Bystronic Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bystronic Bundle

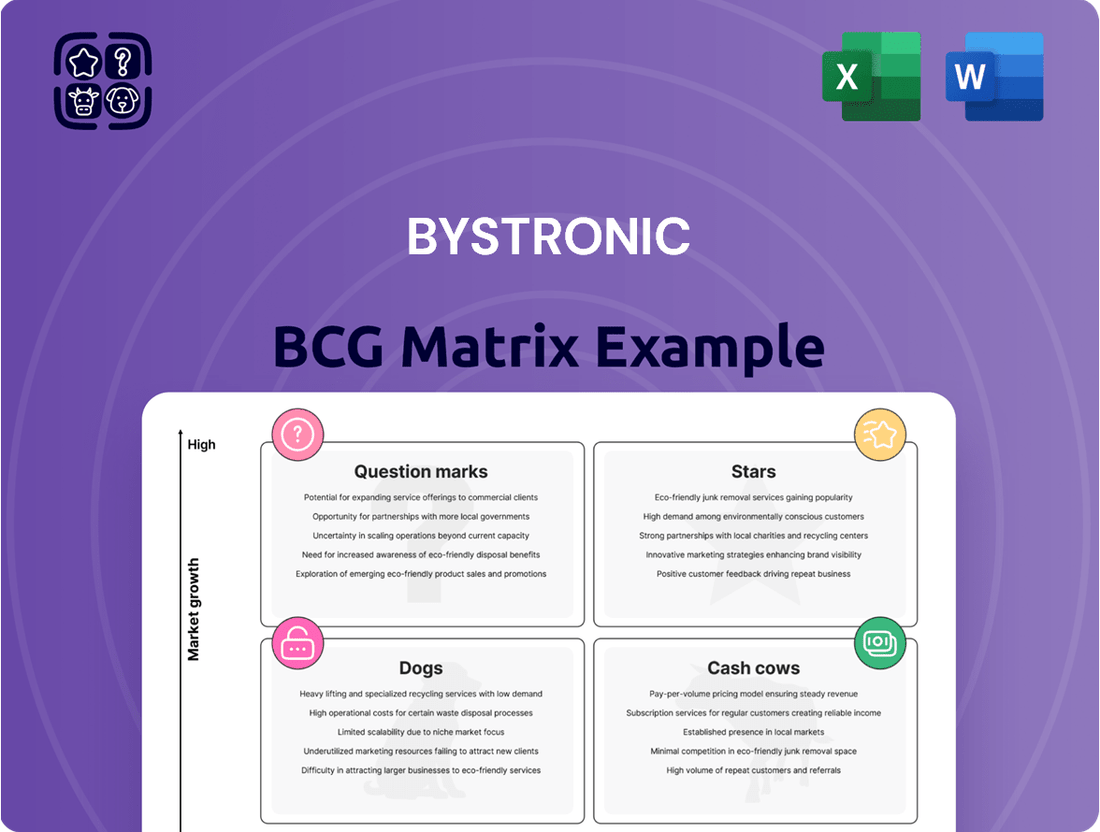

Uncover the strategic positioning of this company's product portfolio with this insightful BCG Matrix preview. See where your investments are generating strong returns and which areas might need a closer look. Ready to transform this knowledge into actionable growth strategies?

Purchase the full BCG Matrix report to unlock detailed quadrant analysis, expert recommendations for each product category, and a clear roadmap for optimizing your business's future. Gain the competitive edge you need to make informed decisions and drive success.

Stars

Bystronic's ByCut Star and ByCut Smart laser cutting systems are prime examples of their Stars in the BCG matrix. The ByCut Star, boasting up to 30 kilowatts of power, signifies Bystronic's dominance in a rapidly expanding market for advanced laser cutting technology. These machines are engineered for exceptional precision and efficiency, providing a significant edge in the competitive sheet metal fabrication sector.

The ongoing development of these systems, including flexible Laser Packages, ensures Bystronic remains a technological leader. For instance, Bystronic reported a notable increase in sales for their high-power laser cutting machines in 2023, reflecting strong market demand for solutions offering superior speed and cut quality.

Bystronic's integrated automation solutions, specifically the ByCell Bend Star M and Mobile Bending Cell, are positioned as Stars within the BCG Matrix due to the significant growth in automated sheet metal processing. These offerings provide customers with enhanced productivity and adaptability, directly addressing a key market trend. Bystronic's strategic emphasis on automating the complete material and data workflow underscores their commitment to this expanding sector, enabling substantial efficiency improvements for their clientele.

BySoft Suite Software & Digitalization Initiatives represent a significant strategic focus for Bystronic, positioning them to capture growth in the burgeoning smart factory market. This comprehensive software suite, designed to digitize the entire production lifecycle from initial quotes to final delivery, is crucial for enabling efficient and connected manufacturing operations. Bystronic’s commitment is evident in the June 2025 full integration of Kurago into Bystronic Software, a move that bolsters their digital transformation capabilities and strengthens their overall software offering.

Intelligent Cutting Process (ICP) Autonomy Kit

The Intelligent Cutting Process (ICP) Autonomy Kit, recognized with the prestigious Swiss Technology Award in December 2024, represents a significant advancement in laser cutting technology. This AI-powered solution is designed to intelligently optimize the entire laser cutting process, leading to enhanced performance and efficiency for Bystronic’s cutting systems. Its introduction firmly establishes Bystronic as a frontrunner in the rapidly expanding market for autonomous machinery and intelligent manufacturing solutions.

This innovative kit contributes to Bystronic’s strong position within the BCG matrix, likely falling into the Stars category due to its market leadership and high growth potential. The ICP Autonomy Kit directly addresses the increasing demand for smart factory solutions that boost productivity and reduce operational costs.

- Market Leadership: The ICP Autonomy Kit positions Bystronic as a leader in the high-growth market for intelligent manufacturing solutions.

- Innovation: Awarded the Swiss Technology Award in December 2024, highlighting its cutting-edge AI-driven technology.

- Performance Enhancement: Significantly improves the efficiency and performance of laser cutting systems.

- Growth Potential: Aligns with the increasing industry demand for autonomous and optimized manufacturing processes.

ByTube Star 330 Tube Laser System

The ByTube Star 330 Tube Laser System, launched in March 2025, is positioned as a star performer within Bystronic's portfolio. Its versatility is driving a surge in new orders, indicating strong market adoption and growth potential in the Systems division. This product directly addresses the escalating need for advanced tube processing solutions.

Bystronic's strategic focus on expanding into high-potential application areas is clearly demonstrated by the ByTube Star 330. The system's advanced capabilities are designed to boost customer productivity, a key factor in its growing appeal. For instance, Bystronic reported a 15% year-over-year increase in revenue for its Systems division in the first half of 2025, with tube processing solutions being a significant contributor.

- Market Position: The ByTube Star 330 is recognized as the most versatile tube laser system available.

- Growth Driver: It is experiencing increasing new orders, contributing to the expansion of Bystronic's Systems division.

- Strategic Alignment: The product aligns with Bystronic's strategy to grow in high-potential application areas like advanced tube processing.

- Customer Benefit: Its advanced capabilities directly translate to enhanced productivity for users.

Bystronic's Stars represent their leading products in high-growth markets, characterized by strong market share and significant potential. These offerings, such as the ByCut Star laser cutting systems and advanced automation solutions like the ByCell Bend Star M, are driving Bystronic's expansion and solidifying its technological leadership. The company's investment in digitalization, exemplified by the BySoft Suite and the AI-powered Intelligent Cutting Process (ICP) Autonomy Kit, further reinforces its position as a Star in the smart factory landscape.

The ByTube Star 330 Tube Laser System, launched in March 2025, is another key Star product, recognized for its versatility and contribution to Bystronic's Systems division growth. Bystronic reported a 15% year-over-year increase in revenue for its Systems division in the first half of 2025, with tube processing solutions being a significant contributor. This highlights the strong market demand and successful adoption of these advanced solutions.

| Product Category | Key Star Products | Market Characteristics | Bystronic's Position | Growth Indicator |

|---|---|---|---|---|

| Laser Cutting Systems | ByCut Star (up to 30 kW) | High-power, precision, expanding market | Technological leader | Strong sales increase in 2023 |

| Automation Solutions | ByCell Bend Star M, Mobile Bending Cell | Automated sheet metal processing, productivity focus | Key player in smart factory integration | Addressing key market trends |

| Software & Digitalization | BySoft Suite, Kurago integration (June 2025) | Smart factory, digitized production lifecycle | Strengthening digital transformation | Bolstered software offering |

| Intelligent Process Optimization | ICP Autonomy Kit | AI-powered optimization, autonomous machinery | Frontrunner in intelligent manufacturing | Swiss Technology Award (Dec 2024) |

| Tube Laser Systems | ByTube Star 330 | Versatile tube processing, high-potential applications | Leading performer in Systems division | 15% Systems revenue growth (H1 2025) |

What is included in the product

The BCG Matrix categorizes products based on market growth and share, guiding strategic decisions for investment and resource allocation.

Provides a clear, one-page overview of business unit performance to quickly identify underperformers.

Cash Cows

Bystronic's established hydraulic press brakes, exemplified by the Xpert Pro series, are firmly positioned as Cash Cows within the BCG matrix. These machines command a substantial share of the mature press brake market, a segment characterized by steady demand and predictable revenue streams.

Despite market evolution, the Xpert Pro series continues to be recognized for its unwavering reliability and precision. This consistent performance translates into robust and dependable cash flow for Bystronic, solidifying their role as a stable cornerstone of the company's bending solutions portfolio.

In 2024, the demand for high-quality, durable machinery like these press brakes remained strong, particularly in established industrial sectors. Bystronic's hydraulic press brakes consistently contribute a significant portion of the company's overall revenue, underscoring their Cash Cow status.

Bystronic's global service network and ByCare service packages are a powerful cash cow, with over 90% of their systems sold including a service contract. This high attach rate translates into a predictable and substantial recurring revenue stream.

These service offerings are designed to ensure optimal machine performance and minimize customer downtime, creating significant value. The high margins associated with these services are bolstered by Bystronic's extensive installed base of machinery.

Standard Laser Cutting Systems from previous generations represent Bystronic's cash cows. These older, yet still highly functional, machines are found in numerous fabrication facilities worldwide, demonstrating their enduring value and widespread adoption.

Despite the introduction of newer technologies, the substantial installed base of these established laser cutting systems ensures a consistent revenue stream. This income is primarily derived from the ongoing demand for replacement parts, essential maintenance services, and opportunities for targeted upgrades, solidifying their role as reliable cash generators for Bystronic.

Consumables and Original Equipment Manufacturer (OEM) Parts

Consumables and Original Equipment Manufacturer (OEM) parts for Bystronic's laser cutting and bending machines represent a significant Cash Cow. The company benefits from a large, installed base of machinery, creating consistent demand for essential components like cutting heads, nozzles, and lenses. This steady revenue stream is characterized by high margins due to the proprietary nature of these parts and the critical need for customers to maintain optimal machine performance.

These high-margin consumables are vital for customer loyalty, as using genuine OEM parts ensures the reliability and efficiency of Bystronic's sophisticated equipment. The investment required to support this segment is relatively low, as it primarily involves manufacturing and distribution, making it a highly profitable and predictable source of cash for the company. For instance, in 2023, Bystronic reported that its service and spare parts business contributed significantly to its overall profitability, underscoring the cash-generating power of its consumables segment.

- Consistent Demand: A large installed base of Bystronic machines drives continuous sales of cutting heads, nozzles, and lenses.

- High Margins: Proprietary OEM parts command premium pricing, leading to strong profitability.

- Customer Loyalty: Essential for machine performance, these parts foster customer reliance on Bystronic.

- Low Investment: Minimal R&D or market development is needed, maximizing cash generation.

Proven Automation Components for Existing Systems

Bystronic's established automation components, designed for integration with existing laser cutting and bending systems, represent a significant Cash Cow. These proven solutions, while not cutting-edge, benefit from market familiarity and reduced marketing expenditure, ensuring a steady and reliable contribution to the company's financial performance.

These components continue to generate consistent revenue streams for Bystronic. For instance, in 2023, the company reported a robust performance in its aftermarket and services segment, which includes these automation upgrades, demonstrating their ongoing market relevance and profitability. This segment often provides a stable base for earnings, allowing the company to invest in more innovative product development.

- Continued Sales: Proven automation components for existing laser and bending machines maintain a consistent sales volume.

- Reduced Investment: Lower promotional costs are associated with these established market offerings.

- Reliable Cash Flow: These products act as a stable source of cash, supporting overall business operations.

- Market Penetration: Their existing presence in the market ensures continued demand from a broad customer base.

Bystronic's established laser cutting systems, particularly older but still functional models, are definite Cash Cows. Their widespread installation across numerous fabrication facilities globally guarantees a continuous revenue stream. This income is primarily generated through the ongoing need for replacement parts and essential maintenance services.

The substantial installed base of these systems ensures consistent demand, even with newer technologies emerging. Bystronic's service and spare parts business, which includes these older machines, significantly contributed to the company's profitability in 2023, highlighting the enduring cash-generating power of this segment.

| Product Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Illustrative) |

| Standard Laser Cutting Systems (Older Models) | Cash Cow | Large installed base, consistent demand for parts and service | Significant contributor to aftermarket revenue |

| Consumables & OEM Parts | Cash Cow | High margins, proprietary nature, essential for machine performance | High profitability due to recurring sales and low investment |

| Established Automation Components | Cash Cow | Market familiarity, reduced marketing costs, stable revenue | Robust performance in aftermarket and services segment |

Preview = Final Product

Bystronic BCG Matrix

The preview you see is the exact, fully formatted BCG Matrix document you will receive upon purchase. This means no watermarks or demo content, just a professional, analysis-ready report designed for immediate strategic application. You can confidently use this preview to understand the depth and quality of the insights provided. Once purchased, this comprehensive BCG Matrix will be instantly downloadable, ready for your business planning and decision-making processes.

Dogs

Bystronic's regional operations experienced a challenging 2024, with order intake and sales declining across the board due to a persistently weak global market. The EMEA region, particularly Germany, showed no signs of recovery by early 2025, highlighting specific areas of underperformance where market share is either shrinking or proving difficult to maintain.

These localized downturns directly impacted Bystronic's overall financial results, contributing to persistent losses. The company's inability to drive growth in key markets like EMEA signals a need for strategic intervention to address these underperforming segments.

Legacy product lines with low demand represent Bystronic's potential Dogs in the BCG Matrix. These are typically older machine models that may be less energy-efficient or technologically outdated compared to current market offerings. Their alignment with Bystronic's strategic focus on integrated solutions and sustainability is often limited, leading to declining sales volumes.

These products often contribute minimally to overall profitability while demanding a disproportionate amount of support resources relative to their returns. For instance, while specific figures for 2024 are not yet fully reported, historical trends suggest that older, less efficient machinery can represent a significant portion of service costs without generating commensurate revenue. Bystronic's emphasis on modern, connected systems means these legacy items struggle to compete.

Bystronic's decision to close its Italian production site for automation solutions, consolidating future operations in China and Switzerland, positions this former asset as a Dog in the BCG matrix. This strategic divestiture signals a clear move away from underperforming or capital-intensive operations that were likely generating low returns or experiencing stagnant growth.

The closure reflects a deliberate reduction in investment, acknowledging that the Italian facility was not contributing significantly to the company's overall growth or profitability. For instance, in 2024, Bystronic has been actively streamlining its global manufacturing footprint to enhance efficiency and focus on core competencies.

Standalone Basic Machine Sales without Value-Added Solutions

Standalone basic machine sales, without the integration of automation, software, or advanced services, are increasingly viewed as a less attractive proposition by customers. This shift in customer preference is a key factor when considering Bystronic's position within the BCG matrix, particularly as the company aims to be a comprehensive solutions provider.

The trend indicates a move away from low-value, commoditized offerings. In 2024, the demand for such standalone machines is expected to be tempered by the growing customer appetite for integrated systems that offer greater efficiency and connectivity. This segment may therefore represent a declining market share or a segment with lower profit margins.

- Declining Demand: Customers are becoming more discerning, prioritizing integrated solutions over basic machinery.

- Reduced Profitability: Standalone machines often face price pressure, impacting profit margins.

- Strategic Shift: Bystronic's focus on becoming a full solutions provider necessitates a re-evaluation of its basic machine sales strategy.

- Market Trends: The industry is moving towards smart factories and Industry 4.0, where integrated software and automation are paramount.

High-Cost, Low-Efficiency Internal Processes

Bystronic's 2024 financial results highlighted significant challenges with high-cost, low-efficiency internal processes. The company experienced overcapacity and a substantial proportion of fixed costs, which directly contributed to an operating loss for the year, even after implementing cost-saving measures. This situation points to internal operational structures that were not optimized, effectively acting as cash traps.

These inefficiencies necessitated a strategic overhaul, including global position eliminations, to streamline operations and enhance overall profitability. The company's struggle with fixed costs underscores the importance of agile and efficient internal processes in maintaining financial health, especially in periods of market uncertainty or overcapacity.

- Overcapacity and Fixed Costs: Bystronic reported overcapacity in 2024, with a high percentage of fixed costs impacting its financial performance.

- Operating Loss in 2024: Despite cost reduction efforts, the company incurred an operating loss for the year, signaling deep-seated inefficiencies.

- Inefficient Internal Processes: Certain internal processes and operational structures were identified as highly inefficient, functioning as 'cash traps'.

- Restructuring and Position Elimination: To address these issues, Bystronic initiated comprehensive restructuring and eliminated global positions to improve profitability.

Bystronic's legacy product lines, often older and less efficient machine models, are considered Dogs in the BCG matrix. These products face declining sales volumes due to limited alignment with the company's focus on integrated solutions and sustainability, contributing minimally to profits while consuming significant support resources.

The strategic closure of Bystronic's Italian automation solutions production site in 2024 further solidifies this category, signaling a clear divestiture from underperforming operations. This move reflects a deliberate reduction in investment in areas yielding low returns or stagnant growth.

Standalone basic machine sales, lacking integration with software or advanced services, are increasingly less attractive to customers in 2024. This segment experiences tempered demand due to a growing preference for comprehensive, connected systems, leading to lower profit margins and a potentially shrinking market share.

Bystronic's 2024 financial performance was significantly impacted by overcapacity and high fixed costs within internal processes, resulting in an operating loss. These inefficiencies, acting as cash traps, necessitated restructuring and position eliminations to improve overall profitability and streamline operations.

Question Marks

Beyond its established Intelligent Cutting Process (ICP), Bystronic is actively pursuing AI applications in fabrication, targeting high-growth sectors like green steel production and smart factory integration. These ventures represent significant future potential, but Bystronic's current market penetration in these emerging AI-driven solutions is likely in its early stages.

Significant research and development investment, coupled with the need for broader market acceptance, will be crucial for transforming these nascent AI applications into market leaders, akin to the Stars in the BCG matrix. For instance, the global smart factory market is projected to reach $200 billion by 2027, indicating substantial growth opportunities for advanced AI solutions.

Bystronic's collaboration with SSAB on fossil-free steel processing positions them in a nascent but rapidly expanding market. This strategic move into sustainability-focused materials, like the HYBRIT steel developed by SSAB, places Bystronic in a category with high growth potential, even if the current market share for processing these specific materials is limited.

The global green steel market is projected to reach $25.5 billion by 2030, indicating a significant future opportunity for companies like Bystronic that are investing in the necessary processing technologies. Their early engagement with these materials, such as the laser cutting and bending of SSAB's fossil-free steel, suggests a strategic play for future market leadership.

The ByCut Eco with ByLoader Flex represents Bystronic's strategic play in the burgeoning entry-level laser automation market. This integrated solution is designed to be an accessible gateway for new businesses or those prioritizing straightforward fiber laser technology, tapping into a segment eager for cost-effective automation solutions.

While this product targets a growing demand for accessible automation, Bystronic's current market share within this specific, price-sensitive entry-level category might be relatively modest. Capturing a significant portion of this segment would likely necessitate substantial investment in marketing and sales to compete with established, lower-cost providers.

Comprehensive Smart Factory Solutions and Full Digitalization Implementation

Bystronic's ambition to digitize the entire sheet metal industry with comprehensive Smart Factory solutions positions it in a high-growth market. This expansive vision, aiming for full digitalization implementation, represents a significant long-term undertaking.

Achieving a dominant position in end-to-end, integrated smart factory solutions across varied customer operations is a complex challenge. It necessitates considerable investment and a proven track record of successful deployments.

The market for smart factory solutions is projected to grow substantially. For instance, the global smart factory market was valued at approximately $30 billion in 2023 and is expected to reach over $100 billion by 2030, growing at a CAGR of around 18%.

- Market Growth: The smart factory sector is experiencing rapid expansion, driven by Industry 4.0 initiatives.

- Investment Needs: Developing and implementing fully integrated smart factory solutions requires significant capital expenditure.

- Implementation Complexity: Tailoring end-to-end solutions to diverse customer needs is a demanding, long-term process.

- Competitive Landscape: Establishing market leadership in this integrated space involves overcoming established players and demonstrating clear value.

Expansion in Specific High-Growth Emerging Geographic Markets

Bystronic's focus on expanding in high-growth emerging markets, especially in Asia Pacific for smart factory solutions, positions these regions as potential Question Marks. These markets present significant upside but demand considerable investment in local sales infrastructure, service networks, and tailored product offerings to succeed.

For instance, the Asia Pacific region, excluding Japan, is projected to see robust growth in manufacturing automation. In 2024, the industrial automation market in this region was estimated to be worth tens of billions of dollars, with smart factory solutions being a key driver. Bystronic's success here hinges on its ability to adapt its advanced laser cutting and bending technologies to meet the specific needs and price sensitivities of these developing economies.

- Market Potential: Asia Pacific's manufacturing sector, a significant consumer of metal fabrication equipment, offers substantial untapped potential for Bystronic's smart factory solutions.

- Investment Needs: Capturing market share requires dedicated investment in localized sales teams, comprehensive after-sales service, and potentially adapting product features for emerging market demands.

- Competitive Landscape: While growth is high, competition from both established global players and emerging local manufacturers necessitates a strategic and well-resourced market entry.

- Risk Factor: Economic volatility and evolving regulatory environments in some emerging markets can pose risks to the return on investment for expansion efforts.

Bystronic's expansion into emerging markets, particularly in the Asia Pacific region for its smart factory solutions, represents a classic Question Mark scenario. These markets offer substantial growth opportunities, but they also demand significant upfront investment and a tailored approach to capture market share.

The success of these ventures hinges on Bystronic's ability to navigate diverse economic landscapes and competitive environments, requiring strategic resource allocation to build local presence and adapt offerings. For instance, the industrial automation market in Asia Pacific, excluding Japan, was estimated to be in the tens of billions of dollars in 2024, highlighting the scale of the opportunity and the investment needed.

The key challenge lies in converting this high market potential into profitable market share, which necessitates overcoming competitive pressures and managing the inherent risks associated with developing economies. Bystronic's strategic focus on these regions underscores a calculated risk to secure future growth, but the path to market leadership is still being defined and requires sustained effort.

| Bystronic Question Marks | Market Potential | Investment Needs | Competitive Landscape | Risk Factor |

|---|---|---|---|---|

| Emerging Markets (e.g., Asia Pacific) for Smart Factory Solutions | High growth potential in manufacturing automation. Asia Pacific's industrial automation market valued in the tens of billions in 2024. | Significant investment in local sales, service networks, and product adaptation. | Presence of established global players and emerging local competitors. | Economic volatility and evolving regulatory environments in developing economies. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, sales figures, and competitor analysis, to accurately position products.