Brookline Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookline Bank Bundle

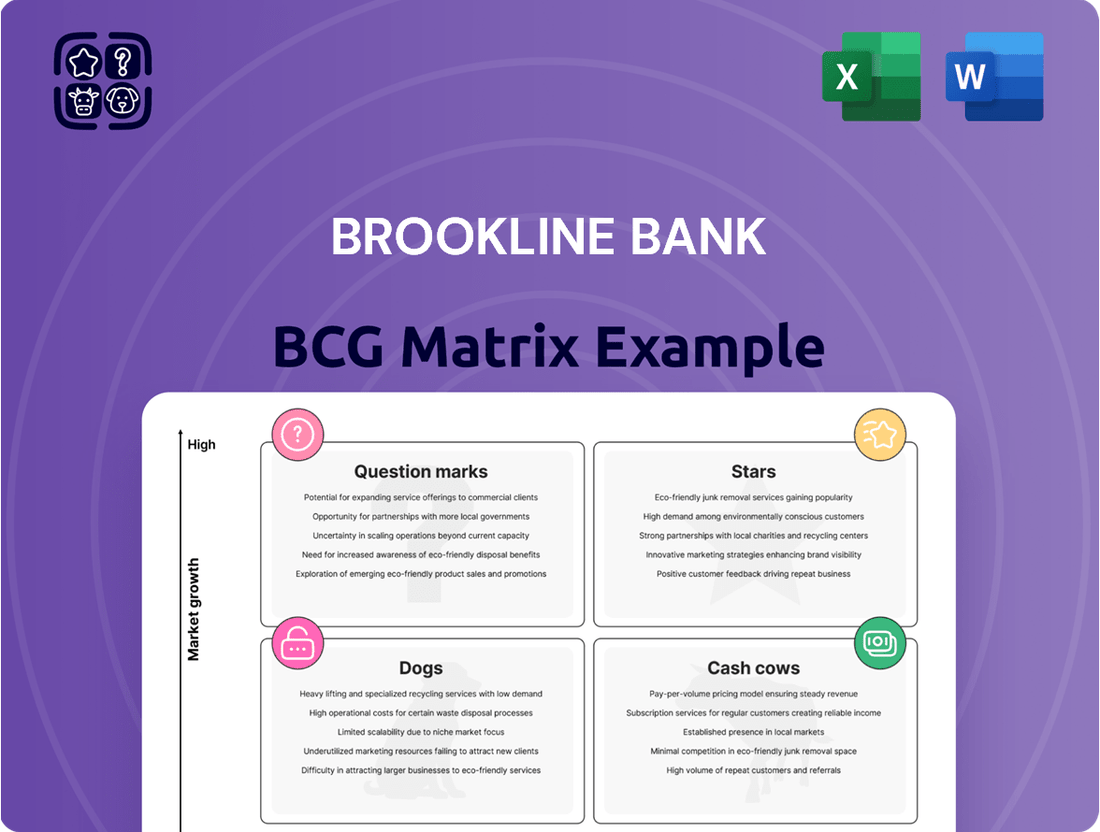

Curious about Brookline Bank's strategic positioning? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full picture!

Unlock the complete Brookline Bank BCG Matrix to gain a comprehensive understanding of their product portfolio's performance and potential. Purchase the full report for actionable insights and a clear roadmap to optimize your investments and product development strategies.

Stars

Brookline Bank is making a concerted effort to expand its presence in the Commercial and Industrial (C&I) loan sector. This strategic move highlights the bank's focus on a segment showing considerable potential for growth and profitability.

The bank's commitment to C&I lending is evident in its performance. In the second quarter of 2025, the commercial loan portfolio experienced a substantial increase of $53 million. This growth directly contributed to the bank's positive earnings, underscoring the success of this strategic initiative.

This intentional expansion into C&I lending positions it as a key driver of future growth for Brookline Bank. The bank is actively seeking to capture a larger share of this dynamic market.

Brookline Bancorp has shown impressive customer deposit growth, a key indicator of its market strength. In the second quarter of 2025, deposits grew by $58.3 million, reaching a total of $9.0 billion. This follows a substantial increase of $113.8 million in the first quarter of 2025.

This consistent rise in customer deposits signifies a growing and loyal customer base, which is vital for the bank's financial health and operational capacity. The strategic emphasis on attracting and retaining customer deposits over brokered deposits underscores a commitment to building a stable, high-market-share funding foundation.

Clarendon Private, Brookline Bancorp's wealth management arm, is a key player in their fee income strategy. This full-service firm caters to a broad clientele, including individuals, families, foundations, and endowments. Their focus on growing fee-based services, particularly wealth and asset management, began in 2022, demonstrating a clear commitment to this segment.

Brookline Bancorp is actively investing in its wealth management capabilities, evidenced by the recent addition of new financial advisors. This strategic move aims to bolster Clarendon Private's capacity to serve a growing market and enhance its fee income generation. For 2024, Brookline Bancorp reported that its wealth management segment contributed significantly to its overall revenue, with fee income showing a steady upward trend year-over-year.

Digital Banking Transformation

Brookline Bank is actively pursuing digital transformation, a strategic move reflected in its investment in new Online & Mobile Banking systems and a revamped website. These efforts are designed to elevate the customer experience and streamline operations, tapping into the significant industry-wide growth in digital banking. For instance, in 2024, the financial sector saw continued strong adoption of digital channels, with many banks reporting over 70% of customer interactions occurring online or via mobile apps.

The bank's commitment to digital innovation is further underscored by its upcoming core banking platform conversion, a critical step following its merger. This conversion is set to unlock a host of advanced digital capabilities, enhancing service offerings and competitive positioning. Such platform upgrades are crucial; a 2024 industry survey indicated that banks prioritizing core system modernization experienced a 15% increase in customer retention compared to those with legacy systems.

These digital initiatives place Brookline Bank's digital banking services in a strong position, aligning with the high-growth potential of the sector.

- Digital Investment: Introduction of new Online & Mobile Banking systems and website.

- Customer Experience Focus: Enhancing user interaction and accessibility.

- Operational Efficiency: Streamlining internal processes through digital tools.

- Future Capabilities: Core banking platform conversion to introduce new digital features.

Strategic Merger with Berkshire Hills Bancorp

The strategic merger with Berkshire Hills Bancorp represents a pivotal moment for Brookline Bank, aiming to establish a formidable regional banking presence. Upon completion, the combined entity is projected to manage around $24 billion in assets, significantly expanding its market reach and operational capacity. This consolidation is anticipated to unlock considerable growth opportunities by leveraging economies of scale and integrating complementary market footprints, thereby improving profitability.

The integration process is slated for February 2026, marking a clear timeline for the realization of the merged bank's strategic objectives and enhanced financial performance.

- Merger with Berkshire Hills Bancorp

- Projected combined assets: approximately $24 billion

- Key benefits: economies of scale, expanded market footprint, improved profitability

- System integration targeted for February 2026

Stars represent high-growth, high-market share business units within Brookline Bank's portfolio. These are areas where the bank has a strong competitive advantage and significant opportunities for further expansion. Investing in Stars is crucial for future revenue generation and market leadership. Brookline Bank's focus on Commercial and Industrial (C&I) lending, with a $53 million increase in its commercial loan portfolio in Q2 2025, exemplifies a Star business line. Similarly, the robust growth in customer deposits, up $58.3 million in Q2 2025 to $9.0 billion, indicates strong market share in a growing sector.

| Business Unit | Market Growth | Market Share | Strategic Focus |

|---|---|---|---|

| Commercial & Industrial Lending | High | Strong | Expansion and increased profitability |

| Customer Deposits | High | Strong | Building stable funding foundation |

What is included in the product

Brookline Bank's BCG Matrix offers strategic insights into its product portfolio, highlighting which units to invest in, hold, or divest.

Brookline Bank's BCG Matrix offers a clear, visual roadmap for strategic resource allocation, alleviating the pain of uncertainty in business unit investment.

Cash Cows

Brookline Bank's residential mortgage portfolio, offering fixed and adjustable-rate options, operates within the mature and stable Greater Boston market. This segment functions as a cash cow, generating consistent interest income for the bank.

Despite interest rate fluctuations, the mortgage market demonstrated resilience. In January 2025, mortgage activity in the Greater Boston area saw a notable 19% increase compared to January 2024, underscoring the steady demand and income potential of this portfolio.

Brookline Bank's established branch network, spanning Massachusetts, Rhode Island, and New York, represents a significant Cash Cow. This extensive physical presence in mature markets provides a stable platform for deposit gathering and customer service, ensuring consistent revenue generation.

These branches in established markets allow for reliable customer engagement and traditional banking operations. For instance, as of Q1 2024, Brookline Bank reported over $7.8 billion in total deposits, a testament to the strength of its branch network in attracting and retaining customer funds.

Brookline Bank's core commercial deposit accounts are a significant strength, holding a high market share within the Greater Boston area. These offerings are crucial for attracting and retaining business clients, acting as a stable and cost-effective funding base for the bank's lending operations.

Net Interest Income and Margin

Brookline Bancorp's net interest income and margin are key indicators of its core banking strength. The bank has shown a consistent ability to grow its net interest income, a testament to its effective management of loan portfolios and deposit bases.

The net interest margin (NIM) is a critical measure of profitability for banks. In the second quarter of 2025, Brookline Bancorp reported a stable and expanding NIM, reaching 3.32%. This figure highlights the bank's success in managing the spread between the interest it earns on assets, like loans, and the interest it pays on liabilities, such as deposits, even amidst fluctuating interest rate environments.

- Net Interest Income Growth: Brookline Bancorp has consistently generated growing net interest income, reflecting strong performance in its primary lending and deposit-taking operations.

- Net Interest Margin Expansion: The bank's net interest margin reached 3.32% in Q2 2025, demonstrating its capability to effectively manage funding costs and maximize profitability from its interest-earning assets.

- Future Outlook: The company projects further improvements in its net interest margin throughout the remainder of 2025, suggesting continued operational efficiency and favorable market conditions.

- Core Profitability Driver: The stable and expanding NIM underscores the bank's robust foundation in traditional banking activities, providing a reliable source of earnings.

Syndicated and Participated Loans

Brookline Bank's involvement in syndicated and participated loans likely positions these activities as cash cows within its business portfolio. While precise market share data for these specific loan types isn't publicly detailed, the bank's established presence in the Greater Boston commercial lending landscape, a mature market, suggests a stable and predictable income generation. These operations benefit from ongoing relationships with businesses, yielding consistent interest revenue with comparatively modest reinvestment needs for growth.

The bank's commercial loan portfolio, excluding areas where it may be strategically reducing focus, is a significant contributor to its financial stability. In 2024, the U.S. commercial and industrial loan portfolio saw continued demand, reflecting ongoing business activity. For instance, the Federal Reserve's Senior Loan Officer Opinion Survey on Bank Lending Practices throughout 2024 indicated generally stable, albeit sometimes tightening, credit standards for commercial and industrial loans, implying a consistent, albeit competitive, lending environment.

- Stable Income: Syndicated and participated loans generate consistent interest income from established commercial relationships.

- Mature Market Advantage: Operating in a mature market like Greater Boston provides a predictable revenue stream.

- Lower Growth Investment: These segments typically require less aggressive investment for market penetration compared to emerging areas.

- Contribution to Portfolio: The broader commercial loan portfolio, a key component, reflects ongoing business lending activity.

Brookline Bank's established branch network, a key component of its operations, functions as a cash cow. This extensive physical presence across Massachusetts, Rhode Island, and New York in mature markets offers a stable foundation for deposit gathering and customer service, ensuring consistent revenue generation.

These branches in established markets facilitate reliable customer engagement and traditional banking operations. For instance, as of Q1 2024, Brookline Bank reported over $7.8 billion in total deposits, a clear indicator of the strength of its branch network in attracting and retaining customer funds.

The bank's core commercial deposit accounts are a significant strength, holding a high market share within the Greater Boston area. These offerings are crucial for attracting and retaining business clients, acting as a stable and cost-effective funding base for the bank's lending operations, contributing to its overall profitability.

Brookline Bancorp's net interest income and margin are critical indicators of its core banking strength, demonstrating a consistent ability to grow net interest income through effective management of its loan portfolios and deposit bases.

| Segment | Description | Status | Key Metric | 2024 Data Point |

|---|---|---|---|---|

| Branch Network | Physical presence in MA, RI, NY | Cash Cow | Total Deposits | Over $7.8 billion (Q1 2024) |

| Commercial Deposits | High market share in Greater Boston | Cash Cow | Funding Base Stability | Consistent client retention |

| Net Interest Margin | Profitability from interest-earning assets | Cash Cow | Net Interest Margin (NIM) | 3.32% (Q2 2025) |

What You See Is What You Get

Brookline Bank BCG Matrix

The Brookline Bank BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report, designed for strategic insight, will be delivered without any watermarks or demo content, ensuring you get a professional and actionable analysis of Brookline Bank's business units.

Dogs

Brookline Bank is strategically scaling back its investment commercial real estate (CRE) loans, a move reflected in a $110 million reduction in this segment during the second quarter of 2025. This deliberate reduction signals a shift away from areas perceived as having lower growth potential and elevated risk profiles.

The ongoing challenges within the Boston office sector, a key component of their CRE portfolio, have directly impacted the bank. This stress has necessitated higher provisions for credit losses and resulted in net charge-offs, underscoring the segment's current difficulties.

Consequently, investment CRE loans are being de-emphasized by Brookline Bank. The bank's strategic focus is clearly moving towards sectors offering more robust growth prospects and a more favorable risk-reward balance, aligning with a more cautious approach to lending in this market.

Eastern Funding, a subsidiary of Brookline Bank, is actively winding down its specialty vehicle lending business. This strategic decision signals that this particular segment is being divested, likely due to its underperformance.

The move to exit specialty vehicle lending positions it as a 'dog' within Brookline Bank's broader BCG Matrix. This classification suggests the business unit exhibits low market share and low market growth, making it a candidate for divestment or harvesting.

Brookline Bank's brokered deposits have significantly declined, reflecting a strategic shift. In Q2 2025, these deposits fell by $8.5 million, following a substantial $104.0 million decrease in Q1 2025. This trend positions brokered deposits as a 'dog' within the bank's funding mix.

While brokered deposits can provide essential liquidity, a reduced reliance suggests a move towards more stable and cost-effective funding sources. This strategic adjustment is common for banks looking to improve their funding profile and reduce reliance on potentially volatile, higher-cost instruments.

Underperforming Legacy Products

Underperforming legacy products at Brookline Bank, much like in the broader banking sector, represent offerings that have struggled to keep pace with evolving customer expectations and technological advancements. These might include services that are heavily reliant on manual processes or have not been integrated with the bank's digital platforms. For instance, a significant portion of the banking industry in 2024 still grapples with the declining relevance of certain in-branch, paper-intensive services as consumers increasingly favor mobile banking and online account management. This can lead to a low market share and stagnation in growth for these specific product lines.

These legacy offerings often exhibit characteristics of a dog in the BCG matrix: low relative market share and low market growth. Examples could include outdated checking account structures or specialized loan products that have seen demand erode due to more competitive or streamlined alternatives. In 2023, for example, reports indicated that while digital banking adoption continued to rise, traditional paper statement requests and in-person transaction volumes for certain older account types remained stubbornly high, yet contributed minimally to overall revenue growth for many regional banks.

- Declining Demand: Products like physical check cashing services for non-customers or outdated wire transfer methods are seeing reduced usage.

- Low Profitability: The cost to maintain these services often outweighs the revenue generated, impacting net interest margins.

- Digitalization Gap: Failure to integrate these products into user-friendly mobile or online platforms alienates a growing customer base.

- Market Saturation: Many legacy product categories are mature, with little room for expansion, especially when competing against modern digital solutions.

Certain Non-Interest Income Streams

Certain non-interest income streams at Brookline Bank, like loan level derivative income, are showing weakness. This specific area saw a $0.9 million decrease in Q1 2025, impacting the bank's overall fee income growth. Such volatile or declining income sources, especially without a dominant market position, can be categorized as dogs within a BCG matrix framework.

- Loan Level Derivative Income Decline: Experienced a $0.9 million decrease in Q1 2025.

- Impact on Fee Income: Contributes to a broader challenge in growing fee income streams.

- BCG Matrix Classification: Potential classification as a 'dog' due to declining performance and volatility.

- Strategic Consideration: Requires evaluation for potential divestment or significant restructuring to improve profitability.

Eastern Funding's exit from specialty vehicle lending and Brookline Bank's reduced reliance on brokered deposits highlight segments with low market share and growth, fitting the 'dog' category in the BCG matrix. These areas, like underperforming legacy products and declining loan level derivative income, represent strategic challenges. The bank is actively managing these by scaling back or divesting, aiming for a more robust and profitable portfolio.

| Business Segment | BCG Classification | Key Financial Indicator (2025 Data) | Strategic Action |

|---|---|---|---|

| Specialty Vehicle Lending (Eastern Funding) | Dog | Winding down operations | Divestment/Harvesting |

| Brokered Deposits | Dog | -$8.5M decrease in Q2 2025 (following -$104.0M in Q1 2025) | Reduced reliance, seeking stable funding |

| Loan Level Derivative Income | Dog | -$0.9M decrease in Q1 2025 | Evaluation for restructuring/divestment |

Question Marks

Brookline Bank's recent expansions into markets like Lawrence and Wellesley Lower Falls in 2025 position these new branches as potential Stars in the BCG Matrix. These locations represent strategic investments aimed at capturing growth in communities with promising economic outlooks.

While these areas offer high growth potential, Brookline Bank's initial market share in these newly established branches is naturally low. This requires substantial investment to build brand awareness and customer acquisition, characteristic of a Star's early phase.

Brookline Bank's new first-time homebuyer programs, developed in collaboration with the Massachusetts Housing Partnership and the City of Boston, represent a strategic move to penetrate the growing first-time buyer market. These initiatives are designed to attract a demographic poised for future financial engagement, aligning with a high-growth potential objective.

While these programs signal a clear intent to capture market share, Brookline Bank's current standing within this specific first-time homebuyer segment is likely modest. This positions these offerings as question marks within the BCG matrix – high potential for growth, but currently holding a low market share.

Following the merger, Brookline Bank plans to launch advanced digital services, aiming to capture high-growth opportunities in the evolving banking sector. These services, extending beyond traditional online banking, represent a strategic push into new digital frontiers. While the potential is significant, the specific market share and adoption rates for these new offerings are still developing and represent an area of focus for the combined entity.

Targeted Commercial & Industrial Niche Markets

Brookline Bank's Commercial & Industrial (C&I) lending, while a strong performer overall, presents an opportunity to explore new, highly specialized niche markets within Greater Boston. These emerging sectors, though currently holding a small market share, are categorized as Question Marks in the BCG Matrix. For instance, the burgeoning life sciences and advanced manufacturing sectors in the region are prime candidates for this strategic focus. The bank's 2024 performance saw C&I loans grow by 8.5%, indicating a robust existing portfolio.

Developing these niche markets requires significant, targeted investment and strategic planning to assess their potential. Brookline Bank might consider focusing on areas like sustainable technology startups or specialized healthcare service providers. These ventures, while offering high growth potential, carry inherent risks and require careful evaluation to determine if they can transition into Stars or Dogs. The bank's commitment to innovation in 2024 included a 15% increase in its technology investment budget, which could be leveraged for these new ventures.

- Emerging Life Sciences: Focusing on biotech startups and pharmaceutical support services in the Kendall Square ecosystem.

- Advanced Manufacturing: Targeting companies involved in robotics, automation, and specialized materials production.

- Sustainable Technology: Supporting businesses in renewable energy, cleantech, and circular economy initiatives.

- Specialized Healthcare Services: Lending to niche healthcare providers and medical technology firms.

Expansion into New Geographic Areas via Acquisitions (Post-Merger)

Brookline Bancorp's expansion into new geographic areas, particularly following its merger with Berkshire Hills Bancorp, positions it to leverage its expanded footprint across New England and New York. This strategic move allows for deeper market penetration within existing territories and the potential introduction of new product offerings in nascent, high-growth sub-markets. For instance, the combined entity could focus on underserved suburban areas experiencing significant population influx and economic development, areas that currently represent potential growth opportunities but require targeted investment to capture substantial market share.

The integration of Berkshire Hills Bancorp's operations is expected to bolster Brookline's presence in key New England states and New York. This expansion creates opportunities to build upon the existing strengths of its subsidiaries, Bank Rhode Island and PCSB Bank, by introducing a wider array of financial products and services. The focus would be on identifying and developing specific sub-markets within these expanded regions that exhibit strong demographic trends and economic vitality, aiming to establish a commanding market presence.

- Geographic Expansion: Merger with Berkshire Hills Bancorp extends Brookline's reach into new markets in New England and New York.

- Market Penetration: Opportunities exist for deeper penetration in existing territories and new product launches in high-growth sub-markets.

- Strategic Investment: Nascent high-growth areas require strategic investment to gain significant market share, leveraging the combined entity's capabilities.

Brookline Bank's strategic focus on emerging niche markets within its Commercial & Industrial lending portfolio, such as sustainable technology and specialized healthcare, exemplifies its approach to Question Marks. These sectors, while currently holding a low market share, represent significant growth potential for the bank.

The bank's increased technology investment in 2024, up 15%, is a key enabler for developing these new ventures, allowing for targeted data analysis and tailored product development. This investment is crucial for assessing the viability and potential market capture within these nascent areas.

Brookline Bank's expansion into new geographic areas, particularly after its merger with Berkshire Hills Bancorp, creates opportunities to cultivate new sub-markets. These areas require strategic investment to build market share, aligning with the characteristics of Question Marks in the BCG Matrix.

The bank's new first-time homebuyer programs, designed to attract a growing demographic, also fall into the Question Mark category. While these initiatives aim for high growth, Brookline Bank's current market share in this specific segment is still developing.

| Business Area | Market Growth | Market Share | BCG Category | Strategic Focus |

|---|---|---|---|---|

| Emerging Life Sciences Lending | High | Low | Question Mark | Targeted investment, specialized product development |

| Advanced Manufacturing Lending | High | Low | Question Mark | Niche market penetration, tailored financial solutions |

| Sustainable Technology Financing | High | Low | Question Mark | Partnerships, innovation funding |

| Specialized Healthcare Services Lending | High | Low | Question Mark | Relationship building, risk assessment |

| New Geographic Sub-markets | High | Low | Question Mark | Market research, tailored product offerings |

| First-Time Homebuyer Programs | High | Low | Question Mark | Customer acquisition, brand building |

BCG Matrix Data Sources

Our Brookline Bank BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.