Inner Mongolia Baotou Steel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inner Mongolia Baotou Steel Bundle

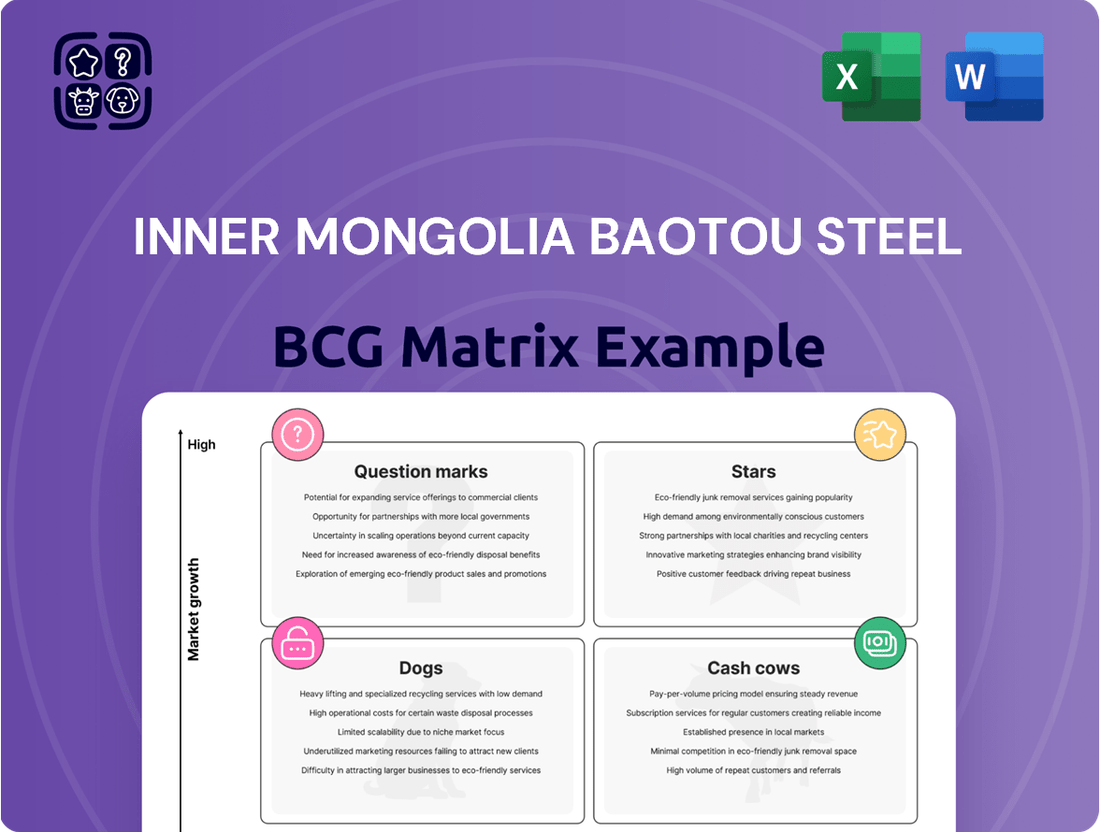

Curious about Inner Mongolia Baotou Steel's market standing? This preview offers a glimpse into their product portfolio's potential, but the full BCG Matrix unlocks the complete picture. Discover which segments are driving growth and which require strategic attention.

Uncover the hidden opportunities and potential challenges within Inner Mongolia Baotou Steel's operations. The complete BCG Matrix provides a detailed quadrant analysis, empowering you to make informed decisions and optimize resource allocation for maximum impact.

Don't miss out on crucial strategic insights. Purchase the full Inner Mongolia Baotou Steel BCG Matrix to gain a comprehensive understanding of their market position and unlock a roadmap for future success.

Stars

Inner Mongolia Baotou Steel's rare earth products, primarily rare earth concentrates, are positioned as Stars in the BCG matrix. This classification stems from the segment's substantial market share within a rapidly expanding industry. The demand for rare earths is being propelled by critical sectors such as electric vehicles, advanced consumer electronics, and renewable energy technologies like wind turbines.

Baotou Steel, operating through its significant stake in China Northern Rare Earth, is a leading global producer. The company experienced notable price increases for its rare earth concentrates in the third quarter of 2025. This price appreciation underscores the robust market conditions and the strong demand-supply dynamics currently favoring producers.

High-End & Specialized Steel Grades are Baotou Steel's Stars, representing products with significant growth potential and high market share. The company's dedication to producing high-strength, lightweight, and specialized steel grades for sectors like automotive, wind power, and pipelines is a key driver. These advanced materials are crucial for industries seeking efficiency and durability.

These specialized steel products typically command premium pricing, contributing to higher profit margins for Baotou Steel. For instance, the automotive industry’s demand for advanced high-strength steels (AHSS) for lightweighting vehicles has been a significant growth area. In 2023, the global AHSS market was valued at approximately $25 billion and is projected to grow substantially, indicating strong demand for Baotou Steel's offerings in this segment.

Baotou's rare earth new materials segment is a strategic star in its BCG matrix, with ambitious plans to become a global leader. This focus is fueled by high growth potential, driven by emerging applications in sectors like electric vehicles and advanced electronics, and Baotou's unparalleled rare earth reserves.

Investments in research and development are key to unlocking this potential, with significant capital allocated to innovation in 2024. For instance, Baotou Steel announced a substantial R&D budget increase for its rare earth division in early 2024, aiming to develop high-purity rare earth oxides and alloys. This proactive approach is designed to capture new market opportunities and solidify its competitive advantage.

Baotou Steel Pipe Industry Base

The Baotou Steel Pipe Industry Base, a significant new venture launched in July 2025, is positioned as a Star within Inner Mongolia Baotou Steel's BCG Matrix. This state-of-the-art facility is poised to become a major player in the production of diverse pipe fittings essential for critical infrastructure and energy transmission projects. Its strategic importance is underscored by a projected output value nearing 10 billion yuan.

- Projected Output Value: Nearly 10 billion yuan.

- Market Focus: Infrastructure and energy transmission pipe fittings.

- International Traction: Secured international orders, demonstrating global demand.

- Growth Potential: High, driven by market demand and strategic positioning.

Rare Earth Permanent Magnets and Components

Rare Earth Permanent Magnets and Components are Inner Mongolia Baotou Steel's Stars. Products like electroacoustic magnetic materials and magnetic components have captured over 50% of their respective markets, demonstrating a strong competitive position.

The demand for these components is fueled by rapidly expanding sectors, including electric vehicles (EVs) and robotics. For instance, the global EV market is projected to reach over $1.5 trillion by 2030, with permanent magnets being essential for EV motors. Similarly, the robotics industry is experiencing significant growth, with the global market expected to surpass $200 billion by 2030.

Baotou Steel is strategically investing in this area, evidenced by its collaborations with technology firms to develop advanced magnetic components for emerging applications, such as humanoid robots. This proactive approach positions them to capitalize on future market trends and maintain their leadership in high-growth segments.

- Market Dominance: Over 50% market share in specific rare earth application products like electroacoustic magnetic materials and magnetic components.

- Growth Drivers: Benefiting from high growth in industries such as electric vehicles and robotics, both critical users of permanent magnets.

- Strategic Partnerships: Collaborating with technology firms to develop next-generation magnetic components, particularly for humanoid robots.

- Future Outlook: Positioned to leverage the increasing demand for high-performance magnetic materials in advanced technological applications.

Inner Mongolia Baotou Steel's rare earth products, particularly concentrates and permanent magnets, are firmly established as Stars in the BCG matrix. These segments exhibit high market share within rapidly expanding industries like electric vehicles and renewable energy. The company's strategic investments in R&D for high-purity rare earth oxides and alloys in 2024 further solidify their position. Baotou Steel’s rare earth new materials segment is also a star, with ambitious plans to lead globally, fueled by unparalleled reserves and emerging applications.

| Segment | BCG Classification | Key Growth Drivers | Market Share Indication | Strategic Focus |

| Rare Earth Concentrates | Star | EVs, renewable energy, consumer electronics | Leading global producer | Price appreciation, robust market conditions |

| High-End & Specialized Steel Grades | Star | Automotive (AHSS), wind power, pipelines | Significant growth potential | Premium pricing, lightweighting solutions |

| Rare Earth Permanent Magnets & Components | Star | EVs, robotics, electroacoustic applications | >50% in specific sub-segments | Advanced magnetic components, technology collaborations |

| Baotou Steel Pipe Industry Base | Star | Infrastructure, energy transmission | Projected output value ~10 billion yuan | New venture, international orders secured |

What is included in the product

This BCG Matrix overview provides strategic insights for Baotou Steel's product portfolio, identifying units for investment, holding, or divestment.

The Inner Mongolia Baotou Steel BCG Matrix offers a clear, one-page overview to strategically position each business unit, alleviating the pain of unclear portfolio performance.

Cash Cows

Traditional steel products like plates, sections, rods, and wires form the bedrock of Baotou Steel Union's operations, serving critical sectors such as construction, machinery, and railways. These are the company's cash cows, consistently generating robust revenue despite broader market headwinds.

In 2023, China's crude steel output reached approximately 1.02 billion tonnes, highlighting the sheer scale of the domestic market, though growth has moderated. Baotou Steel Union's established production capacity for these foundational products ensures they remain a significant revenue generator, even amidst challenges like overcapacity in the Chinese steel industry.

Inner Mongolia Baotou Steel's iron ore mining operations, especially the Bayan Obo deposit, are a prime example of a Cash Cow. This extensive resource base offers a cost-effective and consistent supply of raw materials for its steel production.

The Bayan Obo West Mine alone holds 660 million metric tons of proven iron ore reserves, ensuring a stable, long-term supply. This captive resource significantly reduces external procurement costs, contributing a reliable and steady cash flow to the company's overall financial health.

Baotou Steel commands a significant portion of the domestic Chinese steel market, with a target of 15% market share by the end of 2024. This strong foothold translates into consistent and substantial cash flow generation from its extensive customer network.

The company's enduring presence in the industry, coupled with its comprehensive industrial chain, underpins its stable operational results, even amidst varying market conditions.

Coke By-products

The coke by-products segment, including metallurgical coke, coke oven gas, and various oils, is a stable revenue generator for Inner Mongolia Baotou Steel. This mature business requires minimal new investment for marketing or expansion, fitting the characteristics of a cash cow.

The company is focused on enhancing resource efficiency within this established segment. In 2024, Baotou Steel reported significant output from its coke production facilities, contributing to its overall financial stability.

- Metallurgical Coke: A primary output, essential for steel production, providing consistent sales.

- Coke Oven Gas: Utilized internally for energy or sold externally, adding to revenue streams.

- Oils and Chemicals: Various oils and chemical by-products are refined and sold, diversifying income.

- Resource Utilization: Efforts in 2024 focused on maximizing the value extracted from each ton of coal processed.

Fluorite Concentrate Production

Baotou Steel's fluorite concentrate production, a byproduct of its rare earth mining, acts as a reliable cash cow. The company holds approximately 200 million metric tons of resources in its tailings pond, ensuring a stable supply of this key industrial mineral.

The company is actively developing its fluorite industry chain, aiming to maximize the value derived from this resource. This strategic focus on downstream processing and application development further solidifies its position as a consistent revenue generator.

- Resource Base: Approximately 200 million metric tons of fluorite resources available in tailings ponds.

- Market Position: A steady supplier of a valuable industrial mineral, leveraging its rare earth operations.

- Strategic Development: Focused on building out the fluorite industry chain to enhance value and market reach.

- Financial Contribution: Serves as a consistent cash generator for Baotou Steel.

Baotou Steel's traditional steel products are its cash cows, consistently generating substantial revenue. These foundational products, including plates and sections, benefit from the company's established market position and extensive industrial chain. China's robust demand for steel, with an estimated output of 1.02 billion tonnes in 2023, provides a stable market for these mature offerings.

The company's strong domestic market share, targeting 15% by the end of 2024, ensures a predictable and significant cash flow from these core steel segments. This stability allows Baotou Steel to rely on these products to fund other strategic initiatives.

| Product Segment | Description | Market Context (2023-2024) | Cash Flow Contribution |

|---|---|---|---|

| Traditional Steel Products | Plates, sections, rods, wires | China's crude steel output ~1.02 billion tonnes (2023); Baotou Steel targeting 15% domestic market share (2024) | High and consistent |

| Coke By-products | Metallurgical coke, coke oven gas, oils | Stable output reported in 2024; focus on resource efficiency | Reliable and diversified |

| Fluorite Concentrate | By-product of rare earth mining | ~200 million metric tons of resources in tailings; developing industry chain | Steady and growing |

What You’re Viewing Is Included

Inner Mongolia Baotou Steel BCG Matrix

The Inner Mongolia Baotou Steel BCG Matrix you are currently previewing is the complete, unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously prepared for strategic decision-making, will be delivered directly to you, ready for immediate application in your business planning.

Dogs

Certain basic steel products from Inner Mongolia Baotou Steel, especially those in highly competitive Chinese markets with substantial overcapacity, would likely be classified as Cash Cows in a BCG matrix. These are mature products with established demand but limited growth potential.

The profitability of China's steel sector experienced a notable decline in 2024, with reports indicating a significant drop in overall industry profits due to sluggish demand and persistent supply-demand imbalances. This environment directly impacts commodity steel products.

These commodity steel products, facing these market pressures, typically yield low profit margins and require substantial capital to maintain production levels, tying up resources that could be allocated to more promising ventures.

Outdated steel production lines at Baotou Steel, those not yet converted to green smelting or advanced technologies, represent a significant challenge. These older facilities often come with higher operating expenses and environmental concerns, limiting their growth potential and impacting the company's overall efficiency. For instance, in 2023, Baotou Steel reported that its older blast furnaces had higher emissions per ton of steel compared to its newer, upgraded facilities.

Baotou Steel's general-purpose steel exports are likely positioned as a Question Mark or potentially a Dog within the BCG matrix. While the company has seen an increase in overall export volume, there's a strategic shift away from these bulk commodities. This is driven by intense global competition and thinner profit margins, making them a less desirable focus for Baotou Steel's growth strategy.

Steel Products Heavily Reliant on Slumping Sectors

Steel products heavily reliant on slumping sectors, like those serving China's struggling real estate market, would likely be classified as Dogs within the BCG Matrix. This reliance means Baotou Steel's sales and profitability for these specific steel products are directly impacted by the downturn. For instance, a significant portion of steel demand typically comes from construction, and with new housing starts in China declining, the outlook for these steel products is dim.

The negative impact of the real estate slump on steel demand is substantial. In 2024, China's property investment saw a notable year-on-year decrease, directly translating to reduced orders for construction-grade steel. This situation creates a challenging environment for Baotou Steel's products tied to this sector, leading to lower revenue and potential margin erosion.

- Declining Real Estate Investment: China's property investment figures in early 2024 showed a contraction, impacting steel demand.

- Reduced Construction Activity: Lower new housing starts directly correlate with a decrease in the need for structural steel.

- Profitability Pressures: The slump forces steel producers to compete on price, squeezing profit margins for affected product lines.

- Market Share Challenges: Products in declining markets often struggle to maintain or grow market share, further weakening their position.

Non-compliant or High-Emission Production Assets

Non-compliant or high-emission production assets within Inner Mongolia Baotou Steel's portfolio represent significant challenges. These are facilities or processes that haven't established clear low-carbon transition plans or publicly stated emission reduction goals, according to external sustainability reviews. For instance, if a significant portion of their steel production relies on outdated, coal-intensive methods without a clear roadmap for modernization, these assets would fall into this category.

These underperforming assets pose substantial risks from a sustainability and long-term viability standpoint. In 2024, the global steel industry faced increasing pressure to decarbonize, with many regions implementing stricter environmental regulations and carbon pricing mechanisms. Assets lacking a transition strategy are exposed to heightened regulatory penalties and diminishing market demand as stakeholders increasingly favor greener products.

These high-emission assets could become financial drains, or cash traps, within a decarbonizing economy. For example, if Baotou Steel has significant investments in blast furnaces that are not slated for upgrades or replacement with greener technologies like electric arc furnaces powered by renewable energy, these could incur substantial operational costs due to carbon taxes or be devalued as the market shifts. The International Energy Agency reported in 2024 that direct emissions from steelmaking accounted for approximately 7% of global CO2 emissions, highlighting the urgency for industry-wide transition.

- Regulatory Risk: Assets without low-carbon transition plans face potential fines and operational restrictions as environmental regulations tighten globally.

- Market Risk: Growing investor and customer preference for sustainable products can lead to reduced demand and lower valuations for companies with high-emission assets.

- Financial Strain: These assets may become costly to operate due to carbon pricing and the need for eventual, potentially expensive, retrofitting or replacement.

- Competitive Disadvantage: Companies with greener production methods gain a competitive edge, leaving those with non-compliant assets behind.

Steel products tied to China's struggling real estate sector, such as those for construction, are likely classified as Dogs in Baotou Steel's BCG matrix. This is due to declining property investment and reduced construction activity. For example, China's property investment saw a year-on-year decrease in early 2024, directly impacting demand for construction-grade steel.

These "Dog" products generate low returns and require significant capital to maintain, often with shrinking market share. The persistent oversupply in the general steel market further exacerbates profitability challenges for these segments. This situation forces Baotou Steel to compete on price, squeezing margins for affected product lines.

Outdated production facilities, especially those with high emissions and without clear decarbonization plans, also fall into the Dog category. These assets face increasing regulatory risks and market disadvantages as the global steel industry prioritizes sustainability. The International Energy Agency noted in 2024 that steelmaking contributes significantly to global CO2 emissions, underscoring the need for greener production.

These high-emission assets can become financial burdens, potentially incurring costs from carbon pricing or requiring expensive retrofitting. Companies with greener production methods are gaining a competitive edge, leaving those with non-compliant assets at a disadvantage. For instance, Baotou Steel's older blast furnaces reported higher emissions per ton of steel in 2023 compared to upgraded facilities.

Question Marks

Baotou Steel's exploration of hydrogen-based steel production positions it as a Question Mark within the BCG matrix. This forward-looking initiative aligns with the global push for decarbonization in heavy industries, a sector responsible for roughly 7% of global greenhouse gas emissions.

The potential for significant environmental benefits is high, as hydrogen can replace coal in the steelmaking process, drastically reducing carbon footprints. Major steelmakers worldwide are investing heavily, with industry projections indicating the commercial launch of hydrogen-based steel plants around 2025, signaling a burgeoning market.

However, the substantial capital investment required and the nascent stage of commercial viability mean immediate returns are uncertain. This makes it a high-risk, high-reward venture, characteristic of a Question Mark, demanding careful strategic evaluation and significant R&D commitment.

Investments in Carbon Capture, Utilization, and Storage (CCUS) technologies for steel plants are increasing, driven by ambitious environmental goals and the potential to repurpose captured carbon. For instance, China, a major steel producer, has been actively exploring CCUS projects to meet its carbon neutrality targets. While the growth potential is significant due to tightening regulations, the current high development costs and uncertain immediate market returns place these technologies in the question mark category for Baotou Steel's BCG Matrix.

Advanced steel alloys, like self-repairing or rust-proof varieties, are currently in the innovation pipeline for Baotou Steel. These materials hold immense potential to transform sectors like automotive and construction, offering extended lifespans and reduced maintenance. For instance, the global market for advanced high-strength steels (AHSS) was projected to reach over $50 billion by 2024, indicating a strong future demand for such innovations.

3D Printing for Steel Components

3D printing for steel components represents a significant Question Mark for Baotou Steel within the BCG matrix. The technology holds considerable growth potential, particularly for creating intricate, customized steel parts demanded by sectors like automotive and aerospace. For instance, by 2024, the global metal 3D printing market, which includes steel, was projected to reach approximately $10 billion, highlighting its expanding reach.

Despite this promise, the current market penetration of 3D printing in large-scale steel manufacturing remains relatively low. Challenges such as cost-effectiveness for mass production, material limitations, and the need for specialized expertise still hinder widespread adoption. However, advancements continue, with research focusing on improving printing speeds and material properties for steel alloys.

Key considerations for Baotou Steel regarding this segment include:

- High Growth Potential: Industries like automotive and aerospace are increasingly seeking complex, lightweight steel components that 3D printing can deliver efficiently.

- Nascent Market Penetration: While growing, the application of 3D printing for mass-produced steel components is still in its early stages, presenting both risk and opportunity.

- Technological Advancements: Ongoing developments in metal additive manufacturing could significantly improve the viability and cost-effectiveness of 3D printed steel in the near future.

- Investment Needs: Significant investment in research, development, and specialized equipment will be required for Baotou Steel to capitalize on this emerging technology.

Innovative Rare Earth Applications (e.g., Robotics Components)

Innovative rare earth applications, such as high-performance magnetic components for humanoid robots, are emerging as a key area for Baotou Steel. These applications are characterized by their high growth potential but currently represent a low market share for the company.

While these advanced uses align with Baotou Steel's innovation goals and could drive future demand, they require substantial research and development investment. This investment phase means these segments are currently cash consumers, fitting the profile of a question mark in the BCG matrix.

- High Growth Potential: The robotics sector, particularly humanoid robots, is projected for significant expansion, with the global robotics market expected to reach hundreds of billions of dollars by the late 2020s.

- Low Market Share: Baotou Steel's current market share in these niche, high-tech rare earth applications is likely minimal as these technologies are still in early development and adoption phases.

- R&D Intensive: Developing specialized magnetic materials for advanced robotics demands considerable capital and expertise, impacting profitability in the short term.

- Strategic Investment: Despite current costs, investing in these areas positions Baotou Steel for future market leadership as demand for sophisticated rare earth applications grows.

Baotou Steel's ventures into hydrogen-based steel production and advanced steel alloys, alongside 3D printing for steel components and innovative rare earth applications, all represent Question Marks in the BCG matrix. These areas exhibit high growth potential driven by global trends like decarbonization and technological advancement, yet they currently demand significant investment and have uncertain immediate returns.

The global steel industry, a major contributor to emissions, is actively exploring greener methods. For instance, by 2024, investments in green steel technologies were projected to accelerate, with hydrogen-based direct reduction seen as a key pathway. Similarly, the market for advanced high-strength steels was anticipated to surpass $50 billion by 2024, underscoring the demand for innovative materials.

Emerging technologies like 3D printing in metal manufacturing, including steel, were projected to reach around $10 billion globally by 2024. However, widespread adoption for mass production of steel components faces hurdles like cost and material development. Rare earth applications in advanced robotics also show strong future growth, with the overall robotics market expected to see substantial expansion in the coming years.

These segments are characterized by their high risk and high reward, requiring substantial R&D and strategic capital allocation from Baotou Steel to navigate their nascent stages and capitalize on future market opportunities.

BCG Matrix Data Sources

Our Inner Mongolia Baotou Steel BCG Matrix leverages official company financial reports, comprehensive industry market research, and expert analyses of steel production and demand trends.