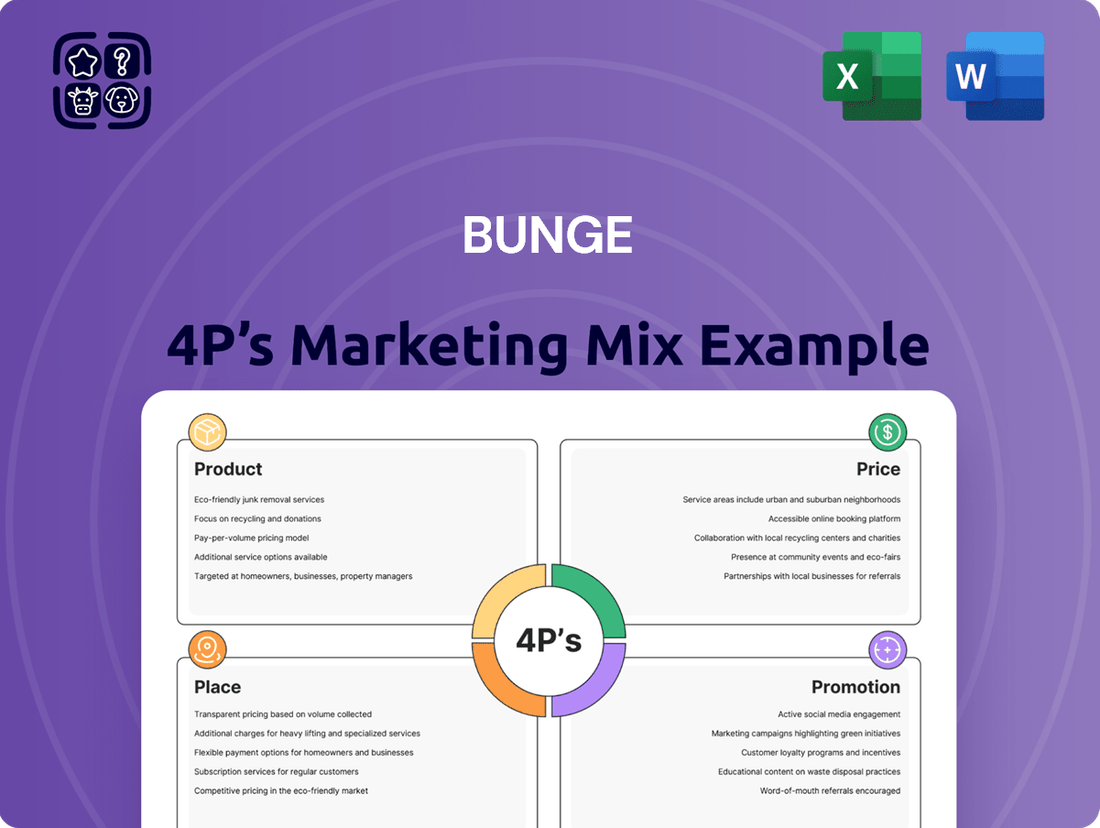

Bunge Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bunge Bundle

Discover how Bunge leverages its product portfolio, competitive pricing, extensive distribution network, and impactful promotional campaigns to maintain its market leadership. This analysis offers a glimpse into their strategic brilliance.

Ready to unlock the full picture? Dive deeper into Bunge's marketing success with our comprehensive 4Ps analysis, providing actionable insights and a strategic roadmap.

Product

Bunge's product strategy centers on a broad range of global agricultural commodities, predominantly oilseeds like soybeans and canola, alongside vital grains such as corn and wheat. These are the foundational raw materials that fuel Bunge's diverse downstream operations and serve numerous global industries. For instance, in 2024, Bunge's agribusiness segment generated a significant portion of its revenue from these core commodities, reflecting their crucial role in the global food and feed supply chain.

Bunge's processed food ingredients are central to their business, transforming raw agricultural commodities into vital components for food manufacturers. This product category includes a wide array of edible oils, shortenings, and flours derived from wheat and corn, designed to meet changing dietary preferences and consumer demands. For instance, Bunge's focus on innovation in edible oils saw them investing in solutions for plant-based alternatives, a growing market segment. In 2023, the global food ingredients market was valued at over $700 billion, with processed ingredients forming a significant portion.

Bunge's animal feed solutions, primarily protein meal derived from oilseeds, are a cornerstone of its agribusiness. In 2024, the global animal feed market was valued at approximately $470 billion, with protein meal being a critical ingredient for livestock nutrition. Bunge's integrated processing model, from sourcing oilseeds to producing meal, ensures a consistent supply of high-quality feed components, supporting the productivity of the livestock sector.

Renewable Fuel Feedstocks

Bunge's renewable fuel feedstocks are crucial for the burgeoning sustainable energy market. They supply key ingredients for renewable diesel and sustainable aviation fuel (SAF), directly addressing the global push for lower-carbon alternatives.

The company processes oilseeds, a primary feedstock, and actively researches new crops to enhance the low-carbon intensity of these fuels. This strategic focus positions Bunge to capitalize on the increasing demand for environmentally friendly energy solutions.

Bunge's commitment to decarbonizing agriculture is evident in their innovative partnerships. For instance, by 2024, Bunge aimed to increase its sustainable sourcing of soy to 90% in Brazil and Argentina, a significant step towards a greener supply chain for renewable fuels.

- Feedstock Processing: Bunge processes oilseeds like soybeans and canola, vital components for renewable diesel production.

- SAF Development: The company is exploring and supplying feedstocks for Sustainable Aviation Fuel (SAF), a key area for aviation's decarbonization.

- Low-Carbon Solutions: Research into novel crops and improved agricultural practices aims to reduce the carbon intensity of Bunge's fuel feedstocks.

- Agricultural Decarbonization: Partnerships and initiatives support the broader goal of making agriculture more sustainable, benefiting the entire renewable fuel value chain.

Specialty Plant-Based Proteins

Bunge is strategically enhancing its product offerings by venturing into high-value specialty items, with a particular focus on plant-based proteins. This move directly addresses the escalating global demand for alternative protein sources, a trend projected to continue its upward trajectory.

A significant development in this area is the upcoming opening of a new soy protein concentrate plant in the U.S. in 2025. This facility is poised to establish Bunge as a formidable competitor in the burgeoning plant-based protein market.

The company's investment in specialty plant-based proteins aligns with broader market shifts. For instance, the global plant-based protein market was valued at an estimated $13.7 billion in 2023 and is forecasted to reach $32.5 billion by 2030, growing at a compound annual growth rate of approximately 13.1% during this period.

- Product Innovation: Bunge is developing advanced plant-based protein ingredients to meet diverse consumer needs.

- Market Expansion: The 2025 U.S. soy protein concentrate plant signifies a major commitment to this growth sector.

- Consumer Demand: This expansion caters to the increasing preference for sustainable and alternative protein options.

- Strategic Positioning: Bunge aims to become a leading supplier in the specialty plant-based protein landscape.

Bunge's product portfolio spans essential agricultural commodities, value-added food ingredients, animal feed components, and renewable fuel feedstocks, demonstrating a diversified approach to global food and energy markets.

The company is actively expanding into high-growth areas like plant-based proteins, exemplified by its 2025 U.S. soy protein concentrate plant, to capture evolving consumer preferences.

Bunge's strategic product development emphasizes sustainability, particularly in renewable fuels, and innovation in food ingredients to meet diverse industry needs.

| Product Category | Key Offerings | 2024/2025 Relevance |

|---|---|---|

| Global Commodities | Soybeans, Corn, Wheat, Canola | Foundation of agribusiness revenue, crucial for global food and feed supply chains. |

| Processed Food Ingredients | Edible Oils, Shortenings, Flours | Meeting evolving dietary preferences; significant portion of the $700B+ global food ingredients market. |

| Animal Feed Solutions | Protein Meal (from oilseeds) | Critical ingredient for livestock nutrition, supporting the ~$470B global animal feed market. |

| Renewable Fuel Feedstocks | Oilseed derivatives for Renewable Diesel & SAF | Capitalizing on demand for lower-carbon energy alternatives; aiming for 90% sustainable soy sourcing in Brazil/Argentina by 2024. |

| Specialty Plant-Based Proteins | Soy Protein Concentrate | Targeting the rapidly growing plant-based protein market (est. $13.7B in 2023), with a new U.S. plant opening in 2025. |

What is included in the product

This analysis provides a comprehensive examination of Bunge's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights for strategic decision-making.

Simplifies complex Bunge 4P's marketing strategies into actionable insights, alleviating the pain of strategic overload.

Provides a clear, concise overview of Bunge's marketing approach, easing the burden of detailed analysis for busy executives.

Place

Bunge's integrated global network is a cornerstone of its marketing strategy, connecting farmers to consumers across the world. This expansive infrastructure, encompassing crushing plants, refineries, and distribution hubs, facilitated the movement of over 55 million metric tons of agricultural commodities in 2023. This vast operational reach is crucial for ensuring product availability and managing supply chain complexities.

Bunge's strategic sourcing hinges on direct farmer engagement across vital agricultural hubs, securing consistent raw material flow and cultivating robust rural partnerships. This approach, exemplified by its extensive network in North America and South America, underpins supply chain stability.

In 2023, Bunge reported sourcing a significant portion of its soybeans and corn directly, reflecting its commitment to farmer relationships. This direct origination strategy is crucial for managing price volatility and ensuring quality inputs for its processing operations.

Bunge operates an extensive network of crushing, refining, and milling plants. These facilities are strategically positioned to ensure efficient processing and close proximity to key markets, a crucial element in managing supply chain costs. For instance, in 2024, Bunge continued to invest in upgrading its existing infrastructure, aiming to boost throughput and reduce operational expenditures across its global footprint.

Recent capital expenditures have focused on enhancing these processing capabilities. The company has notably invested in new multi-oil plants and a significant large-scale soy protein concentrate facility, expanding its capacity to produce higher-value ingredients. These advancements are vital for Bunge's strategy of transforming basic agricultural commodities into specialized, market-ready products.

Global Distribution Channels

Bunge's distribution strategy is robust, utilizing direct sales to industrial clients, extensive bulk shipping, and a comprehensive network of storage and port facilities. This multi-faceted approach ensures efficient product movement across global markets.

The 2023 merger with Viterra was a game-changer, notably enhancing Bunge's export capabilities and physical grain handling infrastructure. This strategic move significantly bolsters its presence in vital agricultural hubs, including Canada and Australia, facilitating greater market access and supply chain control.

- Expanded Export Capacity: The Viterra integration is projected to significantly increase Bunge's export volumes, especially from North America and Australia.

- Enhanced Storage and Handling: Bunge now operates a more extensive network of grain elevators and port terminals, improving logistics efficiency.

- Global Reach: This expansion solidifies Bunge's position as a major player in international agricultural commodity trading and distribution.

Logistics and Supply Chain Management

Bunge's logistics and supply chain management are critical for its global operations, ensuring products reach customers efficiently. This encompasses managing vast inventories of agricultural commodities and processed goods, optimizing complex transportation networks, including significant ocean freight operations, and guaranteeing on-time delivery across diverse markets. Their model prioritizes seamless global trade, reflecting a commitment to reliability and operational excellence. For instance, in 2023, Bunge reported shipping over 50 million metric tons of grains and oilseeds, underscoring the sheer scale of its logistical undertakings.

The company's approach to logistics is designed for maximum efficiency and resilience, a key factor in maintaining competitive pricing and market access. This involves sophisticated inventory control systems to minimize holding costs while ensuring product availability, and strategic partnerships with shipping companies to manage freight costs and transit times effectively. Bunge's investment in technology, such as advanced tracking and analytics, further enhances its ability to navigate the complexities of international supply chains. In the first quarter of 2024, Bunge highlighted efforts to streamline its European distribution network, aiming for a 5% reduction in transportation costs.

- Global Reach: Bunge operates a vast network of processing plants, storage facilities, and distribution centers across more than 40 countries.

- Transportation Expertise: The company manages a substantial portion of its shipping needs through owned and chartered vessels, alongside rail and trucking, to move millions of tons of product annually.

- Inventory Management: Sophisticated systems are in place to balance the need for readily available stock against the costs of holding large inventories, particularly for seasonal commodities.

- Supply Chain Resilience: Bunge continuously invests in diversifying its supplier base and transportation routes to mitigate risks associated with geopolitical events or natural disasters, as seen in its 2023 strategic sourcing initiatives.

Bunge's place strategy is defined by its extensive global footprint, encompassing over 40 countries with a robust network of processing plants, storage facilities, and distribution centers. This vast infrastructure, significantly bolstered by the 2023 merger with Viterra, enhances its ability to source, process, and deliver agricultural commodities efficiently. The company's logistical prowess, managing millions of tons of product annually via owned vessels, chartered ships, rail, and trucking, ensures broad market access and supply chain reliability.

| Metric | 2023 Data | 2024 Outlook |

| Countries of Operation | 40+ | Continued expansion in key agricultural regions |

| Commodities Handled (Million Metric Tons) | 55+ | Expected increase due to Viterra integration |

| Distribution Network | Global (plants, storage, ports) | Ongoing investment in infrastructure upgrades |

What You See Is What You Get

Bunge 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Bunge 4P's Marketing Mix Analysis is fully complete and ready for your immediate use.

Promotion

Bunge's promotional strategy heavily leans into business-to-business (B2B) engagement, cultivating robust relationships with key industry players like farmers, food manufacturers, animal feed producers, and renewable fuel companies. Their communication highlights dependability, superior quality, and customized solutions designed to meet the precise needs of their industrial clientele.

This focused B2B approach ensures Bunge's products and services align with specific industry demands, thereby fostering customer success and loyalty. For instance, in 2024, Bunge reported that over 90% of its revenue was derived from B2B sales, underscoring the critical importance of these relationships.

Bunge's promotional efforts heavily emphasize its dedication to sustainability and corporate responsibility. A prime example is their achievement of 100% traceability and monitoring for soy in Brazil, a significant milestone demonstrating responsible sourcing practices.

These communications are designed to resonate with partners and consumers who increasingly value ethically produced goods. By showcasing transparency in their supply chains, Bunge aims to build trust and attract stakeholders aligned with their commitment to a more sustainable future.

Bunge actively cultivates strategic partnerships to enhance its market presence and promote its capabilities. A prime example is their collaboration with Nutrien Ag Solutions, aimed at advancing lower-carbon agriculture. This initiative, ongoing as of 2024, demonstrates Bunge's commitment to sustainable practices and innovation within the agricultural sector.

Further solidifying its forward-thinking approach, Bunge has partnered with Repsol to explore and develop renewable feedstocks. This collaboration, highlighted in recent industry reports from early 2025, underscores Bunge's dedication to pioneering advancements in the renewable energy and agricultural supply chain.

These alliances are not merely about operational advancements; they serve as a powerful promotional tool. By aligning with industry leaders, Bunge effectively communicates its innovative spirit and commitment to driving progress, thereby reinforcing its leadership position in the global agribusiness and food sectors.

Thought Leadership and Industry Presence

Bunge actively cultivates thought leadership through its participation in key industry conferences and the publication of insightful reports. These contributions often focus on critical areas like global food security, evolving agricultural trends, and the imperative of sustainable practices. For instance, Bunge's presence at events like the World Economic Forum's Food Action Alliance discussions in 2024 highlights their commitment to shaping global agricultural dialogue.

This strategic engagement positions Bunge as a recognized expert and a reliable partner within the agribusiness and food sectors. Their consistent involvement in industry discourse, such as contributing to discussions on supply chain resilience in the face of climate change, reinforces their authority. In 2024, Bunge's sustainability report detailed a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, underscoring their practical commitment to the topics they champion.

- Industry Conferences: Bunge executives frequently speak at major agricultural and food industry forums, sharing insights on market dynamics and future outlooks.

- Published Reports: The company releases data-driven analyses on topics ranging from crop yields to the economic impact of sustainable farming.

- Shaping Dialogue: Bunge contributes to discussions on policy and innovation, aiming to influence positive change in the global food system.

- Reputation Enhancement: This proactive approach builds trust and strengthens Bunge's standing as a leader committed to industry advancement and responsible operations.

Investor Relations and Financial Communications

Bunge's investor relations and financial communications are vital promotional elements, ensuring financial stakeholders understand the company's performance and strategic vision. Regular earnings calls, annual reports, and investor presentations are key touchpoints for this engagement.

These communications offer a transparent view into Bunge's financial health and future prospects, fostering investor confidence. For instance, Bunge's Q1 2024 earnings call on April 24, 2024, detailed strong performance in its Agribusiness segment, with adjusted EPS of $2.15, exceeding analyst expectations.

The company's commitment to clear and consistent financial reporting is paramount for attracting and retaining investment. This includes detailed breakdowns of segment performance, such as the 2023 full-year results which showed significant growth in their Food & Ingredients division.

- Earnings Calls: Bunge held its Q1 2024 earnings call on April 24, 2024, reporting $2.15 adjusted EPS.

- Annual Reports: The 2023 annual report highlighted robust performance in Food & Ingredients.

- Investor Presentations: These provide in-depth analysis of strategic initiatives and financial outlook.

- Transparency: Key to building and maintaining investor trust and capital inflow.

Bunge's promotional strategy is deeply rooted in its B2B relationships, emphasizing reliability and tailored solutions for sectors like food manufacturing and renewable fuels. Their commitment to sustainability is a key message, exemplified by achieving 100% traceability for soy in Brazil, resonating with ethically-minded partners.

Strategic partnerships, such as the one with Nutrien Ag Solutions for lower-carbon agriculture and with Repsol for renewable feedstocks, serve as powerful endorsements of Bunge's innovative and sustainable approach. These collaborations highlight Bunge's role as a leader driving progress in agribusiness.

Bunge actively shapes industry dialogue through thought leadership at conferences and insightful reports on topics like food security and sustainable agriculture, reinforcing their expert status. Their 2024 sustainability report noted a 15% reduction in Scope 1 and 2 GHG emissions against a 2019 baseline, backing their advocacy.

Financial communications, including earnings calls and investor reports, are crucial for promoting Bunge's performance and strategic vision, fostering investor confidence. For instance, their Q1 2024 earnings call on April 24, 2024, reported adjusted EPS of $2.15, surpassing expectations.

| Promotional Focus | Key Activities | 2024/2025 Data/Highlights |

|---|---|---|

| B2B Engagement | Relationship building, highlighting quality and custom solutions | Over 90% of revenue from B2B sales in 2024 |

| Sustainability & Responsibility | Traceability initiatives, ethical sourcing communication | 100% soy traceability in Brazil; 15% GHG emission reduction (Scope 1 & 2) vs. 2019 baseline (reported 2024) |

| Strategic Partnerships | Collaborations for innovation and sustainability | Partnerships with Nutrien Ag Solutions (low-carbon ag) and Repsol (renewable feedstocks) active through 2024/early 2025 |

| Thought Leadership | Industry conference participation, published reports | Participation in World Economic Forum Food Action Alliance (2024); focus on supply chain resilience |

| Investor Relations | Earnings calls, annual reports, investor presentations | Q1 2024 adjusted EPS of $2.15 (April 24, 2024); strong 2023 Food & Ingredients segment performance |

Price

Bunge's pricing strategy is intrinsically linked to the volatile global commodity markets, with key inputs like soybeans and wheat experiencing significant price swings. For instance, soybean prices, a major driver for Bunge, saw considerable volatility throughout 2024, influenced by weather patterns in South America and demand from China.

The company's integrated supply chain and risk management capabilities are crucial for navigating these fluctuations. By hedging and optimizing logistics, Bunge aims to maintain competitive pricing, even amidst market uncertainty. This approach ensures they can effectively respond to shifts in supply and demand, which are often exacerbated by geopolitical events impacting trade flows.

Bunge utilizes value-based pricing for its processed goods like edible oils and specialty ingredients, aligning costs with the quality and customization provided to industrial clients. This strategy acknowledges the superior functionality and tailored solutions offered, aiming to capture the full perceived worth in the market.

Bunge's commitment to operational efficiency and stringent cost management is a cornerstone of its pricing strategy, particularly when facing volatile market conditions. For example, in the first quarter of 2024, the company reported an adjusted earnings before interest and taxes (EBIT) of $544 million, demonstrating their ability to manage costs even amidst global economic shifts.

Through strategic investments in facility upgrades and the implementation of the Bunge Production System, the company actively works to lower its operational expenses. This focus on cost reduction empowers Bunge to adopt more flexible pricing models while ensuring sustained profitability, a crucial advantage in competitive agricultural markets.

The direct correlation between streamlined operations and the capacity to offer attractive, market-competitive prices cannot be overstated. By optimizing its supply chain and production processes, Bunge enhances its ability to pass cost savings onto customers, thereby strengthening its market position.

Strategic Divestitures and Acquisitions Impact

Bunge's pricing strategies are dynamically shaped by its strategic portfolio management. Recent divestitures, such as the sale of its Brazilian sugar and bioenergy joint venture and certain corn milling assets, aim to streamline operations and focus on core agribusiness. These moves are designed to improve overall financial health, which can indirectly support more competitive pricing in its remaining segments.

The monumental merger with Viterra, finalized in July 2025, represents a significant inflection point for Bunge's pricing power. This combination is projected to unlock substantial synergies, estimated to be around $300 million annually, through operational efficiencies and expanded market access. The enhanced global scale and integrated supply chain resulting from this merger are anticipated to provide Bunge with greater flexibility in its pricing strategies, potentially leading to more advantageous cost structures and competitive offers.

- Portfolio Optimization: Divestitures of non-core assets like the sugar and bioenergy JV and corn milling businesses are part of a strategy to focus on core agribusiness strengths.

- Merger Synergies: The Viterra merger, completed in July 2025, is expected to generate approximately $300 million in annual run-rate synergies, enhancing operational efficiencies.

- Global Scale Enhancement: The combined entity boasts a significantly larger global footprint, potentially improving Bunge's ability to negotiate pricing with suppliers and customers.

- Market Reach Impact: Increased market reach and a more integrated supply chain can lead to more competitive pricing strategies and improved market share.

Capital Allocation and Shareholder Returns

Bunge's approach to capital allocation, including its share repurchase programs and dividend payouts, is a key component of its overall financial strategy. This disciplined management of capital aims to deliver long-term value to shareholders.

In 2024, Bunge demonstrated its financial strength by returning significant capital to its investors, even amidst prevailing market challenges. This action underscores the company's confidence in its ongoing earnings capacity and its robust financial standing.

- Share Repurchases: Bunge actively engages in share buybacks, reducing the number of outstanding shares and potentially increasing earnings per share.

- Dividend Payments: The company consistently provides dividends, offering a direct return of profits to shareholders.

- 2024 Capital Return: Bunge returned substantial capital to shareholders in 2024, reflecting confidence in its financial health.

- Long-Term Value: This capital allocation strategy is designed to support and enhance shareholder value over the long term.

Bunge's pricing is deeply influenced by commodity markets, with 2024 seeing significant soybean price fluctuations due to South American weather and Chinese demand. The Viterra merger, finalized in July 2025, is expected to unlock around $300 million in annual synergies, enhancing pricing flexibility through greater scale and efficiency.

| Metric | 2024 (Est.) | Post-Merger Impact (2025+) |

|---|---|---|

| Soybean Price Volatility | High | Mitigated by scale and hedging |

| Synergies from Viterra Merger | N/A | ~$300 million annually |

| Operational Efficiency | Focus on Bunge Production System | Enhanced by combined operations |

4P's Marketing Mix Analysis Data Sources

Our Bunge 4P's Marketing Mix Analysis leverages a comprehensive suite of data, including internal sales figures, market research reports, and competitor pricing strategies. We also incorporate data from distribution channel partners and consumer feedback platforms to ensure a holistic view.