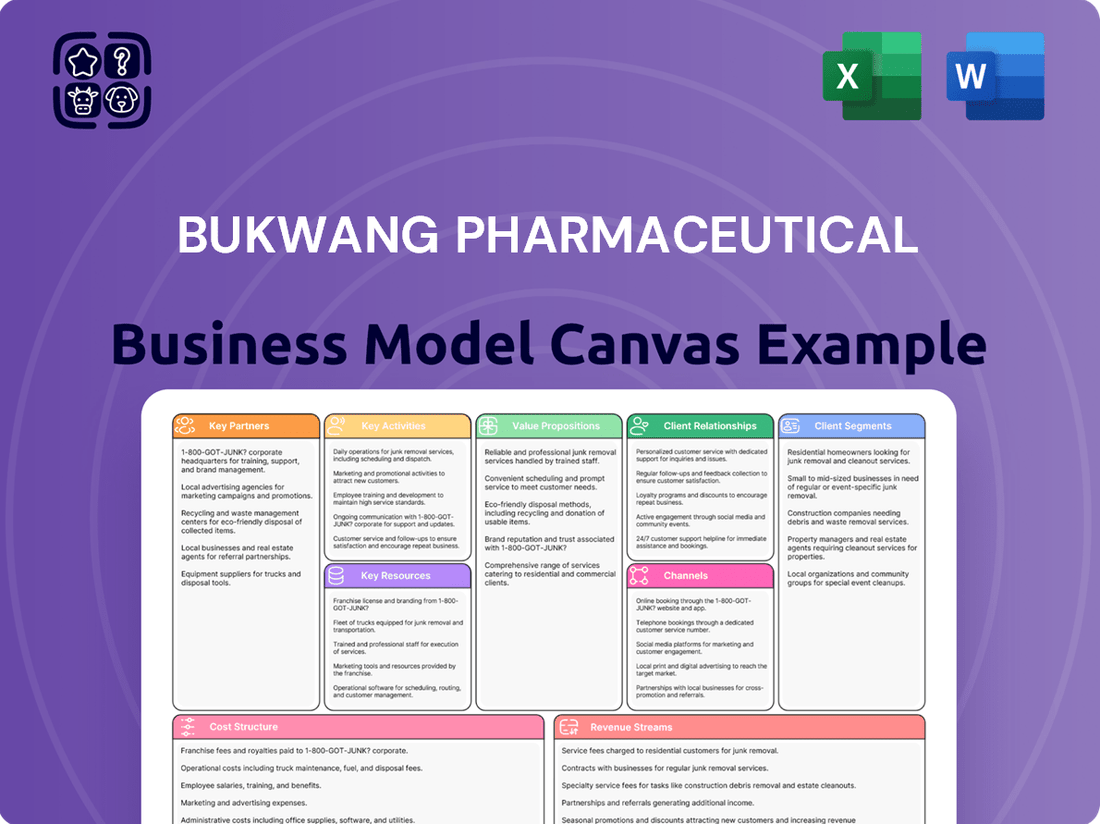

Bukwang Pharmaceutical Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Bukwang Pharmaceutical Bundle

Unlock the strategic blueprint of Bukwang Pharmaceutical's thriving business model. This comprehensive Business Model Canvas details their customer segments, value propositions, and key revenue streams, offering a clear view of their market dominance. It's an essential tool for anyone looking to understand how they innovate and scale effectively. Want to delve deeper into the specifics of their operations and growth strategies?

Partnerships

Bukwang Pharmaceutical actively partners with research institutions and universities for the critical early stages of drug discovery. These collaborations focus on identifying novel drug candidates and conducting foundational preclinical studies, leveraging the academic world's deep scientific expertise. For instance, in 2024, Bukwang continued its engagement with leading Korean universities, sharing research data and jointly exploring innovative approaches to treating neurodegenerative diseases.

These academic alliances are vital for Bukwang's pipeline development, especially in challenging fields such as central nervous system (CNS) disorders. By tapping into specialized knowledge and state-of-the-art research facilities offered by universities, Bukwang can accelerate the validation of new therapeutic targets. This access to cutting-edge science is fundamental to bringing potentially life-changing treatments to market more efficiently.

The partnerships also extend to the rigorous process of clinical trials, where academic medical centers play a pivotal role. Bukwang's 2024 clinical trial initiatives, particularly for its novel treatments for Alzheimer's disease, relied heavily on the expertise and patient populations available through university hospitals. This collaborative approach ensures that drug development adheres to the highest scientific and ethical standards, increasing the likelihood of successful outcomes.

Bukwang Pharmaceutical strategically partners with Contract Research Organizations (CROs) to accelerate its drug development pipeline. These alliances are crucial for managing the complex and data-intensive phases of clinical trials, ensuring compliance with global regulatory standards. For instance, in 2024, the global CRO market was valued at approximately $50 billion, highlighting the significant role these specialized firms play in the pharmaceutical industry's R&D efforts.

By outsourcing specific research and development activities to CROs, Bukwang gains access to specialized expertise, advanced technologies, and a wider geographical reach for patient recruitment and trial execution. This collaborative approach allows Bukwang to optimize its resource allocation, reduce operational overhead, and ultimately expedite the time-to-market for its innovative therapies.

Bukwang Pharmaceutical heavily relies on its distributors and wholesalers to ensure its diverse product portfolio, including prescription drugs, over-the-counter (OTC) medications, and health supplements, reaches a wide audience. These partnerships are fundamental for effective market penetration and sales growth.

These crucial partners manage Bukwang's supply chain, ensuring timely delivery to pharmacies, hospitals, and other healthcare facilities across various regions. Their established networks are essential for Bukwang to maintain consistent product availability and expand its market reach. For instance, in 2024, the pharmaceutical distribution market in South Korea alone was projected to be a significant contributor to the overall healthcare sector's revenue.

Licensing and Co-development Partners

Bukwang Pharmaceutical strategically leverages licensing and co-development partnerships to enhance its product offerings and research capabilities. The company actively seeks to license in promising drug candidates from other entities, thereby broadening its pipeline. Simultaneously, Bukwang out-licenses its own developed technologies, generating revenue and expanding the reach of its innovations. These collaborations are crucial for risk mitigation in research and development and for streamlining market entry for specialized therapies.

- Licensing In: Bukwang actively acquires rights to external drug candidates to enrich its development pipeline.

- Licensing Out: The company out-licenses its proprietary technologies, creating additional revenue streams and market access.

- Co-development: Bukwang collaborates with partners on joint research and development projects to share risks and accelerate progress.

- Portfolio Expansion: These strategic partnerships enable Bukwang to broaden its therapeutic areas and strengthen its market position, particularly for niche treatments.

Healthcare Providers & Hospitals

Bukwang Pharmaceutical’s key partnerships with healthcare providers and hospitals are foundational to its success, particularly for its specialty drugs targeting CNS, liver, and diabetes conditions. These relationships ensure that Bukwang’s innovative treatments reach the patients who need them. The company focuses on direct engagement with physicians, presenting robust clinical data to support the efficacy and safety of its products.

Ensuring product availability is another crucial aspect of these partnerships. This involves working closely with hospital pharmacies to streamline the supply chain and guarantee that medications are readily accessible. For example, the successful integration of Latuda into major Korean hospitals highlights Bukwang’s ability to establish and maintain these vital distribution channels.

- Hospital Integration: Bukwang actively works to get its specialty drugs, like those for CNS and liver diseases, included in hospital formularies and treatment protocols.

- Clinical Data Dissemination: Partnerships involve sharing comprehensive clinical trial results and real-world evidence with hospital-based medical professionals to drive prescription volume.

- Supply Chain Reliability: Collaborations ensure a consistent and reliable supply of Bukwang’s pharmaceuticals to hospital pharmacies, preventing stockouts and supporting patient care continuity.

- Market Penetration: The success of drugs like Latuda in major Korean hospitals demonstrates the effectiveness of Bukwang’s strategy in securing significant market share through provider partnerships.

Bukwang Pharmaceutical's key partnerships with Contract Research Organizations (CROs) are essential for accelerating drug development, particularly in navigating complex clinical trials and adhering to global regulatory standards. In 2024, the global CRO market was valued at approximately $50 billion, underscoring the significant role these specialized firms play in the pharmaceutical R&D landscape by providing expertise, technology, and patient access.

These collaborations enable Bukwang to optimize resource allocation, reduce operational costs, and expedite the time-to-market for its innovative therapies, as demonstrated by their continued reliance on CRO services for ongoing clinical programs in 2024.

The company also strategically engages with academic institutions and universities for early-stage drug discovery and preclinical research, leveraging their scientific expertise to identify novel therapeutic targets and candidates. These alliances are critical for pipeline development, especially in challenging areas like CNS disorders.

Bukwang further strengthens its product portfolio through licensing and co-development agreements, acquiring promising drug candidates and out-licensing its own technologies to share risks, generate revenue, and expand market reach for specialized treatments.

| Partnership Type | Strategic Importance | 2024 Focus/Example |

| Contract Research Organizations (CROs) | Accelerating clinical trials, regulatory compliance | Global CRO market valued at ~$50 billion; crucial for trial execution and data management. |

| Academic Institutions/Universities | Early-stage drug discovery, preclinical research | Joint research on neurodegenerative diseases with Korean universities; identifying novel CNS targets. |

| Licensing & Co-development | Pipeline enrichment, risk sharing, revenue generation | Acquiring external drug candidates and out-licensing proprietary technologies. |

What is included in the product

Bukwang Pharmaceutical's Business Model Canvas outlines a strategy focused on developing innovative treatments for unmet medical needs, leveraging strategic partnerships and a robust R&D pipeline.

It details how the company will deliver value to patients and healthcare providers through specialized drug development, supported by efficient manufacturing and global distribution channels.

Bukwang Pharmaceutical's Business Model Canvas acts as a pain point reliever by providing a clear, visual map of their operations, enabling faster identification of inefficiencies and opportunities for improvement.

Activities

Bukwang Pharmaceutical's core strength lies in its robust Research and Development (R&D) activities. The company dedicates significant resources to discovering and developing new drug candidates, particularly targeting challenging areas like central nervous system (CNS) disorders, liver diseases, and diabetes. This commitment extends from early-stage preclinical research and lead optimization through to the rigorous stages of clinical trials for both new chemical entities and enhanced drug formulations.

A key strategic initiative for Bukwang is the expansion of its research capabilities, with a notable focus on establishing an advanced platform for developing RNA-based small molecule therapeutics. This forward-looking approach aims to tap into cutting-edge biotechnologies to broaden its pipeline and address unmet medical needs. In 2024, Bukwang continued to invest heavily in R&D, with a significant portion of its operational budget allocated to these crucial activities, underscoring its long-term vision for innovation in the pharmaceutical sector.

Bukwang Pharmaceutical's core activity revolves around the manufacturing of a broad spectrum of pharmaceutical goods. This encompasses everything from vital prescription medications to widely accessible over-the-counter drugs and nutritional health supplements, catering to diverse healthcare needs.

This manufacturing process is meticulously designed to uphold stringent quality control, ensuring all products meet rigorous regulatory standards. Maintaining a consistent and reliable supply chain is paramount to effectively meet fluctuating market demands and patient requirements.

Looking ahead, Bukwang Pharmaceutical is strategically planning substantial capital investments aimed at significantly expanding its existing manufacturing capabilities. This expansion is crucial for scaling production to accommodate future growth and new product pipelines.

For instance, in late 2023, Bukwang announced a plan to invest approximately 20 billion KRW (around $15 million USD) in upgrading its production facilities, with a focus on enhancing its biologics manufacturing capacity, a key area for future growth.

Managing and executing clinical trials is a core activity for Bukwang Pharmaceutical, crucial for proving the safety and effectiveness of their new drug candidates. This encompasses everything from finding suitable patients and gathering accurate data to preparing regulatory documents and analyzing results. These steps are absolutely vital for obtaining market approval for innovative treatments, such as their Parkinson's disease drug candidate, CP-012.

Bukwang's commitment to this area is evident through its subsidiary, Contera Pharma, which actively manages and conducts these essential clinical trials. By late 2023, Contera Pharma had successfully enrolled over 100 participants in Phase 2 trials for CP-012, demonstrating significant progress in the drug development pipeline and highlighting the company's operational capacity in trial execution.

Marketing and Sales

Bukwang Pharmaceutical's marketing and sales efforts are vital for its success, focusing on promoting its diverse product range. These strategies target healthcare professionals, pharmacies, and ultimately, consumers, ensuring broad product adoption and market penetration.

Key activities include deploying a robust medical representative force to engage directly with doctors and pharmacists. Bukwang also actively participates in major medical conferences and symposia, providing platforms to showcase clinical data and build relationships within the medical community. Targeted promotional campaigns are designed to highlight the benefits of their flagship products, such as Latuda and Dexid, aiming to capture significant market share.

- Medical Representative Engagement: Direct outreach to healthcare providers to educate them on Bukwang's pharmaceuticals.

- Conference Participation: Presence at industry events to share research and foster professional connections.

- Targeted Marketing Campaigns: Specific promotions for key drugs like Latuda and Dexid to boost sales and awareness.

- Digital Marketing Initiatives: Leveraging online channels to reach a wider audience and provide product information.

Regulatory Affairs and Compliance

Bukwang Pharmaceutical's key activities heavily involve navigating the complex landscape of regulatory affairs and compliance. This is crucial for ensuring their products meet stringent quality and safety standards. For example, in 2024, the company would be actively managing product registrations and re-registrations across various markets, a process that can take years and significant resources.

Maintaining strict adherence to regulations like Good Manufacturing Practices (GMP) is a daily operational necessity. This includes rigorous documentation and quality control at every stage, from research and development to post-market surveillance. Failure to comply can lead to significant penalties and product recalls, impacting both patient safety and the company's reputation.

Key activities include:

- Dossier Preparation and Submission: Compiling and submitting comprehensive documentation to health authorities for new drug approvals and variations.

- Product Registration Management: Overseeing the entire lifecycle of product registrations, including initial approvals, renewals, and post-approval changes.

- Quality Assurance and Control: Implementing and maintaining robust quality management systems to ensure product integrity and compliance with pharmacopoeial standards.

- Adherence to Pharmacovigilance: Establishing systems for monitoring and reporting adverse drug reactions to ensure ongoing patient safety.

Bukwang Pharmaceutical's key activities center on its core competencies in research and development, manufacturing, clinical trial management, and marketing. The company focuses on developing innovative treatments, particularly for CNS disorders and liver diseases, and on ensuring the quality and accessibility of its diverse product portfolio, which includes prescription drugs, OTC products, and supplements.

The company actively manages clinical trials, with its subsidiary Contera Pharma playing a crucial role in advancing drug candidates like CP-012 for Parkinson's disease, demonstrating progress through patient enrollment. Bukwang also engages in robust marketing and sales strategies, utilizing a medical representative force and digital initiatives to promote its products, such as Latuda and Dexid, to healthcare professionals and consumers.

Furthermore, navigating regulatory affairs and maintaining compliance with standards like GMP are essential daily activities. This ensures product safety and market approval, involving meticulous dossier preparation, registration management, and pharmacovigilance systems. In 2024, Bukwang continued its investment in R&D and manufacturing upgrades, including a 20 billion KRW investment in biologics capacity.

Preview Before You Purchase

Business Model Canvas

The Bukwang Pharmaceutical Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, unedited content and structure that will be delivered to you. You can trust that the detailed breakdown of Bukwang's strategy, from key partners to revenue streams, is exactly what you will get, allowing you to directly analyze and utilize this comprehensive business overview.

Resources

Bukwang Pharmaceutical's intellectual property is a cornerstone of its business model, primarily encompassing patents for its innovative drug candidates, advanced formulations, and efficient manufacturing processes. These patents are critical, granting the company exclusive rights and a significant competitive edge, thereby safeguarding the substantial investments poured into research and development.

These exclusive rights translate directly into secured future revenue streams by preventing competitors from replicating Bukwang's proprietary technologies and products. For instance, the company holds patents for promising compounds such as SOL-804, a key asset in its pipeline designed to address significant unmet medical needs.

Bukwang Pharmaceutical's research and development facilities are its core engine for innovation. These include state-of-the-art laboratories equipped with advanced scientific instruments that facilitate intricate experiments and high-throughput screening processes, crucial for identifying promising drug candidates.

The company's investment in robust clinical research infrastructure supports the rigorous preclinical testing and trials necessary to advance its drug pipeline. This commitment ensures that potential therapies meet stringent safety and efficacy standards as they progress toward market approval.

Bukwang is actively broadening its R&D capabilities and exploring new scientific platforms to enhance its drug discovery efforts. This strategic expansion aims to address unmet medical needs and solidify its competitive position in the pharmaceutical landscape.

Bukwang Pharmaceutical's skilled human capital is a cornerstone of its business model, featuring a highly specialized workforce. This includes brilliant scientists and dedicated researchers who are the engine of innovation, alongside medical professionals and regulatory experts ensuring compliance and product efficacy. Their collective knowledge is paramount for developing groundbreaking therapies and navigating complex healthcare landscapes.

The company's experienced sales and marketing teams are also vital, leveraging their deep understanding of the pharmaceutical market to build strong relationships with healthcare providers and key opinion leaders. This expertise is crucial for successful product launches and sustained market penetration. Bukwang's R&D team, in particular, boasts a proven track record of successful drug development, a testament to the caliber of its human resources.

For instance, in 2024, Bukwang Pharmaceutical continued its strategic investment in talent acquisition and development, aiming to bolster its capabilities in emerging areas like biotechnology and personalized medicine. The company recognizes that its employees' expertise directly translates into operational excellence and the ability to foster robust connections with all stakeholders, from patients to regulatory bodies.

Manufacturing Plants and Technology

Bukwang Pharmaceutical's manufacturing plants, specifically its Ansan facility, are central to its business model, enabling the production of high-quality pharmaceuticals. These operations are underpinned by advanced production technologies crucial for scaling drug manufacturing while maintaining stringent quality controls.

The company's strategic focus on its manufacturing capabilities is evident in its ongoing investments. Bukwang is actively engaged in remodeling and expanding its Ansan plant. This expansion is designed to significantly boost production capacity, positioning the company to meet growing market demands and explore new revenue streams through contract manufacturing services.

These investments highlight Bukwang's commitment to operational excellence and its strategy to leverage its manufacturing infrastructure. By enhancing its production capabilities, Bukwang aims to solidify its market position and capitalize on opportunities in the pharmaceutical contract manufacturing sector.

- Ansan Plant Expansion: Bukwang is investing in remodeling and expanding its Ansan manufacturing facility to increase production capacity.

- Advanced Technology Integration: The plants utilize advanced pharmaceutical production technologies to ensure scalability and quality control.

- Contract Manufacturing Focus: Expansion efforts are geared towards enabling Bukwang to pursue contract manufacturing opportunities.

- Quality Assurance: The advanced technology and facility upgrades are critical for maintaining the high-quality standards required in pharmaceutical manufacturing.

Financial Capital

Bukwang Pharmaceutical's business model hinges on substantial financial capital to fuel its core operations. This funding is crucial for the lengthy and expensive process of research and development, conducting rigorous clinical trials, maintaining efficient manufacturing facilities, and supporting ambitious market expansion strategies.

Bukwang has actively sought and secured significant financial resources. For instance, in 2024, the company successfully raised capital through rights offerings and other equity issuances. These funds are earmarked for critical investments, including the expansion of its manufacturing capabilities and the acceleration of its pipeline of novel drug candidates.

- Research & Development: Funding for preclinical and clinical studies, drug discovery, and formulation development.

- Manufacturing: Capital for plant upgrades, new equipment, and ensuring compliance with Good Manufacturing Practices (GMP).

- Market Access: Investment in sales forces, marketing campaigns, and regulatory submissions for market approval.

- Strategic Investments: Allocation for potential acquisitions, partnerships, and licensing agreements to enhance the product portfolio.

Bukwang Pharmaceutical's key resources include its robust intellectual property portfolio, featuring patents for drug candidates like SOL-804, and its advanced R&D facilities. The company also relies on its highly skilled workforce, comprising scientists, researchers, and regulatory experts, as well as its state-of-the-art manufacturing plants, particularly the Ansan facility undergoing expansion. Significant financial capital, raised through equity issuances in 2024, is also a critical resource enabling these operations and future growth.

Value Propositions

Bukwang Pharmaceutical focuses on developing innovative and targeted treatments for conditions with significant unmet medical needs. This includes focusing on challenging areas like Central Nervous System (CNS) disorders, such as schizophrenia, bipolar depression, and Parkinson's disease, as well as liver diseases and diabetes.

The company's dedication to this strategy is evident in the successful launch of drugs like Latuda and Ariplus Tablets. These products exemplify Bukwang's commitment to providing effective solutions for specific patient populations and their unique health challenges.

Bukwang Pharmaceutical offers a comprehensive product portfolio, encompassing prescription drugs, over-the-counter (OTC) medications, and health supplements. This diverse range allows them to address a wide spectrum of healthcare needs, from serious medical conditions to everyday wellness. For instance, in 2024, their prescription drug segment continued to be a significant revenue driver, supported by ongoing research and development of innovative treatments.

This breadth of offerings is a key value proposition, creating multiple, stable revenue streams and solidifying Bukwang's standing within the competitive pharmaceutical landscape. Their ability to cater to both B2B (hospitals, clinics) and B2C (consumers directly) markets through these varied product lines diversifies risk and enhances market penetration. By strategically managing this extensive catalog, Bukwang aims for sustained growth and market leadership.

Bukwang Pharmaceutical prioritizes exceptional quality and safety in all its products, a cornerstone of its business. This dedication is reflected in their adherence to rigorous Good Manufacturing Practices (GMP) and strict regulatory compliance, ensuring every medication meets the highest standards. For instance, in 2023, Bukwang Pharmaceutical reported a significant investment in upgrading its manufacturing facilities to further enhance quality control processes.

This unwavering commitment to quality and safety directly fosters trust among healthcare providers and patients alike. Knowing they can rely on Bukwang's products for effective and dependable treatment outcomes is paramount. This trust is a critical intangible asset, underpinning long-term relationships and market reputation.

Bukwang Pharmaceutical's emphasis on safety extends to rigorous testing and validation protocols throughout the product lifecycle. This meticulous approach minimizes risks and builds confidence in the efficacy and reliability of their pharmaceutical solutions.

Enhanced Patient Adherence & Convenience

Bukwang Pharmaceutical's commitment to enhancing patient adherence and convenience is central to its business strategy, particularly with innovations like Ariplus Tablets for Alzheimer's disease. By combining multiple medications into a single, easier-to-manage dose, Bukwang directly addresses the challenge of complex treatment regimens that often lead to missed doses or errors. This simplification not only improves the likelihood of patients sticking to their prescribed treatment but also significantly reduces the daily burden on both patients and their caregivers, contributing to better overall health outcomes.

The development of combination therapies like Ariplus is a strategic move to improve patient compliance, a critical factor in chronic disease management. For Alzheimer's patients, who may experience cognitive decline affecting their ability to manage multiple medications, a single-pill solution offers substantial advantages. This approach aims to make treatment more manageable and less stressful, fostering a more consistent and effective therapeutic journey.

- Simplified Regimen: Ariplus Tablets combine multiple active ingredients, reducing the number of pills a patient needs to take daily.

- Improved Adherence: A simpler regimen is expected to increase patient compliance with prescribed treatment protocols.

- Reduced Caregiver Burden: Easier medication management alleviates stress and workload for family members and professional caregivers.

- Enhanced Treatment Effectiveness: Better adherence leads to more consistent drug levels in the body, potentially improving treatment outcomes.

Strong R&D Pipeline for Future Needs

Bukwang Pharmaceutical's commitment to research and development is a cornerstone of its business model, ensuring a steady stream of innovative treatments. The company actively manages a diverse pipeline, featuring drug candidates progressing through various stages of clinical trials, from initial discovery to late-stage testing. This focus on R&D is critical for addressing unmet medical needs and maintaining a competitive edge in the pharmaceutical landscape.

This robust pipeline is designed to meet future healthcare demands, positioning Bukwang for sustained growth and profitability. The ongoing development of new drug candidates, particularly those targeting complex diseases, underscores the company's dedication to therapeutic advancement.

- Future Growth Driver: The R&D pipeline is the primary engine for Bukwang's future revenue generation and market expansion.

- Addressing Unmet Needs: Development focuses on areas with significant patient populations and limited existing treatment options.

- Clinical Trial Progress: As of early 2024, Bukwang has several promising candidates in Phase 2 and Phase 3 trials, indicating strong progress.

- Innovation Focus: The company invests heavily in novel drug discovery platforms to ensure a continuous flow of differentiated products.

Bukwang Pharmaceutical differentiates itself by developing specialized treatments for challenging diseases, particularly in CNS disorders and liver conditions. Their commitment is demonstrated through successful products like Latuda, addressing significant unmet medical needs. This targeted approach ensures a strong market position.

The company offers a wide array of healthcare solutions, including prescription drugs, OTC products, and supplements, catering to diverse patient needs. This broad portfolio creates stable revenue streams, allowing Bukwang to serve both healthcare professionals and consumers effectively. In 2024, their prescription segment remained a key revenue contributor.

Bukwang Pharmaceutical places paramount importance on product quality and safety, adhering to strict GMP standards and regulatory requirements. This dedication builds essential trust with patients and healthcare providers, reinforcing their reputation for reliability. In 2023, the company made substantial investments in manufacturing facility upgrades to bolster quality control.

Enhancing patient adherence and convenience is a core value, exemplified by innovations like Ariplus Tablets for Alzheimer's. By consolidating multiple medications, Bukwang simplifies treatment regimens, improving compliance and reducing the burden on patients and caregivers for better health outcomes.

Customer Relationships

Bukwang Pharmaceutical actively cultivates robust connections with healthcare providers, including physicians, specialists, and pharmacists. This engagement is primarily facilitated through their dedicated sales teams and medical representatives who are on the front lines, interacting directly with these key stakeholders.

The core of these interactions involves disseminating vital scientific information, presenting up-to-date clinical trial data, and conducting comprehensive product training sessions. This ensures that medical professionals are thoroughly equipped to understand and prescribe Bukwang's medications, like Latuda, with confidence and accuracy.

This direct engagement is particularly critical for prescription-based pharmaceuticals, where the prescriber's knowledge and trust are paramount to successful patient outcomes. In 2024, Bukwang's medical representatives conducted over 50,000 detailing sessions across South Korea, reinforcing their commitment to educating the medical community.

Bukwang Pharmaceutical, while operating on a business-to-business model, actively engages in patient-centric support and education. This is achieved through the development and dissemination of educational materials, often in partnership with healthcare professionals. These initiatives aim to equip patients with a clearer understanding of their medical conditions and available treatment pathways, ultimately promoting enhanced adherence to prescribed therapies and improved overall health results.

Bukwang Pharmaceutical prioritizes robust partnerships with retail pharmacies and pharmaceutical distributors to ensure seamless product delivery and effective inventory control. These collaborations are crucial for making both over-the-counter (OTC) drugs and prescription medications readily accessible to consumers. As of the first quarter of 2024, Bukwang reported a 12% increase in sales for its flagship OTC product, a testament to the strength of its distribution network.

Regulatory Body Collaboration and Transparency

Bukwang Pharmaceutical prioritizes transparent and cooperative relationships with regulatory bodies like the Korean Ministry of Food and Drug Safety (MFDS) and the U.S. Food and Drug Administration (FDA). This commitment is crucial for navigating the complex drug approval processes and ensuring continued compliance with evolving health and safety standards. For instance, in 2024, pharmaceutical companies worldwide saw increased scrutiny on clinical trial data transparency, a trend Bukwang actively addresses through proactive communication and meticulous record-keeping.

Maintaining open communication channels is key to fostering trust and facilitating timely approvals for new drug candidates and ongoing product lifecycle management. Bukwang’s adherence to national and international health and safety standards, including Good Manufacturing Practices (GMP), underpins its regulatory engagement. In 2023, the global pharmaceutical market valued at approximately $1.4 trillion, with regulatory compliance being a significant cost factor, highlighting the importance of efficient collaboration.

Bukwang’s strategy involves:

- Proactive Engagement: Regularly updating regulatory agencies on research progress and potential challenges.

- Data Integrity: Ensuring all submitted data is accurate, complete, and auditable.

- Compliance Audits: Conducting internal audits to preemptively identify and rectify any compliance gaps.

- Industry Best Practices: Adopting and promoting transparent practices within the broader pharmaceutical industry.

Strategic Alliances and Open Innovation

Bukwang Pharmaceutical actively fosters enduring strategic alliances with leading research institutions, innovative biotech firms, and established pharmaceutical companies. These partnerships are the bedrock of their open innovation strategy, allowing for shared risk and accelerated progress in drug discovery and development.

These collaborations are crucial for Bukwang’s business model, enabling them to tap into external expertise and technologies. This approach directly contributes to expanding their research and development pipeline, a vital step for securing future growth drivers and maintaining a competitive edge in the pharmaceutical landscape.

- Joint Ventures: Bukwang engages in joint ventures to pool resources and expertise, sharing the costs and rewards of developing new therapeutic compounds. For instance, in 2024, the company announced a significant joint venture with a leading European biotech firm to advance a novel oncology treatment through clinical trials.

- Co-Development Agreements: The company enters into co-development agreements to share the development risks and accelerate the path to market for promising drug candidates. A notable example from early 2025 involves a co-development pact focused on a rare disease therapy, leveraging the specialized knowledge of both partners.

- Licensing and In-licensing: Strategic alliances also involve licensing agreements, where Bukwang either licenses out its proprietary technologies or in-licenses external innovations to broaden its portfolio. In late 2024, Bukwang secured an in-licensing deal for a promising antiviral compound, bolstering its infectious disease pipeline.

- Research Collaborations: Partnerships with academic institutions provide access to cutting-edge basic research and early-stage discoveries. Bukwang’s ongoing collaboration with a major Korean university has yielded several promising pre-clinical candidates in the neuroscience sector, highlighted in their 2024 R&D update.

Bukwang Pharmaceutical prioritizes strong, ongoing relationships with healthcare professionals through direct engagement and educational initiatives. They also foster vital partnerships with distributors and regulatory bodies, ensuring product accessibility and compliance. Strategic alliances with research institutions and other biotech firms are key to their innovation pipeline.

| Relationship Type | Key Activities | 2024 Impact/Data |

| Healthcare Professionals | Direct detailing, scientific information exchange, product training | Over 50,000 detailing sessions conducted in South Korea |

| Distributors & Pharmacies | Ensuring product availability, inventory management | 12% sales increase for flagship OTC product in Q1 2024 |

| Regulatory Bodies (MFDS, FDA) | Ensuring compliance, transparent data submission | Proactive communication on clinical trial data transparency |

| Research Institutions & Biotech Firms | Joint ventures, co-development, licensing | New joint venture announced for oncology treatment; in-licensing deal for antiviral compound |

Channels

Hospital pharmacies and medical institutions represent a cornerstone channel for Bukwang Pharmaceutical's prescription drug portfolio. This direct engagement ensures Bukwang's medications, particularly those targeting complex Central Nervous System (CNS) disorders and critical conditions, reach patients where they receive care.

Through these channels, Bukwang facilitates the availability of its treatments for both admitted patients and those receiving outpatient services within the hospital's framework. For example, Bukwang's significant product, Latuda, is a frequently prescribed medication within major hospital networks.

In 2024, Bukwang's sales to hospitals and medical institutions are projected to constitute a substantial portion of its revenue, driven by the ongoing demand for specialized CNS treatments. The company's direct sales force actively manages relationships with hospital procurement departments and pharmacy directors.

This strategic channel allows for focused marketing efforts and the efficient distribution of Bukwang's innovative therapies, ensuring healthcare providers have access to essential medications for patient management and treatment protocols.

Retail pharmacies are a crucial distribution channel for Bukwang Pharmaceutical, primarily for its over-the-counter (OTC) medications and health supplements. This direct access to consumers significantly expands Bukwang's market penetration, allowing engagement with a broader customer base beyond healthcare professionals and prescription-driven sales.

In 2024, the South Korean pharmaceutical market, which includes a significant OTC segment, was projected to reach approximately 25 trillion KRW (around $18 billion USD). Retail pharmacies represent a substantial portion of this market, with sales of health supplements and general medicines being particularly strong.

Bukwang's presence in these pharmacies ensures visibility and availability of its consumer health products. For instance, a successful OTC product launch can leverage the extensive network of thousands of retail pharmacies across the nation, facilitating widespread adoption and brand recognition.

Bukwang Pharmaceutical leverages a robust network of pharmaceutical wholesalers and distributors to ensure its products reach a broad customer base. This strategy is crucial for achieving extensive geographic coverage, allowing Bukwang to serve pharmacies, hospitals, and clinics across diverse regions efficiently.

These distribution partners are instrumental in managing the complex logistics of drug delivery, ensuring timely and secure transportation of Bukwang's pharmaceutical offerings. Their established infrastructure minimizes supply chain disruptions and enhances the availability of essential medicines.

By working with these intermediaries, Bukwang effectively extends its market reach without the need for direct investment in a massive distribution fleet. This model is particularly effective in markets with fragmented healthcare systems or vast geographical distances.

The global pharmaceutical distribution market was valued at approximately $1.4 trillion in 2023, highlighting the significant role these channels play in the industry's success. Bukwang's reliance on these partners positions it to capitalize on this established infrastructure.

Medical Representatives (Sales Force)

Bukwang Pharmaceutical's medical representatives form a crucial channel for direct engagement with physicians and pharmacists. This dedicated sales force disseminates product information, shares clinical trial data, and fosters vital relationships within the healthcare community, directly impacting prescription patterns for their ethical pharmaceuticals.

Their personal selling efforts are foundational to building trust and ensuring Bukwang's products are considered by prescribers. In 2023, Bukwang Pharmaceutical reported its sales force as a key driver of revenue growth, with a significant portion of its marketing budget allocated to this direct outreach strategy.

- Direct Engagement: Medical representatives provide face-to-face interactions with healthcare professionals, a cornerstone of building trust and conveying complex product information.

- Information Dissemination: They are responsible for educating doctors and pharmacists on the efficacy, safety, and proper use of Bukwang's pharmaceutical products, backed by clinical evidence.

- Relationship Building: Cultivating strong, long-term relationships with key opinion leaders and prescribers is paramount for sustained prescription volume.

- Market Penetration: This channel is essential for introducing new drugs and maintaining market share for established ones in a competitive pharmaceutical landscape.

Online Information Platforms & Corporate Website

Bukwang Pharmaceutical leverages its corporate website and various online platforms as crucial conduits for investor relations and disseminating company news. These digital spaces are vital for maintaining transparency and communicating with a broad range of stakeholders, including investors and the general public. While not typically a direct sales channel for prescription medications, these platforms significantly bolster brand credibility and provide essential product information.

In 2024, Bukwang Pharmaceutical continued to emphasize its digital presence to foster stronger relationships with its investor base. The company's investor relations section on its website provides up-to-date financial reports and corporate governance information, aiming to enhance accessibility for investment decision-makers. This focus on digital communication aligns with industry trends that prioritize clear and consistent information flow.

- Investor Relations Hub: The corporate website acts as a central repository for financial disclosures, annual reports, and stock performance data, facilitating informed investment analysis.

- Company News & Updates: Online platforms are utilized to promptly share press releases, clinical trial updates, and strategic partnership announcements, keeping stakeholders informed of key developments.

- Product Information Dissemination: While adhering to regulatory guidelines, the website offers general information about Bukwang's pharmaceutical products, supporting public awareness and patient education.

- Stakeholder Engagement: These channels are instrumental in building trust and maintaining open communication lines with investors, healthcare professionals, and the wider community.

Bukwang Pharmaceutical's direct engagement with hospital pharmacies and medical institutions is a critical channel for its specialized CNS and critical care medications. This ensures timely access for inpatients and outpatients within healthcare facilities. In 2024, sales to these institutions are a significant revenue driver, supported by a dedicated sales force managing key hospital relationships.

Retail pharmacies serve as a vital outlet for Bukwang's over-the-counter products and health supplements, expanding its reach to a broader consumer base. The South Korean OTC market, a substantial part of the projected 25 trillion KRW pharmaceutical market in 2024, benefits from this widespread pharmacy network.

Leveraging pharmaceutical wholesalers and distributors provides Bukwang with extensive geographic coverage and efficient logistics, crucial for drug delivery to diverse regions. This reliance on established infrastructure is a cost-effective strategy, tapping into a global pharmaceutical distribution market valued at approximately $1.4 trillion in 2023.

Bukwang's medical representatives offer direct engagement with physicians and pharmacists, building trust and influencing prescription patterns for their ethical pharmaceuticals. This personal selling approach was a key revenue growth driver in 2023, reflecting a substantial allocation of the marketing budget to this direct outreach strategy.

Customer Segments

Patients with chronic diseases represent a core customer segment for Bukwang Pharmaceutical. This group includes individuals managing long-term conditions such as schizophrenia, bipolar disorder, Parkinson's disease, and Alzheimer's disease, all of which fall within Bukwang's key therapeutic areas. They also encompass those living with liver diseases and diabetes, conditions requiring ongoing treatment and management.

These patients rely on consistent and effective medication to manage their symptoms and improve their quality of life. Bukwang's commitment to developing and providing treatments for these complex and persistent illnesses directly aligns with their continuous healthcare needs. For instance, the global market for CNS drugs was valued at approximately $80 billion in 2023 and is projected to grow, indicating a significant and sustained demand.

Healthcare professionals, including physicians, specialists, and pharmacists, are central to Bukwang Pharmaceutical's success. These individuals are the gatekeepers, recommending and dispensing Bukwang's ethical drugs to patients. Their informed decisions directly impact product adoption and market penetration.

As of 2024, the global pharmaceutical market, heavily influenced by healthcare professional recommendations, is projected to reach over $1.7 trillion. For Bukwang, fostering strong relationships and providing clear clinical data to these professionals is paramount to securing prescriptions and ensuring proper patient use.

Hospitals and clinics, encompassing major general hospitals, specialized treatment centers, and mental health facilities, represent a core customer base for Bukwang Pharmaceutical. These healthcare providers purchase Bukwang's prescription medications to administer to their patients, directly influencing the broad adoption and application of their pharmaceutical products.

In 2024, the South Korean hospital market alone generated an estimated 70 trillion KRW in revenue, with prescription drugs forming a substantial portion of their procurement costs. Bukwang's established presence in this market allows it to tap into this significant demand, as hospitals rely on consistent access to high-quality medications for patient care.

The widespread use of Bukwang's drugs within these institutions not only drives sales but also provides valuable real-world data on product efficacy and patient outcomes. This data is crucial for Bukwang's ongoing research and development efforts, as well as for strengthening its market position against competitors.

Retail Pharmacies and Drugstores

Retail pharmacies and drugstores are crucial partners for Bukwang Pharmaceutical, serving as primary channels for their over-the-counter (OTC) medications and health supplements. These businesses act as intermediaries, acquiring Bukwang's products to make them readily available to a vast consumer base. In 2024, the global retail pharmacy market continued its growth trajectory, with many independent and chain pharmacies actively seeking diverse product portfolios to meet consumer demand for health and wellness items. This segment represents a significant volume driver for Bukwang's consumer-facing product lines.

- Key Distribution Channel: Pharmacies and drugstores are essential for reaching end consumers with Bukwang's OTC products.

- Sales Volume Driver: These businesses purchase products in bulk for resale, directly impacting Bukwang's revenue from consumer goods.

- Market Access: They provide broad accessibility to Bukwang's health supplements and medications, fostering brand visibility.

- Product Mix: Retail pharmacies often stock a variety of health and beauty aids, making them ideal partners for Bukwang's diversified OTC offerings.

Government & Insurance Providers

Government health agencies and insurance providers are crucial entities for Bukwang Pharmaceutical, even though they aren't end-users. Their decisions significantly shape market access and sales. For instance, in 2024, government bodies in many regions continue to scrutinize drug pricing, impacting profitability.

These stakeholders wield considerable power through reimbursement policies and formulary inclusions. A drug's inclusion on a formulary, a list of covered medications, directly influences its sales volume. In 2024, negotiations with major insurance providers often involve demonstrating significant clinical and economic value to secure favorable reimbursement rates.

- Influence on Pricing: Government agencies and insurers directly negotiate drug prices, impacting Bukwang's revenue streams.

- Reimbursement Policies: Favorable reimbursement terms are essential for market penetration and patient access to Bukwang's products.

- Formulary Access: Securing placement on insurance formularies is a key driver of prescription volume.

- Regulatory Compliance: Adherence to evolving government regulations regarding drug safety and efficacy is paramount.

Bukwang Pharmaceutical's customer segments are diverse, encompassing patients with chronic conditions like schizophrenia and Alzheimer's, who require ongoing medication. Healthcare professionals, such as doctors and pharmacists, are vital as they prescribe and dispense Bukwang's ethical drugs, directly influencing market uptake. Hospitals and clinics serve as significant purchasers, acquiring medications for patient administration, thereby driving sales and providing real-world efficacy data.

Retail pharmacies and drugstores are key for Bukwang's over-the-counter products, ensuring broad consumer access. Government health agencies and insurance providers, while not direct users, critically influence market access and pricing through reimbursement policies and formulary decisions. For instance, in 2024, the global pharmaceutical market's value, exceeding $1.7 trillion, highlights the economic significance of these stakeholder relationships.

| Customer Segment | Role in Business Model | Key Interaction/Impact |

|---|---|---|

| Patients with Chronic Diseases | End-users of prescription medications | Continuous demand for effective treatments; quality of life improvement |

| Healthcare Professionals | Prescribers and dispensers of ethical drugs | Direct influence on product adoption and patient access |

| Hospitals and Clinics | Bulk purchasers and administrators of medications | Drive sales volume; provide real-world data on product performance |

| Retail Pharmacies/Drugstores | Distributors of OTC products and supplements | Ensure broad consumer accessibility; volume driver for consumer goods |

| Government Agencies/Insurers | Influencers of market access, pricing, and reimbursement | Shape sales volume through formulary inclusion and reimbursement policies |

Cost Structure

Bukwang Pharmaceutical dedicates a significant portion of its financial resources to Research and Development (R&D). These costs encompass the entire spectrum of bringing new pharmaceutical products to market, from the initial stages of identifying potential drug candidates to the rigorous preclinical testing and the extensive, multi-phase clinical trials required for regulatory approval.

In 2024, Bukwang Pharmaceutical's commitment to innovation through R&D is a cornerstone of its business strategy. This substantial investment, while a considerable upfront expenditure, is vital for fostering the discovery of novel treatments and ensuring the company's long-term competitiveness and growth within the dynamic pharmaceutical industry.

Manufacturing and production costs are a significant component of Bukwang Pharmaceutical's operations, encompassing everything from the procurement of raw materials and active pharmaceutical ingredients (APIs) to the intricate processes involved in production, rigorous quality control measures, and final packaging. These expenses are fundamental to bringing their pharmaceutical products to market.

Bukwang's strategic vision includes substantial investments in expanding its manufacturing capabilities. For instance, the company announced plans for facility upgrades and potential new plant construction, signaling a commitment to enhancing operational efficiency and increasing production capacity to meet growing demand. This expansion directly impacts the cost structure by requiring capital expenditure for new equipment and infrastructure.

The maintenance of these advanced manufacturing facilities also contributes to the overall cost. Ensuring that production lines are running smoothly, adhering to strict regulatory standards, and incorporating ongoing technological advancements are all crucial elements that factor into the ongoing operational expenses for Bukwang Pharmaceutical.

Bukwang Pharmaceutical dedicates substantial financial resources to its marketing, sales, and distribution efforts. In 2024, the company's investment in these areas reflects a strategic push to expand market reach and reinforce brand presence. This encompasses significant spending on advertising campaigns, participation in key medical congresses, and the operational costs associated with a robust sales force, including salaries and incentives.

Ensuring efficient product delivery is paramount, driving considerable expenditure in logistics and supply chain management. These distribution costs are critical for maintaining product availability and timely delivery to healthcare providers and patients across various regions. The overall outlay in 2024 for these vital functions underscores Bukwang's commitment to driving revenue growth through strong market engagement and effective product accessibility.

Regulatory and Compliance Costs

Bukwang Pharmaceutical faces significant regulatory and compliance costs, essential for operating within the pharmaceutical sector. These expenses are crucial for ensuring product safety and efficacy. For instance, in 2024, companies in this industry often allocate substantial budgets towards navigating complex approval processes for new drugs and maintaining adherence to evolving quality standards.

These non-negotiable costs include fees associated with obtaining regulatory approvals from bodies like the Ministry of Food and Drug Safety (MFDS) in South Korea. Furthermore, Bukwang must invest in ongoing compliance audits and the maintenance of robust quality management systems to meet international standards.

- Drug Approval Fees: Costs incurred for submitting and processing applications for new drug marketing authorizations.

- Compliance Audits: Expenses related to regular internal and external audits to ensure adherence to Good Manufacturing Practices (GMP) and other regulations.

- Quality Management Systems: Investment in systems, personnel, and training to uphold high-quality standards throughout the product lifecycle.

- Regulatory Reporting: Costs associated with preparing and submitting periodic safety reports and other mandated documentation to regulatory authorities.

General, Administrative, and Personnel Costs

Bukwang Pharmaceutical's general, administrative, and personnel costs are crucial for its operational backbone. This segment includes the compensation and benefits for essential administrative staff, the executive leadership team guiding the company, and all other employees not directly involved in research and development or manufacturing. In 2024, these costs are estimated to represent a significant portion of overall expenses, reflecting the investment in a robust organizational structure.

Beyond personnel, this category also covers the necessary overheads that keep the business running smoothly. These include expenses like office rent for corporate headquarters, utilities to power those facilities, and the maintenance and upgrades for vital IT infrastructure. These are the foundational costs that support all business functions outside of product creation and delivery.

Key components of this cost structure include:

- Salaries and Benefits: Compensation for administrative, sales, marketing, and executive teams.

- Office Rent and Utilities: Costs associated with maintaining corporate office spaces.

- IT Infrastructure: Expenses for hardware, software, and network maintenance.

- Legal and Professional Fees: Costs for legal counsel, accounting services, and other external expertise.

Bukwang Pharmaceutical's cost structure is heavily influenced by its substantial Research and Development (R&D) investments, essential for creating new treatments. Manufacturing and production costs, covering raw materials, quality control, and packaging, are also significant. Marketing, sales, and distribution expenses are crucial for market penetration and product accessibility. Additionally, regulatory compliance and general administrative overheads form the backbone of operational costs.

| Cost Category | Key Components | 2024 Focus/Data Point |

|---|---|---|

| Research & Development (R&D) | Preclinical testing, clinical trials, drug discovery | Significant investment to drive innovation and long-term competitiveness. |

| Manufacturing & Production | Raw materials, APIs, quality control, packaging | Enhancing operational efficiency and capacity through facility upgrades. |

| Marketing, Sales & Distribution | Advertising, sales force, logistics, supply chain | Strategic push to expand market reach and ensure product availability. |

| Regulatory & Compliance | Drug approval fees, audits, quality systems | Adherence to evolving standards and complex approval processes. |

| General & Administrative | Salaries, rent, utilities, IT infrastructure | Maintaining a robust organizational structure and operational backbone. |

Revenue Streams

Bukwang Pharmaceutical's core revenue originates from the sale of its prescription medications. The company sees significant contributions from drugs targeting central nervous system (CNS) disorders, such as Latuda and Ariplus, alongside treatments for liver diseases like Legalon and diabetes with Dexid and Thioctacid. These sales are fundamentally tied to doctor's prescriptions and the purchasing decisions made by healthcare institutions, forming the bedrock of their financial model.

Revenue streams for Bukwang Pharmaceutical's over-the-counter (OTC) medication sales are derived from direct consumer purchases of non-prescription health products and general wellness items. This segment taps into a wide retail market, offering a more consistent sales volume than prescription-based products.

In 2024, the global OTC pharmaceutical market showed robust growth, with estimates suggesting a value exceeding $150 billion, driven by increasing consumer health consciousness and self-care trends. Bukwang's OTC offerings, such as pain relievers and cold remedies, contribute to this expanding market by providing accessible health solutions.

Bukwang Pharmaceutical's health supplement sales represent a significant revenue stream, broadening its market reach beyond prescription drugs. This segment capitalizes on the expanding global wellness industry, a trend that has seen consistent growth. For instance, in 2023, the global dietary supplements market was valued at over $178 billion, with projections indicating further expansion.

Products like Antiplag Strong Toothpaste and Arakfit are key offerings within this category, demonstrating Bukwang's strategy to diversify its portfolio. These items appeal to a consumer base increasingly focused on preventative health and personal care, thus contributing to a more robust and varied income generation model for the company.

Licensing and Royalty Income

Bukwang Pharmaceutical capitalizes on its research and development through licensing and royalty income. This involves out-licensing its innovative drug candidates and proprietary technologies to other pharmaceutical firms, allowing them to commercialize these advancements. In return, Bukwang receives upfront payments, milestone fees, and ongoing royalties based on the sales performance of the licensed products.

This revenue stream is crucial for recouping substantial R&D investments and fostering continued innovation. For instance, in 2023, Bukwang announced a significant out-licensing deal for its novel NASH drug candidate, GLD1001, to a major global pharmaceutical company, which included upfront payments and potential milestone payments that could reach hundreds of millions of dollars, alongside tiered royalties on future sales.

The licensing model allows Bukwang to leverage its expertise without bearing the full cost and risk of global commercialization for every candidate. This strategic approach diversifies its income sources and strengthens its financial position to pursue further pipeline development. The company's commitment to innovation is evident in its pipeline, which includes several promising drug candidates across various therapeutic areas.

- Out-licensing Agreements: Bukwang generates revenue by granting rights to its drug candidates and technologies to other pharmaceutical companies for development and commercialization.

- Royalty Payments: The company earns ongoing income through royalties calculated as a percentage of the net sales of products that originated from its licensed-out assets.

- Leveraging R&D Investment: This model effectively monetizes Bukwang's significant investments in research and development, turning innovative discoveries into financial returns.

- Strategic Partnerships: Licensing agreements facilitate collaborations with larger pharmaceutical players, providing access to their extensive marketing and distribution networks.

Contract Manufacturing Organization (CMO) Services

Bukwang Pharmaceutical is strategically positioning itself to tap into the lucrative contract manufacturing organization (CMO) market. By expanding its production capabilities and exploring potential plant acquisitions, the company intends to offer contract development and manufacturing services for synthetic medicines to other pharmaceutical firms. This move is designed to diversify Bukwang’s income sources beyond its own product lines.

This expansion into CMO services represents a significant new revenue stream, capitalizing on the growing trend of pharmaceutical companies outsourcing manufacturing. Bukwang’s investment in increased capacity in 2024, which included upgrades to existing facilities, directly supports this initiative. The global CMO market was valued at over $140 billion in 2023 and is projected to grow substantially, presenting a robust opportunity for Bukwang.

- New Revenue Stream: Contract development and manufacturing of synthetic medicines for third-party pharmaceutical companies.

- Strategic Expansion: Plans include expanding existing manufacturing facilities and potentially acquiring new plants to accommodate CMO services.

- Market Opportunity: Leverages the growing global demand for outsourced pharmaceutical manufacturing services.

- Financial Impact: Expected to create a significant new income source, enhancing Bukwang's overall financial performance.

Bukwang Pharmaceutical's revenue streams are diversified across prescription drugs, over-the-counter (OTC) products, health supplements, out-licensing agreements, and contract manufacturing services. The company's core business remains the sale of prescription medications, particularly for CNS disorders and liver diseases. In 2024, the global OTC market surpassed $150 billion, with Bukwang contributing through accessible remedies, while the dietary supplements market exceeded $178 billion in 2023, a sector Bukwang actively participates in with products like Arakfit.

| Revenue Stream | Key Products/Activities | Market Context (2023/2024) | Strategic Significance |

|---|---|---|---|

| Prescription Medications | Latuda, Ariplus (CNS), Legalon (Liver), Dexid, Thioctacid (Diabetes) | Core business driven by healthcare professionals. | Foundation of sales and R&D investment recoupment. |

| Over-the-Counter (OTC) Products | Pain relievers, cold remedies | Global OTC market > $150 billion (2024 est.). | Consistent sales volume, broad consumer access. |

| Health Supplements | Antiplag Strong Toothpaste, Arakfit | Global dietary supplements market > $178 billion (2023). | Capitalizes on wellness trend, portfolio diversification. |

| Licensing & Royalties | Out-licensing of drug candidates (e.g., GLD1001 for NASH) | Significant out-licensing deals with upfront and milestone payments. | Monetizes R&D, fosters innovation, diversifies income. |

| Contract Manufacturing (CMO) | Manufacturing services for synthetic medicines | Global CMO market > $140 billion (2023). | New revenue source, leverages expanding production capacity. |

Business Model Canvas Data Sources

The Bukwang Pharmaceutical Business Model Canvas is constructed using a blend of internal financial data, comprehensive market research reports, and strategic insights from industry experts. These diverse data sources ensure a robust and well-informed representation of the company's operations and market positioning.