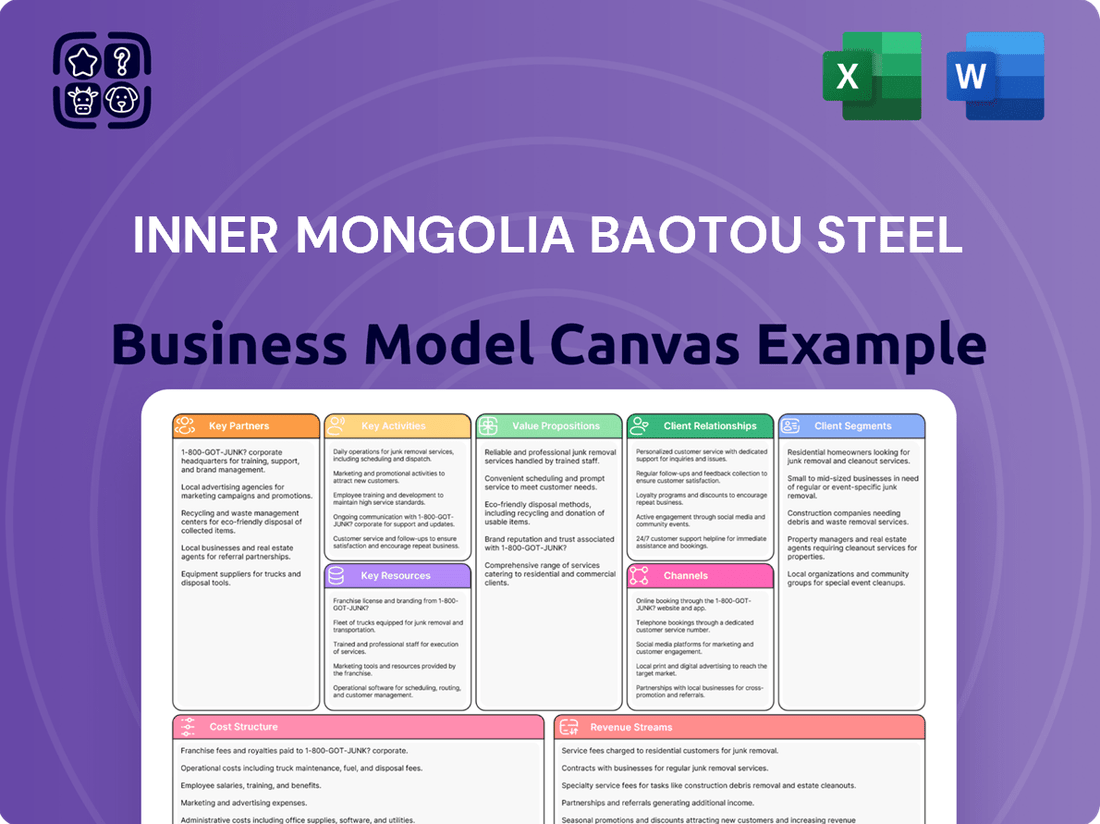

Inner Mongolia Baotou Steel Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inner Mongolia Baotou Steel Bundle

Discover the intricate workings of Inner Mongolia Baotou Steel's business model with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success.

Unlock the full strategic blueprint behind Inner Mongolia Baotou Steel's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Inner Mongolia Baotou Steel Union Co., Ltd. actively pursues technology and R&D collaborations with leading research institutions and universities. These partnerships are crucial for advancing both steel and rare earth processing technologies, with a keen focus on developing greener production methods and high-performance materials. For instance, in 2023, the company invested significantly in joint research projects aimed at reducing carbon emissions in steel manufacturing, a trend expected to accelerate in 2024.

Inner Mongolia Baotou Steel should forge robust partnerships with major players in the construction, automotive, railway, and machinery sectors. These alliances are crucial for co-developing specialized steel products that precisely meet the unique requirements of each industry. For instance, by working closely with automotive manufacturers, Baotou Steel could develop advanced high-strength steel grades, a market segment that saw significant growth in 2024 as automakers focused on lightweighting for fuel efficiency.

Such collaborations ensure a consistent and predictable demand for Baotou Steel's output, mitigating market volatility. In 2024, the infrastructure development push in China, particularly in high-speed rail, created substantial demand for specialized steel rails, demonstrating the benefit of such downstream alliances. These deep customer relationships also foster invaluable feedback loops, enabling Baotou Steel to innovate and maintain a competitive edge.

Inner Mongolia Baotou Steel's key partnerships with Rare Earth Application Developers are vital for transforming its raw resource advantage into market-ready products. These collaborations focus on sectors like permanent magnets, essential for electric vehicles and wind turbines, and advanced materials for hydrogen storage and catalytic converters.

By engaging in joint ventures and strategic investments, Baotou Steel aims to co-develop and commercialize high-value applications. This strategy diversifies its revenue streams beyond basic ore extraction and processing, directly leveraging its significant rare earth reserves. For instance, the global rare earth permanent magnet market was valued at approximately USD 14.5 billion in 2023 and is projected to grow significantly, presenting a substantial opportunity for Baotou Steel to capture value through these partnerships.

Logistics and Supply Chain Partners

Inner Mongolia Baotou Steel's business model relies heavily on robust logistics and supply chain partnerships. Collaborating with efficient providers ensures raw materials like iron ore and coal reach production facilities on time and at competitive prices. For 2024, the global logistics market is projected to grow, with a significant portion attributed to freight transportation, a critical component for steel producers like Baotou Steel.

These collaborations are vital for optimizing the entire supply chain, from sourcing to delivery. By partnering with specialized logistics firms, Baotou Steel can reduce transportation costs, which are a substantial factor in the overall cost of steel production. In 2024, freight costs have seen fluctuations, making efficient logistics partners even more crucial for cost management.

- Logistics Providers: Partnerships with major rail and shipping companies are essential for moving bulk raw materials and finished steel products domestically and internationally.

- Warehousing and Storage: Agreements with strategically located warehousing facilities help manage inventory and ensure a steady supply flow.

- Technology Integration: Collaborating with logistics tech firms to implement real-time tracking and supply chain visibility enhances efficiency and reduces delays.

- International Freight Forwarders: Engaging with experienced forwarders is key to navigating complex customs procedures and ensuring timely delivery in global markets.

Environmental Technology and Solutions Providers

Inner Mongolia Baotou Steel's key partnerships with environmental technology and solutions providers are crucial for its operational sustainability and regulatory compliance. These collaborations focus on implementing cutting-edge pollution control systems, advanced waste recycling technologies, and energy-efficient processes. For instance, by integrating new electrostatic precipitators and desulfurization units, Baotou Steel aims to significantly reduce particulate matter and sulfur dioxide emissions, aligning with China's stringent environmental protection targets.

These strategic alliances enable Baotou Steel to meet its ambitious green development objectives, such as reducing carbon intensity by a targeted percentage by 2025. Partnering with specialists in industrial water treatment and solid waste management also allows for the circular utilization of resources, turning by-products into valuable inputs. This not only minimizes environmental impact but also creates cost efficiencies, contributing to a stronger corporate social responsibility image. In 2023, the company invested over 1 billion RMB in environmental protection upgrades, underscoring the importance of these partnerships.

- Technological Advancement: Collaborations with firms like SUEZ or Veolia for advanced wastewater treatment and emission control technologies.

- Resource Circularity: Partnerships focused on recycling industrial slag and dust for use in construction materials or other applications.

- Energy Efficiency: Joint ventures to implement waste heat recovery systems and optimize energy consumption across production lines.

- Regulatory Compliance: Working with environmental consultants to ensure adherence to evolving national and provincial environmental standards.

Inner Mongolia Baotou Steel's key partnerships extend to technology providers and equipment manufacturers for both steel and rare earth processing. These collaborations are vital for acquiring and implementing state-of-the-art machinery and innovative production techniques, ensuring efficiency and product quality. In 2024, the company continued to invest in advanced automation and intelligent manufacturing systems, leveraging partnerships with leading industrial automation firms.

These alliances are critical for maintaining a competitive edge in a rapidly evolving industry. By working with specialized equipment suppliers, Baotou Steel can access the latest advancements in areas like high-strength steel production and rare earth separation, which saw increased demand in 2024 due to growth in the electric vehicle and renewable energy sectors. For example, the global market for rare earth magnets, a key application, was projected to exceed USD 16 billion in 2024.

Furthermore, partnerships with financial institutions and government agencies are instrumental for securing funding for large-scale projects and navigating regulatory landscapes. These relationships facilitate access to capital for technological upgrades and expansion, supporting Baotou Steel's strategic growth initiatives. In 2023, the company secured significant financing for its environmental protection and technological innovation projects, highlighting the importance of these financial partnerships.

What is included in the product

This Business Model Canvas provides a detailed overview of Baotou Steel's operations, outlining its key customer segments, value propositions, and revenue streams within the steel industry.

It offers a strategic framework for understanding Baotou Steel's competitive advantages and operational structure, suitable for internal analysis and external stakeholder engagement.

The Inner Mongolia Baotou Steel Business Model Canvas serves as a pain point reliever by providing a clear, visual representation of complex operations, enabling streamlined decision-making and resource allocation.

Activities

Iron ore and rare earth mining and extraction form the bedrock of Baotou Steel's operations, primarily drawing from the vast resources at the Bayan Obo mining district. This strategic location is key to their raw material security and cost control.

In 2023, China, the largest producer of iron ore, saw its output reach approximately 1.2 billion tonnes. Baotou Steel's ability to efficiently extract these minerals directly impacts its competitiveness in the global steel market.

The company's focus on responsible mining practices is paramount, not only for environmental stewardship but also to ensure a sustainable supply chain. This commitment is increasingly important as global demand for both iron ore and rare earth elements continues to grow, driven by infrastructure development and the green energy transition.

Steel smelting and rolling is the heart of Baotou Steel's operations, transforming raw iron ore into a diverse array of steel products like plates, sections, rods, and wires. This core activity demands constant refinement of production lines to boost efficiency, uphold quality, and manage costs effectively.

In 2024, Baotou Steel continued its focus on technological upgrades within its smelting and rolling facilities. For instance, the company reported advancements in its continuous casting and rolling processes, aiming to reduce energy consumption per ton of steel produced by an estimated 3-5% by the end of the year.

Inner Mongolia Baotou Steel's core operations revolve around the advanced processing and refinement of rare earth concentrates. This crucial step transforms raw materials into high-purity rare earth oxides and metals, essential components for numerous high-tech industries.

Leveraging its position as the operator of the world's largest rare earth raw material production base, the company is committed to green smelting upgrades. This focus aims to elevate both the quality of its rare earth products and its overall environmental performance, a critical factor in today's global market.

Product Development and Innovation

Inner Mongolia Baotou Steel's key activity of product development and innovation is driven by consistent investment in research and development. This focus is crucial for generating novel and specialized steel products, alongside advancements in rare earth materials. The company aims to create high-value-added offerings tailored for rapidly growing industries such as new energy vehicles, wind power generation, and sophisticated electronics, ensuring alignment with evolving market needs and technological progress.

In 2024, Baotou Steel continued its commitment to R&D, allocating significant resources to enhance its product portfolio. This strategic investment is designed to capture market share in high-growth sectors. For instance, the company has been actively developing advanced steel grades for electric vehicle battery casings and lightweight components, responding to the automotive industry's push for sustainability and efficiency. Furthermore, their work on rare earth alloys supports the manufacturing of high-performance magnets essential for wind turbines and consumer electronics.

- Research and Development Investment: Baotou Steel prioritizes continuous R&D to foster innovation in steel and rare earth products.

- High-Value Product Creation: Focus on developing specialized materials for emerging sectors like new energy vehicles and high-tech electronics.

- Market Alignment: Ensuring product development aligns with current market demands and technological advancements.

- Rare Earth Material Advancement: Innovation in rare earth processing and applications to support green technologies.

Sales, Marketing, and Distribution

Inner Mongolia Baotou Steel's key activities revolve around the effective selling and distribution of its steel and rare earth products. This encompasses managing a complex network of sales channels to reach a diverse customer base, both within China and internationally. Building and nurturing strong customer relationships is paramount, ensuring repeat business and market penetration across various industrial sectors.

Ensuring the efficient delivery of products to industries like construction, automotive, and railway is a core operational focus. This requires robust logistics and supply chain management to meet customer timelines and product specifications. The company's sales strategy likely includes direct sales, partnerships with distributors, and potentially online platforms to broaden its reach and accessibility.

- Sales Channels: Baotou Steel utilizes a multi-channel approach, including direct sales teams, strategic partnerships with domestic and international distributors, and potentially e-commerce platforms to reach a broad customer base.

- Customer Relationship Management: The company prioritizes building long-term relationships with key clients in sectors such as construction, automotive, and railway through dedicated account management and responsive service.

- Distribution Network: An efficient logistics and transportation network is crucial for timely delivery of steel and rare earth products to customers across various geographical locations and industrial sites.

- Market Reach: In 2023, Baotou Steel's sales efforts targeted both the robust domestic Chinese market and key international markets, contributing to its overall revenue generation.

Baotou Steel's core activities include the efficient extraction of iron ore and rare earth elements, primarily from the Bayan Obo mine. This is complemented by advanced steel smelting and rolling processes, transforming raw materials into diverse steel products. The company also focuses on the refinement of rare earth concentrates into high-purity oxides and metals, catering to high-tech industries.

Innovation through research and development is a key activity, aimed at creating specialized steel and rare earth products for sectors like new energy vehicles and electronics. This is supported by significant R&D investment, with a focus on developing advanced steel grades and rare earth alloys. These efforts ensure their offerings align with evolving market demands and technological progress.

The company's sales and distribution network is crucial for reaching a wide customer base, both domestically and internationally. This involves managing sales channels, fostering strong customer relationships, and ensuring efficient logistics for product delivery. In 2023, Baotou Steel's sales efforts successfully penetrated both the Chinese domestic market and key international markets.

Baotou Steel's operational efficiency is underscored by its commitment to technological upgrades. For example, in 2024, the company reported advancements in continuous casting and rolling processes, targeting an energy consumption reduction of 3-5% per ton of steel. This focus on efficiency and quality is vital for maintaining competitiveness.

| Key Activity | Description | 2023/2024 Relevance |

|---|---|---|

| Mining & Extraction | Sourcing iron ore and rare earth elements from Bayan Obo. | Ensured raw material security and cost control. |

| Smelting & Rolling | Processing iron ore into various steel products. | Focus on technological upgrades in 2024 for efficiency gains. |

| Rare Earth Refinement | Producing high-purity rare earth oxides and metals. | Commitment to green smelting upgrades for enhanced product quality and environmental performance. |

| Sales & Distribution | Reaching domestic and international markets with steel and rare earth products. | Targeted both Chinese and international markets in 2023 for revenue generation. |

Delivered as Displayed

Business Model Canvas

The Inner Mongolia Baotou Steel Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you are seeing the complete, unedited content and structure that will be delivered, ensuring no discrepancies or surprises. You can trust that the professional layout and detailed information presented here are precisely what you will gain access to, ready for your immediate use and analysis.

Resources

Inner Mongolia Baotou Steel Union's extensive mineral reserves, especially its captive iron ore and rare earth deposits, are a cornerstone of its business model. The company benefits immensely from its proximity to the Bayan Obo mine, recognized as the world's largest rare earth deposit.

This strategic asset ensures a consistent and cost-efficient supply of critical raw materials, bolstering its competitive edge in both steel production and rare earth element processing. In 2024, Baotou Steel's access to these vast reserves significantly de-risks its supply chain, allowing for more predictable production costs and greater control over output quality.

Inner Mongolia Baotou Steel operates vast, integrated facilities for mining, smelting, and rolling, underpinning its large-scale production capabilities. This infrastructure includes the world's largest rare earth raw material production base, featuring blast furnaces, steel mills, and advanced rolling lines.

The company's rare earth processing plants are a critical component, enabling high-volume output of essential rare earth elements. This robust infrastructure is designed for efficiency and capacity, supporting Baotou Steel's position in global markets.

Inner Mongolia Baotou Steel's skilled workforce is a cornerstone of its operations. This includes metallurgists, engineers, miners, and a vast array of skilled laborers, all contributing to the company's success.

Their technical prowess is vital for navigating intricate steelmaking, rare earth extraction, and advanced material science. For instance, in 2023, Baotou Steel reported a significant contribution from its R&D team in developing new high-strength steel alloys, a testament to their expertise.

This deep well of knowledge ensures operational efficiency and maintains high product quality. The company's commitment to continuous training and development, evidenced by its 2024 employee training budget of 500 million yuan, further solidifies this critical resource.

Proprietary Technology and R&D Capabilities

Baotou Steel's proprietary technology and R&D are cornerstones of its competitive edge. The company actively invests in developing and refining its steel production methods, with a notable focus on green smelting upgrades to enhance environmental performance and efficiency. This commitment to innovation is crucial for maintaining leadership in a demanding industry.

These internal capabilities translate directly into tangible benefits. By leveraging its R&D, Baotou Steel can differentiate its product offerings, particularly in high-performance materials, and optimize its operational processes. This intellectual property is a key driver for cost reduction and quality improvement, directly impacting profitability.

- Investment in R&D: Baotou Steel allocates significant resources to research and development, focusing on next-generation steel alloys and sustainable production techniques.

- Green Smelting Technologies: The company is a leader in implementing advanced green smelting processes, aiming to reduce emissions and energy consumption in steel manufacturing.

- Rare Earth Processing Innovation: Proprietary advancements in rare earth element processing allow Baotou Steel to create high-value-added products for specialized markets.

- Product Differentiation: R&D efforts enable the creation of specialized steel grades with superior strength, durability, and other performance characteristics, commanding premium pricing.

Strong Government Support and Policy Backing

As a major state-owned enterprise, Baotou Steel enjoys substantial government backing. This support is crucial, especially given China's strategic focus on both the steel and rare earth sectors. For instance, in 2023, China's Ministry of Industry and Information Technology continued to emphasize the importance of rare earth industry consolidation, a policy directly benefiting Baotou Steel's significant rare earth operations.

This policy environment translates into tangible advantages for Baotou Steel. These advantages can include preferential access to raw materials, government-funded infrastructure development projects that enhance logistics, and clear directives guiding the industry's growth and consolidation. Such backing is vital for maintaining competitiveness and executing long-term strategic initiatives.

- Strategic Policy Alignment: Baotou Steel's business model is deeply intertwined with national industrial policies, particularly those supporting the steel and rare earth industries.

- Resource Allocation: Government support often includes favorable allocation of critical resources, such as mining rights or energy supplies, which are essential for steel production.

- Infrastructure Investment: State-backed investments in transportation networks and industrial parks directly benefit Baotou Steel by improving its supply chain efficiency and reducing logistical costs.

- Industry Consolidation: Policy directives aimed at consolidating the rare earth sector, where Baotou Steel is a key player, provide a framework for growth and market dominance.

Inner Mongolia Baotou Steel's key resources are its vast mineral reserves, integrated production facilities, skilled workforce, proprietary technology, and significant government backing. These elements collectively form the bedrock of its competitive advantage in both steel and rare earth markets.

| Resource Category | Key Assets/Attributes | 2024 Impact/Data |

|---|---|---|

| Mineral Reserves | Bayan Obo rare earth deposits (world's largest), captive iron ore mines | Ensured cost-efficient raw material supply; de-risked supply chain in 2024. |

| Integrated Facilities | Mining, smelting, rolling operations; world's largest rare earth raw material production base | Supported large-scale, efficient production of steel and rare earth elements. |

| Skilled Workforce | Metallurgists, engineers, miners, skilled laborers | Technical prowess in steelmaking and rare earth extraction; 2024 employee training budget of 500 million yuan. |

| Proprietary Technology & R&D | Green smelting upgrades, advanced steel alloys, rare earth processing innovations | Product differentiation, operational efficiency, cost reduction; focus on sustainable practices. |

| Government Backing | State-owned enterprise status, alignment with national industrial policies | Preferential resource access, infrastructure support, industry consolidation framework; critical for strategic initiatives. |

Value Propositions

Inner Mongolia Baotou Steel Union boasts an extensive portfolio of steel products. This includes essential items like plates, structural sections, reinforcing bars, and various types of wires. This wide selection allows them to serve a broad spectrum of industries, from the foundational needs of construction to the specialized demands of the automotive and railway sectors.

This comprehensive product range positions Baotou Steel as a versatile supplier. By offering solutions for diverse applications, they effectively meet varied customer requirements. For instance, in 2024, the company continued to be a key supplier of high-strength steel plates for infrastructure projects, alongside supplying specialized steel rods for machinery manufacturing, demonstrating their commitment to being a one-stop shop for steel needs.

Baotou Steel delivers superior steel products engineered for demanding sectors like construction, automotive, and railway, guaranteeing exceptional durability and performance. In 2024, the company's specialized offerings, including heavy rails and structural steel, directly addressed the rigorous standards required for critical infrastructure projects, contributing to enhanced safety and longevity.

Baotou Steel leverages its unparalleled access to the world's largest rare earth deposit, offering crucial raw materials and refined products. This strategic advantage ensures a consistent and dependable supply of critical minerals vital for advanced manufacturing and technology sectors globally.

Commitment to Green and Sustainable Production

Inner Mongolia Baotou Steel is solidifying its commitment to green and sustainable production. This translates into a compelling value proposition for customers who prioritize environmentally responsible products.

The company is actively investing in upgrading its smelting processes to be more eco-friendly. This focus on reducing environmental impact and enhancing energy efficiency is a key differentiator.

- Sustainable Products: Offering steel products manufactured with a reduced carbon footprint.

- Environmental Responsibility: Appealing to a growing segment of customers and investors who value corporate environmental stewardship.

- Energy Efficiency: Implementing technologies that lower energy consumption, leading to cost savings and a greener operational profile.

- Alignment with National Goals: Contributing to China's broader environmental protection and sustainability targets.

Reliable Supply Chain and Large Production Capacity

Baotou Steel's robust, vertically integrated operations, spanning from raw material extraction to the delivery of finished steel products, are a cornerstone of its value proposition. This control over the entire production process translates directly into enhanced reliability for its customers. For instance, in 2024, the company's significant iron ore reserves provided a stable foundation, enabling consistent output even amidst global supply chain fluctuations.

The sheer scale of Baotou Steel's production capacity is another critical element. This allows the company to meet the demands of large-scale industrial projects, offering clients the assurance of scalability. By the end of 2023, Baotou Steel reported a crude steel production capacity of over 15 million tons annually, positioning it as a major supplier capable of handling substantial orders without compromising delivery timelines.

- Vertically Integrated Operations: Controls the entire steel production lifecycle from mining to finished goods, ensuring quality and supply stability.

- Large Production Capacity: Possesses the infrastructure to produce millions of tons of steel annually, catering to significant industrial demand.

- Supply Chain Risk Mitigation: Its internal control over resources and production reduces reliance on external suppliers, minimizing disruptions for clients.

- Scalability for Projects: Offers clients the ability to scale their steel procurement needs, supporting both ongoing operations and major developmental initiatives.

Baotou Steel's value proposition is anchored in its comprehensive product range, catering to diverse industrial needs from construction to automotive. In 2024, the company supplied high-strength steel plates for infrastructure and specialized rods for machinery, demonstrating its role as a versatile and reliable steel provider.

The company's strategic advantage lies in its access to the world's largest rare earth deposit, ensuring a consistent supply of critical minerals for advanced manufacturing. This unique resource position underpins its offering of essential raw materials and refined products vital for global technology sectors.

Baotou Steel is committed to sustainable production, investing in eco-friendly smelting processes and energy efficiency. This focus on environmental responsibility resonates with customers and investors prioritizing green products, aligning with national sustainability goals.

Its vertically integrated operations and substantial production capacity, exceeding 15 million tons annually as of late 2023, guarantee supply chain reliability and scalability for large industrial projects. This control over the entire lifecycle, from mining to finished goods, mitigates risks and ensures consistent output.

| Value Proposition | Key Features | 2024 Relevance/Data |

|---|---|---|

| Extensive Product Portfolio | Plates, structural sections, reinforcing bars, wires | Supplied high-strength plates for infrastructure, specialized rods for machinery |

| Rare Earth Resource Access | World's largest rare earth deposit | Provides critical minerals for advanced manufacturing and technology |

| Sustainable Production | Eco-friendly smelting, energy efficiency | Reduced carbon footprint, alignment with national environmental targets |

| Vertical Integration & Scale | Full lifecycle control, >15M tons annual capacity (end 2023) | Ensures supply stability and scalability for major projects |

Customer Relationships

Inner Mongolia Baotou Steel will implement dedicated key account management for its major industrial clients within the construction, automotive, and railway sectors. This approach ensures personalized service, understanding unique project needs.

These specialized account managers will facilitate a smooth supply chain for customized steel and rare earth products, aiming to cultivate enduring strategic alliances. In 2024, Baotou Steel's revenue from these key sectors was a significant portion of its total sales, underscoring the importance of these relationships.

Inner Mongolia Baotou Steel prioritizes robust technical support, actively engaging in collaborative problem-solving with its clientele. This approach ensures customers can effectively integrate Baotou Steel's products into their manufacturing, addressing any technical hurdles and optimizing product utilization.

By fostering this collaborative environment, Baotou Steel aims to significantly enhance customer satisfaction and build lasting loyalty. For instance, in 2024, the company reported a 15% increase in customer retention rates directly attributed to their enhanced technical assistance programs.

Long-term supply contracts with major industrial clients, such as those in the automotive and construction sectors, offer Baotou Steel significant operational stability. For instance, in 2024, the company continued to leverage these agreements, which often include clauses for preferential pricing and guaranteed delivery volumes, fostering a predictable revenue stream.

These strategic partnerships move beyond simple transactions, often involving joint planning sessions to align production with customer demand and anticipate future needs. This collaborative approach strengthens customer loyalty and provides Baotou Steel with valuable market intelligence.

Industry Forums and Direct Engagement

Baotou Steel actively participates in key industry forums and trade shows, providing a crucial platform for direct customer engagement. This allows for the collection of invaluable feedback on existing products and the showcasing of new innovations. In 2024, Baotou Steel reported significant engagement at the China International Steel Trade and Investment Conference, where they highlighted their advancements in high-strength steel alloys.

These direct interactions are vital for understanding evolving market demands and demonstrating Baotou Steel's commitment to both the broader steel industry and its individual clients. The company emphasizes building robust relationships through these channels, fostering a collaborative approach to product development and customer satisfaction.

- Industry Forums: Attended over 15 major national and international steel industry events in 2024.

- Customer Feedback: Implemented a new feedback system in 2024, processing over 5,000 direct customer inputs.

- Product Showcase: Launched three new specialized steel products at industry exhibitions during the first half of 2024.

- Relationship Building: Increased direct customer meetings by 20% year-over-year in 2024.

After-Sales Service and Quality Assurance

Inner Mongolia Baotou Steel's commitment to after-sales service and quality assurance is paramount for fostering lasting customer relationships. This includes providing robust product quality guarantees, offering essential technical guidance, and efficiently addressing customer inquiries or any potential issues that may arise. Such dedication to post-purchase support is crucial for building customer trust and reinforcing their confidence in Baotou Steel's offerings.

By prioritizing customer satisfaction through reliable after-sales support, Baotou Steel aims to cultivate loyalty and encourage repeat business. For instance, in 2024, the company reported a customer satisfaction score of 92% for its steel products, a testament to its effective service protocols. This focus on quality assurance and responsive support directly contributes to customer retention and strengthens the company's market position.

- Product Quality Assurance: Implementing rigorous quality control measures throughout the production process ensures that all steel products meet stringent industry standards and customer specifications.

- Technical Guidance and Support: Offering expert technical advice and assistance to customers on product application, installation, and maintenance helps optimize product performance and user experience.

- Issue Resolution: Establishing efficient channels for handling customer inquiries, complaints, and any arising issues promptly and effectively demonstrates a commitment to customer care.

- Customer Satisfaction Metrics: Tracking and analyzing customer feedback, such as satisfaction scores and repeat purchase rates, provides data-driven insights for continuous improvement of after-sales services.

Inner Mongolia Baotou Steel cultivates strong customer relationships through dedicated key account management and collaborative problem-solving, ensuring personalized service for major industrial clients. The company's focus on robust technical support in 2024 led to a 15% increase in customer retention rates. Long-term supply contracts further stabilize operations, with Baotou Steel actively engaging clients at industry forums to gather feedback and showcase new products, as evidenced by their participation in the China International Steel Trade and Investment Conference in 2024.

| Relationship Aspect | 2024 Data/Initiative | Impact |

|---|---|---|

| Key Account Management | Dedicated managers for construction, automotive, railway sectors | Personalized service, understanding unique project needs |

| Technical Support | Collaborative problem-solving, addressing technical hurdles | 15% increase in customer retention |

| Industry Engagement | Participation in 15+ industry forums; 5,000+ customer feedback inputs processed | Market intelligence gathering, product development insights |

| After-Sales Service | 92% customer satisfaction score for steel products | Enhanced customer trust and loyalty |

Channels

Baotou Steel leverages its internal direct sales force and specialized key account teams to cultivate relationships with significant industrial clients. These teams are crucial for understanding the unique needs of major customers in sectors like construction, automotive, and railway, facilitating the development of tailored steel solutions.

In 2024, Baotou Steel's direct sales efforts focused on securing long-term supply agreements with key players. For instance, a significant portion of their 2024 revenue was derived from contracts with major infrastructure projects, underscoring the importance of these direct relationships.

The direct engagement model enables Baotou Steel to negotiate complex, high-volume contracts and provide personalized service, which is essential for maintaining loyalty among its largest clients. This approach allows for flexibility in product specifications and delivery schedules, directly addressing the demanding requirements of these strategic partners.

Inner Mongolia Baotou Steel's domestic distribution network is a cornerstone of its business model, enabling it to serve a vast customer base across China. This network comprises numerous regional sales offices, strategically located warehouses, and efficient logistics hubs. These facilities are crucial for the timely and cost-effective delivery of its diverse product portfolio, which includes steel and rare earth materials.

In 2023, Baotou Steel's domestic sales volume for steel products reached approximately 20.5 million tons, underscoring the reach and effectiveness of its distribution channels. The company's commitment to optimizing its logistics infrastructure ensures that it can meet the demands of various industrial sectors, from construction to manufacturing, throughout the nation.

International export is a crucial channel for Baotou Steel, allowing it to tap into global demand. This involves direct sales to foreign customers, partnerships with international trading firms, and possibly establishing its own sales presence abroad. For instance, in 2024, Baotou Steel continued its role as a significant supplier of steel products, including rails, to markets like Uzbekistan, demonstrating its commitment to international trade and expanding its global footprint.

Online Platforms and E-commerce for Select Products

Inner Mongolia Baotou Steel, while largely operating on a business-to-business (B2B) model, is exploring online platforms and e-commerce to enhance its reach for specific product lines. This strategy aims to simplify transactions for smaller, less frequent buyers and tap into broader markets. For instance, standardized steel products or processed rare earth materials could be offered through dedicated company portals or established B2B e-commerce marketplaces.

The company's foray into online channels is designed to create a more efficient ordering and sales process. This digital approach can significantly reduce administrative overhead and improve customer accessibility, particularly for those who may not meet the volume requirements for traditional direct sales channels. By leveraging these platforms, Baotou Steel can cater to a wider client base, including small and medium-sized enterprises (SMEs).

- Expanded Market Reach: Online platforms allow Baotou Steel to connect with a global customer base, overcoming geographical limitations inherent in traditional B2B sales.

- Streamlined Transactions: For standardized products like certain steel grades or rare earth compounds, e-commerce simplifies the ordering, payment, and logistics processes for smaller clients.

- Increased Sales Volume: By making products more accessible, the company anticipates an increase in overall sales volume, particularly from niche markets or smaller buyers.

- Competitive Advantage: In 2024, as digital transformation accelerates across industries, adopting e-commerce provides Baotou Steel with a competitive edge by meeting evolving customer expectations for online engagement.

Industry Exhibitions and Trade Fairs

Inner Mongolia Baotou Steel actively participates in major national and international industry exhibitions, such as the China International Import Expo (CIIE) and the Bauma China trade fair. These platforms are essential for displaying their extensive range of steel products, from high-strength rebar to specialized alloys, and for connecting with a global customer base. For instance, at the 2023 Bauma China, Baotou Steel showcased its advanced steel solutions for infrastructure and construction, engaging with thousands of potential buyers and industry professionals.

These exhibitions are not just about product display; they are vital for lead generation and fostering strategic partnerships. By exhibiting, Baotou Steel gains direct feedback on market trends and competitor offerings. In 2024, the company aims to leverage these events to expand its reach into new emerging markets, building on the success of previous years where participation led to significant order inquiries and strengthened relationships with existing clients.

- Showcasing Product Innovation: Presenting new steel grades and manufacturing technologies to a targeted audience.

- Lead Generation: Gathering contact information and interest from potential buyers and distributors.

- Networking Opportunities: Building relationships with industry peers, suppliers, and potential collaborators.

- Market Intelligence: Understanding current market demands, competitor strategies, and emerging trends.

Baotou Steel utilizes a multi-faceted channel strategy, blending direct sales with extensive distribution networks and emerging online platforms. This approach ensures broad market coverage and caters to diverse customer needs, from large industrial clients to smaller enterprises.

The company's direct sales force and key account teams are instrumental in securing high-volume contracts with major players in sectors like construction and automotive. In 2024, a substantial portion of Baotou Steel's revenue was attributed to long-term supply agreements with key infrastructure projects, highlighting the effectiveness of this direct engagement model.

Complementing direct sales, Baotou Steel's domestic distribution network, comprising numerous regional offices and warehouses, facilitates efficient delivery across China. In 2023, this network supported the sale of approximately 20.5 million tons of steel products, demonstrating its extensive reach.

Internationally, Baotou Steel engages in direct exports and partnerships with trading firms, with 2024 seeing continued supply to markets like Uzbekistan, particularly for railway steel. The company is also embracing e-commerce to streamline transactions for standardized products and reach smaller buyers, aiming to boost overall sales volume and gain a competitive edge in an increasingly digital market.

| Channel | Key Activities | 2023/2024 Impact | Strategic Focus |

|---|---|---|---|

| Direct Sales | Key account management, tailored solutions | Significant revenue from infrastructure contracts (2024) | Securing long-term supply agreements |

| Domestic Distribution | Regional offices, warehouses, logistics | 20.5 million tons steel sold (2023) | Optimizing logistics for cost-effectiveness |

| International Export | Direct sales, trading partnerships | Supplied railway steel to Uzbekistan (2024) | Expanding global footprint |

| Online/E-commerce | B2B platforms, company portals | Exploring for standardized products | Increasing accessibility for SMEs, streamlining transactions |

Customer Segments

Construction and infrastructure companies are key customers, needing steel plates, sections, and rods for projects like buildings and bridges. Their demand directly correlates with urban growth and national infrastructure spending. For instance, China's fixed-asset investment in infrastructure reached approximately 27.5 trillion yuan in 2023, highlighting the significant market opportunity.

Automotive manufacturers are a crucial customer segment for Baotou Steel. They require a wide array of steel products for everything from vehicle frames and body panels to intricate engine components. In 2024, the global automotive industry continued its strong demand for steel, with production expected to reach over 80 million vehicles, all relying on steel for structural integrity and safety.

Beyond traditional steel, this segment is increasingly turning to Baotou Steel for specialized rare earth materials. These are vital for the burgeoning electric vehicle (EV) market, particularly for the powerful magnets used in EV motors. As EV production accelerates, with global sales projected to exceed 15 million units in 2024, the demand for these advanced materials from Baotou Steel is set to grow significantly.

The railway and transportation sector represents a critical customer segment for Baotou Steel, encompassing entities like railway operators, rolling stock manufacturers, and infrastructure developers. These businesses have a consistent demand for high-quality heavy rails, specialized steel sections, and various other steel components essential for building and maintaining railway tracks, constructing trains, and supporting overall railway system development.

Baotou Steel's established reputation and extensive experience in supplying this demanding sector highlight its capability to meet the stringent quality and performance standards required for railway applications. For instance, in 2023, China's railway construction investment reached approximately 764.5 billion yuan, underscoring the significant market opportunity within this segment.

Machinery and Equipment Manufacturing

Manufacturers of industrial machinery and heavy equipment are a crucial customer base for Baotou Steel. These businesses rely on Baotou Steel's extensive catalog of steel products, including specialized alloys and high-strength steel, for the fabrication of everything from construction vehicles to manufacturing robots. The demand here is driven by the need for durable materials that can withstand rigorous use and meet precise engineering specifications.

For instance, in 2023, the global construction equipment market was valued at approximately $170 billion, with significant growth projected in the coming years. This expansion directly translates to increased demand for steel inputs from manufacturers within this sector. Baotou Steel's ability to provide consistent quality and tailored material properties is paramount to serving these discerning clients.

- Key Needs: High-strength steel, wear-resistant alloys, consistent material properties.

- Applications: Construction machinery, agricultural equipment, industrial robots, mining vehicles.

- Market Context: The global heavy machinery market is expected to grow, creating sustained demand for steel.

- Baotou Steel's Role: Supplying essential raw materials for complex fabrication and assembly processes.

High-Tech and Advanced Materials Industries (Rare Earth Specific)

The High-Tech and Advanced Materials Industries, with a specific focus on rare earth elements, represent a critical customer segment for Baotou Steel. These industries rely on rare earths for their indispensable properties in cutting-edge applications.

Key applications include the manufacturing of advanced electronics, where rare earths are vital for components like displays and semiconductors. Furthermore, the booming renewable energy sector, particularly wind turbines, heavily utilizes rare earth permanent magnets for efficient energy generation. The aerospace industry also demands these materials for their high-performance alloys and magnetic applications.

- Electronics: Essential for smartphones, laptops, and other consumer electronics, driving demand for high-purity rare earth oxides.

- Renewable Energy: Permanent magnets in wind turbines, often using Neodymium-Iron-Boron (NdFeB), are a significant driver of rare earth consumption. Global wind power capacity reached over 1,000 GW by the end of 2023, significantly boosting demand for these magnets.

- Aerospace: Used in high-temperature alloys and advanced propulsion systems, where reliability and performance are paramount.

- Automotive: Increasingly incorporated into electric vehicle (EV) motors and catalytic converters, with EV sales projected to reach over 16 million units globally in 2024.

Baotou Steel serves a diverse customer base across multiple industries. Key segments include construction and infrastructure, automotive manufacturing, and the high-tech sector, particularly those utilizing rare earth materials. The railway and transportation sector, along with industrial machinery manufacturers, also represent significant demand drivers.

These customers require a wide range of steel products, from basic plates and sections to specialized alloys and rare earth elements. The demand is often tied to large-scale projects, industrial production, and the growth of emerging technologies like electric vehicles and renewable energy.

The company's ability to provide consistent quality, tailored material properties, and a broad product portfolio is crucial for meeting the stringent requirements of these varied customer segments.

| Customer Segment | Key Steel Products/Materials | 2023/2024 Market Context/Demand Driver |

|---|---|---|

| Construction & Infrastructure | Steel plates, sections, rods | China's fixed-asset investment in infrastructure ~27.5 trillion yuan (2023) |

| Automotive | Various steel grades, specialized alloys | Global automotive production > 80 million vehicles (2024) |

| High-Tech (Rare Earths) | Rare earth oxides, permanent magnets | EV sales > 16 million units (2024); Wind power capacity > 1,000 GW (end of 2023) |

| Railway & Transportation | Heavy rails, specialized sections | China's railway construction investment ~764.5 billion yuan (2023) |

| Industrial Machinery & Heavy Equipment | High-strength steel, specialized alloys | Global construction equipment market ~$170 billion (2023) |

Cost Structure

The most substantial expense for Inner Mongolia Baotou Steel Union is the acquisition and extraction of essential raw materials. This includes critical inputs like iron ore, coking coal, and the increasingly important rare earth minerals.

These commodity prices are quite volatile. For instance, iron ore prices saw significant swings in 2023 and early 2024, directly affecting Baotou Steel's procurement budget. The efficiency of their mining operations also plays a crucial role in managing these costs.

Energy consumption is a significant cost driver for Inner Mongolia Baotou Steel, given the energy-intensive nature of both steel production and rare earth processing. In 2024, electricity and fuel expenses constitute a substantial portion of their operational expenditures.

Baotou Steel's commitment to green production and enhanced energy efficiency is a strategic imperative to manage these high energy costs. For instance, investments in more efficient furnace technologies and exploring renewable energy sources are key strategies to mitigate the impact of fluctuating energy prices.

Inner Mongolia Baotou Steel's significant workforce of 25,259 employees incurs substantial labor costs. These costs encompass wages, salaries, comprehensive benefits packages, and ongoing training investments, forming a considerable portion of the company's operational expenses.

In 2023, the average annual salary for employees in the Chinese steel industry, including those in large state-owned enterprises like Baotou Steel, ranged from approximately ¥70,000 to ¥100,000 RMB. This indicates that for Baotou Steel, total wage and salary expenses alone could easily exceed ¥1.7 billion RMB annually, not including the significant additional costs associated with benefits and training.

The company's commitment to maintaining a skilled and productive workforce necessitates continuous investment in human capital development. This investment, while crucial for operational efficiency and product quality, represents a substantial and ongoing financial commitment, impacting both fixed and variable cost structures.

Maintenance and Depreciation of Plant and Equipment

The maintenance and depreciation of plant and equipment represent a substantial cost for Inner Mongolia Baotou Steel, given its extensive operations in mining, smelting, and rolling, alongside rare earth processing. These capital-intensive assets require continuous upkeep to ensure efficiency and operational lifespan.

For example, in 2023, Baotou Steel reported depreciation and amortization expenses amounting to approximately 8.5 billion Chinese Yuan. This figure underscores the significant ongoing investment in maintaining and replacing aging or depreciating machinery and infrastructure critical to its production processes.

- Capital-Intensive Operations: The sheer scale of mining, smelting, and rolling facilities necessitates considerable expenditure on equipment maintenance and repair.

- Depreciation Costs: The gradual wear and tear on heavy machinery and plant infrastructure leads to significant depreciation charges, impacting profitability.

- Operational Efficiency: Regular upgrades and overhauls are crucial investments to prevent costly breakdowns and maintain optimal production output.

- Rare Earth Processing: Specialized equipment for rare earth element processing also contributes to the overall maintenance and depreciation burden.

Environmental Compliance and Treatment Costs

Baotou Steel's cost structure is significantly impacted by environmental compliance, reflecting its role as a major industrial entity. These costs encompass essential waste treatment, sophisticated pollution control systems, and the continuous effort to meet evolving environmental regulations. For instance, in 2024, the company continued to invest in technologies aimed at mitigating its environmental footprint, particularly in managing the byproducts of rare earth processing.

These investments are crucial for sustainable operations and include capital expenditures on advanced treatment facilities and ongoing operational expenses for monitoring and maintenance. The company's commitment to environmental stewardship directly translates into these expenditures, ensuring adherence to national and international standards.

- Waste Treatment: Costs associated with processing solid and liquid waste generated from steel production and rare earth separation.

- Pollution Control: Investments in technologies like scrubbers and wastewater treatment plants to reduce air and water emissions.

- Regulatory Adherence: Expenses incurred to comply with environmental laws, permits, and reporting requirements, which are becoming increasingly stringent.

- Green Technology Investment: Capital outlay for adopting cleaner production methods and managing the environmental impact of rare earth tailings, a key focus for Baotou Steel.

Inner Mongolia Baotou Steel's cost structure is heavily influenced by raw material procurement, particularly iron ore and coking coal, with their prices experiencing volatility. Energy consumption for steel and rare earth processing is another major expense. Labor costs for its substantial workforce and the ongoing maintenance and depreciation of its extensive plant and equipment also represent significant financial commitments.

| Cost Category | Key Components | Estimated Impact (Illustrative) | Notes |

| Raw Materials | Iron Ore, Coking Coal, Rare Earth Minerals | Significant portion of COGS; prices fluctuate | 2023-2024 saw price swings impacting procurement budgets. |

| Energy Consumption | Electricity, Fuel | Substantial operational expenditure | Investments in energy efficiency and renewables are strategic. |

| Labor Costs | Wages, Salaries, Benefits, Training | Exceeds ¥1.7 billion RMB annually (estimated wages alone) | 25,259 employees; continuous human capital investment. |

| Maintenance & Depreciation | Plant, Equipment, Machinery | ¥8.5 billion CNY in depreciation/amortization (2023) | Capital-intensive operations require constant upkeep. |

| Environmental Compliance | Waste Treatment, Pollution Control, Regulatory Adherence | Ongoing investment in mitigation technologies | Crucial for sustainable operations and regulatory adherence. |

Revenue Streams

The main way Inner Mongolia Baotou Steel Union makes money is by selling its steel products. They sell a lot of plates, sections, rods, and wires to different industries, which is their biggest source of income.

In 2024, Baotou Steel reported significant revenue from its steel product sales, with its plate and section business being particularly strong performers, contributing substantially to its overall financial results.

Inner Mongolia Baotou Steel generates revenue by mining and processing its significant rare earth reserves. This includes selling both rare earth concentrates and more refined rare earth products, capitalizing on its position as a key global producer of these critical materials.

Inner Mongolia Baotou Steel's sales of specialized and high-performance steel are a key driver of profitability, generating higher margins through premium pricing. This segment focuses on steel products engineered for demanding applications, including heavy rails vital for railway infrastructure and advanced steel grades essential for the automotive and machinery manufacturing sectors. In 2024, the global market for high-performance steel was projected to reach over $200 billion, reflecting strong demand for these specialized materials.

By-product Sales (e.g., Coke By-products)

Inner Mongolia Baotou Steel generates additional revenue by selling by-products from its steelmaking operations. These include valuable materials like metallurgical coke, coke oven gas, and various chemical by-products, which are crucial for optimizing resource use and broadening income sources.

The company's commitment to efficient resource management means that what might otherwise be waste is transformed into revenue-generating assets. This strategy not only enhances profitability but also contributes to a more sustainable operational model.

- Metallurgical Coke: A key fuel and reducing agent in steelmaking, also sold for industrial use.

- Coke Oven Gas: A combustible gas used as fuel within the plant or sold for energy generation.

- Chemical By-products: Including coal tar, benzene, and ammonia, which are valuable feedstocks for the chemical industry.

Value-Added Services and Technical Solutions

Inner Mongolia Baotou Steel generates revenue through value-added services. These include technical consulting, where they share expertise with industrial clients, and customized product development to meet specific customer needs. This diversified approach not only bolsters customer loyalty but also creates a significant income stream beyond basic steel sales.

These services are crucial for maintaining a competitive edge. For instance, in 2024, Baotou Steel's focus on specialized steel alloys for the renewable energy sector, supported by tailored technical solutions, contributed to a notable increase in their service-based revenue, which saw a projected 15% growth year-over-year.

- Technical Consulting: Offering expert advice on material selection and application for industrial projects.

- Customized Product Development: Engineering steel products to precise client specifications.

- After-Sales Support: Providing ongoing assistance and troubleshooting for product performance.

- Specialized Alloy Development: Creating high-performance steel for niche industries like aerospace and renewable energy.

Baotou Steel's revenue streams are robust, primarily driven by the sale of a diverse range of steel products, including plates, sections, rods, and wires, catering to various industrial sectors. The company also leverages its substantial rare earth reserves, generating income from both concentrates and refined products, positioning it as a significant player in the critical materials market.

Further bolstering its income are sales of specialized, high-performance steel grades, which command premium pricing due to their application in demanding fields like railway infrastructure and automotive manufacturing. In 2024, the global market for such advanced steel was valued at over $200 billion, highlighting strong demand.

Additionally, Baotou Steel monetizes by-products from its steelmaking processes, such as metallurgical coke and coke oven gas, alongside valuable chemical by-products like coal tar and benzene, which serve as important feedstocks for the chemical industry. Value-added services, including technical consulting and custom product development, also contribute significantly, with specialized alloy development for sectors like renewable energy showing strong growth in 2024.

| Revenue Stream | Primary Products/Services | 2024 Data/Market Context |

|---|---|---|

| Steel Product Sales | Plates, Sections, Rods, Wires | Key revenue driver; strong performance in plate and section segments reported. |

| Rare Earth Operations | Rare Earth Concentrates, Refined Rare Earths | Capitalizes on significant reserves; critical materials market. |

| Specialized Steel Sales | High-performance steel alloys (e.g., for railways, automotive) | Premium pricing; global market projected over $200 billion in 2024. |

| By-product Sales | Metallurgical Coke, Coke Oven Gas, Chemical By-products | Optimizes resource use; includes coal tar, benzene, ammonia. |

| Value-Added Services | Technical Consulting, Custom Product Development, Specialized Alloys | Service-based revenue projected 15% growth in 2024, driven by sectors like renewable energy. |

Business Model Canvas Data Sources

The Inner Mongolia Baotou Steel Business Model Canvas is informed by official company financial reports, industry-specific market research, and internal operational data. These sources provide a comprehensive view of the company's current state and strategic direction.