Inner Mongolia Baotou Steel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inner Mongolia Baotou Steel Bundle

Unlock the strategic landscape surrounding Inner Mongolia Baotou Steel with our comprehensive PESTEL analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping its operational environment. This expert-crafted report provides the critical intelligence you need to anticipate challenges and capitalize on opportunities. Download the full version now to gain a decisive market advantage.

Political factors

The Chinese government's industrial planning, particularly through its five-year plans, significantly shapes the steel sector. For instance, the 14th Five-Year Plan (2021-2025) prioritizes green development and technological innovation within the steel industry, directly influencing companies like Inner Mongolia Baotou Steel Union.

As a major state-owned enterprise, Baotou Steel is bound by national directives on capacity reduction, emissions control, and the strategic utilization of resources, including rare earths, which are crucial for its operations. These policies aim to foster a more sustainable and higher-quality industrial landscape.

In 2024, China's steel output is projected to remain robust, though subject to government efforts to manage production and environmental impact. Baotou Steel's adherence to these evolving environmental standards and its strategic alignment with national resource management plans are key to its future operational success.

China, the dominant force in global rare earth production and processing, enacted strict export controls starting October 2024. These measures are designed to safeguard its vast rare earth reserves and ensure their strategic utilization, potentially disrupting worldwide supply chains and influencing market prices.

As a significant player in rare earth mining, Baotou Steel is directly exposed to these evolving Chinese policies. The government's ability to leverage these controls can serve as a powerful geopolitical tool, impacting international trade dynamics and the availability of these essential materials.

Global trade tensions, particularly tariffs and anti-dumping investigations by major economies like the United States and the European Union, significantly impact China's steel exports. For instance, in 2023, the EU continued its safeguard measures on steel imports, which can limit the volume of Chinese steel entering the market. This situation forces Chinese steel producers, including those in Inner Mongolia like Baotou Steel, to contend with reduced access to traditional export markets, potentially increasing domestic competition and driving a strategic shift towards more specialized, higher-value steel products or alternative export destinations.

State-Owned Enterprise (SOE) Reform

Baotou Steel Union, as a state-owned enterprise (SOE), is navigating China's ongoing SOE reforms. These reforms are designed to boost efficiency, tackle overcapacity, and encourage industrial modernization across the sector. For Baotou Steel, this means potential shifts in how it operates, makes investment choices, and structures its corporate governance.

These reforms are not just theoretical; they have tangible impacts. For instance, in 2023, China's State-owned Assets Supervision and Administration Commission (SASAC) continued to push for mixed-ownership reforms in SOEs, aiming to inject private capital and management expertise. This could lead to more market-oriented decision-making within Baotou Steel, potentially improving its competitiveness.

The government's focus on reducing steel overcapacity, a persistent issue in China, directly affects companies like Baotou Steel. Policies aimed at phasing out inefficient production facilities and encouraging consolidation could reshape the industry landscape, influencing Baotou Steel's production volumes and market share.

- Efficiency Drive: SOE reforms prioritize operational efficiency, potentially leading Baotou Steel to adopt leaner production methods and cost-saving measures.

- Capacity Management: Government directives to reduce overcapacity may necessitate adjustments in Baotou Steel's production output or strategic investments in higher-value steel products.

- Governance Modernization: Reforms often involve improving corporate governance structures, which could mean changes in board composition and decision-making processes at Baotou Steel.

- Industrial Upgrading: The push for industrial upgrading encourages SOEs to invest in advanced technologies and sustainable practices, a trend Baotou Steel will likely follow.

Regional Government Influence and Local Economic Interests

While national policies guide the steel industry, regional governments, such as those in Inner Mongolia, actively shape the implementation of these plans. Their influence is significant, especially in areas with strong ties to steel production.

Local economic interests can create a dynamic where regional governments might push back against national directives for capacity reduction. This is particularly true if steel manufacturing is a major employer or contributor to the local economy. For instance, in 2023, Inner Mongolia's industrial output saw contributions from sectors like ferrous metal smelting and rolling, highlighting the region's reliance on such industries.

- Regional Implementation Challenges: National policies on steel capacity reduction may face localized resistance due to regional economic dependencies.

- Economic Dependence: Inner Mongolia's industrial landscape, with significant contributions from metal smelting, makes it sensitive to policies impacting steel production.

- Policy Negotiation: Local governments can negotiate with national bodies, potentially softening the impact of broad industrial directives on regional steel producers like Baotou Steel.

China's national industrial policies, particularly the 14th Five-Year Plan (2021-2025), heavily influence Baotou Steel by emphasizing green development and technological upgrades. State-owned enterprise reforms are also pushing for greater efficiency and modernization. In 2024, China's steel output remains robust but is managed by government directives on production and environmental impact. Baotou Steel's strategic alignment with these national resource management plans, including its rare earth policies enacted in October 2024, is crucial for its future success.

What is included in the product

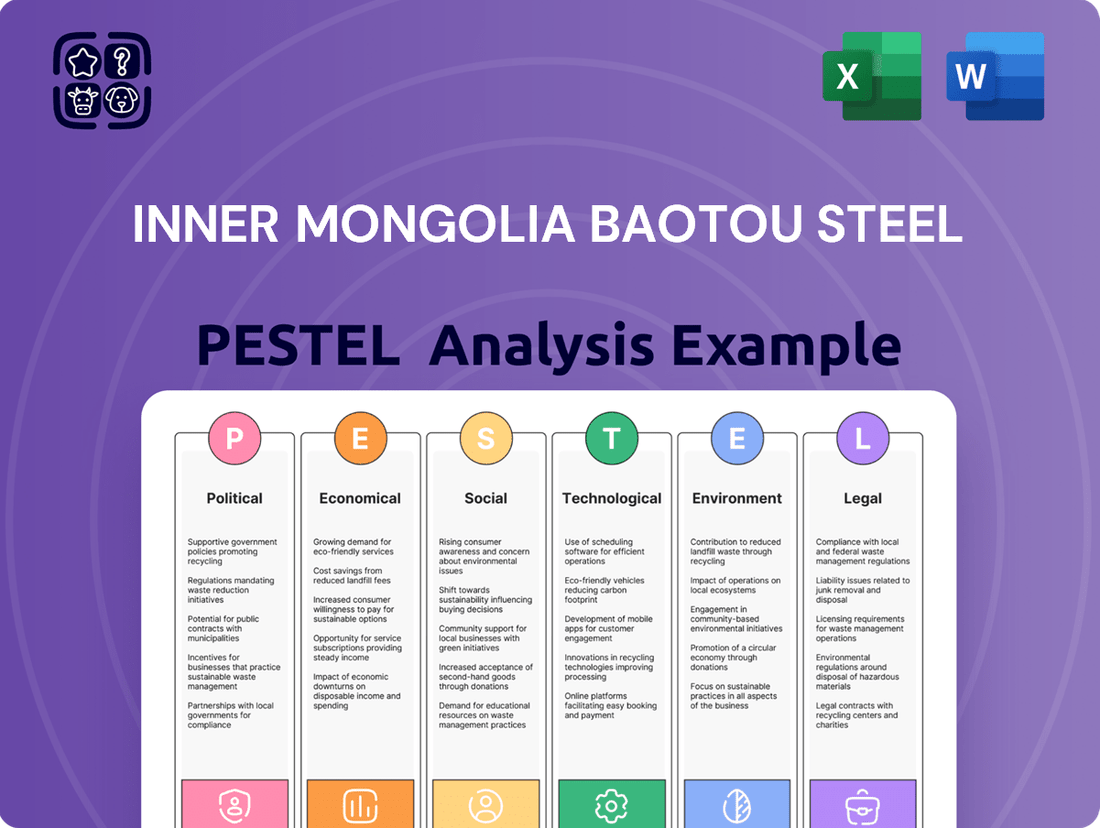

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Inner Mongolia Baotou Steel, offering a comprehensive view of its operating landscape.

It provides actionable insights for strategic decision-making by identifying key external factors and their implications for the company's future growth and sustainability.

This PESTLE analysis of Inner Mongolia Baotou Steel offers a clear, summarized version of external factors, acting as a pain point reliever by simplifying complex market dynamics for easier referencing during strategic planning.

Economic factors

China's property sector, a major steel consumer, is experiencing a slowdown, directly impacting domestic steel demand. This downturn is a significant headwind for companies like Baotou Steel.

Despite efforts to curb production, China's steel output remains substantial, contributing to persistent overcapacity. In 2023, China produced over 1.02 billion metric tons of crude steel, a slight increase from the previous year, underscoring the ongoing supply-demand imbalance.

This overcapacity puts downward pressure on steel prices and erodes profit margins for domestic producers. Baotou Steel, like its peers, grapples with this challenging market environment, where increased supply outstrips weakening demand.

The global steel market anticipates a demand rebound in 2024 and 2025, with projections suggesting a 1.4% increase in steel demand for 2024, reaching approximately 1.79 billion metric tons, followed by a further 1.7% growth in 2025. This recovery is underpinned by anticipated growth in construction and manufacturing sectors, particularly in emerging economies.

Despite the positive outlook, significant uncertainties persist. Geopolitical tensions, such as ongoing conflicts and trade disputes, can disrupt supply chains and impact raw material costs. Fluctuations in energy prices directly affect production costs for steel manufacturers, while persistent inflation can dampen consumer and business spending, thereby influencing steel demand.

For instance, the World Steel Association has noted that while demand is improving, the pace of recovery is uneven across regions. Europe, for example, faces challenges from high energy costs and inflation, impacting its steel consumption, whereas Asia, particularly China and India, continues to be a primary driver of global steel demand growth.

Steel production costs are heavily tied to global inflation and the volatile prices of essential inputs like iron ore, nickel, and chromium. For Baotou Steel, these cost pressures directly affect profitability and necessitate careful procurement strategies. For instance, global iron ore prices saw significant volatility in 2023 and early 2024, with benchmarks fluctuating between $100-$150 per tonne, impacting production expenses.

Fluctuations in energy prices, particularly for electricity and coal, also pose a significant challenge. As of mid-2024, global energy markets continue to experience upward price pressures due to geopolitical events and supply chain disruptions. This directly increases operational expenses for energy-intensive industries like steel manufacturing, forcing companies like Baotou Steel to manage energy consumption and explore cost-saving measures.

Rare Earth Market Dynamics

The global rare earth market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of approximately 6.5% through 2030, reaching an estimated market size of over $10 billion. Baotou Steel's strategic location in Inner Mongolia, a region rich in rare earth deposits, provides a significant advantage in sourcing these critical materials.

However, this market is heavily influenced by China's dominant role, controlling roughly 60% of global rare earth mining and 85% of rare earth processing as of early 2024. This dominance allows China to significantly impact global pricing and supply chain stability, presenting both opportunities and challenges for companies like Baotou Steel.

- Projected Global Rare Earth Market Growth: Expected to exceed $10 billion by 2030, with a CAGR around 6.5%.

- China's Market Dominance: Controls approximately 60% of mining and 85% of processing, influencing global prices and supply.

- Baotou Steel's Advantage: Located in Inner Mongolia, a region with substantial rare earth reserves, offering a strong resource base.

Economic Stimulus and Infrastructure Spending

Government initiatives, including stimulus packages and significant infrastructure spending, are key drivers for steel demand. For instance, China's commitment to large-scale infrastructure projects, such as high-speed rail networks and urban development, directly translates into increased consumption of steel products. This spending is expected to continue supporting the sector through 2024 and into 2025.

While the real estate market has experienced a slowdown, government policies targeting affordable housing and public infrastructure upgrades are providing a crucial counterbalance for the steel industry. These efforts aim to maintain a baseline demand for steel, even amidst broader economic fluctuations.

- Infrastructure Investment: China's 2024 budget includes substantial allocations for infrastructure, with a focus on transportation and energy projects, directly benefiting steel demand.

- Affordable Housing Push: Government support for new affordable housing projects is expected to underpin demand for construction-grade steel, mitigating some of the impact from the private property market downturn.

- Manufacturing Support: Stimulus measures aimed at boosting domestic manufacturing, particularly in sectors like renewable energy equipment and electric vehicles, also create a consistent need for specialized steel grades.

Global steel demand is projected to grow, with an estimated 1.4% increase in 2024 and a further 1.7% in 2025, driven by construction and manufacturing sectors. However, persistent overcapacity in China, with over 1 billion metric tons produced in 2023, continues to suppress prices. Inflation and volatile input costs, such as iron ore fluctuating between $100-$150 per tonne in early 2024, directly impact Baotou Steel's profitability.

Baotou Steel benefits from Inner Mongolia's rich rare earth deposits, a market projected to exceed $10 billion by 2030, though China's 60% mining and 85% processing dominance influences global prices. Government infrastructure spending and affordable housing initiatives in China are crucial demand drivers, offering a vital counterbalance to the slowdown in the private property sector.

| Economic Factor | 2023 Data/2024-2025 Projection | Impact on Baotou Steel |

|---|---|---|

| Global Steel Demand Growth | 1.4% in 2024, 1.7% in 2025 | Positive outlook, but tempered by oversupply. |

| China Steel Production | >1.02 billion metric tons (2023) | Contributes to overcapacity, pressuring prices. |

| Iron Ore Prices | $100-$150/tonne (early 2024) | Volatile input costs affecting profitability. |

| Rare Earth Market Growth | CAGR ~6.5% through 2030 | Strategic advantage due to location, but price volatility due to China's dominance. |

| Chinese Infrastructure Spending | Continued significant investment in 2024 | Key driver for steel demand, offsetting property sector slowdown. |

What You See Is What You Get

Inner Mongolia Baotou Steel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Inner Mongolia Baotou Steel meticulously details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

The content and structure shown in the preview is the same document you’ll download after payment. It provides a comprehensive understanding of the external forces shaping Baotou Steel's business environment, enabling informed decision-making.

Sociological factors

Baotou Steel Union, a major employer in Inner Mongolia, plays a crucial role in maintaining stable employment for thousands. As of early 2024, the company directly employed over 60,000 individuals, contributing significantly to the regional economy and social stability.

Ensuring fair labor practices, including competitive wages and benefits, is paramount for Baotou Steel Union. In 2023, the average annual wage for its employees was approximately ¥85,000, reflecting a commitment to its workforce amidst evolving economic conditions.

The company actively manages the social impacts of industrial restructuring and technological advancements on its workforce. For instance, in response to automation initiatives in 2024, Baotou Steel Union invested ¥50 million in retraining programs to upskill its employees, aiming to mitigate potential job displacement and foster adaptability within its labor force.

Inner Mongolia Baotou Steel's extensive mining and heavy industrial activities directly impact local communities. Sociological factors are crucial, focusing on the company's corporate social responsibility (CSR) initiatives. This includes investments in community development projects and public health programs designed to mitigate the effects of industrial operations.

In 2023, Baotou Steel reported investing over 500 million yuan in environmental protection and community support, aiming to address local concerns and foster positive relationships. Their commitment extends to job creation and local sourcing, with over 70% of their workforce residing within the Baotou region, demonstrating a tangible link to the community's well-being.

Public perception of the steel industry, often linked to environmental concerns like pollution and resource depletion, can significantly impact a company's brand reputation. For Baotou Steel, navigating this sentiment is crucial. In 2024, as environmental regulations tighten globally and consumer awareness grows, companies demonstrating strong environmental stewardship are likely to see improved public favor.

Baotou Steel's commitment to green development, including investments in cleaner production technologies and emission reduction initiatives, directly addresses these public concerns. For instance, their reported efforts in upgrading coking facilities to reduce pollutants aim to bolster their image as a responsible manufacturer. This focus on sustainability is increasingly vital for maintaining a positive brand reputation in the eyes of consumers, investors, and regulators alike.

Urbanization and Infrastructure Development

China's ongoing urbanization and significant infrastructure development projects are key drivers for steel demand. For Baotou Steel, this translates into continued opportunities, particularly as the nation pivots towards manufacturing and advanced infrastructure over a weakening property market. For instance, China's fixed asset investment in infrastructure projects reached approximately 15 trillion yuan in 2023, indicating robust activity.

The expansion of high-speed rail networks and the development of new urban centers across China directly boost the need for steel in construction and manufacturing. Baotou Steel is positioned to benefit from this trend, even with the current real estate sector challenges. The government's focus on building out new energy infrastructure, such as charging stations for electric vehicles, also creates a significant steel demand stream.

- Urbanization Trends: China's urbanization rate reached 66.16% by the end of 2023, up from 65.22% in 2022, signifying continued migration to cities and associated construction needs.

- Infrastructure Investment: Government plans for 2024 emphasize continued investment in transportation, energy, and digital infrastructure, directly supporting steel consumption.

- Manufacturing Focus: The shift towards advanced manufacturing, including automotive and aerospace, requires specialized steel products, presenting a growth avenue for Baotou Steel.

Health and Safety Standards

Ensuring the health and safety of workers in mining, smelting, and rolling operations is paramount for Baotou Steel. Adherence to stringent safety standards and ongoing improvements in workplace conditions directly impact employee well-being and regulatory compliance. For instance, in 2023, China's Ministry of Emergency Management reported a 16.1% decrease in work-related accidents across all industries, highlighting a national focus on safety that extends to heavy industries like steel production.

Baotou Steel's commitment to safety is reflected in its investments in advanced safety equipment and training programs. These initiatives are crucial for mitigating risks inherent in steel manufacturing, from heavy machinery operation to exposure to hazardous materials. The company's performance in this area is closely watched by stakeholders, as a strong safety record contributes to operational stability and a positive corporate reputation.

- Worker Well-being: Prioritizing health and safety fosters a more engaged and productive workforce.

- Regulatory Compliance: Meeting and exceeding safety regulations avoids penalties and ensures operational continuity.

- Reputational Impact: A strong safety record enhances Baotou Steel's image among employees, the community, and investors.

- Operational Efficiency: Reduced accidents and improved working conditions minimize downtime and associated costs.

Baotou Steel's role as a major employer in Inner Mongolia significantly influences regional social dynamics. The company's commitment to fair labor practices, including competitive wages, is crucial for maintaining workforce morale and community stability. In 2023, Baotou Steel reported investing over 500 million yuan in community support and environmental initiatives, demonstrating a focus on its social license to operate.

Public perception of the steel industry, often tied to environmental impact, directly affects Baotou Steel's brand. The company's investments in cleaner production technologies and emission reduction efforts in 2024 aim to improve its image amidst growing environmental awareness. A strong commitment to green development is increasingly vital for positive stakeholder relations.

The health and safety of Baotou Steel's workforce are paramount, with ongoing investments in advanced safety equipment and training. This focus on worker well-being not only ensures regulatory compliance but also enhances operational efficiency by minimizing accidents and downtime. A robust safety record is a key indicator of responsible corporate citizenship.

| Factor | 2023/2024 Data Point | Impact on Baotou Steel |

|---|---|---|

| Employment | Directly employed over 60,000 individuals (early 2024) | Key contributor to regional social stability and economic welfare. |

| Community Investment | Over 500 million yuan in environmental protection and community support (2023) | Mitigates negative industrial impacts and fosters positive community relations. |

| Workforce Safety Investment | ¥50 million in retraining programs (2024) | Enhances worker adaptability and addresses potential job displacement from automation. |

| Public Perception | Increased consumer awareness of environmental stewardship (2024) | Necessitates investment in green technologies to maintain positive brand image. |

Technological factors

Technological advancements are pivotal for the steel industry's green shift, especially in cutting carbon footprints. Innovations like electric arc furnaces (EAFs) that utilize scrap steel, hydrogen-based steelmaking, and carbon capture and utilization (CCU) technologies are at the forefront of this transformation.

By 2024, China, a major steel producer, is investing heavily in green steel technologies. For instance, the nation aims to reduce its steel industry's carbon emissions by 30% by 2030, with EAFs expected to play a significant role. Hydrogen-based steelmaking, though still in its early stages, shows promise for near-zero emissions, with pilot projects demonstrating its feasibility.

Carbon capture technologies are also gaining traction. Companies are exploring CCU methods to convert captured CO2 into valuable products, potentially offsetting production costs and further decarbonizing the steelmaking process. These technological shifts are crucial for companies like Baotou Steel to remain competitive and environmentally responsible in the evolving global market.

Intelligent manufacturing is reshaping the steel sector, with companies like Baotou Steel integrating advanced automation. This includes smart logistics for material handling and online detection systems for real-time quality control, boosting operational efficiency. For instance, by 2024, automation in Chinese steel plants is projected to significantly reduce labor costs, with some estimates suggesting a 15-20% decrease in operational expenses due to robotic integration in hazardous areas.

The development of advanced composite materials, offering superior strength, toughness, and corrosion resistance, represents a significant technological shift. Baotou Steel's commitment to research and development in these high-end and specialty steel products is vital for staying competitive in demanding sectors such as automotive and new energy.

In 2024, China's investment in advanced manufacturing, including materials science, saw substantial growth, with a particular focus on innovation for sectors like electric vehicles and aerospace. Baotou Steel's strategic R&D efforts, aiming to produce specialized steel grades for these burgeoning industries, directly align with these national technological priorities and market needs.

Rare Earth Processing and Separation Technologies

Advancements in rare earth processing and separation technologies are critical for Baotou Steel, given its significant rare earth reserves. These technologies directly impact the efficiency and environmental footprint of extracting and refining valuable elements like neodymium and dysprosium. China's dominance in this sector, holding an estimated 85% of global rare earth processing capacity as of 2023, positions it as a key player in setting technological standards and controlling supply chains.

The ongoing development of more sustainable and cost-effective separation methods, such as solvent extraction and ion exchange, is crucial. These innovations aim to reduce chemical waste and energy consumption, addressing environmental concerns often associated with rare earth mining. For instance, research into bioleaching and supercritical fluid extraction continues to explore greener alternatives.

- Technological Dominance: China's near-monopoly in rare earth processing expertise, accounting for approximately 85% of global processing capacity in 2023, gives it significant leverage.

- Efficiency Gains: Innovations in solvent extraction and ion exchange technologies are improving the recovery rates of critical rare earth elements, potentially increasing yields for companies like Baotou Steel.

- Environmental Focus: Research into bioleaching and supercritical fluid extraction aims to reduce the environmental impact of rare earth processing, a key consideration for sustainable operations.

Energy Efficiency and Waste Heat Recovery

Technological advancements are crucial for Inner Mongolia Baotou Steel, particularly in energy efficiency and waste heat recovery. Innovations in waste heat recovery systems and advanced waste gas treatment technologies are vital for boosting operational efficiency and meeting stringent environmental regulations. For instance, implementing advanced waste heat recovery could significantly reduce the energy consumption per ton of steel produced.

Baotou Steel’s commitment to efficient energy and resource utilization is a cornerstone of its sustainable development strategy. This focus directly impacts its ability to reduce operational costs and environmental footprint. The company's investments in these areas are expected to yield tangible results in terms of reduced emissions and improved energy intensity.

- Waste Heat Recovery Investment: Baotou Steel has been investing in waste heat recovery projects, aiming to capture and reuse heat generated during steelmaking processes, potentially saving millions in energy costs annually.

- Emission Reduction Technologies: The adoption of advanced waste gas treatment systems, such as flue gas desulfurization and denitrification, is critical for compliance and environmental stewardship.

- Energy Intensity Improvement: By integrating these technologies, Baotou Steel targets a reduction in its overall energy consumption per unit of output, a key performance indicator for sustainability.

- Operational Efficiency Gains: Successful implementation of these technological upgrades directly translates to improved operational efficiency, making the company more competitive in the long run.

Technological advancements are critical for Inner Mongolia Baotou Steel's future, especially in adopting green steelmaking processes and enhancing operational efficiency through intelligent manufacturing. China's national push towards decarbonization by 2030, with a 30% reduction target for the steel industry's carbon emissions, underscores the urgency for companies like Baotou Steel to invest in innovations such as electric arc furnaces and carbon capture.

The integration of advanced automation and smart logistics is boosting efficiency, with Chinese steel plants projected to see significant labor cost reductions by 2024 due to robotic integration. Furthermore, Baotou Steel's focus on developing advanced composite materials aligns with China's substantial 2024 investments in materials science for high-growth sectors like electric vehicles.

Crucially, Baotou Steel leverages advancements in rare earth processing technologies, a sector where China held an estimated 85% of global processing capacity in 2023. Innovations in separation methods like solvent extraction and ion exchange are vital for improving efficiency and reducing the environmental impact of rare earth extraction, directly benefiting Baotou Steel's operations.

Investments in energy efficiency, particularly waste heat recovery, are paramount. Baotou Steel's commitment here aims to cut operational costs and environmental impact, with successful implementation directly translating to improved competitiveness.

| Technology Area | Key Advancement | Impact on Baotou Steel | Industry Trend (2024/2025) |

|---|---|---|---|

| Green Steelmaking | Electric Arc Furnaces (EAFs), Hydrogen Steelmaking, CCU | Reduced carbon footprint, compliance with environmental regulations | China aiming for 30% steel industry emission reduction by 2030 |

| Intelligent Manufacturing | Automation, Smart Logistics, Online Detection | Increased operational efficiency, reduced labor costs | Projected 15-20% operational expense reduction via automation in China |

| Advanced Materials | High-strength composites, specialty steel grades | Competitive edge in automotive, new energy sectors | Significant growth in China's materials science investment for EVs, aerospace |

| Rare Earth Processing | Improved separation techniques (solvent extraction, ion exchange) | Enhanced efficiency, reduced environmental impact in rare earth extraction | China's 85% global rare earth processing capacity (2023) sets technological standards |

| Energy Efficiency | Waste Heat Recovery, Advanced Waste Gas Treatment | Lower energy consumption, reduced emissions, cost savings | Focus on reducing energy intensity per ton of steel produced |

Legal factors

China's environmental regulations are becoming significantly stricter, especially for heavy industries like steel. These include mandates for ultra-low emissions and participation in emissions trading systems, impacting companies like Baotou Steel.

Baotou Steel faces the challenge of adhering to these evolving environmental standards, which include national carbon reduction targets. Non-compliance can lead to substantial penalties, threatening operational stability and financial performance.

The 'Rare Earth Management Regulations,' taking effect in October 2024, create a robust legal structure for China's rare earth sector, covering everything from extraction to international sales. These rules introduce stringent measures, such as production quotas and a product tracking mechanism, which directly influence Baotou Steel's activities in this critical industry.

Inner Mongolia Baotou Steel's operations are heavily influenced by legal frameworks governing mining rights and resource exploitation permits. Obtaining and maintaining these permits for both iron ore and rare earth elements is a complex, multi-stage process involving rigorous environmental impact assessments and adherence to national and regional mining laws.

In 2024, China continued to emphasize stricter environmental regulations for mining, impacting permit renewals and the operational costs for companies like Baotou Steel. For instance, the cost of environmental compliance, including waste management and land reclamation, has seen an upward trend, directly affecting the profitability of resource extraction.

Compliance with these evolving legal requirements is paramount. Failure to secure or maintain necessary permits can lead to significant operational disruptions, fines, and reputational damage, underscoring the critical nature of legal diligence in Baotou Steel's raw material sourcing strategy.

Product Quality and Safety Standards

Baotou Steel's extensive product portfolio, serving critical industries like construction, automotive, and railway, necessitates strict adherence to both Chinese national standards (GB) and relevant international quality and safety benchmarks. For instance, in 2023, China's Ministry of Industry and Information Technology continued to emphasize stricter enforcement of quality control for steel products used in infrastructure projects, impacting manufacturers like Baotou Steel. Failure to meet these rigorous standards can result in significant penalties, market exclusion, and reputational damage, making legal compliance a cornerstone of their operational strategy.

Ensuring product quality and safety is not merely a regulatory hurdle but a fundamental requirement for Baotou Steel's market access and sustained competitive advantage. For example, in the automotive sector, compliance with standards such as IATF 16949 for quality management systems is crucial for supplying components. Similarly, for railway applications, adherence to specific safety certifications is non-negotiable. These legal obligations directly influence production processes, material sourcing, and quality assurance protocols, underscoring the importance of a robust legal and compliance framework.

Key legal factors influencing Baotou Steel's product quality and safety include:

- Mandatory National Standards: Compliance with China's GB standards for steel products, covering everything from chemical composition to mechanical properties.

- International Certifications: Obtaining and maintaining certifications like ISO 9001 for quality management and specific industry standards (e.g., for automotive or aerospace).

- Product Liability Laws: Understanding and mitigating risks associated with product defects and potential harm to consumers or end-users.

- Environmental and Safety Regulations: Ensuring that production processes and final products meet all relevant environmental protection and workplace safety laws, which often overlap with product safety.

Trade and Anti-Dumping Laws

Baotou Steel operates within a landscape shaped by international trade regulations, including anti-dumping laws and tariffs. For instance, in 2023, the European Union continued its investigations into alleged dumping of certain steel products from China, which could impact Baotou Steel's export volumes and pricing strategies to the EU market.

Navigating these legal frameworks is paramount for the company's global reach. In 2024, the United States maintained various tariffs on imported steel, including those from China, as part of its Section 232 national security measures, requiring Baotou Steel to factor these costs into its export planning.

- Tariff Impact: Potential increases in the cost of exporting steel products due to tariffs imposed by key importing nations.

- Anti-Dumping Investigations: Exposure to investigations that could lead to restrictive measures on specific product categories.

- Compliance Costs: The necessity of investing in legal and compliance expertise to ensure adherence to diverse international trade laws.

Baotou Steel must navigate China's evolving environmental legislation, including stringent emission standards and participation in carbon trading schemes. The 'Rare Earth Management Regulations,' effective October 2024, introduce production quotas and tracking, directly impacting operations in this sector.

Adherence to mining laws and resource exploitation permits is critical for both iron ore and rare earth extraction. In 2024, stricter mining environmental regulations increased compliance costs, affecting profitability from resource extraction.

Product quality is governed by mandatory Chinese national standards (GB) and international certifications. In 2023, China's Ministry of Industry and Information Technology reinforced quality control for infrastructure steel, with non-compliance leading to penalties and market exclusion.

International trade regulations, including tariffs and anti-dumping laws, significantly influence Baotou Steel's export strategy. For instance, US Section 232 tariffs on Chinese steel remained in place in 2024, impacting export pricing.

Environmental factors

The steel sector, a cornerstone of industrial economies, is also a major source of carbon emissions. Recognizing this, China has set aggressive goals to curb its environmental impact, aiming to peak carbon emissions before 2030 and achieve carbon neutrality by 2060.

These national mandates directly influence Baotou Steel's operational strategy. The company is compelled to invest heavily in green technologies and adopt low-carbon production methods to align with China's ambitious climate targets.

For instance, in 2023, China's steel industry accounted for approximately 15% of the country's total carbon emissions, underscoring the urgency for companies like Baotou Steel to decarbonize.

Industrial operations, especially smelting and mining, are significant sources of air and water pollutants. Baotou Steel, like other heavy industries, must contend with the environmental impact of these processes.

Stringent environmental regulations are increasingly pushing companies towards advanced pollution control. In 2024, China's Ministry of Ecology and Environment continued to emphasize stricter emission standards for industrial sectors, requiring substantial investments in cleaner production technologies and robust monitoring systems to ensure compliance.

China's environmental policies increasingly emphasize resource conservation and the circular economy, directly impacting steel producers like Baotou Steel. This means a stronger push for efficient raw material use and higher recycling rates. For instance, by 2024, China aimed to increase the proportion of scrap steel in crude steel production, a trend expected to accelerate into 2025, driving down reliance on virgin iron ore.

Baotou Steel, like its peers, is under pressure to boost its industrial solid waste recycling rate. By 2023, the steel industry's comprehensive utilization rate of solid waste was around 85%, with continued efforts in 2024 and 2025 focused on further improving this figure and developing new recycling technologies to meet stricter environmental standards.

Waste Management and Land Reclamation

Inner Mongolia Baotou Steel faces significant environmental challenges related to waste management and land reclamation. The company's extensive mining and steel production activities generate substantial volumes of solid waste, including slag, tailings, and dust. Effective management of this waste, focusing on recycling and safe disposal, is crucial for regulatory compliance and environmental stewardship. For instance, in 2023, China's Ministry of Ecology and Environment emphasized stricter regulations on industrial solid waste, pushing companies like Baotou Steel to invest in advanced treatment technologies and circular economy initiatives.

The company's mining operations, particularly iron ore extraction, necessitate comprehensive land reclamation and ecological restoration plans. Disturbed areas must be rehabilitated to prevent soil erosion, water pollution, and habitat loss. As of early 2024, environmental impact assessments for new mining projects in Inner Mongolia require detailed strategies for post-mining land use and biodiversity recovery. Baotou Steel's commitment to these practices directly influences its social license to operate and long-term sustainability.

- Waste Generation: Baotou Steel's production processes generate millions of tons of solid waste annually, requiring robust management systems.

- Recycling Initiatives: Efforts are underway to increase the recycling rate of by-products like steel slag for construction materials, aiming for a circular economy approach.

- Land Reclamation Targets: In 2024, the company is expected to meet specific targets for the ecological restoration of mined lands, with ongoing monitoring of vegetation cover and soil quality.

- Regulatory Compliance: Adherence to China's evolving environmental protection laws, particularly concerning hazardous waste disposal and land rehabilitation, is a primary focus.

Biodiversity and Ecosystem Protection

Mining and extensive industrial operations, such as those undertaken by Baotou Steel, inherently carry the risk of disrupting local biodiversity and delicate ecosystems. For instance, the expansion of mining sites can lead to habitat fragmentation, impacting species reliant on these areas. In 2024, reports indicated that regions with significant industrial activity in Inner Mongolia faced increased pressure on natural habitats, with some studies highlighting a decline in certain endemic plant species.

Baotou Steel has a strategic opportunity to proactively address these environmental concerns. By conducting thorough ecological impact assessments and transparently reporting on its dependencies and impacts on nature, the company can build stakeholder trust. Implementing robust biodiversity protection measures within its operational zones, such as habitat restoration projects or wildlife corridors, is crucial. For example, by 2025, companies in similar sectors have been encouraged to adopt biodiversity action plans, with some reporting a 15% reduction in land disturbance through better planning.

Key areas for Baotou Steel's focus include:

- Assessing and quantifying its ecological footprint, particularly concerning water usage and land reclamation in mining areas.

- Developing and implementing specific biodiversity action plans for its operational sites, potentially including reforestation or wetland restoration initiatives.

- Engaging with local environmental agencies and conservation groups to ensure its practices align with regional biodiversity protection goals.

China's commitment to environmental protection, including ambitious carbon reduction goals for 2030 and 2060, directly mandates Baotou Steel to adopt greener production methods and invest in low-carbon technologies.

The company must manage significant waste generation from mining and steelmaking, with a focus on recycling by-products like slag and meeting land reclamation targets for mined areas. By 2023, China's steel industry achieved an 85% solid waste utilization rate, a figure Baotou Steel aims to improve further into 2025.

Baotou Steel faces the environmental challenge of minimizing its impact on local biodiversity and ecosystems, necessitating thorough ecological assessments and proactive biodiversity action plans by 2025.

In 2024, stringent environmental regulations continue to push for advanced pollution control, requiring Baotou Steel to invest in cleaner production and robust monitoring systems to ensure compliance with evolving national standards.

| Environmental Factor | Impact on Baotou Steel | Key Data/Targets (2023-2025) |

|---|---|---|

| Carbon Emissions | Need to align with national goals (peak before 2030, neutrality by 2060) | Steel sector ~15% of China's 2023 carbon emissions |

| Pollution Control | Compliance with stricter emission standards | Emphasis on advanced treatment and monitoring in 2024 |

| Waste Management & Recycling | Increase solid waste recycling, circular economy focus | Aim to improve on 85% solid waste utilization (2023); increase scrap steel use |

| Land Reclamation & Biodiversity | Ecological restoration of mined lands, habitat protection | Meet land reclamation targets in 2024; develop biodiversity action plans by 2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Inner Mongolia Baotou Steel is built on data from official Chinese government agencies, including national economic and environmental ministries, alongside reports from reputable industry associations and market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the company.