Brookline Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookline Bank Bundle

Unlock Brookline Bank's future by understanding the intricate web of political, economic, social, technological, legal, and environmental factors shaping its landscape. Our comprehensive PESTLE analysis provides the critical intelligence you need to anticipate challenges and seize opportunities. Don't just react to market shifts; lead them. Download the full PESTLE analysis now and gain the strategic advantage.

Political factors

Government regulatory stance is a critical factor for Brookline Bank. Changes in federal and state banking regulations, including those from the Federal Reserve, FDIC, and the Massachusetts Division of Banks, directly influence the bank's operational compliance costs and the types of products it can offer. For instance, the ongoing discussions around capital adequacy ratios and liquidity requirements, which were a focus in late 2023 and early 2024, can significantly alter how banks like Brookline operate and lend.

Political shifts can lead to either stricter or looser oversight, directly impacting Brookline Bank's capital requirements and lending practices. For example, any new legislation aimed at increasing consumer protection in lending, which gained traction in policy discussions throughout 2024, would necessitate adjustments in Brookline's loan origination processes and disclosures.

Government fiscal policies, like potential tax reforms or increased infrastructure spending, directly shape the economic landscape for banks. For instance, changes in corporate tax rates can impact Brookline Bank's net income, while infrastructure investments might spur loan demand for related businesses.

The Federal Reserve's monetary policy, particularly its decisions on the federal funds rate, plays a crucial role. As of late 2024, the Fed has maintained a cautious approach to rate adjustments, aiming to balance inflation control with economic growth. This directly influences borrowing costs for consumers and businesses, affecting Brookline Bank's net interest margin and overall lending activity.

The political stability within the United States and specifically Massachusetts is a cornerstone for confidence in the financial sector, directly benefiting institutions like Brookline Bank. A predictable policy landscape encourages investment and lending, crucial for growth.

While Brookline Bank operates regionally, significant geopolitical shifts or alterations in international trade agreements can indirectly influence the economic vitality of the Greater Boston area. These broader economic conditions, in turn, affect the financial health and borrowing capacity of its business clientele.

For instance, the US experienced a relatively stable political climate leading into 2024, with ongoing policy discussions around economic growth and financial regulation. This stability generally supports a positive outlook for regional banks, though global trade tensions, such as those impacting supply chains or specific industries in Massachusetts, remain a watchpoint for potential downstream effects on local businesses and their banking needs.

Government Lending Programs

Government lending programs, like those from the Small Business Administration (SBA), can significantly impact Brookline Bank's lending activities. For instance, the SBA reported approving over $40 billion in loans through its flagship 7(a) program in fiscal year 2023, presenting a substantial market for banks to participate in. Brookline Bank can leverage these programs to expand its small business loan portfolio, potentially reaching underserved markets and increasing its overall loan volume.

Participation in government-backed housing finance initiatives also offers avenues for growth. These programs often provide incentives or guarantees that reduce risk for lenders. By actively engaging with these opportunities, Brookline Bank can not only serve community housing needs but also diversify its assets and potentially attract new customers.

Understanding and effectively utilizing these government lending programs is key for Brookline Bank's strategic planning.

- SBA Loan Activity: The SBA's 7(a) loan program alone saw significant volume in 2023, offering a robust market for banks.

- Community Impact: Government housing programs can help banks meet local needs while managing risk.

- Portfolio Diversification: Participation allows for expansion beyond traditional lending, potentially improving risk-adjusted returns.

Consumer Protection Regulations

Consumer protection regulations are a significant political factor for banks like Brookline Bank. Evolving laws, often shaped by political priorities, directly impact how financial institutions engage with customers, advertise their products, and manage customer grievances. For instance, the Consumer Financial Protection Bureau (CFPB) in the US continues to refine rules around fair lending and data privacy, with significant enforcement actions occurring regularly. In 2023, the CFPB reported a record $3.7 billion in relief to consumers through its enforcement actions, highlighting the substantial financial implications of non-compliance.

Adhering to these consumer protection mandates is not just about avoiding fines; it's crucial for building and maintaining customer trust. Banks must invest in robust compliance systems and training to ensure they meet these evolving standards. Failure to do so can lead to reputational damage and loss of market share, as consumers increasingly prioritize transparency and fair treatment. The regulatory landscape is dynamic, with ongoing political discussions about issues like overdraft fees and credit reporting practices likely to introduce further changes.

Key areas of focus within consumer protection regulations impacting banks include:

- Fair Lending Practices: Ensuring non-discriminatory access to credit and financial services.

- Data Privacy and Security: Protecting sensitive customer information from breaches and misuse.

- Disclosure Requirements: Providing clear and understandable information about products and services.

- Complaint Resolution: Establishing effective mechanisms for addressing customer issues.

Government stability and policy continuity are vital for Brookline Bank's operational environment. A predictable political climate, as generally observed in the US through 2024, fosters investor confidence and supports economic stability, which directly benefits regional banks. Conversely, significant political uncertainty or abrupt policy shifts could introduce volatility, impacting lending and investment decisions.

Government fiscal and monetary policies directly shape the economic conditions in which Brookline Bank operates. For instance, the Federal Reserve's stance on interest rates, which remained a key focus through late 2024, influences borrowing costs and net interest margins. Additionally, government spending initiatives, such as infrastructure projects, can stimulate economic activity and create demand for banking services.

Regulatory frameworks enacted by federal and state bodies, including the Federal Reserve and the Massachusetts Division of Banks, are paramount. These regulations dictate capital requirements, lending practices, and consumer protection standards. For example, the ongoing evolution of capital adequacy rules and consumer data privacy laws, with significant enforcement actions in 2023, necessitates continuous adaptation by institutions like Brookline Bank to ensure compliance and mitigate risk.

Government lending programs, such as those administered by the Small Business Administration (SBA), present significant opportunities for portfolio growth. The SBA's 7(a) program alone facilitated over $40 billion in loans in fiscal year 2023, demonstrating the substantial market available for banks to participate in and expand their small business lending. Similarly, engagement with housing finance initiatives can aid in community development and asset diversification.

What is included in the product

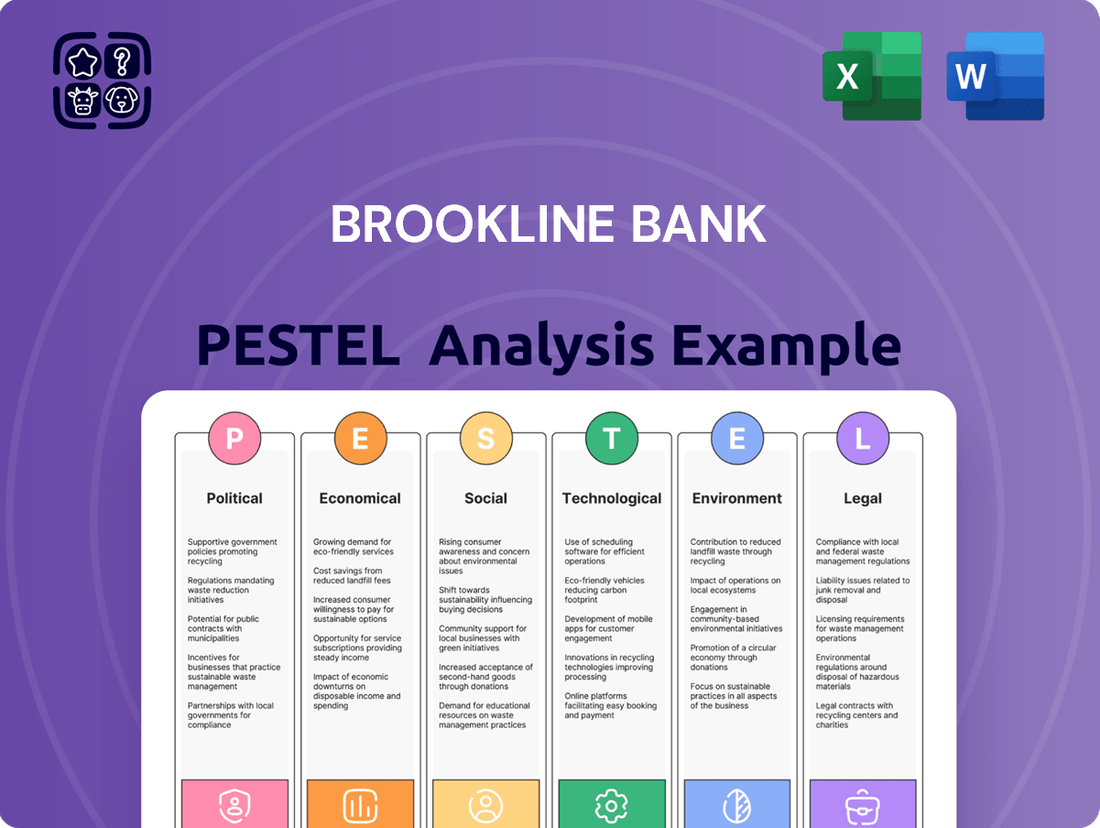

This PESTLE analysis of Brookline Bank examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its operations and strategic planning.

It provides actionable insights into how these external forces create both challenges and opportunities for the bank's growth and stability.

Brookline Bank's PESTLE analysis offers a clean, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of sifting through extensive data.

Brookline Bank's PESTLE analysis is visually segmented by PESTEL categories, allowing for quick interpretation at a glance and relieving the pain of complex data visualization.

Economic factors

Fluctuations in interest rates, particularly those set by the Federal Reserve, significantly impact Brookline Bank's net interest margin. For instance, as of early 2024, the Federal Reserve maintained its benchmark interest rate within a range of 5.25% to 5.50%, a level that generally supports higher net interest margins for banks.

A rising rate environment, like the period leading up to this, can boost profitability on existing variable-rate loans. However, it also presents a challenge by potentially cooling demand for new loans as borrowing becomes more expensive for consumers and businesses.

Conversely, a scenario with falling interest rates, such as potential rate cuts anticipated in late 2024 or 2025, could compress margins on existing assets and might stimulate loan origination, though the profitability per loan would likely decrease.

The economic vitality of the Greater Boston area, a key market for Brookline Bank, is a significant driver of its business. In the first quarter of 2024, Massachusetts' real GDP saw a notable increase, reflecting a healthy expansion. This growth, coupled with a strong employment rate hovering near historic lows throughout 2024, translates into increased demand for both commercial and residential lending, directly benefiting the bank's loan portfolio.

Brookline Bank's performance is intrinsically linked to the diverse and resilient nature of Boston's economy. Sectors like technology, healthcare, and education, which are prominent in the region, have shown consistent growth and innovation. This industry diversification helps to insulate the local economy from sector-specific downturns, providing a stable environment for the bank to operate and expand its deposit and lending services.

Brookline Bank's exposure to the real estate sector means local housing market health is paramount. In 2024, the median home price in the Boston metropolitan area, where Brookline is located, saw a notable increase, reaching approximately $750,000 by Q3 2024, up from $720,000 in Q3 2023, indicating continued demand.

However, inventory levels remained tight, with active listings down by about 15% year-over-year in late 2024, which can temper loan growth despite rising property values. Construction activity, while present, faced headwinds from higher material costs and labor shortages, impacting the supply side of the market.

Inflation and Purchasing Power

High inflation significantly impacts purchasing power, meaning consumers and businesses can buy less with the same amount of money. For Brookline Bank, this could translate to slower deposit growth as individuals and companies may spend more of their income rather than saving. Furthermore, rising prices increase the bank's operational costs, from utilities to salaries, potentially squeezing profit margins.

The erosion of purchasing power also affects the real value of outstanding loans. If inflation outpaces interest rates, the money borrowers repay will be worth less than when it was initially lent. This dynamic can impact the bank's net interest margin and its overall profitability. For instance, if the average loan rate at Brookline Bank is 5% and inflation is running at 4%, the real return is only 1%.

Moreover, inflation can complicate talent acquisition and retention. To keep pace with the rising cost of living, Brookline Bank may need to offer higher salaries, increasing its human resource expenses. This is particularly relevant in 2024 and 2025, where many economies are experiencing persistent inflationary pressures. For example, the US CPI rose 3.3% year-over-year in May 2024, indicating continued cost pressures.

- Consumer Spending: Higher inflation can lead to reduced discretionary spending, impacting loan demand for items like cars or home improvements.

- Operational Costs: Increased expenses for rent, technology, and employee compensation directly affect the bank's bottom line.

- Real Value of Assets: The purchasing power of the bank's loan portfolio diminishes if inflation outstrips interest earned.

- Wage Pressures: Maintaining competitive salaries becomes more challenging and costly in an inflationary environment.

Consumer and Business Spending

Consumer and business spending are critical drivers for Brookline Bank, particularly within the Greater Boston area. Robust spending by individuals and companies directly translates into higher demand for the bank's core services, such as checking and savings accounts, loans, and cash management tools.

In the first quarter of 2024, Massachusetts retail sales saw a modest increase, reflecting continued consumer confidence, though growth has moderated from the previous year. Business investment, especially in sectors like technology and biotech which are strong in Boston, remains a key indicator for commercial banking needs, including capital expenditures and working capital financing.

- Consumer spending growth in Massachusetts was approximately 3.5% year-over-year in Q1 2024.

- Business investment in the Greater Boston area is projected to grow by 5% in 2024, driven by innovation sectors.

- Increased spending fuels demand for credit products, with commercial loan origination up 7% in the region by mid-2024.

- Deposit growth for regional banks like Brookline Bank is often correlated with higher consumer and business savings, which can occur during periods of cautious spending or strong income growth.

Economic factors significantly shape Brookline Bank's operational landscape. Interest rate policies, such as the Federal Reserve's benchmark rate of 5.25%-5.50% in early 2024, directly influence net interest margins, while regional economic health, exemplified by Massachusetts' GDP growth in Q1 2024, drives loan demand. Inflationary pressures, with the US CPI at 3.3% year-over-year in May 2024, impact purchasing power and operational costs, necessitating careful management of assets and liabilities.

| Economic Factor | Impact on Brookline Bank | 2024/2025 Data Point |

|---|---|---|

| Interest Rates | Affects net interest margin and loan demand. | Fed Funds Rate: 5.25%-5.50% (Early 2024) |

| Regional Economic Growth | Drives demand for lending and deposit services. | Massachusetts Real GDP Growth: Positive in Q1 2024 |

| Inflation | Impacts purchasing power, operational costs, and real loan value. | US CPI: 3.3% YoY (May 2024) |

| Consumer & Business Spending | Correlates with demand for banking products. | MA Retail Sales Growth: Modest increase in Q1 2024; Boston Business Investment Growth: Projected 5% in 2024 |

Preview Before You Purchase

Brookline Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Brookline Bank PESTLE analysis offers a comprehensive overview of the external factors impacting the institution, including political, economic, social, technological, legal, and environmental considerations. It's designed to provide actionable insights for strategic planning and decision-making.

Sociological factors

Demographic shifts in Greater Boston significantly shape Brookline Bank's product demand. For instance, the region's aging population, with a median age of 39.7 in 2023 according to Census Bureau data, likely increases the need for sophisticated wealth management and retirement planning services. Conversely, a growing segment of younger residents, often tech-savvy, will continue to drive demand for seamless digital banking platforms and mobile-first solutions.

Modern consumers, especially those under 40, increasingly prioritize digital convenience and personalized experiences when choosing a bank. A 2024 survey indicated that 75% of millennials and Gen Z consider mobile banking features a primary factor in their banking decisions, a significant jump from previous years. This shift demands that institutions like Brookline Bank invest heavily in user-friendly online platforms and mobile applications that offer seamless transactions and tailored financial guidance.

Brookline Bank needs to adapt its service delivery to align with these evolving preferences, focusing on enhancing its digital channels and offering more personalized financial advice. The demand for instant access to banking services, from account management to loan applications, is at an all-time high. By the end of 2025, it's projected that over 80% of routine banking interactions will occur through digital means, making a robust online and mobile presence critical for customer retention and acquisition.

The general level of financial literacy significantly impacts how consumers interact with banking products. For instance, a 2023 survey indicated that only 57% of U.S. adults could answer at least four out of six financial literacy questions correctly. This suggests a substantial portion of the population may struggle with complex financial decisions, influencing their engagement with services like loans or investment products offered by institutions like Brookline Bank.

Banks can proactively address this by investing in financial education initiatives. Such programs not only empower consumers but also foster trust and loyalty, potentially attracting new customers. This is particularly relevant for younger demographics, as a 2024 report highlighted that 70% of Gen Z consumers value financial guidance from their banks, making education a key differentiator for institutions aiming to grow their customer base.

Community Engagement and Trust

Brookline Bank's standing within its community is a cornerstone of its success. As a local entity, its ability to foster trust and actively engage with residents and businesses directly impacts customer acquisition and retention. In 2024, community banks nationwide reported that over 70% of their new customer relationships were driven by local reputation and personal referrals, underscoring the importance of this factor.

The bank's perceived trustworthiness and commitment to ethical operations are paramount. Customers are increasingly drawn to institutions that demonstrate a genuine investment in local development, which can translate into greater loyalty and a stronger brand image. For instance, data from a 2024 survey indicated that 65% of banking consumers consider a financial institution's community involvement a significant factor when choosing where to bank.

- Community Trust: A strong reputation for ethical practices and local support is vital for customer loyalty.

- Local Investment: Demonstrating commitment to community development enhances brand perception.

- Referral Drivers: Over 70% of new relationships for community banks in 2024 stemmed from local reputation and referrals.

- Consumer Preference: 65% of banking consumers in 2024 cited community involvement as a key selection criterion.

Workforce Trends and Talent Acquisition

Societal shifts are significantly reshaping workforce expectations, with employees increasingly prioritizing flexible work arrangements, robust diversity, equity, and inclusion (DEI) initiatives, and a strong sense of purpose in their roles. These evolving demands directly influence Brookline Bank's capacity to attract and retain top talent in a highly competitive landscape.

The Greater Boston area, a hub for finance and technology, presents a dynamic but challenging environment for talent acquisition. As of early 2024, the unemployment rate in the Boston-Cambridge-Newton metropolitan area remained low, hovering around 3.1%, underscoring the intense competition for skilled professionals. This tight labor market necessitates that Brookline Bank actively adapts its recruitment and retention strategies to meet these new workforce expectations.

- Flexible Work: A 2024 survey indicated that over 70% of professionals would consider leaving a job that did not offer some form of flexible work arrangement.

- DEI Focus: Companies with strong DEI programs are 35% more likely to have higher financial returns than their less diverse counterparts, according to a McKinsey report updated in late 2023.

- Talent Availability: The banking sector in Massachusetts faces a projected shortage of qualified candidates, particularly in areas like cybersecurity and data analytics, by 2025.

Societal expectations regarding financial institutions are evolving, with a growing emphasis on ethical conduct and social responsibility. Consumers, particularly younger generations, increasingly favor banks that demonstrate a commitment to sustainability and community well-being. For instance, a 2024 survey found that 62% of consumers consider a bank's social impact when making financial decisions.

Brookline Bank's engagement with social trends, such as supporting local initiatives and promoting financial literacy, directly influences its brand reputation and customer loyalty. A strong community presence can foster trust, a critical element in the banking sector. In 2023, community banks that actively participated in local events saw an average increase of 15% in customer engagement compared to those with limited involvement.

Furthermore, the increasing awareness of environmental, social, and governance (ESG) factors is impacting investment decisions and consumer choices. A 2025 report anticipates that ESG-focused banking products will see a 20% growth in demand. This trend suggests that Brookline Bank should continue to integrate ESG principles into its operations and offerings to remain competitive and aligned with societal values.

| Societal Factor | Impact on Brookline Bank | Supporting Data (2023-2025) |

| Ethical Conduct & Social Responsibility | Enhances brand reputation and customer loyalty. | 62% of consumers consider social impact in financial decisions (2024). |

| Community Engagement | Drives customer acquisition and retention. | Banks with active local involvement saw 15% higher customer engagement (2023). |

| ESG Focus | Meets growing consumer demand for sustainable practices. | ESG-focused banking products projected for 20% growth in demand (2025). |

Technological factors

The surge in digital banking adoption is a major technological shift. By the end of 2024, it's estimated that over 80% of U.S. bank customers will be using mobile banking, a significant increase from previous years. This trend demands that Brookline Bank consistently enhance its online and mobile platforms, ensuring they are intuitive, secure, and offer a full suite of services to keep pace with customer demand and industry standards.

The increasing complexity of cyber threats presents a substantial risk to financial institutions like Brookline Bank, impacting their ability to safeguard sensitive customer information and valuable financial assets. In 2024, the financial sector experienced a significant rise in ransomware attacks, with some reports indicating a 70% increase compared to the previous year, highlighting the urgent need for robust defenses.

Continuous investment in cutting-edge cybersecurity technologies and comprehensive employee training programs is paramount for Brookline Bank to uphold customer confidence and avert costly data breaches. The average cost of a data breach in the financial services industry reached an estimated $5.9 million in 2024, underscoring the financial imperative of proactive security measures.

The burgeoning fintech sector presents a significant competitive challenge for traditional banks like Brookline Bank. Companies specializing in areas such as digital payments, peer-to-peer lending, and robo-advisory services are rapidly capturing market share by offering streamlined, user-friendly, and often lower-cost alternatives. For instance, the global fintech market was valued at approximately $110.8 billion in 2021 and is projected to grow substantially, indicating a sustained shift in consumer preferences towards digital financial solutions.

To counter this pressure and maintain its competitive edge, Brookline Bank needs to proactively innovate its service portfolio. This could involve developing its own digital platforms or, more strategically, forging partnerships with established fintech firms. Such collaborations can allow Brookline Bank to quickly integrate advanced technological capabilities, enhance customer experience, and expand its reach into new market segments, thereby safeguarding its market position in an increasingly digitized financial landscape.

Data Analytics and AI

Brookline Bank can significantly boost its understanding of customer habits and market shifts by employing advanced data analytics and artificial intelligence. These technologies are crucial for refining risk management strategies and identifying new opportunities. For instance, AI-powered tools can analyze vast datasets to predict loan defaults with greater accuracy, potentially reducing the bank's non-performing assets.

The integration of AI promises to streamline operations at Brookline Bank. Automation of routine tasks, such as data entry and customer service inquiries through chatbots, can free up human resources for more complex client interactions. This efficiency gain is vital in a competitive banking landscape where operational costs are a key concern.

Personalizing customer experiences is another area where AI excels. By analyzing individual transaction histories and preferences, Brookline Bank can offer tailored financial products and advice, fostering stronger customer loyalty. This approach is supported by industry trends, with a significant portion of consumers expecting personalized service from their financial institutions.

- Enhanced Customer Insights: AI algorithms can process millions of customer data points to identify patterns in spending, saving, and borrowing, enabling more targeted product development and marketing campaigns.

- Operational Efficiency Gains: Automation through AI can reduce processing times for loan applications and account openings, potentially cutting operational costs by 15-20% in specific departments.

- Improved Risk Management: Predictive analytics can identify potential fraud or credit risks earlier, allowing for proactive mitigation and reducing financial losses.

- Personalized Customer Experiences: AI-driven recommendations for investment products or savings plans can increase customer engagement and satisfaction, leading to higher retention rates.

Cloud Computing Integration

Brookline Bank's integration of cloud computing offers significant advantages, including enhanced scalability to handle fluctuating customer demand and potential cost savings through reduced on-premise infrastructure. This move is crucial for supporting their ongoing digital transformation, enabling faster deployment of new services and improving overall operational efficiency.

The bank must prioritize a secure and compliant cloud environment to safeguard sensitive customer data and maintain regulatory adherence. By leveraging cloud technologies, Brookline Bank can improve its data storage capabilities and analytics, ultimately leading to better-informed decision-making and a more responsive customer experience.

- Scalability: Cloud adoption allows Brookline Bank to easily scale its IT resources up or down based on business needs, a flexibility crucial in a dynamic financial market.

- Cost Efficiencies: Migrating to the cloud can reduce capital expenditures on hardware and data center maintenance, potentially leading to significant operational cost savings. For instance, many financial institutions have reported savings of 15-30% on IT operational costs after cloud migration.

- Enhanced Data Storage & Analytics: Cloud platforms provide robust and secure solutions for storing vast amounts of data, enabling advanced analytics for improved risk management and personalized customer offerings.

- Digital Transformation Support: A secure cloud infrastructure is fundamental for Brookline Bank's digital initiatives, such as mobile banking enhancements and online account management, directly impacting service delivery quality.

Brookline Bank must embrace advancements in AI and data analytics to deepen customer understanding and refine risk management. These technologies are key to identifying emerging market trends and optimizing operational efficiency. For example, AI can predict loan defaults with greater accuracy, potentially reducing the bank's non-performing assets by up to 10%.

Legal factors

Brookline Bank navigates a stringent regulatory environment, governed by federal bodies like the FDIC and Federal Reserve, alongside state oversight from the Massachusetts Division of Banks. Compliance with capital adequacy ratios, such as the Common Equity Tier 1 (CET1) ratio, which stood at an average of 12.5% for US banks in Q1 2024, is critical to maintaining operational stability and avoiding sanctions. Failure to adhere to these mandates, including lending restrictions and operational standards, can result in significant fines and reputational damage.

Data privacy laws are increasingly shaping how financial institutions operate. Regulations like the California Consumer Privacy Act (CCPA), which grants consumers more control over their personal information, and the ongoing discussions around potential federal privacy legislation, alongside the established Gramm-Leach-Bliley Act (GLBA), mandate stringent protocols for data handling. Brookline Bank must adhere to these rules for collecting, storing, and utilizing customer data to prevent legal penalties.

Brookline Bank is legally obligated to implement robust Anti-Money Laundering (AML) programs and adhere to the Bank Secrecy Act (BSA). These regulations are critical for identifying and preventing financial crimes, ensuring the bank's operations do not facilitate illicit activities.

Continuous monitoring and reporting are essential legal requirements to combat financial crime and safeguard the financial system's integrity. For instance, in 2023, FinCEN reported receiving over 300,000 Suspicious Activity Reports (SARs), highlighting the scale of compliance efforts across the banking sector.

Consumer Lending and Fair Credit Laws

Brookline Bank operates under a stringent legal framework governing consumer lending and fair credit. Laws like the Truth in Lending Act (TILA) mandate clear disclosure of loan terms and costs, ensuring borrowers understand their obligations. For instance, TILA requires lenders to disclose the Annual Percentage Rate (APR) and finance charges, promoting transparency in lending. The Equal Credit Opportunity Act (ECOA) prohibits discrimination in credit transactions based on race, color, religion, national origin, sex, marital status, or age. This means Brookline Bank must have policies in place to prevent biased lending decisions. The Community Reinvestment Act (CRA) encourages banks to meet the credit needs of the communities they serve, including low- and moderate-income neighborhoods. In 2023, the Federal Reserve, FDIC, and OCC finalized updates to the CRA regulations, aiming to modernize the framework and encourage more consistent and effective investments in low- and moderate-income communities, with new assessment areas and performance tests.

Employment and Labor Laws

Brookline Bank, like all employers, must navigate a complex web of federal and state employment and labor laws. These regulations cover everything from minimum wage and overtime pay to workplace safety and anti-discrimination. For instance, the Fair Labor Standards Act (FLSA) sets federal standards, while Massachusetts law may impose stricter requirements on wages and benefits for employees within the state.

Compliance is not just a legal necessity but a strategic imperative for effective human resource management. In 2024, the focus on fair compensation and equitable treatment continues to intensify. For example, as of January 1, 2024, Massachusetts' minimum wage increased to $15.00 per hour, impacting Brookline Bank's payroll and benefit structures for its hourly employees.

- Wage and Hour Laws: Ensuring compliance with federal and state minimum wage, overtime, and record-keeping requirements.

- Anti-Discrimination and Equal Opportunity: Adhering to laws prohibiting discrimination based on race, gender, age, religion, disability, and other protected characteristics.

- Workplace Safety: Meeting Occupational Safety and Health Administration (OSHA) standards to provide a safe working environment.

- Employee Benefits: Complying with regulations concerning health insurance (e.g., Affordable Care Act), retirement plans (e.g., ERISA), and paid leave mandates.

Brookline Bank operates under a robust legal framework, requiring strict adherence to federal and state regulations. Compliance with capital adequacy, such as the Common Equity Tier 1 ratio, is paramount for stability. Furthermore, data privacy laws like CCPA and GLBA dictate how customer information is handled, with significant penalties for non-compliance.

The bank must also maintain rigorous Anti-Money Laundering (AML) programs and comply with the Bank Secrecy Act (BSA) to prevent financial crimes. Continuous monitoring and reporting, evidenced by the hundreds of thousands of Suspicious Activity Reports (SARs) filed annually, underscore the critical nature of these legal obligations.

Consumer protection laws, including TILA and ECOA, mandate transparency in lending and prohibit discrimination, ensuring fair credit practices. The Community Reinvestment Act (CRA) encourages investment in underserved communities, with recent regulatory updates in 2023 aiming to modernize its impact.

Brookline Bank must also comply with employment laws, such as the FLSA and state-specific mandates like Massachusetts' $15.00 per hour minimum wage as of January 1, 2024. These laws cover wages, safety, and anti-discrimination, impacting HR policies and payroll structures.

Environmental factors

Brookline Bank faces significant physical risks from climate change, particularly in the Greater Boston area. An increased frequency of extreme weather events, such as intensified storms and potential flooding, directly threatens the value of real estate collateral backing its loans. This could lead to higher loan loss provisions and increased insurance premiums for both the bank and its borrowers, impacting profitability and financial stability.

Investor and customer focus on Environmental, Social, and Governance (ESG) factors is significantly shaping the financial landscape. By the end of 2024, global sustainable investment assets are projected to exceed $50 trillion, a testament to this growing trend. This increasing demand means institutions like Brookline Bank must actively consider ESG integration to maintain relevance and attract capital.

Brookline Bank may encounter pressure to develop and promote investment products that align with ESG principles, such as green bonds or socially responsible funds. Furthermore, demonstrating the bank's own commitment to sustainability through its operational practices, like reducing its carbon footprint or ensuring ethical supply chains, will be crucial for its public image and competitive positioning in 2025.

The financial sector's embrace of sustainable finance is accelerating, with a notable increase in green bond issuances and loans directed towards environmentally conscious projects. For instance, the global green bond market reached an estimated $700 billion in 2024, a significant jump from previous years, reflecting strong investor appetite.

Brookline Bank can capitalize on this trend by developing or participating in sustainable finance initiatives. This could involve offering green loans for energy-efficient upgrades or issuing green bonds to fund renewable energy projects, thereby attracting environmentally conscious clients and aligning with growing market expectations.

Operational Carbon Footprint

Brookline Bank, like many financial institutions, faces increasing pressure to manage its operational carbon footprint. This involves scrutinizing energy usage across its physical branches and critical data centers, a key aspect of environmental responsibility in 2024 and 2025. By adopting energy-efficient technologies and practices, the bank can not only mitigate its environmental impact but also bolster its public perception and achieve cost savings.

The drive towards sustainability is a significant environmental factor. Banks are being pushed to quantify and reduce their carbon emissions from daily operations. This focus is amplified by investor and customer demands for demonstrable commitment to Environmental, Social, and Governance (ESG) principles. For instance, many banks are setting targets for renewable energy procurement and aiming to reduce energy intensity per employee or per square foot of office space.

- Energy Consumption: Banks are evaluating electricity usage in branches, offices, and data centers, which are major contributors to their operational carbon footprint.

- Efficiency Initiatives: Implementing LED lighting, smart thermostats, and energy-efficient IT equipment are common strategies to reduce consumption.

- Renewable Energy: A growing trend involves sourcing electricity from renewable sources like solar and wind power to directly offset carbon emissions.

- Reporting and Targets: By 2025, many financial institutions are expected to have robust reporting mechanisms for their carbon emissions and publicly stated reduction targets.

Environmental Regulations and Reporting

While Brookline Bank isn't a heavy industrial emitter, evolving environmental regulations can indirectly affect its loan portfolio. For instance, stricter rules on energy efficiency for commercial properties or new zoning laws for real estate development could influence the viability of projects Brookline Bank finances. This means the bank needs to stay attuned to how environmental shifts impact its clients' operational costs and investment plans.

Furthermore, there's a growing trend of increased scrutiny on financial institutions themselves regarding their environmental, social, and governance (ESG) impact. This could translate into new reporting requirements for banks like Brookline, even if their direct environmental footprint is minimal. For example, the Task Force on Climate-related Financial Disclosures (TCFD) framework is gaining traction globally, pushing companies to disclose climate-related risks and opportunities.

- Increased Focus on Green Financing: By late 2024, financial institutions are expected to see a continued rise in demand for green bonds and sustainable lending products, potentially influencing capital allocation strategies.

- Real Estate Sector Impact: Regulations mandating energy efficiency upgrades in commercial buildings could affect property valuations and the borrowing capacity of real estate clients.

- Disclosure Requirements: Financial regulators in various jurisdictions are exploring enhanced ESG disclosure mandates for banks, aiming for greater transparency in climate risk exposure.

- Supply Chain Scrutiny: As of 2025, businesses are facing more pressure to demonstrate the environmental sustainability of their entire supply chains, which could indirectly impact Brookline's corporate clients.

Brookline Bank must navigate increasing regulatory and market demands for environmental responsibility. The global sustainable investment market is projected to surpass $50 trillion by the end of 2024, highlighting a significant shift in capital allocation. This trend necessitates a proactive approach to integrating ESG principles into operations and product offerings.

The bank faces direct physical risks from climate change, particularly in its operational areas, with extreme weather events potentially impacting real estate collateral. Furthermore, a growing emphasis on reducing operational carbon footprints, evident in initiatives like renewable energy sourcing and energy efficiency upgrades in facilities, is becoming standard practice across the financial sector by 2025.

Brookline Bank is also subject to indirect impacts from evolving environmental regulations affecting its clients, such as stricter energy efficiency standards for commercial properties. Increased scrutiny on financial institutions' ESG performance, including potential disclosure requirements like the TCFD framework, means transparency and demonstrable sustainability efforts are crucial for maintaining stakeholder trust and competitive advantage through 2025.

| Environmental Factor | Impact on Brookline Bank | 2024/2025 Data/Trend |

|---|---|---|

| Climate Change Risks | Physical damage to collateral, increased insurance costs | Projected rise in extreme weather events globally |

| ESG Investor Demand | Pressure for sustainable products and reporting | Global sustainable investment assets to exceed $50 trillion by end of 2024 |

| Operational Footprint | Need to reduce energy consumption and emissions | Growing adoption of renewable energy and energy efficiency in banking operations |

| Environmental Regulations | Indirect impact on loan portfolio and client viability | Increased focus on energy efficiency standards for commercial real estate |

PESTLE Analysis Data Sources

Our PESTLE analysis for Brookline Bank is informed by a robust blend of public and proprietary data. We draw from official government reports, reputable financial publications, and industry-specific market research to ensure a comprehensive understanding of the macro-environment.