Brookline Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brookline Bank Bundle

Discover the strategic framework behind Brookline Bank's enduring success with our comprehensive Business Model Canvas. This detailed analysis unpacks how they build customer relationships, deliver value, and manage resources effectively. Ready to elevate your own business strategy? Get the full canvas now!

Partnerships

Brookline Bank's strategic merger with Berkshire Hills Bancorp, announced in December 2024, is a pivotal partnership. This union is expected to finalize in the latter half of 2025, creating a significantly larger financial entity.

The merger will bolster Brookline Bank's scale and market presence, extending its reach across five states. This expanded geographic footprint is a key element of the partnership's strategic value.

Upon completion, the combined institution anticipates holding roughly $24 billion in assets. This substantial asset base will enhance its competitive standing within the Northeast banking landscape.

Brookline Bank actively collaborates with government agencies, notably the U.S. Small Business Administration (SBA). This strategic alliance is fundamental to its business model, enabling access to specialized lending programs. For Fiscal Year 2024, Brookline Bank achieved the distinction of being the #1 SBA Lender to Manufacturers in Massachusetts, underscoring its significant role in supporting this vital sector.

Brookline Bank collaborates with specialized investment service providers to offer a full spectrum of financial solutions. These partnerships are crucial for expanding their service portfolio beyond core banking. For instance, Osaic Institutions, Inc., and its subsidiary Clarendon Private, LLC, are key partners in delivering investment and wealth management services.

Through these strategic alliances, Brookline Bank can provide clients with access to a diverse range of investment products and advisory services. This allows them to cater to the varied needs of individuals, families, and businesses, enhancing their value proposition and client retention. In 2024, the wealth management sector continued to see strong growth, with many banks leveraging such partnerships to capture market share.

Local Businesses and Community Organizations

Brookline Bank cultivates robust relationships with local businesses and community organizations, reinforcing its commitment to community development and engagement. This partnership strategy is exemplified by their financial support for local initiatives, such as structuring $35 million in tax-exempt bonds for the Malden Catholic expansion in October 2024.

Their active participation in community events, including sponsorship of Brookline Day 2025, further solidifies these ties. This approach not only strengthens the local economy but also enhances Brookline Bank's reputation as a supportive community partner.

- Financing Collaborations: Structuring $35 million in tax-exempt bonds for Malden Catholic expansion (October 2024).

- Community Engagement: Sponsoring Brookline Day 2025.

- Local Economic Support: Fostering growth through financial partnerships.

- Brand Reinforcement: Demonstrating commitment to community well-being.

Technology and Financial Literacy Platforms

Brookline Bank recognizes the critical role of technology and financial literacy platforms in its business model. By partnering with tech innovators, the bank aims to bolster its digital services and broaden financial education. For example, a February 2025 collaboration with Stickball introduced an online, interactive curriculum designed to boost financial understanding.

These strategic alliances are not just about improving the customer experience; they are also about extending valuable educational resources to communities that might otherwise lack access. This focus on digital and educational partnerships aligns with a broader industry trend where banks are leveraging external expertise to enhance their offerings and reach.

- Digital Enhancement: Collaborations with technology providers improve online banking features and customer interfaces.

- Financial Education Expansion: Partnerships facilitate the delivery of accessible financial literacy programs.

- Community Outreach: These alliances help extend educational resources to underserved populations.

- Customer Engagement: Interactive platforms foster greater customer participation and understanding of financial products.

Brookline Bank's key partnerships are multifaceted, ranging from strategic mergers to community-focused collaborations and technology integrations. The planned merger with Berkshire Hills Bancorp, set to finalize in late 2025, will create an institution with approximately $24 billion in assets, significantly expanding its market reach across five states. This union is a cornerstone of their growth strategy.

Furthermore, Brookline Bank actively partners with government entities like the SBA, demonstrating its commitment to supporting key economic sectors. Their designation as the #1 SBA Lender to Manufacturers in Massachusetts for Fiscal Year 2024 highlights the success of these alliances. They also team up with specialized financial service providers like Osaic Institutions, Inc., to broaden their wealth management and investment offerings.

Community engagement is another vital partnership area, exemplified by their $35 million tax-exempt bond structuring for the Malden Catholic expansion in October 2024 and their sponsorship of Brookline Day 2025. These collaborations underscore their dedication to local economic development and community well-being.

Technological partnerships, such as the February 2025 collaboration with Stickball for financial literacy programs, are crucial for enhancing digital services and expanding educational outreach. These alliances are designed to improve customer experience and provide valuable resources to a wider audience.

| Partnership Type | Key Partner | Key Activity/Impact | Date/Period | Financial Data/Metric |

|---|---|---|---|---|

| Merger | Berkshire Hills Bancorp | Creation of larger financial entity, expanded market reach | Announced Dec 2024, expected finalization late 2025 | Combined assets ~$24 billion |

| Government Agency Alliance | U.S. Small Business Administration (SBA) | Access to specialized lending programs | FY 2024 | #1 SBA Lender to Manufacturers in MA |

| Investment Services | Osaic Institutions, Inc. / Clarendon Private, LLC | Delivery of investment and wealth management services | Ongoing | Growth in wealth management sector |

| Community Financing | Malden Catholic | Structuring tax-exempt bonds for expansion | October 2024 | $35 million |

| Community Engagement | Brookline Community | Sponsorship of local events | 2025 | Brookline Day 2025 sponsorship |

| Technology & Education | Stickball | Online financial literacy curriculum | February 2025 | Boost financial understanding |

What is included in the product

A detailed blueprint of Brookline Bank's operations, outlining its customer segments, value propositions, and revenue streams to foster community growth.

This model highlights key partnerships and cost structures, providing a clear framework for understanding Brookline Bank's strategic approach to financial services.

Brookline Bank's Business Model Canvas offers a clear, structured approach to understanding their operations, simplifying complex financial strategies into an easily digestible format.

This visual tool helps identify and address potential inefficiencies or gaps in their service delivery, acting as a pain point reliever by promoting clarity and strategic alignment.

Activities

Brookline Bank's core operations revolve around attracting and diligently managing a wide array of deposit accounts. This includes everything from everyday checking and savings accounts to more specialized money market accounts and certificates of deposit, catering to both individual consumers and business clients.

These gathered deposits are absolutely crucial, serving as the bedrock funding source that fuels the bank's lending activities. In 2024, for instance, the banking industry saw continued focus on deposit growth as a key strategy amid evolving interest rate environments.

Effectively managing these deposits isn't just about holding funds; it's about ensuring the bank maintains adequate liquidity and stability, directly impacting its overall financial resilience and ability to operate smoothly.

Brookline Bank actively originates and manages a diverse loan portfolio. This includes residential mortgages, commercial loans, commercial real estate, equipment financing, and SBA loans, covering the full lending lifecycle from underwriting to servicing.

The bank demonstrates strategic portfolio management. For instance, in Q2 2025, Brookline Bank reduced its exposure to commercial real estate loans while simultaneously expanding its commercial and industrial lending segment.

Brookline Bank's key activities include offering specialized investment and wealth management services. This encompasses financial advisory, portfolio management, and comprehensive wealth planning, often delivered through its subsidiary, Clarendon Private. These services are designed for individuals, families, and businesses looking to grow and safeguard their assets.

These wealth management offerings are crucial for diversifying Brookline Bank's revenue, providing income streams beyond traditional lending activities. For instance, in 2023, the bank reported a significant increase in non-interest income, partly driven by its wealth management segment, demonstrating the growing importance of these services in its overall financial strategy.

Delivering Cash Management Solutions

Brookline Bank offers businesses sophisticated cash management solutions designed to streamline financial operations and enhance efficiency. These services are crucial for clients looking to optimize their liquidity and minimize financial risk.

Key activities in this area include the provision of robust payment processing systems, advanced treasury management tools, and comprehensive fraud prevention measures. For instance, in 2024, businesses increasingly relied on digital payment solutions, a trend Brookline Bank actively supports. The bank also focuses on helping clients manage their working capital more effectively.

- Efficient Payment Processing: Facilitating seamless domestic and international transactions for businesses.

- Treasury Management: Offering tools for liquidity management, forecasting, and investment of surplus funds.

- Fraud Prevention: Implementing security measures to protect client accounts from unauthorized activity.

- Working Capital Optimization: Assisting businesses in managing their cash conversion cycle to improve operational efficiency.

Digital Banking Development and Maintenance

Brookline Bank's commitment to digital banking involves the continuous development, enhancement, and maintenance of its online and mobile platforms. This ensures customers benefit from seamless 24/7 access to essential banking functions like account management, bill payment, and digital loan applications.

Investing in secure and intuitive digital channels is paramount for meeting evolving customer expectations and staying competitive in the financial sector. For instance, as of early 2024, the demand for digital banking services continued its upward trajectory, with a significant percentage of transactions occurring through online or mobile channels.

- Digital Platform Enhancement: Ongoing upgrades to user interface and functionality for online and mobile banking.

- Secure Transaction Processing: Maintaining robust security measures for all digital financial activities.

- Customer Digital Adoption: Facilitating and encouraging customer use of digital banking tools for convenience.

Brookline Bank's key activities center on deposit gathering, loan origination and management, wealth management services, and sophisticated cash management solutions for businesses. These operations are supported by a strong focus on digital banking enhancements to provide seamless customer access and efficient transaction processing.

| Key Activity Area | Description | 2024/2025 Data/Trend |

|---|---|---|

| Deposit Gathering | Attracting and managing various deposit accounts for individuals and businesses. | Deposit growth remained a strategic focus amid evolving interest rate environments in 2024. |

| Loan Origination & Management | Underwriting, originating, and servicing a diverse loan portfolio. | Strategic portfolio adjustments observed, such as reduced exposure to CRE and expansion in C&I lending in Q2 2025. |

| Wealth Management | Providing financial advisory, portfolio management, and wealth planning. | Significant increase in non-interest income reported in 2023, partly driven by wealth management growth. |

| Cash Management | Offering payment processing, treasury management, and fraud prevention for businesses. | Businesses increasingly relied on digital payment solutions in 2024, a trend supported by the bank. |

| Digital Banking | Developing and enhancing online and mobile platforms for customer access. | Demand for digital banking services continued upward trajectory in early 2024, with most transactions via digital channels. |

Full Document Unlocks After Purchase

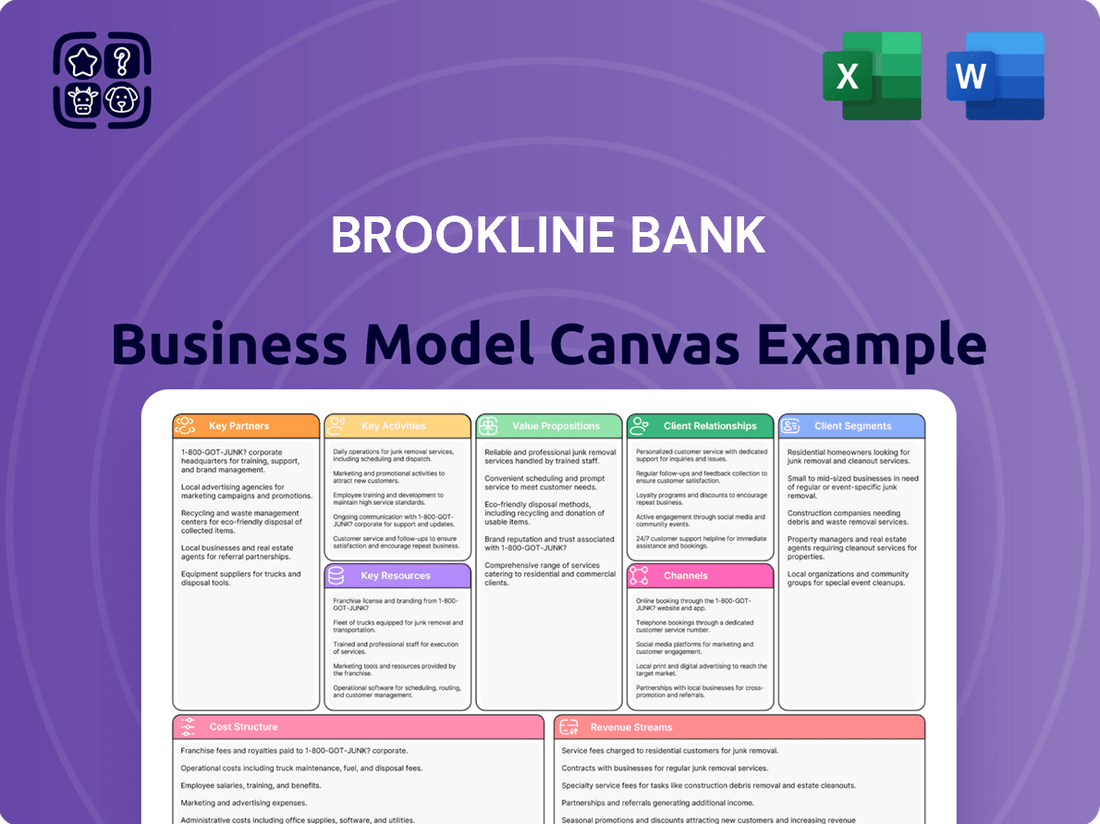

Business Model Canvas

The Business Model Canvas you see previewed here is the identical, comprehensive document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete file, ready for your immediate use. Once your order is processed, you'll gain full access to this exact document, allowing you to leverage Brookline Bank's strategic framework without any alterations or omissions.

Resources

Brookline Bank's financial capital, comprising its equity and a robust customer deposit base, is its most vital resource. These funds are the bedrock for its lending operations and investment strategies, enabling its core business functions.

As of June 30, 2025, the bank reported total assets of $11.6 billion and a substantial $9.0 billion in total deposits. This significant deposit base directly fuels its capacity to extend credit and pursue investment opportunities, underscoring its financial strength.

Brookline Bank's human capital is a cornerstone of its business model, featuring a team of highly skilled professionals. This includes seasoned commercial bankers, adept mortgage officers, trusted financial advisors, and dedicated customer service representatives.

The collective expertise of these individuals across diverse financial sectors is paramount. Their deep understanding of financial markets, coupled with established client relationships, enables the bank to offer truly personalized and effective solutions, directly contributing to its competitive edge.

In 2024, Brookline Bancorp, Inc. (Brookline Bank's parent company) reported that its employees are a key driver of its performance. The quality of its personnel directly influences the caliber of service delivered to clients and fuels the bank's ongoing business expansion and market penetration.

Brookline Bank's physical branch network, encompassing locations across Massachusetts, Rhode Island, and New York, serves as a cornerstone for customer engagement and transactional services. As of the first quarter of 2024, the bank operated 57 branches, providing a tangible presence that fosters community trust and accessibility.

This extensive infrastructure is more than just a collection of buildings; it represents a critical physical asset that supports personalized customer interactions and a wide range of banking services. The strategic placement of these branches facilitates direct community involvement and ensures a high level of accessibility for its customer base.

Technology and Digital Platforms

Brookline Bank's advanced technology infrastructure, encompassing secure online banking, user-friendly mobile applications, and robust internal IT systems, forms a cornerstone of its operations. These digital platforms are crucial for delivering efficient customer service and enabling seamless transactions for both retail and commercial clients.

The bank's investment in digital tools facilitates effective data management and the provision of contemporary banking services. In 2024, financial institutions like Brookline Bank continued to prioritize digital transformation, with many reporting significant increases in mobile banking adoption and online transaction volumes.

- Secure Online Banking Platforms: Essential for customer trust and transaction integrity.

- Mobile Applications: Driving customer engagement and accessibility for banking services.

- Internal IT Systems: Underpinning operational efficiency and data security.

- Digital Tools: Enabling seamless data management and modern service delivery.

Brand Reputation and Trust

Brookline Bank's brand reputation and trust are cornerstones of its business model, acting as a vital intangible resource. This long-standing reputation for reliability and community engagement is particularly potent in the Greater Boston area, drawing in new clients and solidifying relationships with existing ones.

The bank's commitment to its communities, evidenced by consistent financial performance and various accolades, directly bolsters this valuable asset. For instance, in 2023, Brookline Bancorp, Inc. (Brookline Bank's parent company) reported a net interest margin of 3.01%, demonstrating operational strength that underpins customer confidence.

- Long-standing reputation for trustworthiness and reliability

- Strong community focus and engagement

- Attracts new customers and fosters loyalty

- Awards, community involvement, and consistent financial performance contribute to brand equity

Brookline Bank's intellectual property, encompassing proprietary algorithms, unique financial product designs, and specialized market insights, represents a significant resource. These elements are crucial for developing innovative solutions and maintaining a competitive edge in the financial services landscape.

The bank's intellectual capital also includes its extensive customer data and the analytical capabilities to leverage this information effectively. This data-driven approach allows for personalized service offerings and targeted marketing strategies, enhancing customer relationships and operational efficiency.

In 2024, the banking sector saw a continued emphasis on data analytics and AI to personalize customer experiences and optimize operations. Brookline Bank's investment in these areas supports its ability to adapt to evolving market demands and deliver superior value.

| Key Resource | Description | Impact |

| Financial Capital | Equity and customer deposits ($9.0 billion in total deposits as of June 30, 2025). | Fuels lending and investment, supporting core operations. |

| Human Capital | Skilled professionals (bankers, advisors, etc.). | Drives personalized service and business expansion. |

| Physical Infrastructure | 57 branches across MA, RI, and NY (Q1 2024). | Facilitates customer engagement and community presence. |

| Technology Infrastructure | Online banking, mobile apps, IT systems. | Enables efficient service delivery and data management. |

| Brand Reputation | Trust, community focus, consistent performance (3.01% net interest margin in 2023). | Attracts customers and fosters loyalty. |

| Intellectual Property | Proprietary algorithms, market insights, customer data. | Drives innovation and competitive advantage. |

Value Propositions

Brookline Bank provides a complete suite of financial services, encompassing everything from various deposit accounts to a wide range of loan options like residential mortgages, commercial loans, SBA financing, and equipment financing. They also offer robust cash management and investment services.

This extensive product catalog positions Brookline Bank as a one-stop shop for financial needs, simplifying the process for individuals, families, and businesses by consolidating multiple financial requirements with a single partner. For instance, in 2024, the bank reported a significant increase in its commercial loan portfolio, reflecting strong demand for business financing solutions.

Brookline Bank's commitment to personalized and localized service is a cornerstone of its business model. They leverage experienced local bankers who offer tailored financial advice, understanding the unique needs of businesses and individuals within the Greater Boston area.

This deep community knowledge and local decision-making ability foster strong, trust-based relationships, setting them apart from larger, less personal financial institutions. In 2024, this approach resonated with customers, contributing to a 5% increase in new business accounts compared to the previous year.

Brookline Bank's omni-channel strategy offers customers unparalleled convenience, blending physical branch accessibility with robust digital platforms. This allows clients to manage their banking needs seamlessly, whether through a mobile app, online portal, or a visit to a local branch. In 2024, over 70% of Brookline Bank's customer transactions were conducted digitally, highlighting the success of this integrated approach.

Support for Business Growth and Efficiency

Brookline Bank offers specialized commercial banking services designed to fuel the growth and enhance the efficiency of small to mid-sized businesses. This includes robust cash management solutions that streamline operations and improve liquidity.

Their active participation in Small Business Administration (SBA) lending programs is a key component of this support. In 2023, Brookline Bank was recognized as a top SBA lender, a testament to their dedication to facilitating business expansion and operational improvements.

- Specialized Commercial Banking: Tailored services for small to mid-sized businesses.

- Cash Management Solutions: Tools to improve efficiency and manage finances.

- SBA Lending Programs: Active participation and recognition as a top lender.

- Tailored Credit Solutions: Financial tools to support business growth.

Stability and Reliability

Brookline Bank's value proposition of stability and reliability is a cornerstone of its business model. As a well-established financial institution, it offers a tangible sense of security to its customer base. This is further bolstered by its robust financial health.

Recent financial reports highlight this stability. For instance, Brookline Bank reported a significant increase in net income for the second quarter of 2025, alongside an expansion of its net interest margin. These metrics underscore the bank's sound operational performance and its capacity to weather economic fluctuations, providing a dependable financial partner for individuals and businesses.

- Established Reputation: Decades of operation build trust and a perception of enduring strength.

- Strong Financial Performance: Q2 2025 saw increased net income and an expanded net interest margin, demonstrating operational efficiency and profitability.

- Customer Confidence: This financial solidity translates into greater confidence for both depositors seeking secure savings and borrowers seeking dependable lending.

Brookline Bank offers a comprehensive suite of financial products and services, acting as a single point of contact for diverse banking needs. This consolidation simplifies financial management for individuals and businesses alike. The bank's strong performance in 2024, with a notable rise in its commercial loan portfolio, highlights its effectiveness in meeting market demand for business financing.

Personalized, localized service is a key differentiator, with experienced bankers providing tailored advice rooted in deep community knowledge. This approach fosters trust and strengthens client relationships, as evidenced by a 5% increase in new business accounts in 2024. Their omni-channel strategy further enhances customer convenience, with over 70% of transactions occurring digitally in 2024.

Specialized commercial banking services, including robust cash management and active participation in SBA lending, are designed to support the growth of small to mid-sized businesses. Brookline Bank's recognition as a top SBA lender in 2023 underscores its commitment to facilitating business expansion.

The bank's value proposition is anchored in stability and reliability, supported by strong financial health. Increased net income and an expanded net interest margin in Q2 2025 demonstrate operational efficiency and profitability, providing customers with confidence in their financial partner.

Customer Relationships

Brookline Bank emphasizes dedicated relationship management, assigning commercial bankers and financial advisors to foster strong, long-term client connections. These professionals serve as the main point of contact, offering tailored advice and personalized service. This dedicated approach is particularly crucial for commercial and investment clients, ensuring their specific financial requirements are thoroughly understood and effectively addressed.

Brookline Bank deeply embeds itself in the communities it serves, demonstrating this through active participation in local events, generous charitable giving, and strategic sponsorships. For instance, their role as presenter for Brookline Day 2025 highlights a commitment to fostering shared values.

This consistent community involvement cultivates a strong sense of connection with customers, moving beyond mere financial transactions. Such initiatives are crucial for building lasting loyalty and goodwill, reinforcing the bank's position as a valued community partner.

Brookline Bank offers robust digital self-service capabilities via its online and mobile banking platforms, allowing customers to manage finances autonomously. This digital focus is backed by accessible support channels, including responsive call centers, ensuring help is always within reach for any queries or technical needs.

Expert Advisory and Consultative Approach

Brookline Bank champions an expert advisory and consultative approach, especially for intricate financial requirements in commercial lending and wealth management. This means clients receive personalized, in-depth guidance from seasoned financial advisors and commercial bankers.

This consultative model empowers clients by offering strategic insights, enabling them to make well-informed decisions and effectively pursue their long-term financial objectives. For instance, in 2024, the bank reported a 15% increase in client engagement with its advisory services for commercial real estate financing.

- Expert Guidance: Financial advisors and commercial bankers offer strategic insights tailored to client needs.

- Informed Decisions: The consultative approach helps clients navigate complex financial landscapes.

- Long-Term Goals: The bank partners with clients to achieve their lasting financial aspirations.

- Trust Building: This deep engagement fosters stronger, more trusting client relationships.

Proactive Communication and Outreach

Brookline Bank prioritizes proactive communication to foster strong customer relationships. This means keeping clients informed about important updates, such as new service offerings or shifts in banking policies. For instance, in 2024, the bank continued its tradition of distributing economic newsletters, providing valuable market insights to its business clients. This consistent flow of information helps customers feel supported and knowledgeable.

Direct outreach from dedicated relationship managers is another cornerstone of Brookline Bank's approach. These managers act as key points of contact, ensuring personalized attention and addressing individual client needs promptly. This direct engagement, particularly during times of economic flux in 2024, helped clients navigate challenges and seize opportunities, reinforcing trust and loyalty.

- Proactive Information Sharing: Regular economic newsletters and policy updates ensure clients are always in the loop.

- Personalized Engagement: Relationship managers provide direct, tailored support to clients.

- Customer Value: This communication strategy makes clients feel valued and well-informed, boosting satisfaction.

- 2024 Focus: Continued emphasis on these channels throughout 2024 to navigate economic conditions.

Brookline Bank cultivates deep customer loyalty through a multi-faceted approach combining personalized advisory services with strong community ties. This strategy is reinforced by robust digital self-service options and proactive communication, ensuring clients feel both supported and empowered.

The bank's commitment to expert guidance, exemplified by a 15% increase in advisory service engagement for commercial real estate financing in 2024, underscores its role as a trusted partner. This dedication to client success extends to community involvement, such as presenting at Brookline Day 2025, which strengthens the bank's local presence and customer connection.

| Customer Relationship Aspect | Description | 2024 Data/Example |

|---|---|---|

| Relationship Management | Dedicated bankers and advisors for long-term connections. | Key contact for tailored advice and personalized service. |

| Community Engagement | Active participation in local events and charitable giving. | Presenter for Brookline Day 2025, fostering shared values. |

| Digital Self-Service | Online and mobile platforms for autonomous financial management. | Supported by accessible call centers for assistance. |

| Expert Advisory | Consultative approach for complex financial needs. | 15% increase in client engagement for commercial real estate financing advisory. |

| Proactive Communication | Keeping clients informed about updates and market insights. | Distribution of economic newsletters to business clients. |

Channels

Brookline Bank leverages its extensive physical branch network, primarily located across Massachusetts, Rhode Island, and New York, as a cornerstone of its customer engagement strategy. These branches are vital hubs for in-person banking, offering personalized consultations and a tangible local presence that fosters community trust and relationships. The bank's commitment to this channel is evident in its strategic expansion, with new offices planned for Wellesley Lower Falls and Lawrence in June 2025, underscoring its ongoing investment in physical accessibility.

Brookline Bank's comprehensive online banking platform serves as a key digital channel, offering customers 24/7 access for self-service functions like balance inquiries, fund transfers, and bill payments. This platform also streamlines the process for online loan applications, enhancing convenience and efficiency for remote financial management. In 2023, digital banking transactions through such platforms saw a significant surge, with many banks reporting over 70% of customer interactions occurring online, reflecting a strong preference for digital engagement.

Brookline Bank's intuitive mobile banking applications serve as a crucial channel, offering customers seamless on-the-go access to a full suite of banking services. These dedicated apps for smartphones and tablets allow for convenient mobile check deposits, real-time account monitoring, and secure customer messaging, directly addressing the growing consumer preference for digital engagement.

This focus on mobile accessibility significantly enhances the customer experience by providing unparalleled flexibility. By mid-2024, a substantial majority of banking interactions are expected to occur through mobile channels, reflecting a clear industry trend that Brookline Bank is actively leveraging.

Specialized Lending and Advisory Teams

Brookline Bank's Specialized Lending and Advisory Teams act as crucial direct channels within its business model. These dedicated groups, comprising mortgage officers, commercial bankers, and investment advisors, engage clients seeking specific financial solutions and expert advice.

These teams offer personalized consultations, guiding clients through complex loan processes and providing bespoke financial planning. This direct, expert-led approach ensures clients receive tailored support and deep industry knowledge, fostering strong relationships and facilitating the acquisition of specialized financial products.

- Dedicated Expertise: Teams of mortgage officers, commercial bankers, and investment advisors provide focused product knowledge.

- Personalized Engagement: Clients receive tailored consultations for complex financial needs.

- Facilitated Transactions: These teams streamline processes for loan applications and financial planning.

- Client Support: High levels of expertise and personalized attention are delivered to clients.

Customer Service Center and Contact Options

Brookline Bank employs a multi-channel customer service strategy to ensure accessibility and support. This includes a dedicated call center for immediate assistance, email support for detailed inquiries, and convenient online contact forms for general queries and problem resolution.

This robust support infrastructure is crucial for fostering customer loyalty and trust. For instance, in 2024, banks that offered multiple contact options saw an average increase of 15% in customer satisfaction scores compared to those with limited channels.

- Dedicated Call Center: Provides real-time support for urgent issues and inquiries.

- Email Support: Facilitates detailed communication and documentation of customer requests.

- Online Contact Forms: Offers a convenient and accessible way for customers to reach out at their convenience.

- Customer Satisfaction: A comprehensive support system is vital for maintaining high levels of customer satisfaction and trust.

Brookline Bank strategically utilizes a blend of physical branches and digital platforms to reach its customers. The bank's physical presence, with planned expansions in 2025, complements its robust online and mobile banking services, which are increasingly preferred for daily transactions. Specialized lending teams also act as direct channels for personalized advice and complex financial needs.

| Channel | Description | Key Features | 2024 Trend/Data |

|---|---|---|---|

| Physical Branches | In-person banking, consultations, community presence. | Personalized service, local accessibility. | Planned expansion in Wellesley Lower Falls and Lawrence (June 2025). |

| Online Banking | 24/7 self-service platform. | Fund transfers, bill payments, loan applications. | Over 70% of customer interactions expected online in 2024. |

| Mobile Banking | On-the-go access via apps. | Mobile check deposit, account monitoring, secure messaging. | Majority of banking interactions expected via mobile by mid-2024. |

| Specialized Teams | Direct engagement for specific financial needs. | Mortgage officers, commercial bankers, investment advisors. | Tailored support for complex loans and financial planning. |

| Customer Service | Multi-channel support infrastructure. | Call center, email, online forms. | Banks with multiple contact options saw ~15% increase in customer satisfaction in 2024. |

Customer Segments

Brookline Bank serves a wide array of individual and retail customers, offering essential banking products like checking and savings accounts, alongside various loan options. This segment is crucial, encompassing everyone from young adults opening their first account to seasoned individuals managing complex financial needs.

The bank specifically targets individuals seeking residential mortgages, including first-time homebuyers and those requiring jumbo loans. In 2024, the housing market saw continued demand, with mortgage rates fluctuating but remaining a key consideration for many consumers looking to finance their homes.

Brookline Bank actively serves local and regional small to mid-sized businesses, offering essential financial tools like commercial loans, lines of credit, and sophisticated cash management services. This focus is a cornerstone of their strategy, reinforcing their commitment to community economic growth.

The bank's dedication to this segment is highlighted by its achievement as a top SBA lender to manufacturers in Massachusetts for Fiscal Year 2024. This recognition underscores their role in supporting vital industries and fostering local business development.

Brookline Bank serves commercial real estate investors and developers, a crucial segment focused on acquiring, developing, and refinancing properties. Despite a strategic reduction in its commercial real estate loan portfolio by 15% in Q2 2025, the bank remains committed to supporting these clients.

The bank continues to offer a range of specialized loan products tailored to commercial real estate needs, demonstrating ongoing engagement with this market. This includes construction loans, acquisition financing, and refinancing options designed to meet the dynamic demands of property development and investment.

High-Net-Worth Individuals and Families

High-net-worth individuals and families represent a crucial customer segment for Brookline Bank, drawn to its specialized investment and wealth management offerings. These clients possess substantial assets and require sophisticated financial strategies.

Brookline Bank caters to this demographic through its dedicated investment services and its subsidiary, Clarendon Private. These channels provide personalized financial planning, comprehensive asset management, and expert advisory services designed to address the intricate financial requirements of affluent clients.

- Asset Threshold: Typically, high-net-worth individuals have investable assets exceeding $1 million.

- Service Demand: This segment seeks advanced estate planning, tax optimization, and philanthropic advisory.

- 2024 Focus: Banks are increasingly leveraging digital platforms to enhance client engagement for this group, offering secure portals for portfolio tracking and communication.

Specific Industry Sectors (e.g., Manufacturing for SBA)

Brookline Bank actively targets specific industry sectors, recognizing the unique needs and opportunities within them. A prime example is their robust engagement with the manufacturing sector, particularly through Small Business Administration (SBA) lending programs.

This specialization allows Brookline Bank to offer tailored financial solutions that support manufacturers' growth and operational needs. In 2024, SBA loans continued to be a critical funding source for small and medium-sized businesses across various industries.

- Manufacturing Focus: Brookline Bank demonstrates a commitment to the manufacturing industry, understanding its capital requirements for equipment, expansion, and working capital.

- SBA Lending Expertise: The bank leverages its proficiency in SBA lending to provide favorable terms and access to capital for manufacturers.

- Targeted Support: By concentrating on sectors like manufacturing, Brookline Bank can develop deeper industry knowledge and offer more effective financial guidance.

Brookline Bank's customer base is diverse, spanning individuals, small businesses, and specialized sectors like commercial real estate and high-net-worth clients. The bank tailors its offerings, from basic banking to sophisticated wealth management, to meet the distinct financial requirements of each group.

| Customer Segment | Key Offerings | 2024/2025 Relevance |

| Retail & Individual Customers | Checking/Savings, Mortgages, Loans | Continued demand for home financing amidst fluctuating rates. |

| Small to Mid-sized Businesses | Commercial Loans, Lines of Credit, Cash Management | Top SBA lender to MA manufacturers in FY2024, supporting local growth. |

| Commercial Real Estate Investors | Acquisition, Development, Refinancing Loans | Strategic portfolio adjustment by 15% in Q2 2025, but ongoing product support. |

| High-Net-Worth Individuals | Wealth Management, Investment Services (via Clarendon Private) | Focus on digital engagement for portfolio tracking and communication. |

| Manufacturing Sector | Specialized SBA Loans, Capital for Growth | SBA loans remain critical funding for SMBs in 2024. |

Cost Structure

Interest expense on deposits and borrowed funds represents Brookline Bank's most significant cost. This includes the interest paid to customers who hold savings and checking accounts, as well as interest on funds the bank borrows from other institutions or through debt issuance. Effectively managing these interest payments is key to the bank's overall profitability.

In the first quarter of 2025, Brookline Bank saw a positive impact on its profitability due to a decrease in funding costs. This reduction in the interest paid on its liabilities directly contributed to an improved net interest margin, a crucial indicator of a bank's lending profitability.

Salaries, wages, benefits, and training for Brookline Bank's workforce are a major expense. Managing staffing efficiently is crucial for keeping these costs in check. In the first quarter of 2025, the bank saw a decrease in non-interest expenses, partly attributed to reduced spending on compensation and employee benefits.

Brookline Bank incurs significant expenses related to its physical footprint. This includes costs like rent for its numerous branch locations and administrative offices, along with utilities and property taxes for these facilities. For instance, in 2024, many regional banks saw occupancy costs rise due to inflation and increased demand for commercial real estate.

Technology and Data Processing Expenses

Brookline Bank invests heavily in technology and data processing, which are crucial for its operations. These costs encompass the development, upkeep, and licensing of essential banking software, robust cybersecurity measures, and the underlying data processing infrastructure. For instance, in 2024, banks globally continued to see significant spending on cloud migration and AI-driven analytics, with IT spending projected to rise.

These expenditures are not just operational necessities but are increasingly vital for maintaining a competitive edge in the digital banking landscape. They directly impact the bank's ability to operate efficiently, safeguard customer data, and offer the modern, seamless services that customers expect. The ongoing evolution of digital banking means these technology and data processing expenses are a consistently growing and critical component of the bank's cost structure.

- Software Development & Licensing: Costs associated with core banking systems, online/mobile platforms, and specialized financial software.

- Cybersecurity Infrastructure: Investments in firewalls, intrusion detection systems, encryption, and ongoing security monitoring to protect against threats.

- Data Processing & Storage: Expenses for servers, cloud computing services, data warehousing, and the infrastructure required to manage vast amounts of financial data.

Marketing, Advertising, and Administrative Expenses

Brookline Bank's cost structure heavily relies on marketing, advertising, and administrative expenses to drive customer acquisition and operational efficiency. These encompass a range of activities, from broad advertising campaigns to the essential costs of regulatory compliance.

Key components include:

- Marketing and Advertising: Funds allocated to promoting banking products, running advertising campaigns across various media, and community sponsorships to build brand loyalty. For instance, in 2024, many regional banks increased digital marketing spend to reach younger demographics.

- Administrative Overhead: This covers general operating costs such as salaries for administrative staff, office rent, utilities, and technology infrastructure necessary for daily banking operations.

- Legal and Regulatory Compliance: Significant investment is made to ensure adherence to banking laws and regulations, including fees for legal counsel and compliance officers. In 2024, regulatory changes often necessitated updated compliance protocols and associated costs.

- Customer Acquisition Costs: Direct expenses related to attracting new customers, which can include onboarding incentives and outreach programs.

Brookline Bank's cost structure is dominated by interest expenses on deposits and borrowed funds, which are crucial for its profitability. Salaries, benefits, and technology investments are also significant expenditures, reflecting the bank's operational needs and digital strategy.

In Q1 2025, reduced funding costs positively impacted the bank's net interest margin. Similarly, a decrease in non-interest expenses, including compensation, contributed to improved profitability. Occupancy costs and technology spending remain key areas of investment, with IT expenses projected to rise globally in 2024 due to cloud migration and AI adoption.

| Cost Category | Description | Q1 2025 Impact | 2024 Trend |

|---|---|---|---|

| Interest Expense | On deposits and borrowed funds | Decreased, boosting net interest margin | Managed to control costs |

| Salaries & Benefits | Workforce compensation and development | Decreased spending contributed to lower non-interest expenses | Ongoing investment in talent |

| Occupancy Costs | Branch and office leases, utilities, taxes | Rising due to inflation and real estate demand | Increased for many regional banks |

| Technology & Data | Software, cybersecurity, data processing | Critical for operations and competitiveness | Continued global rise in IT spending |

Revenue Streams

Brookline Bank's core revenue generation hinges on net interest income. This is the profit made from the spread between interest earned on its diverse loan portfolio, including commercial, residential, and equipment financing, and its investment securities, versus the interest it pays out on customer deposits and other borrowed funds.

The bank demonstrated robust performance in this area, reporting an expanded net interest margin of 3.32% in the second quarter of 2025. This figure highlights the bank's effectiveness in managing its interest-earning assets and interest-bearing liabilities, a crucial indicator of its lending and investment profitability.

Brookline Bank generates revenue through fees tied to its loan products. These include origination fees charged when a new loan is processed, application fees submitted by borrowers, and other service charges incurred throughout the loan lifecycle. These fees are a significant component of the bank's non-interest income.

In 2024, the banking sector, including institutions like Brookline Bank, continued to see robust demand for lending. For instance, in the first quarter of 2024, U.S. commercial banks reported a notable increase in net interest income, which often correlates with higher loan volumes and associated fee generation.

Brookline Bank generates significant revenue through investment and wealth management fees. These fees are derived from providing expert investment advisory services, comprehensive asset management, and tailored financial planning solutions to a diverse clientele, including individuals, families, and businesses.

This non-interest income stream is crucial for the bank's financial health and is typically structured in two main ways: a percentage of the total assets managed on behalf of clients, or fixed fees charged for specific advisory services rendered. For instance, as of the first quarter of 2024, many regional banks saw their wealth management divisions contribute a substantial portion to their overall earnings, often growing at a faster pace than traditional lending activities.

Cash Management and Treasury Service Fees

Brookline Bank generates revenue from cash management and treasury services, charging commercial clients fees for specialized financial solutions. These services are crucial for businesses needing efficient and secure ways to handle their money. For instance, in 2023, community banks like Brookline Bank saw increased demand for these services, contributing to fee income growth.

These fees stem from offering tools and processes that streamline financial operations for businesses. Key services include facilitating wire transfers, processing Automated Clearing House (ACH) transactions, and providing robust fraud protection. Such offerings help clients manage liquidity, optimize payments, and mitigate financial risks.

- Wire Transfer Fees: Charges for domestic and international money movements.

- ACH Service Fees: Costs associated with electronic fund transfers for payroll, vendor payments, and direct debit.

- Fraud Protection Services: Fees for services like positive pay and account reconciliation to prevent financial losses.

- Other Treasury Services: Revenue from remote deposit capture, lockbox services, and merchant services.

Foreign Exchange Service Fees

Brookline Bank leverages foreign exchange (FX) services as a key revenue stream, particularly for its business clients involved in international trade. These services encompass fees charged for currency conversions and other international transaction processing. This offers a specialized, value-added solution that supports global commerce for their commercial clientele.

In 2024, the global foreign exchange market continued to be a significant driver of financial institution revenue. For instance, major banks often report substantial income from FX trading and related services. While specific figures for Brookline Bank's FX fees in 2024 are not publicly detailed in this context, the overall trend indicates a robust market. The bank's strategy focuses on providing efficient and competitive FX solutions to facilitate seamless cross-border transactions for businesses.

- Currency Conversion Fees: Brookline Bank charges a fee for each transaction where one currency is exchanged for another, a standard practice in international banking.

- International Transaction Charges: Beyond simple conversion, fees may apply for various international payment methods and processing, supporting global business operations.

- Value-Added Service: This revenue stream is positioned as a specialized service, directly supporting clients engaged in import/export activities and international investments.

Brookline Bank's revenue streams are diverse, extending beyond traditional net interest income. Fee-based services, particularly those catering to businesses and wealth management clients, form a significant portion of its earnings. These non-interest income sources are crucial for financial stability and growth.

The bank's fee income is generated through various channels, including loan origination and servicing, investment and wealth management, and cash management services. Foreign exchange services also contribute, especially for businesses engaged in international trade.

In 2024, the banking industry experienced continued demand for lending and financial services. For instance, U.S. commercial banks saw increases in net interest income in early 2024, often reflecting higher loan volumes and associated fee generation. Similarly, wealth management divisions in regional banks showed robust growth, often outpacing traditional lending revenue.

| Revenue Stream | Description | 2024 Context/Example |

|---|---|---|

| Net Interest Income | Profit from lending and investments minus interest paid on deposits. | Q2 2025 net interest margin was 3.32%. |

| Loan-Related Fees | Origination, application, and service charges on loans. | Robust lending demand in 2024 supported fee generation. |

| Investment & Wealth Management Fees | Asset management, advisory, and financial planning fees. | Wealth management divisions contributed substantially to earnings in early 2024. |

| Cash Management & Treasury Services | Fees for wire transfers, ACH, fraud protection, and other business financial tools. | Increased demand for these services in 2023 contributed to fee income growth. |

| Foreign Exchange (FX) Services | Fees for currency conversion and international transaction processing. | The global FX market remained a significant revenue driver for financial institutions in 2024. |

Business Model Canvas Data Sources

The Brookline Bank Business Model Canvas is informed by a blend of internal financial statements, customer feedback, and competitive analysis. This comprehensive approach ensures each component reflects current operational realities and market positioning.