Brookline Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookline Bank Bundle

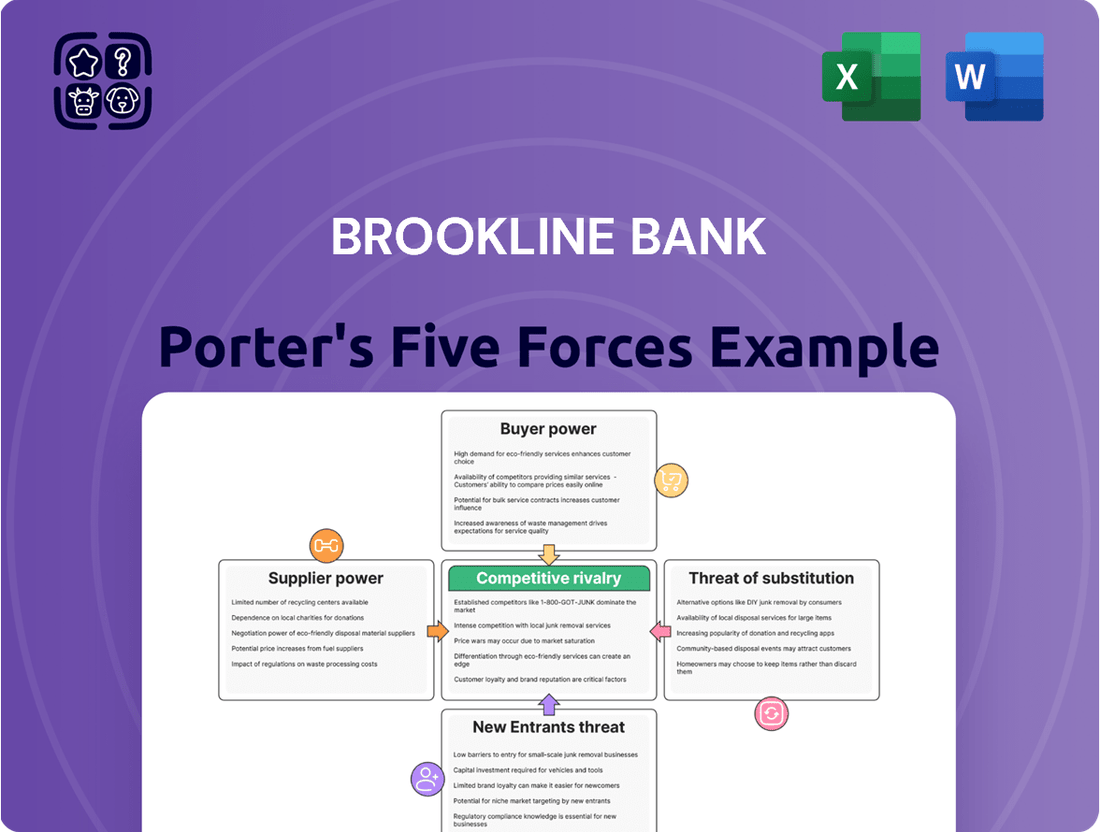

Brookline Bank operates within a dynamic financial landscape, where understanding the interplay of competitive forces is crucial for sustained success. Our analysis delves into the bargaining power of both its customers and suppliers, the intensity of rivalry among existing competitors, and the ever-present threats of new entrants and substitute products.

The complete report reveals the real forces shaping Brookline Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Technology providers wield increasing influence over banks like Brookline Bank. The financial sector's deep integration of advanced software for operations, cybersecurity, and customer engagement amplifies this power. Banks are channeling substantial investments into areas like AI and data analytics, making them more dependent on specialized tech vendors.

This dependency is particularly pronounced for providers offering critical solutions in fraud detection and digital onboarding. For instance, the global financial technology market was projected to reach over $1.5 trillion by 2024, highlighting the immense value and demand for innovative financial software.

Financial market data providers wield considerable influence over Brookline Bank. Access to real-time, accurate data is non-negotiable for investment services and risk management, making these suppliers essential. Their specialized offerings and the proprietary nature of some data, coupled with high switching costs, grant them moderate to significant bargaining power.

The banking sector, Brookline Bank included, grapples with securing and keeping skilled professionals, especially in burgeoning fields such as cybersecurity, artificial intelligence, and digital innovation. This scarcity empowers employees with niche expertise, driving up salary demands and intensifying recruitment competition.

In 2024, the demand for cybersecurity professionals in the financial services sector remained exceptionally high, with a reported shortage of over 3.5 million skilled individuals globally, according to industry surveys. This shortage directly translates to increased bargaining power for those possessing these critical skills.

Core Banking System Providers

Core banking system providers wield considerable influence over institutions like Brookline Bank. These systems are the backbone of a bank's entire operation, handling everything from customer accounts to loan processing and transactions.

The difficulty and expense associated with switching these critical systems are substantial. For instance, a typical core banking system replacement project can cost tens of millions of dollars and take several years to complete, often causing significant operational disruptions. This high switching cost grants incumbent providers substantial leverage, as banks are hesitant to undertake such a risky and resource-intensive transition.

- High Switching Costs: Migrating core banking systems can cost anywhere from $50 million to over $200 million for larger financial institutions.

- Operational Dependence: Banks rely entirely on these systems for daily functions, making any disruption during a switch extremely impactful.

- Limited Vendor Pool: The market for robust, secure core banking solutions is relatively concentrated, further empowering established providers.

Regulatory Compliance Service Providers

Regulatory compliance service providers hold significant bargaining power, particularly for institutions like Brookline Bank. As regulatory landscapes become more intricate, especially concerning cybersecurity and fraud prevention, specialized firms offering these essential services are in high demand. Their expertise is critical for banks to avoid costly penalties and maintain operational integrity, thereby increasing their leverage.

The demand for these specialized services is driven by increasing regulatory scrutiny. For instance, in 2024, financial institutions faced heightened expectations regarding data privacy and anti-money laundering (AML) compliance. This necessity makes it difficult for banks to switch providers easily, as the transition can be complex and disruptive, further solidifying the power of existing compliance service providers.

- Increased Regulatory Burden: Banks must invest heavily in compliance, with global spending on regulatory technology (RegTech) projected to reach over $100 billion by 2025.

- Specialized Expertise Demand: The need for niche skills in areas like AI-driven fraud detection and blockchain-based transaction monitoring empowers providers with unique capabilities.

- High Switching Costs: Implementing new compliance systems often involves significant integration efforts and data migration, making it costly and time-consuming for banks to change vendors.

- Risk of Non-Compliance: The potential for substantial fines and reputational damage for non-compliance gives service providers considerable leverage in contract negotiations.

Core banking system providers and specialized technology vendors exert considerable influence over Brookline Bank due to high switching costs and operational dependence. The demand for niche expertise, particularly in cybersecurity and AI, further empowers these suppliers. For example, the global financial technology market was projected to exceed $1.5 trillion by 2024, underscoring the critical role and leverage of tech providers in the banking sector.

| Supplier Type | Bargaining Power | Key Factors |

| Core Banking System Providers | High | High switching costs (tens of millions of dollars, years to implement), operational dependence, limited vendor pool. |

| Technology Providers (AI, Cybersecurity) | Moderate to High | Increasing dependency for critical functions like fraud detection, significant market growth ($1.5T+ projected for FinTech by 2024), specialized expertise. |

| Financial Data Providers | Moderate | Essential for operations, proprietary data, moderate switching costs. |

| Regulatory Compliance Service Providers | High | Complex regulatory environment, high switching costs, risk of non-compliance (e.g., projected RegTech spending over $100B by 2025). |

What is included in the product

Tailored exclusively for Brookline Bank, analyzing its position within its competitive landscape by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of existing rivalry.

Brookline Bank's Porter's Five Forces analysis provides a clear, one-sheet summary of competitive pressures, perfect for quick strategic decision-making.

Easily swap in your own data and labels to reflect current business conditions, making the analysis highly adaptable and relevant.

Customers Bargaining Power

The bargaining power of Brookline Bank's deposit account holders is typically moderate. While a single depositor's influence is minimal, the potential for widespread account movement, particularly within the competitive Greater Boston financial landscape, presents a notable factor for the bank.

Customers can readily shop around, comparing interest rates and services offered by numerous banks and emerging fintech companies. This ease of comparison compels institutions like Brookline Bank to actively pursue deposit growth and maintain competitive product offerings to retain their customer base.

Residential mortgage borrowers in the Greater Boston area generally possess moderate bargaining power. This power is shaped by the current interest rate environment and the array of lending options available. For instance, in early 2024, while mortgage rates remained higher than recent historical lows, borrowers had the flexibility to compare offers from numerous financial institutions, including traditional banks and specialized mortgage companies.

The ability for borrowers to easily switch lenders or secure more favorable terms, especially during periods of intense competition among mortgage providers, directly impacts their leverage. In 2024, the mortgage market saw a dynamic interplay between borrower demand and lender offerings, with some lenders actively competing for market share by adjusting rates and fees, thus empowering borrowers to negotiate better deals.

Commercial loan borrowers, especially larger corporations, often wield significant bargaining power. This is because the sheer volume of their borrowing allows them to negotiate more favorable interest rates and loan covenants. For instance, in 2024, large corporate borrowers frequently secured prime-plus rates, demonstrating their leverage.

Brookline Bank, by concentrating on small to mid-sized businesses, may experience a different dynamic. While these borrowers still seek competitive terms, their individual loan sizes typically mean less negotiating clout compared to major corporate clients. However, the overall commercial lending market remains competitive, requiring banks to remain responsive to borrower needs.

Wealth Management Clients

Wealth management clients, particularly high-net-worth individuals and businesses, wield considerable bargaining power. They demand tailored services, competitive pricing, and superior investment performance, making them mobile across the financial landscape. Brookline Bank's strategic focus on expanding its fee-based income streams, including wealth management, underscores the critical need for client loyalty in this sector.

The ability of these clients to switch providers easily means Brookline Bank must continuously offer value. For instance, in 2023, the average assets under management for a high-net-worth individual globally exceeded $1 million, a segment where client expectations for service and returns are exceptionally high. This client base is not shy about seeking better terms or performance elsewhere.

- Client Leverage: Wealth management clients can negotiate fees and service levels due to the ease of transferring assets.

- Performance Demands: High-net-worth clients expect personalized strategies and consistent, strong investment returns.

- Competitive Landscape: The availability of numerous wealth management firms and larger financial institutions intensifies competition for client assets.

- Retention Imperative: Brookline Bank's growth in fee income relies heavily on retaining these valuable clients.

Cash Management Clients

Cash management clients at Brookline Bank possess moderate bargaining power. The essential nature of these services for business operations is balanced by a competitive landscape. This includes a range of providers, from traditional large banks to innovative fintech companies offering integrated financial solutions.

Businesses can readily compare the features, pricing structures, and ease of integration offered by different cash management providers. For instance, in 2024, many businesses are evaluating providers based on real-time transaction visibility and automated reconciliation, key differentiators in the market.

- Competitive Offerings: Clients can switch providers if better terms or services are available elsewhere.

- Information Availability: Transparency in pricing and service levels allows for informed comparisons.

- Fintech Integration: The rise of embedded finance solutions provides clients with more choices and leverage.

- Service Customization: The ability to tailor cash management solutions to specific business needs influences client loyalty.

The bargaining power of Brookline Bank's customers is generally moderate, influenced by the competitive financial services landscape. For deposit accounts, customers can easily compare rates and services across numerous institutions, compelling banks like Brookline to offer competitive terms to retain business. Similarly, mortgage borrowers in 2024 found they had leverage due to a competitive market where lenders adjusted rates and fees to attract clients.

Commercial clients, especially larger corporations, possess higher bargaining power due to their borrowing volume, often securing prime-plus rates as seen in 2024. However, Brookline's focus on small to mid-sized businesses means these clients have less individual negotiation clout. Wealth management clients, particularly high-net-worth individuals, have significant power, demanding tailored services and competitive performance, as evidenced by global high-net-worth individuals managing over $1 million in assets in 2023, making them mobile and discerning.

| Customer Segment | Bargaining Power | Key Factors Influencing Power (2023-2024) |

|---|---|---|

| Deposit Account Holders | Moderate | Ease of comparison, competitive interest rates, fintech alternatives. |

| Residential Mortgage Borrowers | Moderate | Interest rate environment, availability of lenders, lender competition for market share. |

| Commercial Loan Borrowers (Large Corps) | High | Borrowing volume, negotiation of rates (e.g., prime-plus), loan covenants. |

| Commercial Loan Borrowers (SME) | Moderate | Loan size, seeking competitive terms, responsiveness of banks. |

| Wealth Management Clients (HNW) | High | Demand for tailored services, investment performance expectations, ease of switching providers. |

| Cash Management Clients | Moderate | Availability of providers (traditional banks, fintech), real-time transaction visibility, automated reconciliation. |

Same Document Delivered

Brookline Bank Porter's Five Forces Analysis

This preview shows the exact Brookline Bank Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. It thoroughly examines the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the banking industry. This comprehensive document is ready for your immediate use and strategic planning.

Rivalry Among Competitors

Brookline Bank faces significant competitive rivalry within the Greater Boston area, with numerous local and regional banks vying for customers. Key competitors include established institutions like Eastern Bank, Rockland Trust, and Middlesex Savings Bank, all actively competing for deposit accounts, residential mortgages, and commercial loans.

Large national banks like Citibank, while not directly targeting Brookline Bank's core customer base in Boston, significantly shape the competitive landscape. Their substantial market presence and broad product suites, which include wealth management and sophisticated investment services, set a benchmark that influences customer expectations across the financial sector.

These behemoths, with their extensive branch networks and advanced digital platforms, often possess economies of scale that Brookline Bank cannot match. For instance, as of Q1 2024, major national banks reported billions in assets under management and significant investments in technology, creating a formidable competitive force that indirectly impacts pricing and service innovation for smaller institutions.

Credit unions present a notable competitive challenge to Brookline Bank, primarily due to their member-owned structure which often allows for more competitive rates on deposits and loans. This fosters a strong rivalry, especially for individual and small business accounts within the same community-focused market segment.

In 2024, credit unions continued to expand their reach, with the National Credit Union Administration (NCUA) reporting over 5,000 federally insured credit unions in the United States, collectively holding trillions in assets. Their emphasis on member benefits rather than shareholder profit allows them to offer attractive terms, directly competing with Brookline Bank for market share in essential banking services.

Fintech Companies

Fintech companies are significantly intensifying competitive rivalry within the banking sector. These agile firms, offering digital-first banking, real-time payment solutions, and embedded finance, are attracting customers with innovative technology and often lower operational costs. For instance, the global fintech market was valued at approximately $2.5 trillion in 2023 and is projected to grow substantially, indicating their increasing market share and influence.

This disruption forces traditional institutions like Brookline Bank to expedite their digital transformation strategies to remain competitive. Fintechs’ ability to provide specialized lending and seamless user experiences puts direct pressure on incumbent banks to enhance their own digital offerings and customer service models. By mid-2024, many traditional banks are reporting increased investment in digital channels to counter this trend.

- Digital-First Offerings: Fintechs excel in providing intuitive, mobile-centric banking experiences.

- Cost Advantages: Lower overhead allows fintechs to offer competitive pricing and fees.

- Specialized Lending: Niche fintech lenders can offer faster approvals and tailored products.

- Embedded Finance: Integration of financial services into non-financial platforms expands fintech reach.

Non-Bank Lenders

Non-bank lenders, such as mortgage originators and insurance companies, are significant competitors in the lending landscape, especially within commercial real estate and residential mortgages. These entities often possess specialized expertise and operate under distinct regulatory structures, allowing them to offer alternative financing solutions that directly challenge traditional banks.

For instance, in 2024, non-bank mortgage originators continued to play a substantial role in the U.S. housing market. Data from the Mortgage Bankers Association indicated that non-bank lenders originated approximately 47% of all residential mortgages in the first half of 2024, a slight increase from the previous year. This demonstrates their robust presence and ability to capture market share.

- Market Share: Non-bank lenders accounted for nearly half of all residential mortgage originations in the first half of 2024.

- Specialization: Their focused approach on specific loan types, like mortgages, allows for agility and tailored product offerings.

- Competitive Pressure: This specialization creates direct competition for banks, particularly in sectors where non-banks have a strong foothold.

- Regulatory Differences: Varied regulatory environments can sometimes provide non-banks with cost advantages or operational flexibility.

Brookline Bank faces intense competition from a diverse set of players, including local banks, national giants, credit unions, fintech innovators, and specialized non-bank lenders. This broad competitive field means Brookline must constantly adapt its offerings and pricing to retain and attract customers across various financial products.

The rivalry is particularly fierce in core banking services like deposits and loans, where competitors leverage scale, technology, or specialized advantages. Fintechs, for example, are rapidly gaining traction with their digital-first approach, forcing traditional banks to accelerate their own technological advancements. By mid-2024, many banks are significantly increasing their digital channel investments to counter this trend.

Non-bank lenders, especially in the mortgage market, also present a substantial challenge, originating nearly half of all residential mortgages in the first half of 2024. This underscores the need for Brookline Bank to maintain competitive rates and efficient service delivery across all its product lines to thrive in this dynamic environment.

| Competitor Type | Key Strengths | Impact on Brookline Bank |

|---|---|---|

| Local/Regional Banks | Community focus, established relationships | Direct competition for core customer base |

| National Banks | Economies of scale, broad product suite, advanced tech | Sets market benchmarks, influences customer expectations |

| Credit Unions | Member-focused, competitive rates | Attracts individual and small business accounts |

| Fintech Companies | Digital-first, agile, cost advantages | Drives digital transformation, pressures pricing |

| Non-Bank Lenders | Specialization, regulatory flexibility | Significant competition in lending segments (e.g., mortgages) |

SSubstitutes Threaten

Digital payment platforms, like PayPal and Venmo, and mobile wallets such as Apple Pay and Google Pay, represent significant substitutes for traditional banking transactions. These tech-driven solutions offer streamlined, often instant, payment capabilities, directly challenging the need for checks or standard bank transfers. In 2023, the global digital payments market was valued at over $9 trillion, demonstrating a clear shift in consumer behavior away from traditional banking methods.

Online lending platforms, encompassing peer-to-peer networks and direct-to-consumer digital lenders, present a significant substitute for traditional bank loans. These platforms often streamline the application process, making it quicker for both individuals and businesses to secure funding. For instance, by the end of 2023, the global online lending market was valued at over $130 billion, demonstrating substantial growth and customer adoption.

These digital alternatives frequently serve niche markets or customers who might find it challenging to obtain credit from conventional banks. Their agility and focus on specific borrower profiles can attract a segment of the market that Brookline Bank traditionally serves, thereby posing a competitive threat. The convenience and potentially lower overheads of these platforms can translate into more competitive interest rates for borrowers.

For Brookline Bank's wealth management services, dedicated investment management firms and automated robo-advisors represent significant substitutes. These alternatives offer a spectrum of investment choices, from specialized active management to low-cost passive strategies, often with different fee models that can be more attractive to certain client segments.

Robo-advisors, in particular, have seen substantial growth, with assets under management in the US projected to reach over $3 trillion by 2027, according to industry forecasts. This digital-first approach appeals to a younger demographic and cost-conscious investors, providing a direct challenge to traditional bank-led wealth management by offering accessible, technology-driven investment advice and portfolio management.

Direct-to-Consumer Financial Apps

The rise of direct-to-consumer financial apps presents a significant threat of substitutes for traditional banking services. These platforms, focusing on budgeting, savings, and micro-lending, can easily replicate some of Brookline Bank's core offerings. For instance, budgeting apps like Mint, which boasts millions of users, and savings apps such as Digit, which automatically saves money, provide convenient alternatives for customers seeking to manage their finances without a traditional bank account.

These fintech solutions often win over customers, especially younger demographics, with their intuitive design and niche functionalities. By 2024, the digital banking landscape has seen a substantial shift, with a growing preference for mobile-first experiences. Data from Statista indicated that in 2023, over 70% of consumers preferred using mobile banking apps for their transactions, highlighting the increasing competition from these agile digital substitutes.

- User-Friendly Interfaces: Apps like Chime and SoFi offer streamlined, mobile-centric experiences that appeal to tech-savvy consumers.

- Specialized Features: Many apps provide hyper-focused tools, such as automated savings plans or peer-to-peer lending, that traditional banks may not offer as prominently.

- Lower Fees: Direct-to-consumer apps often operate with lower overheads, allowing them to offer services with fewer or no fees, a significant draw for cost-conscious customers.

- Customer Acquisition: These digital platforms are adept at acquiring customers through targeted marketing and referral programs, rapidly building user bases.

Cryptocurrencies and Decentralized Finance (DeFi)

Cryptocurrencies and decentralized finance (DeFi) present a growing, albeit still developing, threat of substitution for traditional banking services. These technologies offer alternative avenues for payments, lending, and borrowing, potentially bypassing established financial institutions.

While mainstream adoption is ongoing, the underlying technologies are maturing, suggesting a long-term disruptive potential. For instance, the total value locked (TVL) in DeFi protocols reached a peak of over $200 billion in late 2021, demonstrating significant user engagement and capital allocation outside traditional systems.

The threat is amplified by DeFi's permissionless nature, allowing users to access financial services without traditional gatekeepers. As of mid-2024, the global cryptocurrency market capitalization hovers around $2.5 trillion, indicating a substantial and growing alternative financial ecosystem.

- Decentralized Finance (DeFi) Market Size: The total value locked (TVL) in DeFi protocols has shown significant growth, indicating a substantial shift of assets into these alternative systems.

- Cryptocurrency Market Capitalization: The overall market cap of cryptocurrencies, exceeding $2 trillion in 2024, represents a significant pool of capital operating outside traditional banking.

- Transaction Volume: While not always directly comparable to traditional banking, the sheer volume of transactions occurring on various blockchain networks highlights the growing utility of these digital assets for financial activities.

The threat of substitutes for Brookline Bank is substantial, stemming from a wide array of digital platforms and fintech innovations. These substitutes offer convenience, specialized features, and often lower costs, directly challenging traditional banking services across payments, lending, and wealth management.

Digital payment solutions and online lending platforms are rapidly gaining traction, with the global digital payments market exceeding $9 trillion in 2023 and the online lending market surpassing $130 billion by the end of that year. Robo-advisors are also a significant substitute in wealth management, with US assets under management projected to reach over $3 trillion by 2027.

| Substitute Category | Examples | Market Size/Growth Indicator (2023-2024) | Key Threat |

| Digital Payments | PayPal, Venmo, Apple Pay | Global market > $9 trillion (2023) | Streamlined, instant transactions |

| Online Lending | P2P platforms, digital lenders | Global market > $130 billion (2023) | Faster, accessible credit |

| Wealth Management | Robo-advisors, investment firms | US Robo-advisor AUM projected > $3 trillion (by 2027) | Lower fees, digital-first advice |

| Direct-to-Consumer Apps | Budgeting/Savings Apps | >70% consumers preferred mobile banking (2023) | Niche features, user-friendly interfaces |

| Cryptocurrencies/DeFi | Bitcoin, Ethereum, DeFi protocols | Global crypto market cap ~ $2.5 trillion (2024) | Decentralized financial services |

Entrants Threaten

Fintech startups pose a considerable threat of new entrants for traditional banks like Brookline Bank. These agile companies leverage cutting-edge technology to offer specialized financial services, often with a superior digital user experience. For instance, in 2024, the global fintech market was valued at over $1.1 trillion, demonstrating its substantial growth and potential to disrupt established players by bypassing legacy systems.

Tech giants like Apple, Google, and Amazon are leveraging their massive user bases and advanced technological infrastructure to offer financial services, directly competing with traditional banks.

For instance, Apple Pay has seen significant adoption, and Google Pay continues to expand its reach, presenting a formidable challenge to established payment systems.

These tech companies possess the capital and data analytics capabilities to innovate rapidly, potentially disrupting traditional banking models and capturing market share from incumbents like Brookline Bank.

Neobanks and digital-only banks represent a significant threat due to their lean operating models, bypassing the overhead of physical branches. This allows them to offer highly competitive, often lower, fees and a seamless digital user experience, directly appealing to a growing segment of tech-savvy consumers. For instance, by mid-2024, several prominent neobanks reported substantial user growth, with some exceeding 10 million customers, demonstrating their rapid market penetration and ability to attract a significant customer base away from traditional institutions.

Community Banks Expanding Geographically or Through Mergers

The threat of new entrants for Brookline Bank is amplified by the potential for other community banks to expand their reach either by opening new branches in its service areas or by merging with existing institutions. This consolidation trend can create larger, more formidable regional competitors. For instance, Brookline Bancorp itself is in the process of merging with Berkshire Hills Bancorp, a move that will significantly alter the competitive landscape by creating a larger entity with broader geographic coverage and enhanced market power.

This consolidation means that what were once smaller, localized competitors could evolve into significant regional players, directly challenging Brookline Bank's market share. The banking industry's ongoing consolidation, as evidenced by Brookline's own merger, suggests that the threat of new, larger entrants through M&A activity is a persistent concern.

- Geographic Expansion: Community banks can enter new markets by establishing physical branches or expanding digital services into Brookline Bank's operating regions.

- Mergers and Acquisitions: Consolidation within the banking sector can lead to the emergence of larger, more competitive regional banks that pose a direct threat.

- Brookline's Merger: The pending merger of Brookline Bancorp with Berkshire Hills Bancorp itself signifies the industry trend towards consolidation, potentially creating a stronger competitor from within the existing banking ecosystem.

Regulatory Changes Lowering Barriers to Entry

While the banking sector is typically characterized by stringent regulations, shifts in policy could significantly alter the competitive landscape. For instance, if future regulatory changes simplify licensing processes or mandate open banking principles, it could dramatically reduce the hurdles for new entities to enter the market. This would likely foster increased competition as a wider array of companies, potentially including fintech firms, gain the ability to offer financial services.

The potential impact of such changes is substantial. Consider the ongoing discussions around open banking, which aim to give consumers more control over their financial data and encourage innovation. In 2024, many jurisdictions continued to explore or implement open banking frameworks, signaling a trend towards greater data sharing and interoperability.

- Regulatory Easing: Future regulatory adjustments could lower capital requirements or streamline approval processes for new financial institutions.

- Open Banking Initiatives: Mandates for data sharing can empower non-traditional players to offer banking-like services.

- Fintech Disruption: Technology companies are increasingly capable of providing digital-first financial solutions, potentially bypassing traditional banking infrastructure.

- Increased Competition: Lowered barriers mean more diverse competitors vying for market share, impacting established players like Brookline Bank.

The threat of new entrants for Brookline Bank is multifaceted, encompassing agile fintech startups, tech giants, digital-only banks, and even traditional banks expanding through consolidation. These new players often bypass legacy infrastructure, offering superior digital experiences and competitive pricing. For instance, the global fintech market's valuation exceeding $1.1 trillion in 2024 highlights the significant capital and innovation potential entering the financial services space.

The rise of neobanks, with their lean operating models and rapid customer acquisition, exemplified by some exceeding 10 million users by mid-2024, directly challenges traditional banks. Furthermore, industry consolidation, as seen in Brookline's own merger with Berkshire Hills Bancorp, can create larger, more formidable regional competitors, increasing the intensity of market rivalry.

| Competitor Type | Key Characteristics | Impact on Brookline Bank | 2024 Data/Trend |

|---|---|---|---|

| Fintech Startups | Agile, tech-driven, specialized services | Disrupt market with innovative digital offerings | Global fintech market valued over $1.1 trillion |

| Tech Giants (e.g., Apple, Google) | Large user bases, advanced tech, significant capital | Leverage existing ecosystems to offer financial services | Widespread adoption of Apple Pay and Google Pay |

| Neobanks/Digital-Only Banks | Lean operations, low fees, seamless digital experience | Attract tech-savvy customers with competitive offerings | Rapid user growth, some exceeding 10 million customers |

| Consolidating Traditional Banks | Increased scale, broader geographic reach | Create larger, more powerful regional competitors | Brookline Bancorp merger with Berkshire Hills Bancorp |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Brookline Bank leverages data from industry-specific reports, financial statements, and publicly available market research to assess competitive dynamics.

We incorporate insights from regulatory filings, macroeconomic data, and competitor analysis to provide a comprehensive view of the banking industry's competitive landscape.