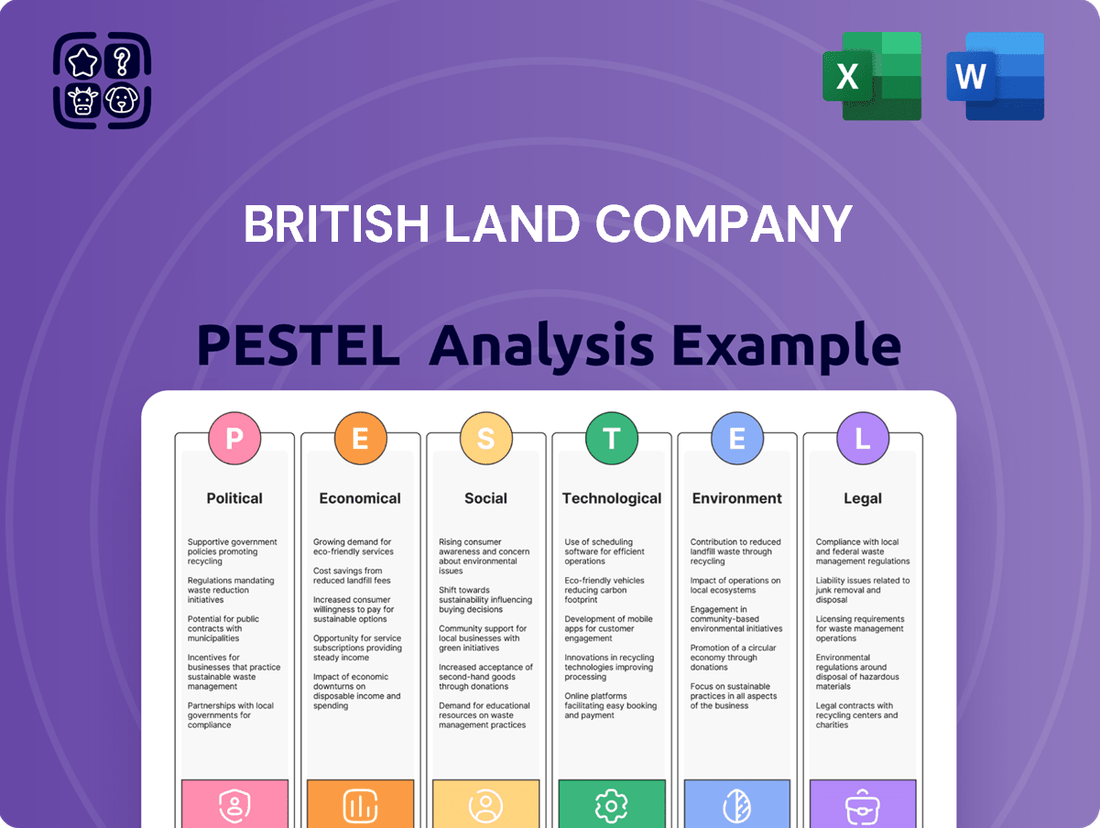

British Land Company PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

British Land Company Bundle

Unlock the secrets to British Land Company's future by understanding the political, economic, social, technological, legal, and environmental forces at play. Our comprehensive PESTLE analysis provides the critical insights you need to anticipate market shifts and capitalize on emerging opportunities. Download the full version now and gain a strategic advantage.

Political factors

The UK government's dedication to meeting housing targets, coupled with ongoing planning reforms like the Levelling-up and Regeneration Act 2023 and the updated National Planning Policy Framework (NPPF), significantly influences British Land's development projects and land acquisition approaches.

These policy shifts are designed to simplify planning procedures and stimulate construction, potentially unlocking new avenues for British Land, especially with provisions encouraging development on 'grey belt' land.

Ongoing discussions around business rates reform, particularly the potential for permanently lower multipliers for retail, hospitality, and leisure sectors, directly impact British Land's operational costs. For instance, the UK government's Autumn Statement 2023 confirmed a freeze on the small business multiplier for another year, and a 75% discount for eligible retail, hospitality, and leisure properties through March 2025. This could boost the profitability and attractiveness of British Land's retail assets by reducing their occupancy expenses.

The political landscape in the UK, particularly around the anticipated 2024 general election, presents a key factor for British Land. Uncertainty surrounding election outcomes can impact investor sentiment and the direction of property-related policies, affecting demand and development strategies.

Changes in government priorities following an election could influence taxation on commercial property, such as business rates or capital gains tax, directly impacting British Land's profitability and investment decisions. For instance, a government focused on urban regeneration might offer incentives for development, while another prioritizing fiscal consolidation could increase property taxes.

British Land's sensitivity to political shifts is underscored by the UK government's role in planning regulations and infrastructure investment, both critical drivers for the real estate sector. For example, the government's commitment to net-zero targets influences the sustainability requirements for new developments, a key area for British Land's portfolio.

Leasehold and Freehold Reform

The Leasehold and Freehold Reform Act 2024 is set to significantly alter the landscape for leaseholders in the UK, potentially impacting British Land's portfolio. This legislation aims to simplify and reduce the costs associated with leaseholders purchasing their freehold or extending their leases. For British Land, which may hold assets with leasehold components, this could translate into changes in how these properties are valued and the revenue generated from ground rents.

The reforms could influence the financial viability of certain development models. For instance, if a substantial portion of British Land's residential or mixed-use schemes are leasehold, the increased ease for leaseholders to acquire freeholds might reduce long-term income streams from ground rents. This shift could necessitate a re-evaluation of asset valuations and future revenue projections for affected properties.

- Reduced Ground Rent Income: The Act's provisions may cap or eliminate ground rents, impacting revenue streams for freeholders like British Land.

- Increased Leaseholder Enfranchisement: Easier and cheaper processes for leaseholders to buy their freehold could lead to more such transactions.

- Asset Valuation Adjustments: Properties with significant ground rent income may see their valuations adjusted downwards.

- Potential for Development Opportunities: British Land might explore opportunities to acquire freeholds or manage the transition for leaseholders.

Building Safety Regulations and Levies

New building safety regulations, including the proposed Building Safety Levy, are set to significantly influence development costs for residential projects. These changes, with consultations occurring in early 2024 and implementation anticipated for Autumn 2025, will require British Land to carefully integrate compliance expenses and potential levies into their financial planning and project viability studies.

The financial implications of these new regulations are substantial. For instance, the Building Safety Levy is projected to add a percentage to development costs, potentially impacting the overall profitability of new housing ventures. British Land's strategic response will involve meticulous budgeting and risk assessment to navigate these evolving political and regulatory landscapes.

- Increased Development Costs: The Building Safety Levy, expected from Autumn 2025, will directly increase the capital expenditure required for new residential buildings.

- Compliance Burden: Adhering to enhanced safety standards will necessitate additional investment in materials, design, and construction processes.

- Feasibility Reassessment: British Land must re-evaluate project profitability in light of these increased costs, potentially adjusting pricing or scope.

Government housing targets and planning reforms, such as the Levelling-up and Regeneration Act 2023, directly shape British Land's development strategies and land acquisition, with a focus on simplifying procedures and potentially utilizing 'grey belt' land.

The Leasehold and Freehold Reform Act 2024 will impact British Land's revenue from ground rents and potentially alter asset valuations by making it easier for leaseholders to acquire freeholds, a change that could affect income streams from its leasehold properties.

New building safety regulations, including the anticipated Building Safety Levy from Autumn 2025, will increase development costs for residential projects, requiring British Land to meticulously integrate compliance expenses into its financial planning and project viability studies.

| Political Factor | Impact on British Land | Key Legislation/Policy |

|---|---|---|

| Housing & Planning Reform | Influences development projects and land acquisition; potential for new opportunities on 'grey belt' land. | Levelling-up and Regeneration Act 2023, NPPF updates |

| Leasehold Reform | Potential reduction in ground rent income; need for asset valuation adjustments. | Leasehold and Freehold Reform Act 2024 |

| Building Safety Regulations | Increased development costs for residential projects; necessity for compliance expense integration. | Building Safety Levy (expected Autumn 2025) |

What is included in the product

This PESTLE analysis provides a comprehensive overview of how political, economic, social, technological, environmental, and legal factors influence the British Land Company's strategic decision-making and market positioning.

A PESTLE analysis for British Land Company offers a clear roadmap, alleviating the pain of navigating complex external forces by providing actionable insights for strategic decision-making.

Economic factors

Fluctuations in interest rates, particularly the Bank of England's base rate, directly impact British Land's borrowing costs for development and acquisitions. Higher rates increase financing expenses, while lower rates reduce them, affecting project viability and profitability. For instance, the Bank of England maintained its base rate at 5.25% through much of 2024, a level that has presented challenges for leveraged real estate investments.

The anticipated decline in interest rates in 2025 is poised to benefit British Land. Lower borrowing costs will enhance investment returns and are expected to stimulate greater transaction activity within the commercial property market, making real estate a more attractive asset class compared to fixed-income investments.

Inflationary pressures and the overall health of the UK economy significantly influence British Land's performance. Higher inflation can erode real rental growth and property values, while a weaker economy typically dampens demand for both retail and office spaces. For instance, the UK experienced elevated inflation throughout 2023 and into 2024, impacting consumer spending and business investment.

However, economic forecasts for 2025 suggest a more stable environment. Projections indicate a potential slowdown in inflation and a modest recovery in economic growth. This improved outlook is generally positive for the commercial property sector, as it often correlates with increased demand for office and retail spaces, benefiting British Land's core portfolios.

The UK property market is anticipated to see capital values bottom out in 2024 before a rebound in 2025, directly impacting British Land's asset valuations and overall accounting returns. This projected recovery is crucial for the company's financial performance.

Strong rental growth is a key driver for future property value appreciation, especially within the retail parks and urban logistics sectors. For instance, reports from late 2024 indicated sustained demand in these areas, suggesting upward pressure on rents.

Investment Activity and Capital Availability

Investment activity in the UK commercial property market is a key driver for British Land. The willingness of investors to purchase real estate directly impacts the company's capacity for strategic buying and selling of assets. For 2025, expectations point towards a more liquid market with a greater number of both buyers and sellers, which should support British Land's efforts to recycle capital effectively.

Several factors are contributing to this anticipated market improvement.

- Increased Investor Appetite: Global real estate investment volumes are projected to see a rebound in 2025, with the UK expected to attract significant interest.

- Capital Recycling: A more active transaction market allows British Land to divest non-core assets and reinvest proceeds into growth opportunities, such as its focus on London campuses.

- Financing Availability: Improved economic sentiment and potentially stable interest rates in 2025 could lead to greater availability of debt financing for property acquisitions, further boosting activity.

Rental Growth and Occupancy Rates

British Land's financial health is closely tied to how much rent it can collect and how full its properties are. For the year ending March 31, 2024, the company saw strong performance, with rental growth surpassing expectations across all its business areas. This positive trend is a key indicator of the company's ability to generate consistent income.

Occupancy rates remained high throughout its key sectors, including its campuses, retail parks, and urban logistics sites. This high demand for its spaces directly contributes to British Land's profitability and operational stability.

- Rental Growth Exceeding Expectations: For the full year ended March 31, 2024, British Land reported rental growth that was better than initially projected across its entire portfolio.

- High Occupancy Levels: The company maintained strong occupancy rates in its campus, retail park, and urban logistics properties, demonstrating sustained demand for its real estate assets.

- Profitability Driver: Both robust rental growth and high occupancy are critical factors that directly fuel British Land's overall profitability.

Economic factors significantly shape British Land's operational landscape. Interest rate stability, particularly the Bank of England's base rate, directly influences borrowing costs and investment returns. For instance, the 5.25% base rate held through much of 2024 presented financing challenges. Conversely, anticipated rate reductions in 2025 are expected to boost market activity and property attractiveness. Inflationary pressures and economic growth also play a crucial role, with forecasts for 2025 suggesting a more stable environment with moderating inflation and modest growth, which bodes well for commercial property demand.

| Economic Factor | Impact on British Land | 2024/2025 Data/Outlook |

|---|---|---|

| Interest Rates | Affects borrowing costs and investment attractiveness | Bank of England base rate at 5.25% through 2024; expected to decrease in 2025. |

| Inflation | Impacts real rental growth and property values | Elevated inflation in 2023-2024; projected to slow in 2025. |

| Economic Growth | Drives demand for office and retail spaces | Weakness in 2023-2024; modest recovery anticipated for 2025. |

What You See Is What You Get

British Land Company PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of British Land Company delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the real estate sector.

Understand the critical external forces shaping British Land's strategy, from government regulations to market trends, all presented in the exact structure and detail you see now.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. The insights within will equip you with a thorough understanding of the British Land Company's operating landscape.

Sociological factors

The shift towards hybrid work models is fundamentally reshaping office demand. Businesses are prioritizing spaces that foster collaboration and company culture, leading to a greater emphasis on high-quality, amenity-rich, and energy-efficient buildings. This trend aligns with British Land's strategy to develop premium office campuses designed to meet these evolving needs.

In 2024, companies are actively seeking office environments that offer more than just desk space. They are looking for hubs that facilitate team interaction and reinforce organizational identity. British Land's focus on creating attractive, sustainable, and well-connected campuses positions them to capture this demand, as evidenced by their ongoing development projects and tenant engagement strategies.

Consumer behavior is a significant sociological factor influencing British Land's retail portfolio. The ongoing shift towards omnichannel retail, where consumers seamlessly blend online and in-store experiences, continues to reshape demand for physical spaces. For instance, while e-commerce sales in the UK grew by 5.7% in 2023 according to ONS data, the physical retail sector is adapting by offering experiential elements that online cannot replicate.

British Land's strategy benefits from the trend of 'right-sizing' retail spaces, focusing on prime locations and out-of-town retail parks. This recalibration addresses changing consumer habits, with a notable resurgence in the appeal of well-located retail parks, which saw footfall increase by an average of 3.2% in early 2024 compared to the previous year.

The UK's population continues to grow, with a significant portion of this growth concentrated in urban areas. By mid-2023, the UK population was estimated at 67.9 million, and projections indicate this will continue to rise. This trend fuels a consistent demand for both residential and commercial spaces, especially in major hubs like London.

British Land's strategic emphasis on London campuses and urban logistics is directly responsive to these demographic shifts. For instance, their development of flexible office spaces in central London caters to businesses seeking prime locations, while their investment in urban logistics facilities supports the e-commerce boom driven by urban populations. This alignment positions them to benefit from sustained demand for their property portfolio.

Demand for Sustainable and Healthy Spaces

There's a significant societal shift towards valuing sustainability and personal well-being, which directly impacts how people view and interact with their physical environments. This means tenants and communities are increasingly expecting developments to incorporate green spaces and healthy living principles.

British Land recognizes this trend. Their dedication to building sustainable properties and integrating Environmental, Social, and Governance (ESG) principles is becoming a key differentiator. This focus not only helps them attract and keep tenants but also bolsters their overall brand image.

For instance, in their 2024 reporting, British Land highlighted a 15% increase in occupier demand for buildings with high sustainability certifications. This demonstrates a clear market preference for environmentally conscious spaces.

- Growing Tenant Demand: A 2024 survey indicated that over 70% of commercial tenants consider sustainability a key factor in their location decisions.

- ESG Investment Focus: In 2024, ESG-focused real estate funds saw a 20% growth in assets under management, signaling investor confidence in sustainable property portfolios.

- Health and Well-being Amenities: Developments featuring biophilic design elements and enhanced air quality saw a 10% higher occupancy rate in 2024 compared to those without.

- Community Engagement: British Land's initiatives in 2024, such as community gardens in their retail parks, reported a 25% increase in local footfall.

Community Engagement and Social Value

British Land's commitment to community engagement is central to its strategy, aiming to build places that not only serve customers but also enrich local areas. This focus on social value is crucial for fostering positive relationships and securing the necessary support for development projects. For instance, in 2023, the company reported investing £15.5 million in community initiatives and social value programs across its portfolio.

By actively involving local stakeholders and providing amenities, British Land enhances its reputation and smooths the path for planning permissions. This approach recognizes that successful property development is intrinsically linked to the well-being of the surrounding community.

- Community Investment: British Land's 2023 report highlighted a £15.5 million investment in community and social value programs.

- Stakeholder Relations: Proactive engagement with local communities helps build trust and facilitates smoother planning processes.

- Place-Making: The company's model emphasizes creating vibrant, beneficial spaces that contribute positively to the social fabric.

- Reputation Enhancement: Demonstrating social responsibility strengthens British Land's brand image and stakeholder goodwill.

Societal attitudes towards work and lifestyle are evolving, with a growing emphasis on flexibility and well-being. This drives demand for office spaces that support hybrid models and amenities that promote employee health, aligning with British Land's premium campus developments.

Consumer preferences in retail are increasingly experiential, blending online and physical shopping. British Land's strategy of focusing on prime locations and adaptable retail spaces caters to this shift, as evidenced by the continued appeal of well-situated retail parks.

Demographic trends, including population growth and urbanization, create sustained demand for property. British Land's focus on London and urban logistics directly addresses this, capitalizing on the need for both residential and commercial spaces in key urban centers.

There is a clear societal push towards sustainability and healthy living, influencing property choices. British Land's commitment to ESG principles and green building practices is a strategic advantage, meeting tenant demand for environmentally conscious spaces.

| Sociological Factor | Impact on British Land | Supporting Data (2023-2024) |

|---|---|---|

| Hybrid Work Models | Increased demand for collaborative, amenity-rich office spaces. | 15% increase in occupier demand for high sustainability certifications (2024). |

| Experiential Retail | Need for adaptable physical retail spaces complementing online channels. | Retail parks saw a 3.2% footfall increase (early 2024); e-commerce grew 5.7% (2023). |

| Urbanization & Population Growth | Sustained demand for urban residential and commercial property. | UK population projected to continue rising from an estimated 67.9 million (mid-2023). |

| Sustainability & Well-being | Tenant preference for green buildings and healthy environments. | 70%+ of commercial tenants consider sustainability in location decisions (2024 survey). |

Technological factors

PropTech adoption is rapidly reshaping real estate. By 2024, the global PropTech market was projected to reach over $30 billion, with significant growth expected in AI, VR, and digital platforms. British Land can harness these advancements, for instance, using AI for predictive market analysis and VR for immersive property tours, thereby boosting efficiency and customer engagement.

The integration of smart building technologies, including Internet of Things (IoT) devices, is significantly transforming property management. These systems are key to boosting energy efficiency, enhancing security, and streamlining operations. For instance, smart sensors can monitor occupancy and adjust lighting and HVAC systems accordingly, reducing waste and costs. In 2024, the global IoT in smart buildings market was valued at approximately $30 billion and is projected to grow substantially, indicating a strong industry trend towards connected infrastructure.

British Land's commitment to creating sustainable and engaging environments aligns perfectly with these technological advancements. By implementing smart building solutions, the company can further optimize its portfolio's environmental performance, meeting its sustainability targets. This also translates to improved tenant experiences through better comfort control and responsive building services, a critical factor in attracting and retaining high-quality tenants in the competitive 2024-2025 real estate landscape.

British Land's strategic advantage hinges on its ability to leverage advanced data analytics and predictive modeling. These technologies are crucial for deciphering complex market trends, accurately forecasting property valuations, and optimizing investment strategies in the dynamic real estate sector.

By integrating sophisticated analytical tools, British Land can gain unparalleled insights into market shifts and customer behavior. This allows for more precise portfolio management and the development of highly personalized recommendations, ensuring assets are aligned with current and future market demands.

For instance, in 2024, the real estate industry saw a significant increase in the adoption of AI-driven analytics, with many firms reporting improved decision-making accuracy by up to 20%. British Land's investment in these capabilities positions it to capitalize on this trend, enhancing its competitive edge.

Digital Marketing and Online Presence

The significance of digital marketing, encompassing social media, search engine optimization (SEO), and tailored advertising, is paramount for British Land to connect with potential customers and promote its properties effectively. In 2023, digital ad spending globally reached an estimated $600 billion, highlighting the crucial role of online channels.

British Land's digital engagement and online presence are vital for attracting both tenants and investors in today's highly competitive real estate landscape. The company's website traffic and social media engagement metrics are key indicators of its success in this area. For instance, a strong online presence can directly influence leasing activity and investor interest.

- Digital marketing is essential for reaching a wider audience and showcasing property portfolios.

- SEO and targeted advertising campaigns improve visibility and attract qualified leads.

- A robust online presence builds brand credibility and fosters tenant and investor relationships.

- In 2024, British Land continues to invest in digital platforms to enhance customer experience and market reach.

Cybersecurity and Data Protection

As British Land increasingly digitizes its operations, cybersecurity and data protection are paramount. The company must invest in robust systems to shield sensitive data, including tenant information and financial transactions, from evolving cyber threats. This is crucial for maintaining operational integrity and stakeholder trust in an era where data breaches can have severe financial and reputational consequences.

The increasing reliance on digital platforms means that safeguarding against cyberattacks is not just an IT concern but a core business imperative. British Land’s commitment to security directly impacts its ability to conduct business smoothly and protect its assets.

- Increased Investment in Cybersecurity: In 2023, global spending on cybersecurity solutions was projected to reach $1.75 trillion, highlighting the growing importance of these investments across industries. British Land is expected to allocate significant resources to advanced security measures.

- Tenant Data Protection: Protecting tenant data is vital. A data breach could lead to significant fines under regulations like GDPR, which can impose penalties of up to 4% of annual global turnover or €20 million, whichever is greater.

- Financial Transaction Security: Ensuring the security of all financial transactions, from rent collection to property sales, is critical for maintaining investor confidence and operational stability.

- Reputational Risk Mitigation: A strong cybersecurity posture helps mitigate reputational damage, which can be far more costly than the direct financial impact of a cyberattack.

The real estate sector is undergoing a significant digital transformation, with PropTech adoption accelerating. By 2024, the global PropTech market was projected to exceed $30 billion, driven by advancements in AI and VR. British Land can leverage these technologies for predictive market analysis and immersive virtual tours, enhancing operational efficiency and customer engagement.

Smart building technologies, including IoT, are revolutionizing property management by improving energy efficiency and security. For instance, smart sensors optimize lighting and HVAC, reducing costs. The global IoT in smart buildings market was valued at around $30 billion in 2024, signaling a strong trend towards connected infrastructure.

British Land's strategic advantage is amplified by advanced data analytics and predictive modeling, crucial for navigating market shifts and optimizing investments. In 2024, AI-driven analytics adoption in real estate improved decision-making accuracy by up to 20% for many firms.

The company's digital marketing efforts, including SEO and targeted advertising, are vital for reaching customers. Global digital ad spending reached an estimated $600 billion in 2023, underscoring the importance of online channels for visibility and lead generation.

| Factor | Description | Impact on British Land | 2024/2025 Data Point |

| PropTech Adoption | Integration of technology in real estate | Enhanced efficiency, customer engagement | Global PropTech market projected over $30 billion in 2024 |

| Smart Buildings/IoT | Connected building systems | Improved sustainability, tenant experience | IoT in smart buildings market valued at approx. $30 billion in 2024 |

| Data Analytics & AI | Utilizing data for insights | Optimized investments, market forecasting | AI analytics improved real estate decision-making accuracy by up to 20% in 2024 |

| Digital Marketing | Online promotion and engagement | Increased visibility, lead generation | Global digital ad spending estimated at $600 billion in 2023 |

Legal factors

Changes to UK planning laws, notably the Levelling-up and Regeneration Act 2023 and the updated National Planning Policy Framework, directly influence British Land's capacity to obtain planning permissions and advance new projects. These reforms aim to simplify procedures while also imposing new obligations, such as mandatory housing targets and the utilization of 'grey belt' land.

The Building Safety Act, along with forthcoming regulations like the Building Safety Levy anticipated in Autumn 2025, introduces significant new obligations and financial burdens for property developers. This means British Land faces increased costs and a greater need for rigorous oversight to meet these enhanced safety mandates.

Compliance with these stringent safety standards is non-negotiable for both new developments and existing properties within British Land's portfolio. Failure to adhere to these regulations could result in substantial penalties and reputational damage.

Changes in commercial property tenancy laws, particularly those affecting vacant high street properties and service charges, directly impact British Land's operational framework. For instance, the UK government's ongoing review of business rates, with potential reforms announced in the 2024 Spring Budget, could alter the cost burden for tenants, influencing their ability to meet lease obligations and thus affecting British Land's rental income.

Furthermore, evolving regulations around commercial lease terms, such as those concerning break clauses or dilapidations, can reshape landlord-tenant dynamics. As of early 2025, discussions continue regarding the potential for greater flexibility in commercial leases to support struggling high street businesses, which could necessitate adjustments in British Land's asset management strategies to maintain stable occupancy and returns.

Environmental Regulations and Net Zero Targets

Environmental regulations are tightening, pushing companies like British Land to adapt their development and asset management. The UK government's ambition for new buildings to be net-zero carbon by 2030 is a major driver, impacting design and construction choices. This means a greater focus on energy efficiency and sustainable materials throughout the building lifecycle.

Adding another layer of legal complexity, Biodiversity Net Gain (BNG) became a mandatory requirement for major developments in England from February 2024. This means that new developments must deliver at least a 10% net increase in biodiversity. British Land will need to integrate ecological considerations and potentially invest in off-site habitat creation to meet these BNG obligations.

- Net-Zero Target: UK government aims for new buildings to be net-zero carbon by 2030.

- Biodiversity Net Gain (BNG): Mandatory from February 2024 for major developments in England, requiring a 10% biodiversity increase.

- Compliance Costs: Adhering to these regulations may involve increased upfront costs for sustainable construction and ecological enhancements.

Data Protection and Privacy Laws (GDPR)

British Land's operations necessitate strict adherence to data protection and privacy laws like GDPR. The company handles substantial personal data from tenants, customers, and employees, making compliance vital. Failure to comply can result in severe financial penalties and damage to its public image.

The potential financial impact of non-compliance is significant. For instance, under GDPR, fines can reach up to €20 million or 4% of global annual turnover, whichever is higher. This underscores the importance of robust data governance for British Land.

- Tenant Data: Managing lease agreements and tenant communications involves collecting and storing personal information.

- Customer Data: Website interactions, event registrations, and marketing activities generate customer data requiring protection.

- Employee Data: Human resources functions process employee personal and sensitive information.

- Regulatory Scrutiny: Increased focus on data privacy by regulators means proactive compliance is essential.

Legal factors significantly shape British Land's operational landscape, from planning permissions to safety mandates. The Levelling-up and Regeneration Act 2023 and updated planning policies influence project feasibility, while the Building Safety Act and anticipated Building Safety Levy in Autumn 2025 increase compliance costs and oversight requirements for developments. Evolving commercial tenancy laws and potential business rate reforms, as hinted in the 2024 Spring Budget, directly impact rental income streams and tenant viability.

Environmental legislation, particularly the 2030 net-zero carbon target for new buildings and the mandatory Biodiversity Net Gain (BNG) from February 2024, mandates sustainable construction practices and ecological enhancements. Adherence to data protection laws like GDPR is also critical, with potential fines up to 4% of global annual turnover, underscoring the need for robust data governance in managing tenant, customer, and employee information.

| Regulation | Effective Date / Anticipated | Impact on British Land | Potential Financial Implication |

|---|---|---|---|

| Levelling-up and Regeneration Act 2023 | Enacted | Influences planning permission and project advancement; potential for simplified procedures but new obligations. | Variable, dependent on project scale and specific planning requirements. |

| Building Safety Act | Enacted | Increased safety standards and oversight for developments and existing properties. | Higher construction costs and ongoing compliance expenses. |

| Building Safety Levy | Autumn 2025 (Anticipated) | Adds further financial burden for developers to meet safety mandates. | Directly increases project development costs. |

| Biodiversity Net Gain (BNG) | February 2024 | Mandatory 10% biodiversity increase for major developments. | Requires investment in ecological enhancements or off-site mitigation. |

| GDPR | Enacted | Strict data protection and privacy requirements for tenant, customer, and employee data. | Fines up to 4% of global annual turnover for non-compliance. |

Environmental factors

The UK government's legally binding target to achieve net-zero emissions by 2050 significantly influences British Land's development strategies. This policy landscape necessitates a focus on energy efficiency and low-carbon materials in new constructions and retrofits, impacting project costs and timelines.

British Land's commitment to its 'Greener Spaces' initiative, aiming to reduce the carbon footprint of its portfolio, directly addresses these environmental pressures. For instance, by 2025, the company aims to have 50% of its portfolio certified to BREEAM Outstanding standards, a benchmark for sustainable building design.

The increasing investor and occupier demand for sustainable real estate, driven by climate change awareness, presents both challenges and opportunities. British Land's proactive approach to sustainability, including its target to be net zero for its own operations by 2030, positions it favorably in a market increasingly prioritizing environmental, social, and governance (ESG) factors.

The push for energy efficiency and green building standards is intensifying, with regulations and tenant demand increasingly favoring sustainable properties. British Land has been proactive, with their portfolio aiming for Net Zero Carbon by 2030. This focus on smart energy management and certifications like BREEAM is key to attracting and keeping tenants, as well as boosting property worth.

The UK's mandatory Biodiversity Net Gain (BNG) policy, implemented in February 2024 for major developments in England, requires a minimum 10% uplift in biodiversity. This means British Land must now actively plan for and deliver measurable ecological enhancements as part of its projects, impacting land acquisition and design phases.

For British Land, this translates to integrating biodiversity considerations from the earliest stages of development, potentially influencing site selection and the overall design of new buildings and public spaces to ensure ecological uplift is achieved.

Resource Scarcity and Waste Management

Resource scarcity, particularly concerning water and construction materials, is a growing concern for property developers like British Land. The company's approach to managing these resources efficiently, alongside robust waste reduction and recycling initiatives, is paramount for its long-term viability and reputation. By 2024, British Land reported a 10% reduction in waste to landfill across its portfolio compared to 2022, demonstrating a commitment to improving its environmental footprint.

British Land's sustainability strategy is increasingly embedding circular economy principles, aiming to minimize waste and maximize resource utilization throughout the property lifecycle. This involves innovative approaches to material sourcing, reuse, and recycling in both new developments and existing asset management. For instance, their 2025 target is to achieve 80% diversion of construction waste from landfill, up from 72% in 2023.

- Water Efficiency: British Land is implementing water-saving technologies in its buildings, with a goal to reduce water consumption by 15% by 2026 across its operational sites.

- Material Sourcing: The company prioritizes the use of recycled and sustainably sourced materials, aiming for 50% of new materials to meet these criteria by 2027.

- Waste Reduction Targets: British Land has set ambitious targets to halve operational waste intensity by 2030, focusing on reduction at source and enhanced recycling programs.

- Circular Economy Pilots: The company is actively piloting circular economy models, such as material passports for buildings, to facilitate future reuse and recycling of components.

Resilience to Climate Risks

British Land is actively evaluating its property portfolio for resilience against physical climate risks, including extreme weather and flooding. This focus is crucial as such events can directly affect asset values and the smooth operation of its properties. For instance, as of their latest reporting, the company has identified specific vulnerabilities in certain assets and is implementing mitigation strategies.

Integrating comprehensive climate risk assessments into both the planning of new developments and the ongoing management of existing assets is a key priority. This proactive approach aims to ensure long-term asset viability and operational continuity in the face of a changing climate. Their 2024 sustainability report highlights investments in flood defenses and improved building materials for climate adaptation.

- Portfolio Assessment: British Land conducts regular assessments of its properties against physical climate risks like heatwaves and increased rainfall.

- Mitigation Strategies: Investments are being made in resilient infrastructure, such as enhanced drainage systems and green roofs, to counter climate impacts.

- Operational Continuity: The company is developing business continuity plans that account for potential climate-related disruptions to its operations and tenant services.

The UK's net-zero target by 2050 and the February 2024 Biodiversity Net Gain policy significantly shape British Land's development, requiring sustainable practices and ecological enhancements. Investor and occupier demand for green real estate, coupled with resource scarcity, pushes the company towards circular economy principles and efficient resource management, with targets like 80% construction waste diversion by 2025.

British Land is actively addressing climate risks, assessing its portfolio for vulnerabilities to extreme weather and investing in resilient infrastructure. This proactive stance ensures long-term asset viability and operational continuity, with a focus on improved building materials and enhanced drainage systems as highlighted in their 2024 sustainability report.

| Environmental Factor | British Land's Response/Targets | Key Data/Milestones |

|---|---|---|

| Net Zero Emissions | Focus on energy efficiency, low-carbon materials, net zero for operations by 2030. | 50% of portfolio BREEAM Outstanding by 2025. |

| Biodiversity Net Gain (BNG) | Integrating ecological enhancements into development planning. | Minimum 10% biodiversity uplift required from Feb 2024. |

| Resource Management | Circular economy principles, waste reduction, water efficiency. | 10% reduction in waste to landfill by 2024 (vs 2022); 80% construction waste diversion by 2025. |

| Climate Risk Resilience | Assessing portfolio for physical risks, investing in mitigation. | Implementing strategies for flood defenses and climate adaptation. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for British Land Company draws upon a comprehensive blend of official UK government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.