Bunge PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bunge Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Bunge. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Changes in global trade policies and tariffs directly affect Bunge's operations. For instance, the imposition of new tariffs on agricultural imports or exports can increase costs for sourcing soybeans or distributing processed goods like soybean oil. In 2024, ongoing trade discussions between major agricultural players, such as the US and China, continue to create uncertainty, potentially impacting Bunge's access to key markets.

Geopolitical tensions and a rise in protectionist policies worldwide pose significant risks. These can disrupt Bunge's established supply chains, making it more expensive and complex to move raw materials and finished products. For example, trade disputes can lead to retaliatory tariffs, directly increasing Bunge's operational expenses and affecting the competitiveness of its commodity trading business.

Adapting to these evolving trade landscapes is paramount for Bunge's sustained market access and profitability. The company must navigate a complex web of international regulations and trade agreements to ensure smooth operations. For instance, in 2025, Bunge will likely be closely monitoring any updates to the EU's Common Agricultural Policy and its implications for global grain trade flows.

Government subsidies, like those provided by the US Department of Agriculture (USDA) which allocated billions in 2024 to support farmers, directly influence Bunge's raw material sourcing. These subsidies can make certain crops more economically viable for farmers, potentially increasing their availability for Bunge's processing operations. For instance, continued support for corn and soybean production in the US, key commodities for Bunge, ensures a more stable supply chain.

Geopolitical stability is crucial for Bunge, a major player in global agribusiness. Political instability in key agricultural regions, such as recent events impacting grain exports from Ukraine, can severely disrupt supply chains. For instance, the conflict in Eastern Europe in 2022-2023 led to significant volatility in global grain prices and access issues, directly affecting Bunge's sourcing and distribution networks.

Disruptions stemming from conflicts, political unrest, or international sanctions create significant challenges. These can manifest as supply chain bottlenecks, driving up logistical costs, and restricting access to vital markets. Bunge's operational efficiency and profitability are directly tied to its ability to navigate these complex global political landscapes and ensure uninterrupted business continuity.

Food Security Policies

Governmental policies focused on national food security, such as maintaining strategic grain reserves or imposing export restrictions, significantly shape global commodity movements and pricing. These measures directly affect Bunge's operations by influencing the availability and cost of raw materials, as well as creating varied market dynamics. For instance, in 2024, several countries reinforced their domestic food reserves, leading to tighter export availability for key agricultural commodities.

Bunge must closely monitor and adapt to these evolving food security policies, which can present both opportunities and considerable challenges. For example, import quotas implemented by a nation can limit Bunge's market access, while a policy encouraging agricultural production might open new sourcing avenues. Understanding these policy shifts is crucial for Bunge's strategic market entry and expansion plans.

- Strategic Reserves: Many nations are increasing strategic grain reserves to buffer against supply chain disruptions, impacting export availability.

- Export Restrictions: Policies like export bans or licensing requirements directly limit Bunge's ability to source and sell commodities globally.

- Import Quotas: Tariffs and quotas set by governments can alter the cost competitiveness of Bunge's products in specific markets.

- Subsidies and Incentives: Government support for domestic agriculture can influence planting decisions and the overall supply of crops Bunge handles.

Biofuel Mandates and Renewable Energy Policies

Government mandates for biofuel usage, such as the Renewable Fuel Standard (RFS) in the United States, significantly influence Bunge's demand for corn and soybeans. For instance, the RFS for 2024 requires 23.02 billion gallons of renewable fuel, with a substantial portion coming from these feedstocks. This policy directly boosts Bunge's processing volumes and can impact commodity prices.

Shifting renewable energy policies create both opportunities and risks for Bunge. For example, the Inflation Reduction Act of 2022 in the US offers tax credits for sustainable aviation fuel (SAF), a potential growth area for Bunge's oilseed processing capabilities. Conversely, changes in ethanol blending mandates could alter the economics of corn processing.

- US Renewable Fuel Standard (RFS) targets for 2024 mandate 23.02 billion gallons of renewable fuel.

- The Inflation Reduction Act of 2022 provides incentives for sustainable aviation fuel production.

- European Union’s RED II directive aims for 14% renewable energy in transport by 2030, impacting Bunge’s European operations.

- Bunge's strategic planning must account for evolving biofuel mandates and renewable energy support mechanisms globally.

Political stability in key agricultural regions is critical for Bunge's supply chain integrity. Geopolitical events, like the ongoing conflict in Eastern Europe, have demonstrated the potential for severe disruptions, impacting global grain prices and access. For instance, the 2022-2023 period saw significant volatility directly affecting Bunge's sourcing and distribution networks.

Government policies on food security, including strategic reserves and export restrictions, directly influence commodity flows and pricing. In 2024, several nations reinforced domestic grain reserves, tightening export availability for key agricultural products, which impacts Bunge's operational scope.

Trade policies and tariffs remain a significant factor, with ongoing discussions between major agricultural economies like the US and China in 2024 creating market uncertainty. Such policies can increase sourcing costs and affect market access for Bunge's products.

Subsidies provided by governments, such as those from the USDA in 2024 supporting billions in farmer aid, directly influence raw material availability. Continued support for crops like corn and soybeans in the US ensures a more stable supply for Bunge's processing needs.

What is included in the product

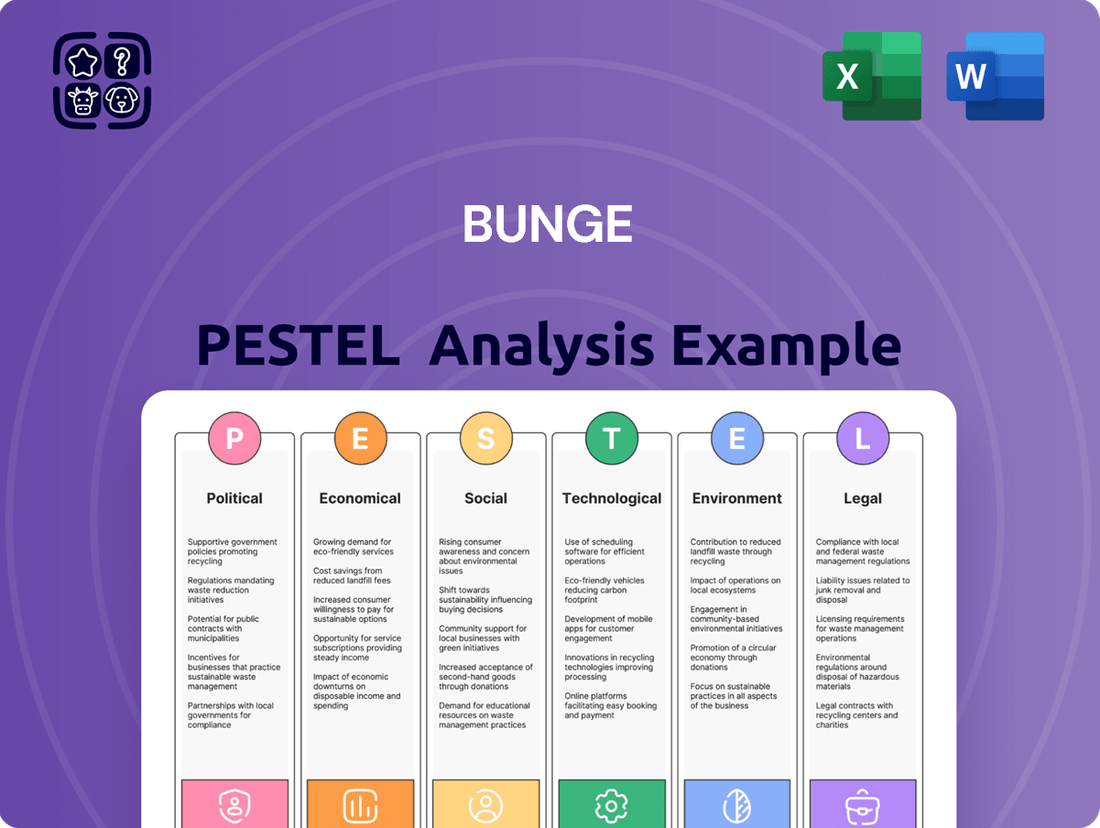

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Bunge, offering actionable insights for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a quick and digestible overview of Bunge's external environment to facilitate strategic discussions.

Economic factors

Global commodity price volatility presents a significant challenge for Bunge. Fluctuations in the prices of key agricultural products such as soybeans, corn, wheat, and edible oils directly affect Bunge's revenue streams and overall profitability. For instance, the average price of soybeans saw considerable swings throughout 2024, influenced by weather events in major producing regions and shifting demand from China.

These price movements are driven by a complex interplay of global supply and demand, unpredictable weather patterns impacting crop yields, and the influence of speculative trading in futures markets. This creates substantial market risk that Bunge must navigate. For example, a severe drought in South America during the first half of 2025 could dramatically increase soybean prices, impacting Bunge's crushing margins.

To manage these risks, Bunge relies heavily on robust hedging strategies and sophisticated supply chain management. These tools are essential for mitigating the financial impact of commodity price swings and ensuring more stable financial performance. As of early 2025, Bunge's forward contracts and inventory management are key components in buffering against potential price downturns.

Rising inflation in 2024 and projected into 2025 directly impacts Bunge's operational expenses. For instance, the cost of agricultural inputs, energy for processing, and global transportation are all susceptible to inflationary pressures, potentially squeezing profit margins. For example, the US Producer Price Index for finished goods saw a notable increase in early 2024, signaling broader cost pressures.

Furthermore, the prevailing interest rate environment, with central banks like the Federal Reserve maintaining or adjusting rates in response to inflation, affects Bunge's cost of capital. Higher borrowing costs for expansion projects or to finance inventory can strain financial leverage and influence investment decisions. As of mid-2024, benchmark interest rates remain elevated compared to previous years, a key consideration for Bunge's capital allocation.

Currency exchange rate fluctuations are a critical factor for Bunge, a global agribusiness and food company. As of late 2024, the strengthening US dollar against many emerging market currencies could increase the cost of Bunge's imported raw materials and reduce the dollar value of its earnings generated in those regions. Conversely, a weaker dollar might boost its export competitiveness and the translated value of foreign profits.

For instance, Bunge's financial reports often highlight the impact of currency headwinds or tailwinds. In 2023, the company noted that unfavorable currency movements had a negative impact on its earnings per share, demonstrating the direct link between exchange rates and profitability. Effective hedging strategies and diversified global operations are therefore vital to mitigate these risks and ensure stable financial performance.

Global Economic Growth and Consumer Demand

The global economic landscape significantly shapes Bunge's performance. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, impacting consumer purchasing power and, consequently, demand for Bunge's core products like food ingredients, animal feed, and biofuels. Economic slowdowns can particularly dampen demand for premium processed food items, while periods of robust growth tend to boost sales across Bunge's entire product range.

Bunge's strategic planning must remain agile to navigate these economic fluctuations. For example, during economic upturns, there's a greater propensity for consumers to spend on value-added food products, which Bunge offers. Conversely, in challenging economic climates, consumers may shift towards more basic, less processed food options, requiring Bunge to adjust its product mix and marketing efforts accordingly.

- Global GDP Growth: Projected at 3.2% for 2024 by the IMF, influencing overall consumer spending capacity.

- Inflationary Pressures: Persistent inflation in key markets can erode consumer purchasing power for food and fuel.

- Commodity Price Volatility: Fluctuations in agricultural commodity prices, directly impacting Bunge's input costs and product pricing strategies.

- Emerging Market Growth: Developing economies often present higher growth potential for food and feed demand, but are also more susceptible to economic shocks.

Supply Chain and Logistics Costs

Bunge's extensive global operations mean that transportation, storage, and energy costs within its supply chain are a major economic consideration. Fluctuations in fuel prices, such as the Brent crude oil price which averaged around $82.45 per barrel in Q1 2024, directly influence these expenses. Similarly, rising labor costs for logistics personnel and persistent infrastructure challenges in various regions can impede operational efficiency and profitability, impacting Bunge's ability to maintain competitive pricing for its agricultural products and ingredients.

Optimizing logistics is therefore crucial for Bunge's financial health. The company's ability to manage these costs is directly tied to its competitive edge. For instance, disruptions like the Red Sea shipping crisis in early 2024 led to increased transit times and freight rates, highlighting the sensitivity of Bunge's cost structure to global logistics stability.

- Fuel Price Volatility: Global oil prices, impacting transportation costs, are subject to geopolitical events and market demand.

- Labor Costs: Wages for truck drivers, warehouse staff, and other logistics personnel represent a significant and often rising expense.

- Infrastructure Bottlenecks: Congested ports, inadequate road networks, and limited rail capacity can lead to delays and increased storage costs.

- Energy Costs: The price of electricity and natural gas for storage facilities and processing plants directly affects operational expenditures.

Global economic conditions significantly influence Bunge's operational environment. The International Monetary Fund (IMF) projected global GDP growth at 3.2% for 2024, a figure that shapes consumer spending power for Bunge's products. Persistent inflation in key markets, as evidenced by a notable increase in the US Producer Price Index for finished goods in early 2024, directly impacts Bunge's input costs and can erode consumer purchasing power.

Commodity price volatility remains a core economic challenge, with soybean prices experiencing significant swings in 2024 due to weather and demand shifts. This volatility, coupled with rising interest rates affecting the cost of capital, necessitates robust hedging and financial management. For instance, benchmark interest rates in mid-2024 remained elevated, impacting Bunge's borrowing costs.

Currency exchange rates also play a crucial role; a strengthening US dollar in late 2024 could reduce the dollar value of Bunge's foreign earnings. Bunge's 2023 financial reports highlighted the negative impact of unfavorable currency movements on its earnings per share, underscoring the need for effective currency risk mitigation strategies.

| Economic Factor | 2024/2025 Data Point | Impact on Bunge |

|---|---|---|

| Global GDP Growth (IMF Projection) | 3.2% for 2024 | Influences overall consumer spending and demand for Bunge's products. |

| US Producer Price Index (Finished Goods) | Notable increase in early 2024 | Indicates rising operational costs for Bunge. |

| Benchmark Interest Rates (e.g., Federal Reserve) | Elevated compared to previous years (mid-2024) | Increases cost of capital for Bunge's financing needs. |

| US Dollar Strength | Strengthening against emerging market currencies (late 2024) | Can reduce the dollar value of foreign earnings and increase imported raw material costs. |

Full Version Awaits

Bunge PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Bunge PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into the strategic landscape Bunge operates within.

Sociological factors

Consumers are increasingly prioritizing health, sustainability, and ethical sourcing in their food choices. This shift directly impacts demand for Bunge's offerings, pushing for more plant-based options and traceable ingredients. For instance, the global plant-based food market was valued at approximately $27.5 billion in 2023 and is projected to reach $162 billion by 2030, highlighting a significant growth area that Bunge needs to address.

This evolving landscape demands that Bunge innovate its product development and sourcing strategies. Meeting the growing demand for specific oils, proteins, and specialty ingredients requires a proactive approach to align with these dietary and lifestyle changes. Companies like Bunge are investing in research and development for alternative proteins and healthier oil formulations to capture market share.

Global population is projected to reach 9.7 billion by 2050, with a significant portion of this growth occurring in developing countries. This demographic expansion directly translates to increased demand for food, a core market for Bunge.

Urbanization is accelerating, with over half the world's population now living in cities, a figure expected to climb to 68% by 2050. This shift often correlates with changing dietary habits, favoring more processed foods and animal proteins, which in turn boosts the need for agricultural commodities like soybeans and corn, Bunge's primary products.

Public and investor focus on corporate social responsibility, encompassing labor, human rights, and ethical sourcing, significantly shapes Bunge's public image and operational landscape. For instance, in 2024, reports highlighted increased consumer boycotts of brands perceived as lacking in ethical supply chain practices, directly impacting sales volumes for companies in the food processing sector.

Stakeholders, from end consumers to institutional investors, are increasingly vocal in their demand for complete transparency and accountability across the entire supply chain, from the origin of raw materials to the final product. This push for visibility is evident in the growing adoption of blockchain-based traceability systems within the agricultural industry, with adoption rates projected to reach 15% by the end of 2025 for major commodity traders.

Bunge's dedication to responsible sourcing and upholding fair labor standards is therefore paramount for fostering and retaining trust, which is essential for sustained market acceptance and long-term business viability. Companies demonstrating strong ESG (Environmental, Social, and Governance) performance in 2024 saw an average 5% higher valuation compared to peers with weaker ESG profiles.

Public Perception of Agribusiness

Public perception of large agribusinesses like Bunge is a significant sociological factor, especially concerning environmental impact, land use, and genetic modification. Negative views can translate into stricter regulations and shifts in consumer preference, potentially impacting market access and brand reputation. For instance, a 2023 survey indicated that 62% of consumers are concerned about the environmental footprint of food production, a sentiment that directly affects companies in the agribusiness sector.

These perceptions can fuel boycotts or intensify scrutiny from environmental and consumer advocacy groups. Such pressure can lead to increased operational costs due to compliance measures or reputational damage that hinders sales growth. Bunge's proactive communication regarding its sustainability initiatives and contributions to global food security is therefore crucial for navigating this landscape. For example, Bunge's 2024 sustainability report highlighted a 15% reduction in water usage across its operations, a figure aimed at addressing public environmental concerns.

- Environmental Concerns: Growing public awareness of climate change and biodiversity loss puts agribusinesses under a microscope regarding their environmental practices.

- Consumer Sentiment: Negative perceptions can lead to reduced demand for products from companies perceived as unsustainable or unethical.

- Regulatory Landscape: Public opinion often influences government policies and regulations, creating a more challenging operating environment for agribusinesses.

- Brand Image: A strong, positive public image is vital for Bunge to maintain consumer trust and attract investment in an increasingly conscious market.

Labor Availability and Workforce Dynamics

The availability of both skilled and unskilled labor is a major sociological consideration for Bunge, especially in its agricultural sourcing regions and processing plants. For instance, in 2024, the U.S. Department of Agriculture reported ongoing labor shortages in certain agricultural sectors, impacting harvest efficiency.

Demographic shifts, such as an aging workforce in some traditional farming communities and migration patterns influencing labor pools, directly affect Bunge's ability to staff operations. In 2025, projections suggest continued urbanization in key sourcing countries, potentially exacerbating rural labor scarcity.

- Labor Shortages: Reports from 2024 highlighted persistent labor gaps in agricultural processing, with some regions experiencing up to a 15% deficit in available workers.

- Demographic Trends: The average age of farmworkers in many developed nations continues to rise, creating a need for new recruitment strategies.

- Worker Expectations: Evolving expectations around fair wages, benefits, and working conditions are shaping labor negotiations and operational costs for companies like Bunge.

- Automation Investment: Bunge's strategic focus on automation in processing facilities aims to mitigate risks associated with labor availability and improve overall productivity.

Sociological factors significantly influence Bunge's operations, driven by evolving consumer preferences towards health, sustainability, and ethical sourcing. The global plant-based food market, valued at approximately $27.5 billion in 2023 and projected to reach $162 billion by 2030, exemplifies this trend, pushing Bunge to innovate its product offerings and supply chains. Furthermore, increasing urbanization and a growing global population, expected to reach 9.7 billion by 2050, directly increase demand for Bunge's core agricultural commodities.

Public perception of agribusinesses, particularly concerning environmental impact and ethical practices, directly affects brand image and regulatory environments. In 2024, consumer boycotts against companies with perceived ethical supply chain gaps highlighted the financial risks of negative public sentiment. Bunge's commitment to ESG performance, which saw companies with stronger profiles achieve 5% higher valuations in 2024, is crucial for maintaining trust and market acceptance.

Labor availability and worker expectations are also critical sociological considerations. Reports from 2024 indicated labor shortages in agricultural processing, with some regions experiencing up to a 15% deficit. Demographic shifts, such as an aging workforce in farming communities, coupled with evolving expectations for fair wages and benefits, necessitate strategic investments in automation and worker welfare to ensure operational continuity and productivity.

| Sociological Factor | 2023/2024 Data Point | Projected Trend/Impact | Bunge Relevance |

|---|---|---|---|

| Consumer Preference Shift | Plant-based food market valued at $27.5B (2023) | Market to reach $162B by 2030 | Demand for alternative proteins and healthier oils |

| Global Population Growth | Projected 9.7B by 2050 | Increased demand for food commodities | Core market expansion for Bunge's products |

| Public Perception & ESG | Companies with strong ESG saw 5% higher valuation (2024) | Increased scrutiny on environmental and ethical practices | Reputational risk and opportunity for Bunge |

| Labor Availability | 15% labor deficit in some agricultural processing regions (2024) | Continued urbanization impacting rural labor pools | Need for automation and improved worker conditions |

Technological factors

Advancements in agricultural technology are a game-changer for companies like Bunge. Precision farming, which uses data and technology to manage crops more effectively, is becoming more widespread. For instance, the global precision agriculture market was valued at approximately USD 8.5 billion in 2023 and is projected to reach over USD 20 billion by 2030, indicating significant adoption. This means Bunge can expect more consistent and higher-quality raw materials as farmers adopt these practices, potentially reducing its sourcing costs and improving supply chain reliability.

Biotechnology and improved crop genetics also play a crucial role. These innovations can lead to crops that are more resistant to diseases and environmental stresses, ultimately boosting yields. For example, drought-tolerant corn varieties have shown yield increases of 5-10% in water-scarce regions. Bunge can capitalize on these developments by partnering with seed developers or investing in companies at the forefront of agricultural biotechnology, thereby securing a more resilient and productive supply chain for its key commodities.

Technological advancements in oilseed crushing and grain milling are allowing Bunge to create more valuable and sustainable products. For instance, their investments in advanced processing techniques contribute to improved yields and reduced waste, directly impacting their bottom line and environmental footprint.

Innovations in protein extraction and fermentation are particularly promising, opening doors to new markets for plant-based ingredients. Bunge's commitment to research and development in these areas is crucial for staying ahead in the competitive food ingredient sector, with a focus on enhancing product functionality and meeting evolving consumer demands.

Bunge is increasingly leveraging digital technologies like the Internet of Things (IoT) and blockchain to enhance its vast global supply chain. This digital transformation aims to boost efficiency, transparency, and traceability, crucial for a company dealing with agricultural commodities. For instance, by mid-2024, Bunge reported significant progress in implementing digital tracking solutions across key sourcing regions, aiming to reduce transit times by up to 15%.

The enhanced traceability offered by these digital tools is vital for Bunge's risk management and regulatory compliance. By mid-2025, Bunge expects to have 80% of its traceable soybean supply chain integrated with blockchain technology, providing immutable records of origin and handling. This not only helps meet stringent international food safety standards but also builds consumer confidence in product authenticity and ethical sourcing.

Data Analytics and Artificial Intelligence

Bunge is actively leveraging big data analytics and artificial intelligence to gain a competitive edge. These technologies enable the company to extract deeper insights from market trends, forecast commodity price fluctuations with greater accuracy, and refine trading strategies. For instance, Bunge's investment in AI-powered analytics for its supply chain in 2024 aims to reduce logistics costs by an estimated 5-7% through optimized routing and predictive maintenance of its fleet and processing facilities.

The application of AI extends to operational efficiencies, significantly impacting Bunge's bottom line. By implementing AI for predictive maintenance in its processing plants, Bunge anticipates a reduction in unplanned downtime by up to 15% in 2025, thereby improving asset utilization and lowering repair expenses. This data-driven approach is paramount for navigating the inherent volatility of global agricultural markets.

- Enhanced Market Insights: AI algorithms analyze vast datasets to identify emerging consumer preferences and shifts in agricultural demand, informing Bunge's sourcing and product development.

- Optimized Trading and Risk Management: Predictive analytics help Bunge anticipate price volatility for key commodities like soybeans and wheat, allowing for more strategic hedging and trading decisions.

- Supply Chain Efficiency Gains: AI-driven route optimization and predictive maintenance for Bunge's logistics network are projected to yield cost savings and improve delivery reliability.

- Operational Performance Improvement: Machine learning models are being deployed to optimize processing yields and energy consumption at Bunge's global facilities.

Renewable Energy Technologies

The accelerating development and adoption of renewable energy technologies like solar, wind, and biomass directly influence Bunge's operational sustainability and energy expenditures. For instance, by 2024, global renewable energy capacity additions were projected to reach record levels, with solar PV leading the charge. This trend offers Bunge opportunities to lower its carbon footprint and reduce operational costs.

Investing in or sourcing renewable energy sources can significantly decrease Bunge's reliance on fossil fuels, thereby enhancing its energy independence and aligning with increasingly stringent global environmental regulations and consumer expectations. By 2025, many corporations are setting ambitious targets for renewable energy procurement, with Bunge likely to follow suit to maintain competitive advantage.

These advancements in renewable energy are becoming critical for sustainable manufacturing and processing within the agribusiness sector. For example, the International Energy Agency reported in late 2023 that renewables are expected to account for over 90% of global electricity capacity expansion in the coming years. This shift necessitates that companies like Bunge integrate these cleaner energy solutions into their supply chains and processing facilities.

Key impacts on Bunge include:

- Reduced Carbon Footprint: Transitioning to renewables helps Bunge meet its environmental, social, and governance (ESG) goals.

- Lower Operational Costs: Renewable energy can offer more stable and predictable energy pricing compared to volatile fossil fuel markets.

- Enhanced Energy Security: On-site or locally sourced renewables can mitigate risks associated with grid instability and energy supply disruptions.

- Improved Brand Reputation: Demonstrating commitment to sustainability through renewable energy adoption can attract environmentally conscious consumers and investors.

Technological advancements are reshaping Bunge's operations, from precision agriculture boosting crop yields to AI optimizing supply chains. The global precision agriculture market, valued at approximately USD 8.5 billion in 2023, is expected to exceed USD 20 billion by 2030, signaling widespread adoption of data-driven farming practices. Bunge is also integrating IoT and blockchain for enhanced traceability, aiming for 80% of its soybean supply chain on blockchain by mid-2025. AI-powered analytics are projected to reduce logistics costs by 5-7% in 2024 and decrease unplanned downtime by up to 15% in 2025 through predictive maintenance.

Legal factors

Bunge navigates a complex web of global food safety regulations, adhering to standards set by bodies like the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). For instance, in 2024, the FDA continued its focus on proactive measures against foodborne illnesses, impacting ingredient sourcing and processing protocols.

Maintaining compliance with these evolving rules, which cover everything from product purity to accurate labeling and hygiene, is critical. Failure to do so can result in significant financial penalties, costly product recalls, and severe damage to Bunge's brand reputation, as seen in past industry incidents.

Strict adherence to these food safety mandates is not just about avoiding penalties; it's fundamental for building and retaining consumer trust. This trust directly translates into sustained market access and competitive advantage for Bunge's diverse product portfolio.

Bunge operates under stringent environmental protection laws globally, covering everything from air emissions and waste disposal to water consumption and land use. For instance, in 2024, the company faced increased scrutiny regarding its supply chain's impact on deforestation, a key area regulated by many national and international environmental frameworks.

Failure to comply with these regulations, which also encompass biodiversity protection, can result in significant financial penalties and legal disputes. In 2025, Bunge's investments in sustainable agriculture practices are partly driven by the need to meet evolving standards in regions like South America, where land conservation laws are becoming more rigorous.

Beyond avoiding legal repercussions, a strong commitment to environmental stewardship, as demonstrated by Bunge's 2024 sustainability reports detailing reductions in greenhouse gas emissions by 5% compared to 2023, bolsters its corporate reputation and aligns with investor expectations for responsible business conduct.

Bunge, as a significant global agribusiness firm, faces scrutiny under anti-trust and competition laws across numerous jurisdictions. These regulations are designed to prevent monopolistic practices and ensure a level playing field for all market participants.

In 2024, for instance, regulatory bodies worldwide continue to monitor large-scale consolidations within the agricultural sector. Bunge's proposed or completed acquisitions, such as those impacting grain trading or oilseed processing, are subject to rigorous review to prevent undue market concentration. Failure to comply can result in substantial fines and operational restrictions.

These legal frameworks directly influence Bunge's strategic decisions regarding market share expansion and pricing. For example, pricing strategies in key commodity markets are closely watched for any signs of collusion or anti-competitive behavior. Navigating these complex legal landscapes is crucial for Bunge to avoid costly litigation and maintain its operational freedom.

Labor Laws and Employment Regulations

Bunge operates under a complex web of labor laws and employment regulations across its global operations. This includes adhering to varying national and international standards concerning minimum wages, working hours, workplace safety, and employee benefits. For instance, in 2024, many countries continued to update their labor codes, with some regions seeing increases in statutory minimum wages to combat inflation.

Compliance with these diverse legal frameworks is not just a matter of avoiding penalties but is essential for maintaining stable operations and a positive corporate image. Failure to comply can lead to significant labor disputes, costly legal battles, and damage to Bunge's reputation as an employer. In 2024, the International Labour Organization (ILO) reported a rise in labor inspections in several key agricultural producing nations where Bunge has significant interests.

Ensuring fair and safe working conditions for its entire workforce, from farm laborers to corporate staff, is a fundamental legal and ethical obligation for Bunge. This commitment is particularly critical in the agricultural sector, where Bunge sources a substantial portion of its raw materials.

- Compliance with minimum wage laws: Bunge must ensure wages meet or exceed the legal minimums in all operating jurisdictions, which saw adjustments in many countries throughout 2024.

- Workplace safety standards: Adherence to occupational health and safety regulations is paramount to prevent accidents and ensure a healthy work environment.

- Employee rights and collective bargaining: Respecting employees' rights to organize and engage in collective bargaining is a key legal requirement in many of Bunge's markets.

- Addressing labor disputes: Proactive management of employee relations is crucial to mitigate the risk of strikes or legal challenges that could disrupt operations.

International Trade Agreements and Tariffs

Bunge's extensive global operations are significantly shaped by international trade agreements and tariff policies. For instance, the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, continues to influence agricultural trade flows and could impact Bunge's North American supply chains. Fluctuations in global tariffs, such as those experienced in recent years affecting agricultural commodities, directly alter import and export costs, potentially impacting Bunge's profitability and market positioning.

Navigating these complex legal frameworks is crucial for Bunge's success. For example, trade disputes between major agricultural producers and consumers can lead to retaliatory tariffs, disrupting established trade routes and increasing operational expenses. As of early 2024, ongoing trade negotiations and potential shifts in protectionist policies worldwide necessitate continuous adaptation from Bunge to maintain its competitive edge and ensure market access for its products.

- USMCA Impact: The USMCA's provisions on agricultural trade continue to be a key consideration for Bunge's North American operations, influencing market access and regulatory compliance.

- Tariff Volatility: Recent years have seen increased volatility in global tariffs on agricultural goods, directly affecting Bunge's import/export costs and overall competitiveness.

- Trade Dispute Repercussions: Trade tensions between major economies can result in retaliatory tariffs, posing risks to Bunge's established supply chains and market access.

- Adaptation Necessity: Bunge must actively monitor and adapt to evolving international trade laws and agreements to safeguard its global business strategy and profitability.

Bunge is subject to stringent intellectual property (IP) laws, particularly concerning its proprietary seed varieties, processing technologies, and branding. Protecting these assets is vital for maintaining competitive advantage and preventing unauthorized use. For instance, in 2024, the company continued to invest in R&D, necessitating robust IP protection strategies against infringement.

Navigating patent disputes and trademark infringements can lead to significant legal costs and operational disruptions. Bunge's commitment to innovation means it must vigilantly monitor its IP portfolio and enforce its rights globally. As of early 2025, the company's legal strategy includes proactive measures to safeguard its technological advancements and brand integrity in a competitive market.

Compliance with data privacy regulations, such as GDPR and similar laws enacted globally, is also a growing legal concern for Bunge. Managing customer and supplier data requires adherence to strict protocols to avoid penalties and maintain trust. The company's 2024 data governance initiatives reflect the increasing legal emphasis on data protection across its operations.

Environmental factors

Climate change is a significant environmental factor affecting Bunge. Altered weather patterns, more frequent extreme events like droughts and floods, and shifting growing seasons directly impact crop yields, which are Bunge's primary raw materials. For instance, the 2023 U.S. growing season saw widespread drought in key agricultural regions, impacting corn and soybean production, two critical commodities for Bunge.

These climate-related disruptions create volatility in raw material availability and pricing, posing a substantial risk to Bunge's supply chain reliability. The company must implement adaptive sourcing strategies and bolster its supply chain management to buffer against potential crop failures and the resulting price fluctuations. This resilience is crucial for maintaining consistent operations and profitability.

Integrating climate resilience into Bunge's long-term strategic planning is paramount. This includes investing in drought-resistant crop varieties, exploring alternative sourcing regions less susceptible to climate shocks, and enhancing logistics to manage supply disruptions. Proactive adaptation will be key to navigating the evolving agricultural landscape and ensuring Bunge's sustained success.

Bunge, as a significant player in agricultural commodities, faces intense scrutiny over its impact on deforestation and land use. The company's sourcing practices, especially in critical regions like the Amazon, are under a microscope. For instance, reports in 2024 highlighted ongoing concerns about the link between certain agricultural supply chains and forest clearing, putting pressure on companies like Bunge to demonstrate robust sustainability efforts.

To address these environmental factors, Bunge's commitment to responsible sourcing and enhanced supply chain traceability is paramount. Stakeholders, including investors and consumers, increasingly demand transparency regarding where commodities originate. Meeting these expectations, alongside navigating evolving regulations designed to curb deforestation, such as those being implemented or strengthened in the EU and other key markets throughout 2024 and into 2025, is vital for maintaining Bunge's environmental reputation and securing its long-term social license to operate.

Water availability is a significant environmental concern for Bunge, particularly in its agricultural sourcing regions and processing plant locations. Droughts and changing rainfall patterns, exacerbated by climate change, directly threaten crop yields for commodities like soybeans and corn, which are central to Bunge's operations. For instance, in 2023, parts of the US Midwest experienced significant drought, impacting corn production and prices.

Water scarcity also elevates operational costs. Increased competition for limited water resources can lead to higher water prices for industrial use, and stricter regulations on wastewater discharge necessitate investment in advanced treatment technologies. Bunge's commitment to sustainability requires proactive strategies for efficient water use across its value chain.

Implementing advanced water management solutions, such as precision irrigation techniques at farms and closed-loop water systems in processing plants, is crucial. Bunge's sustainability reports often highlight initiatives aimed at reducing water intensity; for example, in 2022, they reported a reduction in water withdrawal intensity by 5% compared to their 2019 baseline across their global operations.

Biodiversity Loss and Ecosystem Health

Bunge's extensive agricultural operations, particularly in soy and palm oil, can significantly impact biodiversity. For instance, the expansion of agricultural land often leads to deforestation, directly contributing to habitat loss for numerous species. This degradation of natural ecosystems presents a substantial environmental risk, potentially affecting supply chain stability and Bunge's reputation. The company's commitment to sustainable sourcing must actively mitigate these impacts.

Protecting biodiversity and fostering ecosystem health are becoming critical for ensuring the long-term viability of agriculture. Healthy ecosystems provide essential services like pollination and soil fertility, which are vital for crop yields. As of 2024, global efforts to halt biodiversity loss are intensifying, with organizations like the UN highlighting the urgent need for nature-positive business practices. Bunge's environmental strategy needs to demonstrably address its influence on local ecosystems within its sourcing regions.

- Impact on Habitats: Large-scale monoculture farming practices, common in Bunge's supply chains, can reduce habitat diversity and fragment ecosystems.

- Ecosystem Services: Degradation of natural habitats can impair crucial ecosystem services such as water regulation and carbon sequestration.

- Regulatory Scrutiny: Increasing global focus on biodiversity conservation means Bunge faces growing pressure from regulators and stakeholders to demonstrate responsible land management.

- Supply Chain Resilience: Maintaining healthy ecosystems is directly linked to the long-term productivity and resilience of agricultural supply chains.

Carbon Emissions and Renewable Energy Transition

Bunge's extensive operations, spanning agriculture, processing, and global logistics, inherently generate greenhouse gas emissions, creating significant pressure to reduce its environmental impact. The company's reliance on energy across these diverse activities means that the global shift towards decarbonization directly influences its operational strategies and energy procurement choices.

The accelerating transition to renewable energy sources presents both challenges and opportunities for Bunge. For instance, in 2023, Bunge reported progress in its sustainability efforts, including a reduction in Scope 1 and 2 greenhouse gas emissions intensity by 10% compared to its 2019 baseline, demonstrating a tangible step towards its climate goals.

Investing in renewable energy solutions and implementing robust energy-efficient practices are therefore critical for Bunge to meet its sustainability targets and effectively manage climate-related financial risks. The company's commitment to these areas is highlighted by its ongoing projects to increase renewable energy usage in its facilities, aiming for a substantial portion of its electricity needs to be met by renewables in the coming years.

- Bunge's emissions intensity reduction targets are a key focus in its environmental strategy for 2024-2025.

- The company is exploring investments in solar and wind power for its processing plants.

- Energy efficiency improvements in its logistics network are being prioritized to lower its carbon footprint.

Bunge's environmental footprint is heavily influenced by climate change, impacting crop yields and supply chain stability. Extreme weather events, like the widespread drought affecting U.S. corn and soybean production in 2023, directly increase raw material price volatility. To mitigate these risks, Bunge is investing in drought-resistant crops and exploring alternative sourcing regions, aiming to enhance supply chain resilience against climate shocks.

Deforestation and land use practices remain critical environmental concerns for Bunge, particularly in its soy and palm oil sourcing regions. Growing global pressure, including new EU regulations in 2024-2025 targeting deforestation, necessitates increased transparency and robust traceability in its supply chains. Bunge's commitment to responsible sourcing is vital for maintaining its environmental reputation and social license to operate.

Water scarcity poses a significant challenge, impacting crop yields and increasing operational costs for Bunge. The company is implementing water-efficient technologies, such as precision irrigation and closed-loop systems, and reported a 5% reduction in water withdrawal intensity by 2022 from its 2019 baseline. These efforts are crucial for sustainable operations amidst growing water stress.

Biodiversity loss, driven by agricultural expansion, directly affects Bunge's supply chains through habitat degradation. As global efforts to halt biodiversity decline intensify in 2024, Bunge faces pressure to adopt nature-positive practices. Maintaining healthy ecosystems is essential for long-term agricultural productivity and supply chain resilience.

Bunge is actively working to reduce its greenhouse gas emissions, reporting a 10% reduction in Scope 1 and 2 emissions intensity by 2023 compared to its 2019 baseline. The company is prioritizing investments in renewable energy for its processing plants and improving energy efficiency across its logistics network to meet its decarbonization goals.

PESTLE Analysis Data Sources

Our Bunge PESTLE Analysis draws from a comprehensive mix of official government publications, international economic data from organizations like the World Bank and IMF, and reports from leading market research firms. This ensures a robust understanding of political, economic, social, technological, legal, and environmental factors impacting Bunge's operations.