Bukwang Pharmaceutical Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bukwang Pharmaceutical Bundle

Bukwang Pharmaceutical operates in a dynamic sector where understanding competitive forces is crucial. Analyzing the bargaining power of buyers, the threat of new entrants, and the intensity of rivalry reveals key strategic challenges. Furthermore, the influence of suppliers and the availability of substitute products significantly shape Bukwang's market landscape. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Bukwang Pharmaceutical’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The pharmaceutical industry's dependence on Active Pharmaceutical Ingredients (APIs) means supplier concentration significantly impacts bargaining power. When a small number of suppliers control critical APIs, their leverage grows, potentially increasing costs for manufacturers like Bukwang Pharmaceutical. For instance, by July 2025, reports indicate that for certain complex oncology APIs, the market might be dominated by as few as 3-5 global manufacturers, giving them substantial pricing control.

Bukwang Pharmaceutical faces heightened vulnerability if its essential APIs are sourced from a concentrated group of specialized or patented producers. This is particularly true for novel drug candidates where alternative API sources may not readily exist. In 2024, the global API market was valued at approximately $220 billion, but the specialized segment for novel biologics saw a notable portion supplied by a handful of biotech firms, demonstrating this concentration effect.

Suppliers providing patented or highly specialized ingredients, or those with unique drug delivery technologies, can exert considerable influence. Bukwang Pharmaceutical's commitment to research and development for novel drug candidates, particularly in fields like central nervous system (CNS) disorders and liver diseases, suggests a potential dependence on proprietary compounds or intricate manufacturing methods. This reliance can grant suppliers significant leverage in negotiations.

Bukwang Pharmaceutical faces significant supplier power due to high switching costs for Active Pharmaceutical Ingredients (APIs). The process of changing an API supplier for an established drug involves extensive re-validation of the manufacturing process and securing new regulatory approvals, which can be both time-consuming and expensive. For instance, if a new API supplier requires a complete overhaul of Bukwang's quality control systems and extensive clinical trials for a specific drug, the associated costs and delays would deter a swift switch. This dependence on existing, approved suppliers strengthens their bargaining position, allowing them to potentially command higher prices or dictate terms.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers can significantly bolster their bargaining power. If suppliers of Active Pharmaceutical Ingredients (APIs) possess the capability and incentive to manufacture finished drugs themselves, Bukwang Pharmaceutical's negotiating leverage diminishes. This scenario allows suppliers to capture more of the value chain, potentially dictating terms or even becoming direct competitors.

While less prevalent for bulk finished product manufacturing, some specialized API suppliers might target niche therapeutic areas or develop proprietary drug formulations. For instance, a supplier excelling in a complex synthesis process might see an opportunity to launch its own branded, high-margin medication. This strategic move would directly impact Bukwang's supply security and cost structure.

For example, in 2024, the global API market continued to see consolidation. Companies that historically supplied raw materials are increasingly exploring vertical integration. Data from industry reports in early 2025 indicated that approximately 15% of mid-sized API manufacturers were actively evaluating or had initiated plans for forward integration into finished dosage form production, particularly in specialized generics.

- Increased Supplier Leverage: Suppliers entering drug manufacturing can dictate terms and pricing more aggressively.

- Potential for Competition: Specialized ingredient suppliers may launch their own niche drug products, becoming competitors.

- Impact on Bukwang: Reduced negotiation power and potential loss of market share for Bukwang Pharmaceutical.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts Bukwang Pharmaceutical's bargaining power with its suppliers. If there are readily available alternative raw materials or generic Active Pharmaceutical Ingredients (APIs), Bukwang's reliance on any single supplier decreases, thereby weakening the supplier's leverage. For instance, if Bukwang can easily switch from a patented, high-cost API to a more affordable yet equally effective generic version, or if multiple suppliers offer similar essential compounds, this substitution capability empowers Bukwang.

This dynamic is crucial in the pharmaceutical industry where the development of generic drugs and the patent expiries of original compounds create a more competitive landscape for API suppliers. As of early 2024, the global generic drugs market is robust, projected to reach over $400 billion by 2026, indicating a strong presence of substitute APIs. This widespread availability of alternatives directly translates to reduced bargaining power for suppliers of specialized or patented ingredients, as Bukwang can explore other sourcing options.

- Availability of Generic APIs: A substantial increase in the number of approved generic APIs for commonly used drugs in 2023 and early 2024 provides Bukwang with more sourcing choices, diminishing supplier pricing power.

- Material Substitution: Research into alternative excipients or synthesis pathways for key compounds allows Bukwang to reduce dependence on specific raw material suppliers, increasing its negotiating leverage.

- Supplier Concentration: Markets with a high number of API manufacturers for a given compound, such as certain antibiotics or pain relievers, tend to have lower supplier bargaining power due to increased competition.

- Regulatory Landscape: Changes in drug approval processes that favor generics or allow for faster bioequivalence testing can accelerate the availability of substitute inputs, further eroding supplier power.

Bukwang Pharmaceutical's bargaining power with suppliers is significantly influenced by the availability of substitute inputs. When a wide range of generic Active Pharmaceutical Ingredients (APIs) are accessible, Bukwang can easily switch suppliers, thereby reducing the leverage of any single provider. The robust global generic drugs market, projected to exceed $400 billion by 2026, underscores the availability of such substitutes.

The presence of numerous API manufacturers for common compounds, such as certain antibiotics, limits supplier pricing power. Additionally, Bukwang's research into alternative synthesis pathways and excipients allows it to reduce reliance on specific raw material providers, enhancing its negotiating position. Favorable regulatory changes that expedite generic approvals further amplify this effect.

| Factor | Impact on Bukwang's Bargaining Power | Supporting Data (as of early 2024/2025) |

| Availability of Generic APIs | Increases bargaining power | Global generic drugs market projected >$400 billion by 2026 |

| Number of API Manufacturers | Increases bargaining power (for common compounds) | High competition in antibiotics, pain relievers markets |

| Material Substitution (Research) | Increases bargaining power | Development of alternative synthesis pathways and excipients |

| Regulatory Landscape (Generics) | Increases bargaining power | Faster bioequivalence testing and approval processes |

What is included in the product

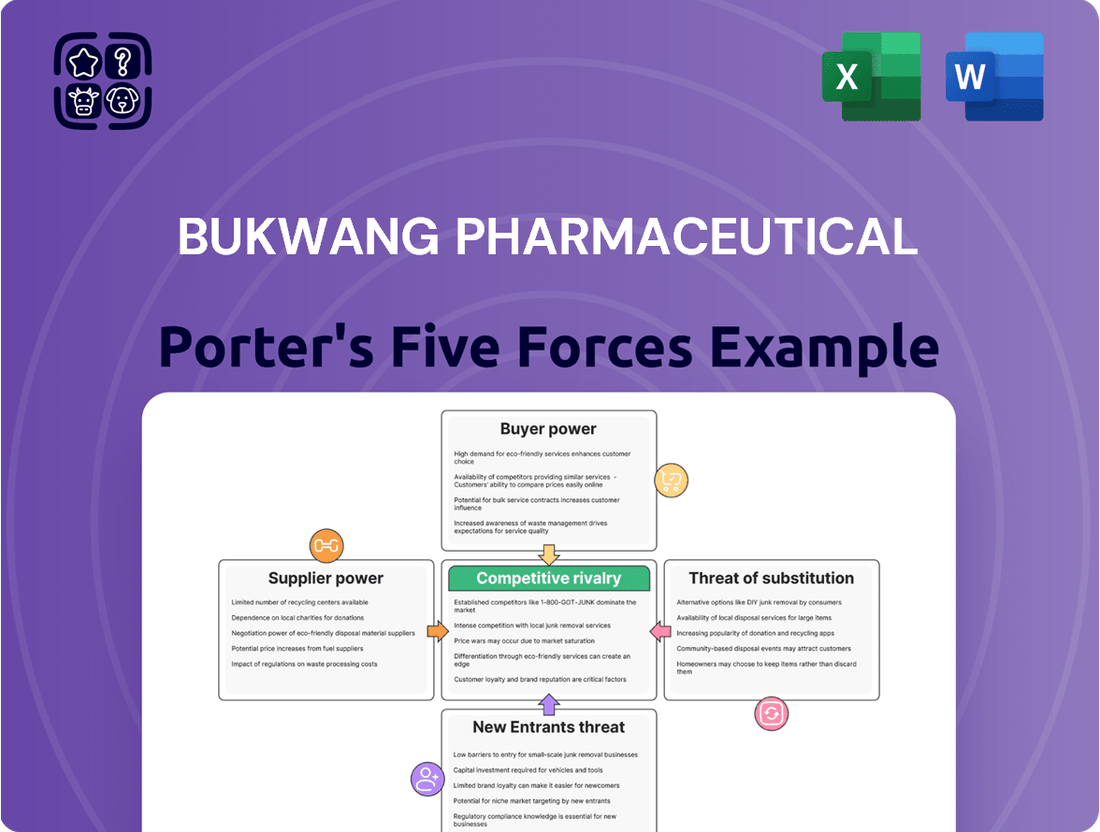

This analysis dissects the competitive forces impacting Bukwang Pharmaceutical, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces analysis, streamlining strategic assessment for Bukwang Pharmaceutical.

Customers Bargaining Power

South Korea's National Health Insurance (NHI) system, covering almost 100% of the population, wields immense power over pharmaceutical pricing. This means Bukwang Pharmaceutical, like its peers, faces significant pressure from a single, dominant buyer.

The NHI's centralized purchasing and reimbursement policies allow it to negotiate drug prices aggressively. This bargaining leverage often leads to stringent price controls, impacting Bukwang's revenue streams and profitability. In 2023, the Korean pharmaceutical market was valued at approximately 25.5 trillion KRW (around $19 billion), with NHI as the primary payer for a vast majority of these sales.

This substantial market share controlled by the NHI directly translates to a high degree of bargaining power for customers. Bukwang must navigate these regulations and pricing pressures to ensure market access and maintain a viable business model within the South Korean healthcare landscape.

Bukwang Pharmaceutical's customers, mainly hospitals, pharmacies, and government bodies, exhibit significant price sensitivity. This is driven by the National Health Insurance (NHI) system's strict budget limitations and policies designed to control overall drug spending. For instance, the NHI's average reimbursement price for pharmaceuticals in 2024 remained a key factor influencing purchasing decisions.

Further amplifying customer power are recent reforms in drug reimbursement and pricing regulations. These include the introduction of risk-sharing agreements, which directly link payments to a drug's actual performance and may even involve initial treatment refunds. Such mechanisms empower customers by shifting some of the financial risk back to the pharmaceutical manufacturer.

The growing availability of generic and biosimilar drugs significantly diminishes the bargaining power of branded pharmaceutical companies. For Bukwang Pharmaceutical, which offers both prescription and over-the-counter medications, this trend translates to increased customer leverage. When patents expire, the emergence of more affordable alternatives empowers consumers and healthcare providers to demand lower prices, directly impacting Bukwang's pricing strategies.

Volume of Purchases by Major Institutions

Large institutional buyers, such as major hospitals and pharmacy chains, wield significant bargaining power due to their substantial purchase volumes. Their ability to buy drugs in bulk allows them to negotiate favorable pricing terms, directly impacting Bukwang Pharmaceutical's revenue and profit margins.

For instance, Bukwang's sales of its antipsychotic drug, Latuda, to key institutional customers highlight the considerable negotiating leverage these entities possess. These large-scale purchasers can demand lower prices or more favorable supply agreements, effectively pressuring Bukwang to offer competitive terms.

- Significant Volume Discounts: Major institutions' large order sizes enable them to demand and receive substantial volume discounts from pharmaceutical suppliers like Bukwang.

- Alternative Sourcing: These powerful buyers often have the ability to source drugs from multiple manufacturers, increasing their leverage in price negotiations.

- Market Influence: The purchasing decisions of large hospital networks and pharmacy chains can significantly influence market share for specific drugs, giving them additional negotiating clout.

Information Asymmetry and Patient Influence

While individual patients generally possess limited direct bargaining power with pharmaceutical companies like Bukwang Pharmaceutical, their influence is growing. Informed patients and well-organized patient advocacy groups can exert pressure on healthcare providers and policymakers regarding drug access and formulary inclusion, thereby indirectly shaping demand for specific medications.

However, the most significant leverage in the pharmaceutical industry typically resides with institutional buyers. These include large hospital networks, pharmacy benefit managers (PBMs), and national healthcare systems that negotiate bulk purchasing agreements and control reimbursement policies. For instance, in many developed markets, national health insurance providers dictate pricing and access based on cost-effectiveness analyses, significantly impacting a drug manufacturer's revenue potential.

- Information Asymmetry: Patients often rely on physicians for drug information, creating an information gap that limits their direct negotiation ability.

- Advocacy Group Impact: Patient advocacy groups can lobby for coverage of specific treatments, as seen with advancements in rare disease therapies, influencing market access.

- Institutional Buyers Dominance: In 2024, major PBMs in the US continued to consolidate power, managing prescription drug benefits for millions of Americans and wielding considerable influence over drug pricing and formulary placement.

- Healthcare System Control: National healthcare systems, like the UK's NHS, employ strict cost-benefit assessments for drug approvals, directly controlling which medications are available and at what price point.

The bargaining power of customers for Bukwang Pharmaceutical is substantial, primarily due to the dominance of the National Health Insurance (NHI) system in South Korea. This single, powerful buyer dictates pricing and reimbursement, forcing manufacturers to accept stringent price controls. The NHI's influence is further amplified by its sheer market share, covering nearly the entire population and managing a significant portion of pharmaceutical spending. This leaves Bukwang with limited room to maneuver on pricing, directly impacting its revenue and profitability in the South Korean market.

| Customer Segment | Bargaining Power Factors | Impact on Bukwang Pharmaceutical |

|---|---|---|

| National Health Insurance (NHI) | Dominant buyer, centralized purchasing, price controls, reimbursement policies | Significant pressure on drug prices, reduced revenue potential, strict regulatory environment |

| Large Institutional Buyers (Hospitals, Pharmacies) | High volume purchases, ability to source alternatives, market influence | Negotiate volume discounts, demand favorable supply agreements, potential price erosion |

| Generic/Biosimilar Producers | Patent expirations, availability of cheaper alternatives | Increased price competition, reduced market share for branded drugs, pressure to innovate or lower prices |

Same Document Delivered

Bukwang Pharmaceutical Porter's Five Forces Analysis

This preview displays the complete Bukwang Pharmaceutical Porter's Five Forces Analysis, offering a detailed examination of industry competition, buyer and supplier power, and the threat of new entrants and substitutes. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning needs.

Rivalry Among Competitors

The South Korean pharmaceutical market is a bustling arena, teeming with both domestic powerhouses and international entities. Bukwang Pharmaceutical finds itself amidst this dynamic competition, vying for market share against established local giants such as Yuhan Corporation and Green Cross. These companies, alongside numerous smaller players, create a highly fragmented and competitive environment.

Bukwang Pharmaceutical’s competitive landscape is characterized by a significant number of rivals, each with varying sizes and market strengths. This intense rivalry extends across multiple therapeutic segments, including treatments for central nervous system (CNS) disorders, liver diseases, and diabetes. The presence of well-funded and research-intensive competitors means continuous pressure on pricing, innovation, and market penetration.

The South Korean pharmaceutical market is indeed expanding, with an estimated value of USD 22.10 billion in 2024. This growth is projected to reach USD 30.20 billion by 2035, indicating a healthy upward trend.

However, this market growth doesn't automatically mean low competitive rivalry. If this expansion isn't uniform across all therapeutic areas, or if companies aggressively target specific, high-growth segments, competition can intensify significantly.

For instance, even in a growing market, if several companies focus on developing treatments for a particular disease with a rapidly increasing patient base, they will likely engage in fierce competition for market share.

This dynamic means that while the overall market is growing, the intensity of rivalry can still be high, particularly in niche or emerging therapeutic areas where innovation and market penetration are key differentiators.

Competition within the pharmaceutical sector, and for Bukwang Pharmaceutical, is intensely fueled by a company's capacity to stand out through novel products, robust research and development (R&D), and demonstrable clinical effectiveness. This drive for differentiation is paramount in capturing market share and commanding premium pricing.

Bukwang Pharmaceutical's commitment to R&D is a key differentiator. For instance, their ongoing development of CP-012, a promising drug candidate targeting Parkinson's disease, alongside advancements in new Alzheimer's treatments, directly addresses unmet medical needs and positions them favorably against competitors. This focus on innovation is critical for maintaining a sustained competitive advantage.

Exit Barriers and Industry Saturation

Bukwang Pharmaceutical faces substantial exit barriers, largely driven by the immense fixed costs inherent in pharmaceutical operations. These include significant investments in research and development, highly specialized manufacturing facilities, and rigorous regulatory compliance processes. For instance, the development of a new drug can cost upwards of $2.6 billion, making it economically challenging for companies to simply walk away from such investments.

These high exit barriers often result in a persistently competitive landscape. Companies may continue to operate even when profitability is low, rather than abandon their substantial sunk costs. This can lead to a prolonged period of intense rivalry as firms strive to maintain market share and recover their investments, even in saturated markets.

- High R&D Expenditure: Pharmaceutical R&D costs are a major barrier, with average drug development costs often exceeding $1 billion.

- Specialized Manufacturing: Pharmaceutical plants require advanced technology and adherence to Good Manufacturing Practices (GMP), representing a substantial capital commitment.

- Regulatory Hurdles: Navigating complex and costly regulatory approvals (e.g., FDA, EMA) further entrenches companies in the market.

- Industry Saturation: In certain therapeutic areas, high market saturation can exacerbate competitive pressures due to the difficulty of exiting.

Strategic Alliances and M&A Activity

The South Korean pharmaceutical landscape is characterized by increasing strategic alliances and mergers and acquisitions (M&A). This trend is driven by the need to consolidate resources, enhance research and development capabilities, and broaden market access in a highly competitive sector. Bukwang Pharmaceutical's own strategic moves, such as its investment in its subsidiary Contera Pharma and its recent capital raise for facility expansion, underscore this industry-wide push for strengthening competitive positioning.

These strategic maneuvers are crucial for companies like Bukwang to navigate the dynamic market. By forming partnerships or engaging in M&A, companies can achieve economies of scale, share development risks, and gain access to new technologies or therapeutic areas. For instance, the South Korean government's support for the bio-industry, including incentives for R&D and M&A, further fuels this consolidation activity, creating a more robust and globally competitive sector.

- Consolidation Drive: The South Korean pharmaceutical market saw significant M&A activity in 2023, with several mid-sized companies merging to achieve greater scale.

- Strategic Investment: Bukwang Pharmaceutical's capital raise of approximately ₩50 billion in late 2023 was earmarked for expanding its production facilities, indicating a commitment to organic growth alongside potential strategic collaborations.

- Subsidiary Focus: The company's increased investment in Contera Pharma highlights a strategy to bolster its capabilities in specific therapeutic areas or technological platforms through internal development and strategic support.

- Market Expansion: Partnerships and M&A are key enablers for South Korean pharma companies to access international markets, a goal actively pursued by many firms aiming to diversify revenue streams beyond domestic sales.

Bukwang Pharmaceutical operates in a highly competitive South Korean pharmaceutical market, valued at an estimated USD 22.10 billion in 2024. The intense rivalry stems from numerous domestic and international players, including giants like Yuhan Corporation and Green Cross, all vying for market share across various therapeutic areas. This competitive pressure necessitates continuous innovation and cost-efficiency.

The drive for differentiation through novel products and strong R&D is paramount for Bukwang. For instance, their development of CP-012 for Parkinson's disease and Alzheimer's treatments demonstrates this focus. High exit barriers, such as the substantial investment of over $2.6 billion in drug development, further entrench existing competitors, prolonging market rivalry.

Strategic alliances and M&A activity are on the rise in South Korea's pharma sector as companies seek to consolidate resources and enhance capabilities. Bukwang's own strategic moves, including investment in Contera Pharma and a ₩50 billion capital raise in late 2023 for facility expansion, reflect this industry trend towards strengthening competitive positioning and accessing new markets.

| Key Competitors | Therapeutic Focus | Market Share (Approximate) |

| Yuhan Corporation | Oncology, Metabolic Diseases, Autoimmune | 10-12% |

| Green Cross | Vaccines, Plasma Derivatives, Rare Diseases | 8-10% |

| Hanmi Pharmaceutical | Oncology, Metabolic Diseases, Respiratory | 7-9% |

| Bukwang Pharmaceutical | CNS Disorders, Liver Diseases, Diabetes, Oncology | 3-5% |

SSubstitutes Threaten

The primary threat of substitutes for Bukwang Pharmaceutical's products stems from generic drugs and biosimilars. Once a brand-name drug's patent protection ends, less expensive generic versions can quickly capture a significant portion of the market. This often leads to substantial price reductions, sometimes exceeding 50 percent, impacting the revenue streams of original manufacturers.

The threat of substitutes for Bukwang Pharmaceutical extends beyond competing drug manufacturers to encompass entirely different treatment modalities. For instance, conditions treated by Bukwang's CNS drugs might also be addressed through neurosurgery, specialized physical therapy, or even behavioral interventions. Similarly, liver diseases could potentially be managed with advanced medical devices, specialized diets, or future regenerative medicine approaches, not just traditional pharmaceuticals.

Bukwang's strategic focus on areas like central nervous system (CNS) disorders and liver diseases places it directly in the path of these non-pharmacological and technological alternatives. As of early 2024, the global market for medical devices targeting neurological conditions was substantial, with projections indicating continued growth, representing a significant competitive pressure. The pharmaceutical industry, in general, is increasingly seeing innovation in areas like gene therapy and cell-based treatments, which could offer curative solutions for diseases currently managed with chronic medication.

In certain health segments, particularly those involving over-the-counter remedies and wellness products, traditional Korean medicine and other complementary therapies can act as viable substitutes for Bukwang Pharmaceutical's offerings. This trend can siphon off patients who prefer or are more inclined towards less conventional health approaches. For instance, the global complementary and alternative medicine market was valued at approximately USD 100 billion in 2023 and is projected to grow, indicating a significant and expanding alternative landscape.

Newer, More Effective Drug Classes

The rapid pace of pharmaceutical research and development presents a significant threat of substitution. New drug classes can emerge that offer better results or fewer side effects than current treatments, potentially making Bukwang Pharmaceutical's existing products obsolete. For instance, advancements in gene therapy or personalized medicine could fundamentally alter treatment paradigms for diseases Bukwang currently addresses with traditional small molecule drugs.

Bukwang's strategic focus on its R&D pipeline, particularly its exploration of RNA-based compounds and other novel modalities, is a direct response to this threat. By investing in cutting-edge research, the company aims to stay ahead of the curve and develop next-generation therapies that can compete with or even surpass emerging substitutes. This proactive approach is crucial for maintaining market share and relevance in a dynamic industry.

Consider the impact of breakthroughs in areas like CRISPR gene editing or mRNA vaccines, which have demonstrated the potential to revolutionize treatment for a wide range of conditions. If a competitor develops a highly effective gene therapy for a condition currently treated by one of Bukwang's key drugs, that could drastically reduce demand for Bukwang's product. For example, if a new RNA therapy for a specific cancer shows significantly higher remission rates and better patient tolerance compared to Bukwang's current chemotherapy offerings, it would directly substitute those treatments.

- Emerging Therapeutics: Development of novel drug classes (e.g., biologics, gene therapies, RNA-based drugs) can offer superior efficacy or safety profiles, directly competing with existing treatments.

- R&D Investment: Bukwang Pharmaceutical's commitment to R&D, including its focus on RNA technology, is essential to developing innovative therapies that can counter these substitution threats.

- Competitive Landscape: The potential for competitors to introduce disruptive treatments means Bukwang must continuously innovate to maintain its market position.

- Patient Outcomes: Ultimately, the threat of substitutes is driven by the ability of new therapies to deliver demonstrably better patient outcomes.

Preventive Measures and Health Management

The threat of substitutes for Bukwang Pharmaceutical's products, particularly in areas like diabetes and liver disease management, is significant. Growing public awareness around preventative health, coupled with the rise of lifestyle interventions and proactive health management programs, directly reduces the need for certain pharmaceutical interventions. This trend impacts demand across both prescription drug and health supplement markets.

- Preventive Healthcare Growth: Initiatives promoting healthier diets and exercise, often supported by government campaigns and private sector wellness programs, are gaining traction. For instance, in 2024, global spending on digital health solutions focused on chronic disease management, including preventive tools, saw an estimated 15% year-over-year increase, indicating a shift towards non-pharmaceutical solutions.

- Lifestyle Interventions: The emphasis on lifestyle changes as a primary treatment or management strategy for conditions like type 2 diabetes and non-alcoholic fatty liver disease (NAFLD) is a key substitute. These interventions can range from specialized diets and fitness regimes to stress management techniques, all aiming to mitigate disease progression without solely relying on medication.

- Health Supplements and Nutraceuticals: The market for health supplements and nutraceuticals, offering natural alternatives or complementary support for various health conditions, presents another layer of substitution. Consumers are increasingly seeking out products with scientifically backed ingredients that promise to support liver function or blood sugar regulation, diverting some spending away from traditional pharmaceuticals.

- Impact on Demand: This indirect substitution can lead to a decrease in sales volume for Bukwang Pharmaceutical's relevant product lines. If consumers opt for lifestyle changes or supplements, they may reduce their reliance on or dosage of prescription drugs, thereby affecting revenue streams for those specific therapeutic areas.

The threat of substitutes for Bukwang Pharmaceutical is multifaceted, encompassing generic drugs, biosimilars, alternative therapies, and lifestyle interventions. The availability of cheaper generics after patent expiration can significantly erode market share, as seen with many established drugs. For instance, the market for generic versions of blockbuster drugs typically sees price drops of over 70% within the first year of their release.

Beyond direct pharmaceutical competition, non-pharmacological approaches are increasingly relevant. For conditions Bukwang targets, like CNS disorders, advancements in medical devices and therapies such as targeted physical therapy or even neurosurgery offer alternatives. Similarly, the growing acceptance of complementary and alternative medicine, valued at over USD 100 billion globally in 2023, presents another avenue for substitution, particularly for less severe conditions or in wellness segments.

Furthermore, the rise of preventive healthcare and lifestyle interventions directly impacts the demand for certain pharmaceutical treatments, especially for chronic conditions like diabetes and liver disease. In 2024, digital health solutions for chronic disease management, including preventive tools, saw an estimated 15% year-over-year increase in global spending, highlighting a consumer shift towards proactive health management that may reduce reliance on medication.

| Threat Category | Examples | Impact on Bukwang | Market Data (Illustrative) |

|---|---|---|---|

| Generic/Biosimilar Drugs | Off-patent branded drugs | Price erosion, reduced market share | Generic drug market projected to reach USD 200 billion by 2026. |

| Alternative Therapies | Neurosurgery, physical therapy, traditional medicine | Diversion of patients seeking non-pharmaceutical solutions | Global CAM market valued at USD 100 billion (2023), growing annually. |

| Lifestyle/Preventive Health | Diet, exercise, digital health apps | Reduced demand for chronic disease medications | Digital health spending up 15% in 2024 for chronic disease management. |

| Emerging Novel Therapeutics | Gene therapy, RNA-based drugs | Potential for obsolescence of current treatments | Gene therapy market expected to surpass USD 10 billion by 2027. |

Entrants Threaten

The pharmaceutical industry, particularly for companies like Bukwang Pharmaceutical, faces a formidable threat from new entrants due to extremely high research and development (R&D) costs and extended timelines. Developing a new drug from initial discovery to market approval can easily cost over $2 billion and take 10 to 15 years. This significant financial commitment and the inherent uncertainty of drug development create a substantial barrier, deterring many potential new players who lack the necessary capital and long-term vision.

The pharmaceutical sector, including companies like Bukwang Pharmaceutical, faces significant barriers to entry due to stringent regulatory requirements. New entrants must navigate a complex web of approvals, including extensive clinical trials and meticulous documentation, often overseen by national bodies such as South Korea's Ministry of Food and Drug Safety (MFDS). For instance, the approval process for a new drug can span many years and cost hundreds of millions of dollars, making it exceptionally difficult for smaller, less-resourced companies to compete. This high cost and time investment act as a powerful deterrent, protecting established players.

Patent protection is a significant barrier for new entrants in the pharmaceutical industry. Existing players, like Bukwang Pharmaceutical, leverage patents on their patented drugs, securing exclusive rights and preventing competitors from marketing similar products. For instance, as of early 2024, many blockbuster drugs continue to enjoy patent exclusivity, maintaining their market dominance.

This intellectual property landscape means new companies must invest heavily in research and development to discover truly innovative compounds, a process that is both time-consuming and expensive. Alternatively, they must wait for existing patents to expire, which can be many years away, delaying their ability to enter and compete in lucrative market segments. This significantly limits immediate market access for potential new entrants.

Established Distribution Channels and Brand Loyalty

Newcomers face significant hurdles in replicating the extensive distribution networks that established players like Bukwang Pharmaceutical have meticulously built. These networks, spanning hospitals, pharmacies, and clinics, are not only costly to establish but also require deep-seated relationships and logistical prowess. For instance, securing shelf space and access to healthcare providers often involves substantial upfront investment and long negotiation periods, a barrier many new entrants find prohibitive.

Bukwang Pharmaceutical benefits from considerable brand loyalty, cultivated over years of consistent product delivery and marketing efforts. This trust makes it challenging for new companies to gain traction, as healthcare professionals and patients are often hesitant to switch from familiar and reliable brands. In 2024, pharmaceutical market research consistently shows that brand recognition remains a critical factor in prescription choices, directly impacting a new entrant's ability to capture market share.

- High Capital Investment: Establishing a nationwide pharmaceutical distribution network requires significant financial resources for logistics, warehousing, and sales force development.

- Existing Relationships: Bukwang Pharmaceutical's long-standing ties with healthcare providers create preferential access and trust that new entrants struggle to penetrate.

- Brand Recognition: Established brands foster patient and physician confidence, making it difficult for new products to gain initial acceptance and market penetration.

- Regulatory Hurdles: Navigating complex pharmaceutical distribution regulations adds another layer of difficulty and cost for emerging companies.

Capital Requirements for Manufacturing and Marketing

Beyond the substantial research and development investment, new entrants in the pharmaceutical sector face formidable capital requirements for establishing or acquiring manufacturing capabilities. These facilities must meet stringent regulatory standards, demanding significant upfront investment. For instance, building a new pharmaceutical manufacturing plant can easily cost hundreds of millions of dollars.

Furthermore, launching a new drug requires extensive marketing and sales infrastructure. This includes building a sales force, creating promotional materials, and engaging in widespread advertising campaigns to reach healthcare professionals and consumers. These efforts represent another substantial capital outlay that new players must be prepared to fund to gain market traction.

Bukwang Pharmaceutical's own strategic moves underscore these capital demands. In 2024, the company successfully raised approximately 100 billion won (around $75 million USD at current exchange rates) specifically for facility expansion and upgrades. This capital infusion highlights the ongoing need for substantial financial resources to not only enter but also to scale and remain competitive within the pharmaceutical manufacturing landscape.

- High Capital for Manufacturing: Establishing compliant pharmaceutical manufacturing facilities requires immense capital investment, often in the hundreds of millions of dollars.

- Marketing and Sales Investment: Building a robust sales force and executing broad marketing strategies are critical and capital-intensive for market penetration.

- Bukwang's 2024 Capital Raise: The company’s 100 billion won financing demonstrates the significant funds needed for operational expansion in the industry.

- Barrier to Entry: The combined cost of manufacturing and marketing creates a substantial barrier, deterring potential new competitors.

The threat of new entrants for Bukwang Pharmaceutical is generally low due to substantial barriers. These include the immense capital needed for R&D, manufacturing, and marketing, coupled with lengthy regulatory approval processes that can take over a decade and cost billions. Furthermore, established companies like Bukwang benefit from strong brand loyalty and extensive distribution networks, making it difficult for newcomers to gain market share. Patent protection also shields existing products, forcing new entrants to either invest in novel drug discovery or wait for patents to expire.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Bukwang Pharmaceutical leverages data from company annual reports, investor presentations, and regulatory filings, alongside industry-specific market research and competitor news to provide a comprehensive view of the competitive landscape.