargaining power. The limited number of manufacturers capable of producing these critical technologies creates a scenario where fewer alternatives exist for Bystronic, potentially driving up costs or dictating less favorable terms.

Switching suppliers for Bystronic's complex machinery components, like laser cutting systems, involves significant costs. These include expenses for re-engineering, rigorous testing, and the lengthy process of qualifying new suppliers and their parts. For instance, a single component change could necessitate months of validation to ensure it meets Bystronic's high-performance standards.

These substantial switching costs inherently limit Bystronic's flexibility. The financial and operational hurdles associated with changing suppliers often outweigh the potential benefits of seeking lower-priced alternatives. This dynamic directly amplifies the bargaining power of Bystronic's existing suppliers, as the risk and investment required for Bystronic to switch are considerable.

Furthermore, the increasing integration of software and specialized services within Bystronic's advanced machinery creates even deeper ties to specific vendors. This technological interdependence makes it more challenging and costly for Bystronic to decouple from its current hardware and software providers, thereby further solidifying supplier power.

Suppliers of highly specialized or proprietary technology represent a potential threat if they decide to integrate forward and enter Bystronic's market as direct competitors. This is particularly true for those with strong research and development capabilities and a deep understanding of the downstream customer needs. For instance, a supplier of advanced laser cutting components with unique patented technology might consider this move if the high-end sheet metal processing market shows substantial growth and their component is critical to a superior product offering.

Uniqueness of Input and Supplier Reputation

The uniqueness and performance of Bystronic's inputs, like specialized laser sources and sophisticated control systems, are critical to the quality and precision of its offerings. Suppliers providing these high-caliber, dependable, and innovative components wield significant bargaining power. Their products are directly linked to Bystronic's ability to stand out in the market and ensure customer contentment. For instance, leading suppliers of advanced laser technology, whose components are essential for Bystronic's high-performance cutting and bending machines, can command premium pricing due to the specialized nature of their intellectual property and manufacturing processes.

Bystronic's commitment to delivering premium solutions means it must source from suppliers with established reputations for excellence. This reliance on reputable entities further amplifies the suppliers' leverage. In 2023, Bystronic reported a revenue of CHF 2,411.1 million, underscoring the scale of its operations and the importance of its supply chain. The company's strategic partnerships with key component manufacturers, who consistently deliver cutting-edge technology, are vital for maintaining its competitive edge.

The bargaining power of these suppliers is also influenced by factors such as:

- Proprietary Technology: Suppliers possessing unique, patented technologies for critical components like fiber laser sources or advanced automation modules have considerable sway.

- Supplier Concentration: A limited number of suppliers capable of meeting Bystronic's stringent quality and performance standards can increase their bargaining power.

- Switching Costs: The expense and complexity involved in qualifying and integrating new suppliers for highly specialized components can make Bystronic hesitant to switch, thus empowering existing suppliers.

- Supplier Reputation: Companies known for reliability, innovation, and exceptional after-sales support, such as those providing advanced optics or precision-engineered drives, can leverage their strong brand and track record.

Impact of Raw Material Prices and Supply Chain Stability

Fluctuations in the prices of key raw materials like steel and aluminum directly affect Bystronic's suppliers. For instance, in early 2024, steel prices saw volatility due to global demand shifts, potentially squeezing supplier margins and leading them to seek higher prices from Bystronic. This dynamic grants suppliers leverage, especially when Bystronic's own product pricing is less flexible.

Global supply chain disruptions, a persistent issue through 2023 and into 2024, have significantly amplified supplier bargaining power. Limited availability and extended lead times for critical components, such as specialized electronic parts or high-grade metals, mean suppliers can dictate terms more readily. This was evident when certain semiconductor shortages in late 2023 impacted various manufacturing sectors, including those supplying Bystronic.

- Increased Raw Material Costs: For example, a 10% increase in steel prices could directly impact the cost of goods sold for Bystronic's suppliers.

- Supply Chain Bottlenecks: In 2023, shipping container costs, a key indicator of supply chain efficiency, remained elevated compared to pre-pandemic levels, increasing supplier operational expenses.

- Supplier Consolidation: In certain niche component markets, a limited number of suppliers can consolidate their position, thereby increasing their bargaining power over customers like Bystronic.

Suppliers of specialized components for Bystronic's advanced machinery possess significant bargaining power due to the limited number of qualified manufacturers and the high switching costs involved. This power is further amplified by the proprietary nature of the technology they supply, their strong reputations, and the increasing integration of software and services, making it difficult for Bystronic to change providers.

The bargaining power of Bystronic's suppliers is evident in their ability to influence pricing and terms, especially during periods of supply chain volatility or raw material cost increases. For instance, global supply chain disruptions in 2023 and early 2024 led to increased lead times and limited availability of critical parts, allowing suppliers to dictate terms more readily.

Factors like proprietary technology, supplier concentration, and the substantial costs and time required for Bystronic to qualify new suppliers reinforce the leverage held by existing vendors. This dynamic means Bystronic must often accept less favorable terms to ensure a stable supply of critical, high-performance components essential for its product quality and market competitiveness.

| Key Factor | Impact on Supplier Bargaining Power | Example for Bystronic |

| Proprietary Technology | High | Suppliers of unique fiber laser sources or advanced automation modules |

| Supplier Concentration | Moderate to High | Limited number of manufacturers for high-precision optics |

| Switching Costs | High | Months of validation for new control system components |

| Supplier Reputation | Moderate | Companies known for reliability in delivering advanced drives |

What is included in the product

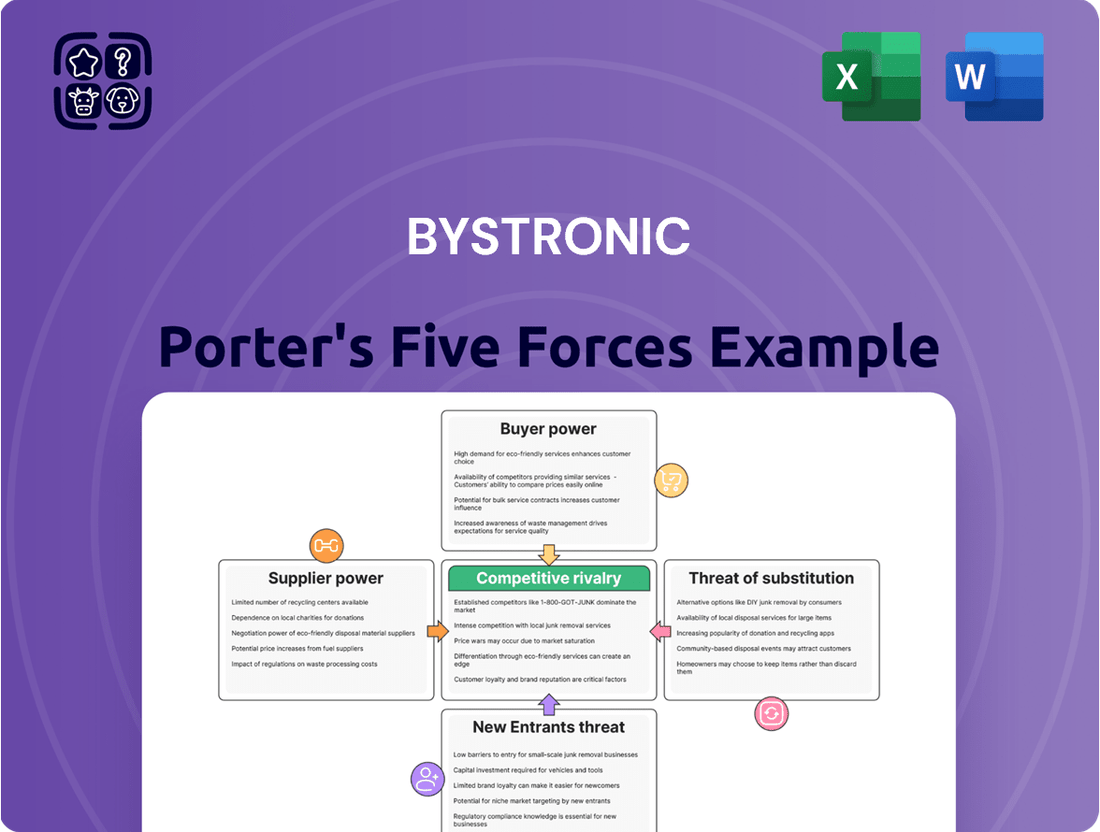

This Porter's Five Forces analysis for Bystronic dissects the competitive intensity within the sheet metal processing machinery industry, examining supplier and buyer power, the threat of new entrants and substitutes, and the rivalry among existing players.

Quickly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Bystronic's customer base is quite varied, spanning industries like automotive, construction, and general manufacturing. This diversity generally limits the power of any single customer, as no one industry or client represents an overwhelmingly large portion of Bystronic's sales. For instance, while the automotive sector is significant, it's not the sole driver of revenue.

However, the picture isn't entirely uniform. Large original equipment manufacturers (OEMs) or major contract manufacturers, especially those placing substantial, high-volume orders for Bystronic's advanced cutting and bending machinery, can wield considerable bargaining power. Their sheer scale of purchasing means they can negotiate more favorable terms, potentially impacting Bystronic's pricing and margins.

Bystronic actively mitigates this by pursuing a strategy of broad market diversification. By serving a wide array of end markets and customer types, the company reduces its reliance on any single customer or industry segment. This approach is crucial for maintaining a stable revenue stream and limiting the concentrated bargaining power of any particular customer group.

Customers investing in Bystronic's advanced laser cutting systems, press brakes, and automation solutions encounter substantial switching costs. These costs stem from the significant capital outlay for the machinery, the intricate integration required with existing production lines, and the specialized operator training necessary to maximize efficiency. For instance, a company investing millions in a Bystronic fiber laser cutting machine will find it prohibitively expensive and disruptive to switch to a competitor mid-production cycle.

Furthermore, Bystronic's proprietary software and comprehensive service packages create a 'sticky' customer base. Migrating to a different vendor would necessitate not only replacing hardware but also retooling, retraining staff on new interfaces, and potentially losing accumulated operational data. This deep integration and reliance on Bystronic's ecosystem considerably raise the barrier to switching, thereby diminishing the bargaining power of individual customers.

While Bystronic's high-precision, automated sheet metal processing machinery faces few direct substitutes offering the same level of integrated capability, customers do have options. These might include exploring alternative fabrication techniques or opting for less sophisticated, lower-cost equipment from competitors.

For instance, while the market for advanced CNC press brakes and laser cutting systems shows strong growth, driven by demand for precision and efficiency, budget limitations or unique project needs can push buyers to consider other avenues. This availability of alternatives, even if not perfectly equivalent, influences customer bargaining power.

Customer Price Sensitivity

Customers in the industrial machinery sector, including those looking at Bystronic's advanced laser cutting and bending solutions, often exhibit high price sensitivity. This is largely due to the substantial capital investment required for such equipment. For instance, a new Bystronic high-power fiber laser cutting machine can represent a significant portion of a manufacturing facility's annual capital budget.

Economic downturns or periods of intense competition within key customer industries, such as automotive manufacturing, can amplify this price sensitivity. In 2023, global automotive production saw fluctuations, which in turn can lead manufacturers to scrutinize every expenditure, demanding more competitive pricing from their suppliers like Bystronic. This pressure means customers are constantly seeking the best value proposition.

Bystronic addresses this by emphasizing the total cost of ownership and long-term operational efficiency. Their solutions are designed to deliver energy savings and increased throughput, aiming to offset the initial purchase price through tangible benefits over the machine's lifespan. For example, Bystronic's advancements in energy-efficient drives can lead to substantial savings on electricity bills, a critical factor for cost-conscious buyers.

- High Capital Outlay: Industrial machinery purchases are significant investments, making price a primary consideration for customers.

- Economic Sensitivity: Fluctuations in customer industries, like automotive, directly impact their willingness and ability to pay premium prices.

- Value Proposition: Bystronic counters price sensitivity by highlighting long-term cost savings through efficiency and sustainability features.

- Competitive Landscape: Downward price pressure from competitors forces Bystronic to justify its pricing through superior performance and total cost of ownership benefits.

Potential for Backward Integration by Customers

Large customers, particularly those with significant manufacturing needs, could theoretically integrate backward by developing their own sheet metal processing capabilities. This would mean less reliance on purchasing advanced machinery like laser cutters or press brakes from companies like Bystronic.

However, the reality for most customers is that full backward integration is extremely difficult and expensive. Developing the sophisticated technology, extensive research and development, and specialized expertise needed for high-quality laser cutting and press brake systems is a massive undertaking. For instance, Bystronic invests heavily in R&D, which in 2023 reached CHF 150 million, highlighting the significant capital required to stay competitive in this sector.

- High R&D Investment: Bystronic's 2023 R&D expenditure of CHF 150 million underscores the technological barrier for potential customer integration.

- Specialized Expertise: Developing and maintaining cutting-edge sheet metal processing machinery requires highly specialized engineering talent, which is scarce and costly to cultivate internally for most customers.

- Complexity of Manufacturing: The intricate design, precision engineering, and advanced software required for Bystronic's solutions are far beyond the core competencies of typical sheet metal fabricators.

Bystronic's bargaining power of customers is moderate, primarily influenced by the high cost of their advanced machinery and the significant switching costs involved. While large clients can negotiate, Bystronic's market diversification and technological integration limit overall customer leverage.

The substantial capital investment required for Bystronic's cutting and bending solutions, often running into hundreds of thousands or even millions of Swiss Francs per machine, inherently gives buyers leverage. For example, a major automotive supplier looking to equip a new production line might negotiate pricing on a fleet of Bystronic machines. In 2023, Bystronic reported revenues of CHF 2,407 million, indicating the scale of transactions possible.

| Factor | Impact on Bargaining Power | Bystronic's Mitigation Strategy |

|---|---|---|

| High Switching Costs | Lowers customer power due to integration and training needs. | Proprietary software and comprehensive service packages increase customer stickiness. |

| Price Sensitivity | Moderate to high, especially during economic downturns. | Emphasis on total cost of ownership and long-term operational efficiency. |

| Availability of Substitutes | Low for highly integrated, advanced solutions. | Focus on technological superiority and innovation. |

| Customer Concentration | Low due to broad market diversification. | Serving diverse industries reduces reliance on any single customer segment. |

Full Version Awaits

Bystronic Porter's Five Forces Analysis

This preview showcases the complete Bystronic Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the sheet metal processing industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, providing comprehensive insights into industry rivalry, buyer and supplier power, the threat of new entrants, and the threat of substitute products. Rest assured, there are no placeholders or missing sections; what you preview is precisely what you will download and utilize.

Rivalry Among Competitors

Bystronic operates in a highly competitive arena within the sheet metal processing equipment market. Key global rivals such as Trumpf, Amada, Salvagnini, and LVD offer comparable core products, including advanced laser cutting systems and sophisticated press brakes. This direct product overlap fuels a fierce battle for market dominance.

The competitive landscape is further characterized by its diversity. It's not just the major global manufacturers vying for position; a multitude of specialized players also contribute to the market's complexity. This blend of industry titans and niche providers intensifies rivalry, forcing companies like Bystronic to constantly innovate and differentiate their offerings to capture and retain market share.

The sheet metal processing equipment market is showing strong growth, which generally eases competitive rivalry. For instance, the laser cutting machine segment is expected to expand at a compound annual growth rate of 10.5% from 2024 to 2025. This expanding market offers ample room for multiple companies to thrive, potentially dampening aggressive price wars.

However, this growth doesn't eliminate competitive pressures entirely. Periods of market slowdown or declining demand, as Bystronic observed in early 2025, can intensify competition. When demand falters, companies may resort to more aggressive pricing or promotional strategies to secure sales, thereby increasing the rivalry among existing players.

Bystronic stands out by heavily differentiating its products, emphasizing high-quality, precision engineering, and advanced automation. Their integrated software solutions and comprehensive service offerings further set them apart in the competitive landscape.

Innovation is a cornerstone for Bystronic, with a remarkable statistic showing that nearly half of their sales in 2024 were generated from products introduced within the last three years. This relentless pursuit of new technology is key to staying ahead.

Rival companies are also pouring significant resources into research and development. They are actively pursuing advancements in areas like fiber laser technology, artificial intelligence integration, and the broader concept of smart manufacturing to deliver increasingly sophisticated solutions to the market.

Exit Barriers for Competitors

High capital investment in manufacturing facilities, specialized R&D, and established global distribution and service networks create significant exit barriers for existing competitors in the laser cutting machinery market. These substantial sunk costs make it difficult for companies to divest or exit the market, fostering sustained competition even during economic downturns.

The long-term nature of customer relationships and service contracts further solidifies these barriers. Once a Bystronic machine is installed, customers often rely on ongoing service, maintenance, and software updates, creating a sticky ecosystem that discourages switching and makes exiting costly for competitors who have invested in these relationships.

- High Capital Investment: Setting up advanced manufacturing for precision machinery requires hundreds of millions in capital, making it prohibitive to exit without significant loss.

- Specialized R&D: Continuous investment in laser technology and automation R&D creates intellectual property and specialized knowledge that is difficult to redeploy elsewhere.

- Global Service Networks: Establishing and maintaining a worldwide network of sales, service, and spare parts depots represents a substantial, unrecoverable investment.

- Customer Lock-in: Long-term service agreements and integrated software solutions for existing installations create a strong incentive for customers to stay with a provider, increasing exit costs for competitors.

Intensity of Competition and Strategic Actions

Competition in the laser cutting and automation industry is fierce, driven by continuous technological innovation, aggressive pricing, and a strong emphasis on global reach and customer support. Companies are constantly pushing the boundaries with new features and efficiency gains.

Bystronic’s strategic restructuring in late 2024, focusing on cost reduction and profitability enhancement, underscores the intense pressure to maintain a competitive edge in a demanding market. This move reflects the need to adapt to evolving economic conditions and competitive landscapes.

Rival firms actively pursue strategic alliances and acquisitions to broaden their product offerings and strengthen their geographical presence. For instance, in early 2024, competitors have announced several key partnerships aimed at integrating advanced software solutions and expanding into emerging markets, further intensifying the competitive rivalry.

- Technological Advancement: Competitors are investing heavily in R&D for faster, more precise, and energy-efficient cutting technologies.

- Pricing Strategies: Aggressive pricing models and flexible financing options are common tactics to win market share.

- Global Presence: Establishing robust sales, service, and support networks worldwide is crucial for customer retention and expansion.

- Strategic Partnerships & Acquisitions: Companies are consolidating to gain economies of scale, access new technologies, and enter new markets.

The competitive rivalry within Bystronic's market is intense, with major global players like Trumpf and Amada offering similar high-tech laser cutting and press brake systems. This overlap forces constant innovation, as evidenced by Bystronic generating nearly half its 2024 sales from products launched within the last three years, a testament to the rapid pace of technological advancement. While market growth, projected at 10.5% CAGR for laser cutting machines through 2025, can temper aggression, periods of slower demand, like early 2025, can trigger price wars and heightened competition.

| Competitor | Key Product Overlap | 2024/2025 Market Focus |

|---|---|---|

| Trumpf | Laser Cutting, Press Brakes, Automation | Advancements in fiber laser, smart factory integration |

| Amada | Laser Cutting, Press Brakes, Automation | Digitalization, AI in manufacturing processes |

| Salvagnini | Flexible Manufacturing Systems, Punching & Bending | Integrated automation solutions, Industry 4.0 |

| LVD | Press Brakes, Laser Cutting, Automation | High-speed processing, user-friendly interfaces |

SSubstitutes Threaten

While Bystronic excels in laser cutting and press brakes, alternative metal processing technologies like plasma cutting, waterjet cutting, and mechanical punching offer viable substitutes. These methods can be more cost-effective for less demanding tasks, potentially impacting Bystronic's market share in those segments.

Additive manufacturing, or 3D printing for metal, presents a potential threat of substitution for traditional sheet metal fabrication, especially in niche markets. This technology allows for the creation of intricate metal parts layer by layer, offering design flexibility that can be difficult or impossible with conventional methods.

While 3D printing for metal is not yet a widespread substitute for high-volume sheet metal production due to cost and speed limitations, its capabilities are rapidly advancing. For instance, in 2024, the global metal 3D printing market was valued at approximately $6.5 billion, with projections indicating significant growth. This suggests increasing viability for specialized applications where complexity and customization are prioritized over sheer volume.

As the cost-effectiveness and speed of metal additive manufacturing improve, it could erode demand for certain sheet metal components, particularly those requiring complex geometries or low-volume production runs. Companies are investing heavily in this area; for example, major industrial players reported substantial R&D spending in additive manufacturing throughout 2024, aiming to overcome current limitations.

The threat of substitutes for sheet metal processing, and by extension Bystronic's core business, is growing as industries increasingly explore alternative materials. Sectors like automotive and aerospace, driven by the need for lightweighting, are showing a significant interest in advanced composites and plastics. For instance, the automotive industry's push for electric vehicles (EVs) often involves using lighter materials to offset battery weight; by 2024, the global automotive lightweight materials market was valued at over $160 billion, with composites holding a substantial share.

While sheet metal remains a strong contender due to its durability and established recycling infrastructure, the continuous innovation in material science presents a long-term substitution risk. The development of new composite materials offering enhanced strength-to-weight ratios or specific performance advantages could gradually erode demand for traditional sheet metal fabrication. This shift could impact the market for laser cutting and bending machines, Bystronic's primary product lines, if manufacturers increasingly opt for processes suited to these newer materials.

Customer Willingness to Switch to Alternatives

Customer willingness to switch to alternative technologies for sheet metal processing is influenced by several key factors. These include the cost of adoption, the level of precision required for their applications, their typical production volumes, and the specific needs of their manufacturing processes. For instance, businesses requiring high precision and operating at high production volumes often find Bystronic's integrated solutions, which combine cutting, bending, and automation, offer a compelling value proposition that makes a complete shift to alternatives less appealing in the immediate future.

However, the landscape can shift for niche or emerging applications. In these scenarios, customers might actively seek out new methods if those alternatives promise substantial improvements in either cost-effectiveness or overall performance. For example, advancements in additive manufacturing or novel laser cutting techniques could present viable substitutes for certain traditional Bystronic applications if they achieve significant breakthroughs in speed or material utilization.

In 2023, the global market for sheet metal fabrication equipment saw continued demand, with the laser cutting segment alone projected to grow. While specific data on customer switching behavior is proprietary, industry analysts observed a trend where companies investing in Industry 4.0 technologies, like those offered by Bystronic, prioritize seamless integration and efficiency gains. This suggests that while substitutes exist, the total cost of ownership and the complexity of integrating new systems often act as deterrents for established high-volume producers.

- Cost of Switching: High initial investment for new technologies can be a significant barrier.

- Precision Requirements: Applications demanding tight tolerances often favor established, proven systems.

- Production Volume: High-volume operations benefit most from integrated, automated solutions, reducing switching likelihood.

- Application Specifics: Niche or rapidly evolving needs might drive exploration of novel, potentially disruptive substitutes.

Impact of Software and Services as Substitutes

The threat of substitutes in the sheet metal processing industry is influenced by advancements in software and services. Sophisticated design optimization and simulation tools can reduce the reliance on physical prototyping and potentially lessen the demand for certain types of machinery by improving material efficiency. For instance, advanced nesting software in 2024 can achieve material utilization rates exceeding 95%, directly impacting the perceived need for additional cutting capacity.

Bystronic proactively addresses this by embedding software and services into its product ecosystem. This strategy aims to enhance the entire workflow, from initial design to final production, making its integrated solutions more valuable than standalone software or machinery. By offering solutions that optimize data flow and operational efficiency, Bystronic aims to mitigate the substitutive threat, turning it into a competitive advantage.

- Software-driven efficiency: Advanced simulation software can reduce material waste by up to 10% in complex cutting jobs.

- Integrated service models: Bystronic's service packages, including predictive maintenance, aim to increase machine uptime by an estimated 15%.

- Data flow optimization: By managing the entire data chain, Bystronic helps customers streamline production, potentially reducing the need for external process-specific software.

While traditional metal fabrication methods like laser cutting and press braking remain robust, alternative technologies pose a growing threat. These substitutes, such as advanced additive manufacturing and novel composite materials, offer unique advantages in specific applications, potentially impacting Bystronic's market share.

The increasing adoption of metal 3D printing, valued at approximately $6.5 billion globally in 2024, highlights a shift towards customized and complex part production. Similarly, the lightweight materials market, exceeding $160 billion in the automotive sector by 2024, shows a clear trend towards alternatives like composites, driven by efficiency and performance demands.

Customer adoption of substitutes is largely dictated by cost, precision needs, and production volumes, with high-volume, precision-focused clients often sticking with integrated solutions like Bystronic's. However, advancements in speed and cost-effectiveness for alternatives could disrupt this balance, particularly in niche markets.

| Substitute Technology | Key Advantage | Potential Impact on Bystronic | 2024 Market Context |

|---|---|---|---|

| Metal Additive Manufacturing (3D Printing) | Design complexity, customization | Erosion of demand for certain niche parts | Global market ~$6.5 billion, rapid growth |

| Advanced Composites/Plastics | Lightweighting, specific performance | Reduced demand for sheet metal in automotive/aerospace | Automotive lightweight materials market >$160 billion |

| Plasma Cutting, Waterjet Cutting, Mechanical Punching | Lower cost for less demanding tasks | Market share impact in lower-segment applications | Established, but evolving capabilities |

Entrants Threaten

The sheet metal processing equipment industry, especially for sophisticated laser cutting and press brake systems, demands significant capital. This includes outlays for advanced manufacturing facilities, specialized machinery, and continuous research and development. For instance, Bystronic’s commitment to innovation means new entrants must also invest heavily in R&D to compete, creating a substantial financial hurdle.

The threat of new entrants in the high-precision sheet metal processing industry, particularly for companies like Bystronic, is significantly mitigated by the immense need for specialized expertise and advanced technology. Developing and manufacturing cutting-edge automated solutions requires deep engineering knowledge, sophisticated technological capabilities, and a keen understanding of specific customer applications. This complex knowledge base, honed over decades of experience, presents a substantial barrier for newcomers. For instance, Bystronic's investment in areas like laser cutting technology and advanced software solutions represents a significant upfront cost and learning curve that new players would find challenging to replicate quickly.

Bystronic's robust global sales and service infrastructure, present in over 30 countries, is a formidable barrier for potential new entrants. This network provides crucial customer support, maintenance, and training, which are vital for building trust and ensuring customer satisfaction in the high-tech machinery sector.

Developing a comparable distribution and service network requires substantial capital investment and considerable time, often spanning years. For instance, building out a service team with specialized technicians and spare parts depots across numerous regions is a massive undertaking that deters many new players from entering the market.

Brand Loyalty and Customer Relationships

Bystronic's strong brand reputation, built on decades of delivering quality, precision, and reliability in the demanding sheet metal processing sector, presents a significant barrier. New entrants must contend with the challenge of establishing credibility in a market where trust is paramount.

Existing customers often demonstrate considerable loyalty, a factor amplified by the substantial switching costs associated with replacing high-value, integrated capital equipment. This inertia makes it difficult for newcomers to dislodge established relationships.

Overcoming this entrenched loyalty and building the necessary trust to compete effectively is a lengthy and resource-intensive undertaking for any new entrant in the B2B capital goods arena.

- Established Brand Equity: Bystronic's brand recognition is a key asset, fostering customer confidence.

- High Switching Costs: The financial and operational implications of changing suppliers for complex machinery deter customers from switching.

- Customer Relationships: Long-standing partnerships and proven performance create a sticky customer base.

- Market Inertia: The capital goods market often exhibits a slower pace of adoption for new suppliers, favoring incumbents with a track record.

Economies of Scale and Experience Curve

Established players like Bystronic leverage significant economies of scale in manufacturing, procurement, and research and development. This allows them to achieve lower per-unit production costs, making it difficult for new entrants to compete on price initially. For instance, Bystronic’s substantial production volumes in 2024 likely translate into more favorable material sourcing agreements and optimized factory utilization.

The experience curve further solidifies this advantage. Over years of operation, Bystronic has continuously refined its production processes, improved its technological efficiency, and built deep institutional knowledge. This accumulated experience leads to higher quality output and more streamlined operations, creating a barrier that newcomers must overcome through substantial investment and time.

- Economies of Scale: Bystronic’s large production volumes in 2024 enable cost efficiencies in manufacturing and procurement.

- Experience Curve: Decades of operational refinement have led to optimized processes and technological expertise for Bystronic.

- Cost Disadvantage for Newcomers: Entrants face higher initial per-unit costs, hindering price competitiveness against established firms.

- R&D Investment: Bystronic’s ongoing R&D spending, likely in the hundreds of millions in 2024, further entrenches its technological lead.

The threat of new entrants into the high-end sheet metal processing equipment market, where Bystronic operates, is generally low. This is due to the substantial capital investment required for advanced manufacturing, specialized machinery, and ongoing research and development. For example, Bystronic’s significant R&D expenditure, which was CHF 119.2 million in 2023, highlights the financial commitment needed to stay competitive, a hurdle for potential newcomers.

Furthermore, the need for deep technical expertise in areas like laser cutting and automation, coupled with the time and resources needed to build a global sales and service network, acts as a significant deterrent. Bystronic’s presence in over 30 countries underscores the scale of infrastructure required to effectively serve this market.

The established brand reputation of companies like Bystronic, built on decades of reliability and precision, along with high customer switching costs, further solidifies this low threat. Customers are often hesitant to change suppliers for complex, integrated machinery due to operational disruptions and the need to re-establish trust.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for advanced manufacturing, R&D, and specialized machinery. | Significant financial hurdle; Bystronic's 2023 R&D was CHF 119.2 million. |

| Technical Expertise | Need for deep engineering knowledge in laser cutting, automation, and software. | Steep learning curve and R&D investment required to match existing capabilities. |

| Global Infrastructure | Establishing a worldwide sales, service, and support network. | Time-consuming and capital-intensive; Bystronic operates in over 30 countries. |

| Brand Reputation & Switching Costs | Customer loyalty and high costs associated with changing suppliers. | Difficult to gain market share against established, trusted brands with proven performance. |

Porter's Five Forces Analysis Data Sources

Our Bystronic Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Bystronic's annual reports, investor presentations, and publicly available financial statements. We supplement this with industry-specific market research reports from firms like Statista and IBISWorld, along with insights from trade publications and competitor announcements.