Bunge Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bunge Bundle

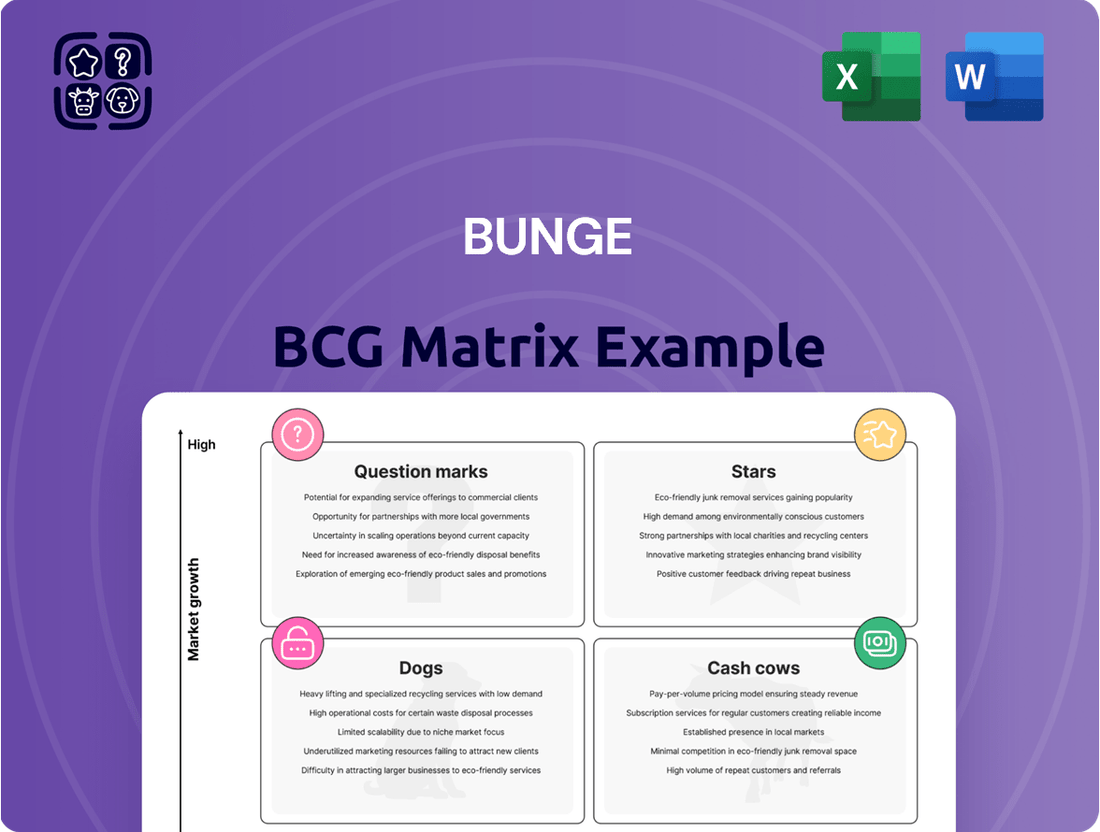

Unlock the secrets to strategic portfolio management with the BCG Matrix, a powerful tool that categorizes products into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share. Understanding these classifications is crucial for optimizing resource allocation and driving future success. Don't settle for a glimpse; purchase the full BCG Matrix report for in-depth analysis and actionable insights that will transform your business strategy.

Stars

Bunge's joint venture, Bunge Chevron Ag Renewables LLC, is a prime example of a Star in the BCG matrix, directly addressing the booming renewable fuels sector. This partnership is actively working to enhance the production of lower carbon intensity feedstocks, a critical component for this expanding market.

The venture's commitment to growth is evident in its plans to double the capacity of key oilseed processing facilities by the close of 2024. Furthermore, a new processing plant is slated for operation in 2026, specifically designed to meet the escalating demand for renewable fuel feedstocks.

These strategic investments underscore Bunge's focus on leveraging the global shift towards sustainable energy. By positioning itself at the forefront of renewable fuel feedstock production, Bunge is poised to benefit from increasing market opportunities.

Bunge's significant investment in its soy protein concentrate (SPC) facilities, such as the €484 million state-of-the-art plant in Morristown, Indiana, slated for mid-2025 commissioning, highlights a strategic push into a rapidly growing market. This facility is designed to produce high-purity protein, catering to the increasing demand for plant-based food ingredients.

The global plant-based protein market was valued at €8.8 billion in 2024 and is anticipated to expand to €15.8 billion by 2034, underscoring the substantial growth potential Bunge is targeting. By focusing on SPC, Bunge is positioning itself to capture a significant share of this expanding market, meeting evolving consumer preferences for alternative protein sources.

Bunge is expanding its plant-based food ingredient portfolio beyond its core soy protein concentrate (SPC) offerings. A key development in 2024 was the North American launch of Beleaf PlantBetter, a plant-based butter alternative designed to compete with traditional dairy butter on both cost and sensory appeal. This strategic move taps into growing consumer demand for healthier and more sustainable food choices.

The company's commitment to innovation in this sector is further underscored by its investment in enhanced plant protein technical capabilities at its Creative Solutions Center. This investment is crucial for developing next-generation plant-based solutions that meet the evolving needs of the food industry and consumers alike.

Global Oilseed Processing Capacity Expansion

Bunge's strategic expansion of its global oilseed processing capacity, exemplified by its joint venture with Chevron and other investments, firmly places it as a star in the BCG matrix. This growth is fueled by robust demand for edible oils, animal feed, and biofuels.

The global oilseed processing market is anticipated to experience substantial growth, with projections indicating a compound annual growth rate (CAGR) of approximately 5.5% from 2024 to 2033. This upward trend underscores the strategic advantage of Bunge's capacity enhancements.

Bunge's increased scale and operational efficiency, resulting from these expansions, enable it to effectively meet escalating worldwide market demands. This positions the company to capitalize on the growing opportunities within the oilseed sector.

- Global Oilseed Processing Market Growth: Projected CAGR of 5.5% from 2024-2033.

- Bunge's Strategic Moves: Expansion via Chevron JV and other initiatives.

- Market Drivers: Increasing demand for edible oils, animal feed, and biofuels.

- Competitive Advantage: Enhanced scale and efficiency to meet global demand.

Strategic Integration (Post-Viterra Merger)

The pending merger with Viterra, slated for completion in 2025 pending regulatory approvals, positions Bunge as a significantly larger global agribusiness player. This strategic integration is expected to unlock substantial long-term advantages for Bunge, including enhanced operational scale and greater efficiencies.

The combined entity will boast an expanded global footprint, enabling Bunge to more effectively link farmers with consumers. This improved connectivity is crucial for delivering vital food, feed, and fuel products worldwide.

- Increased Scale: The merger is projected to create an agribusiness powerhouse with combined revenues potentially exceeding $100 billion, based on 2024 pro forma estimates, solidifying its market leadership.

- Enhanced Efficiency: Synergies from the integration are anticipated to yield significant cost savings, estimated in the hundreds of millions of dollars annually, through optimized supply chains and shared resources.

- Stronger Competitive Position: The expanded reach across diverse crops and geographies will bolster Bunge's ability to navigate market volatility and capitalize on global demand trends, especially in key agricultural markets.

- Improved Farmer-Consumer Link: The enlarged network will facilitate more direct and efficient pathways for agricultural products, benefiting both producers through better market access and consumers through reliable supply.

Bunge's strategic investments in renewable fuels and plant-based proteins position it firmly in the Star category of the BCG matrix. The joint venture with Chevron Ag Renewables is set to significantly boost feedstock production, with plans to double capacity by the end of 2024 and a new plant opening in 2026. This focus on a high-growth sector, driven by global sustainability trends, demonstrates Bunge's commitment to capturing future market share.

The company's expansion into the plant-based protein market, highlighted by its €484 million soy protein concentrate facility in Indiana, also signifies a Star. This market, valued at €8.8 billion in 2024 and projected to reach €15.8 billion by 2034, offers substantial growth opportunities. Bunge's introduction of Beleaf PlantBetter butter alternative further solidifies its presence in this expanding consumer-driven sector.

Bunge's overall expansion in global oilseed processing, with a projected market CAGR of 5.5% from 2024 to 2033, reinforces its Star status. These moves, coupled with the pending Viterra merger expected to close in 2025, are creating a more efficient and larger agribusiness entity, poised to capitalize on global demand for food, feed, and fuel.

| Business Area | BCG Category | Key Growth Drivers | Bunge's Strategic Action | Market Data (2024 Estimates) |

|---|---|---|---|---|

| Renewable Fuels Feedstock | Star | Growing demand for sustainable energy | Chevron JV, capacity expansion by 2024, new plant 2026 | Sector experiencing rapid growth |

| Plant-Based Proteins | Star | Consumer shift to alternative proteins | €484M SPC plant (2025 commissioning), Beleaf PlantBetter launch | Market valued at €8.8 billion |

| Global Oilseed Processing | Star | Demand for edible oils, animal feed, biofuels | Capacity expansions, Viterra merger (2025) | Projected CAGR of 5.5% (2024-2033) |

What is included in the product

The Bunge BCG Matrix categorizes business units by market share and growth rate, guiding strategic decisions.

The Bunge BCG Matrix offers a clear, visual tool to identify underperforming units, relieving the pain of inefficient resource allocation.

Cash Cows

Bunge's core global agribusiness operations are undeniably its cash cow, consistently driving the bulk of its revenue. This segment, which involves the sourcing, processing, and distribution of essential agricultural products like oilseeds and grains, is the bedrock of the company's financial strength.

In 2024, Bunge's agribusiness segment continued to be the primary engine for cash generation, leveraging its extensive global infrastructure. The company's ability to manage supply chains and processing efficiently, even amidst market volatility, ensures a steady and significant contribution to its overall financial performance.

Bunge's position as the world's largest oilseed processor, boasting a vast and well-established network, firmly places this segment within the Cash Cows category of the BCG Matrix. These mature operations are highly efficient in transforming oilseeds into vital products for food, animal feed, and biofuels, consistently yielding steady profits.

In 2024, Bunge's oilseed processing segment continued to be a bedrock of its financial performance. For instance, the company reported substantial revenue contributions from its crushing operations, underscoring the segment's reliability and its ability to generate significant, predictable cash flow. This stability allows Bunge to fund investments in its growth-oriented business areas.

Bunge's Refined and Specialty Oils segment is a classic Cash Cow. Despite some market rebalancing, this mature portfolio consistently generates significant cash flow. The segment's strength lies in its essential role supplying high-quality plant-based specialty oils, fats, and lecithins to the food and nutrition industry, bolstered by strong customer ties and predictable demand.

This segment's established competitive advantage translates into steady profit margins, making it a reliable source of funds for Bunge. For instance, in 2023, Bunge reported that its Specialty Oils business demonstrated resilience, contributing positively to overall earnings despite broader commodity market fluctuations.

Global Grain Trading Operations

Bunge's extensive global grain trading operations are a significant cash cow, leveraging an integrated network for efficient sourcing and distribution of essential commodities.

Despite facing headwinds in the 2024/2025 period, including anticipated declines in global trade volumes due to lower import demand from key consumers and reduced yields from major exporting regions, Bunge's deep-seated expertise remains a strong differentiator.

This expertise spans the entire value chain – from managing production and ensuring reliable distribution to maintaining stringent quality control and effectively mitigating market risks.

This robust operational capability underpins its consistent generation of cash flow, even amidst market volatility.

- Market Share: Bunge consistently ranks among the top global grain traders, handling millions of metric tons annually.

- Revenue Contribution: The agribusiness segment, heavily reliant on grain trading, often accounts for a substantial portion of Bunge's total revenue. For instance, in 2023, Bunge's Agribusiness segment reported significant revenue streams, highlighting the importance of its trading operations.

- Profitability: Despite fluctuations in commodity prices and trade flows, Bunge's efficient risk management and logistical prowess allow for sustained profitability in its trading activities.

- Global Reach: With operations in over 40 countries, Bunge's grain trading network provides unparalleled access to both supply and demand centers worldwide.

Milling Segment (North America)

Bunge's milling segment in North America stands as a reliable source of cash for the company. This division, which processes essential grains like wheat and corn, serves major food producers, solidifying its stable market presence.

While global milling performance can fluctuate due to competitive pressures, especially in areas like South America, North American milling operations have demonstrated notable resilience. Projections indicate a stronger performance for this segment in 2025, reinforcing its position as a key contributor to Bunge's financial stability.

- Consistent Cash Generation: The North American milling segment reliably generates significant cash flow for Bunge.

- Essential Product Offering: Supplies vital milled grains such as wheat and corn to major industry players.

- Market Resilience: North American operations have shown strength despite broader milling market challenges.

- Positive 2025 Outlook: Expected to improve performance in the upcoming year, further bolstering its cash cow status.

Bunge's established agribusiness operations, particularly its oilseed processing and global grain trading, are the company's primary cash cows. These mature segments benefit from extensive infrastructure and deep market expertise, consistently generating substantial and predictable cash flow. This financial strength allows Bunge to invest in other areas of its business.

In 2024, Bunge's agribusiness segment continued to be a powerhouse, with oilseed processing and grain trading forming the backbone of its profitability. The company's vast global network and efficient supply chain management were key drivers of this performance, ensuring a steady inflow of cash despite market fluctuations.

The Refined and Specialty Oils segment also operates as a cash cow, supplying essential ingredients to the food and nutrition sector. Its consistent demand and strong customer relationships contribute to stable profit margins, reinforcing its role as a reliable cash generator for Bunge.

| Segment | BCG Category | 2024 Performance Highlight | Key Strength |

|---|---|---|---|

| Agribusiness (Oilseed Processing & Grain Trading) | Cash Cow | Continued to be the primary engine for cash generation, leveraging global infrastructure. | Vast network, efficient supply chains, deep market expertise. |

| Refined and Specialty Oils | Cash Cow | Demonstrated resilience, contributing positively to earnings. | Essential product offering, strong customer ties, predictable demand. |

| North American Milling | Cash Cow | Showed notable resilience and is expected to improve performance in 2025. | Stable market presence, serves major food producers. |

Full Transparency, Always

Bunge BCG Matrix

The preview you see is the complete, unwatermarked Bunge BCG Matrix document you will receive immediately after purchase. This means the strategic framework, analysis, and visual representation are exactly as they will be in your final download, ready for immediate application in your business planning. You can confidently use this preview to understand the depth and quality of the BCG Matrix report you're acquiring, ensuring it meets your strategic needs without any hidden surprises. This ensures you're purchasing a fully formatted and actionable tool designed for effective market analysis and decision-making.

Dogs

Bunge's divestiture of its 50% stake in the BP Bunge Bioenergia joint venture in October 2024 places this business unit firmly in the Dogs category of the BCG Matrix. This strategic move, aimed at streamlining operations and focusing on global integrated value chains, suggests the venture was a low-growth, potentially cash-draining asset. The company's decision to allocate the sale proceeds towards stock repurchase programs further underscores its assessment of this segment as non-core and unlikely to generate significant future returns.

Bunge's divestiture of its European margarine business aligns with a strategic portfolio optimization, likely placing this segment in the Dogs quadrant of the BCG Matrix. This suggests the business, while potentially stable, may have limited growth potential and low market share in a competitive landscape. For instance, in 2023, the global margarine market experienced moderate growth, but specific regional segments like Europe might face intense competition from plant-based alternatives and private label brands, impacting profitability.

Bunge's divested U.S. corn milling business would likely be categorized as a Dog in the BCG matrix. This is because its divestiture indicates it was not a significant growth driver or market share leader for the company, and was instead seen as a non-core asset.

The decision to sell this business, similar to the European margarine business, suggests it was underperforming or not strategically aligned with Bunge's global integrated value chains. Divesting such operations allows Bunge to reallocate capital and focus on more promising ventures.

Underperforming Regional Assets

Bunge's strategic divestitures, such as its corn milling and margarine businesses, are classic examples of addressing underperforming regional assets within the BCG framework. These moves indicate a deliberate effort to shed operations that likely possessed low market share and limited growth prospects in their respective regions.

These divested assets often represent a drain on capital, tying up resources that could be better allocated to more promising areas of the business. By selling off these units, Bunge aims to enhance its overall portfolio efficiency and financial health.

- Divestiture of Corn Milling: Bunge's exit from certain regional corn milling operations in 2023, for instance, signals a strategic retreat from markets where its competitive position was weak.

- Margarine Business Sale: The sale of its margarine business in several markets in 2024 underscores a focus on core strengths, moving away from segments with slower growth or intense competition.

- Capital Reallocation: Such divestitures free up capital, allowing Bunge to reinvest in higher-growth segments like its oilseed processing or food ingredients divisions, which are likely its Stars or Cash Cows.

- Portfolio Optimization: Ultimately, these actions are about optimizing Bunge's global portfolio, ensuring that resources are concentrated on businesses with the greatest potential for future returns and market leadership.

Legacy Non-Core Business Units

Legacy Non-Core Business Units in Bunge's portfolio, identified through their ongoing divestment, represent segments that no longer align with the company's strategic focus on high-growth or high-market-share areas. These units, by definition, are considered Dogs in the BCG matrix.

Their classification as Dogs stems from their characteristic low market share in a low-growth industry, meaning they generate minimal profits and often require significant resource investment without promising future returns. For instance, Bunge's strategic review in 2023 and 2024 has led to the divestiture of certain operations, reflecting this portfolio optimization process.

- Divestment Rationale: Legacy units are divested because they no longer fit Bunge's core strategy for growth and profitability.

- BCG Matrix Classification: These businesses are categorized as Dogs due to their low market share and participation in low-growth markets.

- Resource Consumption: They consume valuable company resources, such as capital and management attention, without generating substantial returns or future potential.

- Strategic Alignment: Bunge's ongoing portfolio adjustments, including the sale of certain segments in 2023 and 2024, underscore the move away from these non-core, underperforming assets.

Bunge's divestiture of its BP Bunge Bioenergia stake in October 2024 clearly places this venture in the Dogs category of the BCG Matrix. This move, along with the sale of its European margarine business and certain U.S. corn milling operations, signals a strategic pruning of low-growth, non-core assets. These divested units likely had low market share and limited future prospects, freeing up capital for more promising ventures.

| Business Unit | BCG Category | Rationale |

| BP Bunge Bioenergia | Dogs | Divested Oct 2024; low growth, non-core |

| European Margarine Business | Dogs | Divested 2024; competitive, slow growth |

| U.S. Corn Milling (certain operations) | Dogs | Divested 2023; weak competitive position |

Question Marks

Novel winter oilseed crops like winter canola and CoverCress are positioned as potential Stars within Bunge's BCG Matrix. Bunge Chevron Ag Renewables is actively investing in processing facilities designed for flexibility, signaling a commitment to these emerging, high-growth feedstocks for renewable fuels.

Despite their promising future, these crops currently hold a low market share due to their early stage of development and adoption. Significant capital investment is necessary to build out the required supply chains and achieve widespread market acceptance, a characteristic of Star businesses that require substantial investment to maintain their growth trajectory.

Bunge is exploring blockchain for deforestation-free soy traceability, especially for Brazilian grains bound for Asia. This aligns with increasing global demand for supply chain transparency and sustainability. The company's current market share in offering these advanced tech solutions for widespread adoption is still in its nascent stages, indicating a need for significant investment to establish leadership.

Bunge's foray into niche plant-based products like Beleaf PlantBetter positions them in a burgeoning sector with substantial growth potential but currently low market penetration. This strategic move targets emerging consumer preferences for alternative proteins.

These new product lines are essentially startups within Bunge's portfolio, aiming to establish a foothold in nascent markets. Their success hinges on rapid market penetration, requiring substantial marketing and investment to outpace competitors and avoid becoming stagnant offerings.

New Market Penetration in Specific Geographies

Bunge's expansion into new geographic markets for specific product lines, where it currently holds a smaller market share, can be viewed as question marks within its portfolio. These ventures are often in regions with promising growth potential but also feature established competitors, necessitating significant investment to build brand recognition and distribution networks.

For instance, Bunge's efforts to increase its footprint in emerging Asian markets for its specialty oils and ingredients, areas where local players are strong, exemplify this. These markets are projected for substantial growth; for example, the Southeast Asian edible oil market was valued at approximately USD 30 billion in 2023 and is expected to grow at a CAGR of over 4% through 2028. Bunge's success hinges on its capacity to tailor its offerings and marketing strategies to diverse regional consumer preferences and regulatory landscapes.

- Market Entry Challenges: Bunge faces intense competition from established regional and global players in these new geographies, requiring substantial marketing and distribution investments.

- Growth Potential: These markets offer attractive long-term growth prospects, driven by increasing populations and rising disposable incomes, making the investment potentially rewarding.

- Adaptability is Key: Bunge's ability to adapt its product portfolio, pricing, and supply chain to meet local demands and navigate regulatory environments will be critical for success.

- Investment Requirements: Gaining significant market share in these question mark segments demands considerable capital outlay for brand building, infrastructure development, and market penetration strategies.

Specific Biofuel Feedstock Innovations

Bunge's exploration into novel, lower carbon intensity feedstocks signifies a strategic move into the question mark quadrant of the BCG matrix. This includes their collaboration with Repsol, targeting European markets with advanced biofuel components derived from sources beyond traditional soybean oil.

The global market for diverse low-carbon feedstocks is experiencing robust expansion, with projections indicating continued growth. For instance, the renewable diesel market, a key beneficiary of such feedstock innovations, was valued at approximately $20 billion in 2023 and is anticipated to reach over $40 billion by 2028, showcasing significant potential.

- Diversification Beyond Soy: Bunge is actively investigating and investing in feedstocks such as used cooking oil (UCO), animal fats, and potentially cellulosic materials to broaden its biofuel supply chain.

- Strategic Partnerships: The alliance with Repsol exemplifies Bunge's strategy to gain early market access and technical expertise in emerging feedstock processing for the European renewable fuels sector.

- Market Entry Challenges: While the market for these alternative feedstocks is growing, Bunge's current market share in these specific nascent categories is likely minimal, necessitating substantial research, development, and market cultivation investments.

- Investment Horizon: Significant capital expenditure will be required for scaling up collection, pre-treatment, and processing technologies for these new feedstocks, positioning them as future growth drivers but with inherent developmental risks.

Question Marks represent Bunge's ventures into new or developing markets where the company has a low market share but faces high growth potential. These segments require significant investment to gain traction and could become Stars or even Cash Cows if successful.

Bunge's strategic expansion into new geographic markets for specialty oils and ingredients, particularly in Asia, exemplifies a Question Mark. These regions, like Southeast Asia with its USD 30 billion edible oil market in 2023, offer substantial growth but are characterized by strong local competition, demanding considerable investment in brand building and distribution.

The company's exploration of novel, lower carbon intensity feedstocks, such as used cooking oil and animal fats, for advanced biofuels also falls into the Question Mark category. While the global renewable diesel market is projected to double from $20 billion in 2023 to over $40 billion by 2028, Bunge's current share in these specific nascent feedstock categories is minimal, necessitating substantial R&D and market cultivation.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.