Bukwang Pharmaceutical PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bukwang Pharmaceutical Bundle

Navigate the complex external environment impacting Bukwang Pharmaceutical with our expert PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends are directly influencing their market position and future growth strategies. This comprehensive report empowers you with the foresight needed to make informed decisions.

Unlock actionable intelligence on the technological advancements and environmental regulations shaping the pharmaceutical industry, specifically for Bukwang Pharmaceutical. Our PESTLE analysis provides a clear roadmap to anticipate challenges and capitalize on opportunities.

Gain a critical competitive advantage by leveraging our in-depth understanding of the legal landscape affecting Bukwang Pharmaceutical. Equip yourself with the knowledge to proactively adapt and thrive in a dynamic global market.

Don't miss out on crucial insights that could redefine your strategy. Purchase the full Bukwang Pharmaceutical PESTLE analysis today to access detailed, expert-driven recommendations and secure your market edge.

Political factors

South Korea's government is actively fostering its bio-pharmaceutical industry, aiming to become a global leader by 2027. This strategic push involves significant policy support and investment, directly influencing companies like Bukwang Pharmaceutical. These initiatives include funding for research and development and favorable regulatory pathways, designed to accelerate drug discovery and commercialization.

The government also prioritizes strengthening essential medical services, which translates into policies that could impact drug pricing and accessibility. For instance, efforts to ensure a stable supply of critical medicines and promote preventative care may create both opportunities and challenges for pharmaceutical firms in terms of market demand and sales strategies.

Specific government plans to enhance the bio-pharmaceutical sector include substantial R&D subsidies and tax incentives for innovative drug development. In 2023, the government allocated over 1.2 trillion KRW (approximately $900 million USD) towards bio-health industry promotion, with a significant portion directed at pharmaceutical innovation.

South Korea's Ministry of Health and Welfare (MoHW) is actively shaping drug pricing and reimbursement policies, directly impacting Bukwang Pharmaceutical's revenue streams. Recent reforms, particularly those implemented in 2024, focus on incentivizing pharmaceutical innovation and ensuring a consistent supply of essential medicines.

These policy adjustments include modifications to risk-sharing agreements, where manufacturers share the financial risk of a drug's performance with the government. Furthermore, new criteria for cost-effectiveness evaluations are being introduced, meaning drugs must demonstrate clear value for money to secure favorable reimbursement status.

For instance, the MoHW's Health Insurance Review & Assessment Service (HIRA) continues to refine its cost-effectiveness analysis, a critical step for new drug approvals and pricing negotiations. This process, which has seen evolving methodologies in 2024, directly influences how much Bukwang Pharmaceutical can charge for its innovative treatments.

Political stability is a cornerstone for predictable operations in the pharmaceutical sector. In South Korea, recent political tensions surrounding healthcare policy, particularly the government's decision to increase medical school admissions by 2,000 seats for 2025, have created significant uncertainty. This move, aimed at addressing physician shortages, directly impacts the healthcare ecosystem Bukwang Pharmaceutical operates within, potentially altering the demand for and distribution of its products.

The 2024-2025 South Korean medical crisis, stemming from this policy dispute between the government and medical professionals, has led to disruptions in healthcare services. This instability can affect patient access to treatments and create challenges for pharmaceutical companies in terms of sales and clinical trial progression. The government's stance on healthcare workforce planning directly influences the long-term supply and demand dynamics for pharmaceuticals.

Government Support for Pharmaceutical R&D and Innovation

Government backing for pharmaceutical research and development significantly boosts companies like Bukwang. Initiatives focused on accelerating AI-driven drug discovery and development, such as those seen in South Korea's push for digital healthcare, provide crucial support. These programs aim to streamline the lengthy and expensive process of bringing new medicines to market.

Financial incentives and grants play a vital role in fostering innovation. For instance, government funding can de-risk early-stage research, encouraging investment in novel therapeutic areas. This support is essential for companies exploring complex fields like personalized medicine and advanced biologics.

Efforts to create a more favorable investment climate, including tax breaks and regulatory streamlining, directly benefit pharmaceutical firms. By reducing barriers to entry and operation, governments encourage both domestic and foreign investment in the sector. This can lead to increased capital availability for R&D and expansion.

- Government funding for AI drug development: South Korea, for example, has been investing heavily in AI-based drug discovery platforms, aiming to accelerate the R&D pipeline.

- Support for new drug discovery: Programs often include grants for preclinical and clinical trials, easing the financial burden on companies.

- Investment attraction measures: Tax incentives and regulatory reforms are designed to make the pharmaceutical industry a more appealing sector for venture capital and corporate investment.

- Industry-academia collaboration: Government-led initiatives often facilitate partnerships between research institutions and pharmaceutical companies, fostering a more robust innovation ecosystem.

International Trade Agreements and Global Collaboration

South Korea's active participation in international trade agreements significantly shapes the pharmaceutical landscape for companies like Bukwang Pharmaceutical. These policies influence the cost and accessibility of raw materials for manufacturing and the market reach for finished products. In 2023, South Korea's pharmaceutical exports reached approximately $8.1 billion, highlighting the sector's global integration.

Bukwang Pharmaceutical can leverage these trade policies to expand its international presence. The South Korean government's ambitious goal to double pharmaceutical exports to $16 billion by 2030 underscores a supportive environment for growth. This objective encourages collaborations and partnerships, which are crucial for accessing new markets and technologies.

- Trade Agreements Impact: International trade policies directly affect import costs for raw materials and export market accessibility for Bukwang Pharmaceutical's products.

- Export Growth Target: South Korea aims to double pharmaceutical exports to $16 billion by 2030, creating a favorable climate for export-oriented companies.

- Global Partnerships: Collaborations with international firms offer opportunities for market expansion, technology transfer, and enhanced R&D capabilities for Bukwang.

- Market Access Challenges: Navigating diverse regulatory requirements and potential trade barriers in different countries presents ongoing challenges for global market penetration.

Political factors significantly influence Bukwang Pharmaceutical's operating environment through government support for R&D and healthcare policy. South Korea's commitment to becoming a bio-health leader by 2027, backed by substantial funding, fosters innovation. However, recent political disputes, like the medical school admission increase for 2025, have introduced healthcare system instability, potentially impacting drug demand and distribution.

The government's active role in shaping drug pricing and reimbursement through entities like HIRA directly affects Bukwang's revenue potential. Reforms in 2024, focusing on cost-effectiveness and risk-sharing, are critical for securing favorable market access for new treatments. Furthermore, international trade policies and a target to double pharmaceutical exports to $16 billion by 2030 present both opportunities for global expansion and challenges in navigating diverse regulatory landscapes.

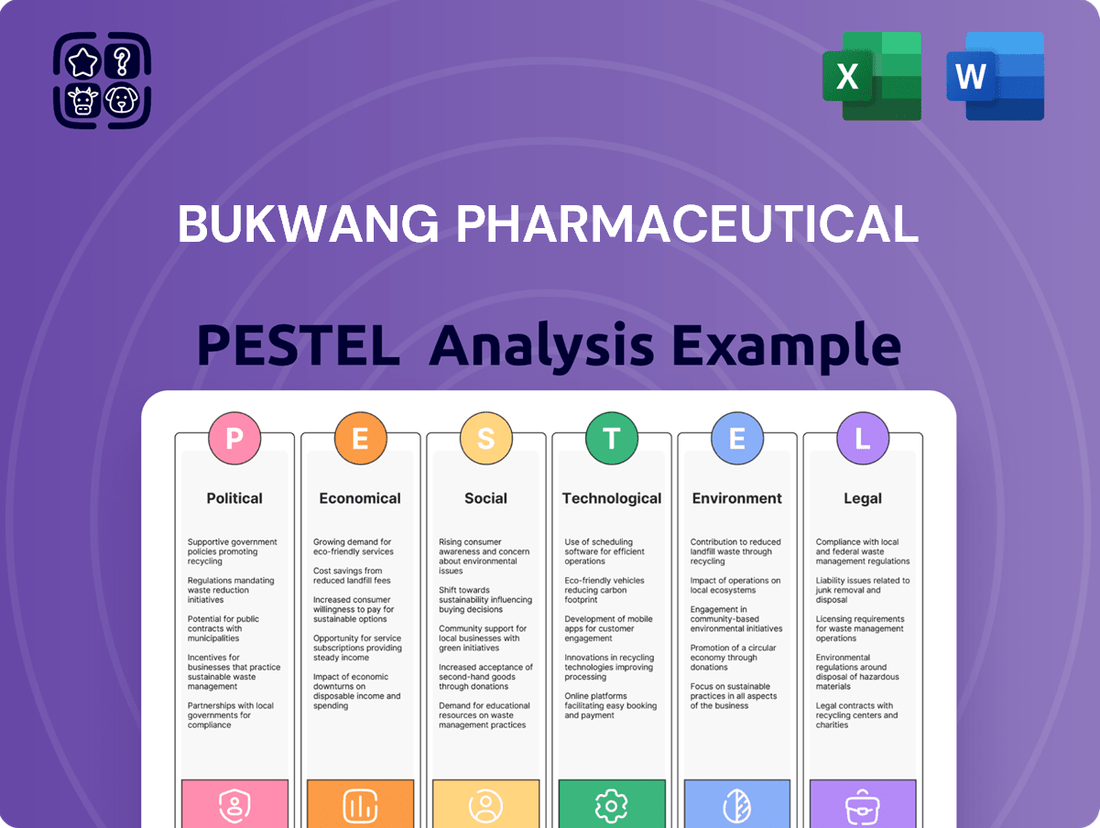

What is included in the product

This Bukwang Pharmaceutical PESTLE analysis dissects the influence of political, economic, social, technological, environmental, and legal forces on the company's operations and strategic direction.

It offers actionable insights into market trends and regulatory landscapes, empowering stakeholders to navigate external challenges and capitalize on emerging opportunities for Bukwang Pharmaceutical.

Bukwang Pharmaceutical's PESTLE analysis provides a crucial pain point reliever by offering a clear, summarized version of external factors for easy referencing during strategic planning meetings.

This analysis acts as a pain point reliever by visually segmenting external influences into PESTEL categories, allowing for quick interpretation and informed decision-making.

Economic factors

South Korea's economic trajectory significantly influences its healthcare sector. As the nation's economy continues to expand, so does its capacity and willingness to invest in health and wellness. This overall economic vitality directly correlates with increased healthcare expenditure, creating a favorable environment for pharmaceutical companies like Bukwang Pharmaceutical.

The South Korean pharmaceutical market is poised for continued growth. Projections indicate a compound annual growth rate (CAGR) of approximately 6.5% for the market from 2023 to 2028, reaching an estimated value of around $27 billion by 2028. This expansion is underpinned by rising national health expenditure, which has seen a steady increase, reflecting a strong commitment to healthcare infrastructure and services.

In 2023, South Korea's national health expenditure was estimated to be around 125.8 trillion KRW (approximately $95 billion USD), representing a notable portion of its GDP. This consistent rise in spending demonstrates a robust demand for pharmaceutical products and services, directly benefiting companies operating within this sphere.

Bukwang Pharmaceutical's financial performance is significantly shaped by South Korea's drug pricing and reimbursement system. The Maximum Allowable Price (MAP) system, a key mechanism, directly caps the prices of existing drugs, potentially squeezing profit margins on established Bukwang products. Recent reforms, aimed at controlling healthcare spending, could further impact the profitability of both new and existing medications by introducing stricter price negotiations or value-based assessments.

These policy shifts can directly affect Bukwang's revenue streams. For instance, a new drug's reimbursement approval and its pricing tier, often determined by comparative effectiveness or innovation, will dictate its market penetration and ultimate sales figures. In 2023, the South Korean government continued its efforts to manage drug expenditures, with a focus on ensuring affordability, which implies continued pressure on pharmaceutical companies like Bukwang to demonstrate clear value for their products.

Inflation significantly impacts Bukwang Pharmaceutical's operational costs. Rising inflation in South Korea, which saw consumer prices increase by 3.6% year-on-year in May 2024, directly affects the procurement of raw materials and active pharmaceutical ingredients (APIs). This upward pressure on input prices can lead to higher manufacturing expenses, impacting overall production costs.

The escalating cost of goods sold due to inflation can compress Bukwang Pharmaceutical's profit margins. For instance, if the cost of key chemical compounds or packaging materials rises sharply, the company may struggle to pass these increases onto consumers, especially in a competitive pharmaceutical market. This necessitates proactive cost management strategies.

To mitigate the impact of rising operational expenses, Bukwang Pharmaceutical might explore strategic cost reduction initiatives. This could involve diversifying its supplier base to find more cost-effective raw material sources or renegotiating contracts with existing vendors. Efficiency improvements in manufacturing processes are also crucial to maintain competitiveness amidst inflationary pressures.

Investment in R&D and Capital Expenditure

Bukwang Pharmaceutical's economic strategy heavily relies on substantial investment in research and development (R&D). This commitment is crucial for discovering and bringing new, innovative drugs to market, a key driver of long-term revenue and competitive advantage in the pharmaceutical sector.

In 2023, Bukwang Pharmaceutical reported R&D expenses amounting to approximately 39.6 billion Korean Won. This significant allocation underscores the company's focus on pipeline development and technological advancement. Furthermore, the company has been actively pursuing capital raises specifically earmarked for expanding its manufacturing capabilities and acquiring new production facilities, signaling a clear economic intent to scale operations and enhance production efficiency for future growth.

These strategic financial commitments are designed to bolster Bukwang's market position and ensure its ability to meet growing demand and explore new therapeutic areas. The company's financial maneuvers reflect a proactive approach to leveraging economic opportunities within the dynamic pharmaceutical landscape.

- R&D Investment: Bukwang Pharmaceutical's R&D expenditure reached approximately 39.6 billion KRW in 2023, highlighting a strong financial commitment to innovation.

- Capital for Expansion: The company has engaged in capital raises to fund plant expansions and the acquisition of manufacturing assets.

- Growth Strategy: These investments are integral to Bukwang's economic strategy for future growth, market penetration, and enhanced operational capacity.

- Innovation Focus: The financial commitment to R&D directly supports the development of new pharmaceutical products and the pursuit of novel therapeutic solutions.

Consumer Purchasing Power and Out-of-Pocket Expenses

Consumer purchasing power significantly impacts Bukwang Pharmaceutical's market, especially for over-the-counter (OTC) products. As disposable incomes rise, consumers are more likely to spend on non-essential health items. For instance, in South Korea, real disposable income saw a modest increase in early 2024, suggesting a stable, albeit not booming, environment for OTC sales.

Trends in out-of-pocket health expenditures are crucial for prescription drug demand. A decline in these expenses, perhaps due to expanded insurance coverage or government subsidies, can free up consumer funds for other healthcare needs, including Bukwang's prescription medications. Data from the OECD indicates that South Korea's out-of-pocket health spending as a share of total health expenditure has been gradually decreasing, a positive sign for pharmaceutical demand.

- Increased Disposable Income: Higher consumer purchasing power directly correlates with greater spending on both prescription and OTC pharmaceuticals, especially for elective or supplementary treatments.

- Reduced Out-of-Pocket Costs: A downward trend in direct healthcare payments by individuals can lead to increased demand for healthcare services and products, including pharmaceuticals.

- Affordability of Medications: When out-of-pocket expenses for drugs decrease, consumers are more likely to adhere to treatment plans and explore a wider range of available medications.

- Market Responsiveness: Bukwang Pharmaceutical's product portfolio, particularly its OTC offerings, will likely benefit from a robust economy with strong consumer spending capacity.

South Korea's economic growth directly fuels healthcare spending, creating opportunities for pharmaceutical companies like Bukwang. In 2023, national health expenditure reached approximately 125.8 trillion KRW, signifying robust demand for medicines. While inflation, at 3.6% year-on-year in May 2024, impacts operational costs, Bukwang's strategic R&D investments, totaling 39.6 billion KRW in 2023, aim to offset these pressures through innovation. Consumer purchasing power, supported by rising disposable incomes, also bolsters the market for Bukwang's products.

| Economic Factor | 2023 Data/Trend | Impact on Bukwang Pharmaceutical |

| GDP Growth | South Korea's GDP grew by 1.4% in 2023. | Increased healthcare spending capacity. |

| National Health Expenditure | 125.8 trillion KRW in 2023. | Directly drives demand for pharmaceutical products. |

| Inflation Rate | 3.6% year-on-year in May 2024. | Increases raw material and operational costs. |

| R&D Investment | 39.6 billion KRW in 2023. | Supports pipeline development and future revenue. |

| Disposable Income | Modest increase in early 2024. | Boosts consumer spending on OTC and prescription drugs. |

Same Document Delivered

Bukwang Pharmaceutical PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Bukwang Pharmaceutical's PESTLE analysis. This comprehensive report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market trends, regulatory landscapes, and competitive pressures relevant to Bukwang Pharmaceutical's operations and strategic planning. The content and structure shown in the preview is the same document you’ll download after payment, providing a complete and actionable analysis.

Sociological factors

South Korea's demographic shift towards an aging society is a significant sociological factor impacting Bukwang Pharmaceutical. By 2025, the proportion of citizens aged 65 and over is projected to reach approximately 20%, a substantial increase that directly fuels demand for treatments addressing chronic conditions like hypertension, diabetes, and dementia. This demographic trend presents a dual challenge and opportunity for the healthcare sector, as a larger elderly population necessitates greater investment in long-term care and specialized pharmaceuticals, creating a growing market for companies like Bukwang.

Growing public awareness about health and wellness is significantly impacting the pharmaceutical sector. As people become more proactive about their well-being, there's a noticeable shift towards preventive care and healthier lifestyles. This trend directly translates into increased demand for both prescription and over-the-counter (OTC) medications, particularly those addressing lifestyle-related chronic conditions. For Bukwang Pharmaceutical, this means opportunities to innovate and market products that align with these evolving consumer priorities.

The rising prevalence of chronic illnesses such as cardiovascular diseases and diabetes further fuels this demand. In 2024, it's estimated that over 38% of adults in South Korea have at least one chronic condition, a figure projected to grow. This demographic shift creates a sustained market for treatments and management solutions, directly influencing Bukwang Pharmaceutical's product development pipeline and strategic marketing efforts, focusing on efficacy and patient outcomes.

Societal expectations increasingly demand healthcare services that are not only readily available but also fair to everyone. This includes a growing focus on services like home-visiting healthcare, particularly for the elderly who may have mobility issues. For instance, in South Korea, the government has been expanding its home care services, with a goal to increase the number of elderly individuals receiving such support by 2025.

Policy shifts aimed at making healthcare more accessible and affordable directly respond to these societal needs. When governments work to reduce out-of-pocket medical expenses, it aligns with the public's desire for less financial burden from healthcare. In 2024, many nations are reviewing or implementing measures to cap drug prices or increase insurance coverage, reflecting a clear trend towards greater affordability.

Public Perception and Trust in Pharmaceutical Companies

Public perception significantly impacts Bukwang Pharmaceutical's brand reputation and the acceptance of its products. Concerns over drug safety, pricing strategies, and marketing ethics can erode trust. For instance, a 2024 Gallup poll indicated that only 30% of Americans express a great deal or quite a lot of confidence in the pharmaceutical industry, a sentiment that can extend to individual companies like Bukwang.

Transparency and ethical conduct are paramount in rebuilding and maintaining public trust. Patients and healthcare providers are increasingly scrutinizing drug development processes and pricing models. Bukwang's commitment to open communication about clinical trial data and responsible pricing will be crucial for its market standing.

- Public Trust Erosion: A 2024 survey revealed that only 30% of Americans have high confidence in the pharmaceutical industry, impacting brand perception.

- Safety Scrutiny: Past incidents of adverse drug reactions or recalls can lead to lasting public skepticism regarding drug safety.

- Pricing Concerns: High drug costs remain a major point of contention, affecting patient adherence and overall public opinion of pharmaceutical companies.

- Ethical Marketing: Perceptions of aggressive or misleading marketing practices can damage a company's reputation and lead to regulatory scrutiny.

Demographic Shifts and Changing Healthcare Needs

Broader demographic shifts, including declining birth rates and evolving household structures, are fundamentally reshaping long-term healthcare needs and influencing the demand for specific pharmaceutical products. South Korea, for example, is projected to become a super-aged society by 2025, with over 20% of its population aged 65 and above. This demographic transformation directly translates to increased demand for treatments related to chronic diseases, age-related conditions, and pharmaceuticals supporting geriatric care.

These societal changes necessitate a strategic focus on developing and marketing medications addressing the complex health challenges faced by an aging population. The changing family dynamics, with more single-person households, also impact healthcare delivery and product accessibility, potentially increasing the need for convenient and easily managed treatment options.

- Super-aged society projection: South Korea's anticipated status as a super-aged society by 2025 indicates a significant increase in the elderly demographic.

- Chronic disease prevalence: An aging population typically experiences a higher incidence of chronic conditions, driving demand for related pharmaceuticals.

- Household structure evolution: Changes in household composition, such as an rise in single-person households, influence how healthcare is accessed and managed.

- Product demand shifts: Demand is shifting towards pharmaceuticals that manage chronic illnesses and support the specific needs of older adults.

Societal expectations are increasingly prioritizing accessible and affordable healthcare, driving demand for services like home-visiting care, particularly for the elderly. In South Korea, government initiatives aim to boost support for home-based elder care, with a goal of increasing recipients by 2025. This trend highlights a growing public emphasis on convenience and support for vulnerable populations, influencing pharmaceutical delivery models and product design.

Technological factors

Technological factors are significantly reshaping drug discovery and development, a crucial area for companies like Bukwang Pharmaceutical. AI-driven platforms are now accelerating the identification of promising drug candidates. For instance, by 2024, AI in drug discovery is projected to save billions in R&D costs.

These advancements are not just speeding things up; they are also making the process more efficient. By 2025, AI is expected to reduce drug development timelines by an average of 25%, leading to lower expenses for pharmaceutical firms and potentially improving clinical success rates through better candidate selection.

The pharmaceutical industry is rapidly evolving, with biotechnology, cell therapy, and gene therapy playing increasingly vital roles. These advanced treatments offer new avenues for addressing complex diseases, driving significant investment and innovation. Biosimilars are also gaining traction, providing more affordable alternatives to biologic drugs, which is crucial for market access and patient affordability.

South Korea has solidified its position as a burgeoning hub for biopharmaceutical innovation, actively fostering growth in these cutting-edge sectors. The nation has seen substantial government and private sector investment, leading to advancements in areas like cell and gene therapy development. For instance, by the end of 2023, South Korea's biopharmaceutical exports reached approximately $1.5 billion, a testament to its growing capabilities.

Bukwang Pharmaceutical must recognize and capitalize on these technological shifts. The company's strategic planning should incorporate leveraging South Korea's strong biopharma ecosystem, including potential collaborations and R&D initiatives in gene therapy and biosimilars. Staying ahead in these technologically driven fields is paramount for sustained growth and competitive advantage in the global pharmaceutical market.

The healthcare landscape is rapidly evolving with the increasing adoption of digital health solutions. Telemedicine, in particular, has seen significant growth, with the global telemedicine market projected to reach USD 396.3 billion by 2027, according to Grand View Research. This trend impacts drug delivery by enabling remote monitoring and patient management, opening avenues for Bukwang Pharmaceutical to innovate its service offerings.

Digital therapeutics (DTx) are also gaining traction, offering software-based interventions for various medical conditions. The DTx market was valued at USD 3.4 billion in 2022 and is expected to grow substantially, presenting opportunities for Bukwang to integrate these solutions into its pharmaceutical products and patient support programs. As regulatory frameworks for decentralized clinical trials continue to mature, Bukwang can leverage these digital advancements to streamline its research and development processes and enhance patient engagement.

Manufacturing Process Automation and Efficiency

Technological advancements are significantly reshaping pharmaceutical manufacturing. Bukwang Pharmaceutical's focus on automation and efficiency in its production processes is a key factor in its competitive strategy. By embracing modern technologies, the company aims to boost its production capacity and streamline operations, which is crucial for meeting growing market demands and maintaining cost-effectiveness.

Bukwang Pharmaceutical has made strategic investments in modernizing its manufacturing capabilities, evident in recent plans for plant expansion and remodeling. These initiatives are designed to integrate cutting-edge automation, leading to enhanced operational efficiency and higher output. For instance, the company's commitment to upgrading its facilities aligns with industry trends towards smart manufacturing and Industry 4.0 principles, promising improved quality control and faster production cycles.

- Automated Production Lines: Implementing automated systems for drug formulation, packaging, and quality testing can reduce human error and increase throughput.

- Process Optimization Software: Utilizing advanced analytics and AI-driven software to monitor and optimize manufacturing parameters, leading to reduced waste and energy consumption.

- Robotic Integration: Deploying robots for repetitive tasks, such as material handling and assembly, can further enhance efficiency and worker safety.

- Digitalization of Operations: Creating a connected manufacturing environment through IoT devices and digital platforms for real-time data acquisition and control.

Data Analytics and Personalized Medicine

Bukwang Pharmaceutical is poised to benefit from advancements in data analytics and artificial intelligence, which are revolutionizing personalized medicine. These technologies allow for a deeper understanding of individual patient responses to treatments, leading to more effective drug development and better patient outcomes. By leveraging big data, companies can predict how patients will react to specific therapies, significantly improving the accuracy of clinical trial predictions and overall drug efficacy forecasts.

The integration of AI in drug discovery and development offers a substantial competitive edge. For instance, AI platforms can analyze vast datasets, identifying novel drug targets and optimizing molecular structures at an unprecedented speed. This acceleration is crucial in a market where time-to-market directly impacts profitability and patient access to life-saving medications. Companies that embrace these technological shifts are better positioned to innovate and deliver tailored healthcare solutions.

The impact of data analytics and AI in the pharmaceutical sector is already evident in several key areas:

- Enhanced Clinical Trials: AI can optimize patient selection for clinical trials, increasing the likelihood of successful outcomes and reducing trial duration. For example, a 2024 report indicated that AI-driven patient recruitment can reduce trial timelines by up to 25%.

- Predictive Diagnostics: Big data analytics enable the development of predictive models for disease progression and treatment response, allowing for earlier intervention and personalized treatment plans.

- Drug Efficacy Forecasting: AI algorithms can analyze real-world evidence and preclinical data to more accurately predict a drug candidate's potential efficacy and side effects, leading to more informed go/no-go decisions in R&D.

- Precision Medicine Development: The ability to segment patient populations based on genetic, lifestyle, and environmental factors allows for the development of highly targeted therapies, a growing trend in the pharmaceutical industry.

Technological advancements are fundamentally altering drug discovery and manufacturing for companies like Bukwang Pharmaceutical. AI-driven platforms are accelerating the identification of drug candidates, with AI in drug discovery projected to save billions in R&D costs by 2024. These innovations are also streamlining development, with AI expected to reduce drug development timelines by an average of 25% by 2025, enhancing efficiency and potentially improving clinical success rates.

The rise of biotechnology, cell therapy, and gene therapy presents new opportunities for treating complex diseases, driving significant investment. South Korea, a key player in this landscape, has seen substantial investment in these areas, with biopharmaceutical exports reaching approximately $1.5 billion by the end of 2023, underscoring its growing innovation capabilities.

Digital health solutions, including telemedicine and digital therapeutics (DTx), are transforming patient management and treatment delivery. The telemedicine market is projected to reach USD 396.3 billion by 2027, while the DTx market, valued at USD 3.4 billion in 2022, is expected to grow substantially, offering Bukwang avenues to innovate its service offerings and patient support programs.

Bukwang Pharmaceutical's strategic focus on manufacturing automation and efficiency is crucial for its competitive edge. Investments in modernizing facilities and integrating cutting-edge automation are key to boosting production capacity and streamlining operations, aligning with Industry 4.0 principles for improved quality control and faster production cycles.

Legal factors

In South Korea, the legal framework for drug approval is primarily overseen by the Ministry of Food and Drug Safety (MFDS). This regulatory body ensures the safety, efficacy, and quality of pharmaceuticals available to the public.

Recent reforms have been implemented to expedite the drug approval process. For instance, in 2024, the MFDS announced initiatives to shorten review times for new drugs, particularly those addressing unmet medical needs. This includes streamlining processes for imported active pharmaceutical ingredients.

These changes aim to reduce the time from clinical trial completion to market availability. For manufacturers, compliance procedures are also being simplified to foster innovation and market entry. For example, the MFDS has introduced updated guidelines for Good Manufacturing Practice (GMP) in 2025, focusing on digital integration and efficiency.

Intellectual property (IP) laws, particularly patent protection and data exclusivity, are crucial for pharmaceutical companies like Bukwang Pharmaceutical. These legal frameworks safeguard the significant investments made in research and development, ensuring that companies can recoup costs and fund future innovation. Without robust IP protection, the incentive to develop novel treatments would be severely diminished.

A significant development for Bukwang Pharmaceutical and the industry is the new drug data protection system set to take effect in February 2025. This system replaces the existing re-examination system, offering a more defined and predictable legal shield for innovative drugs. This change is expected to provide clearer, extended protection for new pharmaceutical products, bolstering the competitive advantage of companies that successfully bring novel therapies to market.

Bukwang Pharmaceutical, like all healthcare entities, must navigate stringent legal frameworks surrounding data privacy and patient information. Regulations such as GDPR in Europe and HIPAA in the United States dictate how sensitive patient data can be collected, stored, processed, and shared. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. This is particularly relevant for Bukwang as they engage in clinical trials, which inherently involve vast amounts of patient data, and potentially digital health services.

Anti-trust and Competition Laws

South Korea's Fair Trade Commission (KFTC) actively enforces anti-trust and competition laws to maintain a healthy pharmaceutical market. These regulations significantly impact how companies like Bukwang Pharmaceutical can operate, particularly concerning pricing, market access, and potential mergers or acquisitions. The KFTC's oversight is crucial for preventing monopolistic practices and fostering a competitive environment where innovation and patient access to medicines are prioritized.

In 2023, the KFTC continued its scrutiny of the pharmaceutical sector, addressing issues like unfair pricing and market exclusivity. For Bukwang Pharmaceutical, this means careful consideration of pricing strategies to avoid accusations of price gouging, especially for essential or patented drugs. Furthermore, any proposed mergers or acquisitions involving Bukwang would undergo rigorous review to ensure they do not unduly stifle competition.

- Market Dynamics: Anti-trust laws ensure that new entrants can compete fairly with established players, preventing dominance by a few large firms.

- Mergers and Acquisitions: The KFTC scrutinizes M&A deals to prevent consolidation that could lead to reduced competition or higher prices for consumers.

- Pricing Strategies: Regulations aim to curb anti-competitive pricing practices, such as price fixing or predatory pricing, ensuring fair market value for pharmaceuticals.

- Enforcement Actions: In 2024, the KFTC may continue to investigate and penalize companies found to be in violation of competition laws, impacting market behavior and compliance costs.

Product Liability and Consumer Protection Laws

Bukwang Pharmaceutical, like all drug manufacturers, operates under stringent product liability and consumer protection laws. These regulations are designed to ensure patient safety and hold companies accountable for defective or harmful products. For instance, in South Korea, the Pharmaceutical Affairs Act mandates rigorous reporting of adverse drug reactions, a critical component for monitoring drug safety post-market. Failure to comply can result in severe penalties, including product recalls and significant fines.

Ensuring patient safety is paramount, especially with advanced therapies. For cutting-edge treatments like CAR T-cell therapies, which involve complex manufacturing and administration processes, the legal obligations are even more pronounced. These therapies, while offering revolutionary treatment options for certain cancers, also carry inherent risks that must be meticulously managed and communicated. Bukwang must adhere to regulations that govern the entire lifecycle of such products, from development and clinical trials to manufacturing and post-market surveillance.

The regulatory landscape for pharmaceutical products is continuously evolving. As of 2024, global regulatory bodies, including the Ministry of Food and Drug Safety (MFDS) in South Korea, are placing increased emphasis on pharmacovigilance and post-market studies. This means Bukwang needs robust systems to track and report any unexpected side effects or safety concerns related to its products. For example, a 2023 report indicated a rise in regulatory scrutiny for biologics and advanced therapies, highlighting the need for proactive compliance.

- Mandatory Adverse Event Reporting: Bukwang must report all serious adverse events associated with its products to regulatory authorities within stipulated timelines, typically within 15 days for serious and unexpected events.

- Product Recall Procedures: The company must have established protocols for product recalls, ensuring swift and efficient removal of faulty or dangerous products from the market to protect consumers.

- Labeling and Marketing Compliance: All product labeling and marketing materials must be accurate, not misleading, and fully compliant with consumer protection laws, especially concerning efficacy claims and potential risks.

- Patient Safety in Advanced Therapies: For products like CAR T-cell therapies, Bukwang must demonstrate robust risk management plans, including patient monitoring and management of potential toxicities, to meet stringent safety standards.

Intellectual property laws are critical for Bukwang Pharmaceutical, safeguarding R&D investments and incentivizing innovation through patent protection and data exclusivity. The new drug data protection system, effective February 2025, replaces the re-examination system, offering clearer, extended protection for novel therapies.

Bukwang must comply with data privacy regulations like GDPR, especially relevant for clinical trials and digital health services. Failure to comply can lead to significant penalties, with GDPR fines potentially reaching 4% of global annual revenue or €20 million. This highlights the importance of robust data management practices.

Anti-trust laws enforced by the Fair Trade Commission (KFTC) ensure market competition, impacting pricing and M&A activities. The KFTC's scrutiny in 2023 and anticipated actions in 2024 mean Bukwang must be mindful of pricing strategies and potential consolidation impacts.

Stringent product liability and consumer protection laws hold Bukwang accountable for product safety, including mandatory adverse event reporting under the Pharmaceutical Affairs Act. For advanced therapies, like CAR T-cell treatments, meticulous management and communication of inherent risks are legally mandated.

Environmental factors

South Korea enforces stringent environmental regulations on pharmaceutical manufacturing, impacting companies like Bukwang Pharmaceutical. These rules cover wastewater discharge limits, air pollutant emissions, and hazardous waste disposal. For instance, the Waste Control Act dictates how pharmaceutical waste, often containing chemical residues, must be treated and disposed of, with strict penalties for non-compliance.

Bukwang Pharmaceutical must navigate regulations set by the Ministry of Environment, focusing on areas like volatile organic compound (VOC) emissions and greenhouse gas reductions. The country's commitment to environmental protection means pharmaceutical plants require advanced pollution control technologies. In 2023, South Korea's environmental protection expenditure reached approximately 11.5 trillion KRW, reflecting a strong national focus on these issues.

The pharmaceutical industry is increasingly focused on integrating sustainable practices across its entire supply chain. This means looking at everything from how raw materials are sourced, to how medicines are manufactured and delivered, with a keen eye on environmental impact. Companies are actively seeking ways to reduce their carbon footprint, for example, by optimizing logistics and energy consumption in manufacturing facilities. In 2023, the global pharmaceutical industry's greenhouse gas emissions were estimated to be around 50 million tons of CO2 equivalent, highlighting the significant room for improvement.

Resource conservation is another critical element, involving efforts to minimize water usage and waste generation throughout production processes. This can include implementing water recycling systems and developing more efficient packaging solutions. For instance, many pharmaceutical companies are exploring biodegradable or recyclable packaging materials to lessen their environmental burden. A report by McKinsey in 2024 noted that implementing circular economy principles in packaging could save the industry billions annually.

Promoting eco-friendly operations also extends to responsible waste management, particularly concerning chemical byproducts and expired medications. This involves investing in advanced treatment technologies and adhering to strict disposal regulations to prevent environmental contamination. The World Health Organization estimates that around 15% of healthcare waste is hazardous, underscoring the need for robust waste management strategies in the pharmaceutical sector.

The pharmaceutical industry, including companies like Bukwang Pharmaceutical, faces stringent legal and ethical obligations regarding the safe management and disposal of its by-products. Failure to comply can result in significant fines and reputational damage. For instance, in South Korea, where Bukwang operates, regulations under the Waste Control Act mandate proper handling of hazardous chemical waste, which often includes pharmaceutical by-products, with penalties for non-compliance.

Furthermore, evolving environmental standards are pushing companies towards more sustainable practices. Mandatory recycling rates for product packaging, a growing trend globally and likely to be reinforced in South Korea's 2024-2025 policy landscape, could increase operational costs for Bukwang Pharmaceutical if current disposal methods are not aligned with circular economy principles. The push for reduced landfill waste and increased material recovery directly impacts how pharmaceutical waste streams are managed.

Climate Change Impact on Raw Material Sourcing

Climate change presents significant challenges for Bukwang Pharmaceutical's raw material sourcing. Extreme weather events, such as droughts or floods, can disrupt agricultural yields, impacting the availability and price of plant-derived active pharmaceutical ingredients (APIs) and excipients. For instance, the World Meteorological Organization reported in 2024 that global temperatures continued to set records, increasing the likelihood of such disruptions.

To counter these environmental risks, Bukwang Pharmaceutical must prioritize supply chain resilience. This involves diversifying its supplier base geographically to reduce reliance on regions particularly vulnerable to climate impacts. Additionally, establishing long-term contracts with suppliers who demonstrate strong environmental stewardship and have robust contingency plans in place can provide greater stability.

The escalating costs associated with climate adaptation and mitigation efforts by raw material suppliers could also translate into higher input prices for Bukwang. This necessitates a proactive approach to cost management and potential exploration of alternative, more climate-resilient sourcing options.

- Supply Chain Diversification: Reducing dependence on single geographic regions for critical raw materials.

- Supplier Resilience Programs: Partnering with suppliers who invest in climate adaptation and sustainable practices.

- Cost Volatility Mitigation: Exploring long-term contracts and hedging strategies against price fluctuations driven by environmental factors.

- Alternative Sourcing: Investigating synthetic or bio-engineered alternatives for plant-derived ingredients to bypass agricultural vulnerabilities.

Corporate Social Responsibility (CSR) and Green Initiatives

Societal expectations are increasingly pushing pharmaceutical firms like Bukwang Pharmaceutical to actively participate in corporate social responsibility (CSR), with a significant emphasis on environmental stewardship. Consumers and investors alike are scrutinizing companies' impacts, demanding more than just product efficacy. This shift means that Bukwang's commitment to sustainability is no longer optional but a crucial element for maintaining its reputation and fostering trust.

Implementing robust green initiatives, such as reducing manufacturing waste or investing in renewable energy sources for its facilities, can significantly bolster Bukwang Pharmaceutical's public image. For instance, many leading pharmaceutical companies are setting ambitious targets for carbon neutrality. In 2024, for example, several major global players announced plans to achieve net-zero emissions by 2040, demonstrating a tangible commitment to environmental goals. Transparently reporting on these environmental performance metrics, perhaps through annual sustainability reports, allows Bukwang to showcase its progress and build stronger relationships with stakeholders.

Bukwang Pharmaceutical can leverage these green efforts to differentiate itself in a competitive market. Stakeholders, including investors and potential partners, are increasingly factoring environmental, social, and governance (ESG) performance into their decision-making. Companies with strong CSR programs often see improved access to capital and a more positive public perception. For example, ESG funds saw substantial inflows in 2023, highlighting investor appetite for sustainable businesses.

- Enhanced Brand Reputation: Demonstrating commitment to environmental protection improves public perception.

- Stakeholder Trust: Transparent reporting on green initiatives builds confidence among investors and the public.

- Competitive Advantage: Strong CSR practices can differentiate Bukwang Pharmaceutical in the market.

- Investor Attraction: Growing demand for ESG-compliant investments favors companies with robust environmental programs.

South Korea's environmental regulations, overseen by the Ministry of Environment, impose strict standards on pharmaceutical manufacturing, covering emissions and waste. For instance, the Waste Control Act mandates specific handling procedures for pharmaceutical waste, with significant penalties for non-compliance, affecting companies like Bukwang Pharmaceutical. The nation's environmental protection expenditure reached approximately 11.5 trillion KRW in 2023, underscoring a strong commitment to these issues.

The pharmaceutical industry, including Bukwang, is increasingly focused on sustainability, aiming to reduce its carbon footprint and resource consumption. This involves optimizing logistics and energy use, with global pharmaceutical greenhouse gas emissions estimated at around 50 million tons of CO2 equivalent in 2023. Companies are also exploring biodegradable packaging, a move that McKinsey reported in 2024 could save the industry billions annually.

Climate change poses risks to Bukwang Pharmaceutical's supply chain, potentially disrupting the availability and price of plant-derived ingredients due to extreme weather events. Global temperatures continued to set records in 2024, increasing the likelihood of such disruptions. Bukwang must prioritize supply chain resilience through diversification and by partnering with suppliers committed to environmental stewardship to mitigate these challenges.

| Environmental Factor | Impact on Bukwang Pharmaceutical | 2023/2024 Data Point |

| Regulatory Compliance | Adherence to stringent waste disposal and emission standards. | South Korea environmental protection expenditure: 11.5 trillion KRW. |

| Sustainability Initiatives | Need for reduced carbon footprint and resource conservation. | Global pharmaceutical GHG emissions: ~50 million tons CO2e. |

| Climate Change Impact | Risk of raw material supply disruption and price volatility. | Global temperatures continued record-breaking trends in 2024. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Bukwang Pharmaceutical is grounded in a comprehensive review of official government publications, reputable industry journals, and economic data from leading international organizations. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.