Bukwang Pharmaceutical Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bukwang Pharmaceutical Bundle

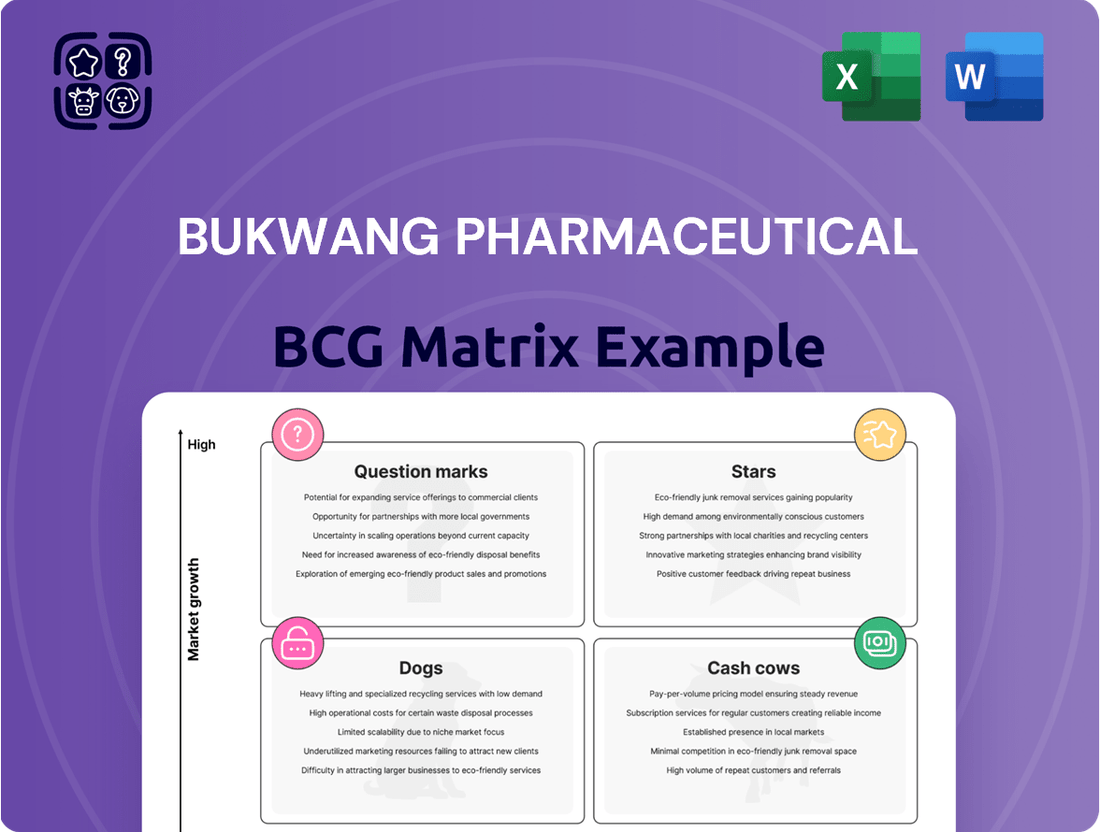

Curious about Bukwang Pharmaceutical's strategic product portfolio? This glimpse into their BCG Matrix reveals how their offerings are positioned in terms of market share and growth. Understanding whether products are Stars, Cash Cows, Dogs, or Question Marks is crucial for effective resource allocation and future success.

Don't miss out on the full picture! Purchase the complete Bukwang Pharmaceutical BCG Matrix to unlock detailed quadrant placements, data-driven insights, and actionable recommendations. Equip yourself with the strategic clarity needed to make informed decisions about Bukwang's product pipeline and market strategies.

Stars

Latuda, launched in August 2024, has significantly boosted Bukwang Pharmaceutical's performance. This antipsychotic drug contributed to a remarkable 42% year-on-year sales increase in the company's Central Nervous System (CNS) strategic product category for 2024. Its swift market penetration and widespread adoption in major hospitals underscore its strong potential.

The successful prescription of Latuda in key healthcare institutions positions it as a frontrunner in a rapidly expanding therapeutic segment. Bukwang Pharmaceutical has set an ambitious target of exceeding 30 billion won in CNS sales within the next three years, with Latuda identified as a primary catalyst for this growth.

This robust initial market reception and projected future expansion firmly establish Latuda as a Star within Bukwang Pharmaceutical's product portfolio, indicating substantial market share capture and high growth prospects.

Dexid and Thioctacid are Bukwang Pharmaceutical's stars. These diabetic neuropathy treatments achieved an impressive 181% sales growth in 2024, a key driver for the company's return to operating profitability. With plans for continued expansion in 2025, their strong market presence and high growth in a critical therapeutic area solidify their star status.

Bukwang Pharmaceutical's Central Nervous System (CNS) product category is a significant growth driver, achieving a remarkable 42% year-over-year increase in 2024. This surge is attributed to the strong performance of Latuda, alongside robust sales from established CNS medications such as Zaledip, Excel Capsule, and Orfil.

This impressive growth in the CNS segment underscores Bukwang's expanding market share and its strategic focus on this therapeutic area. The company's ambition to be recognized as the leading CNS brand company further emphasizes the critical role this product category plays in its overall business strategy and future development.

Ariplus Tablets (Alzheimer's Combination Drug)

Ariplus Tablets, launched by Bukwang Pharmaceutical in March 2025, represents a significant advancement in Alzheimer's treatment. This combination drug targets moderate to severe stages of the disease, offering a more convenient therapeutic option by integrating two active ingredients into a single tablet.

The Alzheimer's drug market is experiencing robust growth, driven by an aging global population and a persistent demand for more effective treatments. Ariplus enters this landscape addressing a critical need for enhanced patient adherence and improved treatment outcomes.

Given its innovative formulation and the substantial market potential within Alzheimer's care, Ariplus is positioned as a strong contender for high growth and significant market share capture. Analysts predict the global Alzheimer's drug market to reach approximately $15 billion by 2026, with combination therapies expected to play an increasingly vital role.

- Product: Ariplus Tablets (Alzheimer's Combination Drug)

- Launch Date: March 2025

- Target Market: Moderate to severe Alzheimer's disease

- Key Differentiator: Two active ingredients in a single tablet for improved adherence and efficacy.

- Market Context: Growing Alzheimer's drug market with unmet needs for better patient compliance and treatment effectiveness.

Strategic Expansion in Chronic Disease Sector

Bukwang Pharmaceutical's 2025 strategy hinges on expanding prescription coverage within primary care by introducing new chronic disease medications. This aligns with a projected 5.3% compound annual growth rate for the global chronic disease management market through 2027, reaching an estimated $3.2 trillion. The company is targeting high-potential therapeutic areas, including cardiovascular, diabetes, respiratory, psychiatry, and gastroenterology, areas that represent significant growth opportunities. For example, the diabetes drug market alone is forecast to exceed $70 billion by 2025.

Bukwang's proactive approach involves acquiring and developing innovative products, alongside strategic alliances, to solidify its market presence. This focus on chronic conditions, which affect a substantial portion of the population – over 60% of adults in the US have at least one chronic disease – positions Bukwang for sustained expansion. By investing in these growing segments, the company aims to achieve high growth and secure a leading position.

- Targeting High-Growth Segments: Bukwang is focusing on cardiovascular, diabetes, respiratory, psychiatry, and gastroenterology, areas with significant market potential.

- Market Expansion: The company plans to increase prescription coverage in primary care institutions, broadening its reach.

- Strategic Investments: New product launches and partnerships are key to Bukwang's strategy for capturing market share.

- Industry Growth: The global chronic disease management market is projected to grow substantially, offering a favorable environment for Bukwang's expansion.

Bukwang Pharmaceutical's Stars are products with high market share and high growth potential, often recently launched or experiencing rapid expansion. Dexid and Thioctacid, key treatments for diabetic neuropathy, exemplify this category with an impressive 181% sales growth in 2024, driving the company's profitability. Latuda, an antipsychotic launched in August 2024, contributed to a 42% sales increase in the CNS category and is projected to exceed 30 billion won in CNS sales within three years, marking it as a significant Star. Ariplus Tablets, a new Alzheimer's drug launched in March 2025, is also positioned as a Star, entering a growing market with potential for high market share capture.

| Product | Therapeutic Area | Launch Date | 2024 Sales Growth | Market Outlook |

| Dexid / Thioctacid | Diabetic Neuropathy | N/A | 181% | High Growth |

| Latuda | Central Nervous System (CNS) / Antipsychotic | August 2024 | 42% (CNS Category) | High Growth |

| Ariplus Tablets | Alzheimer's Disease | March 2025 | N/A (New Launch) | High Growth |

What is included in the product

Bukwang Pharmaceutical's BCG Matrix provides a framework for analyzing its product portfolio, guiding strategic decisions on investment and resource allocation.

Bukwang Pharmaceutical's BCG Matrix offers a pain point reliever by visually clarifying its product portfolio's strategic positioning.

It provides a clear roadmap for resource allocation, easing the burden of complex investment decisions.

Cash Cows

Legaron stands out as a significant contributor to Bukwang Pharmaceutical's revenue, solidifying its position within the liver disease treatment sector. This established product reflects a strong market presence, consistently generating substantial sales.

Despite the emergence of newer treatments like Regadex, Legaron is expected to retain a considerable market share. Its presence in a mature market segment ensures a steady stream of cash flow for the company, underscoring its role as a reliable revenue generator.

The long history of Legaron in the market suggests a reduced need for extensive marketing expenditure. This efficiency allows it to operate as a dependable source of cash, supporting Bukwang Pharmaceutical's overall financial health.

Zaledip, a key product in Bukwang Pharmaceutical's portfolio for insomnia treatment, demonstrated robust performance in 2024. Its sales growth was notably bolstered by the successful market entry of Latuda, Bukwang's new antipsychotic medication. This synergy indicates Zaledip's established strength within the mature insomnia market, leveraging the company's broader Central Nervous System (CNS) offerings.

The drug's position suggests it generates consistent, reliable revenue for Bukwang without demanding significant capital expenditure. As a result, Zaledip functions as a dependable cash cow, contributing steadily to the company's financial stability.

Excel Capsule, a depression treatment, saw its sales climb alongside Latuda's market entry, mirroring the success of Zaledip. This performance highlights Excel Capsule's enduring presence in the depression treatment market and its ability to maintain a solid market share.

As a mature product within Bukwang Pharmaceutical's central nervous system (CNS) portfolio, Excel Capsule functions as a reliable cash generator. Its consistent revenue stream is crucial for funding the company's other growth-oriented projects and research endeavors.

Orfil (Epilepsy Treatment)

Orfil, a key epilepsy treatment from Bukwang Pharmaceutical, is a prime example of a cash cow within the company's portfolio. Its sales have benefited from the broader success Bukwang has seen in the Central Nervous System (CNS) market, particularly with the introduction of Latuda. This suggests Orfil likely commands a strong and stable market share in its specific epilepsy segment, acting as a reliable source of consistent revenue for the company.

As a cash cow, Orfil generates substantial profits without requiring significant new capital expenditures for growth or market expansion. Its established position allows it to maintain its market share through ongoing, but not aggressive, investment in marketing and production. This steady contribution to Bukwang Pharmaceutical's overall profitability is crucial for funding other ventures within the company.

- Product: Orfil (Epilepsy Treatment)

- Market Position: Stable, high market share in the epilepsy segment.

- Financial Contribution: Consistent revenue generation, contributing to overall profitability.

- Strategic Role: Functions as a cash cow, funding other company initiatives.

Established OTC Product Lines

Bukwang Pharmaceutical's established over-the-counter (OTC) product lines function as its cash cows within the BCG matrix. These offerings, which include a variety of medications and health supplements, cater to mature markets characterized by predictable consumer needs. The company has cultivated a strong presence in these segments, commanding significant market share.

These established OTC products are key profit drivers for Bukwang Pharmaceutical. Their consistent sales translate into reliable cash flow, often with lower marketing expenditures compared to newer or prescription-based products. This financial stability allows Bukwang to fund investments in other areas of its business.

For instance, Bukwang Pharmaceutical's portfolio includes well-recognized brands in the digestive health and pain relief categories, which have historically demonstrated stable demand. In 2023, sales from these mature OTC segments contributed a substantial portion to the company's overall revenue, underscoring their role as dependable cash generators.

- Strong Market Share: Established OTC products often hold leading positions in their respective categories.

- Stable Demand: Mature markets ensure consistent consumer purchasing patterns.

- Profitability: High market share and lower promotional costs lead to healthy profit margins.

- Cash Flow Generation: These products are the primary source of reliable, ongoing cash for the company.

Bukwang Pharmaceutical's established over-the-counter (OTC) product lines are its primary cash cows. These mature products, like those in digestive health and pain relief, benefit from predictable consumer demand and have secured significant market share. Their consistent sales are key profit drivers, generating reliable cash flow with relatively low marketing costs.

These OTC offerings are crucial for Bukwang's financial stability, providing the necessary funds to invest in research and development for new products. For example, in 2023, these mature segments contributed a considerable portion of the company's overall revenue, confirming their role as dependable cash generators.

The company's strategy leverages the sustained demand for these established OTC brands. Their consistent revenue stream, unaffected by the high R&D costs associated with new drug development, allows Bukwang to maintain a healthy financial footing and pursue growth opportunities across its portfolio.

The established OTC product lines within Bukwang Pharmaceutical's portfolio serve as the company's cash cows. These products operate in mature markets with stable consumer needs and have achieved strong market positions. Their consistent sales translate into reliable cash flow, often requiring less marketing investment compared to newer products, thereby supporting the company's overall financial health and funding other strategic initiatives.

Preview = Final Product

Bukwang Pharmaceutical BCG Matrix

The Bukwang Pharmaceutical BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no altered content; just the complete, professionally crafted strategic analysis ready for your immediate use. You can confidently assess the detailed breakdown of Bukwang Pharmaceutical's product portfolio within the BCG framework, knowing that the purchased version will be precisely the same. This ensures you acquire a ready-to-implement tool for your business planning and strategic decision-making processes.

Dogs

Following its acquisition by OCI, Bukwang Pharmaceutical strategically reduced its product portfolio by over 50 items. This streamlining effort was a clear signal of shedding products that were underperforming, likely in mature or declining market segments.

These divested items are classic examples of 'Dogs' in the BCG Matrix. They were likely characterized by low market share and low growth, meaning they consumed resources without generating significant returns or future potential.

For instance, a pharmaceutical product with declining sales due to patent expiry and strong generic competition would typically fall into this category. In 2024, the pharmaceutical industry saw continued pressure on older drugs, making such divestitures a common strategy for optimizing resource allocation and focusing on more promising therapeutic areas.

Bukwang Pharmaceutical's older, non-strategic generic drugs likely represent a category of products that have seen their market relevance diminish. These generics, once a staple, now face significant competition, leading to price erosion and reduced profitability. In 2024, the generic drug market continued to be highly competitive, with many established products struggling to maintain market share against newer entrants and biosimil options.

Products in this segment typically exhibit low growth rates and hold a small portion of their respective markets. For instance, many older generics might have experienced a decline in sales volume as newer, more effective treatments become available. This scenario often results in these drugs generating minimal profits, or even just covering their production costs, thus tying up valuable capital that could be reinvested in more promising areas of the business.

Bukwang Pharmaceutical's legacy products in saturated markets are likely its "Dogs" in the BCG matrix. These are established medications, perhaps from the early 2000s or before, that are now facing intense competition from newer, more effective treatments or a flood of generic alternatives. For instance, a once-popular cardiovascular drug might now be competing with dozens of generics, driving down prices and Bukwang's market share.

These products, while still generating some revenue, require continued investment in manufacturing and distribution without offering significant growth potential. In 2024, it's estimated that a substantial portion of Bukwang's older portfolio, particularly in areas like basic antibiotics or older pain relievers, could be exhibiting this "Dog" characteristic. Their declining sales figures, potentially showing a year-over-year decrease of 5-10% in revenue, mark them as cash traps rather than growth drivers.

Products Impacted by Patent Expiry and Intense Competition

Pharmaceutical companies like Bukwang regularly grapple with patent expirations, which inevitably invite generic competition. Products that once enjoyed patent exclusivity but have since seen that protection lapse often find themselves in intensely competitive, commoditized markets. These products typically exhibit both low market share and low market growth, a combination that significantly erodes profitability.

When a pharmaceutical product loses its patent, it often becomes vulnerable to numerous generic manufacturers. This influx of competition drives down prices and reduces margins, pushing the product into the 'Dog' category of the BCG matrix. For instance, in 2024, the global pharmaceutical market saw continued pressure on off-patent drugs, with many established brands experiencing significant revenue declines due to generic substitutions.

Bukwang Pharmaceutical, like its peers, must manage products that fall into this category. These are often older drugs with declining sales and limited future growth prospects. The challenge lies in managing these assets efficiently or considering divestment to reallocate resources to higher-potential products.

- Low Market Share: Products in the 'Dog' quadrant typically represent a small fraction of the company's overall sales.

- Low Market Growth: The market for these products is often saturated or declining, offering little opportunity for expansion.

- Reduced Profitability: Intense generic competition significantly compresses profit margins for these drugs.

- Resource Drain: Continued investment in marketing or development for 'Dogs' can be a poor use of capital.

Any Products Divested Due to Capital Raise

Bukwang Pharmaceutical's strategic capital raise of 100 billion won in March 2025 signals a significant portfolio optimization. This infusion of capital is earmarked for facility investments and potential acquisitions, implying a sharpened focus on growth areas.

While no specific product divestitures were announced as a direct result of this capital raise, the move suggests a proactive approach to portfolio management. Underperforming assets or those not fitting the company's future strategic direction could be candidates for divestment or discontinuation to free up resources and enhance overall efficiency.

- Capital Infusion: 100 billion won raised in March 2025.

- Strategic Allocation: Funds designated for facility upgrades and potential acquisitions.

- Portfolio Optimization: Potential divestment of non-core or underperforming assets.

- Future Focus: Emphasis on aligning products with new strategic priorities.

Bukwang Pharmaceutical's 'Dogs' are likely its older, generic drugs facing intense competition and declining market relevance. These products, characterized by low market share and low growth, consume resources without significant returns. For example, established generics losing ground to newer treatments or biosimil alternatives fit this profile, a trend prevalent in the competitive 2024 pharmaceutical landscape.

The company's divestment of over 50 products post-acquisition underscores a strategic move away from such underperformers. These divested items represent classic 'Dogs', likely struggling with patent expirations and strong generic rivalry, leading to price erosion and reduced profitability in 2024.

Bukwang's legacy products, such as older antibiotics or pain relievers, are probable 'Dogs' exhibiting declining sales, potentially a 5-10% revenue decrease year-over-year in 2024. These are often cash traps, tying up capital that could be better invested in growth-oriented areas.

The 100 billion won capital raise in March 2025, designated for facility investments and acquisitions, further signals a strategic shift. This move implies a proactive approach to portfolio management, potentially leading to the divestment of these 'Dog' assets to optimize resource allocation and focus on more promising ventures.

| BCG Category | Bukwang Pharmaceutical Example | Characteristics | 2024 Market Context |

|---|---|---|---|

| Dogs | Older, off-patent generics | Low market share, low market growth, reduced profitability | Intense generic competition, price erosion |

| Dogs | Legacy products in saturated therapeutic areas | Minimal profit generation, potential cash traps | Competition from newer, more effective treatments |

| Dogs | Products with declining sales (e.g., 5-10% YoY revenue decrease) | Require continued investment without significant growth potential | Patent expirations leading to commoditization |

Question Marks

CP-012, a promising Parkinson's disease treatment from Bukwang Pharmaceutical's subsidiary Contera Pharma, is currently in Phase 1b clinical trials. This drug aims to address morning OFF symptoms, a significant unmet need in the Parkinson's market.

The global Parkinson's disease market was valued at approximately USD 7.5 billion in 2023 and is projected to reach over USD 11 billion by 2030, indicating substantial growth potential. However, CP-012, being in its early stages, has a current market share of zero. The significant investment required for its extensive clinical development, coupled with the inherent uncertainties of drug approval, firmly places it in the 'Question Mark' category of the BCG matrix.

JM-010, a promising pipeline asset from Contera Pharma, is designed to address dyskinesia associated with Parkinson's disease, a condition affecting millions globally. In 2024, Parkinson's disease prevalence continued to be a significant health concern, with estimates suggesting over 10 million people worldwide live with the condition, and dyskinesia being a common, often debilitating, side effect of levodopa therapy.

Currently in the development stage, JM-010, much like CP-012, operates within a growing therapeutic area. However, as it has not yet reached commercialization, it holds no current market share. The success of JM-010 in the BCG matrix hinges on its progression through clinical trials and subsequent market acceptance.

Its potential to ascend to the status of a 'Star' within Bukwang Pharmaceutical's portfolio is directly tied to positive clinical trial outcomes and strong market adoption. The global market for Parkinson's disease therapeutics, including treatments for motor complications like dyskinesia, is projected to grow substantially, reaching tens of billions of dollars in the coming years.

JaguAhR Therapeutics, a Bukwang Pharmaceutical affiliate, is actively pursuing innovative immunotherapies targeting solid tumors. This strategic focus aligns with the robust growth trajectory of the oncology sector.

Despite the promising market, JaguAhR's pipeline assets are in their nascent stages. For instance, in vivo efficacy validation occurred in 2024, with anticipated efficacy test results expected in the first half of 2025.

These early-stage developments necessitate significant research and development expenditures. The commercial viability of these assets remains uncertain, a characteristic that firmly places them within the 'Question Mark' category of the BCG Matrix.

Regadex (New Liver Disease Combination Drug)

Regadex, launched in June 2025, represents Bukwang Pharmaceutical's strategic entry into the liver disease market with its first combination drug, expanding the established Regaron brand. This innovative product has demonstrated encouraging clinical outcomes, specifically in normalizing liver enzyme levels, a key indicator of liver health.

However, as a newly introduced product in a competitive landscape, Regadex currently occupies a nascent market share. The liver disease market is characterized by numerous established treatments and therapies, making rapid market penetration a critical challenge.

Bukwang Pharmaceutical's success with Regadex will be heavily influenced by its ability to execute robust marketing campaigns and secure swift market adoption. The company's investment in promotion and physician education will be paramount to differentiating Regadex and capturing a significant portion of the market share, thereby positioning it favorably within the BCG matrix.

- Product: Regadex (Liver Disease Combination Drug)

- Company: Bukwang Pharmaceutical

- Launch Date: June 2025

- Market Position: New entrant, low market share in a competitive liver disease market.

- Key Success Factors: Rapid market adoption, strong marketing efforts, clinical efficacy in normalizing liver enzymes.

RNA-based Small Molecule Development Platform / New Research Projects

Bukwang Pharmaceutical is strategically investing in an RNA-based small molecule development platform. This move signifies a commitment to innovation and expanding its drug discovery pipeline into a highly promising, albeit nascent, field. The company's 2024 financial reports indicate a significant allocation towards R&D, with a notable portion earmarked for advanced technology platforms like this.

These new research projects, centered around RNA-based therapeutics, are characterized by their high-risk, high-reward profile. While they hold the potential for significant future breakthroughs in treating various diseases, they currently have no established market share. Bukwang's investment here is akin to a venture into the unknown, demanding substantial upfront capital before any commercial viability can be assessed.

- RNA Platform Investment: Bukwang Pharmaceutical is dedicating resources to build a novel RNA-based small molecule development platform, a key component of its 2024 strategic growth initiatives.

- Early-Stage Focus: The company is launching new research projects within this platform, targeting early-stage drug discovery with the aim of identifying future blockbuster therapies.

- Speculative Nature: These ventures are highly speculative, lacking immediate market presence and requiring sustained financial commitment prior to potential commercialization.

- R&D Expenditure: Bukwang's 2024 R&D budget reflects this forward-looking strategy, with substantial funding allocated to cutting-edge research and technological advancements.

Question Marks in Bukwang Pharmaceutical's portfolio represent products with low market share in high-growth markets. These are typically new ventures or early-stage developments that require significant investment to achieve market penetration.

CP-012 and JM-010, both Parkinson's disease treatments from Contera Pharma, fall into this category due to their current developmental stage and lack of commercialization. Similarly, JaguAhR Therapeutics' novel immunotherapies for solid tumors are in early-stage validation, positioning them as Question Marks.

Bukwang's investment in its RNA-based small molecule development platform also represents a Question Mark; it's a high-potential, high-risk area with no current market share but significant future prospects. Regadex, despite its June 2025 launch, is also a Question Mark due to its nascent market share in a competitive liver disease sector.

| Product/Platform | Market Growth | Market Share | BCG Category | Key Considerations |

|---|---|---|---|---|

| CP-012 (Parkinson's) | High (Global market > USD 11 billion by 2030) | Low (Zero, early stage) | Question Mark | Significant R&D investment, clinical trial uncertainties. |

| JM-010 (Parkinson's Dyskinesia) | High (Growing therapeutics market) | Low (Zero, development stage) | Question Mark | Progression through clinical trials, market acceptance critical. |

| JaguAhR Immunotherapies | High (Oncology sector) | Low (Nascent stages) | Question Mark | Early-stage validation, significant R&D expenditure. |

| Regadex (Liver Disease) | Moderate to High | Low (New entrant) | Question Mark | Requires robust marketing and swift adoption. |

| RNA Platform | Very High (Nascent field) | Low (Zero, new research) | Question Mark | High-risk, high-reward, substantial upfront capital. |

BCG Matrix Data Sources

Our BCG Matrix is constructed using robust data from Bukwang Pharmaceutical's financial disclosures, comprehensive market research reports, and industry growth trend analyses to provide a clear strategic overview.